Professional Documents

Culture Documents

Is This The Right Time To Invest?: Here Will Come Betty's Graph

Uploaded by

Chaitanya SivaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Is This The Right Time To Invest?: Here Will Come Betty's Graph

Uploaded by

Chaitanya SivaCopyright:

Available Formats

Is this the right time to invest?

Betty was 45 years old when she decided to invest CHF 200 a month (CHF 2’400 a year). With an

average yearly return of 4%, after 20 years – at 65 – she has almost CHF 75’000 (48’000 contributed,

and around 27’000 of compound interests). If she had started investing when she was 35, by the time

she was 65 she would’ve accumulated almost CHF 140,000. I bet she regrets that, ouch!

As a Chinese proverb says: “The best time to plant a tree was 20 years ago. The second-best time is

now.”. Same story for investing, the best time to invest was the first time you had some small savings

and the second-best time is now.

The mathematical reason for starting investing as soon as possible lays in the compound interest

effect. If you reinvest interest (or returns) from an investment, you will accrue even more interest

(returns). The longer you keep investing these returns, the greater the compound interest effect

Here will come Betty’s graph

You may ask, “Ok Rosa, this makes sense in normal times, but we are living through an exceptional

pandemic. Shouldn’t we wait until the situation clears?”

First things first, I hope that you and your family are staying healthy and safe. Secondly, yes, it’s an

exceptional moment, and we don’t know when and how we will get back to normality, nor what that

new normality would look like. Finally, the answer remains the same. Yes, that’s right, you should

invest or stay invested.

“Time in the market” is more important than “Market Timing”

Waiting for the right timing to invest, or trying to buy at the lowest and sell at the highest

(so-called “market timing”), simply doesn’t work. It’s impossible to consistently predict when a

specific investment has hit its lowest or highest. Plenty of studies have shown that “time in the

market” is the way to go: just stay invested, until the original reasons for investing change or you’ve

reached your goals.

During the past twenty years, we had some difficult moments for many investors. The recession of

2008–2009 made some so fearful, they thought that divesting and keeping cash seemed a good

strategy. But trying to avoid the worst drops means also missing the opportunity for gains.

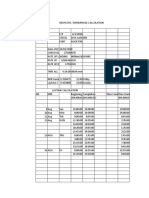

If we look at the last 20 years:

⦁ CHF 1’000 invested in the SMI would have grown to around CHF 2’300 - with an annualized return of

around 4%

⦁ missing just the 10 best days in that period would have reduced the final amount to around 1’150 – and the

annualized return to 0.7%,

⦁ missing the 20 best days would have put the investor in negative territory.

Of course, you could also leave the market and miss the worst days. However, studies show that

people generally sell when the market is down, and they return after the market has already begun to

bounce back, the perfect way to lose!

“Behavior Gap”, the fleeting win

We are all human, and naturally we keep close track of our money. When markets are fluctuating, the

“market-timer” in each of us is tempted to sell the investment too quickly (to capture a small profit, or

to avoid a loss). This is known as the “behavior gap”. “We’re wired to avoid pain and pursue pleasure

and security. It feels right to sell when everyone around us is scared and buy when everyone feels

great. It may feel right – but it’s not rational” (Carl Richards, his books are among the references

below). Unfortunately, once we’ve sold, it’s not easy to identify when we can get back in, and usually

we get back in too late and after a tough emotional rollercoaster!

Here will come Rollercoaster presentation

Again, rather than trying to predict highs and lows, it’s important to stay invested through the

ups’n’downs and focus on the time you stay invested, not the timing of your investments.

Investing your money will support your financial stability, not destroy it.

“But, where do I start? I am scared to invest wrongly and lose my money. I’m not really a numbers

person.”, you might wonder.

Investing doesn’t need to be the aggressive zero-sum game, where someone wins and someone

loses, and you have to beat the market.

The best strategy is to invest gradually in a diversified portfolio, aligned with your investor profile,

preferably paying low fees. How to recognize your needs and values (your so called investor profile),

what is a diversified portfolio and how to build your long term investment plan will be the topics of next

weeks’ articles!

Imagine, how cool will it be, when you learn to use your money for positive change, not just for

yourself, but for your family and the causes you believe in too!

