Professional Documents

Culture Documents

Zapanta Vs Posadas GR No L-29204-09

Uploaded by

Joyjoy C LbanezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zapanta Vs Posadas GR No L-29204-09

Uploaded by

Joyjoy C LbanezCopyright:

Available Formats

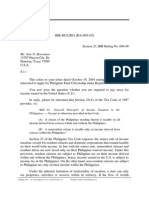

Zapanta v.

Posadas

(G.R. No. L-29204. December29, 1928)

FACTS:

Father Braulio Pineda died in January 1925 without any ascendants or descendants, leaving a will in

which he instituted his sister Irene Pineda as the sole heiress. During his lifetime, he donated some of his

property to the six plaintiffs in this case with the condition to pay him a certain amount of rice, and

others of money every year, and with the express provision that failure to fulfil this condition would

revoke the donations ipso facto. These plaintiffs, relatives and some of them brothers of Fr. Pineda, filed

an action against the Collector of Internal Revenue as they were made to pay inheritance taxes on the

properties donated to them. They paid under protest and claimed that the donation was inter vivos,

thus not subject to inheritance tax and ordered the defendants to return to each plaintiffs the sum paid

by the latter. Dependant appealed.

ISSUE:

Whether or not the deeds of donation executed by Fr. Pineda to each of the plaintiffs are donations

inter vivos, or mortis causa, for it is the latter upon which the Administrative Code imposes inheritance

tax.

HELD:

The contentions of the plaintiffs are correct. Donations were made inter vivos; thus, they are not subject

to inheritance tax. Judgment appealed from is affirmed. In a donation mortis causa it is the donor’s

death that determines that acquisition of, or the right to, the property donated, and the donation is

revocable at the donor’s will, Where the donation took effect immediately upon the donee’s acceptance

thereof and it was subject to the resolutory condition that the donation would be rovoked if the done

did not give the donor a certain quantity of rice or sum of money, the donation is inter vivos.

Neither does the fact that these donations are revocable, give them the character of donations mortis

causa, in as much as the revocation is not the failure to fulfil the condition imposed. Neither can these

donations reconsidered as an advance on inheritance or legacy because they are neither an inheritance

nor a legacy. And it cannot be said that the plaintiffs received such advance on inheritance or legacy,

since they were not heirs or legatees of their predessor in interest upon his death. Neither can it be said

that they obtained this inheritance or legacy by virtue of a document which does not contain the

requisites of a will.

Moreover, they were made in consideration of the donor’s affection for the donees, and of the services

they had rendered him, but he has charged them with the obligation to pay him a certain amount of rice

and money, respectively, each year during his lifetime, the donations to become effective upon

acceptance. They are therefore not in the nature of donations mortis causa but inter vivos.

.

You might also like

- Fitness Vs CIR - Powers of The CIRDocument3 pagesFitness Vs CIR - Powers of The CIRCarl MontemayorNo ratings yet

- Solicitation Letter SPGDocument5 pagesSolicitation Letter SPGcatherinerenante80% (5)

- Bill Harry - The Paul McCartney Encyclopedia 4Document155 pagesBill Harry - The Paul McCartney Encyclopedia 4david.barnes386240No ratings yet

- Case 1 Tridharma Marketing Corp. Vs CTA and CIRDocument2 pagesCase 1 Tridharma Marketing Corp. Vs CTA and CIRlenvfNo ratings yet

- Values List Scott Jeffrey v2Document6 pagesValues List Scott Jeffrey v2Daniela PopaNo ratings yet

- Philippine Acetylene Co. Inc vs. CirDocument2 pagesPhilippine Acetylene Co. Inc vs. Cirbrendamanganaan100% (1)

- Domingo v. GarlitosDocument1 pageDomingo v. GarlitosJazz TraceyNo ratings yet

- CIR Vs Seagate, GR 153866Document3 pagesCIR Vs Seagate, GR 153866Mar Develos100% (1)

- CIR vs. PHILEXDocument2 pagesCIR vs. PHILEXBarem Salio-anNo ratings yet

- Rajasthan PMKK ListDocument99 pagesRajasthan PMKK ListMANOJNo ratings yet

- MARUBENI Vs CIR TAXDocument2 pagesMARUBENI Vs CIR TAXLemuel Angelo M. EleccionNo ratings yet

