Professional Documents

Culture Documents

Form 706-NA Estate Tax Return for Nonresident Alien

Uploaded by

douglas jonesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 706-NA Estate Tax Return for Nonresident Alien

Uploaded by

douglas jonesCopyright:

Available Formats

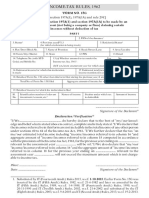

Form 706-NA United States Estate (and Generation-Skipping Transfer) Tax Return

Estate of nonresident not a citizen of the United States

To be filed for decedents dying after December 31, 2011. OMB No. 1545-0531

(Rev. June 2019)

Go to www.irs.gov/Form706NA for instructions and the latest information.

▶ File Form 706-NA at the following address:

Department of the Treasury

Internal Revenue Service Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999.

Attach supplemental documents and translations. Show amounts in U.S. dollars.

Part I Decedent, Executor, and Attorney

1a Decedent’s first (given) name and middle initial b Decedent’s last (family) name 2 U.S. taxpayer ID number (if any)

3 Place of death 4 Domicile at time of death 5 Citizenship (nationality) 6 Date of death

7a Date of birth b Place of birth 8 Business or occupation

9a Name of executor

b Address (city or town, state or province, country, and ZIP or foreign postal code)

c Telephone number d Fax number e Email address

10a Name of attorney for estate

b Address (city or town, state or province, country, and ZIP or foreign postal code)

c Telephone number d Fax number e Email address

11 If there are multiple executors or attorneys, check here and attach a list of the names, addresses, telephone numbers, fax

numbers, and email addresses of the additional executors or attorneys.

Part II Tax Computation

1 Taxable estate from Schedule B, line 9 . . . . . . . . . . . . . . . . . . . . . 1

2 Total taxable gifts of tangible or intangible property located in the U.S., transferred (directly or indirectly)

by the decedent after December 31, 1976, and not included in the gross estate (see section 2511) . . 2

3 Total. Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Tentative tax on the amount on line 3 (see instructions) . . . . . . . . . . . . . . . . 4

5 Tentative tax on the amount on line 2 (see instructions) . . . . . . . . . . . . . . . . 5

6 Gross estate tax. Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . 6

7 Unified credit. Enter smaller of line 6 amount or maximum allowed (see instructions) . . . . . . 7

8 Balance. Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . 8

9 Other credits (see instructions) . . . . . . . . . . . . . . . . 9

10 Credit for tax on prior transfers. Attach Schedule Q, Form 706 . . . . . 10

11 Total. Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Net estate tax. Subtract line 11 from line 8 . . . . . . . . . . . . . . . . . . . . 12

13 Total generation-skipping transfer tax. Attach Schedule R, Form 706 . . . . . . . . . . . 13

14 Total transfer taxes. Add lines 12 and 13 . . . . . . . . . . . . . . . . . . . . 14

15 Earlier payments. See instructions and attach explanation . . . . . . . . . . . . . . . 15

16 Balance due. Subtract line 15 from line 14 (see instructions) . . . . . . . . . . . . . . 16

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. I understand that a complete return requires listing all property constituting the part of the decedent’s gross estate (as defined by the statute)

situated in the United States. Declaration of preparer (other than the executor) is based on all information of which preparer has any knowledge.

May the IRS discuss this return

▲ ▲

▲ ▲

with the preparer shown below?

Sign Signature of executor Date See instructions.

Here Yes No

Signature of executor Date

Print/Type preparer’s name Preparer’s signature Date PTIN

Paid Check if

self-employed

Preparer

Firm’s name ▶ Firm’s EIN ▶

Use Only Firm’s address ▶ Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 10145K Form 706-NA (Rev. 6-2019)

Form 706-NA (Rev. 6-2019) Page 2

Part III General Information

Authorization to receive confidential tax information under Regulations section 601.504(b)(2), to act as the estate’s representative before

the IRS, and/or to make written or oral presentations on behalf of the estate:

Name of representative (print or type) License state Address (city or town, state or province, country, and ZIP or foreign postal code)

I declare that I am the attorney/ certified public accountant/ enrolled agent/ other representative (check the applicable

box) for the executor. If licensed to practice in the United States, I am not under suspension or disbarment from practice before the Internal

Revenue Service and am qualified to practice in the state shown above. If not licensed to practice in the United States, check here.

