Professional Documents

Culture Documents

Visda, Jan Carmel S.

Visda, Jan Carmel S.

Uploaded by

Robert Darwin GabrielOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Visda, Jan Carmel S.

Visda, Jan Carmel S.

Uploaded by

Robert Darwin GabrielCopyright:

Available Formats

VISDA, JAN CARMEL S.

April 1,

2020

NEGOLAW / 3:00 - 4:30/ TTH

Assignment #2

CASE:

A draws a check for P50,000 in favor of "B or order" against his account with X Bank. C

steals the check and erases the name of B by means of chemicals and places his own, thereafter

indorses it at the back and deposits it with Y Bank. After receiving the check, Y Bank stamped it

for Central Bank clearing "all prior endorsements xxx guaranteed, Y Bank," After it was cleared,

Y Bank allows C to withdraw the amount. C then absconds. Upon discovery by A of the material

alteration, he complains to X Bank who then credits the amount of A. X Bank demands

reimbursement from Y Bank. Y Bank refuses, claiming it acted as an agent for collection. Who

shall bear the loss? Reason.

ANSWER:

Under Section 23 of the Negotiable Instruments Law, a forged signature in a check,

whether it be that of the drawer or the payee, is wholly inoperative and no one can gain title to

the instrument through it. A person whose signature was forged was never a party and never

consented to the contract. Thus, a forged endorsement does not operate as the payee’s

endorsement. That is why Y Bank shall bear the loss and is under liability to X bank for

reimbursement of the credited amount of A as Y Bank failed to verify the genuineness of the

drawer's signature.

You might also like

- Problem No. 1: Alex Issued A Check But Does Not Deliver It. Beth Stole It and Filled Up The Amount andDocument4 pagesProblem No. 1: Alex Issued A Check But Does Not Deliver It. Beth Stole It and Filled Up The Amount andJulie Ann Moina100% (1)

- NIL Bar QuestionsDocument81 pagesNIL Bar Questionscezz2386No ratings yet

- EJTEQJ4JDocument5 pagesEJTEQJ4J132345usdfghj0% (1)

- Jai-Alai, V. Bpi 66 Scra 29 August 6, 1975Document3 pagesJai-Alai, V. Bpi 66 Scra 29 August 6, 1975Fritzie G. PuctiyaoNo ratings yet

- Associated Bank vs. Hon. Court of Appeals, and Merle V. Reyes G.R. No. 89802, May 7, 1992 Cruz, J. FactsDocument50 pagesAssociated Bank vs. Hon. Court of Appeals, and Merle V. Reyes G.R. No. 89802, May 7, 1992 Cruz, J. FactsAlexir MendozaNo ratings yet

- Law Finals ReviewerDocument4 pagesLaw Finals ReviewerJohn Villacorte CondesNo ratings yet

- Great Eastern Life Ins. Co. V. Hongkong Shanghai Bank (1922)Document11 pagesGreat Eastern Life Ins. Co. V. Hongkong Shanghai Bank (1922)Vitas VitalyNo ratings yet

- Bar Qs NegoDocument3 pagesBar Qs NegoAra Princess OlamitNo ratings yet

- SPL Bar Exam Questions With Answers: BP 22 Memorandum Check (1994)Document38 pagesSPL Bar Exam Questions With Answers: BP 22 Memorandum Check (1994)Carla January Ong100% (1)

- Negotiable Instruments Law: San Carlos Mining Vs BPIDocument5 pagesNegotiable Instruments Law: San Carlos Mining Vs BPIkathNo ratings yet

- Liability Sadaya V. Sevilla 19 SCRA 924: Defense Ilusorio V. Court of AppealsDocument10 pagesLiability Sadaya V. Sevilla 19 SCRA 924: Defense Ilusorio V. Court of AppealsTats YumulNo ratings yet

- Forgery CasesDocument2 pagesForgery CasesLittle GirlblueNo ratings yet

- Midterm Exam SPLDocument43 pagesMidterm Exam SPLCarla January OngNo ratings yet

- SPL Bar Exam Questions With Answers B.P. 22: BP 22 Memorandum Check (1994)Document12 pagesSPL Bar Exam Questions With Answers B.P. 22: BP 22 Memorandum Check (1994)Carla January OngNo ratings yet

- Case Digests 2 - NegoDocument14 pagesCase Digests 2 - NegoAIZEL JOY POTOTNo ratings yet

- Negotiable Inst. 1-10Document12 pagesNegotiable Inst. 1-10Reiden VizcarraNo ratings yet

