Professional Documents

Culture Documents

Notes - Chapter III

Uploaded by

Michelle BabaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes - Chapter III

Uploaded by

Michelle BabaCopyright:

Available Formats

Chapter 1 In COM, the debtor retains the beneficial

Provisions common to Pledge and Mortgage interest over the property notwithstanding the

encumbrance, since the mortgage only serves to secure

Art. 2085. The following requisites are essential to the fulfilment of the principal obligation.

the contracts of pledge and mortgage:

1. that they be constituted to secure the Art. 2087.

fulfilment of a principal obligation Note:

2. that the pledger or mortgagor be the When the principal obligation becomes due

absolute owner of the pledge or mortgaged and the debtor fails to perform his obligation, the

3. that the persons constituting the pledge or creditor may foreclose on the pledge or mortgage for

mortgage have the free disposal of their property, and the purpose of alienating the property to satisfy his

in the absence thereof, that they be legally authorized credit.

for the purpose.

Third persons who are not parties to the Art. 2088. The creditor cannot appropriate the things

principal obligation may secure the latter by pledging given by way of pledge or mortgage, or dispose of

or mortgaging their own property. them. Any stipulation to the contrary is null and void.

Note: Pactum commissorium

Pledges and mortgages are accessory -is among the contractual stipulations that are

contracts. Thus, principal obligation may still be valid deemed contrary to law. It is defined “ a stipulation

even if the pledge or mortgage is void. empowering the creditor to appropriate the thing given

as guaranty for the fulfilment of the obligation…

What is Pledge? - intended to protect the obligor, pledger, or mortgagor

Is an accessory, real and unilateral contract by against being overreached by his creditor who holds a

virtue of which the debtor or a third person delivers to pledge or mortgage over the property whose value is

the creditor or to a 3rd person movable property as much more than the debt.

security for the performance of the principal

obligation. -Essence of PC is that the ownership of the security

will pass to the creditor by the mere default of the

What is a Real Estate Mortgage? debtor.

Is a contract embodied in a public instrument

recorded in the Registry of Property, by which the Art. 2089. A pledge or mortgage is indivisible, even

owner of an immovable directly and immediately though the debtor may be divided among the

subjects it, whoever the possessor may be, to the successors in the interest of the debtor or of the

fulfilment of the obligation for whose security it was creditor.

constituted. Therefore, the debtor’s heir who has paid a

part of the debt cannot ask for the proportionate

Note: extinguishment of the pledge or mortgage as long as

-A mortgage is regarded as nothing more than a mere the debt is not completely satisfied.

lien, encumbrance, or security for a debt, and passes no Neither can the creditor’s heir who received

title or estate to the mortgagee and gives him no right his share of the debt return the pledged or cancel

or claim to the possession of the property. the mortgage, to the prejudice of the other heir who

- The mortgagee only owns the mortgage credit, not have not been paid.

the property itself.

-The mortgage is not valid, as where it is executed Indivisibility of a pledge or mortgage

by one who is not the owner of the property, or the -arises only when there is a debt, that is, there

consideration of the contract is simulated or false, the is a debtor-creditor relationship.

principal obligation which it guarantees is not thereby

rendered null and void. Art. 2090. The indivisibility of a P&M is not

affected by the fact that the debtor are not

solidarily liable.

Art. 2091. The COP or M may secure all kinds of

obligations, be they pure or subjective to a

Two contractual modes by which personal property suspensive or resolutory condition.

can be used to secure a principal obligation:

1. through a contract of pledge Art. 2092.

2. through a chattel mortgage Note:

A promise to constitute a pledge or mortgage

Debtor retains the beneficial interest in mortgage gives rise only to a personal action between the

contracting parties, it does not create a real right in the the nature of obligation requires the assumption of

property. Consequently, what exists is only a right of risk.

action to compel the fulfilment of the promise as there

is no pledge or mortgage yet. Art. 2100.

GR: the pledgee cannot deposit the thing pledged with

a third person

Chapter 2

Pledge E: there is a stipulation authorizing the pledgee to do

so.

In a contract of pledge, the creditor is given the right

to retain his debtor’s movable property in his Note:

possession, or in that of a third person to whom it has The acts of the agents of the pledgee are the

been delivered, until the debt is paid. acts of the principal-pledgee by operation of law.

