0% found this document useful (0 votes)

7K views50 pagesCourt Judgment

Court Judgment: Court Slams N60M Fine Against Keystone Bank, Convicts Bank Officials Of Financial Scandal

Uploaded by

Sahara ReportersCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0% found this document useful (0 votes)

7K views50 pagesCourt Judgment

Court Judgment: Court Slams N60M Fine Against Keystone Bank, Convicts Bank Officials Of Financial Scandal

Uploaded by

Sahara ReportersCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

- Introduction and Charges

- Statements of Offence - Counts 1 and 2

- Statements of Offence - Counts 3 and 4

- Statements of Offence - Counts 5 and 6

- Statements of Offence - Counts 7 to 9

- Statements of Offence - Counts 10 to 12

- Statements of Offence - Count 13

- Witness Testimony PW1

- Witness Testimony Continued - PW1

- Exhibit Analysis

- Witness Statements - PW2 and PW3

- Analysis of Financial Transactions

- Defendant Explanations

- Legal Framework and Court's Analysis

- Judgment and Sentencing

- Allocutus by Counsel

- Conclusion and Official Signatures

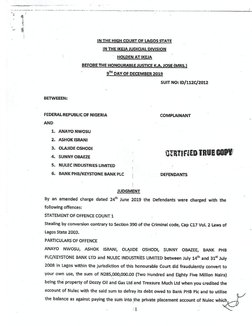

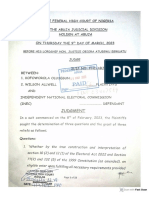

INTHE HIGH COURT OF LAGOS STATE

IN THE IKEJA JUDICIAL DIVISION

HOLDEN ATIKEJA

BEFORE THE HONOURABLE JUSTICE K.A. JOSE (MRS.)

oT DAY OF DECEMBER 2019

‘SUIT NO: ID/112¢/2012

BETWEEN:

FEDERAL-REPUBLIC OF NIGERIA COMPLAINANT

i

1. ANAYO NWOsU

2. ASHOKISRANI

i cmos GERTIFIED TRUE CODY:

5. NULEC INDUSTRIES LIMITED

6. BANK PHB/KEYSTONE BANK PLC DEFENDANTS:

JUDGMENT

By an amended charge dated 24” June 2019 the Defendants were charged with the

following offences:

‘STATEMENT OF OFFENCE COUNT 1

Stealing by conversion contrary to Section 390 of the Criminal code, Cap C17 Vol. 2 Laws of

Lagos State 2003,

PARTICULARS OF OFFENCE

ANAYO NWOSU, ASHOK ISRANI, OLAIIDE OSHODI, SUNNY OBAZEE, BANK PHB

PLC/KEYSTONE BANK LTD and NULEC INDUSTRIES LIMITED between July 14 and 31° July

2008 in Lagos within the jurisdiction of this honourable Court did fraudulently convert to

your own use, the sum of N285,000,000.00 (Two Hundred and Eighty Five Million Naira)

being the property of Dozzy Oil and Gas Ltd and Treasure Much Ltd when you credited the

account of Nulec with the said sum to defray its debt owed to Bank PHB Plc and to utilise

the balance as against paying the sum into the private placement account of Nulec which

1

sum was to be used as payment for the purchase of shares of Nulec industries Limited under

a private placement.

STATEMENT OF OFFENCE COUNT 2

Stealing by conversion contrary to Section 390 of the Criminal code, Cap C17 Vol. 2 Laws of

Lagos State 2003.

PARTICULARS OF OFFENCE

ANAYO NWOSU, ASHOK ISRANI, OLAJIDE OSHODI, SUNNY OBAZEE, BANK PHB

PLC/KEYSTONE BANK LTD and NULEC INDUSTRIES LIMITED between July 14 and 31" July

2008 in Lagos within the jurisdiction of this honourable Court did fraudulently convert to

Your own use, the sum of N145,000,000.00 (One Hundred and Forty Five Million Naira}

belng the property of Dozzy Oil and Gas Ltd and Treasure Much Ltd when you transferred

the sald sum Into the account of Nulee with Guaranty Trust Bank as against paying the sum

into the private placement account of Nulec whit

sum was to be used as payment for the

Purchase of shares of Nulec industries Limited under a private placement,

‘STATEMENT OF OFFENCE COUNT 3

Stealing by conversion contrary to Section 390 of the Criminal code, Cap C17 Vol. 2 Laws of

Lagos State 2003,

PARTICULARS OF OFFENCE

ANAYO NWOSU and OLAJIDE OSHODI between June and September 2008 in Lagos within

the jurisdiction of this honourable Court did fraudulently convert to your own use, the sum

of N110,000,000.00 (One Hundred and Ten Million Naira) being the property of Dozzy Oil

and Gas Ltd and Treasure Much Ltd when the sald sum was paid into the account of

Drillcom Investement W/A Limited as premium charge of NJ.10 per share in respect of 100

milion shares aside the original N2.85 per share being payment for the purchase of shares

Of Nulec industries Limited under a private placement.

STATEMENT OF OFFENCE COUNT 4 ‘

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol 2

Laws of Lagos State 2003.

PARTICULARS OF OFFENCE ‘ CERTIFIED TRUE COPY

NULEC INDUSTRIES LIMITED and ASHOK ISRANI being a director of Nulec industries Limited

Detween June and September 2008 within the jurisdiction ofthis Court with intert to induce

Dozzy Oil and Gas Ltd, Treasure Much Limited and Sir Daniel Chukwudotie to buy the Sa

of Nulec Industries Limited published a written statement to wit: a private placement

Memorandum wherein you stated in a material particular at page 8 thereof that the

company would take the necessary steps to list the shares on the floor of the Nigerian stock

Exchange immediately after the private placement has been concluded but which statement

is to your knowledge false.

STATEMENT OF OFFENCE COUNTS

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol. 2

Laws of Lagos State 2003.

PARTICULARS OF OFFENCE

NULEC INDUSTRIES LIMITED and ASHOK ISRANI being a director of Nulec industries Limited

between June and September 2008 within the Jurisdiction of this Court with intent to induce

Dozzy Oil and Gas Ltd, Treasure Much Limited and Sir Daniel Chukwudozie to buy the shares

of Nulec Industries Limited published a written statement to wit: a private placement

memorandum wherein you omitted to state in a material particular at page 7 thereof that

an amount more than 31.41% or N415,000,000.00 (Four Hundred and Fifteen Million Naira)

of the proceeds would be used for loan repayment but you stated that the said published

amount or percentage thereof was to be used only for loan repayment, and which

‘statement Is to your knowledge false.

‘STATEMENT OF OFFENCE COUNT 6

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol. 2

Laws of Lagos State 2003.

PARTICULARS OF OFFENCE

NULEC INDUSTRIES LIMITED and ASHOK ISRANI bei 18 a director of Nulec industries Limited

between June and September 2008 within the Jurisdiction of this Court with intent to induce

Dozzy Oil and Gas Ltd, Treasure Much Limited and Sir Daniel Chukwudozie to buy the shares

of Nulec Industries Limited published a written statement to wit: a private placement

memorandum wherein you omitted to state in a material particular at page 7 thereof that

an amount more than 1.8% or N25,000,000.00 (Twenty Five Million Naira) of the proceeds

would be used for local supply payment but you stated that the Said published amount or

Percentage thereof was to be used only for local supply payment, and which statement is to

your knowledge false. .

= CERTIFIED TRUE COPY

‘STATEMENT OF OFFENCE COUNT 7

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol. 2

Laws of Lagos State 2003,

PARTICULARS OF OFFENCE

NNULEC INDUSTRIES LIMITED and ASHOK ISRANI being a director of Nulec industries Limited

between June and September 2008 within the jurisdiction of this Court with intent to induce

Dozzy Oil and Gas Ltd, Treasure Much Limited and Sir Daniel Chukwudozle to buy the shares

of Nulec Industries Limited published a written statement to wit: a private placement

Memorandum wherein you omitted to state in a material particular at page 7 thereof that

an amount more than 24.21% or N320,000,000.00 (Three Hundred and Twenty Million

Naira) of the proceeds would be used for foreign supply payment but you stated that the

sald published amount or percentage thereof was to be used only for foreign supply

Payment, and which statement is to your knowledge false.