Signature CAF number Date Telephone number

Yes No Yes No

1a Did the decedent die testate? . . . . . 7 Did the decedent make any transfer (of

b Were letters testamentary or of administration property that was located in the United States

at either the time of the transfer or the time of

granted for the estate? . . . . . . .

death) described in section 2035, 2036, 2037,

If granted to persons other than those filing the or 2038? See the instructions for Form 706,

return, include names and addresses on page 1. Schedule G . . . . . . . . . . .

2 Did the decedent, at the time of death, own any: If “Yes,” attach Schedule G, Form 706.

a Real property located in the United States? . 8 At the date of death, were there any trusts in

b U.S. corporate stock? . . . . . . . . existence that were created by the decedent

c Debt obligations of (1) a U.S. person; or (2) the and that included property located in the

United States, a state or any political United States either when the trust was

subdivision, or the District of Columbia? . created or when the decedent died? . . .

d Other property located in the United States? . If “Yes,” attach Schedule G, Form 706.

3 Was the decedent engaged in business in the 9 At the date of death, did the decedent:

United States at the date of death? . . . a Have a general power of appointment over

4 At the date of death, did the decedent have any property located in the United States? .

access, personally or through an agent, to a b Or, at any time, exercise or release the power?

safe deposit box located in the United States? If “Yes” to either a or b, attach Schedule H,

5 At the date of death, did the decedent own Form 706.

any property located in the United States as a 10a Have federal gift tax returns ever been filed? .

joint tenant with right of survivorship; as a

tenant by the entirety; or, with surviving b Periods covered ▶

spouse, as community property? . . . . c IRS offices where filed ▶

If “Yes,” attach Schedule E, Form 706. 11 Does the gross estate in the United States

6a Had the decedent ever been a citizen or resident include any interests in property transferred to

of the United States? See instructions . . . a “skip person” as defined in the instructions

b If “Yes,” did the decedent lose U.S. citizenship or for Schedule R of Form 706? . . . . .

residency within 10 years of death? See instructions If “Yes,” attach Schedules R and/or R-1, Form 706.

Schedule A. Gross Estate in the United States (see instructions) Yes No

Do you elect to value the decedent’s gross estate at a date or dates after the decedent’s death (as authorized by section 2032)? ▶

To make the election, you must check this box ‘‘Yes.’’ If you check ‘‘Yes,’’ complete all columns. If you check ‘‘No,’’ complete

columns (a), (b), and (e); you may leave columns (c) and (d) blank or you may use them to expand your column (b) description.

(a) (b) (c) (d) (e)

Item Description of property and securities Alternate Alternate value in Value at date of

no. For securities, give CUSIP number valuation date U.S. dollars death in U.S. dollars

(If you need more space, attach additional sheets of same size.)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule B. Taxable Estate (Caution: You must document lines 2 and 4 for the deduction on line 5 to be allowed.)

1 Gross estate in the United States (Schedule A total) . . . . . . . . . . . . . . . . . 1

2 Gross estate outside the United States (see instructions) . . . . . . . . . . . . . . . 2

3 Entire gross estate wherever located. Add amounts on lines 1 and 2 . . . . . . . . . . . 3

4 Amount of funeral expenses, administration expenses, decedent’s debts, mortgages and liens, and

losses during administration. Attach itemized schedule (see instructions) . . . . . . . . . . 4

5 Deduction for expenses, claims, etc. Divide line 1 by line 3 and multiply the result by line 4 . . . . 5

6 Charitable deduction (attach Schedule O, Form 706) and marital deduction (attach Schedule M, Form

706, and computation) . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 State death tax deduction (see instructions) . . . . . . . . . . . . . . . . . . . 7