Note: Art. 2101

A pledge is an accessory contract, and is Note:

necessarily discharged if the principal obligation is The pledger who, knowing the flaws of the

extinguished. thing object of pledge, does not advise the pledgee of

the same, shall be liable to the latter for the damages

Art. 2094. All movables which are within commerce which he may suffer by reason thereof.

may be pledged, provided they are susceptible of

possession.

Art. 2095.

Pledge of incorporeal rights

1. the instrument proving the right pledged shall be Right of the pledger to ask the thing

delivered to the creditor pledged be deposited

2. if the instrument is negotiable, it must be indorsed.

1. if the creditor uses the thing without authority

2. if the creditor should misuse the thing in any

Art. 2096. other way.

Note:

The thing pledged must be amply and clearly The prescriptive period within which to

described and specifically identified. If the pledge does demand the return of the thing pledged should

not appear in a public instrument, it is void against begin to run only after the payment of the loan

third persons. and a demand for the thing has been made.

Note : the reason for the deposit with a 3rd

Art. 2097. person is due to the negligence or wilful act of

Note: the pledgee.

The pledger retains ownership of the thing

pledged. Thus, the pledger has the right to alienate the Remedy for the pledgor: may demand the return

thing pledged with the consent of the pledgee. of the thing upon offering another thing in pledge.

Art.2098. Remedy for the pledgee: the pledgee may cause

Note: the same to be sold at a public safe.

There is no doubt that if the principal

obligation is satisfied, the pledges should be What if the pledgee is deceived on the

terminated as well. Art. 2098 provides that the right of quality of the thing pledged?

the creditor to retain possession of the pledged item 1. the pledgee may claim another thing in its stead

exists only until the debt is paid. 2. the pledgee may demand immediate payment for the

principal obligation.

Art. 2099.

Note: PURPOSE OF NOTICE

The pledgee is not liable in case of loss or Is to sufficiently apprise the debtor and the

deterioration of the thing pledged due to fortuitous pledgor that the thing pledged to secure payment of the

event. However, the pledgee is liable for loss or loan will be sold in a public auction and the proceeds

deterioration if there is a contrary stipulation or when thereof shall be applied to satisfy the debt.

Note:

The pledger and the pledgee may bid at the public registered. description of the thing

auction. The pledger has a better right if he should pledged and the date of

offer the same terms as the highest bidder. The pledge appear in a

pledgee’s offer shall not be valid if he is the only public instrument.

bidder.

Chapter 3

Mortgage Extent of mortgage

1. natural accessions

Art. 2124. Only the following property may be the 2.improvements

object of a COM 3.growing fruits

1. immovables 4. rents or income not yet received when the obligation

2. alienable real rights in accordance with the laws, becomes due

imposed upon immovable 5. amount of the indemnity granted or owing to the

Nevertheless, movables may be the object of a proprietor from:

chattel mortgage a. the insurers of the property mortgaged

What is mortgage? b. expropriation for public use.

Is a contract in which the debtor guarantees to

the creditor the fulfilment of a principal obligation, What is foreclosure?

subjecting to the faithful compliance therewith a real Is a remedy available to the mortgagee by

property in case of non-fulfillment of said obligation at which he subjects the mortgaged property to the

the time stipulated. satisfaction of the obligation to secure that for which

the mortgage was given.

Kinds of Real Mortgage

1. voluntary or conventional- created by agreement When to foreclose?

between the parties 1. when the principal obligation is not paid

2. legal mortgage- required by law when due

3. equitable mortgage- which reveals an intent to make 2. when the debtor has violated the terms and

the property a security, even if the contract lacks conditions of the mortgage

proper formalities of a real-estate mortgage.

Who can foreclose?

Note: The mortgagee or his assigns

The essence of a COM is that the property has

been set apart from the mass of the property of the Kinds of foreclosure

debtor-mortgagor as security for the fulfilment of his 1. judicial

obligation in case of default of payment. Based on a personal claim against a specific

property of the mortgagor.

Object of mortgage 2. extrajudicial

1. immovables When a mortgagee is given a special power of

2. alienable real rights attorney to sell the mortgaged property by public

auction.

Cause or consideration in mortgage Effect of inadequacy of price in foreclosure sale

Its consideration is the same as that of the

principal contract from which it receives its life, and General rule: when there is a right to redeem,

without which it cannot exist as an independent inadequacy of price is immaterial because the

contract. judgement debtor may reacquire the property easier at

a low price or sell his right to redeem.