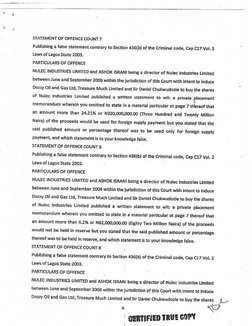

‘STATEMENT OF OFFENCE COUNT 8

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol. 2

Laws of Lagos State 2003.

PARTICULARS OF OFFENCE

NULEC INDUSTRIES LIMITED and ASHOK ISRANI being a director of Nulec industries Limited

between June and September 2008 within the jurisdiction of this Court with intent to induce

Dozzy Oil and Gas Ltd, Treasure Much Limited and Sir Daniel Chukwudozle to buy the shares

of Nulec Industries Limited published a written statement to wit: a private placement

‘memorandum wherein you omitted to state in a material particular at page 7 thereof that

an amount more than 6.2% or N82,000,000.00 (Eighty Two Million Naira) of the proceeds

would not be held in reserve but you stated that the said published amount or percentage

thereof was to be held in reserve, and which statement is to your knowledge false,

STATEMENT OF OFFENCE COUNT 8 i

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol. 2

Laws of Lagos State 2003.

PARTICULARS OF OFFENCE

NULEC INDUSTRIES LIMITED and ASHOK ISRANI being a director of Nulec industries Limited

between June and September 2008 within the jurisdiction of this Court with intent to induce

Dowzy Cll and Gas Ltd, Treasure Much Limited and Sir Daniel Chukwudozie to buy the ™

4

: GERTIFIED TRUE COPY

Of Nulec Industries Limited published a written statement to wi

private placement

memorandum which in a material particular is to your knowledge false by omitting to state

in the private placement memorandum that 9.6% or 'N104,000,000.00 (One Hundred and

Four Naira) of the proceeds would be used for new Purchases and miscellaneous but which

‘statement is to your knowledge false.

STATEMENT OF OFFENCE COUNT 10

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol. 2

Laws of Lagos State 2003.

PARTICULARS OF OFFENCE

ANAYO NWOSU, ASHOK ISRANI, OLAJIDE OSHODI, SUNNY OBAZEE, BANK PHB

PLC/KEYSTONE BANK LTD and NULEC UNDUSTRIES LIMITED being promoters, directors

and/or officers of Nulec industries Limited’s shares subscription by private placement

between June and September 2008 within the jurisdiction of this Court with intent to induce

Dozzy Oil and Gas Ltd, Treasure Much Limited and Sir Daniel Chukwudozie to buy the shares

of Nulec Industries Limited published a written statement to wit: @ private placement

memorandum wherein you stated in a material particular at page 8 thercof that the Private

Placement is underwritten on a standby basis but which statement is to your knowledge

false.

‘STATEMENT OF OFFENCE COUNT 11

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol. 2

Laws of Lagos State 2003,

PARTICULARS OF OFFENCE

NULEC INDUSTRIES LIMITED and ASHOK ISRANI being promoters and director of Nulec

Industries Limited's shares subscription by private placement between June and September

2008 within the Jurisdiction of this Court with intent to induce Dozzy Oil and Gas Ltd,

Treasure Much Limited and Sir Daniel Chukwudozie to buy the shares of Nulec Industies

Limited published a written statement to wit: a private placement memorandum wherein

You omitted to state in a material particular at page 7 thereof that an amount more than

'N480,000,000.00 (Four Hundred and Eighty, Million Naira) representing 36.31% of the

Proceeds would not be used for the product line expansion but you stated that the said

Published amount or percentage thereof was to be used only for product line expansion,

and which statement is to your knowledge fals

‘STATEMENT OF OFFENCE COUNT 12

Publishing a false statement contrary to Section 436(b) of the Criminal code, Cap C17 Vol. 2

Laws of Lagos State 2003.

PARTICULARS OF OFFENCE

NULEC INDUSTRIES LIMITED and ASHOK ISRANI being promoters and director of Nulec

Industries Limited’s shares subscription by private placement between June and September

2008 within the jurisdiction of this Court with intent to induce Dozzy Oil and Gas Ltd,

Treasure Much Limited and Sir Daniel Chukwudozie to buy the shares of Nulec industies

Limited published a written statement to wit: a private placement memorandum wherein

you stated in a material particular at page 13 thereof that the purpose of the offer was to

add new production faci :

ies for electric kettles, food blenders, free standing cookers and

fans and which productions were expected to commence in October 2008 for small

appliances and November 2008 for cookers but which statement Is to your knowledge false.

STATEMENT OF OFFENCE COUNT 13,

Publishing a false statement contrary to Section 436(b) of the Criminal’ code, Cap C17 Vol. 2

Laws of Lagos State 2003.

PARTICULARS OF OFFENCE

ANAYO NWOSU (officer of Bank PHB), [Link], OLAIIDE OSHODI(officer of Bank PHB),

SUNNY OBAZEE(officer of Bank PHB), BANK PHB PLC/KEYSTONE BANK LTD and NULEC

UNDUSTRIES LIMITED being promoters, directors and/or officers of Nulec industries

Limited's shares subscription by private placement between June and September 2008

Within the jurisdiction of this Court with intent to induce Dozzy Oil and Gas Ltd, Treasure

Much Limited and Sir Daniel Chukwudozie to buy the shares of Nulec Industries Limited

Published a written statement to wit: a private placement memorandum wherein you

omitted to state in a material particular at page 39 thereof that the loan of N130,000,000.00

(One Hundred and Thirty Million) owed by, Nulec Industries to Bank PHB would nat be

Tepaid from the business cash flow of Nulec Industries Limited but you stated that the said

Published loan thereof was to be repaid from the business cash flows of Nulec Industries

Limited, and which statement is to your knowledge false. :

‘STATEMENT OF OFFENCE COUNT 14

Conspiracy to obtain money by false pretence contrary to Section (a) and punishable under’

Section 1(3) of the Advance Fee Fraud and Other Fraud Related Offences Act of 2006.

GERTIFIED TRUE COPY

6

PARTICULARS OF OFFENCE

ANAYO NWOSU, ASHOK ISRANI, OLAIIDE OSHODI, SUNNY OBAZEE, BANK PHB

PLC/KEYSTONE BANK LTD and NULEC UNDUSTRIES LIMITED sometime in 2008 in Lagos

within the jurisdiction of this honourable Court conspired to commit an offence to wit:

obtaining the sum of N&55,000,000.00 (Eight Hundred and Fifty Five Million Naira) from

Dozzy Oil and Gas Ltd and Sir Daniel Chukwudozie on the false pretence that Nulec

Industries Limited was in active profit making, manufacturing and trading activities thereby

purporting same to be payment for the purchase of shares of Nulec industries Limited under

a private placement.

‘STATEMENT OF OFFENCE COUNT 15

‘Obtaining money by false pretence contrary to Section 1(3) of the Advance Fee Fraud and

Other Fraud Related Offences Act of 2006,

PARTICULARS OF OFFENCE

ANAYO NWOSU, ASHOK ISRANI, OLAJIDE OSHODI, SUNNY OBAZEE, BANK PHB.

PLC/KEYSTONE BANK LTD and NULEC UNDUSTRIES LIMITED sometime in 2008 in Lagos

within the jurisdiction of this honourable Court with intent to defraud obtained the sum of

NB55,000,000.00 (Eight Hundred and Fifty Five Million Naira) from Dozzy Oil and Gas Ltd on

the false pretence that Nulec Industries Limited was in active profit making, manufacturing

and trading activities thereby purporting same to be payment for the purchase of shares of

Nulec industries Limited under a private placement.

‘The Defendants pleaded not guilty to the charges consequent to which the matter went into

trial,

The 1* prosecution witness (PW1) was Chukwuma Orjl an operative with the Economic and

Financial-Crimes Commission (EFCC) who said that his office received a petition from Dozzy

Oil and Gas Limited (the complainant) which alleged that the 1* Defendant approached one

Chukwudozie Daniel managing director of the complainant and his associates to invest in

the private placement of shares of the 5" Defendant and they so invested, It was alleged

that the shares were not listed on the Stock Exchange as promised and that the collection of

money for the sale of the shares had been fraudulent. The complainant also sald that it had

been misled into investing in the 5" Defendant by the false information given to it by fp

7

GERTIFIED TRUE COPY

Defendant. The EFCC thereafter wrote the 6" Defendant to request for the private

placement proceeds account as well as the operating account of the 5" Defendant and was

given the account statements, PW41 said he saw fraudulent manipulation in the account

statements and the 1* Defendant was invited to make a statement. In same he stated that

he was the one who invited the complainant to invest in the private placement. He agreed

that he gave the complainant the impression that the shares would on completion of the

private placement be listed at a higher price than that of the placement.

