Professional Documents

Culture Documents

How Will Your Income Tax Payments Change How Will Your Income Tax Payments Change

Uploaded by

Tin Portuzuela0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

FIN

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageHow Will Your Income Tax Payments Change How Will Your Income Tax Payments Change

Uploaded by

Tin PortuzuelaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

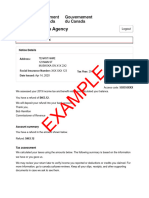

How

will your income tax payments change

..

Please enter the needed

OLD TAX CODE RA 10963

information in the boxes

below: Annual Gross Income (A+C): P260,000 P260,000

Monthly salary: Less:

Non-taxable income (B+C) P46,100 P46,100

P20,000

Exemptions (D) P75,000 n/a

A. Annual salary: P240,000 Health Insurance P0 n/a

Monthly mandatory Equals:

contributions: Net taxable income P138,900 P213,900

SSS

P1,800.00

GSIS Estimated tax due: P22,280 P0

Philhealth P275.00

Pag-ibig P100.00

Your additional take-home P22,280

B. Total annual income per year:

contributions: P26,100

C. 13th month pay

& other benefits

P22,280

P20,000 or P1,857 per month

D. No. of qualified

dependents Your tax will increase/decrease by:

1

-100.0% What you are paying..

P0

What you will pay ..

Note: Calculations are only estimates and will not necessarily reflect your actual tax liability

You might also like

- Assessment 4 Tax 1Document3 pagesAssessment 4 Tax 1Judy Ann Gaceta0% (1)

- Activity-Partnerships-METRILLO, JOHN KENNETH R.Document4 pagesActivity-Partnerships-METRILLO, JOHN KENNETH R.LordCelene C MagyayaNo ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Front - Maintain Training FacilitiesDocument5 pagesFront - Maintain Training FacilitiesRechie Gimang AlferezNo ratings yet

- Primer On Train LawDocument8 pagesPrimer On Train LawVeronica ChanNo ratings yet

- Tax DueDocument2 pagesTax DueKoro SenseiNo ratings yet

- Letters p1 Individual and Company Nil Estimate 3Document3 pagesLetters p1 Individual and Company Nil Estimate 3Mark SilbermanNo ratings yet

- Partnership OperationsDocument20 pagesPartnership OperationsRujean Salar AltejarNo ratings yet

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNo ratings yet

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- Partnership Operation Quiz 2Document2 pagesPartnership Operation Quiz 2cabbigatcrisanta04No ratings yet

- Compensation IncomeDocument18 pagesCompensation IncomeMoon KimNo ratings yet

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Module 4 IntaxDocument14 pagesModule 4 IntaxPark MinyoungNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- How To Compute Individual Income TaxDocument4 pagesHow To Compute Individual Income TaxberinguelajunahNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- Sample Notice of Assessment Oct 2020 (NOA)Document2 pagesSample Notice of Assessment Oct 2020 (NOA)splouffevachonNo ratings yet

- Income Tax ExercisesDocument3 pagesIncome Tax ExercisesLaguna HistoryNo ratings yet

- 2019 Tax Year Assessment Ivolpe PDFDocument5 pages2019 Tax Year Assessment Ivolpe PDFLISA VOLPENo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- 2018-Tax Reform For Acceleration and Inclusion2Document14 pages2018-Tax Reform For Acceleration and Inclusion2Sinetch EteyNo ratings yet

- Notice of Assessment 2021 03 22 15 36 05 837221Document4 pagesNotice of Assessment 2021 03 22 15 36 05 837221Joseph HudsonNo ratings yet

- Deductions ExamplesDocument25 pagesDeductions ExamplesKezNo ratings yet

- A Study On Income Tax Law & Accounting 2019Document26 pagesA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNo ratings yet

- Null 3Document2 pagesNull 3bibhuti bhusan routNo ratings yet

- FunaccDocument11 pagesFunaccCanceran CarolynNo ratings yet

- Final ExamDocument8 pagesFinal ExamJunior ArgieNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- WTAXESDocument31 pagesWTAXESlance757No ratings yet

- Taxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Document4 pagesTaxation 1-Midterms Exam-Reynancia, Maria Beatrice N.Beatrice ReynanciaNo ratings yet

- Taxation On IndividualsDocument10 pagesTaxation On IndividualsHERNANDO REYESNo ratings yet

- Income Tax Individual Sample ProblemsDocument13 pagesIncome Tax Individual Sample Problemscharlene marie goNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- Notice of Assessment 2020 03 12 18 58 03 155882Document4 pagesNotice of Assessment 2020 03 12 18 58 03 155882Dishantt GandhiNo ratings yet

- Income Tax Quiz AnswerDocument4 pagesIncome Tax Quiz AnswerMarco Alejandro Ibay100% (1)

- Additional Examples of Income Tax For IndividualsDocument8 pagesAdditional Examples of Income Tax For IndividualsMary Rose BuaronNo ratings yet

- Dizon Lands Realty and Development Corporation - 2.17.2022Document6 pagesDizon Lands Realty and Development Corporation - 2.17.2022Kervin GalangNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Regular Allowable Itemized Deductions Itemized Deductions From Gross IncomeDocument13 pagesRegular Allowable Itemized Deductions Itemized Deductions From Gross IncomeRosalie Colarte LangbayNo ratings yet

- Janus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsDocument2 pagesJanus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsCHARMAINE ROSE CABLAYANNo ratings yet

- Ege, Kenneth M. Bsa22A1Document3 pagesEge, Kenneth M. Bsa22A1Kenneth Marcial Ege IINo ratings yet

- Salary Slip (31753687 November, 2019)Document1 pageSalary Slip (31753687 November, 2019)naheedNo ratings yet

- PAS 12 - Income Tax - AssignmentDocument8 pagesPAS 12 - Income Tax - Assignmentviva nazarenoNo ratings yet

- Taxation On Partnership FirmDocument11 pagesTaxation On Partnership FirmnarendraNo ratings yet

- Acc 3013 - Fwa Revision AnswersDocument15 pagesAcc 3013 - Fwa Revision Answersfalnuaimi001No ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document8 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Salary Slip (32114282 October, 2019) PDFDocument1 pageSalary Slip (32114282 October, 2019) PDFSafa Saleem ButtNo ratings yet

- Lecture Notes: Afar de Leon/De Leon/Alenton 3201-Partnership Batch: May 2021Document9 pagesLecture Notes: Afar de Leon/De Leon/Alenton 3201-Partnership Batch: May 2021ruel c armillaNo ratings yet

- 2018 Income Tax QDocument4 pages2018 Income Tax QlightNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Problem 12 & 13Document3 pagesProblem 12 & 13Mary Lynn Sta PriscaNo ratings yet

- Lecture NotesDocument25 pagesLecture NotesPrecious Diarez Pureza67% (3)

- Notice of Assessment 2021 05 07 05 37 16 132636Document4 pagesNotice of Assessment 2021 05 07 05 37 16 132636bibicolibri1961No ratings yet

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Document4 pagesLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNo ratings yet

- 3rd Quizzer TAX 2nd Sem SY 2019 2020Document4 pages3rd Quizzer TAX 2nd Sem SY 2019 2020Ric John Naquila CabilanNo ratings yet

- AFAR 1 Exams 2020Document7 pagesAFAR 1 Exams 2020RJ Kristine DaqueNo ratings yet

- The Documented Essay On A Concept: Abuan, Alcantara, Cajucom, Daganta, Gepiga, MolinaDocument107 pagesThe Documented Essay On A Concept: Abuan, Alcantara, Cajucom, Daganta, Gepiga, MolinaTin PortuzuelaNo ratings yet

- Research Paper: Common Financial Problems of EntrepreneursDocument30 pagesResearch Paper: Common Financial Problems of EntrepreneursTin PortuzuelaNo ratings yet

