Professional Documents

Culture Documents

009 DCFValuation MC 2RVsNegC

009 DCFValuation MC 2RVsNegC

Uploaded by

Monit Goyal0 ratings0% found this document useful (0 votes)

14 views2 pagesvaluation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentvaluation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pages009 DCFValuation MC 2RVsNegC

009 DCFValuation MC 2RVsNegC

Uploaded by

Monit Goyalvaluation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

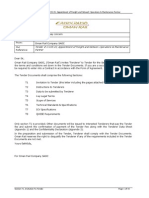

A B C D E F G H

1 Earthilizer Project --- Valuation Model Setup

2

3 Certain inputs to valuation Value

4 Initial investment in plant and equipment ($000) 330.00

5 Initial new working capital requirements ($000) 250.00

6 Fixed Operating Costs ($000) 115.00

7 Depreciation Method Straight Line Equation in B14 <-- =D14+D23*(E14-D14)

8 Depreciable life of plant and equipment (Years) 10.00 Equation in B15 <-- =IF(AND(0<D24,D24<G17),G18,G19)

9 Tax Rate 0.30

10 Net Working Capital / Sales 0.25

11 Project WACC 0.1325

12

13 Uncertain (potentially) inputs to valuation Simulated Value Distribution Min Max Most likely Uncorr. Univ. RV

14 Base year sales for 2011 ($000) 710.93 Uniform 500.00 1,500.00 0.21 <-- =RAND()

15 Expected sales Growth Rate 0.1701 Triangular -0.10 0.30 0.10 0.11 <-- =RAND()

16 Gross Profit / Sales 0.33 Non-Stochastic Supporting Calculations Triang. D.

17 Variable Operating Expenses (before depr.) / Sales 0.10 Non-Stochastic Calculate Th 0.5000 <-- =(F15-D15)/(E15-D15)

18 Terminal value multiple of PPE book value 1.00 Non-Stochastic Case if 0 < u i < Th 0.1512 <-- =D15+SQRT(D24*(E15-D15)*(F15-D15))

19 Terminal value multiple of NWC book values 1.00 Non-Stochastic Case if Th <= u i <= 1 0.1701 <-- =E15-SQRT((1-D24)*(E15-D15)*(E15-F15))

20

21 Supplementary Calculations for Cholesky Decomposition

22 Correlation Coefficient Uncorr. Std. Norm. RV Corr. Std. Norm. RV Corr. Univ. RV

23 -1.00 -0.80 -0.80 0.21 <-- =NORM.S.DIST(C23,1)

24 -1.22 0.80 0.79 <-- =NORM.S.DIST(C24,1)

