Professional Documents

Culture Documents

Various Types of Loan Provided by Banks in Nepalese Market

Uploaded by

Narendra KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Various Types of Loan Provided by Banks in Nepalese Market

Uploaded by

Narendra KumarCopyright:

Available Formats

Various Types of Loan Provided by Banks in Nepalese Market.

Term Loan = Usually used to finance a Project for the expansion, diversification and modernization of

projects. Purchase of Vehicle/Machinery/Building etc are some example. It is also called project

financing. This type of loans are repayable in the periodic installments. In general sense, it is said to be a

payments of Equal Monthly Installments(EMI). It is of secured loan. Generally, asset of the company

serve as collateral security. Interest and principal repayment are obligatory on the part of borrower.

Whether the firm is earning profit or not, term loans are being repaid over a period of time. It is

generally of 5 to 10 years.

Note: Debt financing is beneficial only if the IRR is greater than its Cost of Capital, otherwise it adversely

affects the benefits of Shareholders.

Cash Credit(Bank OD) = It is for short term source of financing. In this bank offers its customers to take a

loan upto a certain limit. It is also called Bank Over Draft. This loan is given to meet the Working Capital

Requirements of a company. It is given against collateral security. It can be obtained very easily. The rate

of interest charged is very high. It is charged only on utilized amount. This loan is granted by bank on the

basis of company’s turnover, its financial status, value of inventory etc. So, it is very difficult for new &

financially weak company to obtain cash credit. By this generally the credit planning of a company is

disturbed.

Demand Loan = it is the loan that can be called at any time by the lender. It is also called Call Loan. The

lender (Bank) can demand full payment of the remaining balance of the loan at anytime. Before, lender

grants this type of loan, the borrower agrees to the arrangement. The demand loan has no maturity

date. It expires when it has been paid off. It doesn’t have scheduled date for making payments. In this,

there is good understanding that borrower will settle the debt within reasonable period. So, lender

doesn’t provide demand loan until the borrower has a good history with the lender. Bank OD is also in

some case considered as Demand Loan. Demand Loan has low interest rate but can be repossess

anytime by the lender.

Short Term Loan = Short term loan is obtained to support temporary personal or business capital need.

It involves that interest and principal needs to be returned or paid back at a given due date. It is usually

of less than a year. Interest rate is lower as compared to long term debts. In this, the borrower can

obtained the needed fund as quickly because of Unsecured in nature. A smaller loan amount is

disbursed because borrower won’t be feel burdened with large monthly installment. Generally. This

type of loan is more focused to the smaller business.

Funded Loan = Working Capital loan, Overdraft, Cash Credit, Demand Loan, Term Loan, Bills discounting,

Factoring are its example. In this, Actual disbursement of money is involved.

Non funded Loan = Letter of Credit, Bank Guarantee, Bid Bond, Performance Bond etc are some

example. In this, Bank doesn’t give any cash but take risk of the companies & charge commission.

You might also like

- Credit Rating:: Working Capital LoansDocument7 pagesCredit Rating:: Working Capital Loansdon faperNo ratings yet

- Understanding Loans and AdvancesDocument51 pagesUnderstanding Loans and AdvancesNaveen KNo ratings yet

- Short - Term Sources of FinanceDocument10 pagesShort - Term Sources of FinanceRadha ChoudhariNo ratings yet

- Loan Discounts Finance 7Document41 pagesLoan Discounts Finance 7Elvie Anne Lucero ClaudNo ratings yet

- Dhere Vikas Krishna MBA 1stDocument9 pagesDhere Vikas Krishna MBA 1stvikas dhereNo ratings yet

- Loan and AdvancesDocument9 pagesLoan and AdvancesSumit NaugraiyaNo ratings yet

- Long Term Finance Short Term FinanceDocument15 pagesLong Term Finance Short Term FinanceGangadhar MamadapurNo ratings yet

- Bank CreditDocument5 pagesBank Creditnhan thanhNo ratings yet

- Loans & Advances Study at Ujjivan BankDocument75 pagesLoans & Advances Study at Ujjivan Banksachin mohanNo ratings yet

- Loans and Advances - IRCBDocument68 pagesLoans and Advances - IRCBDr Linda Mary Simon100% (1)

- Chapter 6-8 - Sources of Finance & Short Term FinanceDocument8 pagesChapter 6-8 - Sources of Finance & Short Term FinanceTAN YUN YUNNo ratings yet

- Restrictions on loans and advances by banksDocument28 pagesRestrictions on loans and advances by banksleela naga janaki rajitha attiliNo ratings yet

- Types of Credit Instruments & Its FeaturesDocument22 pagesTypes of Credit Instruments & Its Featuresninpra94% (18)

- What is a Bank and its FunctionsDocument12 pagesWhat is a Bank and its FunctionsvarunNo ratings yet

- Working Capital Loan: LoansDocument5 pagesWorking Capital Loan: LoansNiharika SharmaNo ratings yet

- Debt Financing: Promise To Repay The LoanDocument3 pagesDebt Financing: Promise To Repay The LoanMicahNo ratings yet

- Types of LoansDocument8 pagesTypes of LoansFirdaus PanthakyNo ratings yet

- WCM AssignmentDocument11 pagesWCM AssignmentSakshi LodhaNo ratings yet

- LRM Final 77 PDFDocument77 pagesLRM Final 77 PDFCHAPAL CHANDRA DASNo ratings yet

- LRM Final PDFDocument77 pagesLRM Final PDFneel shimantoNo ratings yet

- LoansDocument7 pagesLoansmba departmentNo ratings yet

- BLP 130405093007 Phpapp01Document22 pagesBLP 130405093007 Phpapp01Rohit DonNo ratings yet