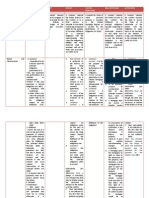

Real Mortgage Pledge Exception: when the price is so inadequate as to shock

It is constituted on Constituted on movables the conscience of the court taking into consideration

immovables the peculiar circumstances attendant thereto.

Delivery is not required Property is delivered to

the pledgee or by

common agreement to a

third person

It is not valid against It is not valid as to 3rd

third persons unless it is person unless a

Chapter 4 Obligation of the debtor

Antichresis To pay totally what he owes the creditor.

Note:

What is a contract of antichresis? The principle of pactum commissorium is

The creditor acquires the right to receive the applicable to contract of antichresis

fruits of an immovable of his debtor, with the

obligation to apply them to the payment of the interest, Remedies of the creditor

if owing, and thereafter to the principal of his credit. 1. the creditor may petition the court for the payment

of the debt

Note: 2. the creditor may petition the court for the sale of the

Antichresis is an accessory contract as it real property.

secures the performance of a principal obligation. It is

also a formal contract as the amount of the principal

and of the interest shall be specified in writing.

Chapter 5

Antichresis Real Mortgage Chattel mortgage

Real property is Debtor usually retains

delivered to the creditor possession of the real

property

The creditor is obliged to The creditor has no such What is a contract of chattel mortgage?

pay the taxes and obligation A contract where a personal property is

charges upon the estate recorded in the chattel mortgage register as security for

unless there is stipulation the performance of an obligation.

to contrary

Rights of an antichretic creditor Examples of properties subject to chattel mortgage

1. the right to the fruits of the thing 1. shares of stock in a corporation

2. the right to retain the thing until the debt is paid 2. interest in the business

3. the right to have the thing sold upon non-payment at 3. machinery vessel

maturity. 4. motor vehicles

Measure of application of fruits

The actual market value of the fruits at the Validity between parties

time of the application thereof to the interest and The personal property must be recorded in the

principal shall be at the measure of such application. chattel mortgage register.

Validity as to third persons

Form of the contract of antichresis The personal property must be recorded in the

The amount of the principal and of the interst chattel mortgage register and must be accompanied by

shall be sbecified in writing, otherwise COA shall be an affidavit of good faith.

void.

Note: Venue of registration

Antichresis is an accessory contract. Thus,

even if the antichresis is void, the principal obligation 1. if he resides in the Philippines

may still be valid. In the office of the register of deeds of the

province in which the mortgagor resides at the time of

making of the CM

2. if he does not reside in the Philippines

The province in which the property is located

Obligations of the antichretic creditor 3. if the property is situated in the province

1. to pay taxes and charges upon the estate, unless different from that in which the mortgagor resides

there is stipulation to the contrary. The mortgagor shall be recorded in both

2. to bear the expenses necessary for the preservation provinces.

and repair

3. to apply all the fruits, after receiving them, to the When mortgage must be registered in two chattel

payment of interest, if owing, and thereafter to the mortgage register?

principal When the mortgagor resides in one province,

4. to render an account of the fruits to the debtor. but the property is located in another province. The

registration must be in both, otherwise the chattel

mortgage is void.

Effect of registration

The registration of CM is an effective and

binding notice to other creditor of its existence and

creates a real right or a lien which, being recorded,

follows the chattel wherever it goes.

Chattel mortgage Real mortgage

It is constituted on Constituted on

movables immovable

It cannot guarantee It may guarantee future

future obligations obligation

Chattel mortgage pledge

Delivery is not Delivery is an essential in

essential element in a a contract

contract

In case of foreclosure, In case of foreclosure, the

the excess of the debtor is not entitled to the

amount due goes to excess unless it is

the debtor otherwise agreed upon

In case of foreclosure, In case of foreclosure, the

the creditor is entitled creditor is not entitled to

to recover the recover deficiency

deficiency from the notwithstanding any

debtor, except if the stipulation to the contrary.

chattel mortgage is a

security for the

purchase of personal

property in

instalments.

Affidavit of good faith

It is an oath contract of CM wherein the parties severally swear that the mortgage is made for the purpose of

securing the obligation specified in the conditions thereof and for no other purposes and that the same is a just and

valid obligation and one not entered into for the purpose of fraud.

In the absence of an affidavit of good faith

The CM is still valid between the parties.