8 Total deductions. Add lines 5, 6, and 7 . . . . . . . . . . . . . . . . . . . . . 8

9 Taxable estate. Subtract line 8 from line 1. Enter here and on line 1 of Part II . . . . . . . . . 9

Form 706-NA (Rev. 6-2019)

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Generation-Skipping Transfer Tax Return For Distributions: General InformationDocument1 pageGeneration-Skipping Transfer Tax Return For Distributions: General Informationdouglas jonesNo ratings yet

- Amended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesDocument4 pagesAmended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesMoose112No ratings yet

- United States Additional Estate Tax Return: General InformationDocument4 pagesUnited States Additional Estate Tax Return: General Informationdouglas jonesNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDocument28 pagesUnited States Estate (And Generation-Skipping Transfer) Tax ReturnsirpiekNo ratings yet

- F 706Document31 pagesF 706Bogdan PraščevićNo ratings yet

- F1040nre 2012 PDFDocument2 pagesF1040nre 2012 PDFJohanna AriasNo ratings yet

- Tax Form Template 21 Page1 0001Document1 pageTax Form Template 21 Page1 0001ayesha mihiraniNo ratings yet

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDocument29 pagesUnited States Estate (And Generation-Skipping Transfer) Tax Returndouglas jonesNo ratings yet

- Form 709 US Gift Tax ReturnDocument4 pagesForm 709 US Gift Tax ReturnHazem El SayedNo ratings yet

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDocument31 pagesUnited States Estate (And Generation-Skipping Transfer) Tax ReturnHazem El SayedNo ratings yet

- Form 3520-A (Rev. December 2023)Document5 pagesForm 3520-A (Rev. December 2023)Jeff LouisNo ratings yet

- Certificate of Payment of Foreign Death TaxDocument3 pagesCertificate of Payment of Foreign Death Taxdouglas jonesNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Application For Registration: (For Certain Excise Tax Activities)Document6 pagesApplication For Registration: (For Certain Excise Tax Activities)douglas jonesNo ratings yet

- U.S. Departing Alien Income Tax Return: Print or TypeDocument4 pagesU.S. Departing Alien Income Tax Return: Print or TypeDavid WebbNo ratings yet

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- File PDFDocument18 pagesFile PDFAmanda CoffeyNo ratings yet

- US Internal Revenue Service: F3520a - 1999Document4 pagesUS Internal Revenue Service: F3520a - 1999IRSNo ratings yet

- U.S. Departing Alien Income Tax ReturnDocument14 pagesU.S. Departing Alien Income Tax ReturnViorel OdajiuNo ratings yet

- Form 709 United States Gift Tax ReturnDocument5 pagesForm 709 United States Gift Tax ReturnBogdan PraščevićNo ratings yet

- IRS Publication Form 706Document4 pagesIRS Publication Form 706Francis Wolfgang UrbanNo ratings yet

- Remic Tax FormDocument4 pagesRemic Tax Formnutech18No ratings yet

- Individual Return IT-Gha (2023) 1Document2 pagesIndividual Return IT-Gha (2023) 1monir7898No ratings yet

- Amended 1040 Tax Form ExplainedDocument2 pagesAmended 1040 Tax Form Explainedgolcha_edu532No ratings yet

- Form No. 15GDocument9 pagesForm No. 15Gjpsmu09No ratings yet

- US Internal Revenue Service: f8404 - 2003Document2 pagesUS Internal Revenue Service: f8404 - 2003IRSNo ratings yet

- Form 5472Document3 pagesForm 5472A.F. GRANADANo ratings yet

- Form 709 Gift Tax Return GuideDocument5 pagesForm 709 Gift Tax Return GuidepdizypdizyNo ratings yet

- f1040xDocument2 pagesf1040xmarxvera158No ratings yet

- 1041 Form: U.S. Income Tax Return for Estates and TrustsDocument2 pages1041 Form: U.S. Income Tax Return for Estates and TrustsLauren100% (2)