Infographic vector created by dooder - www.freepik.com

Further random interesting readings:

https://www.investopedia.com/terms/m/markettiming.asp

https://en.wikipedia.org/wiki/Market_timing

Benjamin Graham's "The Intelligent Investor"

Erin Lowry’s “Broke Millennial Takes On Investing"

Daniel Kahneman "Thinking, Fast and Slow"

Carl Richards “The One-Page Financial Plan: A Simple Way to Be Smart About Your Money”

Carl Richards “The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money”

Aysha van de Paer, Tedx “What every woman needs to know to close the gender gap”

You might also like

- The Tao of Trading: How to Build Abundant Wealth in Any Market ConditionFrom EverandThe Tao of Trading: How to Build Abundant Wealth in Any Market ConditionRating: 4.5 out of 5 stars4.5/5 (7)

- Is This The Right Time To Invest?Document2 pagesIs This The Right Time To Invest?Chaitanya SivaNo ratings yet

- Safe, Debt-Free, and Rich!: High-Return, Low-Risk Investing Strategies to Grow Your WealthFrom EverandSafe, Debt-Free, and Rich!: High-Return, Low-Risk Investing Strategies to Grow Your WealthNo ratings yet

- EifrigDocument15 pagesEifrigHNmaichoi100% (1)

- 16 Rules For Investing - Sir John TempletonDocument20 pages16 Rules For Investing - Sir John Templetonjude55No ratings yet

- The Smooth Ride Portfolio: How Great Investors Protect and Grow Their Wealth...and You Can TooFrom EverandThe Smooth Ride Portfolio: How Great Investors Protect and Grow Their Wealth...and You Can TooNo ratings yet

- 10 Investment Rules From Investing LegendsDocument7 pages10 Investment Rules From Investing LegendseliforuNo ratings yet

- Your Little Book of Asset Allocation: Everything You Need For Worry-Free InvestmentFrom EverandYour Little Book of Asset Allocation: Everything You Need For Worry-Free InvestmentNo ratings yet

- Sir Templeton's 16 Rules For Investment SuccessDocument20 pagesSir Templeton's 16 Rules For Investment Successmstybluemoon100% (1)

- Millennial Money: How Young Investors Can Build a FortuneFrom EverandMillennial Money: How Young Investors Can Build a FortuneRating: 4.5 out of 5 stars4.5/5 (4)

- TL R16 PDFDocument20 pagesTL R16 PDFelisaNo ratings yet

- Blog 1Document2 pagesBlog 1Amisha PatelNo ratings yet

- Your Money Mentality: How You Feel About Risk, Losses, and GainsFrom EverandYour Money Mentality: How You Feel About Risk, Losses, and GainsRating: 3 out of 5 stars3/5 (1)

- How To Read Financial Statements, Part 1 (Risk Over Reward)Document9 pagesHow To Read Financial Statements, Part 1 (Risk Over Reward)Arun Rao0% (2)

- Rocking Wall Street (Review and Analysis of Marks' Book)From EverandRocking Wall Street (Review and Analysis of Marks' Book)No ratings yet

- Trading The TalentsDocument6 pagesTrading The TalentsciprianNo ratings yet

- The Investor's Manifesto (Review and Analysis of Bernstein's Book)From EverandThe Investor's Manifesto (Review and Analysis of Bernstein's Book)No ratings yet

- The Psychology of Money: Author: Morgan HouselDocument3 pagesThe Psychology of Money: Author: Morgan Houselarrajab MuhammadNo ratings yet

- The Little Book That Makes You Rich: A Proven Market-Beating Formula for Growth InvestingFrom EverandThe Little Book That Makes You Rich: A Proven Market-Beating Formula for Growth InvestingNo ratings yet

- What To Do in Todays MarketDocument5 pagesWhat To Do in Todays MarketSecure PlusNo ratings yet

- EMF BookSummary TheMostImportantThingDocument3 pagesEMF BookSummary TheMostImportantThingVaishnaviRavipatiNo ratings yet

- Winning With the Market: Beat the Traders and Brokers In Good Times and BadFrom EverandWinning With the Market: Beat the Traders and Brokers In Good Times and BadRating: 2.5 out of 5 stars2.5/5 (2)

- Buying The Best StocksDocument3 pagesBuying The Best StocksCarlos TresemeNo ratings yet

- From The Editor, S Desk: Best Regards, NSDLDocument8 pagesFrom The Editor, S Desk: Best Regards, NSDLDikshit KashyapNo ratings yet

- Stock Market Investing For Beginners: The Complete Guide to Investing in Stocks and SharesFrom EverandStock Market Investing For Beginners: The Complete Guide to Investing in Stocks and SharesRating: 5 out of 5 stars5/5 (1)