- DURAN Nego PDFDocument28 pagesDURAN Nego PDFDana DNo ratings yet

- Metropolitan Bank Vs CabilzoDocument10 pagesMetropolitan Bank Vs CabilzoJoey MapaNo ratings yet

- Nego Bar Qs and AnsDocument30 pagesNego Bar Qs and AnsEugene Albert Olarte Javillonar100% (1)

- Negotiable Instruments Digested Cases 2Document9 pagesNegotiable Instruments Digested Cases 2ChristineNo ratings yet

- Westmont Bank (Formerly Associated Banking Corp.) vs. Eugene Ong GR No. 132560, January 30, 2002 FactsDocument54 pagesWestmont Bank (Formerly Associated Banking Corp.) vs. Eugene Ong GR No. 132560, January 30, 2002 FactsKrystalynne AguilarNo ratings yet

- Great Eastern Life Insurance Co. v. HSBC, G.R. No. 18657, August 23, 1922Document4 pagesGreat Eastern Life Insurance Co. v. HSBC, G.R. No. 18657, August 23, 1922liz kawiNo ratings yet

- Ambito AlmazanDocument17 pagesAmbito AlmazanAlyk Tumayan Calion0% (1)

- Quiz MidtermDocument4 pagesQuiz MidtermAndrei ArkovNo ratings yet

- Case DigestDocument4 pagesCase DigestRose Anne CuarterosNo ratings yet

- Libertas (Jurisprudence On Nego)Document106 pagesLibertas (Jurisprudence On Nego)Vince AbucejoNo ratings yet

- Forgery - NIL Section 23Document13 pagesForgery - NIL Section 23Kirby ReniaNo ratings yet

- Mitra V PP and Tarcelo FactsDocument4 pagesMitra V PP and Tarcelo FactsBenn DegusmanNo ratings yet

- Case No. 1 and No.6Document5 pagesCase No. 1 and No.6Pinca RenNo ratings yet

- Question Answer Negotiable Instrument LawDocument4 pagesQuestion Answer Negotiable Instrument LawEuxine Albis0% (2)

- Garin DigestDocument6 pagesGarin DigestConcepcion Mallari GarinNo ratings yet

- Alteration & Discharge Case DigestsDocument4 pagesAlteration & Discharge Case Digestsblackphoenix303No ratings yet

- Digest 2Document6 pagesDigest 2Van CazNo ratings yet

- Negotiable Instrument CasesDocument14 pagesNegotiable Instrument CasesDianne D.No ratings yet

- Chan Wan Vs Tan KimDocument12 pagesChan Wan Vs Tan KimCarlo ColumnaNo ratings yet

- Jai-Alai Corp. of The Phil. vs. Bank of The Phil. Islands G.R. No. L-29432 August 6, 1975 66 SCRA 29 - ForgeryDocument4 pagesJai-Alai Corp. of The Phil. vs. Bank of The Phil. Islands G.R. No. L-29432 August 6, 1975 66 SCRA 29 - ForgeryAdrian HilarioNo ratings yet

- Nego Case Digest 1 PDFDocument70 pagesNego Case Digest 1 PDFJulie Ann PiliNo ratings yet

- TDocument11 pagesTfrgteryNo ratings yet

- Great EasternhjDocument3 pagesGreat EasternhjJames WilliamNo ratings yet

- Discharge of Negotiable InstrumentDocument4 pagesDischarge of Negotiable InstrumentMarieNo ratings yet

- CaseDocument16 pagesCaseLexa L. DotyalNo ratings yet

- Negotiable InstrumentsDocument11 pagesNegotiable InstrumentsFersal AlbercaNo ratings yet

- Associated Bank Vs CADocument4 pagesAssociated Bank Vs CATacoy DolinaNo ratings yet

- Case Digest JohnDocument29 pagesCase Digest JohnGretchen Alunday Suarez100% (1)

- Nego Jan 7Document23 pagesNego Jan 7Michelle AsagraNo ratings yet

- Law Neg o PDFDocument14 pagesLaw Neg o PDFKendrew SujideNo ratings yet

- Savings Account Current Account Branch Manager DolarDocument10 pagesSavings Account Current Account Branch Manager Dolarjpoy61494No ratings yet

- Banking Law CasesDocument27 pagesBanking Law CasesAlvin JohnNo ratings yet

- Negotiable Instrument (Discharge of Instrument)Document15 pagesNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- Case Digests: Maynard A. Gabayno Jr. Negotiable InstrumentDocument37 pagesCase Digests: Maynard A. Gabayno Jr. Negotiable InstrumentMaynard GabaynoNo ratings yet