- CIR vs. Pilipinas ShellDocument3 pagesCIR vs. Pilipinas ShellArchie Torres88% (8)

- Gestopa vs. CA (Case Digest)Document2 pagesGestopa vs. CA (Case Digest)Angelo Castillo100% (1)

- Charles Stanley - in Touch Ministries.Document50 pagesCharles Stanley - in Touch Ministries.TheAgapeIncNo ratings yet

- GR. No. 187056Document4 pagesGR. No. 187056Joyjoy C LbanezNo ratings yet

- A - Pirovano Vs CIRDocument1 pageA - Pirovano Vs CIRceilo coboNo ratings yet

- CIR V Pilipinas ShellDocument4 pagesCIR V Pilipinas ShellCedric Enriquez100% (2)

- Coca-Cola Bottlers v. Cir DigestDocument4 pagesCoca-Cola Bottlers v. Cir DigestkathrynmaydevezaNo ratings yet

- China Banking Corporation vs. CADocument1 pageChina Banking Corporation vs. CAArmstrong BosantogNo ratings yet

- China Banking Corporation v. CIRDocument2 pagesChina Banking Corporation v. CIRRaymond Cheng80% (5)

- CIR v. Citytrust Investment Phils (2006)Document3 pagesCIR v. Citytrust Investment Phils (2006)Aila Amp100% (1)

- Bir Ruling Da 095 05Document2 pagesBir Ruling Da 095 05RB BalanayNo ratings yet

- San Roque Power Corporation Vs CirDocument2 pagesSan Roque Power Corporation Vs Cirleslansangan100% (3)

- Cir v. Domingo Jewellers Inc DigestDocument2 pagesCir v. Domingo Jewellers Inc DigestjohanyarraNo ratings yet

- Dizon Vs Posadas JRDocument1 pageDizon Vs Posadas JRArahbells100% (1)

- Spec Pro DigestDocument4 pagesSpec Pro DigestRose Ann CalanglangNo ratings yet

- Tax Case DigestDocument4 pagesTax Case DigestRuby Reyes100% (1)

- Smart Communications vs. Municipality of MalvarDocument3 pagesSmart Communications vs. Municipality of MalvarClark Edward Runes Uytico0% (1)

- Case #38 - CIR vs. United Cadiz SugarDocument2 pagesCase #38 - CIR vs. United Cadiz SugarJeffrey Magada100% (2)

- 04 - Tuason V PosadasDocument2 pages04 - Tuason V Posadascool_peachNo ratings yet

- LORENZO Vs Posadas GR. No L-43082Document4 pagesLORENZO Vs Posadas GR. No L-43082Joyjoy C LbanezNo ratings yet

- People v. Sandiganbayan DIGESTDocument4 pagesPeople v. Sandiganbayan DIGESTkathrynmaydeveza100% (1)

- Case Digest of CIR v. Aichi ForgingDocument4 pagesCase Digest of CIR v. Aichi ForgingJeng Pion100% (1)

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)

- 52 CIR V LedesmaDocument4 pages52 CIR V LedesmaMiggy CardenasNo ratings yet

- Tax 2 Digest (0406) GR 108576 012099 Cir Vs CaDocument3 pagesTax 2 Digest (0406) GR 108576 012099 Cir Vs CaAudrey Deguzman100% (1)

- CIR V GR. No 140230Document3 pagesCIR V GR. No 140230Joyjoy C LbanezNo ratings yet

- BIR Vs First E-Bank Tower Condominium CorpDocument3 pagesBIR Vs First E-Bank Tower Condominium CorpHaniya Solaiman Guro50% (2)

- Javier v. AnchetaDocument1 pageJavier v. AnchetaGSSNo ratings yet

- MARCOS II Vs GR. No. 120880Document2 pagesMARCOS II Vs GR. No. 120880Joyjoy C Lbanez75% (4)

- Philippine Airlines vs. Commissioner of Internal RevenueDocument3 pagesPhilippine Airlines vs. Commissioner of Internal RevenueGenebva Mica NodaloNo ratings yet

- Dizon V CTA DigestDocument2 pagesDizon V CTA DigestNicholas FoxNo ratings yet

- F - CIR Vs LaraDocument1 pageF - CIR Vs Laraceilo cobo50% (2)

- Digest CIR Vs PinedaDocument2 pagesDigest CIR Vs PinedaLoraine Ferrer100% (1)