- 10 Golden Rules To Become RichDocument39 pages10 Golden Rules To Become RichAlmas K ShuvoNo ratings yet

- The Intelligent Investor PDFDocument15 pagesThe Intelligent Investor PDFThaw TarNo ratings yet

- Rescue Your Money: How to Invest Your Money During these Tumultuous TimesFrom EverandRescue Your Money: How to Invest Your Money During these Tumultuous TimesRating: 4.5 out of 5 stars4.5/5 (5)

- GSI Premium GSI015 Hedge Fund SecretsDocument13 pagesGSI Premium GSI015 Hedge Fund SecretsMeihull Mehta100% (3)

- Compounding Interest TablesDocument4 pagesCompounding Interest TablesP. PolimenakosNo ratings yet

- Capital Compounders: How to Beat the Market and Make Money Investing in Growth StocksFrom EverandCapital Compounders: How to Beat the Market and Make Money Investing in Growth StocksRating: 4.5 out of 5 stars4.5/5 (2)

- Beginner - S Guide To Mutual Fund - Abhishek Raja RamDocument81 pagesBeginner - S Guide To Mutual Fund - Abhishek Raja Ramk praNo ratings yet

- The All Weather Trader: Mr. Serenity's Thoughts on Trading Come Rain or ShineFrom EverandThe All Weather Trader: Mr. Serenity's Thoughts on Trading Come Rain or ShineRating: 5 out of 5 stars5/5 (2)

- 12 Market Wisdoms From Gerald LoebDocument7 pages12 Market Wisdoms From Gerald LoebJohn MooreNo ratings yet

- Stay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindFrom EverandStay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindRating: 3 out of 5 stars3/5 (1)

- Years and Keep From Losing It When The Brown Stuff Hits The Blades. You Will HaveDocument7 pagesYears and Keep From Losing It When The Brown Stuff Hits The Blades. You Will Havehunghl9726No ratings yet

- The Art of Execution: How the world's best investors get it wrong and still make millionsFrom EverandThe Art of Execution: How the world's best investors get it wrong and still make millionsRating: 5 out of 5 stars5/5 (21)

- DR Muthu 1 PDFDocument233 pagesDR Muthu 1 PDFPratik Mehta100% (1)

- Jesse Livermore 01Document5 pagesJesse Livermore 01ehemNo ratings yet

- The Battle for Investment Survival (Essential Investment Classics)From EverandThe Battle for Investment Survival (Essential Investment Classics)Rating: 4 out of 5 stars4/5 (1)

- Wiseguy Investing: Beginner Guide & TipsDocument12 pagesWiseguy Investing: Beginner Guide & TipsGorge LeonNo ratings yet

- The Zurich Axioms (Review and Analysis of Gunther's Book)From EverandThe Zurich Axioms (Review and Analysis of Gunther's Book)No ratings yet

- TIPS FiveTotalWealthPrinciplesDocument12 pagesTIPS FiveTotalWealthPrinciplessankarjv100% (1)

- Prosper From Financial Bubbles... And Protect Your Profits: Money for Main St book seriesFrom EverandProsper From Financial Bubbles... And Protect Your Profits: Money for Main St book seriesNo ratings yet

- Week-9-15 CM MDL 4Q Fin121Document15 pagesWeek-9-15 CM MDL 4Q Fin121max manobanNo ratings yet

- Fundamental Analysis - PpsDocument98 pagesFundamental Analysis - PpsRaj Shah100% (1)

- The 5 Mistakes Every Investor Makes and How to Avoid Them (Review and Analysis of Mallouk's Book)From EverandThe 5 Mistakes Every Investor Makes and How to Avoid Them (Review and Analysis of Mallouk's Book)No ratings yet

- Lecture Note #2Document6 pagesLecture Note #2Samyak SethiNo ratings yet

- How to Make More Money By Sitting on Your Butt: and Other Contrarian Conclusions From a Lifetime in the MarketsFrom EverandHow to Make More Money By Sitting on Your Butt: and Other Contrarian Conclusions From a Lifetime in the MarketsRating: 4.5 out of 5 stars4.5/5 (2)

- First Workshop On Creative GardeningDocument1 pageFirst Workshop On Creative GardeningChaitanya SivaNo ratings yet

- 5 Women Who Braved The Indian SoceityDocument4 pages5 Women Who Braved The Indian SoceityChaitanya SivaNo ratings yet