- 11 - Greater Easter Life Insurance Vs Hong Kong Shang Hai BankDocument3 pages11 - Greater Easter Life Insurance Vs Hong Kong Shang Hai BankKeej DalonosNo ratings yet

- NIL Digest For May 6Document94 pagesNIL Digest For May 6Crystene R. SarandinNo ratings yet

- 2nd Part 1Document5 pages2nd Part 1howaanNo ratings yet

- Philippine Education CoDocument11 pagesPhilippine Education CoMark Hiro NakagawaNo ratings yet

- Dela Victoria V. Burgos 245 SCRA 374Document4 pagesDela Victoria V. Burgos 245 SCRA 374Sangguniang BayanNo ratings yet

- Ilusorio v. CaDocument2 pagesIlusorio v. Camichelle m. templadoNo ratings yet

- 01 July AM Remedial LawDocument2 pages01 July AM Remedial LawGNo ratings yet

- Defenses Case - Ilusorio vs. CADocument2 pagesDefenses Case - Ilusorio vs. CAbemjamisonNo ratings yet

- Barq CompiledDocument36 pagesBarq CompiledPamNo ratings yet

- Mastering Credit - The Ultimate DIY Credit Repair GuideFrom EverandMastering Credit - The Ultimate DIY Credit Repair GuideRating: 1 out of 5 stars1/5 (1)

- September 11Document2 pagesSeptember 11Robert Darwin GabrielNo ratings yet

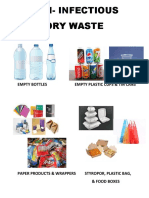

- Empty Bottles Empty Plastic Cups & Tin CansDocument3 pagesEmpty Bottles Empty Plastic Cups & Tin CansRobert Darwin GabrielNo ratings yet

- Hi Guys!!: Good Morning!! Welcome To Our Report - (Philippine Contemporary Art)Document29 pagesHi Guys!!: Good Morning!! Welcome To Our Report - (Philippine Contemporary Art)Robert Darwin GabrielNo ratings yet

- Gabriel, Robert Darwin D. 20160200113Document2 pagesGabriel, Robert Darwin D. 20160200113Robert Darwin GabrielNo ratings yet

- Full Papers 6 (Revised)Document49 pagesFull Papers 6 (Revised)Robert Darwin GabrielNo ratings yet

- Formalism: Phase Ii Text Dependent InterpretationDocument1 pageFormalism: Phase Ii Text Dependent InterpretationRobert Darwin GabrielNo ratings yet

- Public Address: Its Principles and PracticesDocument19 pagesPublic Address: Its Principles and PracticesRobert Darwin GabrielNo ratings yet

- Inside BillDocument5 pagesInside BillRobert Darwin Gabriel100% (1)

- Robert Darwin D. Gabriel 20160200113Document6 pagesRobert Darwin D. Gabriel 20160200113Robert Darwin GabrielNo ratings yet

- In PlantsDocument23 pagesIn PlantsRobert Darwin GabrielNo ratings yet

- Materials Formed: During Volcanic EruptionsDocument10 pagesMaterials Formed: During Volcanic EruptionsRobert Darwin GabrielNo ratings yet

- Studies and Literature On Capital PunishmentDocument10 pagesStudies and Literature On Capital PunishmentRobert Darwin GabrielNo ratings yet

- Teacher Newly Hired: For CSC Requirements in Brown FolderDocument2 pagesTeacher Newly Hired: For CSC Requirements in Brown FolderRobert Darwin Gabriel100% (1)

- Ang Tiong Vs Ting 22 SCRA 713, 714, February 22, 1968Document2 pagesAng Tiong Vs Ting 22 SCRA 713, 714, February 22, 1968Robert Darwin GabrielNo ratings yet

- Rights of The HolderDocument34 pagesRights of The HolderRobert Darwin Gabriel100% (1)

- Good Diction TipsDocument3 pagesGood Diction TipsRobert Darwin GabrielNo ratings yet

- Set A. Midterm Speech 2020Document4 pagesSet A. Midterm Speech 2020Robert Darwin GabrielNo ratings yet

- Course Title: NEGOLAW Professor: Atty. Jose T. Yayen Section: BA 44 & 43 Learning Module No. 2 Negotiation I. Introduction / OverviewDocument3 pagesCourse Title: NEGOLAW Professor: Atty. Jose T. Yayen Section: BA 44 & 43 Learning Module No. 2 Negotiation I. Introduction / OverviewRobert Darwin GabrielNo ratings yet

- Supan NegolawDocument3 pagesSupan NegolawRobert Darwin GabrielNo ratings yet