PW1 said that investigation showed that the 1* Defendant was the one who moved funds

from the complainant's Zenith Bank account to the account of another company called

‘Treasure Much Limited (Treasure Much) which was also being run by Chukwudozie Daniel.

The 1" Defendant was said to have given instructions for the issuance of a bank draft of

N285 Million from the account of Treasure Much and this draft was used to buy shares in

the private placement for Daniel Chukwudozie and his associates, PW1 said as at the time

Of the private placement the 5" Defendant was almost a dead company and was indebted

to the 6" Defendant in the sum of N130 Million. The 1 Defendant who was the account

officer to the 5 Defendant packaged the private placement to make sure that the N130

Million owed to the 6" Defendant was paid through the proceeds of the private placement

which was to open on 16” July 2008 and close on 31* July 2008. On 14" July 2008 however,

the draft of N285 Million issued by the complainant was paid into the 5" Defendant's

operating account instead of the private proceeds account which had yet to be opened,

PW1 said that the sum of Ni.1 Billion was realised from the private placement and from

this, the sur of N102 Million was used for expenses. Out of the balance of N970 Million, the

sum of N547 Million was wired outside Nigeria whilst the private placement was still

ongoing through a company in Switzerland called Risa Enterprises. From Switzerland the

monies were wired back to the UBA domiciliary account of the 2" Defendant. PW1 said that

although the draft of N285 Million p:

into the 5" Defendant’s operating account was said

by the 5" Defendant to have been paid in error and the transaction reversed, no reversal

took place as the money realised at the end jof the private placement was a little bit over

N700 Million as against the over N900 Million that should have been realised. He said the

monies were also spent during the private placement as opposed to the private ne

SERTIFLED TRUE COPY

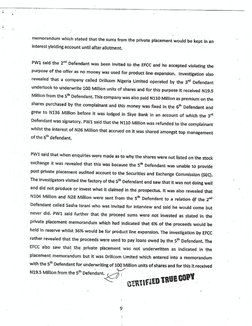

‘memorandum which stated that the sums from the private placement would be kept in an

interest ylelding account until after allotment,

PW4 said the 2" Defendant was been invited to the EFCC and he accepted violating the

Purpose of the offer as no money was used for product line expansion. Investigation also

revealed that a company called Drillcom Nigeria Limited operated by the 3” Defendant

undertook to underwrite 100 Million units of shares and for this purpose it received N19.5

Million from the 5 Defendant, This company was also paid N110 Million as premium on the

shares purchased by the complainant and this money was fixed in the 6" Defendant and

grew to N136 Million before it was lodged in Skye Bank in an account of which the 3

Defendant was signatory. PW1 said that the N110 Million was refunded to the complainant

whilst the interest of N26 Million that accrued on it was shared amongst top management

of the 6" defendant.

PW/1 sald that when enquiries were made as to why the shares were not listed on the stock

exchange it was revealed that this was because the 5" Defendant was unable to provide

Post private placement audited account to the Securities and Exchange Commission (SEC).

The investigators visited the factory of the 5"" Defendant and saw that It was not doing well

and did not produce or invest what it claimed in the prospectus. It was also revealed that

"1104 Million and N28 Million were sent from the 5" Defendant to a relation éf the 2

Defendant called Sasha Israni who was invited for interview and said he would come but

ever did. PW4 said further that the proceed sums were not invested as stated in the

Private placement memorandum which had indicated that 6% of the proceeds would be

held In reserve whilst 36% would be for product line expansion. The investigation by EFCC

rather revealed that the proceeds were used to pay loans owed by the 5" Defendant. The

EFCC also saw that the private placement was not underwritten as in

ted in the

placement memorandum but it was Drilicom Limited which entered into a memorandum

with the 5" Defendant for underwriting of 100 Million units of shares and for this it received

N19.5 Milllion from the 5 Defendant

Several documents including the petition written by the complainant, the private placement

memorandum and statements made-by the Defendants were tendered through PW1 and

marked as Exhibits P1-P391,

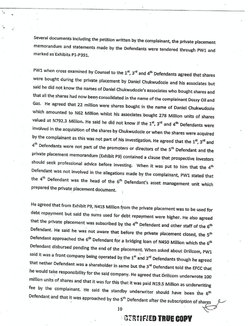

PW1 when cross examined by Counsel to the 1", 3" and 4" Defendants agreed that shares

‘were bought during the private placement by Daniel Chukwudovie and his associates but

Said he did not know the names of Daniel Chukwudozie's associates who bought shares and

that al the shares had now been consolidated in the name of the complainant Dozzy Oll and

Gas. He agreed that 22 milion were shares bought in the name of Daniel Chukwudozte

Which amounted to N62 Million whist his associates. bought 278 Million units of shares

valued at N792.3 Million. He said he did not know if the 1", 3" and at Defendants were

Involved in the acquisition of the shares by Chukwudozle or when the shares were acquired

by the complainant as this was not part of his investigation. He ‘agreed that the 1% 3" and

4" Defendants were not Part of the promoters or directors of the 5 Defendant and the

Private placement memorandum (Exhibit F9) contained a clause that prospective Investors

should seek professional advice before investing. When it was put to him that the 4”

Defendant was not involved in the allegations made by the complainant, PW1 stated that

the 4 Defendant was the head of the 6! Defendant's asset management unit which

Prepared the private placement document.

He agreed that from Exh

P9, N445 Million from the private placement was to be used for

debt repayment but sald the sums used for debt repayment were higher. He also agreed

that the private placement was subscribed by the 4 Defendant and other staff of the 6”

Defendant. He said he was not aware that before the Private placement closed, the 5

Defendant approached the 6 Defendant for a bridging loan of N4S0O Million which the 6

Defendant disbursed pending the end of the placement. When asked about Drilleom, PW

sald it was a front company being operated by the 1" and 3" Defendants though he agreed

‘that nether Defendant was a shareholder in same but the 3" Defendant told the EFCC that

hhe would take responsibilty for the said company. He agreed that Brilleom underwrote 100

million units of shares and that it was for this that it was patd N19.5 Million as underwr

is

fee by the complainant. He said the standby underwriter should have been the 6”

Defendant and that it was approached by the 5" Defendant after the subscription vistas f*

10 S

GERTIFIED TRUE COPY

fell short by N300 million for Payment of this sum based on the underwriting agreement but

the 6" defendant did not pay the said N300 Million. He however agreed that no name was

mentioned in Exhibit P9 as the underwriter of the placement.

When cross examined by Counsel to the 2™ and st Defendants PW1 maintained that the

N2E5 Million paid on behalf of the complainant by Drillcom into the operating account of

the 5" Defendant before the private Placement opened was did not stay in the private

Placement account as although the money was transferred into the placement account, it

was moved back into the operating account immediately by the 6" Defendant. He agreed

‘hat the complainant filed a suit in the Federal High Court against the s* Defendant but said

this was not the reason why the shares were not lsted on the stock exchange and the non

listing was due to failure of the 5” Defendant to ‘meet with the requirements of SEC. When

asked if was due to the shortfall in the amount realised from the subscription and the 130

Million taken by the 6" Defendant that the 5! Defendant was not able to utilise the

Smounts earmarked in the private placement, PW1 said even the litle amount realised was

OF used as stated in the private placement. PW/1 said he knew Sasha Israni was a board

‘member of the 5" Defendant but he did not know if the 5" Defendant borrowed money

from him.

