Professional Documents

Culture Documents

Service Rules: Online Assignment #

Uploaded by

aliakhtar020 ratings0% found this document useful (0 votes)

9 views1 pageThe document provides instructions for an online assignment from the Pakistan Institute of Public Finance Accountants Lahore, asking students to define non-refundable GPF advances, describe conditions for a second refundable GPF advance, and explain GPF rules regarding deduction of Zakat. It also provides particulars for a worked example to calculate a GPF closing balance statement for the year 2017-18.

Original Description:

Original Title

Online Assignmen - 5

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides instructions for an online assignment from the Pakistan Institute of Public Finance Accountants Lahore, asking students to define non-refundable GPF advances, describe conditions for a second refundable GPF advance, and explain GPF rules regarding deduction of Zakat. It also provides particulars for a worked example to calculate a GPF closing balance statement for the year 2017-18.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageService Rules: Online Assignment #

Uploaded by

aliakhtar02The document provides instructions for an online assignment from the Pakistan Institute of Public Finance Accountants Lahore, asking students to define non-refundable GPF advances, describe conditions for a second refundable GPF advance, and explain GPF rules regarding deduction of Zakat. It also provides particulars for a worked example to calculate a GPF closing balance statement for the year 2017-18.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

PAKISTAN INSTITUTE OF PUBLIC FINANCE ACCOUNTANTS LAHORE

Online Assignment # 5 –Service Rules

Submission of Assignment: May 19, 2020 - between 20:00 to 21:00 - on WhatsApp

Group titled “SR”

A. 1 Define non-refundable GPF advances.

A. 2 What are conditions for second refundable GFP advance?

A. 3 Describe GPF rules regarding deduction of Zakat.

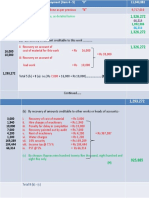

A. 4 Work out GPF closing balance statement for the year 2017-18 from the

following particulars:

Balance as on 30th June 2017: 1,035,890

Rate of monthly subscription: 4,270

Drew refundable GPF advance of Rs.100,000 on August 28, 2016. The

subscriber opted to refund advance in 20 equal installments.

He draw 2nd refundable advance of Rs. 300,000, in adjustment of

outstanding balance of 1st refundable GPF advance on September 14,

2017. The subscriber opted to refund this advance in 30 equal

installments.

Rate of interest for the FY 2017-18 is 11.70%.

You might also like

- PDFDocument1 pagePDFVENKAT RAO0% (1)

- 1476422537107Document1 page1476422537107Tech Beat4uNo ratings yet

- GPF Rules 2020Document9 pagesGPF Rules 2020maazkundiNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormFermarc Lestajo100% (1)

- Web It CertDocument1 pageWeb It CertGuna SeelanNo ratings yet

- HHLHYE00424239 Provisional (2019-2020)Document1 pageHHLHYE00424239 Provisional (2019-2020)sanjeevNo ratings yet

- 27122018-UPDATED - FAQs ON BANKING, INSURANCE AND STOCK BROKERSDocument34 pages27122018-UPDATED - FAQs ON BANKING, INSURANCE AND STOCK BROKERSHimanshu PanchpalNo ratings yet

- Faqs On Banking, Insurance and Stock Brokers CbicDocument34 pagesFaqs On Banking, Insurance and Stock Brokers CbicVenkataramana NippaniNo ratings yet

- NRLMDocument10 pagesNRLMTushar DashNo ratings yet

- HHLHYD00208643 ProvisionalDocument1 pageHHLHYD00208643 ProvisionalPranab PaulNo ratings yet

- FAQs PDFDocument9 pagesFAQs PDFHumera FaizanNo ratings yet

- Awadesh Kumar Rai & Another Vs Registrar, U.P. Co-Operative ... On 28 March, 2016Document7 pagesAwadesh Kumar Rai & Another Vs Registrar, U.P. Co-Operative ... On 28 March, 2016Akanksha BohraNo ratings yet