25 <-- =NORM.S.INV(G15) <-- =A23*B23+SQRT(1-A23^2)*B24

26

27 FCF Calculations ($000) 2010 2011 2012 2013 2014 2015

28 Revenues 710.93 831.86 973.36 1,138.93 1,332.65 <-- =F28*(1+$B$15)

29 Less: Cost of goods sold -479.17 -560.68 -656.04 -767.64 -898.21 <-- =-G28*(1-$B$16)

30 Equals: Gross profit 231.76 271.19 317.32 371.29 434.45 <-- =G28+G29

31 Less: Operating expenses before depreciation -186.09 -198.19 -212.34 -228.89 -248.27 <-- =-($B$6+$B$17*G28)

32 Equals: EBITDA 45.67 73.00 104.98 142.40 186.18 <-- =G30+G31

33 Less: Depreciation and amortization -33.00 -33.00 -33.00 -33.00 -33.00 <-- =-($B$4/$B$8)

34 Equals: EBIT 12.67 40.00 71.98 109.40 153.18 <-- =G32+G33

35 Less: Tax -3.80 -12.00 -21.59 -32.82 -45.95 <-- =-G34*$B$9

36 Equals: NOPAT (Net op. profits after taxes) 8.87 28.00 50.39 76.58 107.23 <-- =G34+G35

37 Plus: Depreciation 33.00 33.00 33.00 33.00 33.00 <-- =-G33

38 Less: Capital expenditures -330.00

39 Help Row: level of working capital -177.73 -207.97 -243.34 -284.73 -333.16 <-- =G28*$B$10*(-1)

40 Less: Investment in net working capital -250.00 72.27 -30.23 -35.37 -41.39 -48.43 <-- =G39-F39

41 plus: Liquidation of Net Working Capital 333.16 <-- =(-1)*G39

42 plus: Liquidation of PP&E 165.00 <-- =(-1)*B38-C37-D37-E37-F37-G37

43 Equals: Project Free Cash Flow (PFCF) -580.00 114.14 30.77 48.01 68.19 589.96 <-- =G36+G37+G40+G41+G42

44

45 Valuation Output

46 NPV -64.03 <-- =NPV(B11,C43:G43)+B43

47 Internal Rate of Return (IRR) 0.0991 <-- =IRR(B43:G43)

48

A B C D E F G H

49 Monte Carlo Simulation + Analysis of Output

50 Run BYS Exp. SGR NPV Some summary statistics of the simulated RVs

51 710.93 0.17 -64.03 Mean BYS 1,000.34 <-- =AVERAGE(B51:B5051)

52 1 1,458.13 -0.04 112.45 Mean SGR 0.10 <-- =AVERAGE(C51:C5051)

53 2 1,416.16 -0.02 121.66 Corr. BYS and SGR -0.99 <-- =CORREL(B52:B5051,C52:C5051)

54 3 805.89 0.14 -27.99

55 4 609.00 0.21 -102.05

56 5 1,163.40 0.06 92.95 Some summary statistics of the simulation output

57 6 506.57 0.28 -124.28 Mean NPV 25.36 <-- =AVERAGE(D51:D5051)

58 7 513.15 0.27 -126.04 SD NPV 84.35 <-- =STDEV.P(D51:D5051)

59 8 1,115.27 0.08 80.04 Confidence Interv. 2.34 <-- =CONFIDENCE.NORM(0.05,G58,5000)

60 9 707.93 0.17 -65.18 5%-Percentile -120.93 <-- =PERCENTILE.EXC(D51:D5051,0.05)

61 10 1,353.06 0.01 123.51 Prob. of NPV>0 0.621

62 11 949.58 0.11 25.05 Min NPV -126.31 <-- =MIN(D51:D5051)

63 12 892.09 0.12 4.12 Max NPV 123.95 <-- =MAX(D51:D5051)

64 13 1,266.83 0.04 114.45

65 14 1,063.37 0.09 64.38

66 15 1,144.24 0.07 88.01 Manual graphing of histogram

67 16 689.14 0.18 -72.32

68 17 908.41 0.12 10.10 Bins Frequency

69 18 909.55 0.12 10.52 -250 0 <-- =COUNTIF($D$51:$D$5051,"<"&F69)

70 19 535.53 0.25 -124.29 -225 0 <-- =COUNTIF($D$51:$D$5051,"<"&F70)-SUM($G$69:G69)

71 20 1,427.63 -0.02 120.05 -200 0

72 21 656.18 0.19 -84.76 -175 0

73 22 698.25 0.17 -68.86 -150 0

74 23 596.86 0.21 -106.31 -125 125

75 24 701.99 0.17 -67.44 -100 454

76 25 756.34 0.16 -46.75 -75 331

77 26 996.91 0.10 41.97 -50 349

78 27 974.22 0.11 33.89 -25 316

79 28 1,147.16 0.07 88.78 0 325

80 29 532.93 0.25 -124.77 25 331

81 30 1,170.10 0.06 94.62 50 359

82 31 1,058.44 0.09 62.80 75 415

83 32 511.51 0.27 -125.80 100 526

84 33 1,179.33 0.06 96.86 125 1,470

85 34 1,251.56 0.04 111.90 150 0

86 35 573.68 0.22 -114.02 175 0

87 36 815.19 0.14 -24.48 200 0

88 37 1,162.69 0.06 92.78 225 0

89 38 1,442.63 -0.03 117.04 250 0

90 39 596.19 0.21 -106.54 275 0

91 40 988.35 0.10 38.93 300 0

92 41 1,056.70 0.09 62.24 325 0

93 42 907.14 0.12 9.64 350 0

94 43 977.52 0.10 35.07 375 0

95 44 962.72 0.11 29.78 400 0

96 45 1,258.68 0.04 113.12 More -1 <-- =5000-SUM(G69:G95)