- Don't Invest and Forget: A Look at the Importance of Having a Comprehensive, Dynamic Investment PlanFrom EverandDon't Invest and Forget: A Look at the Importance of Having a Comprehensive, Dynamic Investment PlanNo ratings yet

- Labor DiaryDocument5 pagesLabor DiaryChaitanya SivaNo ratings yet

- The Little Book of Alternative Investments: Reaping Rewards by Daring to be DifferentFrom EverandThe Little Book of Alternative Investments: Reaping Rewards by Daring to be DifferentRating: 4 out of 5 stars4/5 (1)

- Has Quarantine Made Us Caged AnimalsDocument3 pagesHas Quarantine Made Us Caged AnimalsChaitanya SivaNo ratings yet

- Vivamost 02 RiskProfileDocument4 pagesVivamost 02 RiskProfileChaitanya SivaNo ratings yet

- Vivamost 02 RiskProfileDocument4 pagesVivamost 02 RiskProfileChaitanya SivaNo ratings yet

- Vivamost 01 Investing GraphsDocument2 pagesVivamost 01 Investing GraphsChaitanya SivaNo ratings yet

- As For Most Things in Life Start With WHY!Document5 pagesAs For Most Things in Life Start With WHY!Chaitanya SivaNo ratings yet

- Strategic Analysis & Choice Topic 5Document48 pagesStrategic Analysis & Choice Topic 5venu100% (1)

- Csec Poa Handout 3Document32 pagesCsec Poa Handout 3Taariq Abdul-MajeedNo ratings yet

- Practice Exam - Part 3: Multiple ChoiceDocument4 pagesPractice Exam - Part 3: Multiple ChoiceAzeem TalibNo ratings yet

- The Canada Pension Plan Investment Board: HistoryDocument8 pagesThe Canada Pension Plan Investment Board: Historyvedant badayaNo ratings yet

- Differences Between Shares and DebenturesDocument2 pagesDifferences Between Shares and DebenturesKartik Chell100% (2)

- Risk Aversion and Capital Allocation To Risky AssetsDocument16 pagesRisk Aversion and Capital Allocation To Risky Assets777priyankaNo ratings yet

- TechnoFunda Investing Screener Excel Template - VFDocument27 pagesTechnoFunda Investing Screener Excel Template - VFsiva100% (1)

- O Grady Apparel CompanyDocument4 pagesO Grady Apparel CompanySoniaKasellaNo ratings yet

- CISI - Financial Products, Markets & Services: Topic - Investment Funds Lesson: Introduction To Investment FundsDocument11 pagesCISI - Financial Products, Markets & Services: Topic - Investment Funds Lesson: Introduction To Investment FundsSewale AbateNo ratings yet

- Consolidation of Wholly Owned Subsidiaries Aquired at More Than Book ValueDocument39 pagesConsolidation of Wholly Owned Subsidiaries Aquired at More Than Book ValuejuniarNo ratings yet

- Lesson 1 - Review of Basic Accounting (Part 1)Document14 pagesLesson 1 - Review of Basic Accounting (Part 1)Laila RodaviaNo ratings yet

- A Study On Investors Preference With Special Reference To Mutual FundDocument98 pagesA Study On Investors Preference With Special Reference To Mutual FundChandan SrivastavaNo ratings yet

- Asset Retirements: Release 12 Oracle Asset Management FundamentalsDocument24 pagesAsset Retirements: Release 12 Oracle Asset Management Fundamentalsvarachartered283No ratings yet

- Chapter 1Document31 pagesChapter 1SainathNo ratings yet

- Review Test QuestionsDocument24 pagesReview Test QuestionsKent Mathew BacusNo ratings yet

- Unclaimed AccountDocument1,790 pagesUnclaimed AccountDipesh100% (1)

- Unit-1 Introduction & Concepts InvestmentDocument41 pagesUnit-1 Introduction & Concepts InvestmentChirag PatilNo ratings yet

- Despatch Demurrage CcalculationDocument17 pagesDespatch Demurrage CcalculationsellappanNo ratings yet

- What Is Behavioral Finance?: Meir StatmanDocument12 pagesWhat Is Behavioral Finance?: Meir Statmanalassadi09No ratings yet

- Progress and Prospect of Bangladesh Money Market and Capital Market Security in BangladeshDocument45 pagesProgress and Prospect of Bangladesh Money Market and Capital Market Security in BangladeshN M Baki Billah94% (16)