- Public Speaking and Reports in The Information AgeDocument122 pagesPublic Speaking and Reports in The Information AgeTin Portuzuela75% (4)

- Expository Essay: Group 5Document9 pagesExpository Essay: Group 5Tin PortuzuelaNo ratings yet

- Beverage Service Styles and Techniques: Unit 8Document33 pagesBeverage Service Styles and Techniques: Unit 8Tin PortuzuelaNo ratings yet

- Unit 9: Food and Beverage Service SequenceDocument30 pagesUnit 9: Food and Beverage Service SequenceTin PortuzuelaNo ratings yet

- Communication Models: Lesson 1Document60 pagesCommunication Models: Lesson 1Tin PortuzuelaNo ratings yet

- Marketing Tools: Each of The 4P'sDocument37 pagesMarketing Tools: Each of The 4P'sTin PortuzuelaNo ratings yet

- 5SDocument2 pages5STin PortuzuelaNo ratings yet

- Unit 6: Beverage KnowledgeDocument46 pagesUnit 6: Beverage KnowledgeTin PortuzuelaNo ratings yet

- Advertising Strategies: Group 2 (Adana, Lontoc, Anit, Latrell, Molina)Document22 pagesAdvertising Strategies: Group 2 (Adana, Lontoc, Anit, Latrell, Molina)Tin PortuzuelaNo ratings yet

- Unit 6: Beverage KnowledgeDocument46 pagesUnit 6: Beverage KnowledgeTin PortuzuelaNo ratings yet

- Unit 7: Food Service Styles and TechniquesDocument26 pagesUnit 7: Food Service Styles and TechniquesTin Portuzuela100% (1)

- Distribution Strategy and The Strategic Selling CycleDocument12 pagesDistribution Strategy and The Strategic Selling CycleTin PortuzuelaNo ratings yet

- AC 103 Group 3 Sales Promotion StrategyDocument17 pagesAC 103 Group 3 Sales Promotion StrategyTin PortuzuelaNo ratings yet

- Environmental IssuesDocument1 pageEnvironmental IssuesTin PortuzuelaNo ratings yet

- ArrayDocument1 pageArrayTin PortuzuelaNo ratings yet

- Alcantara TaxDocument2 pagesAlcantara TaxTin PortuzuelaNo ratings yet

- Cash 1Document15 pagesCash 1Tin PortuzuelaNo ratings yet

- Decision Tree PDFDocument19 pagesDecision Tree PDFTin PortuzuelaNo ratings yet

- Operation Management Assignment Gardenia ReportDocument27 pagesOperation Management Assignment Gardenia ReportMaizul Deraman86% (7)

- Alcantara TaxDocument2 pagesAlcantara TaxTin PortuzuelaNo ratings yet

- ECON13B Managerial EconomicsDocument3 pagesECON13B Managerial EconomicsTin Portuzuela100% (1)

- Ch02 In-Class Problems - SolutionsDocument15 pagesCh02 In-Class Problems - SolutionsWalaa I. MatalqahNo ratings yet

- Introduction To Production and Operations Management PDFDocument6 pagesIntroduction To Production and Operations Management PDFTin PortuzuelaNo ratings yet

- Risk and Return PDFDocument29 pagesRisk and Return PDFTin PortuzuelaNo ratings yet

- Chapter 2 - Cost Terminology and Cost Behaviors: LO1 LO2 LO3 LO4 LO5Document29 pagesChapter 2 - Cost Terminology and Cost Behaviors: LO1 LO2 LO3 LO4 LO5Chem Mae100% (4)

- Risk and Return PDFDocument29 pagesRisk and Return PDFTin PortuzuelaNo ratings yet

- Vertical Integration Refers To The Degree A Firm Chooses To: BE BEDocument1 pageVertical Integration Refers To The Degree A Firm Chooses To: BE BETin PortuzuelaNo ratings yet

- Principle of Income Taxation PDFDocument20 pagesPrinciple of Income Taxation PDFTin PortuzuelaNo ratings yet