Foreclosure of CM

If the mortgagor default in the payment of the secured debt or otherwise fails to comply with the conditions of

the mortgage, the creditor has no right to appropriate to himself the personal property because he is permitted only to

recover his credit from the proceeds of the sale of the property at public auction.

Applications of proceeds of the foreclosure sale

1. costs and expenses of keeping the property and its sale

2. payment of the obligation secured by the mortgage

3. claims of persons holding subsequent mortgages in their order

4. the balance, if, any, shall be paid to the mortgagor or person holding under him.

Right of mortgagee to recover deficiency

General rule:

The creditor-mortgagee may maintain an action for deficiency as the CM is only given as a security and not as

a payment for the debt in case of failure of payment.

Exception:

Where the CM is constituted as security for purchase of personal property payable in instalments. In case,

there is no deficiency judgement and any contrary stipulation is void.

Note:

As between the first and second mortgagees, the latter can only recover the property from the former by

paying him the mortgage debt. Even when the second mortgagee goes through the formality of extrajudicial

foreclosure, the purchaser acquires no more than the right of redemption from the first mortgagee.

You might also like

- Pledge and Mortgage Provisions ExplainedDocument26 pagesPledge and Mortgage Provisions ExplainedAli BastiNo ratings yet

- Provisions common to Pledge and MortgageDocument5 pagesProvisions common to Pledge and Mortgagehyunsuk fhebieNo ratings yet

- SECURE LOANSDocument8 pagesSECURE LOANStrixieNo ratings yet

- Notes On PledgeDocument4 pagesNotes On Pledgefe rose sindinganNo ratings yet

- PledgeDocument54 pagesPledgeLisa PorjeoNo ratings yet

- Araullo University College of Law report on pledgeDocument6 pagesAraullo University College of Law report on pledgeRicel CriziaNo ratings yet

- Art 2085-2141 Reviewer Self MadeDocument15 pagesArt 2085-2141 Reviewer Self MadeJyasmine Aura V. AgustinNo ratings yet

- PledgeDocument4 pagesPledgefe rose sindinganNo ratings yet

- Article 2085Document7 pagesArticle 2085Gnairah Agua AmoraNo ratings yet

- Credit Transactions TranscriptDocument12 pagesCredit Transactions TranscriptFloramae PasculadoNo ratings yet

- Credit Transactions Finals ReviewerDocument12 pagesCredit Transactions Finals ReviewerChristiane Marie BajadaNo ratings yet

- Finals ReviewerDocument13 pagesFinals ReviewerIshmael SalisipNo ratings yet

- Summary on Credit Pledge and MortgageDocument9 pagesSummary on Credit Pledge and MortgageCarmen FrenNo ratings yet

- Common Provisions of Pledge and MortgageDocument3 pagesCommon Provisions of Pledge and Mortgagejr castilloNo ratings yet

- Credit TransactionsDocument11 pagesCredit TransactionsJessicaNo ratings yet

- Law On Credit TransactionsDocument4 pagesLaw On Credit TransactionsBrent LigsayNo ratings yet

- Common provisions for pledge and mortgageDocument6 pagesCommon provisions for pledge and mortgagemarmiedyanNo ratings yet

- Provisions Common To Pledge and Mortgage Group 1Document23 pagesProvisions Common To Pledge and Mortgage Group 1Lisa PorjeoNo ratings yet

- Real Estate Mortgage LectureDocument7 pagesReal Estate Mortgage LectureJoycee MarasiganNo ratings yet

- Essential Requisites for Pledge and Mortgage ContractsDocument184 pagesEssential Requisites for Pledge and Mortgage ContractsJanetGraceDalisayFabreroNo ratings yet

- Chapter 1 - Provisions Common to Pledge and MortgageDocument9 pagesChapter 1 - Provisions Common to Pledge and MortgageLaarni AragonNo ratings yet

- SECURE CREDIT TRANSACTIONSDocument4 pagesSECURE CREDIT TRANSACTIONSKelvin ZabatNo ratings yet

- Real MortgageDocument6 pagesReal Mortgagechisel_159No ratings yet

- Credit Transaction NotesDocument13 pagesCredit Transaction NotesLyra Osorio VillaruelNo ratings yet

- Pledge Mortgage Chattel MortgageDocument17 pagesPledge Mortgage Chattel MortgageNobody XxxNo ratings yet

- This Study Resource Was: Credit TransactionsDocument9 pagesThis Study Resource Was: Credit TransactionsChristian FloraldeNo ratings yet