When cross examined by the 6" Defendant's Counsel PW4 sald the complainant was

advised by the 1* and 3" defendant on the Purchase of the shares but he did not know if It

engaged professional advisers, He also did not;know if the complainant ‘sought the consent

of the 6" Defendant before having the @ssoclates of Daniel Chukwudorie transfer their

shares to it

Pw2 was Jatau Nanpon a stockbroker with a company called APT Security and Funds

Limited, He testified that the 5" Defendant was. client of his company and approached it in

2008 after completion of its private placement exercise for the purpose of getting its shares

listed on the Nigerian Stock Exchange (NSE). His company gave the 5 Defendant the list of

documents required for getting the shares listed but it did not et these docurnents within a

reasonable period of time, The application Was eventually filed in February 2009 and the

NSE commenced the process of going through the documents during which it Teovenss or

11

CFRTICJED TRUE CODY

additional documents. One of the documents requested for was the full account of the 5"

Defendant as at December 2008 whether audited or not but what the 5 Defendant

Provided was the audited accounts for nine months account which ended in September

2008. The NSE thereafter granted provisional approval for the listing.

The process of registering

the Securities and Exchange Commission (SEC) then

commenced but the 5" Defendant did not provide the required documentation ‘one of

which was audited accounts up tl 2009. The NSE sent several reminders from 2009 up tll

2012 by which time there was a need to submit the audited accounts for 2010 as well. A

final reminder was sent by SEC which stated that ifthe 5" Defendant could not comply with

the requirements the entire process would be [Link] would have to start afresh,

PW2's employer thereafter received a letter in which It was informed that the S" Defendant

aid not have a managing director and had just appointed one in 2014 and that once he

came on board it would supply the audited account for 2009 and 2010. The 5 Defendant

however did not send any audited accounts and PW2 sald he assumed that the SEC would

have aborted the process because of what was stated in the last reminder. When asked

‘what the audited accounts had to do with the private placement, PW2 said that it was a

document that would reflect how the placement proceeds was disbursed. He sald the final

approval of SEC was not obtained with the audited account of 2008 as what was used was

the management account of September 2008 on which it gave approval in principle and that

all outstanding documents including the audited accounts for 2008 were expected to be

Presented before listing.

When cross examined by Counsel to the 1", 3% and 4" Defendants PW2 sald

company

was appointed by the 5" Defendant for the listing of the shares and that such listings usually

took between 2-4 months to get approval. He did not know if the 1° 3" and 5! Defendants

hhad any listing role after the private placement exercise,

Under cross examination by Counsel to the 2° and 5! Defendants PW2 sald that approval in

Principle was granted by SEC for the

ing of the shares but before same could be listed the

5" Defendant would have to submit all the documents required. He agreed that NSE

officials visited the factory of the S'* Defendant and that a dead company could not get

12

b

}

aenecicn ToHZeNDy

approval. He said that he wrote asking for the audited accounts but he did not have the

letter before the Court, however several letters were written by SEC asking for the accounts.

He sald he was not aware of a petition written by the complainant against the 5" Defendant

or that an action was filed by the complainants. A letter written by SEC to the 5“ Defendant

was at this stage tendered through PW2 and marked as Exhibit 395,

When cross examined by the 6" Defendant's Counsel, PW2 said he did not know the 6

Defendant and the 6 Defendant was not responsible for the audited accounts which had

Not been provided.

The 3 witness PW3 was ‘Azukaego Ezemakam an employee of Guaranty Trust Bank Plo

(GTBank). This witness testified that the 5" Defendant maintained an account with her

bank. Between July and August 2008 GTaank received the sum of N245 Million from the 6”

Defendant into the 5® Defendant's account and these monies were used to revalidate bills

for collection. PW3 said bills for collection meant that ‘the customer was putting up a

request to purchase foreign funds and remit ‘Same to its supplier whose name in this case

‘was Risa Enterprises and the revalidation was to revive previous approvals that had been

given for purchase of such foreign currency. She referred to some Form Ms which were due

for payment between 2005 ‘and 2006. Further sums of N6O Million and N69 Million were

received from the 6" Defendant into the S! Defendant's account also used to make

Payments on bills for collection. She sald that prior to the inflows from the 6" Defendant

the account had not been in a good state as the 5" Defendant was indebted to the bank and

that after the inflows were received, same were used to pay for the expired bills and the 5"

Defendant remained indebted to his bank, A letter written by GTBank was admitted through

Pw3 and admitted as Exhibit P398, PW3 said that from another document being Exhibit

396 there was a transfer of N29,275,000 by the 5 Defendant to Sasha Israni.

Under cross examination PW3 said she did not know if it was the 1", 3" and 4" Defendants

that effected the transfers of money from the 6" Defendant to GTBank, She said there was

nothing wrong with the transactions on the bills for collection and that same were usually

cone when the payment on such bills expired and the customer would apply through cei

3 CERTIFIED TRUE copy

bank to the CBN for revalidation, PW3 said she did not see from the records any payment

made by Sasha Israni to the 5" Defendant's account.

Pw4 was Amaka Ukachukwu an employee of United Bank for Africa (UBA). She sald that the

5" Defendant maintained a dollar and Nalra account with her bank. In respect of the dollar

account, there were several inflows of dollar amounts from Risa Enterprises and payments

to persons who Included one Ume Vashi Isran and Vashi Dejanni. As regards the Nalra

account, there were inflows of a total sum of N143,018226.04 from the 6" Defendant into

the 5% Defendant’s account with her bank. From the account the 5" Defendant then made

Payment of tax In favour of Lagos State Government as well as payments for bills for Form

M (bills for collection). PW4 said the account was later frozen based o'

struction from the

When cross examined PW4 said the transactions did not involve the 1 3" and 4”

Defendants, She did not know the source of the funds that came from the 6” Defendant but

all the payments on the bills for Collection were made to Risa Enterprises.

PWS was Olawale Adekunle an employee of Skye Bank Plc. He also testified about inflows

totaling N225 Million into the 5" Defendant's account from the 6" Defendant, Out of this

ums about N30 Million was used for liquidation of debt on the account, whilst about N65

Millon purchase dollars for bills for collection on behalf of the S'* Defendant and the rest

withdrawn in cash by the 5" Defendant.

PWE6 was Adefemi Kolawole an employee of First City Monument Bank (FCMB) Plc. He

testified as to th

low of a total sum of N59,100,000.00 from the 6" Defendant into the

5" Defendants account. Out of this Naa Million was used for purchase of dollars for

settlement of bills for collection and the rest used for the payment of the §'* Defendant's

loan to FCMB,

PW? was Dairo Oluwakemi an employee of Access Bank Plc. His testimony was also on

inflow of N23,500,000.00 from bank PHB to the 5! Defendants account which was used to

Purchase dollars and same remitted to Risa Enterprises.

14 - &

' OTRIIFIED TRUE COPY

PW was Hector Oghobahafe a bank employee with ‘Skye Bank Ple. He sald that on 2™

October 2008 the sum of N34 Milion was received into the account of Drillcom Limited

from the 6* Defendant out of which the sum of N110 Million was paid out to the

complainant. Another N20 Million was given value in the name of Kalushe Resources

Limited whilst the remaining money was placed in fixed deposit and later paid out in

tranches,

‘When cross examined PW8 said he did not know If the 1, 3 and a Defendants were

directors of Drillcom and he did not know the signatories to the account. He also did not

know the 2% and 5" defendants and he agreed that the 6! Defendant did not benefit from

the inflow or outflow from ‘the account,

PW9 was Nkoye Egonu an employee of Diamond Bank le. She testified as to the account of

the 5" Defendant which had Previously been in debit and how the sum of. N79,600,000,00

was on 11" August 2008 received fram the 6! Defendant into same. The said sum reversed

the Indebtedness on the account and the rest of the amount in the account now in credit

WAS used to make bids for the purchase of dollars on behalf of the 5" Defendant which

were paid to Risa Enterprises. On 9" September 2008 another Payment of N65 Million was

received from the 6" Defendant and this sum along with other Payments made into the

account put the 5 Defendant's account with Diamond Bank account which had gone into

debit after the purchase of the dollars back into a credit position,

PW20 was Usman Zakari an operative of the EFCC who also testified on investigations done

by the EFCC. He said a cheque of N285 Million was released by the complainant for the

Purchase of shares of the 5" Defendant's in the private Placement. That Prior to this the 6”

Defendant was indebted to the 5" Defendant in the sum of N130 Million and two days

before the commencement of the private placement the cheque of N285 Million was

‘Credited into the 5" Defendant’s account with the 6 Defendant. When this was done the

indebtedness of the 5" Defendant was erased, On the same day the 5" Defendant wrote

that the payment should be reversed stating that the crediting of its account was done in

Srror as there was a private placement account into which the money should have ne

15 S

aratifjeD TRUE COPY

Paid. The 5" Defendant however also instructed the 6" Defendant to issue @ cheque in the

sum of N19,500,000.00 to Drillcom. He said that before the reversal of the N285 Million

Payment, there were series of debits to the tune of the N130 MI

FCMB, Skye Bank, Diamond Sank thus the N285

qn and the transfers to

illion payment was not reversed. PW10

sald that all the transfers were done after the letter of reversal was written,

PW10 said that Drillcom in which he sad the 3" Defendant, his younger sister and her

husband had interest, He said there was a memorandum of understanding (MOU) between

the 5" Defendant and Drillcom in which it was agreed that a flat fee of 7% of the

underwritten sum would be paid to Drillcom. When the MOU was shown to the 3

Defendant he agreed he would refund the sum of N19,500,000.00 but he failed to do that.

