Professional Documents

Culture Documents

The Four R's of Taxation:: Acceleration and Act

The Four R's of Taxation:: Acceleration and Act

Uploaded by

Kristina ConsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Four R's of Taxation:: Acceleration and Act

The Four R's of Taxation:: Acceleration and Act

Uploaded by

Kristina ConsCopyright:

Available Formats

The policy of taxation in the Philippines is governed chiefly by

the Constitution of the Philippines and three Republic Acts.

1. Constitution: Article VI, Section 28 of the Constitution states

that "the rule of taxation shall be uniform and equitable" and

that "Congress shall evolve a progressive system of taxation."

2. National law: National Internal Revenue Code—enacted as

Republic Act No. 8424 or the Tax Reform Act of 1997 and

subsequent laws amending it; the law was most recently

amended by Republic Act No. 10963 or the Tax Reform for

Acceleration and Inclusion Act;

3. Local laws: major sources of revenue for the local government

units (LGUs) are the taxes collected by virtue of Republic Act No.

7160 or the Local Government Code of 1991, and those sourced

from the proceeds collected by virtue of a local ordinance.

The Four R's of Taxation:

Revenue. The taxes raises money to spend of armies, roads,

schools, and hospitals, and on more indirect government

functions like market regulations or legal systems.

Redistribution. This refers to the transferring wealth from the

richer sections of the society to the poorer sections.

Repricing. Taxes are levied to address externalities; for

example, tabacco is taxed to discourage smoking, and a carbon

tax discourages use of carbon based fuels.

Representation. Rulers tax citizens and citizens demand

accountability from their rulers as the other part of this bargain.

The Branch of Government that is assigned in the

Tax Law

Congress. The congress may, by law, authorize the president to fix

with specified limits, and subject to such limitations and restrictions

as it may impose,, tariff taxes, import and export quotas, tonnage

and wharfage dues, and other duties or imposts within the

framework of the national development program of the government.

(Article VI, Section Section 8, Paragraph 2)

The Branches vis-à-vis the Tax Law

President. The president shall have the power to veto any

particular item or items in an appreciation, revenue, or tariff bill,

but the veto shall shall not affect the item or items to which he

dies not object. (Article VI, Section 27, Paragraph 2)

Supreme Court. The supreme court has the power to: review,

revise, reverse, modify, or affirm on appeal or certify, as the law

or the Rules of Court may provide, final judgments or orders of

lower court in "all cases involvement the legality of any tax,

impose, assessment, or toll, or any penalty impose n relation

thereto" (Article VIII, Sec 5, Paragraph 2b).

The Forms of Taxes Imposed on Person and

Property

A、Personal, Capitation, or Poll Taxes

These are taxes of fixed amount upon residents or persons of

a certain class without regard to their property or business.

B、Property Taxes

1 Real Property Tax - Annual tax that may be imposed by a

province or city or municipality on real property such as land,

building, machinery, and other improvements affixed or attached to

real property.

2 Estate Tax - a tax on the right of transmitting property at

the time of death and on the privilege that a person is given in

controlling to a certain extent the disposition of his property to take

effect upon death.

3 Gift or Donor Tax - a tax on the privilege of transmitting

one's property or property rights to another or other's adequate and

full valuable consideration.

4 Capital Gain Tax - tax impose on the sale of exchange of

property. Those impose are presumed to have been realize by the

seller for the sale, exchange or other disposition of real property

located in the Philippines, classified as capital assets.

C. Capital Taxes - Theses are the taxes impose on the income

of the tax payers from whatever sources it is derived. Tax on all

yearly profits arising from property possessions, trades, or income.

D. Excise or License Taxes - Taxes impose on the privilege,

occupation, or business not falling within the classification of poll

taxes or property taxes. These are impose on alcohol products; on

tobacco products; on petroleum products like lubricating oils,

grease, processed gas etc; on mineral products such as coal and

coke and quarry resources; in miscellaneous articles such as

automobiles.

Under this lies two other taxes:

Documentary Stamp Tax - a tax impose upon documents,

instruments, loan agreements and papers, and upon acceptance

of assignments, sales and transfer of obligation etc.

Value Added Tax - a tax that is impose any person who, in

course of trade or business sells, barters, exchange, leases,

goods, or properties, renders services, or engages in similar

transactions.