- Law On BailmentsDocument48 pagesLaw On BailmentsDenmar Daryl GecobeNo ratings yet

- Personal Property Security ActDocument4 pagesPersonal Property Security ActREENA ALEKSSANDRA ACOPNo ratings yet

- Pledge ReportingDocument8 pagesPledge ReportingRosette G. ReynoNo ratings yet

- PledgeDocument26 pagesPledgebluemaja50% (2)

- Pledge ReportingDocument10 pagesPledge ReportingSham GaerlanNo ratings yet

- RFBT.2904 - Credit TransactionsDocument5 pagesRFBT.2904 - Credit Transactionslgcainglet07No ratings yet

- Credit Reviewer HandoutsDocument7 pagesCredit Reviewer HandoutsChrizllerNo ratings yet

- Notes AntichresisDocument3 pagesNotes AntichresisLo100% (1)

- Chapter 1 Provisions Common To Pledge and MortgageDocument3 pagesChapter 1 Provisions Common To Pledge and MortgageDANASOPHIA LEONARDONo ratings yet

- Credit Transactions - NotesDocument74 pagesCredit Transactions - Notesstubborn_dawg100% (9)

- Credit TransactionsDocument84 pagesCredit TransactionsMaricris100% (1)

- MortgageDocument19 pagesMortgageLisa PorjeoNo ratings yet

- PledgeDocument9 pagesPledgeNikka Gloria100% (1)

- BUS-LAW-WRITTEN-REPROTDocument10 pagesBUS-LAW-WRITTEN-REPROTEleah Kim PamplonaNo ratings yet

- The Law On Credit Transactions: Poblacion Dist. 9, Brgy. San Diego, Burauen Sports Complex, Burauen, LeyteDocument4 pagesThe Law On Credit Transactions: Poblacion Dist. 9, Brgy. San Diego, Burauen Sports Complex, Burauen, LeyteKien Saimon JabilloNo ratings yet

- Pledge and AntichresisDocument6 pagesPledge and AntichresisroansalangaNo ratings yet

- GUARANTY Surety Mortgages Pledge AntichresisDocument35 pagesGUARANTY Surety Mortgages Pledge AntichresisJennilyn TugelidaNo ratings yet

- Credtrans Real Mortgage de Leon 2016Document10 pagesCredtrans Real Mortgage de Leon 2016Camille RegalaNo ratings yet

- Pledge and Chattel Mortgage GuideDocument15 pagesPledge and Chattel Mortgage GuideHumility KamiNo ratings yet

- Mortgage (Otherwise Known As "Real Estate Mortgage" or "RealDocument5 pagesMortgage (Otherwise Known As "Real Estate Mortgage" or "Realimsana minatozakiNo ratings yet

- Law On PledgeDocument9 pagesLaw On PledgeBrylle Epemar Bayer CelestialNo ratings yet

- REAL ESTATE MORTGAGE GuideDocument6 pagesREAL ESTATE MORTGAGE GuideGlennReyAninoNo ratings yet

- RFBT - Chapter 9 - Credit Transaction (Part I)Document5 pagesRFBT - Chapter 9 - Credit Transaction (Part I)laythejoylunas21No ratings yet

- Commodatum It Is Contract Where One of The Contracting Parties Delivers To Another A NonDocument3 pagesCommodatum It Is Contract Where One of The Contracting Parties Delivers To Another A NonJenny JspNo ratings yet

- Civ 2 NotesDocument193 pagesCiv 2 NotesKris CaoyonanNo ratings yet

- Pledge (Articles 2085-2123)Document14 pagesPledge (Articles 2085-2123)Aessie Anne Morilla Cagurangan100% (1)

- PledgeNotes HighlightedDocument2 pagesPledgeNotes HighlightedRianna VelezNo ratings yet

- Real Estate Mortgage ReviewerDocument26 pagesReal Estate Mortgage ReviewerBenedict Jonathan Bermudez100% (3)

- 4 Pledge Mortage and AntichresisDocument39 pages4 Pledge Mortage and AntichresisJohn Rey LabasanNo ratings yet

- 04 Pledge Mortgage and AntichresisDocument36 pages04 Pledge Mortgage and Antichresiskim che100% (2)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Comparing Scores from Related Groups or Repeated MeasuresDocument3 pagesComparing Scores from Related Groups or Repeated MeasuresMichelle BabaNo ratings yet