- FD - Form 15 - G - Oct 2015Document6 pagesFD - Form 15 - G - Oct 2015mohantamilNo ratings yet

- U.S. Corporation Income Tax Return: Type OR PrintDocument6 pagesU.S. Corporation Income Tax Return: Type OR PrintWEBTREE TECHNOLOGYNo ratings yet

- Itx203 02 e - Return of Income Entity Colored OrangeDocument9 pagesItx203 02 e - Return of Income Entity Colored OrangeGregory MabinaNo ratings yet

- U.S. Income Tax Return For Estates and Trusts: For Calendar Year 2022 or Fiscal Year Beginning, 2022, and Ending, 20Document3 pagesU.S. Income Tax Return For Estates and Trusts: For Calendar Year 2022 or Fiscal Year Beginning, 2022, and Ending, 20dizzi dagerNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnNo ratings yet

- US Internal Revenue Service: f8404 - 2000Document2 pagesUS Internal Revenue Service: f8404 - 2000IRSNo ratings yet

- US Internal Revenue Service: f8404 - 2001Document2 pagesUS Internal Revenue Service: f8404 - 2001IRSNo ratings yet

- 2010 Blank IRS Form 1065Document5 pages2010 Blank IRS Form 1065Nick PechaNo ratings yet

- 2022 Draft Schedule ADocument2 pages2022 Draft Schedule ARiley CareNo ratings yet

- f1120s AccessibleDocument5 pagesf1120s AccessiblebhanuprakashbadriNo ratings yet

- Form8 2007 08Document5 pagesForm8 2007 08api-3850174No ratings yet

- US Internal Revenue Service: f8404 - 2004Document2 pagesUS Internal Revenue Service: f8404 - 2004IRSNo ratings yet

- Resume of Srpeak4Document2 pagesResume of Srpeak4api-25647173No ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changessud_hotlineNo ratings yet

- Bar CodeDocument6 pagesBar CodeAkashNo ratings yet

- 10 1041sbDocument9 pages10 1041sbTham DangNo ratings yet

- INCOME-TAXDocument3 pagesINCOME-TAXarjunv_14100% (1)

- Submitting Your U.S. Tax Documents: Print, Sign, MailDocument5 pagesSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- Bir Form 1600Document44 pagesBir Form 1600Jerel John CalanaoNo ratings yet

- Form 7200-PDF Reader ProDocument1 pageForm 7200-PDF Reader ProEdward FederisoNo ratings yet

- 1600Document9 pages1600jbabellarNo ratings yet

- Untitled PDFDocument2 pagesUntitled PDFjenny abbottNo ratings yet

- Form 1120-S Tax ReturnDocument5 pagesForm 1120-S Tax ReturnBenny BerniceNo ratings yet

- Irs Form 9465 ExampleDocument2 pagesIrs Form 9465 ExampleScottNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620No ratings yet

- Monthly Remittance Return for VAT and Percentage TaxesDocument9 pagesMonthly Remittance Return for VAT and Percentage TaxesVincent De GuzmanNo ratings yet

- Expatriation & Divorse From U.S.: Emancipation From The GovernmentDocument1 pageExpatriation & Divorse From U.S.: Emancipation From The Governmentdouglas jonesNo ratings yet

- Expatriation & Divorse From U.S.: Emancipation From The GovernmentDocument1 pageExpatriation & Divorse From U.S.: Emancipation From The Governmentdouglas jonesNo ratings yet

- Constitutional Passport RulingDocument42 pagesConstitutional Passport Rulingdouglas jones100% (1)

- Why You Are A "National", "State National", and Constitutional But Not Statutory Citizen, Form #05.006Document645 pagesWhy You Are A "National", "State National", and Constitutional But Not Statutory Citizen, Form #05.006Sovereignty Education and Defense Ministry (SEDM)100% (8)

- Constitutional Passport RulingDocument42 pagesConstitutional Passport Rulingdouglas jones100% (1)

