Professional Documents

Culture Documents

Diagram Aml 2018.07 Ok

Diagram Aml 2018.07 Ok

Uploaded by

Bárbara RosárioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diagram Aml 2018.07 Ok

Diagram Aml 2018.07 Ok

Uploaded by

Bárbara RosárioCopyright:

Available Formats

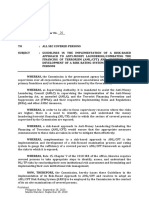

Preventing money laundering and terrorist financing across the EU

How does it work in practice?

EUROPEAN UNION

European Banking

Authority Sets

MEMBER STATE B

guidelines

Financial Intelligence Unit

European Banking Authority

sets guidelines on supervision

of financial institutions and

identifies breaches of EU law

MEMBER STATE A MEMBER STATE C

Financial Intelligence Unit

Anti-money laundering supervisors

AML Supervisor supervise whether obliged entities

carry out their tasks well

Information

Obliged Entities sharing

High-Risk Third (Financial Institutions /

Countries Designated Non-Financial

Business and Professions)

Transactions in EU and from

Other risky Enhanced third countries via bank

situations customer lawyers, accountants

due

diligence

For transactions Financial Intelligence Law enforcement/

Suspicious Competent authority

from high-risk third Transaction Unit

Enhanced countries or in other Reporting

monitoring risky cases Customer Financial Intelligence Unit (FIU) If analysis confirmed, Financial

due analyses the report and shares Intelligence Unit sends it to law

diligence If suspicion with FIUs in other Member enforcement, supervisor or

Monitoring by obliged

European Commission entities who should identified, obliged States other competent authority

determines the list of high-risk ensure they know entity sends report to Financial Intelligence Unit has

third countries, presenting a who their customer is the Financial tools to help analysis:

money laundering/terrorist Intelligence Unit in beneficial ownership registers

financing risk for the Union their Member State (who is the real beneficiary of a

financial system company/trust); and central

Customers bank account registers (who

Other risks identified by Member

States under national risk has which account and where)

assessment or by European

Commission under

supranational risk assessment

You might also like

- FIU Compliance Division Newsletter Issue 02.pdfDocument6 pagesFIU Compliance Division Newsletter Issue 02.pdfKerpenter KokilNo ratings yet

- ITC - TRAINING PRESENTATION On AML CFT 1st SeptDocument21 pagesITC - TRAINING PRESENTATION On AML CFT 1st Septmark1matthewsNo ratings yet

- 2.1 Ppatk - Fin - Rezim Apuppt NotarisDocument27 pages2.1 Ppatk - Fin - Rezim Apuppt NotarisFabian SusiloNo ratings yet

- FIU Compliance Division - Newsletter Issue 01Document7 pagesFIU Compliance Division - Newsletter Issue 01Yaashik HenrageNo ratings yet

- Implementation Guidance On AMLCFT PoliciesDocument26 pagesImplementation Guidance On AMLCFT PoliciesJenevie YiNo ratings yet

- Implementation Guidance On AMLCFT PoliciesDocument27 pagesImplementation Guidance On AMLCFT Policiespalanitewan pandytewanNo ratings yet

- Final - Illicit Financial Flows From Cyber Enabled FraudDocument72 pagesFinal - Illicit Financial Flows From Cyber Enabled FraudAna Gabriela Sánchez RostranNo ratings yet

- ACCO 20083 Task 2 A - Financial RegulationDocument4 pagesACCO 20083 Task 2 A - Financial RegulationVincent Luigil AlceraNo ratings yet

- Notes To Financial Powerventure-2014Document12 pagesNotes To Financial Powerventure-2014M C Dela CrzNo ratings yet

- Anti Money Laundering1Document36 pagesAnti Money Laundering1Manish SinghNo ratings yet

- Combatting Financial Crime in The UAEDocument11 pagesCombatting Financial Crime in The UAEBellaNo ratings yet

- Factsheet AMLD 201712 Ok Web FinalpdfDocument2 pagesFactsheet AMLD 201712 Ok Web FinalpdfTom StammisNo ratings yet

- Live CAMS PrepDocument187 pagesLive CAMS Prepvinttt13409No ratings yet

- Brochures On FIUDocument2 pagesBrochures On FIUredNo ratings yet

- 2019-06-26 Item 1 - Cyber and Third-Party Risk (TPR) ManagementDocument45 pages2019-06-26 Item 1 - Cyber and Third-Party Risk (TPR) ManagementSumaiyaNo ratings yet

- Risk Assessment Guideline: Aml / CFTDocument11 pagesRisk Assessment Guideline: Aml / CFTmutasimNo ratings yet

- Anti-Money Laundering and Its EffectivenessDocument16 pagesAnti-Money Laundering and Its EffectivenessNur Azwa ZulaikaNo ratings yet

- AML - SurveyReportDocument46 pagesAML - SurveyReportRishiNo ratings yet

- FincenDocument3 pagesFincenjana.jffrNo ratings yet

- AMLDocument32 pagesAMLaleeshaNo ratings yet

- Fraud Auditing PPR - EditedDocument3 pagesFraud Auditing PPR - EditedalexNo ratings yet