- 1 - Overview of AccountingDocument19 pages1 - Overview of AccountingMichelle Matubis Bongalonta100% (7)

- Competitors Analysis With 4 Others Bank: Total AssetDocument3 pagesCompetitors Analysis With 4 Others Bank: Total AssetMd. Muhinur Islam AdnanNo ratings yet

- Assignment 1 - BEC325Document6 pagesAssignment 1 - BEC325stanely ndlovuNo ratings yet

- Investing in Fixed Income SecurityDocument4 pagesInvesting in Fixed Income SecuritySheila Grace BajaNo ratings yet

- EIC Torrent PharmaceuticalDocument22 pagesEIC Torrent PharmaceuticalRishi KanjaniNo ratings yet

- Analisis Efisiensi Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Jakarta Sebelum Dan SesudahDocument14 pagesAnalisis Efisiensi Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Jakarta Sebelum Dan Sesudahpriandhita asmoroNo ratings yet

- QUIZ1Document7 pagesQUIZ1Mikaela JeanNo ratings yet

- Safe Strategies For Financial FreedomDocument3 pagesSafe Strategies For Financial Freedomnafulabeatrice1980No ratings yet

- India - UAE Import Export RelationDocument6 pagesIndia - UAE Import Export RelationTaha DholfarNo ratings yet

- A Guide To Best Practices in Documentary Crediting: Created and Recommended by The Documentary Producers Alliance (DPA)Document14 pagesA Guide To Best Practices in Documentary Crediting: Created and Recommended by The Documentary Producers Alliance (DPA)El DivulgadorNo ratings yet

- No Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelFrom EverandNo Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelRating: 5 out of 5 stars5/5 (4)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (2)

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeFrom EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeNo ratings yet

- Summary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearFrom EverandSummary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearRating: 4.5 out of 5 stars4.5/5 (558)

- Eat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less TimeFrom EverandEat That Frog!: 21 Great Ways to Stop Procrastinating and Get More Done in Less TimeRating: 4.5 out of 5 stars4.5/5 (3225)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsFrom EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsRating: 4.5 out of 5 stars4.5/5 (709)

- Quantum Success: 7 Essential Laws for a Thriving, Joyful, and Prosperous Relationship with Work and MoneyFrom EverandQuantum Success: 7 Essential Laws for a Thriving, Joyful, and Prosperous Relationship with Work and MoneyRating: 5 out of 5 stars5/5 (38)

- The 5 Second Rule: Transform your Life, Work, and Confidence with Everyday CourageFrom EverandThe 5 Second Rule: Transform your Life, Work, and Confidence with Everyday CourageRating: 5 out of 5 stars5/5 (9)

- Indistractable: How to Control Your Attention and Choose Your LifeFrom EverandIndistractable: How to Control Your Attention and Choose Your LifeRating: 3 out of 5 stars3/5 (5)

- Growth Mindset: 7 Secrets to Destroy Your Fixed Mindset and Tap into Your Psychology of Success with Self Discipline, Emotional Intelligence and Self ConfidenceFrom EverandGrowth Mindset: 7 Secrets to Destroy Your Fixed Mindset and Tap into Your Psychology of Success with Self Discipline, Emotional Intelligence and Self ConfidenceRating: 4.5 out of 5 stars4.5/5 (561)

- Uptime: A Practical Guide to Personal Productivity and WellbeingFrom EverandUptime: A Practical Guide to Personal Productivity and WellbeingNo ratings yet

- Own Your Past Change Your Future: A Not-So-Complicated Approach to Relationships, Mental Health & WellnessFrom EverandOwn Your Past Change Your Future: A Not-So-Complicated Approach to Relationships, Mental Health & WellnessRating: 5 out of 5 stars5/5 (85)

- Napoleon Hill's Keys to Positive Thinking: 10 Steps to Health, Wealth, and SuccessFrom EverandNapoleon Hill's Keys to Positive Thinking: 10 Steps to Health, Wealth, and SuccessRating: 5 out of 5 stars5/5 (306)

- The Secret of The Science of Getting Rich: Change Your Beliefs About Success and Money to Create The Life You WantFrom EverandThe Secret of The Science of Getting Rich: Change Your Beliefs About Success and Money to Create The Life You WantRating: 5 out of 5 stars5/5 (34)

- Summary of The 48 Laws of Power by Robert GreeneFrom EverandSummary of The 48 Laws of Power by Robert GreeneRating: 4.5 out of 5 stars4.5/5 (36)