PWA0 said that Drillcom was not featured in the private placement memorandum and what

‘the public saw was the 6" Defendant as the standby underwriter.

Under cross examination PW10 said that he did not know whether the ‘SEC regulated private

Placements but the.6" Defendant's job in the placement would end after the proceed funds

had been pald to the 5! Defendant and the shares allotted, He agreed that Daniel

Chukwudozie only bought twenty two million units of shares worth N62 Million and brought

other persons who subscribed to additional shares worth N792 Millon. He agreed that it

‘was after allotment that the complainant acquired the shares from the other persons and

became the owner of same. He agreed that this was a secondary transaction to the initial

Private placement and he did not know the other persons that bought shares and sold same

to the complainant. He agreed that by Exhibit P9 the persons with responsi! lity for the

Private placement memorandum were the directors of the 5 Defendant and not the other

Defendants. He said he was not aware that the 4" Defendant was not involved in the

Private placement and was only charged because an argument ensued when he went to the.

EFCC to explain the private placement exercise. When asked if there was anything wrong

with the 5 Defendant using the funds after allotment PW10 said there was no allotment.

when cross examined further PW10 agreed that al subscribers were meant to study Exhibit

P9 before investing. He said he was not aware if the st* Defendant had been able to hold its

annual general meeting but he agreed that the no name was listed on Exhibit P9 as

stern

1s CERTIFIED TRUE copy

PW41 was Danie! Chukwudozie the chairman of the complainant. He sald he knew the 1

Defendant through his wife as the 1* Defendant's wife and his wife were childhood friends

and that the 1* Defendant's wife was also his account officer in Zenith Bank, The 3%

Defendant was brought to his office by the 1% Defendant when they came to introduce the

5* Defendant's private placement to him, They told him that the 5" Defendant was doing

well and Its shares would be listed on the Stock Exchange within @ month at the rate of NS

Per share. He was told that he could purchase 200 million units of shares at N2.85 per share

‘whilst he would need to pay a premium of N.20 on an additional 100 milion units. Pw11

said though he was informed that some of the private placement proceeds would be used

0 pay part of the loans owed. by the 5!" Defendant, he was not informed that the 5”

Defendant was indebted to the 6 Defendant. He was however told that the shares were

tnderwriten by the 6 Defendant. PW12 said he thereafter Invested a total sum of NESS

Millon to buy 300 milion units of shares in the private placement and also paid adeltional

Sum of N40 Million for the premium on a 100 milion units of shares. He sad he was told

that the N20 was for premium but it was later that he found that the premium was meant

for the 1 and 3" Defendants.

The total sum invested was transferred to the 6" Defendant by the 1°* Defendant's wife as

the 1* Defendant told her he had concluded with PW11. PW11 said that though he was

shocked at this, he later signed cheques to cover the movement of money which he did,

After the money had been transferred to the 6% Defendant, the 1* and 3” Defendants

brought Exhibit 9 to him. The shares were however not lsted within a month ag promised

and PW11 said he started putting pressure on the 1 Defendant who said he would talk to

the 2% Defendant. The 2"! Defendant then told him that he would get some people to buy

back the shares but he did not see the 2™ Defendant again until after the matter was

reported to the EFCC. PW11 said he tried to. 0 to the 5™ Defendant's factory in ‘Sagamu but

the 2" and 2 Defendants asked him not to 80 as the shares would soon be listed. When

nothing happened, he engaged a consultant who told him that he should have checked

before buying the shares but he did not do so because he thought he was dealing with

People that he knew and that their bank was warehousing the funds of the private

Placement as well as underwriting same. He eventually contacted the 5 Defendenes fe

7

GZRTIFIED TRUE COPY

lawyer who agreed that they could go to the factory, whilst on the way he was called back

to come for a meeting at the 5" Defendant's jora office but he sald they were already on

‘the way, When he got to the factory, he saw the manager who told him that not much was

going on in the factory and he was not allowed to inspect the factory and was just looking at

old machines from outside. Pwi1 said he then employed People to investigate and he got

somebody to go to SEC where he was informed that the 5" Defendant had been asked to

bring the required documents but had not done so, therefore SEC could not list the shares.

He however still continued waiting since the 5" Defendant had said it wanted to import

Machines and he felt that if it was in business, then he could recoup his investment, in 2011

he learnt that the 5" Defendant was to hold its annual general meeting (AGM) in Lokoja and

{his was belng done without notifying him. He therefore called his lawyer to go to court to

get an injunction to stop the AGM. PW11 said he was still waiting to be invited toa meeting

by the Sth Defendant but nothing had been done. He said he wrote a petition to the EFCC

that the 5" and 6" Defendants had connived to defraud him, In the course of investigation

the EFCC tock all the parties to the 5" Defendant's factory site and it was seen that nothing

‘was working and that the factory had closed down about four or five years before,

When asked in whose name the 300 Million units of shares had been Purchased, PW11

sald that he had wanted to bring in people to buy the shares but because of the short time

and pressure, the 1* Defendant took his (PW11’s) wife to the 6" Defendant to provide a

Tame and several names were written including his wife’s name and names of people he did

not know. However the whole responsibility was on him thus he asked that the shares be

moved to the name of the complainant, He

id he did not employ another person to verify

what he was told by the 1 and 3" Defendants because he relied on them and if what they

had told him was true the business would still have been viable. He sald it was not true that

he had previously purchased shares ‘through the 1" Defendant and that the only shares that

hhe had ever purchased through him was that of the 6" Defendant,

PW1L agreed under cross examination that he met the 4" Defendant at the EFCC office. He

agreed that 22 million u

of shares were bought in his name whilst the rest were bought

in other names but said all the sharés were bought during the private placement with his

money. He sald It was when he was asking for refund of his money that share certificates

18

SERTIFIED TRUE COPY

sf

were issued by the 5" Defendant and that the complainant had no choice than to take over

the shares since its money was involved. He agreed that he had a lot of professionals

working for him but said the 1" and 3" Defendants did not. give him the chance to conduct

due diligence on the 5" Defendant's private Placement. He however agreed that he was

Siven Exhibit P9 before the shares were purchased. When cross examined by Counsel to the

2 S® Defendants PW11 said that the sult he filed to obtain injunction against the 5®

defendant had been struck out. When cross examined by Counsel to the 6" Defendant PW1

‘maintained that it was the complainant that transferred money to the Treasure Much

account in the 6 Defendant with which the shares were bought.

The last prosecution witness (PW12) was Omudya Dafinone a chartered accountant who

sald he was engaged as a report accountant for the private placement of the 5* Defendant's

‘shares, In the course of this assignment, he audited its financial ‘statements for years 2003-

2007 and also reviewed the Profit forecast together with the assumption to the profit

forecast for years 2008-2011, The materials made avallabe to him were the financial report

and the profit forecast that had been done by the management. He said he made

Projection for increased Profit from N2,449,665.00 in 2006 and N5,386,585.00 in 2007 to

N98 Million in 2008 and N291 Million in 2009, This Profit forecast was based on the

assumption that after the

te placement, the money injected into the 5" Defendant

‘would have been used to buy new machinery and reduce its indebtedness, He said that the

‘forecast could not happen if proper utilization of the Funds was not done and that the job of

management was to utilise the funds in the manner specified in thelr record for the best

interest of the shareholders.