- Quantitative vs Qualitative Variables, Descriptive vs Inferential StatsDocument2 pagesQuantitative vs Qualitative Variables, Descriptive vs Inferential StatsEna BuslonNo ratings yet

- Wilcoxon Rank Sum TestDocument1 pageWilcoxon Rank Sum TestMichelle BabaNo ratings yet

- Quantitative vs Qualitative Variables, Descriptive vs Inferential StatsDocument2 pagesQuantitative vs Qualitative Variables, Descriptive vs Inferential StatsEna BuslonNo ratings yet

- Comparing Scores from Related Groups or Repeated MeasuresDocument3 pagesComparing Scores from Related Groups or Repeated MeasuresMichelle BabaNo ratings yet

- The Problem Characteristics of This Test AreDocument3 pagesThe Problem Characteristics of This Test AreMichelle BabaNo ratings yet

- Comparing Scores from Related Groups or Repeated MeasuresDocument3 pagesComparing Scores from Related Groups or Repeated MeasuresMichelle BabaNo ratings yet

- Wilcoxon Rank Sum Test: One Dependent Variable Continuous Ordinal Continuous Variables Ordinal VariablesDocument3 pagesWilcoxon Rank Sum Test: One Dependent Variable Continuous Ordinal Continuous Variables Ordinal VariablesMichelle BabaNo ratings yet

- Wilcoxon Rank Sum TestDocument1 pageWilcoxon Rank Sum TestMichelle BabaNo ratings yet

- Chapter 11Document2 pagesChapter 11Michelle BabaNo ratings yet

- BDocument3 pagesBMichelle BabaNo ratings yet

- Historical PhasesDocument2 pagesHistorical PhasesMichelle BabaNo ratings yet

- Adjusting EntriesDocument4 pagesAdjusting EntriesMichelle BabaNo ratings yet

- Trial Balance Adjustments FinancialsDocument2 pagesTrial Balance Adjustments FinancialsMichelle BabaNo ratings yet

- Positive RealizationDocument1 pagePositive RealizationMichelle BabaNo ratings yet

- InDocument2 pagesInMichelle BabaNo ratings yet

- Chapter 5Document2 pagesChapter 5Michelle BabaNo ratings yet

- How USAA uses data to devise competitive strategiesDocument2 pagesHow USAA uses data to devise competitive strategiesMichelle BabaNo ratings yet

- Chapter 2Document1 pageChapter 2Michelle BabaNo ratings yet

- A. Digital Economy in The PhilippinesDocument2 pagesA. Digital Economy in The PhilippinesMichelle BabaNo ratings yet

- Accounting Information Systems: An Overview: Suggested Answers To Discussion QuestionsDocument18 pagesAccounting Information Systems: An Overview: Suggested Answers To Discussion QuestionsMichelle BabaNo ratings yet

- Explain The Importance and Advantages of Databases in An OrganizationDocument2 pagesExplain The Importance and Advantages of Databases in An OrganizationMichelle BabaNo ratings yet

- Notes - Chapter 2Document5 pagesNotes - Chapter 2Michelle BabaNo ratings yet

- InDocument2 pagesInMichelle BabaNo ratings yet

- EthicsDocument3 pagesEthicsMichelle BabaNo ratings yet

- Notes - Chapter 1Document3 pagesNotes - Chapter 1Michelle BabaNo ratings yet

- Notes - Chapter 1Document3 pagesNotes - Chapter 1Michelle BabaNo ratings yet

- United States v. Lazaro Tapia-Santana, A/K/A Lazaro Martinez Tapia, A/K/A Lazaro L. Martinez, A/K/A Larry Tapia, A/K/A Lazaro Tapia Martinez, 48 F.3d 1218, 4th Cir. (1995)Document4 pagesUnited States v. Lazaro Tapia-Santana, A/K/A Lazaro Martinez Tapia, A/K/A Lazaro L. Martinez, A/K/A Larry Tapia, A/K/A Lazaro Tapia Martinez, 48 F.3d 1218, 4th Cir. (1995)Scribd Government DocsNo ratings yet

- Grace Christian High School board seat disputeDocument11 pagesGrace Christian High School board seat disputeAlegria IrisNo ratings yet

- Cyber CrimeDocument2 pagesCyber Crimericha928No ratings yet

- Entertainment Law SyllabusDocument7 pagesEntertainment Law SyllabusJeremyNo ratings yet