- I Reserve All Rights and Demand That The Above Mentioned Recipient TAKE NOTICEDocument1 pageI Reserve All Rights and Demand That The Above Mentioned Recipient TAKE NOTICEdouglas jonesNo ratings yet

- Color of Law Form PDF-2Document1 pageColor of Law Form PDF-2douglas jonesNo ratings yet

- Envelope TemplateDocument1 pageEnvelope Templatedouglas jones100% (1)

- Verify SSNs for Federal Agencies and Law EnforcementDocument8 pagesVerify SSNs for Federal Agencies and Law EnforcementTheplaymaker508No ratings yet

- Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243Document1 pageSuperior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243douglas jonesNo ratings yet

- Affidavit of Denial of US CitizenshipDocument1 pageAffidavit of Denial of US Citizenshipdouglas jones100% (1)

- Envelope Template 3Document1 pageEnvelope Template 3douglas jones100% (1)

- Common Law Property Lien DischargedDocument5 pagesCommon Law Property Lien Dischargeddouglas jones100% (1)

- Color of Law Form PDF-2Document1 pageColor of Law Form PDF-2douglas jonesNo ratings yet

- Stepparent Adoption, Family. Code Section 9001Document1 pageStepparent Adoption, Family. Code Section 9001douglas jonesNo ratings yet

- Consent by Birth Parent: Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243Document1 pageConsent by Birth Parent: Superior Court of California, County of Imperial 939 W. Main Street El Centro, Ca 92243douglas jonesNo ratings yet

- PROBABLE CAUSE Updated EnabledDocument1 pagePROBABLE CAUSE Updated Enableddouglas jones100% (2)

- Football Recruit LetterDocument1 pageFootball Recruit Letterdouglas jonesNo ratings yet

- Table 2 - Reserve Bank Serial Number RelationshipDocument1 pageTable 2 - Reserve Bank Serial Number Relationshipdouglas jonesNo ratings yet

- Horizon Football Recruit LetterDocument1 pageHorizon Football Recruit Letterdouglas jonesNo ratings yet

- Superior Court of California, County of Imperial 939 W. Main Street El Centro, CA 92243Document2 pagesSuperior Court of California, County of Imperial 939 W. Main Street El Centro, CA 92243douglas jonesNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- ACH SETTLEMENT Processing: Set Up For Reoccurring Payments To Douglas Charles Bey D/b/a For Fiduciary Duties $25K / MoDocument1 pageACH SETTLEMENT Processing: Set Up For Reoccurring Payments To Douglas Charles Bey D/b/a For Fiduciary Duties $25K / Modouglas jones100% (1)

- Certificated SecurityDocument1 pageCertificated Securitydouglas jonesNo ratings yet

- Recording Cover PageDocument1 pageRecording Cover Pagedouglas jonesNo ratings yet

- FBN InstructionsDocument4 pagesFBN Instructionsdouglas jonesNo ratings yet

- Declaration of StatusDocument4 pagesDeclaration of StatusMaryUmbrello-Dressler100% (2)

- Private Correspondence: Social Security Administration 6401security BLVD., Baltimore, MD 21235-6401Document1 pagePrivate Correspondence: Social Security Administration 6401security BLVD., Baltimore, MD 21235-6401douglas jonesNo ratings yet

- Private Surety BondDocument1 pagePrivate Surety BondJulie Hatcher-Julie Munoz Jackson100% (9)

- Corp StkdissDocument10 pagesCorp Stkdissdouglas jonesNo ratings yet

- Oct 26Document1 pageOct 26ACSOtweetNo ratings yet

- Building Construction Agreement Format in MalayalamDocument15 pagesBuilding Construction Agreement Format in Malayalamachusmohan100% (1)

- Legal Technique and Logic - Assignment No. 7Document2 pagesLegal Technique and Logic - Assignment No. 7Syd Geemson ParrenasNo ratings yet

- Environmental Crime and National Security: DR Ezra ClarkDocument25 pagesEnvironmental Crime and National Security: DR Ezra ClarkDinda PuspahapsariNo ratings yet

