Professional Documents

Culture Documents

Accounting For Managers

Uploaded by

Honey SrivastavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Managers

Uploaded by

Honey SrivastavaCopyright:

Available Formats

Accounting for Managers

Time: Three Hours Maximum: 75 marks

Part A: - (10 * 1 = 10 marks)

Answer all questions:

Write a short note on the following:

1. Accountancy

2. Personal Account

3. Single Entry system

4. Journal

5. Cost

6. Profit

7. Management Accounting

8. Ratio

9. Selling

10. Product

Part B :- (5 * 5 = 25 marks)

Answer all questions, choosing either (a) or (b)

11 a) What are the differences between accounting and book keeping?

Or

b) Briefly explain rules of accounting.

12 a) Briefly explain the merits and demerits of single entry system.

Or

b) What are the reasons for depreciation? Explain.

13 a) What are the classifications of costs? Explain.

Or

b) List out the importance of Activity based costing

14 a) Briefly explain the objectives of management accounting.

Or

b) Briefly explain the costs concepts of decision making.

15 a) What are the objectives of seller process further decision?

Or

b) What are the factors influencing the plant shut decision?

Part C: (5 * 8 = 40 marks)

Answer all questions, choosing either (a) or (b):

16 (a) Explain the fundamental concepts of accounting?

Or

(b) What are the various classifications of accounts? Explain.

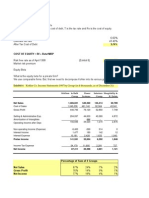

17 (a) Statement of financial position of Mr. Anup is given below:

Liabilities 1.1.05 31.12.05 Assets 1.1.05 31.12.05

Rs. Rs Rs. Rs.

Accounts 25,000 Cash 40,000 30,000

payable 29,000 6,15,000 Debtors 20,000 17,000

Capital 7,39,000 Stock 8,000 13,000

Building 1,00,000 80,000

Other fixed 6,00,000 5,00,000

assets

_______ ________ _______ ________

7,68,000 6,40,000 7,68,000 6,40,000

Additional Information :

(i) There were no drawings :

(ii) There were no purchases or sale of either building or other fixed assets.

Prepare a statement of cash flow:

Or

b) A company purchased 3 years lease on January 1, 2000 for Rs. 25000. It decided to

provide for the replacement of the lease at the end of 3 years by setting up a

depreciation fund. It is expected that investments will fetch interest at 5 %. Table

shows that an annual payment of Re.1 at 5 % compound interest in 3 years

accumulates Rs. 31,525. Investments are made to the nearest rupee. On Jan 1, 2002,

the investments are sold for Rs. 15,250.

Give lease account and depreciation fund account.

18 a) From the following data, calculate :

(i) P/V ratio

(ii) Profit when sales are Rs.20,000

(iii) New Breakeven point if selling price is reduced by 20 %

Fixed expenses Rs. 4000

Break even sales Rs. 10,000

Or

b) From the following information of product No. 888, calculate :

(i) Material Cost Variance

(ii) Material Price Variance

(iii) Material Usage Variance

(iv) Material Mix Variance

(v) Material sub-usage variance

Material Std. Quantity Sp. Actual quantity AP

Kg Rs. Kg Rs.

X 20 5 24 4

Y 16 4 14 4.50

Z 12 3 10 3.25

48 48

19 a) Explain the factors influencing the pricing and special order pricing decision.

Or

From the following details find out:

(i) Current Assets

(ii) Current Liabilities

(iii) Liquid Assets

(iv) Stock amount ratio 2.5, liquid ratio 1.5 , working capital Rs. 90,000.

20 (a) Explain the variables incorporated in make / buy decision

Or

(b) What are the factors influencing the plant shut down decision? Explain.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Athens - BESTDocument27 pagesAthens - BESTCatNo ratings yet

- Nsider Trading: Criminal LawDocument16 pagesNsider Trading: Criminal LawHoney SrivastavaNo ratings yet

- Quiz 2 Answers PDFDocument5 pagesQuiz 2 Answers PDFJohn FerreNo ratings yet

- Bcom MGKVP SlybusDocument30 pagesBcom MGKVP SlybusHoney SrivastavaNo ratings yet

- KohlerDocument10 pagesKohleragarhemant100% (1)

- RFBT-16 (Financial Rehabilitation & Insolvency Act)Document8 pagesRFBT-16 (Financial Rehabilitation & Insolvency Act)Alliah Mae ArbastoNo ratings yet

- F6 SMART Notes Valid Till 03.2024Document43 pagesF6 SMART Notes Valid Till 03.2024Divyang MaheshwariNo ratings yet

- Bitcoin Blockchain Aur Cryptocurrency PDFDocument368 pagesBitcoin Blockchain Aur Cryptocurrency PDFJamie KhanNo ratings yet