97 46 619.02 0.20 -98.46

98 47 1,405.70 -0.01 122.71

99 48 689.42 0.18 -72.22

100 49 1,011.09 0.10 46.96 Histogram

101 50 738.68 0.16 -53.47

102 51 944.36 0.11 23.17 1,600

103 52 848.04 0.13 -12.19 1,400

104 53 1,170.06 0.06 94.61

1,200

105 54 1,208.00 0.05 103.37

106 55 1,150.61 0.07 89.68 1,000

107 56 1,004.47 0.10 44.64 800

108 57 720.76 0.17 -60.29

600

109 58 534.62 0.25 -124.46

110 59 1,191.43 0.06 99.69 400

111 60 990.86 0.10 39.82 200

112 61 607.80 0.21 -102.48 0

113 62 1,043.82 0.09 58.05

114 63 595.01 0.21 -106.94 -200

115 64 629.13 0.20 -94.79

116 65 1,071.68 0.09 67.00

You might also like

- Little Einstein Study Hub: A Business ProposalDocument19 pagesLittle Einstein Study Hub: A Business ProposalJoy-Aira Sedillo75% (4)

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case SolutiontroyanxNo ratings yet

- Corporate Financial Management 5th Edition Glen Arnold Solutions ManualDocument25 pagesCorporate Financial Management 5th Edition Glen Arnold Solutions ManualDonnaNguyengpij98% (52)

- Chapter 12 SolutionsDocument10 pagesChapter 12 Solutionshassan.murad100% (2)

- Heriot-Watt University Dubai Campus: ReceiptDocument2 pagesHeriot-Watt University Dubai Campus: ReceiptMuhammadnasidiNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- FOURmula OneDocument15 pagesFOURmula Onejona phie Montero100% (1)

- Assignment SMEDocument22 pagesAssignment SME114850% (2)

- Maine Republic Journal - All Debts Are PrepaidDocument10 pagesMaine Republic Journal - All Debts Are PrepaidAnonymous nYwWYS3ntV100% (3)

- F9 Mock Exam June 2020 - Answers PDFDocument9 pagesF9 Mock Exam June 2020 - Answers PDFNguyễn Quốc TuấnNo ratings yet

- Ch11 Tool KitDocument368 pagesCh11 Tool KitRoy HemenwayNo ratings yet

- Ch11 - Excel For StudentsDocument90 pagesCh11 - Excel For StudentsSimran Kaur100% (1)

- Lec 11 Cash Flow Estimation Risk Analysis Part 2 21102021 121652pmDocument62 pagesLec 11 Cash Flow Estimation Risk Analysis Part 2 21102021 121652pmosamaNo ratings yet

- Amberwood - 2013 Purchase Analysis - FormulasDocument2 pagesAmberwood - 2013 Purchase Analysis - FormulasBlue8SeaNo ratings yet

- 2022 Ebmv301 TM2 MemoDocument7 pages2022 Ebmv301 TM2 MemoSouthNo ratings yet

- ISE307 153 Final SolvedDocument10 pagesISE307 153 Final SolvedMmNo ratings yet

- 2015 FBS200 Year Test 2 Final Solution - Revised Fabularies June 2017Document10 pages2015 FBS200 Year Test 2 Final Solution - Revised Fabularies June 2017ger pingNo ratings yet

- Solution To 4.13Document5 pagesSolution To 4.13Niyati ShahNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- 2017 FRK 100 Year Test 2 Suggested SolutionDocument5 pages2017 FRK 100 Year Test 2 Suggested SolutionFrederick LekalakalaNo ratings yet