PW12 agreed under cross examination that. his company was engaged to work for the 5

Defendant. He sald he did not test if all the things that had been stated in his report for the

5™ Defendant was true as it was not Possible to test everything and he only carried out

Sample tests but he attended the board meeting at the Stock Exchange after the private

Placement and as at that time he stood by his report. He sald that in writing the report, his

job wes not to do due diligence which [Link] entailed more invest igation. He agreed

that sometimes projected profits do not always come out as planned, et

x

CERTIFIED TRUE COPY

19

Upon conclusion of the prosecution's case all the Defendants made no case submissions

which were dismissed by the Court and after this the 1* to 5" Defendants led evidence

whilst the 6" Defendant rested Its case on that of the prosecuti

‘The 1 Defendant was the 1* defence witness (DW/). He testified that he got to know PW11.

through his wife and that although he tried to make PW11 open an account with the 6”

Defendant, PW refused saying that he was interested in private placements which DW1

could bring to his attention anytime he saw a good one. Consequent to this DW1 introduced

the public offer of shares by the 6" Defendant to PW11 and that of another company called

Dufll Prima, In July 2008 the 5" Defendant which was one of the 6" Defendant's customers

wanted to raise funds by private placement so DW1 introduced same to PW11. He went

with the 3" Defendant who was his boss at work to meet PW11. Exhi it P9 was given to

PW1i who said he wanted full allotment of the shares he was applying for and the 3°

Defendant told him that he knew a company that could arrange for him to get 100 million

Units of shares on preferential allotment based on @ premium of N2.10 per share. The offer

was to open on 16" July 2008 but on 16" July, PW11 gave DW1 and the 3 Defendant

instructions to debit Treasure Much Limited’s account and signed a cheque to this effect.

Prafts of N285 Million and N110 Million were raised from the cheque for the purchase of

the shares and for payment of premium to Drillcom respectively.

DW said the draft of N285 Million was paid into the 5! Defendant's account on 14" July

‘two days before the offer opened. After the payment, sixteen forms were taken to PW11’s

wife and the shares were allotted ‘and DW1 delivered the certificates, Said share certificates

were admitted and marked as Exhibits D6 (1-16). DW1 said the only person he dealt with

‘was PW11 and that the persons in Whose names the certificates were issued included

Pwia’s wife and children, other names borne by PW14 and his children whilst others were

in the names persons he did not know. DW sald he got to know all these when he was

arrested by EFCC and PWi1 claimed that he had been forced to acquire the shares of his

associates but he was unable to Produce the said associates at the EFCC, After delivery of

the share certificates, PW11 called him and: asked if he could help to recover his money,

because SEC had made a rule that shares could only be listed atthe price upon which they

were Issued and also asked that he talk to Drillcom to return the premium pai

20

GERTIFIED TRUE COPY

said he did not sell shares to the complainant and he was not involved in the consolidation

of the shares to the name of the complainant. He was aware that several other persons

including the staff of the 6 Defendant purchased the 5" Defendant's shares none of whom

Sota refund of their money. With respect to the N285 Million payment which was alleged to

have been used to liquidate the 5" Defendant's indebtedness, DW sald that this was not

the case as the 5" Defendant had an overdraft with the bank which was stil operating at

the time the cheque was paid in. He said that the N285 Million was the proceeds of a

Preferential allotment of 100 million units of shares which predated the commencement of

the offer. He said that the major drawdown allowed by the 6” Defendant was the sum of

N45 Millon transferred to GTBank and that the facility which had been granted in January

2008 before the private placement commenced was for a 12 month tenor and continued

running, He Identified the entries on the account as including the debit of N285 Million

based on the 5 Defendant's letter that the sum be moved to the private placement

account. There was however another letter from the 5" Defendant that the money should

be moved back to the ‘operations account for its use which instruction was complied with by

the S" Defendant, Out of the N28S Million, N45 Million was transferred to GTBank on 17

July, N5,490,494.2k used by the 6" Defendant on same day to pay for mature bills for

collection. He also identified other withdrawals by the 5" Defendant as including N2.8

Million on 31° July, N4 Million on 7 August, 'N28,300,000.00, N74,740,000.00,

N73,750,000.00, N79,600,000.00, N60,800,000.00 and N23,500,000.00.

DW said all other proceeds of the private placement were paid into the private placement

account including further sums paid for shares by PW11 and his associates. DW4 said the

N285 Mi

n was payment for the preferential allotment of 100

lion units of shares and

the additional shares PW1 and his associates bought amounting to 200 Million units were

‘ot preferentially allotted. He said that in 2008 the allotment of shares of private companies

was not regulated by NSE or SEC so the 6" defendant saw the preferential allotment as

being a private arrangement between the subscribers and the Si defendant and on the

Strength of writing to the bank with the names of the allottees, the 6! Defendant did not

object to the utilization of the funds. He said further that in a private placement, the

sompany did not need to wait until the end of the offer period before allotting shares. He

said that the cheque of N395 Million issued by Treasure Much which instructed eg

2

QERTIFIED TRUE COPY

Defendant to raise two drafts of N285 Million and N110 Million in favour of the 5”

Defendant and Drillcom respectively were properly issued and signed by the complainant.

On 8" September 2008 the amount standing as balance in the private placement account in

the sum of N748,000,603.68 was transferred to the 5" Defendant's operations account.

WI said it was not true that he spent out of the private proceeds amount or that the 5

Defendant was a dead company at the time of the placement as it was operational and

several members of the 6 Defendant's staff Invested in the private placement.

When cross examined by the 2" and 5" Defendant's Counsel, DW1 agreed that It was the

6" Defendant that prepared Exhibit P9 but said he could not confirm if it was meant to

monitor the money and see that It was spent for the purpose stated in Exhibit P9, He agreed

‘that the 5" Defendant protested vide a letter after the N2&S Millon was ald into its

Curent account that same should have been paid into the private placement account. He

Sereed that the payment was made by Drllcom and that he was the one who collected the

‘cheque and handed over same to the 3" Defendant who Bave It to Drillcom, He said there

NAS an agreement (Exhibit P413) on the preferential allotment which was between Drilleam

and the 5 Defendant on one hand and Drillcom and thé complainant on the other hand. He

‘hen agreed that in all private placements the funds must be placed in the placement

Sccount, He said it was not stated on Exhibit P9 that the 6” Defendant was the underwriter

of the shares. He said all the payments made by the 6! Defendant were in accordance with

the purpose of the private placement, He said the 5! Defendant Was no longer indebted to

the 6 Defendant and that its overdraft had expired, When asked if N130 Million was

Geblted from the account, DW1 said it was not debited but when funds are eid into an

account, the account would adjust itself to remove any debit on same.

When cross examined by the 6" Defendant's Counsel DW1 said that there was nothing he

‘old the complainant which was not in Exhibit P9 and at the time he handed ‘over Exhibit PS

one Mr Williams a chartered accountant was with PW11. He agreed that the 6" Defendant

was not involved in the negotiations between Drillcom and the 5 Defendant or Drillcom

and the complainant. am SERTIFIED TRUE COPY

Under cross examination by Counsel to the prosecution, DW1 agreed that out of the N978

Million realised from the private placement the sum of N&S5 Million was invested from the

‘Treasure Much account of the complainant and that he also knew that the money paid into

Treasure much came from Oozzy Oil and Gas’s account. He agreed that the loan of N130

Million owed to the 6" Defendant was paid after the end of the placement. He agreed that

the complainant was not a party to the memorandum of understanding between Drilicom

and the 5" Defendant. He sald that apart from PW11 there was no complaint from other

subscribers about the non listing of the 5" defendant's shares after the allotment. He

agreed that he did not mention in his statements to the EFCC that the reason PW11

reported to the EFCC was due to non refund of his money. He agreed further that the

account of the S Defendant had been dormant as at 10" January 2007 before It was

reactivated and it was after this that the loan facility of N10 Million was granted to it by

the 6" Defendant.