- Loan Details SampleDocument1 pageLoan Details Samplekarthik dNo ratings yet

- 2017letf RT601 PDFDocument2 pages2017letf RT601 PDFVenkataraju BadanapuriNo ratings yet

- Subject To Reimbursement FDocument2 pagesSubject To Reimbursement FVenkataraju BadanapuriNo ratings yet

- Anant Raj V Yes BankDocument10 pagesAnant Raj V Yes BankRishi SehgalNo ratings yet

- APGLI G.0.Ms - .No - .198-Dt.18.10.2022Document6 pagesAPGLI G.0.Ms - .No - .198-Dt.18.10.2022suhas marlaNo ratings yet

- Hhlkal00211208 17-18Document1 pageHhlkal00211208 17-18RohanNo ratings yet

- Banking and Economy PDF April 2019Document16 pagesBanking and Economy PDF April 2019Saurav MishraNo ratings yet

- 10-12 Assignment 1Document4 pages10-12 Assignment 1Pavan Kasireddy100% (1)

- NIFA Report 2018-20Document26 pagesNIFA Report 2018-20zaka khanNo ratings yet

- HDFC 876Document1 pageHDFC 876Xen Operation DPHNo ratings yet

- Judgement - 05 Mar 2020Document46 pagesJudgement - 05 Mar 2020Harish BishtNo ratings yet

- 9.1 Banking and Financial Laws (Question Paper)Document2 pages9.1 Banking and Financial Laws (Question Paper)Medha DwivediNo ratings yet

- SGST ReimbursmentDocument2 pagesSGST ReimbursmentYours YoursNo ratings yet

- Appropriation Account in PartnershipDocument3 pagesAppropriation Account in PartnershipumeshNo ratings yet

- DownloadDocument3 pagesDownloadVansh AroraNo ratings yet

- Presentation On Contributory Provident FundDocument4 pagesPresentation On Contributory Provident FundAli HaiderNo ratings yet

- Loan 9923281112 30122022175927Document1 pageLoan 9923281112 30122022175927Mohit ChinchkhedeNo ratings yet

- 4330467076170342677Document1 page4330467076170342677vamsi patnalaNo ratings yet

- DocumentDocument1 pageDocumentkalyan0% (1)

- Pay Fixation On Macp: Available Options Under FR 22 (1) (A)Document8 pagesPay Fixation On Macp: Available Options Under FR 22 (1) (A)Horil KumarNo ratings yet

- Guest FacultyDocument6 pagesGuest FacultyDILIP KUMAR REDDYNo ratings yet

- Zxyzvyyyyy 1223Document1 pageZxyzvyyyyy 1223VIGNESHNo ratings yet

- Union Budget HighlightsDocument9 pagesUnion Budget HighlightsJojy SebastianNo ratings yet

- DistDocument2 pagesDistDORAI RAJ GMJNo ratings yet

- 6th Pay Com Salary Calculation: Multiple Factor 2.57Document3 pages6th Pay Com Salary Calculation: Multiple Factor 2.57asdsNo ratings yet

- PayfixationoptionsDocument5 pagesPayfixationoptionsGK TiwariNo ratings yet

- The Kolkata Gazette: Published by AuthorityDocument10 pagesThe Kolkata Gazette: Published by AuthorityCatch a starNo ratings yet

- Bill of Exchange1Document5 pagesBill of Exchange1Himanshi kantiwalNo ratings yet

- Senrnal: Banoko No Pn-TplnasDocument12 pagesSenrnal: Banoko No Pn-TplnasGilbertGalopeNo ratings yet

- Punjab Scale ReviseDocument4 pagesPunjab Scale ReviseFaisal ZameerNo ratings yet

- Emergency Loan (Active Member) Application FormDocument2 pagesEmergency Loan (Active Member) Application FormenzoNo ratings yet