- IFRS-9 SolutionDocument2 pagesIFRS-9 SolutionWaseim khan Barik zaiNo ratings yet

- Lesson 25Document15 pagesLesson 25TUẤN TRẦN MINHNo ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (29)

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- Financial Results For The Quarter Ended 30.09.23Document5 pagesFinancial Results For The Quarter Ended 30.09.23thirudi1980No ratings yet

- Luehrman With ValuesDocument4 pagesLuehrman With ValuesTejdeep ReddyNo ratings yet

- GDV: TDC:: Per PeriodDocument9 pagesGDV: TDC:: Per PeriodM. HfizzNo ratings yet

- Clarkson Lumber CompanyDocument6 pagesClarkson Lumber Companymalishka1025No ratings yet

- 2022 Grade 11 Provincial Examination Accounting P1 (English) June 2022 Possible AnswersDocument10 pages2022 Grade 11 Provincial Examination Accounting P1 (English) June 2022 Possible AnswersChantelle IsaksNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriesRoger FedererNo ratings yet

- Dwnload Full Corporate Financial Management 5th Edition Glen Arnold Solutions Manual PDFDocument35 pagesDwnload Full Corporate Financial Management 5th Edition Glen Arnold Solutions Manual PDFhofstadgypsyus100% (17)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- Name: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureDocument8 pagesName: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureErick KinotiNo ratings yet

- Saving For Retirement Inputs: Step 5 Anlsav Step 6 (C24+D24) DivretDocument2 pagesSaving For Retirement Inputs: Step 5 Anlsav Step 6 (C24+D24) DivretKhalid SediqiNo ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- Daimler Ir Annual Report 2020 Incl Combined Management Report Daimler AgDocument267 pagesDaimler Ir Annual Report 2020 Incl Combined Management Report Daimler AgSaba MasoodNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriestarunyadavfutureNo ratings yet

- Full Download Corporate Financial Management 5th Edition Glen Arnold Solutions ManualDocument35 pagesFull Download Corporate Financial Management 5th Edition Glen Arnold Solutions Manualmasonh7dswebb100% (40)

- Daimler Ir Annual Report 2018Document353 pagesDaimler Ir Annual Report 2018ennnnnnnnNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- ICAP Cost Past PaperDocument9 pagesICAP Cost Past Paperfarooqshah4uNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersDocument8 pages2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersChantelle IsaksNo ratings yet

- Chapter 16: Tool Kit For Working Capital ManagementDocument23 pagesChapter 16: Tool Kit For Working Capital ManagementosamaNo ratings yet

- Term Test 2 SolutionDocument5 pagesTerm Test 2 Solutionlalshahbaz57No ratings yet

- FINANCIAL MANAGEMENT Sesi 5Document4 pagesFINANCIAL MANAGEMENT Sesi 5hestiyaaNo ratings yet

- HCL Income StatementDocument4 pagesHCL Income StatementAswini Kumar BhuyanNo ratings yet

- 722772-6-1EX7-i4 (4 Files Merged)Document4 pages722772-6-1EX7-i4 (4 Files Merged)erferNo ratings yet

- Analysis Investment ProjectDocument13 pagesAnalysis Investment ProjectsolomonNo ratings yet

- Assignment Briefs (Module 4)Document8 pagesAssignment Briefs (Module 4)aung sanNo ratings yet

- Flexible Pavement Design - Page 3Document1 pageFlexible Pavement Design - Page 3RigonDECNo ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Statement of Profit and Loss: Particulars For The Year Ended 31st March 2020 (RS)Document8 pagesStatement of Profit and Loss: Particulars For The Year Ended 31st March 2020 (RS)nidhidNo ratings yet

- AY5122 Semester 2 2022 2023 StudentsDocument8 pagesAY5122 Semester 2 2022 2023 StudentsRahulNo ratings yet

- APT Tax AssignmentDocument11 pagesAPT Tax AssignmentMalik JavidNo ratings yet

- f9 Answer-Mock-Exam-F9Document9 pagesf9 Answer-Mock-Exam-F9amalthomas557No ratings yet

