Professional Documents

Culture Documents

What Are 12% Vatable Transactions? A. Sale of Goods

Uploaded by

Kathrine CruzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Are 12% Vatable Transactions? A. Sale of Goods

Uploaded by

Kathrine CruzCopyright:

Available Formats

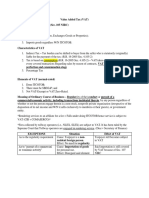

WHAT ARE 12% VATABLE TRANSACTIONS?

A. SALE OF GOODS

Sale of real properties primarily held for sale;

Sale of right or privilege to use patent, copyright, design or model plan, secret formula, or process,

goodwill, trademark, trade brand, or other like property or right;

The right or privilege to use in the Philippines of any industrial, commercial, or scientific

equipment;

The right or privilege to use motion pictures films, tapes, and discs;

Radio, television, satellite transmission and cable transmission time.

B. SALE OF SERVICES

Means the performance of all kinds of service in the Philippines for others for a fee remuneration or

consideration, whether in kind or cash.

C. IMPORTATION OF GOODS

VAT is imposed on goods brought into the Philippines, whether for use in business or not. The tax shall

be based on the total value used by the BOC in determining tariff and customs duties, plus customs

duties, excise tax, if any, and other charges such as postage, commission and similar charges (landed

cost), prior to the release of the goods from customs custody (warehouse).

D. DEEMED SALE TRANSACTIONS

Transfer, use, consumption not in the course of business of goods originally intended for sale.

Distribution to shareholders as share in the profits.

Distributions to creditors as payment of debt.

Consignment of goods if actual sale not made within 60 days.

Retirement or cessation of business with respect to ending inventories.

WHAT IS ZERO (0%) RATED TRANSACTIONS?

A. SALE OF GOODS

Foreign Currency Denominated Sale;

Export Sale;

Sale of person entities which is VAT exempt under special laws or international agreements to which

the Philippines is a signatory;

Sale of power or fuel generated through renewable sources of energy.

You might also like

- Value Added TaxDocument13 pagesValue Added TaxRyan AgcaoiliNo ratings yet

- Value-Added TaxDocument30 pagesValue-Added TaxmeriiNo ratings yet

- Chapter 5.0 Value Added Tax Percentage TaxesDocument14 pagesChapter 5.0 Value Added Tax Percentage TaxesDerick Ocampo Fulgencio0% (1)

- TAX 301 VAT Subject TransactionsDocument9 pagesTAX 301 VAT Subject TransactionsMyrrielNo ratings yet

- Statistical Treatment of DataDocument2 pagesStatistical Treatment of DataKathrine CruzNo ratings yet

- Taxation 08 - Value Added TaxDocument13 pagesTaxation 08 - Value Added TaxKara Clark100% (1)

- VAT ReviewerDocument11 pagesVAT ReviewerMarianne AgunoyNo ratings yet

- Value Added Tax-Summary LectureDocument18 pagesValue Added Tax-Summary LectureUy SamuelNo ratings yet

- Taxation Reviewer VatDocument8 pagesTaxation Reviewer VatDaphne BarceNo ratings yet

- Value Added TaxDocument32 pagesValue Added Taxsei1davidNo ratings yet

- Vat On Sale of Services and Use orDocument53 pagesVat On Sale of Services and Use orJohnAllenMarillaNo ratings yet

- Value Added Tax With AnswerDocument24 pagesValue Added Tax With AnswerKeith China Dela Cruz100% (1)

- VatDocument42 pagesVatRobert WeightNo ratings yet

- VAT On Sale of Goods and ServicesDocument14 pagesVAT On Sale of Goods and Servicesdennilyn recaldeNo ratings yet

- Vat On Sale of ServicesDocument55 pagesVat On Sale of ServicesJohnAllenMarilla67% (3)

- Value-Added Tax Description: A. B. C. D. eDocument7 pagesValue-Added Tax Description: A. B. C. D. eKasteen ManzanoNo ratings yet

- 04 Business Taxation: Clwtaxn de La Salle UniversityDocument51 pages04 Business Taxation: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- 06 Value Added TaxDocument43 pages06 Value Added TaxGolden ChildNo ratings yet

- VAT On Sales of ServicesDocument13 pagesVAT On Sales of ServicesNavarro, April Rose P.No ratings yet

- Ch02 Value-Added TaxDocument22 pagesCh02 Value-Added TaxRenelyn FiloteoNo ratings yet

- ACT26 - Ch02 Value Added TaxDocument26 pagesACT26 - Ch02 Value Added Taxarya starkNo ratings yet

- Vat Taxable Vat Zero-Rated Vat-ExemptDocument5 pagesVat Taxable Vat Zero-Rated Vat-ExemptNgan TuyNo ratings yet

- Tax VatDocument67 pagesTax VatkmabcdeNo ratings yet

- VatDocument6 pagesVatKenneth Bryan Tegerero TegioNo ratings yet

- Value Added TaxesDocument33 pagesValue Added TaxesCathleen TenaNo ratings yet

- Export Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesDocument13 pagesExport Sale of Goods (Sec. 106 (A) (2) (B) ) : Effectively Zero-Rated SalesTricia Rozl PimentelNo ratings yet

- R.A. No. 9238Document6 pagesR.A. No. 9238Jesselle De GuzmanNo ratings yet

- Ra 9238 GRT Vat On BanksDocument8 pagesRa 9238 GRT Vat On Banksapi-247793055No ratings yet