- Filter student data by marksDocument3 pagesFilter student data by marksHoney SrivastavaNo ratings yet

- New 5003Document230 pagesNew 5003Honey SrivastavaNo ratings yet

- I An Going To Select Which One Is Better Investment For The CompanyDocument8 pagesI An Going To Select Which One Is Better Investment For The CompanyHoney SrivastavaNo ratings yet

- Present & Future Value CalculationDocument9 pagesPresent & Future Value CalculationHoney SrivastavaNo ratings yet

- FormatDocument7 pagesFormatHoney SrivastavaNo ratings yet

- Data Capital Budgeting With SolverDocument2 pagesData Capital Budgeting With SolverHoney SrivastavaNo ratings yet

- Indian RetailDocument25 pagesIndian Retailsarveshsharma85No ratings yet

- How To Excel ExportDocument4 pagesHow To Excel ExportHoney SrivastavaNo ratings yet

- S B oDocument1 pageS B oHoney SrivastavaNo ratings yet

- SAURAV SINGH'S RESUMEDocument2 pagesSAURAV SINGH'S RESUMEHoney SrivastavaNo ratings yet

- Probationary Officer Training ProgrammeDocument4 pagesProbationary Officer Training ProgrammeHoney SrivastavaNo ratings yet

- Final Project Repaired)Document263 pagesFinal Project Repaired)Honey SrivastavaNo ratings yet

- AccountsDocument17 pagesAccountsHoney Srivastava100% (1)

- Vincent Briere TessierDocument12 pagesVincent Briere TessierVincent Brière TessierNo ratings yet

- 68th Capping Ceremony Uniform Ordering GuideDocument3 pages68th Capping Ceremony Uniform Ordering GuideIra AcostaNo ratings yet

- Consumer Buying Behaviour Towards Mutual Funds InvestmentDocument80 pagesConsumer Buying Behaviour Towards Mutual Funds InvestmentChandan SrivastavaNo ratings yet

- MFI Quarterly Report 30 Sep 2022Document19 pagesMFI Quarterly Report 30 Sep 2022PanasheNo ratings yet

- 20221231-ANLstat ASB 000013324224Document2 pages20221231-ANLstat ASB 000013324224cd5ws9dvdxNo ratings yet

- Credit BossDocument8 pagesCredit Bossuttamdas79No ratings yet

- Suggested Solutions To Chapter 5 Problems: NswerDocument4 pagesSuggested Solutions To Chapter 5 Problems: Nswerayam bakarNo ratings yet

- Report On MNGT 8Document15 pagesReport On MNGT 8Rhea Mae CarantoNo ratings yet

- A Mba Final Project by Riaz Ahmad and M Bilal AfzalDocument120 pagesA Mba Final Project by Riaz Ahmad and M Bilal Afzalmoss4uNo ratings yet

- Statement of Cash Flow - OnlineDocument36 pagesStatement of Cash Flow - OnlineEvans Galista AHNo ratings yet

- Manual Artic ARTIC 272Document22 pagesManual Artic ARTIC 272Luri KrotteNo ratings yet

- Week1 Assignment1Document8 pagesWeek1 Assignment1kireeti415No ratings yet

- CH 03Document50 pagesCH 03lexfred55No ratings yet

- Investment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Document6 pagesInvestment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Jessie Dela CruzNo ratings yet

- Building Brazil's Derivative CapabilityDocument7 pagesBuilding Brazil's Derivative CapabilityKc CruzNo ratings yet

- Wincorp Investment Dispute Ruling AnalyzedDocument42 pagesWincorp Investment Dispute Ruling AnalyzedCatherine DimailigNo ratings yet

- AYLDC3 Packages and Payment InstructionDocument5 pagesAYLDC3 Packages and Payment InstructionAbu Bakarr ContehNo ratings yet

- NI ACT With CasesDocument27 pagesNI ACT With CasesTaisir MahmudNo ratings yet

- FT Partners Crypto & Blockchain January 2023Document66 pagesFT Partners Crypto & Blockchain January 2023Sarang PokhareNo ratings yet

- Solution AC3 PrelimDocument12 pagesSolution AC3 PrelimYashi SantosNo ratings yet

- Review of Usual End-Of-Period Adjustments, Closing Entries, & Reversing EntriesDocument4 pagesReview of Usual End-Of-Period Adjustments, Closing Entries, & Reversing EntriesmyrangelicNo ratings yet

- Week - 11 AML BasicsDocument26 pagesWeek - 11 AML BasicsEmiraslan MhrrovNo ratings yet

- Convexity and ImmunizationDocument8 pagesConvexity and Immunizationarjun guptaNo ratings yet

- Financial Markets and Cash Flow Streams ExplainedDocument45 pagesFinancial Markets and Cash Flow Streams ExplainedKhan HarisNo ratings yet