- Ar5 PDFDocument164 pagesAr5 PDFBhavna Devi BhoodunNo ratings yet

- Money LaunderingDocument26 pagesMoney Laundering✬ SHANZA MALIK ✬No ratings yet

- Virtual Assets Red Flag IndicatorsDocument24 pagesVirtual Assets Red Flag IndicatorsSubrahmanyam SiriNo ratings yet

- Fraud Prevention The Role of The Managing Authorities: Johan KHOUW, European Commission, OLAFDocument20 pagesFraud Prevention The Role of The Managing Authorities: Johan KHOUW, European Commission, OLAFnohrabassem4091No ratings yet

- Factsheet AMLD 201807 2pdfDocument2 pagesFactsheet AMLD 201807 2pdfSwastik GroverNo ratings yet

- FFL Guide - Fraud - RiskDocument26 pagesFFL Guide - Fraud - RiskMuhammad WaleedNo ratings yet

- Financial System and Markets IntroductionDocument25 pagesFinancial System and Markets IntroductionArpitNo ratings yet

- Trusts Risk Assessment Sanitised VersionDocument28 pagesTrusts Risk Assessment Sanitised VersionVictor ShabaniNo ratings yet

- Failure of Risk Management On Lehman BrothersDocument34 pagesFailure of Risk Management On Lehman Brotherssubsidyscope_bailoutNo ratings yet

- Sector Risk Assessment For Registered BanksDocument56 pagesSector Risk Assessment For Registered BanksmutasimNo ratings yet

- ODNI ResponseDocument3 pagesODNI ResponseSunlight FoundationNo ratings yet

- Economic ConsequencesDocument5 pagesEconomic ConsequencesAbhisekNo ratings yet

- 2020 MCNo 26Document10 pages2020 MCNo 26Jhony Martin AlbaNo ratings yet

- Financial Institutions and The Markets: Presentation 1Document16 pagesFinancial Institutions and The Markets: Presentation 1Yoonaas T WaaqjiraaNo ratings yet

- Uts Iqbal Maulana - 31602300049Document3 pagesUts Iqbal Maulana - 31602300049inianal69No ratings yet

- CDD GuidelinesDocument61 pagesCDD GuidelinesFrancescoNo ratings yet

- 2019-06-26 Item 6 - Cyber Incident ReportingDocument21 pages2019-06-26 Item 6 - Cyber Incident ReportingSumaiyaNo ratings yet

- 5 - Fraud Prevention Detection and Correction - enDocument18 pages5 - Fraud Prevention Detection and Correction - enHà VânNo ratings yet

- AML RiskModelsDocument7 pagesAML RiskModelsAnonymous wcqkliGtjNo ratings yet

- Null 063.2021.issue 003 enDocument21 pagesNull 063.2021.issue 003 enShahabas ShabuNo ratings yet

- Alternative Investment Management AssociationDocument9 pagesAlternative Investment Management AssociationMarketsWikiNo ratings yet

- Contab Petro Regula Crypto-Assets-Regulators-DirectoryDocument31 pagesContab Petro Regula Crypto-Assets-Regulators-DirectoryOmar OteroNo ratings yet

- CYPRUS - National Assessment of Money Laundering and Terrorist Financing RisksDocument118 pagesCYPRUS - National Assessment of Money Laundering and Terrorist Financing Risksru4realcy_838983986No ratings yet

- OTS Examination Handbook Update Section 360Document26 pagesOTS Examination Handbook Update Section 360Foreclosure FraudNo ratings yet

- Financial Intelligence Units (FIUs), The U.S. Financial Crimes Enforcement Network, and FIU Operational IndependenceDocument3 pagesFinancial Intelligence Units (FIUs), The U.S. Financial Crimes Enforcement Network, and FIU Operational IndependenceRenaldy Rembrandt SilaenNo ratings yet

- Ifrs at A Glance IFRS 7 Financial Instruments: DisclosuresDocument5 pagesIfrs at A Glance IFRS 7 Financial Instruments: DisclosuresNoor Ul Hussain MirzaNo ratings yet

- EY Romania Wind of Change AML Risk AssessmentDocument14 pagesEY Romania Wind of Change AML Risk AssessmentBogdan ArseneNo ratings yet

- OIG10030 (SAR Data Quality)Document48 pagesOIG10030 (SAR Data Quality)Joe JosephNo ratings yet

- Guideline No. 3 of 2017 Politically Exposed Person RevisedDocument17 pagesGuideline No. 3 of 2017 Politically Exposed Person RevisedMikhail Chung100% (2)

- Fsa 3,4,5Document17 pagesFsa 3,4,5wambualucas74No ratings yet

- Risk Management Presentation July 30 2012Document106 pagesRisk Management Presentation July 30 2012George Lekatis100% (1)

- Risk Management Information SystemsDocument2 pagesRisk Management Information SystemsskaniniNo ratings yet