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Levying A Tax: Taxation Is The Process or Means by Which The SovereignDocument9 pagesLevying A Tax: Taxation Is The Process or Means by Which The Sovereignmark benson marananNo ratings yet

- Quicknotes in Income TaxDocument13 pagesQuicknotes in Income TaxTrelle DiazNo ratings yet

- UP Taxation Law Pre Week 2017Document28 pagesUP Taxation Law Pre Week 2017Robert Manto67% (3)

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Tax NotesDocument20 pagesTax NotesLaurice Pocais100% (1)

- Jonathan Dee Vs Harvest DigestDocument2 pagesJonathan Dee Vs Harvest DigestKrez DelgadoNo ratings yet

- Chapter 2: Tax Laws and Tax AdminstrationDocument7 pagesChapter 2: Tax Laws and Tax AdminstrationRover Ross100% (1)

- Tax Pre-Week ReviewerDocument29 pagesTax Pre-Week ReviewerJuris TantumNo ratings yet

- Deed of Sale: Signed in The Presence ofDocument4 pagesDeed of Sale: Signed in The Presence ofDennis Vidad DupitasNo ratings yet

- Taxation Virgilio D Reyes 2 PDFDocument273 pagesTaxation Virgilio D Reyes 2 PDFitsmenatoyNo ratings yet

- HITRUST - CSF - 2021.12 - v9.6.0Document547 pagesHITRUST - CSF - 2021.12 - v9.6.0Amr RaghebNo ratings yet

- FORM TP 2013214: Caribbean Council Advanced Proficiency LAW 1-Public Law Paper 01Document8 pagesFORM TP 2013214: Caribbean Council Advanced Proficiency LAW 1-Public Law Paper 01Cherisse MohammedNo ratings yet

- Local Government TaxationDocument48 pagesLocal Government Taxationjan erwin ceroNo ratings yet

- Western Political ThoughtDocument80 pagesWestern Political ThoughtMuhammad JawadNo ratings yet

- Reinforcement Work OrderDocument7 pagesReinforcement Work OrderOm Krish Ram75% (4)

- Ucpb General Insurance Company, Inc. Petitioner, v. Hughes Electronics Corporation, Respondent.Document3 pagesUcpb General Insurance Company, Inc. Petitioner, v. Hughes Electronics Corporation, Respondent.Janet Dawn AbinesNo ratings yet

- System of Taxation in The PhilippinesDocument7 pagesSystem of Taxation in The PhilippinesdendenliberoNo ratings yet

- History, Concepts, & Principles of TaxationDocument52 pagesHistory, Concepts, & Principles of TaxationBianca GalindoNo ratings yet

- General Principles: Acuario Notes Taxation Law ReviewDocument11 pagesGeneral Principles: Acuario Notes Taxation Law ReviewGretch MaryNo ratings yet

- Inherent Limitations On The Taxing PowerDocument8 pagesInherent Limitations On The Taxing PowerFranco David BaratetaNo ratings yet

- Taxation Virgilio D. Reyes 2 PDFDocument194 pagesTaxation Virgilio D. Reyes 2 PDF?????No ratings yet

- LOcal TaxationDocument38 pagesLOcal TaxationDominic BenjaminNo ratings yet

- LVMH, Tiffany Merger AgreementDocument100 pagesLVMH, Tiffany Merger AgreementThe Fashion Law100% (1)

- DATE: 07-07-2018 TITLE OF THESIS: SIGLARO: A Redevelopment of Ormoc City Sports Complex Thesis StatementDocument2 pagesDATE: 07-07-2018 TITLE OF THESIS: SIGLARO: A Redevelopment of Ormoc City Sports Complex Thesis StatementKristina ConsNo ratings yet

- Maceda VS Macaraig, GR No 88291, May 31, 1981Document43 pagesMaceda VS Macaraig, GR No 88291, May 31, 1981KidMonkey2299No ratings yet

- DAR vs. Phil Communications Satellite Corp.Document2 pagesDAR vs. Phil Communications Satellite Corp.Mae NavarraNo ratings yet

- Module 05 - Fundamental Principles of Local TaxationDocument25 pagesModule 05 - Fundamental Principles of Local TaxationKyla Shmily GonzagaNo ratings yet

- Mnemonics in Taxation Law - GarciaDocument82 pagesMnemonics in Taxation Law - Garciadavaounion100% (2)

- Draft Local Revenue CodeDocument49 pagesDraft Local Revenue CodeAngelique ThomasNo ratings yet

- ABAKADA Guro Partylist v. Executive SecretaryDocument6 pagesABAKADA Guro Partylist v. Executive Secretary上原クリスNo ratings yet