- Value-Added Tax Concept: Goods or Properties Other Than Real Property - The Total Amount of Money or ItsDocument10 pagesValue-Added Tax Concept: Goods or Properties Other Than Real Property - The Total Amount of Money or ItsAngelyn SamandeNo ratings yet

- Felipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)Document5 pagesFelipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)AustinNo ratings yet

- Module 3 1Document14 pagesModule 3 1AYEZZA SAMSONNo ratings yet

- Module 3Document13 pagesModule 3Hazelle L. CosteloNo ratings yet

- Value Added TaxDocument13 pagesValue Added TaxKatrina FregillanaNo ratings yet

- Chapter 18 22 Taxation 2Document67 pagesChapter 18 22 Taxation 2Zvioule Ma FuentesNo ratings yet

- Vat On Sale of Services AND Use or Lease of PropertyDocument67 pagesVat On Sale of Services AND Use or Lease of PropertyZvioule Ma FuentesNo ratings yet

- MoA & AoADocument23 pagesMoA & AoAAiswarya KameswaranNo ratings yet

- MODULE 2 Value Added TaxDocument21 pagesMODULE 2 Value Added TaxLenson NatividadNo ratings yet

- Philippine Economic Zone Authority (PEZA Registered) Can Avail of 2 TAXDocument6 pagesPhilippine Economic Zone Authority (PEZA Registered) Can Avail of 2 TAXDaryl Noel TejanoNo ratings yet

- Sec - 42Document7 pagesSec - 42benjo malanaNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesMacatol KristineNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document9 pagesTAX-301 (VAT-Subject Transactions)Princess ManaloNo ratings yet

- Executive Order No. 120 S. 1993 and The Implementing Rules and RegulationsDocument17 pagesExecutive Order No. 120 S. 1993 and The Implementing Rules and RegulationsKimberly TimtimNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxJune Romeo ObiasNo ratings yet

- TAX 301 VAT Subject Transaction 1Document9 pagesTAX 301 VAT Subject Transaction 1Jeen JeenNo ratings yet

- Business Taxes: Certified Accounting Technician NIAT Office 2015Document33 pagesBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7No ratings yet

- Value Added TaxDocument114 pagesValue Added TaxDa Yani ChristeeneNo ratings yet

- 8 - Intangible AssetsDocument80 pages8 - Intangible AssetsKRISTINA DENISSE SAN JOSENo ratings yet

- DomondonDocument40 pagesDomondonCharles TamNo ratings yet

- VAT Group 3Document39 pagesVAT Group 3Andrea GranilNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document10 pagesTAX-301 (VAT-Subject Transactions)Edith DalidaNo ratings yet

- Tax Revalida NotesDocument36 pagesTax Revalida NotesRehina DaligdigNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesSunny DaeNo ratings yet

- MOA Josoft TechnologiesDocument13 pagesMOA Josoft TechnologiesPc RajasekharNo ratings yet

- Title Iv Value-Added Tax: Chapter I - Imposition of TaxDocument3 pagesTitle Iv Value-Added Tax: Chapter I - Imposition of TaxNickNo ratings yet

- Donors and VatDocument179 pagesDonors and VatLayca Clarice Germino BrimbuelaNo ratings yet

- Introduction To Business TaxDocument8 pagesIntroduction To Business TaxJam PotutanNo ratings yet

- Value-Added Tax (VAT) Is A Tax On Consumption Levied On The Sale, Barter, Exchange or LeaseDocument27 pagesValue-Added Tax (VAT) Is A Tax On Consumption Levied On The Sale, Barter, Exchange or LeaseDon CabasiNo ratings yet

- What Is Output?Document1 pageWhat Is Output?Kathrine CruzNo ratings yet

- Investments DiscussionDocument5 pagesInvestments DiscussionKathrine CruzNo ratings yet

- What Are The Transactions Which Are No Longer Subject To Zero-Percent (0%) ?Document1 pageWhat Are The Transactions Which Are No Longer Subject To Zero-Percent (0%) ?Kathrine CruzNo ratings yet

- 9Document1 page9Kathrine CruzNo ratings yet

- 9Document1 page9Kathrine CruzNo ratings yet

- 1,500,000 250,000 1,250,000 Zero: Your AnswerDocument12 pages1,500,000 250,000 1,250,000 Zero: Your AnswerKathrine CruzNo ratings yet

- Problem 1Document1 pageProblem 1Kathrine CruzNo ratings yet

- BCDocument2 pagesBCKathrine CruzNo ratings yet

- What Is Foreign Currency Denominated Sale?Document1 pageWhat Is Foreign Currency Denominated Sale?Kathrine CruzNo ratings yet

- Quarterly Percentage Tax Rates Table: Taxable Base Tax RateDocument4 pagesQuarterly Percentage Tax Rates Table: Taxable Base Tax RateKathrine CruzNo ratings yet

- Ap 8501Document8 pagesAp 8501Kathrine CruzNo ratings yet

- What Is Zero (0%) Rated Transactions? A. Sale of GoodsDocument1 pageWhat Is Zero (0%) Rated Transactions? A. Sale of GoodsKathrine CruzNo ratings yet

- The Perceived Effect of Psychological Pricing To The Profitability of Franchise Food Carts in SM City BaguioDocument2 pagesThe Perceived Effect of Psychological Pricing To The Profitability of Franchise Food Carts in SM City BaguioKathrine CruzNo ratings yet

- Goals of Asean Economic Community (Aec) : ReferencesDocument2 pagesGoals of Asean Economic Community (Aec) : ReferencesKathrine CruzNo ratings yet