DW1 agreed that the debit balance of the 5" Defendant as at 30” June 2008 was Nasi,

144,460.63k and when the cheque of N285,Million was paid in on 14 July the account

balance betame N153,855,539.37 credit, He agreed that four other cheques were issued on

15" July by the 5" Defendant and transactions were also done by the 5" Defendant on the

account. He said the N285 Million payment was reversed on 16" July but the payments

from the account between 14" and 16" July. were not reversed and that the N25 Million

was paid back into the account on the same day after the reversal. He said that on 15

October 2008 the sum of 19,950,000 was issued in the name of Drillcom but disagreed

that said money was shared by him and other management staff of the 6” Defendant. He

agreed that there was nothing on exhibit P9 that spoke about preferential allotment of

shares. He agreed that by Exhibit P9 the time,for the 6" Defendant to release the proceeds

from the share placement to the 5” defendant was 22™ August 2008. He said the proceeds

were not paid until 8"" September when the 6" Defendant paid the N748 Million proceeds

to the 5" Defendant and on sald date, the 5" Defendant was indebted to the 6" Defendant

in the sum of NS45,801,547.22 and when the proceeds were paid into its account its

balance became N202,199,026.64 credit. DW1 said he could not remember if he had

attended a meeting with the 5"" Defendant: prior. to the private placement or if the 5” k

Nt

CERTIFIED TRUE COPY

23

Defendant wrote expressing its displeasure that the 6” Defendant did not take up the

remaining shares as underwriter.

DW2 [Link] 3“ Defendant. He said got to know about the 5" Defendant's private

placement when it invited proposals on same from several banks and the 6"” Defendant won

the bid for said placement, He said when PW1 was marketed on the private placement he

said he wanted guaranteed allotment. DW2 said he then told PW11 that he was a

member/financial controller of an investment club called Drillcom and that he could ask

Drillcom to enter into negotiation with Nulec to buy the shares for PW11 for which would

have to pay him a commission of N1.10 per share for his efforts and PW14 agreed to this.

DW2 said he told the 2" Defendant that he had a potential preferential deal for 100 million

units of shares and the 2" Defendant agreed to pay him a fee of N19.5 Million and an MOU

to this effect was signed between Drillcom and the 5" Defendant,

By the end of 2008, share prices were falling and SEC also made a policy that shares could

only be sold at the last price at which same were sold. it was at this point that DW2 got a

call from DW4 that PW11 was not happy that he might be making a loss. DW2 agreed to

speak to other members of Drillcom and a refund of the N100 Million was made. PW21 then

said he wanted the money paid for the shares back and a meeting was arranged with the 5"

Defendant's officers. The 5 Defendant offered to buy out PW11 over a period of three

Years but he insisted on having his money back or that he should be made a director of the

5" Defendant. DW2 said he was invited to ‘the EFCC and when the matter was explained the

EFCC asked them to go and resolve it among themselves. At another invitation by the EFCC

he learnt that PW11 said he bought shares worth NESS Million which he was not aware of.

He however offered to make a refund of the N19.5 Million paid to Drilicom by the ©

Defendant, He said that although he earlier said the N19.5 Million was shared with other

staff of the 6" Defendant, the ‘2% and 3" Defendants were not among those who shared

same. DW2 agreed that the cheques for N285 Million and N110 Million were handed over to

Drillcom officials and that after the N285 Million was Paid into the 5 Defendant's account

on 14 July it wrote that same should be transferred into the private placement account

when same opened on 16" July, He agreed that the N285 Million was later moved back to

the 5" Defendant's operational account based on the 5" Defendant's written woe R

24

SERTIFIED TRUE copy

Vide Exhibit P41 in view of the fact that the preferential allotment had been concluded and

the 5! Defendant now free to spend the money. He said that the money had only been

‘moved into the private placement account so It could be captured as part of the total

Proceeds of the private placement.

Under cross examination by the 2 and 5" Defendant's Counsel, DW2 said he was not the

5" Defendant's account officer same was one Wahab Fagbo. He said the 5" defendant was

# going concern and that the 6" Defendant was the financial adviser and issuing house for

the private placement. He disagreed that part ofthe N285 Millon was used to Pay the N130

Million indebtedness of the 5" Defendant but said same was used at the end of the

Placement to pay what the 5" Defendant was owing. He sald that the §!™ Defendant did not

know that the sums invested by PW: came from Treasure Much ‘account but it knew about

the

westors on¢e N28S Million was paid to it and itallotted shares,

When cross examined by Counsel to the 6 Defendant, DW2 sald he visited the office of the

5 Defendant in June or July 2008 in relation to the private placement. He

no payment

was made by the 6" Defendant without the consent of the 5” Defendant.

Under cross examination by the prosecution Counsel, DW2 agreed that there was no

provision in Exhibit P9 for proceeds of the private placement to be paid to the 2™ Defendant

before 22" august 2008. He also agreed that it was on a! September 2008 that the

Proceeds in the sum of about N748 Million were remitied to the 5 Defendant's account,

He sald the account was already in debit of N548 Million and said payment wiped out the

debit leaving a credit balance of over N202 Million. He agreed that by Exhibits D8 and D9,

the 6" Defendant agreed to be standby underwriter to the private placement,

When re-examingd DW2 said that the 5" Defendant did not allot preferential shares, but

allotted ordinary Shares on Preferential basis.

The 4" Defendant was the third defence witness (DW). He said he did not play any role in

Packaging the priyate placement memorandum but led other officials in making a pitch for

the 6" defendant to be appointed as issuing house for the private placement. When the A

25 \

CEATIFIED TRUE COPY

offer of shares closed, same was not fully subscribed and the Issue of underwriting came up

with the 5" Defendant asking the 6” Defendant to take up the non subscribed shares. He

then had to come in to explain that from the documents avallable, the 6” Defendant did not

underwrite the offer as no underwri

1g agreement was executed. DW3 sald he was also

one of the subscribers of the shares as he bought two milion units and that after the offer

he went on vacation. It was when he came back that he learnt that the 1* and 3%

Defendants had been arrested by the EFCC and he was asked by the 6" Defendant to ‘go and

expla

the whole process to the EFCC. PWi1 did not however take kindly to his

explanations and shortly after this he was asked to make statements by EFCC officials who

did not give him the opportunity to write freely but were asking him questions and if they

did not like the answers he gave they would not allow him to weite same down. In his

Statement he mentioned that it was one Emeka Obiareri that handled the transaction and

‘was made to give an undertaking to produce the sald Emeka. DW3 said he had never met

PW211 until when he got to the EFCC.

Under cross examination DW3 agreed [Link] and other officials of the 6" Defendant

attended @ meeting with the one Mr Monty the then managing director of the 5*

Defendant. He agreed that the 2" Defendant was not present atthe sald meeting and it was

‘here that terms of the private placement were agreed upon. He agreed that he and Emeka

signed a letter in which the 6" defendant agreed to take up several roles including issuing

house and standby underwriter but said same was subject to internal approval by the 6"

Defendant. He stated that no underwriting agreement was ever executed but agreed that

the 6” Defendant had responsibility for the sums in the proceeds account until same were

handed over to re 5" Defendant.

When cross examined by Counsel to the 6" Defendant, he re-stated that no underwriting

agreement was Signed.

Under cross examination by the prosecution Counsel DW3 agreed that it ‘was not stated that

the agreement for the 6" Defendant to be underwriter was subject to formal agreement. He

agreed that other roles that the 6" Defendant accepted to play in the placement were also

26 GERTIFIED TRUE cay”

Rot covered by separate agreements. He said that he fled a fundamental rights suit against

the EFCC and the complainant which was later withdrawn,

The last defence witness was the 2" Defendant (DW4), He testified that the 5" Defendant

was a company Involved in sales and Production of electrical appliances and goods. He said

that he had held several Positions in same and was its managing director between 1984 and

2007, In 2007 the 5" Defendant decided to raise capltal via private placement of shares to

offset its debts and it approached the 6” Defendant to be the issuing house for sald

placement. Meetings were held with the 6" Defendant's officials who Included the 1%, 3%

and 4 Defendants as well as Emeka Obiareri at which the roles of issuing house, receiving

bank and standby underwriter were agreed to be played by the 6" Defendant and the fees

to be paid to it also agreed. DW said the role of underwriter ‘meant that the 6" Defendant

‘was take up any shares remaining in case the shares inthe private placement were not fully

subscribed, On 14" July prior to the opening of the private Placement, the Sth Defendant

noticed that the sum of N285 Million was Paid into its current account and it immediately

notified the 6 Defendant of this error and that same should be paid into the private

placement proceeds account.