- Notes in Local Government TaxationDocument136 pagesNotes in Local Government TaxationJeremae Ann CeriacoNo ratings yet

- Sources of Tax LawDocument3 pagesSources of Tax Lawlarry tierraNo ratings yet

- Tax Reviewer VitugDocument6 pagesTax Reviewer VitugMis DeeNo ratings yet

- General Principles of TaxationDocument5 pagesGeneral Principles of Taxationmync89100% (3)

- Sce Notes FinalDocument92 pagesSce Notes Finalkarl luisNo ratings yet

- ABAKADA Guro v. Executive SecretaryDocument2 pagesABAKADA Guro v. Executive SecretaryKrish CasilanaNo ratings yet

- TaxationDocument3 pagesTaxationErichWaeschNo ratings yet

- Object 1 Object 2Document5 pagesObject 1 Object 2icccNo ratings yet

- Taxation PresentationDocument31 pagesTaxation Presentationjoseph carl maglinteNo ratings yet

- Fundamental Principles of Local TaxationDocument25 pagesFundamental Principles of Local TaxationKrizzy PatenioNo ratings yet

- Attributes or Essential Characteristics (SLEP)Document11 pagesAttributes or Essential Characteristics (SLEP)Carina Amor ClaveriaNo ratings yet

- Codal-Local Power of TaxationDocument7 pagesCodal-Local Power of TaxationKim DyNo ratings yet

- Taxation 101 Basic Rules and PrinciplesDocument36 pagesTaxation 101 Basic Rules and PrinciplesGrazielle Anne SancejaNo ratings yet

- Module 1 TaxationDocument5 pagesModule 1 TaxationQueenel MabbayadNo ratings yet

- Taxing Powers, Scope and Limitations of Nga and LguDocument7 pagesTaxing Powers, Scope and Limitations of Nga and LguArthur MericoNo ratings yet

- Tax Code Notations Part IDocument31 pagesTax Code Notations Part IJonaliza O. BellezaNo ratings yet

- General Principles and Concepts of TaxationDocument8 pagesGeneral Principles and Concepts of TaxationHERNANDO REYESNo ratings yet

- Basic Principles of Taxation: (Commissioner v. Pineda, 21 SCRA 105)Document6 pagesBasic Principles of Taxation: (Commissioner v. Pineda, 21 SCRA 105)dsndcwnnfnhNo ratings yet

- Local TaxationDocument29 pagesLocal Taxationdlo dphroNo ratings yet

- Chapter 2 - Income TaxDocument30 pagesChapter 2 - Income TaxRochelle ChuaNo ratings yet

- TaxationDocument21 pagesTaxationFOREVER FREENo ratings yet

- P1 10 CDDocument28 pagesP1 10 CDROSASENIA “ROSASENIA, Sweet Angela” Sweet AngelaNo ratings yet

- Tax Research Basic NotesDocument8 pagesTax Research Basic NotesMark EdisonNo ratings yet

- This Research Guide Summarizes The Sources of Philippine Tax LawDocument6 pagesThis Research Guide Summarizes The Sources of Philippine Tax LawMeanne Estaño CaraganNo ratings yet

- Chapter 1. Income TaxationDocument16 pagesChapter 1. Income TaxationAlyssa Joy TercenioNo ratings yet

- TaxationDocument34 pagesTaxationRizi AlconabaNo ratings yet

- 01-Principles of Taxation (Part 3)Document21 pages01-Principles of Taxation (Part 3)Deanne Lorraine V. GuintoNo ratings yet

- Importance of Taxation: Sir Arman S. PascualDocument36 pagesImportance of Taxation: Sir Arman S. PascualJesse OcampoNo ratings yet

- Taxation Notes: Are Deemed To Be The Laws of The Occupied Territory and Not of The Occupying EnemyDocument18 pagesTaxation Notes: Are Deemed To Be The Laws of The Occupied Territory and Not of The Occupying EnemyReynaldo YuNo ratings yet

- Chapter 2 - Background of The StudyDocument28 pagesChapter 2 - Background of The Studyapi-232768261No ratings yet

- Taxation 401 Chapter 1: General PrinciplesDocument4 pagesTaxation 401 Chapter 1: General PrinciplesPritz Co GarciaNo ratings yet