- David Lee Rusher v. Floyd E. Arnold, Warden, United States Penitentiary, Lewisburg, Pennsylvania, 550 F.2d 896, 3rd Cir. (1977)Document7 pagesDavid Lee Rusher v. Floyd E. Arnold, Warden, United States Penitentiary, Lewisburg, Pennsylvania, 550 F.2d 896, 3rd Cir. (1977)Scribd Government DocsNo ratings yet

- What Is The Muurican Gansul / Bar CodeDocument7 pagesWhat Is The Muurican Gansul / Bar Codejaguar99100% (1)

- Tondo Medical Center Employees Association, v. Court of AppealsDocument6 pagesTondo Medical Center Employees Association, v. Court of AppealsKelvin Jhones AligaNo ratings yet

- Cases in Land RegistrationDocument3 pagesCases in Land RegistrationcardeguzmanNo ratings yet

- Nunez v. Hon. Porter/gordon, Ariz. Ct. App. (2014)Document5 pagesNunez v. Hon. Porter/gordon, Ariz. Ct. App. (2014)Scribd Government DocsNo ratings yet

- Prashant Shukla: AdvocateDocument4 pagesPrashant Shukla: AdvocateNikita CapoorNo ratings yet

- Legal Opinion For LegresDocument3 pagesLegal Opinion For LegresJester KutchNo ratings yet

- Dao 2012 07Document16 pagesDao 2012 07Juan LennonNo ratings yet

- Ketua Pengarah Jabatan Alam Sekitar & Anor VDocument29 pagesKetua Pengarah Jabatan Alam Sekitar & Anor VMary Michael100% (4)

- Application For ApsrtcDocument1 pageApplication For ApsrtcmosesnaveenNo ratings yet

- Ibon V Ghengkis KhanDocument5 pagesIbon V Ghengkis KhanGertrude ArquilloNo ratings yet

- Rayray v. Chae Kyung LeeDocument2 pagesRayray v. Chae Kyung Leedenver41No ratings yet

- Province of North Cotabato Vs The Government (Case Digest)Document1 pageProvince of North Cotabato Vs The Government (Case Digest)Deanne Mitzi SomolloNo ratings yet

- Aquino v. Enrile Ruling on Martial Law DetentionsDocument4 pagesAquino v. Enrile Ruling on Martial Law DetentionsMA. TERESA DADIVAS100% (1)

- Labor Arbiter's Ruling on Illegal DismissalDocument16 pagesLabor Arbiter's Ruling on Illegal DismissalJan Paul CrudaNo ratings yet

- Tort Law CasesDocument41 pagesTort Law CasesSamraddhi SohaniNo ratings yet

- Solicitor General Felix Q. Antonio and Solicitor Bernardo P. Pardo For Petitioners. Sycip, Salazar, Luna, Manalo & Feliciano For Private RespondentsDocument6 pagesSolicitor General Felix Q. Antonio and Solicitor Bernardo P. Pardo For Petitioners. Sycip, Salazar, Luna, Manalo & Feliciano For Private RespondentsTrix BermosaNo ratings yet

- 354 Supreme Court Reports Annotated: Chan vs. MajaduconDocument7 pages354 Supreme Court Reports Annotated: Chan vs. MajaduconAngelie FloresNo ratings yet

- Lawsuit Against McDonald'sDocument8 pagesLawsuit Against McDonald'sTodd J. BehmeNo ratings yet

- Recognition of States: Declaratory Theory-It Views That Recognition Is Merely "Declaratory" of TheDocument3 pagesRecognition of States: Declaratory Theory-It Views That Recognition Is Merely "Declaratory" of TheNievesAlarconNo ratings yet

- NLRC Position Paper GuideDocument2 pagesNLRC Position Paper GuideSarah Jane-Shae O. Semblante25% (4)

- Nbi VS VillanuevaDocument3 pagesNbi VS VillanuevaJaneth AbasNo ratings yet

- DDSB Registration FormDocument1 pageDDSB Registration FormAyotte208No ratings yet

- Week 12 Case AnalysisDocument2 pagesWeek 12 Case AnalysisVarun Abbineni33% (3)

- McBayne v. Pugh, 10th Cir. (2003)Document6 pagesMcBayne v. Pugh, 10th Cir. (2003)Scribd Government DocsNo ratings yet

- Affidavit of Presumptive DeathDocument5 pagesAffidavit of Presumptive DeathMerceditas Plameras100% (1)