Professional Documents

Culture Documents

Week 3 Illustrative Example Solutions

Uploaded by

wainikitiraculeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 3 Illustrative Example Solutions

Uploaded by

wainikitiraculeCopyright:

Available Formats

2015

30 April

MARIST ENTERPRISES

A. General Journal

Date Particulars Debit Credit

1. Interest Expense 460

Interest Payable 460

Accrued interest on loan payable

(1.5 mark; 0.5 mark for each correct accounts, 0. 25

mark for each correct amt)

2. Office Supplies Expense 3 460

Office Supplies 3 460

Office supplies used

(1.5 mark; 0.5 mark for each correct accounts, 0. 25

mark for each correct amt)

3. Unearned Fees 550

Fees Revenue 550

Fees revenue received previously, now earned

(1 mark; 0.25 mark for each correct accounts, 0.25 mark for each correct amt)

4. Rent Expense 700

Prepaid Rent 700

Rent expense for April

(1.5 mark; 0.5 mark for each correct accounts, 0. 25

mark for each correct amt)

5. Insurance Expense 2 184

Prepaid Insurance 2 184

Insurance prepaid now expired

(1.5 mark; 0.5 mark for each correct accounts, 0. 25

mark for each correct amt)

6. Salaries Expense 840

Salaries Payable 840

Accrued salaries payable ( 3 days X $280)

(1.5 mark; 0.5 mark for each correct accounts, 0. 25

mark for each correct amt)

7. Telephone Expense 670

Telephone Account Payable 670

Telephone expense for April

(1 mark; 0.25 mark for each correct accounts, 0.25 mark for each correct amt)

B. Assume that closing journal entries are raised at the end of April. Close only the

necessary entries to determine profit for the period.

30 April Dr. Fees Revenue 138 950

Cr. Profit and Loss Summary 138 950

(1 mark; 0. 25 mark for each correct accounts, 0.25 mark for each correct amt)

30 April Dr Profit & Loss Summary 81 814

Cr. Salaries expense 58 040

Cr. Telephone expense 6 770

Cr. Rent expense 10 900

Cr. Internet Expense 460

Cr. Office supplies expense 3 460

Cr. Insurance expense 2 184

(6 marks; 0. 5 mark for each correct expense account, 0.5 mark for each correct expense amt)

Profit and Loss Summary 57136

Capital 57136 1 mark for fully correct entry

Capital 52000

Drawings 52000 1 mark for fully correct entry

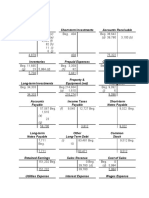

C. Using the journal entries in (B) above, construct and balance 1 Ledger Account, which will

calculate Net Profit for the period. Use the T-account format.

Profit & Loss Summary Account

Apr-30 Total Expenses 81814 Total Revenues 138950

Profit - Closing Entry 57136

138950 138950

( 5.5 MARKS: 0.5 mark for

correct account; 3 marks

(0.5 each) for correct

expense amt; 1 mark for

correct revenue amt; 1 mark

for correct profit)

D. Prepare reversing entries where appropriate.

1. Interest Payable 460

Interest Expense 460

Accrued interest on loan payable

(1 mark; 0.25 mark for each correct accounts, 0.25

mark for each correct amt)

6. Salaries Payable 840

Salaries Expense 840

Accrued salaries payable

(1 mark; 0.25 mark for each correct accounts, 0.25

mark for each correct amt)

7. Telephone Account Payable 670

Telephone Expense 670

Telephone expense for April

(1 mark; 0.25 mark for each correct accounts, 0.25 mark for each correct amt)

E)

Reverse all accruals and deferrals only for which original entries were made to temporary accounts

i.e. revenue and expenses. Reversing entries are made at the beginning of the next accounting period

to simplify the recording in the next accounting period. (3 marks)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Week 5 Tutorial Solutions PDFDocument19 pagesWeek 5 Tutorial Solutions PDFwainikitiraculeNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredDocument26 pagesACC 557 Week 2 Chapter 3 (E3-6, E3-7, E3-11, P3-2A) 100% ScoredJoseph W. RodgersNo ratings yet

- Section A Multiple Choice Questions 25 Marks (Answer in Multiple Choice Answer Sheet Provided) (Suggested Time: 36 Minutes)Document11 pagesSection A Multiple Choice Questions 25 Marks (Answer in Multiple Choice Answer Sheet Provided) (Suggested Time: 36 Minutes)wainikitiraculeNo ratings yet