- FATF-Booklet VADocument8 pagesFATF-Booklet VAVedantSangitNo ratings yet

- Module 8 AssessmentDocument12 pagesModule 8 AssessmentDowluth MansinghNo ratings yet

- 2.2 Mrs. Corinne Dessertenne-Brossard - Docx - The Role of Notary in Ensuring Safe EconomyDocument8 pages2.2 Mrs. Corinne Dessertenne-Brossard - Docx - The Role of Notary in Ensuring Safe EconomyFabian SusiloNo ratings yet

- AT.0105 - Fraud Error and Non ComplianceDocument9 pagesAT.0105 - Fraud Error and Non ComplianceMaeNo ratings yet

- Regulatory Guide to Money Transmission & Payment Laws in the U.S.From EverandRegulatory Guide to Money Transmission & Payment Laws in the U.S.No ratings yet

- FPSC CSS Challan Form 2023 Download PDFDocument5 pagesFPSC CSS Challan Form 2023 Download PDFUm e habibaNo ratings yet

- Unit 5 - Power System Operation and ControlDocument28 pagesUnit 5 - Power System Operation and ControlSilas Stephen100% (2)

- Platinum Wire MSDSDocument5 pagesPlatinum Wire MSDSAlbert PinedaNo ratings yet

- Dastor Pricelist - Up Date 15 DesDocument68 pagesDastor Pricelist - Up Date 15 DesEric YohantaNo ratings yet

- @origen ProfileDocument1 page@origen ProfileCampaign MediaNo ratings yet

- Republic v. CapoteDocument2 pagesRepublic v. CapoteDanna BongonNo ratings yet

- CPL ATPL FuelPlanningDocument19 pagesCPL ATPL FuelPlanningSk ManochaNo ratings yet

- Ministry of OIl & Gas India Statistics 1617Document222 pagesMinistry of OIl & Gas India Statistics 1617R LNNo ratings yet

- Plan of Activities VELA W6 Q4Document2 pagesPlan of Activities VELA W6 Q4JennicaMercadoNo ratings yet

- Infoblox Specs Trinzic Appliances 810 820 1410 1420 2210 2220 4010Document5 pagesInfoblox Specs Trinzic Appliances 810 820 1410 1420 2210 2220 4010frodricrNo ratings yet

- Strategic Management: Date For Submission: Please Refer To The Timetable On IlearnDocument6 pagesStrategic Management: Date For Submission: Please Refer To The Timetable On Ilearnzebst loveNo ratings yet

- 9 - Software TestingDocument61 pages9 - Software TestingAmitabha DeyNo ratings yet

- Material Handling SystemDocument10 pagesMaterial Handling SystemCHAITANYA DAMLENo ratings yet

- Nivelco Sat3040a0600h - 01Document2 pagesNivelco Sat3040a0600h - 01sreeyukthaNo ratings yet

- Parallel Database SystemsDocument17 pagesParallel Database Systemslipika008No ratings yet

- Cable Sizing With SIMARISDocument20 pagesCable Sizing With SIMARISAhmed100% (1)

- Amicable SettlementDocument7 pagesAmicable Settlementally jumanneNo ratings yet

- Energy Tapping Identifier Through Wireless Data AcquisitionDocument4 pagesEnergy Tapping Identifier Through Wireless Data Acquisitionsunil singhNo ratings yet

- Entrepreneurial Development ProgrammesDocument5 pagesEntrepreneurial Development ProgrammesSanjeet PandeyNo ratings yet

- Community Service Project ReportDocument12 pagesCommunity Service Project ReportTrophyson50% (2)

- Maynard v. Eastern Air Lines, Inc, 178 F.2d 139, 2d Cir. (1949)Document4 pagesMaynard v. Eastern Air Lines, Inc, 178 F.2d 139, 2d Cir. (1949)Scribd Government DocsNo ratings yet

- Meritor Spindle NutDocument5 pagesMeritor Spindle NutPhrag MannsteinNo ratings yet

- AllHome All Out Sale Employees As of Sept 19Document298 pagesAllHome All Out Sale Employees As of Sept 19Reymark MusteraNo ratings yet

- Laporan Akhir M3 - Ridho Aulia Ahmad - 120150079 - GeotekDocument22 pagesLaporan Akhir M3 - Ridho Aulia Ahmad - 120150079 - Geotek117RIDHO AULIA AHMADNo ratings yet

- Final Version of End To EndDocument153 pagesFinal Version of End To Endsimonuk1No ratings yet

- 4 1 23 McLaughlin DJTFP24 Polling MemoDocument3 pages4 1 23 McLaughlin DJTFP24 Polling MemoBreitbart NewsNo ratings yet

- Restaurant Employee Performance Evaluation FormDocument9 pagesRestaurant Employee Performance Evaluation FormEbenezer HengNo ratings yet

- Nordstrom MarketingDocument38 pagesNordstrom Marketingwalt34467% (3)

- Configuration ControlDocument29 pagesConfiguration Controlnajam_81No ratings yet

- Narendra RuchandaniDocument3 pagesNarendra Ruchandanidigital damrooNo ratings yet