- Taxation 302Document5 pagesTaxation 302MGCININo ratings yet

- Solution ManualDocument12 pagesSolution ManualReyna BaculioNo ratings yet

- Instructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYFrom EverandInstructor's Manual to Accompany CALCULUS WITH ANALYTIC GEOMETRYNo ratings yet

- Preparing Your Business Plan: DisclaimerDocument16 pagesPreparing Your Business Plan: DisclaimerYan Jie ChongNo ratings yet

- Mitc Gold RCPDocument6 pagesMitc Gold RCPu4rishiNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Oman Rail OM Partner TenderDocument15 pagesOman Rail OM Partner TenderManish GajbeNo ratings yet

- PT Kalbe Farma TBK.: Summary of Financial StatementDocument2 pagesPT Kalbe Farma TBK.: Summary of Financial StatementIshidaUryuuNo ratings yet

- Republic Act 9700Document24 pagesRepublic Act 9700ghernocomNo ratings yet

- Barnet Council - Corporate Risk RegisterDocument8 pagesBarnet Council - Corporate Risk RegisterRoger TichborneNo ratings yet

- PDF 4697270 InvoiceDocument2 pagesPDF 4697270 InvoiceAmis2018 Amis2018No ratings yet

- 11 TaguigCity2013 Part4 AnnexesDocument108 pages11 TaguigCity2013 Part4 AnnexesRoselle SNo ratings yet

- GenMath11 Q2 Mod9 Basic-Concepts-of-Loans Version2Document10 pagesGenMath11 Q2 Mod9 Basic-Concepts-of-Loans Version2Angelica ZipaganNo ratings yet

- FABM2 Module 05 (Q1-W6)Document12 pagesFABM2 Module 05 (Q1-W6)Christian ZebuaNo ratings yet

- PIC/Inter G-2/NOV-22/Audit/CH-3/2 Half Marks: 39 TIME: 1:30 HourDocument4 pagesPIC/Inter G-2/NOV-22/Audit/CH-3/2 Half Marks: 39 TIME: 1:30 HourGaurav rajNo ratings yet

- Message 487 Message IdentifierDocument4 pagesMessage 487 Message Identifiergohoji4169No ratings yet

- Economic Lies and Cuts NOVEMBER 28 2010Document19 pagesEconomic Lies and Cuts NOVEMBER 28 2010Richard DraytonNo ratings yet

- Real P & TCCDocument9 pagesReal P & TCCCloieRjNo ratings yet

- Solan Project With Gantt ChartDocument36 pagesSolan Project With Gantt ChartAltaf AhamedNo ratings yet

- Chapter 3 How Securities Are Traded: Multiple Choice QuestionsDocument28 pagesChapter 3 How Securities Are Traded: Multiple Choice QuestionsSarah100% (1)

- Cik ListDocument8 pagesCik ListStaurt AttkinsNo ratings yet

- General Banking of Sonali BankDocument29 pagesGeneral Banking of Sonali BankMohidul Islam MuhitNo ratings yet

- Solution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionDocument24 pagesSolution Manual For Cost Accounting Foundations and Evolutions Kinney Raiborn 9th EditionJenniferLeonyowc100% (33)

- Analyzing The Implementation Universal Basic Income Policy Across Iran and UKDocument12 pagesAnalyzing The Implementation Universal Basic Income Policy Across Iran and UKDuncan MwauraNo ratings yet

- Debt Collector DirectDocument1 pageDebt Collector DirectRandy RoxxNo ratings yet

- Coca-Cola's Valuation, Warren Buffett's 1988 PurchaseDocument7 pagesCoca-Cola's Valuation, Warren Buffett's 1988 PurchaseDMNo ratings yet

- CA Exam Preparation Guidelines by MahfuzDocument11 pagesCA Exam Preparation Guidelines by MahfuzssalmahfuzNo ratings yet

- Corporations, Issue of Common StockDocument5 pagesCorporations, Issue of Common StockSheikh RakinNo ratings yet