- Banking Assignment 2Document4 pagesBanking Assignment 2Anjali PaneruNo ratings yet

- QRMP Scheme Under GSTDocument7 pagesQRMP Scheme Under GSTshraddhaNo ratings yet

- Ad-Hoc Bonus 2023-2024Document2 pagesAd-Hoc Bonus 2023-2024Aditya NandiNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- INTERNAL GUIDELINES - Bayanihan Act 2 PDFDocument9 pagesINTERNAL GUIDELINES - Bayanihan Act 2 PDFTrini Las IINo ratings yet

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalNo ratings yet

- Impugned AwardDocument5 pagesImpugned AwardVELUSAMY MNo ratings yet

- GO (P) No 1142-98-Fin Dated 25-03-1998Document6 pagesGO (P) No 1142-98-Fin Dated 25-03-1998Saravanan SubramaniNo ratings yet

- Practice Set (Questions) - IFRIC 14Document3 pagesPractice Set (Questions) - IFRIC 14kashan.ahmed1985No ratings yet

- Commercial BankingDocument6 pagesCommercial Bankingom.kumavat23No ratings yet

- 2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsDocument5 pages2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsvinodNo ratings yet

- Cir - 82 - EDocument15 pagesCir - 82 - EArvind BouddhNo ratings yet

- KCC Yeye2012Document19 pagesKCC Yeye2012Aboli GajbhiyeNo ratings yet

- Income Tax Declaration Form 2022-2023Document2 pagesIncome Tax Declaration Form 2022-2023ARUN CHAUHANNo ratings yet

- 16) Tayug Vs Rural BankDocument3 pages16) Tayug Vs Rural BankJohn Ayson100% (2)

- Hbilu Vs HSBCDocument14 pagesHbilu Vs HSBCDwrd GBNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Accounts 2017 NotesDocument40 pagesAccounts 2017 Notesaliakhtar02No ratings yet

- Account Officer 1P2017 PDFDocument1 pageAccount Officer 1P2017 PDFaliakhtar02No ratings yet

- 86 PDFDocument1 page86 PDFaliakhtar02No ratings yet

- Application Form PDFDocument1 pageApplication Form PDFaliakhtar02No ratings yet

- Senior Audit Officer (ESG-3) Equivalent To BS-18: Application FormDocument3 pagesSenior Audit Officer (ESG-3) Equivalent To BS-18: Application Formaliakhtar02No ratings yet

- 27C2018 PDFDocument1 page27C2018 PDFaliakhtar02No ratings yet

- Auditor - General of Pakistan: Audit & Accounts OfficesDocument24 pagesAuditor - General of Pakistan: Audit & Accounts Officesaliakhtar02No ratings yet

- Test Cum Revision PracticeDocument8 pagesTest Cum Revision Practicealiakhtar02No ratings yet

- 27C2018 PDFDocument1 page27C2018 PDFaliakhtar02No ratings yet

- Online Assignment # 3Document1 pageOnline Assignment # 3aliakhtar02No ratings yet

- Onlin Assignment # 4Document1 pageOnlin Assignment # 4aliakhtar02No ratings yet

- Contracor Bill 18.04.20Document2 pagesContracor Bill 18.04.20aliakhtar02No ratings yet

- Public Works Accounts Rules & Procedures: As Would Establish Clearly The Correctness and Necessity of The EntryDocument3 pagesPublic Works Accounts Rules & Procedures: As Would Establish Clearly The Correctness and Necessity of The Entryaliakhtar02No ratings yet

- Payment Now To Be Made, As Detailed Below: Add 5% PSTDocument2 pagesPayment Now To Be Made, As Detailed Below: Add 5% PSTaliakhtar02No ratings yet

- Ii-Account of "Advance Payment" For The Work Done But Not Yet MeasuredDocument1 pageIi-Account of "Advance Payment" For The Work Done But Not Yet Measuredaliakhtar02No ratings yet