Professional Documents

Culture Documents

01 11 Accrued Expenses

01 11 Accrued Expenses

Uploaded by

AnkitaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01 11 Accrued Expenses

01 11 Accrued Expenses

Uploaded by

AnkitaCopyright:

Available Formats

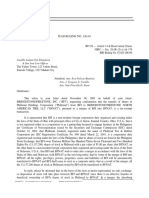

3 Financial Statements - Interview Question Model

($ in Millions, Except Per Share Amounts and Share Counts in Thousands)

Assumptions Interview Questions

Tax Rate: 40% Revenue Changes By… Goodwill Impairment Changes By…

Interest Rate On Debt: 10% Cost of Goods Sold Changes By… PP&E Write-Down Changes By…

Current Share Price: $10.00 SG&A Changes By… Debt Write-Down Changes By…

Par Value of Stock: $1.00 Depreciation Changes By… Deferred Income Taxes Changes By…

Initial Cash Balance: $100

Accounts Receivable Changes By… Long-Term Investments Changes By…

Units for Shares: 1,000 Inventory Changes By… Long-Term Debt Changes By…

Units for Financials: 1,000,000 Accounts Payable Changes By.. Interest Income Changes By…

Accrued Expenses Changes By… $100 Dividends Declared Changes By…

Deferred Revenue Changes By… Dividends Issued Changes By…

CapEx Changes By… Equity Bailout Changes By…

Re-Purchase Shares Changes By…

Issue New Shares Changes By…

Income Statement Balance Sheet Cash Flow Statement

Old New Old New

Assets: Operating Activities:

Revenue: $1,000 $1,000 Current Assets: Net Income:

Cost of Goods Sold: $100 $100 Cash & Cash-Equivalents: $550 $590 Depreciation:

Gross Profit: $900 $900 Accounts Receivable: $100 $100 Stock-Based Compensation:

Operating Expenses: Inventory: $200 $200 Goodwill Impairment:

Research & Development: $100 $100 Total Current Assets: $850 $890 PP&E Write-Down:

Selling, General & Admin.: $100 $200 Debt Write-Down:

Total Operating Expenses: $200 $300 Long-Term Assets: Deferred Income Taxes:

Property & Equip. (PP&E): $200 $200

Depreciation: $100 $100 Long-Term Investments: $100 $100 Changes in Operating Assets & Liabilities:

Stock-Based Compensation: $100 $100 Goodwill: $100 $100 Accounts Receivable:

Total Assets: $1,250 $1,290 Inventory:

Operating Income: $500 $400 Accounts Payable:

Interest Income / (Expense): $0 $0 Liabilities & Shareholders' Equity: Accrued Expenses:

Goodwill Impairment: $0 $0 Current Liabilities: Deferred Revenue:

PP&E Write-Down: $0 $0 Revolver: $50 $50 Cash Flow from Operations:

Debt Write-Down: $0 $0 Accounts Payable: $100 $100

Pre-Tax Income: $500 $400 Accrued Expenses: $100 $200 Investing Activities:

Income Tax Provision: $200 $160 Total Current Liabilities: $250 $350 LT Investments:

Capital Expenditures:

Net Income: $300 $240 Long-Term Liabilities: Cash Flow from Investing:

Deferred Revenue: $200 $200

Earnings Per Share: $3.00 $2.40 Long-Term Debt: $0 $0 Financing Activities:

Shares Outstanding: 100,000 100,000 Deferred Tax Liabilities: $100 $100 Dividends Issued:

Dividends Declared: $0 $0 Long-Term Debt:

Total Liabilities: $550 $650 Equity Bailout:

Re-Purchase Shares:

Shareholders' Equity: Issue New Shares:

Common Stock: $100 $100 Cash Flow from Financing:

Additional Paid-In Capital: $100 $100

Treasury Stock: $0 $0 Increase / Decrease in Cash:

Retained Earnings: $400 $340 Cash & Cash Equivalents:

Accum. Other Comp. Income: $100 $100

Total Shareholders' Equity: $700 $640

Total Liabilities & SE: $1,250 $1,290

mpairment Changes By…

e-Down Changes By…

e-Down Changes By…

ncome Taxes Changes By…

m Investments Changes By…

m Debt Changes By…

come Changes By…

Declared Changes By…

Issued Changes By…

out Changes By…

se Shares Changes By…

Shares Changes By…

w Statement

Old New

Operating Activities:

$300 $240

$100 $100

ased Compensation: $100 $100

ll Impairment: $0 $0

$0 $0

$0 $0

d Income Taxes: $0 $0

n Operating Assets & Liabilities:

s Receivable: $0 $0

$0 $0

$0 $0

$0 $100

$0 $0

from Operations: $500 $540

Investing Activities:

$0 $0

($50) ($50)

from Investing: ($50) ($50)

Financing Activities:

$0 $0

$0 $0

$0 $0

$0 $0

$0 $0

from Financing: $0 $0

Decrease in Cash: $450 $490

sh Equivalents: $550 $590

You might also like

- ACCA Financial Management - Mock Exam 1 - 1000225 PDFDocument25 pagesACCA Financial Management - Mock Exam 1 - 1000225 PDFrash D100% (1)

- 04 Atlassian 3 Statement Model CompletedDocument18 pages04 Atlassian 3 Statement Model CompletedYusuf RaharjaNo ratings yet

- NYSF Practice TemplateDocument22 pagesNYSF Practice TemplaterapsjadeNo ratings yet

- SBICAPS - Model Test 2Document34 pagesSBICAPS - Model Test 2rishav digga0% (1)

- 72 11 NAV Part 4 Share Prices AfterDocument75 pages72 11 NAV Part 4 Share Prices Aftercfang_2005No ratings yet

- DSF Ohada English VersionDocument44 pagesDSF Ohada English VersionNana Abdoulbagui100% (1)

- Project On HDFC BankDocument72 pagesProject On HDFC Banksunit2658No ratings yet

- Siib c1Document38 pagesSiib c1Santanu Das100% (1)

- 723 Summary by Aarish Khan PDFDocument428 pages723 Summary by Aarish Khan PDFMahaboob ShaikNo ratings yet

- Wal-Mart Stores, Inc. - Summary of Financial Statements: Historical Projected 2012 RevenueDocument18 pagesWal-Mart Stores, Inc. - Summary of Financial Statements: Historical Projected 2012 RevenueRakshana SrikanthNo ratings yet

- 1cr4dm8kl 930744Document4 pages1cr4dm8kl 930744DGLNo ratings yet

- F Wall Street 4-MSFT-Analysis (2010) 20100817Document1 pageF Wall Street 4-MSFT-Analysis (2010) 20100817smith_raNo ratings yet

- Expenses: BalancesDocument8 pagesExpenses: BalancesBrookeNo ratings yet

- Lbo DCF ModelDocument38 pagesLbo DCF ModelBobbyNicholsNo ratings yet

- Net Income $1,675 $1,260 $415: Income & Expenses Actual Budget DifferenceDocument6 pagesNet Income $1,675 $1,260 $415: Income & Expenses Actual Budget DifferenceRatiu EvaNo ratings yet

- A13 - Job Order - GJM TailoringDocument13 pagesA13 - Job Order - GJM TailoringTee MendozaNo ratings yet

- Budget MasterDocument44 pagesBudget MasterNayem UddinNo ratings yet

- Amazon Accounting Ver 0.1Document148 pagesAmazon Accounting Ver 0.1Lalit mohan PradhanNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- 12 Month Cash Flow Statement Template Camino FinancialDocument6 pages12 Month Cash Flow Statement Template Camino Financialsandra istalla caceresNo ratings yet

- La Tabla Del Ahorro: Total Gastos Mensuales Monto Financiado: Interés Efectivo MensualDocument21 pagesLa Tabla Del Ahorro: Total Gastos Mensuales Monto Financiado: Interés Efectivo Mensualrociobal03No ratings yet

- Estimating A Firm's Cost of Capital: Chapter 4 OutlineDocument17 pagesEstimating A Firm's Cost of Capital: Chapter 4 OutlineMohit KediaNo ratings yet

- La Tabla Del Ahorro: Monto Financiado: Interés Efectivo MensualDocument21 pagesLa Tabla Del Ahorro: Monto Financiado: Interés Efectivo MensualIvan Forero TorresNo ratings yet