- Angeles Ubalde Puig, Et Al. vs. Estella Magbanua Peñaflorida, Et Al. G.R. No. L-15939 January 31, 1966Document1 pageAngeles Ubalde Puig, Et Al. vs. Estella Magbanua Peñaflorida, Et Al. G.R. No. L-15939 January 31, 1966Joyjoy C LbanezNo ratings yet

- CIR v. CADocument2 pagesCIR v. CAKristina Karen100% (1)

- Zapanta Vs PosadasDocument1 pageZapanta Vs PosadasThomas EdisonNo ratings yet

- Vegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Document2 pagesVegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Maria Fiona Duran MerquitaNo ratings yet

- 28 Municipality of Cainta Vs City of PasigDocument2 pages28 Municipality of Cainta Vs City of Pasighigoremso giensdks100% (3)

- People Vs BalagtasDocument2 pagesPeople Vs BalagtasBilly100% (2)

- 05 - Dison vs. PosadasDocument2 pages05 - Dison vs. Posadascool_peach100% (1)

- Freila Digest - Lladoc Vs CirDocument1 pageFreila Digest - Lladoc Vs CirRen MagallonNo ratings yet

- TORTS DIGEST Kim vs. Phil AerialDocument1 pageTORTS DIGEST Kim vs. Phil AerialCamille GrandeNo ratings yet

- Iloilo Bottlers, Inc. v. City of IloiloDocument1 pageIloilo Bottlers, Inc. v. City of IloiloRNicolo BallesterosNo ratings yet

- Electrical Principles UnitDocument22 pagesElectrical Principles UnitJoyjoy C LbanezNo ratings yet

- Kepco vs. CIR Case DigestDocument2 pagesKepco vs. CIR Case DigestJeremiah Trinidad100% (2)

- People v. Kintanar CTADocument3 pagesPeople v. Kintanar CTAMark CapaciteNo ratings yet

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- Cir vs. Pineda, 21 Scra 105 PDFDocument1 pageCir vs. Pineda, 21 Scra 105 PDFJo DevisNo ratings yet

- 03 - Zapanta V PosadasDocument2 pages03 - Zapanta V Posadascool_peach100% (3)

- 4 - MELECIO R. DOMINGO vs. HON. LORENZO C. GARLITOS - DelfinDocument2 pages4 - MELECIO R. DOMINGO vs. HON. LORENZO C. GARLITOS - DelfinElla CanuelNo ratings yet

- Delpher Trades Corporation vs. IACDocument1 pageDelpher Trades Corporation vs. IACGeoanne Battad Beringuela100% (1)

- Renato V. Diaz V. Secretary of Finance, GR No. 193007, 2011-07-19 FactsDocument2 pagesRenato V. Diaz V. Secretary of Finance, GR No. 193007, 2011-07-19 FactsyetyetNo ratings yet

- Cuyugan Vs Santos G.R. No. L-10265 March 3, 1916Document3 pagesCuyugan Vs Santos G.R. No. L-10265 March 3, 1916Betty Jadina100% (1)

- Soriamont Steamship v. SprintDocument2 pagesSoriamont Steamship v. Sprintd2015memberNo ratings yet

- People vs. Kintanar Case DigestDocument4 pagesPeople vs. Kintanar Case DigestKatNo ratings yet

- Cainta vs. Pasig & Uniwide SalesDocument10 pagesCainta vs. Pasig & Uniwide SalesmarjNo ratings yet

- Atty DinoDocument2 pagesAtty DinoBlanche Khaylil Dela CuestaNo ratings yet

- Taxation Case DigestDocument4 pagesTaxation Case DigestArden KimNo ratings yet

- Pastor V CA Case DigestDocument4 pagesPastor V CA Case DigestNiño CarbonillaNo ratings yet

- G.R. No. L-29204 December 29, 1928 RUFINA ZAPANTA, ET AL., Plaintiffs-Appellees, JUAN POSADAS, JR., ET AL., Defendants-AppellantsDocument4 pagesG.R. No. L-29204 December 29, 1928 RUFINA ZAPANTA, ET AL., Plaintiffs-Appellees, JUAN POSADAS, JR., ET AL., Defendants-AppellantsZiad DnetNo ratings yet

- Zapanta vs. PosadasDocument4 pagesZapanta vs. PosadasKennethQueRaymundoNo ratings yet