- TAXMIDR2Document7 pagesTAXMIDR2Ernuel PestanoNo ratings yet

- VAT NotesDocument43 pagesVAT NotesCharmaine MejiaNo ratings yet

- Fundamental Principles of Taxation: ObjectivesDocument12 pagesFundamental Principles of Taxation: ObjectivesChristelle JosonNo ratings yet

- Concept, Characteristics/elements of VAT-taxable Transactions (G.R. No. 168056)Document27 pagesConcept, Characteristics/elements of VAT-taxable Transactions (G.R. No. 168056)lazylawatudentNo ratings yet

- BBE Lawyers Notes Taxation LawDocument215 pagesBBE Lawyers Notes Taxation LawYoo PawNo ratings yet

- I. What Is Taxation?Document4 pagesI. What Is Taxation?gheljoshNo ratings yet

- Module 2 General Principles of TaxationDocument18 pagesModule 2 General Principles of TaxationLyric Cyrus Artianza CabreraNo ratings yet

- Loadings Marquez PDFDocument32 pagesLoadings Marquez PDFKristina ConsNo ratings yet

- Report SocsciDocument2 pagesReport SocsciKristina ConsNo ratings yet

- Chapter 3 DraftDocument2 pagesChapter 3 DraftKristina ConsNo ratings yet

- Working With Emotional IntelligentDocument7 pagesWorking With Emotional IntelligentMahmoud GhumaidNo ratings yet

- Petitioners vs. vs. Respondent: Second DivisionDocument6 pagesPetitioners vs. vs. Respondent: Second DivisionJennyMariedeLeonNo ratings yet

- Personalism ChapterDocument22 pagesPersonalism ChapterVEEJAY SAULOGNo ratings yet

- LICENSE AGREEMENT DRAFT For HOARDING ADVERTISEMENTDocument6 pagesLICENSE AGREEMENT DRAFT For HOARDING ADVERTISEMENTjohnny bronza100% (1)

- UCSP Reviewer Quarter 2 Function of EducationDocument49 pagesUCSP Reviewer Quarter 2 Function of EducationChlouie DelarocaNo ratings yet

- Big Data Analytics in Accounting and Finance Assignment 3Document7 pagesBig Data Analytics in Accounting and Finance Assignment 3Javier Noel ClaudioNo ratings yet

- Anas Abusaleem The Representation of Gender Roles in Shakespeare'sDocument9 pagesAnas Abusaleem The Representation of Gender Roles in Shakespeare'sAnosNo ratings yet

- Bba Notes 1st UnitDocument51 pagesBba Notes 1st UnitSimran KhandelwalNo ratings yet

- Filipino CultureDocument1 pageFilipino CultureGarry Carl CarilloNo ratings yet

- Hazelwood Nea Constitution and BylawsDocument16 pagesHazelwood Nea Constitution and Bylawsapi-627311240No ratings yet

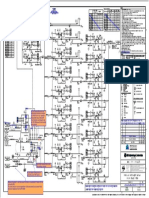

- PP4-PR-PID-469C-B - R04 PID GROUND FLARE SYSTEM (2 OF 2) - 469C-ModelDocument1 pagePP4-PR-PID-469C-B - R04 PID GROUND FLARE SYSTEM (2 OF 2) - 469C-ModelSandesh Shirude 16210085No ratings yet

- The U.P. Protection of Trees Act, 1976Document19 pagesThe U.P. Protection of Trees Act, 1976shubham singhNo ratings yet

- Mehta Omnimbus Order On Motion To Sever Harrelson in Seditious Conspiracy TrialDocument9 pagesMehta Omnimbus Order On Motion To Sever Harrelson in Seditious Conspiracy TrialDaily KosNo ratings yet

- Opd Claim Form - 23022023Document2 pagesOpd Claim Form - 23022023harrypotter 05No ratings yet

- Funds Transfers - OverviewDocument7 pagesFunds Transfers - OverviewCajita FelizNo ratings yet

- NDN Collective LawsuitDocument19 pagesNDN Collective LawsuitOrlando MayorquinNo ratings yet

- 1 - Gulfstream Park DRFDocument3 pages1 - Gulfstream Park DRFTortolero CesarNo ratings yet

- Summary NotesDocument2 pagesSummary NotesFar100% (1)

- Prof Abed Onn-Equity and Efficiency in Private Occupational Health SettingsDocument27 pagesProf Abed Onn-Equity and Efficiency in Private Occupational Health SettingsNavaganesh KannappenNo ratings yet

- Data Analysis ExtraDocument30 pagesData Analysis ExtraImam Hossain MishorNo ratings yet