Dwa testified further that Exhibit P9 was Prepared by the 6" Defendant and the share price

Of N2.85 per share was arrived at based on the value of the shares. The Purpose of the

Private placement was to

‘crease shareholders funds for product line expansion, debt

reduction and to create working capital, The amount ‘Stated on Exhibit P9 for payment of

loans was N415 Million even though the 5" Defendant owed banks around N5OO Million but

because it wanted to work with the 6 Defendant, it had to ay off the other banks. The

amount owed to local Suppliers was close to N40. Million whilst what was owed to foreign

suppliers was around NSOO Million. DW4 said though amount stated on Exhibit P9 for

Payment of loans was N415

lon the total amount Indicated in a later page of Exhibit pg

for payment of debts ‘was N379,685,259.00. He said that at the upon conclusion of the

Private placement exercise, the 5 Defendant was not able to realise the projections or

Purpose of the private placement due to shortfall in the proceeds as the 6" Defendant did

not take up the unsubscribed shares which amounted to 25% of the shares thus there was a

Shortfall of about N350 Million. The 5" Defendant was also indebted to the 6" Defendant

” gentiFiED TRUE COPY

2

but was told that its credit line had been suspended, At the end of the private placement,

the 6 Defendant transferred the money realised to the 5" defendant's current account and

it started to use the mone

the account until same came to zero. DW4 said the loan

Payment projected in the private placement was N450 Million but the total amount paid

from same was N409 Million. He said the amount paid for local supplies was N28 Million

whilst that of foreign supplies was N320 Million though what the 5 Defendant had

Projected was N495 Million. He said that what was projected as payments to local and

foreign suppliers was less than the amount actually of debts owed by the 5™ defendant

because the plan had been that the fest of the debts would be paid in the normal course of

business. DW4 sai

the projections for product line expansion and reserve could not be

realised due to shortfall in the underwriting which meant that no money was available to do

the sald things. He said It was not true that false statements were made in Exhibit P9 as the

figures were carefully studied by the reporting accountant and the 5" Defendant was

‘Optimistic that the private placement would be fully subscribed. He stated that all the

foreign suppliers were paid based on the fact that goods had earlier been supplied but the

Form Ms had expired because of nonpayment at the right time, However the papers were In

order and were revalidated by the banks and the CBN. He said that the S® Defendant was

nota dead company and had many employees and bank statements showing that it was

‘ongoing.

DWwa sald he first got to know PW11 when he'saw his name on the list of names submitted

by Drillcom and PW was among the persons to whom shares were allotted after payment

oF N285 Million by Drillcom. When the 5" Defendant noticed the payment of N285 Million

Into its current account, it immediately wrote the 6” Defendant to complain about the error

and the said sum was credited to the private placement on 16" July 2008 when the private

placement commenced. In the course of the placement, the shares were marketed and sold

and a final list of investors was sent to the 5" Defendant by the 6" Defendant, The 6!

Defendant then paid the proceeds of the shares less Its charges Into the 5 Defendant's

Operational account. He said there were about 330 subscribers and the total amount

realised from the placement was 1,074,000,000.00.

| \= Gaamien tau copy

| 28

After the allotment, DW4 said he received a call in November 2008 from DW. saying that

PW11 was anxious about the status of his investment and the listing of the shares on the

Stock Exchange so a meeting was arranged with PW11 at ‘which he was shown all the efforts

being made by the 5" defendant with respect to the listing. PW41 however said that his

associates who invested were pressurizing him to collect their money back but the s®

Defendant said it could not buy the shares back. The 5 Defendant later received a letter

from solicitors to PW11 asking that the shares bought by PW11 and his associates be

‘consolidated into the name of the complainant. It replied that this could not be done until

after the Stock Exchange had accepted the application for listing and when the sald approval

was obtained the shares were ‘changed to the name of the complainant, it was at this point

that the 5" Defendant realised that the total value of shares bought by the persons

associated with PW11 was 200 million units worth N85S Million which was 20% of the

shares of the 5" Defendant, After the private placement, the §* Defendant commenced the

Process of listing its shares but it could not recelve SEC approval due to the sult filed by the

complainant which prevented it from holding its annual general meeting. He explained that

Payment of N25 Million made to his nephew Sasha Israni @5 narrated in the evidence of

PW1 was due to the fact that his nephew borrowed the 5! Defendant money Prior to the

Private placement. He maintained that the S" Defendant ‘Spent N104 Million from its cash

flow on purchasing materials for its factory In Sagamu and other expenses like travelling

Costs and salaries. He said the shortfall In the share Subscription which should have been

underwritten by the 6 Defendant was N350.4 Million and that the 5 Defendant wrote to

Protest about this. The 5" Defendant was unable to embark on ‘the new product line

expansion that had been stated in Exhibit P9 due to the failure of the 6” Defendant to

underwrite the femalning Shares together with the fact that the 6" Defendant took the

N130 Million that was owed to it from the private Placement proceeds. He said that apart

from the suit which stopped the AGM of the 5" Defendant, the EFCC also got a court order

freezing all the accounts of the 5" Defendant Which order was still in place. He said the s™

Defendant presently had little or no activity due to this ease which started in 2022.

Under cross examination by Counsel to the 1°) 3° and 4 Defendants, DW4 said he met the

1" and 3 Defendant several times before the private placement and met the 4" Defendarit

‘wice when he was told that the 6! Defendant refused to underwrite the shares, He said the

| 29

|

| amatiCieD

5" Defendant however dealt principally with Emeka Obiarerl. When cross examined by

Counsel to the 6" Defendant DW4 agreed that immediately payment was made for the

N28S Million shares, same were allotted and the funds for the shares became the s!*

Defendant's property. He agreed that the funds were moved back from the allotment

account to the 5 defendant's account based on the 5" Defendant's request. He also agreed

‘hat no name of underwriter was stated on Exhibit P9 though it was written on same that

the shares were underwritten,

Under cross examination by the prosecution Counsel, DWA said he was one of the founders

of the 5" Defendant and was its managing director until 1984 when he left for Switzerland

but stil remained on its board and when he came back to Nigeria, he became the chairman

Of the 5" Defendant in 2008. He agreed that the Private placement closed in August 2008

but the listing of the shares had not been done up till August 2012 when PW11 got the

Court order stopping the AGM. He ‘agreed that the 5" Defendant did not submit its 2009

annual report but said it was the 2012 order that made it unable to submit the 2009 report.

He agreed that Exhibit P394E and F were reminders written in 2010 and 2011 by SEC asking

for the 2009 audited account but same was not submitted up till the

fe the order of

injunction was made. He agreed that the amounts Paid as loans from the shares proceeds

were higher than the estimated figures in Exhibit P9. He agreed that based on Exhibit P9 it

‘WAS not out of the place for PW11 to believe the shares were underwritten. He agreed that

the 6" Defendant recouped the loans it had Granted the 5" Defendant after the placement

Proceeds were paid into the 5" defendant's account and that after this it stopped operation

of the 5” Defendant's loan fa ity. He agreed that the account of the 5 Defendant was

dormant from 2005 till it was reactivated in January 2007 when it applied for and got 130

million overdraft which was the amount by which the account was in debit as at the

beginning of the private placement. He agreed that further loans were granted during the

Placement exercise such that as at the date the proceeds of the placement were paid into

Its account it had a debit balance of NS45 million and When the proceeds were Paid the said

debit balance was deducted by the 6" Defendant leaving a credit balance of N202 million,

Ne agreed that the remaining sum of N202 milion was used to pay bank debts less 18

million. He said he did not meet the representatives of Drillcom though he knew the 3

Defendant and that the 285 million was deposited Into the 5" Defendant's account by

30!

QERtifieD TRUE COPY

Drillcom. He also agreed that said payment made the account which was in debit of N132

Million to go into credit and that after this several payments were made on the Instruction

of the 5 Defendant. He agreed that when the 5" Defendant protested that the N28s

Million should have been paid into the proceeds account the current account was debited

by the N285 Million but said amount was credited back immediately and there was no

reversal of the expenditure that had been made on the account, He agreed that the shares

Pald for with the N285 Million were part of the private placement and that all the

information in Exhibit E9 except for the first page came from the 5" Defendant. He agreed

that it was stated on Exhibit P9 that he was the CEO of the 5" Defendant. He agreed that

foreign suppliers were paid 495 million as opposed to the projected 320 million, He agreed

that the response of the 5 defendant to letters by SEC asking [Link] audited accounts was

‘that the delay was caused because the 5" Defendant did not have a managing director. He

agreed that all the sums paid to foreign suppliers were wired out during the period of the