- Week 3 Tutorial SolutionsDocument19 pagesWeek 3 Tutorial SolutionswainikitiraculeNo ratings yet

- Chapter 10: Regulation and The Conceptual Framework: Discussion QuestionsDocument8 pagesChapter 10: Regulation and The Conceptual Framework: Discussion QuestionswainikitiraculeNo ratings yet

- Week 6-Chapter 17Document63 pagesWeek 6-Chapter 17jeena tarakaiNo ratings yet

- CH 8Document19 pagesCH 8Isra' I. SweilehNo ratings yet

- Financial Statement Model For The Clorox Company: Company Name Latest Fiscal YearDocument10 pagesFinancial Statement Model For The Clorox Company: Company Name Latest Fiscal YearArslan HafeezNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other SourcesMuqddas AbbasNo ratings yet

- Chapter 7 National Income 1Document16 pagesChapter 7 National Income 1samjagralaNo ratings yet

- (B) 3,100 9,545 (F) 82 (H) 11 (I) 6 (J) (D) 39,780Document3 pages(B) 3,100 9,545 (F) 82 (H) 11 (I) 6 (J) (D) 39,780Kavya GopakumarNo ratings yet

- Balbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseDocument9 pagesBalbes, Bella Ronah P. Act183: Income Taxation Prelim Exam S.Y 2020-2021 True or FalseBella RonahNo ratings yet

- Jamb Econs Questions 6 10Document43 pagesJamb Econs Questions 6 10princewills130No ratings yet

- TAX Preweek (B44)Document19 pagesTAX Preweek (B44)LeiNo ratings yet

- 36 - Finance Banking 2nd YearDocument9 pages36 - Finance Banking 2nd YearRifat Ul HaqueNo ratings yet

- KFC Marketing Plan For PakistanDocument26 pagesKFC Marketing Plan For PakistanReader80% (5)

- Example of Deferred Tax LiabilityDocument1 pageExample of Deferred Tax Liabilityarjun-chopra-4887No ratings yet

- PDF Income Taxation Ampongan SolmanDocument25 pagesPDF Income Taxation Ampongan SolmanDennis AlarconNo ratings yet

- Feasibility Study Example 01Document13 pagesFeasibility Study Example 01Wondesen Amsalu KasayeNo ratings yet

- Cir v. Suter 27 Scra 152 (1969)Document4 pagesCir v. Suter 27 Scra 152 (1969)FranzMordenoNo ratings yet

- Business - Analysis - and - Valuation - Text - and - Cases-Palepu-Third Edition-Trang-301-330Document30 pagesBusiness - Analysis - and - Valuation - Text - and - Cases-Palepu-Third Edition-Trang-301-330Nguyễn LinhNo ratings yet

- Analysis of Financial StatementDocument15 pagesAnalysis of Financial StatementMohsin Qayyum0% (2)

- Economic Growth and DevelopmentDocument3 pagesEconomic Growth and DevelopmentLelouchNo ratings yet

- Rural RetailingDocument25 pagesRural RetailingKavya VarmaNo ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Regulated Utilites Manual - DeloitteDocument52 pagesRegulated Utilites Manual - DeloitteKevin WaksmundzkiNo ratings yet

- EIA2002/EXEE 2111 Macroeconomics Ii: Theories On ConsumptionDocument37 pagesEIA2002/EXEE 2111 Macroeconomics Ii: Theories On ConsumptionAfifNo ratings yet

- Chapter 6 Applications of Macroeconomics Theory As A Basis For Understanding The Key Economic Variables Affecting The BusinessDocument52 pagesChapter 6 Applications of Macroeconomics Theory As A Basis For Understanding The Key Economic Variables Affecting The Businessaladdin oidacraNo ratings yet

- Do It!: SolutionDocument9 pagesDo It!: Solutionaura fitrah auliya SomantriNo ratings yet

- Catherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Document4 pagesCatherine Viesca Outdoor Ad Concepts Journal Entries January - December 2020Jamycka Antolin100% (1)

- Profitability AnalysisDocument12 pagesProfitability AnalysisJudyeast AstillaNo ratings yet

- Demissie Damite - SNNPDocument155 pagesDemissie Damite - SNNPTesfahun tegegnNo ratings yet

- ECON Model PaperDocument24 pagesECON Model PaperDiniki JayakodyNo ratings yet

- PT ABC Income Statement, Balance SheetDocument3 pagesPT ABC Income Statement, Balance SheetAlfinNo ratings yet