- Bank account transactions and financial recordsDocument5 pagesBank account transactions and financial recordsSyaza AisyahNo ratings yet

- Mecklenburg County DA's Office Concludes Investigation Into Officer-Involved Shooting Death of Frankie JenningsDocument76 pagesMecklenburg County DA's Office Concludes Investigation Into Officer-Involved Shooting Death of Frankie JenningsWCNC DigitalNo ratings yet

- Notes On Business Law - SecuritiesDocument8 pagesNotes On Business Law - SecuritiesNovelyn DuyoganNo ratings yet

- 10yrs GSTDocument70 pages10yrs GSTmehakahuja2003No ratings yet

- Robin Lohre vs. Posh Maids, Et. Al.Document6 pagesRobin Lohre vs. Posh Maids, Et. Al.NickNo ratings yet

- Communist Marxist Rule in IndiaDocument13 pagesCommunist Marxist Rule in Indiaharahara sivasivaNo ratings yet

- Divorce: Meaning, Causes and ImpactDocument6 pagesDivorce: Meaning, Causes and ImpactTarekNo ratings yet

- TCS Ratio AnalysisDocument2 pagesTCS Ratio AnalysisLogesh SureshNo ratings yet

- IRFR 420-IRFU 420-SiHFR420-SiHFU420 - MosfetDocument11 pagesIRFR 420-IRFU 420-SiHFR420-SiHFU420 - MosfetTiago LeonhardtNo ratings yet

- Rizal's Friends and AlliesDocument5 pagesRizal's Friends and AlliesSean HooeksNo ratings yet

- Management ProjectDocument20 pagesManagement ProjectPrasad BhumkarNo ratings yet

- Ross, Lawrence & Selph and Antonio T. Carrascoso, JR., For Appellant. Camus & Delgado For AppelleesDocument30 pagesRoss, Lawrence & Selph and Antonio T. Carrascoso, JR., For Appellant. Camus & Delgado For Appelleespoint clickNo ratings yet

- Module5 AE25 BTDocument5 pagesModule5 AE25 BTJemalyn PiliNo ratings yet

- SB Sec-PirDocument6 pagesSB Sec-PirJomidy MidtanggalNo ratings yet

- Petition Brgy Settlement - ScribdDocument3 pagesPetition Brgy Settlement - ScribdEmma JutaNo ratings yet

- Water (Prevention and Control of Pollution) Act, 1974Document27 pagesWater (Prevention and Control of Pollution) Act, 1974KNOWLEDGE CREATORSNo ratings yet

- Ra 9165: Comprehensive Dangerous Drugs Act: Punishable/Unlawful Acts: Elements/DescriptionDocument20 pagesRa 9165: Comprehensive Dangerous Drugs Act: Punishable/Unlawful Acts: Elements/DescriptionNaye TomawisNo ratings yet

- PadmaAwards2018 E 25012018Document4 pagesPadmaAwards2018 E 25012018NDTV100% (14)

- Feibush - Motion To DismissDocument15 pagesFeibush - Motion To DismissPhiladelphiaMagazineNo ratings yet

- CRAC Lecture Series - On Bravo - Sir SandovalDocument128 pagesCRAC Lecture Series - On Bravo - Sir SandovalJam JamNo ratings yet

- ObliCon ReviewerDocument8 pagesObliCon ReviewerRaymark MejiaNo ratings yet

- BNM Case Study DefinitionsDocument3 pagesBNM Case Study DefinitionsBhavesh JaniNo ratings yet

- BGM091516Document57 pagesBGM091516cnymediaNo ratings yet

- Mtioch: Report To TheDocument78 pagesMtioch: Report To TheantiochpapersNo ratings yet

- Johana oDocument4 pagesJohana oapi-554295561No ratings yet

- Robert Aldrich Greater France A HistoryDocument385 pagesRobert Aldrich Greater France A HistoryJan Zalewski100% (3)