- IPTC CMA Bank FormatDocument12 pagesIPTC CMA Bank FormatRadhesh BhootNo ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- Data Description: Net Present Value of This InvestmentDocument4 pagesData Description: Net Present Value of This InvestmentZeusNo ratings yet

- Kellogg: Balance SheetDocument14 pagesKellogg: Balance SheetSubhajit KarmakarNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookkamranNo ratings yet

- Merger Model PP Allocation BeforeDocument100 pagesMerger Model PP Allocation BeforePaulo NascimentoNo ratings yet

- VC and IPO NumericalDocument16 pagesVC and IPO Numericaluse lnctNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- New Assessment SchemeDocument6 pagesNew Assessment SchemeaakashkagarwalNo ratings yet

- 20.06.26 Nano II Model - SentDocument309 pages20.06.26 Nano II Model - SentAdrian KurniaNo ratings yet

- Capital Budgeting MethodsDocument73 pagesCapital Budgeting MethodsAbhimanyu ChoudharyNo ratings yet

- Inspection Form HDEC 2Document36 pagesInspection Form HDEC 2UD. Gunung JatiNo ratings yet

- In These Spreadsheets, You Will Learn How To Use The Following Excel FunctionsDocument78 pagesIn These Spreadsheets, You Will Learn How To Use The Following Excel FunctionsFaisal SiddiquiNo ratings yet

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Synopsis of Many LandsDocument6 pagesSynopsis of Many Landsraj shekarNo ratings yet

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Document18 pages1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeNo ratings yet

- XIRR Calculator PrimeInvestorDocument12 pagesXIRR Calculator PrimeInvestornbadayaNo ratings yet

- LBO Blank TemplateDocument15 pagesLBO Blank TemplateBrian DongNo ratings yet

- Box IPO Financial ModelDocument42 pagesBox IPO Financial ModelVinNo ratings yet

- Alibaba IPO: Prepared by - Dheeraj Vaidya, CFA, FRMDocument53 pagesAlibaba IPO: Prepared by - Dheeraj Vaidya, CFA, FRMHaysam Tayyab100% (1)

- How To Calculate Terminal ValueDocument4 pagesHow To Calculate Terminal ValueSODDEYNo ratings yet

- KIDO Group (KDC) (SELL - 21.2%) Initiation: Hefty Valuation For An Ice Cream/cooking Oil FranchiseDocument65 pagesKIDO Group (KDC) (SELL - 21.2%) Initiation: Hefty Valuation For An Ice Cream/cooking Oil FranchiseTung NgoNo ratings yet

- M&a - Retail StoresDocument186 pagesM&a - Retail Storesvaibhavsinha101No ratings yet

- Basics of Financial Statement Analysis Tools of AnalysisDocument30 pagesBasics of Financial Statement Analysis Tools of AnalysisNurul MuslimahNo ratings yet

- Assessment SchemesDocument8 pagesAssessment SchemesaakashkagarwalNo ratings yet

- Date of Valuation: Revenue Growth Rate For Next Year 25.00% Operating Margin For Next Year 7.50%Document60 pagesDate of Valuation: Revenue Growth Rate For Next Year 25.00% Operating Margin For Next Year 7.50%anuNo ratings yet

- 2019-057-JSA-Loading Unloading Near Access RoadDocument8 pages2019-057-JSA-Loading Unloading Near Access RoadUD. Gunung JatiNo ratings yet

- ProjectDocument24 pagesProjectAayat R. AL KhlafNo ratings yet

- Fiscal Year Is January-December. All Values ZAR MillionsDocument14 pagesFiscal Year Is January-December. All Values ZAR MillionsRavi JainNo ratings yet

- Valuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsDocument89 pagesValuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsJames MitchellNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- 72Ho-Singer Model V3Document28 pages72Ho-Singer Model V3aqwaNo ratings yet

- Income Statement Vertical Analysis TemplateDocument2 pagesIncome Statement Vertical Analysis TemplateSope DalleyNo ratings yet

- Overview of Investment Banking in IndiaDocument8 pagesOverview of Investment Banking in Indiasumit pamechaNo ratings yet