- Case DigestDocument1 pageCase DigestJoyjoy C LbanezNo ratings yet

- Solar PowerDocument32 pagesSolar PowerJoyjoy C LbanezNo ratings yet

- Machine GuardingDocument5 pagesMachine GuardingJoyjoy C LbanezNo ratings yet

- Third Division (G.R. NO. 135222, March 04, 2005)Document7 pagesThird Division (G.R. NO. 135222, March 04, 2005)Joyjoy C LbanezNo ratings yet

- B-711 Purpose: Agency Name Chapter No./Name Part No./Name Section No./Name Document No./Name Dates Issue EffectiveDocument3 pagesB-711 Purpose: Agency Name Chapter No./Name Part No./Name Section No./Name Document No./Name Dates Issue EffectiveJoyjoy C LbanezNo ratings yet

- Edhi Sample ReportDocument30 pagesEdhi Sample Reporthoor e ainNo ratings yet

- CSR Activities by National Bank LTDDocument3 pagesCSR Activities by National Bank LTDangelNo ratings yet

- Colorado Life Fundraising Starter KitDocument4 pagesColorado Life Fundraising Starter KitJennyNo ratings yet

- Brittany Huonker ResumeDocument2 pagesBrittany Huonker Resumeapi-300167951No ratings yet

- Salem Witchcraft: Charles W. UphamDocument9 pagesSalem Witchcraft: Charles W. UphamGutenberg.org0% (1)

- NSP Impact Report 2006Document20 pagesNSP Impact Report 2006LIFTcommunitiesNo ratings yet

- WAQFDocument7 pagesWAQFanon_140077520No ratings yet

- TWC - Congress Members 3Document27 pagesTWC - Congress Members 3api-257938623No ratings yet

- 07 27 16Document20 pages07 27 16grapevineNo ratings yet

- Hari Keluarga SMK ST Anthony Teluk IntanDocument3 pagesHari Keluarga SMK ST Anthony Teluk IntanHusna IzaNo ratings yet

- Astrology and Your PersonalityDocument4 pagesAstrology and Your PersonalitySonu JaiswalNo ratings yet

- Past Simple and Present PerfectDocument4 pagesPast Simple and Present PerfectAnh Kiều Thị LanNo ratings yet

- Patricia Kenady - ch04 News Release 1Document2 pagesPatricia Kenady - ch04 News Release 1api-432657565No ratings yet

- The Risk Assessment Cycle 1660262208Document3 pagesThe Risk Assessment Cycle 1660262208Mustafa HassanNo ratings yet

- Tax Incentives For CSR Activities - Mr. Yaacob Othman IRBMDocument17 pagesTax Incentives For CSR Activities - Mr. Yaacob Othman IRBMRajiv ThambotheranNo ratings yet

- Molleno ProductionDocument35 pagesMolleno ProductionBernardino VirgilioNo ratings yet

- GLN Returns FormDocument13 pagesGLN Returns FormKbNo ratings yet

- Test About Good Citizen - CorrectionDocument2 pagesTest About Good Citizen - CorrectionDjaouida BoucedraNo ratings yet

- Miri Rubin Charity and Community in Medieval Cambridge Cambridge Studies in Medieval Life and Thought Fourth Series 2002Document379 pagesMiri Rubin Charity and Community in Medieval Cambridge Cambridge Studies in Medieval Life and Thought Fourth Series 2002Joao GomesNo ratings yet

- Donate To Vedic SchoolDocument3 pagesDonate To Vedic SchoolSrinivas VamsiNo ratings yet

- Wildlife Clubs of Seychelles FactsheetDocument2 pagesWildlife Clubs of Seychelles Factsheetapi-348135772No ratings yet

- Rcy LDP NotesDocument4 pagesRcy LDP NotesDisk OdetteNo ratings yet

- Bottesford Village Voice Issue 78Document8 pagesBottesford Village Voice Issue 78robinnjNo ratings yet

- QuizDocument4 pagesQuizampalNo ratings yet

- Donation Form: Please Mail This Completed Form To: American Red Cross PO Box 37839 Boone, Iowa 50037-0839Document1 pageDonation Form: Please Mail This Completed Form To: American Red Cross PO Box 37839 Boone, Iowa 50037-0839Fawaid BudiyantoNo ratings yet