- Work Sample 1Document79 pagesWork Sample 1api-337384142No ratings yet

- Excel Project Timesheet FullDocument4 pagesExcel Project Timesheet Fullprateekchopra1No ratings yet

- Business Combination ExercisesDocument5 pagesBusiness Combination ExercisesmmNo ratings yet

- QuestionsDocument1 pageQuestionsjesicaNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- SCF - OCF - FCF of JCB ChavezDocument2 pagesSCF - OCF - FCF of JCB ChavezRodel LemorinasNo ratings yet

- Balance Sheet Rules SummaryDocument4 pagesBalance Sheet Rules SummaryCristina Bejan100% (1)

- 60 05 CL Provisions AfterDocument4 pages60 05 CL Provisions Aftermerag76668No ratings yet

- Mutual Fund Set-2Document37 pagesMutual Fund Set-2royal62034No ratings yet

- Nism Series Xvii Retirement Adviser Exam Workbook PDFDocument273 pagesNism Series Xvii Retirement Adviser Exam Workbook PDFChandradeep Reddy Teegala100% (1)

- IF AssignmentDocument6 pagesIF AssignmentNGOC VO LE THANHNo ratings yet

- Annual Report 2021Document104 pagesAnnual Report 2021dcsamaraweeraNo ratings yet

- Abm 4 Module 5Document5 pagesAbm 4 Module 5Argene AbellanosaNo ratings yet

- Acc101-FinalRevnew 001yDocument26 pagesAcc101-FinalRevnew 001yJollybelleann MarcosNo ratings yet

- Retained Earnings Quiz 7Document6 pagesRetained Earnings Quiz 7Rhey LeenNo ratings yet

- RMO No. 17-2016Document7 pagesRMO No. 17-2016leeNo ratings yet

- Financial Accounting F3 25 August RetakeDocument12 pagesFinancial Accounting F3 25 August RetakeMohammed HamzaNo ratings yet

- Cash Flow AnalysisDocument15 pagesCash Flow AnalysisMichelle Go0% (1)

- 2001 ITAD RulingsDocument306 pages2001 ITAD RulingsJerwin DaveNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIHooriaNo ratings yet

- Jtiasa 2019 Ar PDFDocument175 pagesJtiasa 2019 Ar PDFSaw Mee LowNo ratings yet

- Finance Terminology - List of Financial Terms With ExamplesDocument7 pagesFinance Terminology - List of Financial Terms With Examplesdevendra_tomarNo ratings yet

- CHAPTER 11 Dividend PolicyDocument56 pagesCHAPTER 11 Dividend PolicyMatessa AnneNo ratings yet

- Comprehensive Topics HandoutsDocument16 pagesComprehensive Topics HandoutsGrace CorpoNo ratings yet

- Elliott Management Crown Castle TMT Elliott Crown Castle Presentation Jul 2020Document67 pagesElliott Management Crown Castle TMT Elliott Crown Castle Presentation Jul 2020Hemad IksdaNo ratings yet

- G. M. Breweries Limited: 35th Annual Report 2017-2018Document68 pagesG. M. Breweries Limited: 35th Annual Report 2017-2018kishore13No ratings yet

- "A Study On Portfolio Management": Summer Internship Project Report OnDocument100 pages"A Study On Portfolio Management": Summer Internship Project Report OnraaaaaaaaaaaaaamNo ratings yet

- Financial Management SyllabusDocument13 pagesFinancial Management Syllabusharshgupta.16018No ratings yet

- Dwnload Full Modern Management Concepts and Skills 12th Edition Certo Test Bank PDFDocument35 pagesDwnload Full Modern Management Concepts and Skills 12th Edition Certo Test Bank PDFmottlebanexkyfxe100% (14)

- Ch01 Introduction To Accounting and BusinessDocument51 pagesCh01 Introduction To Accounting and BusinessGelyn Cruz50% (2)

- FMT 14Document8 pagesFMT 14Armel AbarracosoNo ratings yet

- Apex 2018Document166 pagesApex 2018uzunarumazNo ratings yet

- Multiple Choice Questions 1Document16 pagesMultiple Choice Questions 1Keziah Eden . Tuazon100% (1)