- Unit 05 - Principles of Bank LendingDocument18 pagesUnit 05 - Principles of Bank LendingSayak GhoshNo ratings yet

- Term Loan or Project Finance - A Long Term Source of FinanceDocument3 pagesTerm Loan or Project Finance - A Long Term Source of FinanceNiyati SandisNo ratings yet

- Chapter 4 Banking - Bank LoanDocument28 pagesChapter 4 Banking - Bank LoanIndo WalelengNo ratings yet

- IInformation On Cash Credit AccountDocument4 pagesIInformation On Cash Credit AccountmrbramNo ratings yet

- Raising of FundsDocument5 pagesRaising of FundsSarabjeet SinghNo ratings yet

- Cash Account Bank: Loan Against Bank DepositDocument1 pageCash Account Bank: Loan Against Bank Depositnikhiljain19743No ratings yet

- Banks Loan GuideDocument76 pagesBanks Loan GuidePreshu FuriaNo ratings yet

- Financing Working Capital - Naveen SavitaDocument7 pagesFinancing Working Capital - Naveen SavitaMurli SavitaNo ratings yet

- Short-term Financing Options ExplainedDocument18 pagesShort-term Financing Options Explainedsony4love100% (1)

- f9 Notes (Source of Finance)Document16 pagesf9 Notes (Source of Finance)CHIAMAKA EGBUKOLENo ratings yet

- Business vs Consumer LoansDocument10 pagesBusiness vs Consumer LoansDandreb SardanNo ratings yet

- Dipali Project ReportDocument58 pagesDipali Project ReportAshish MOHARENo ratings yet

- Short-term Finance Sources and Uses for Business OperationsDocument3 pagesShort-term Finance Sources and Uses for Business Operationsgoutham_200589No ratings yet

- Credit ManagementDocument4 pagesCredit ManagementAnshUl SharMaNo ratings yet

- More Locations: Commercial BankDocument6 pagesMore Locations: Commercial BankAyushi KhuranaNo ratings yet

- Long-Term Bank LoanDocument12 pagesLong-Term Bank LoanAbidah Zulkifli100% (1)

- Bridge FinancingDocument11 pagesBridge Financingdimpleshetty100% (1)

- Pooja Project ReportDocument62 pagesPooja Project ReportAshish MOHARENo ratings yet

- Different Types OF: Loans and AdvancesDocument19 pagesDifferent Types OF: Loans and Advancesharesh KNo ratings yet

- Different Types of Bank Loans and Deposits ExplainedDocument5 pagesDifferent Types of Bank Loans and Deposits ExplainedSukant MakhijaNo ratings yet

- Short Term Loans From Financial InstitutionsDocument4 pagesShort Term Loans From Financial InstitutionsDivisha AgarwalNo ratings yet

- What is Letter of Credit, Overdraft and Term LoanDocument5 pagesWhat is Letter of Credit, Overdraft and Term LoanBijal ParekhNo ratings yet

- Short Term FinanceDocument11 pagesShort Term Financethisispurva100% (1)

- What Do You Mean by Banks?: BankingDocument4 pagesWhat Do You Mean by Banks?: Bankingpayal mittalNo ratings yet

- Bank Loans and OverdraftDocument2 pagesBank Loans and OverdraftRaghav SomaniNo ratings yet

- Banking FinanceDocument9 pagesBanking FinanceAstik TripathiNo ratings yet

- GanuDocument39 pagesGanuRushikesh JagtapNo ratings yet

- Everything You Need to Know About Bank FunctionsDocument15 pagesEverything You Need to Know About Bank FunctionsppperfectNo ratings yet

- Term Loan Amortization Principal Amount Lump Sum: Common Types of Bank LoansDocument6 pagesTerm Loan Amortization Principal Amount Lump Sum: Common Types of Bank Loanssmriti-nNo ratings yet

- Loans and Advances Guide for BanksDocument5 pagesLoans and Advances Guide for BanksKaushik PatelNo ratings yet

- Chapter 6Document7 pagesChapter 6Elijah IbsaNo ratings yet

- Kurdistan Region – Iraq Cihan University Sulaimaniya College Loan & investment ProjectDocument25 pagesKurdistan Region – Iraq Cihan University Sulaimaniya College Loan & investment ProjectZana M. KareemNo ratings yet

- Loans and Discounts Functions ExplainedDocument2 pagesLoans and Discounts Functions ExplainedMegan Adeline Hale100% (2)

- Differences Between Term Loans and Working Capital LoansDocument1 pageDifferences Between Term Loans and Working Capital LoansMohitAhujaNo ratings yet

- Topic 4 - Sources of Finance - BasicsDocument36 pagesTopic 4 - Sources of Finance - BasicsSandeepa KaurNo ratings yet

- Capiii Advtax June13Document13 pagesCapiii Advtax June13Narendra KumarNo ratings yet

- Capiii Audit June12Document13 pagesCapiii Audit June12Narendra KumarNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced Audit and AssuranceDocument7 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced Audit and AssuranceNarendra KumarNo ratings yet

- Capiii Advtax June12Document19 pagesCapiii Advtax June12Narendra KumarNo ratings yet

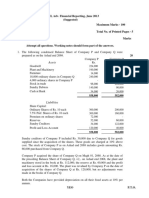

- Suggested Answers of Advanced Cost and Management AccountingDocument12 pagesSuggested Answers of Advanced Cost and Management AccountingNarendra KumarNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Corporate LawsDocument9 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Corporate LawsNarendra KumarNo ratings yet

- Capiii Corporatelaw June12Document11 pagesCapiii Corporatelaw June12Narendra KumarNo ratings yet

- Capiii Costaccount June12Document16 pagesCapiii Costaccount June12Narendra KumarNo ratings yet

- LiquorAct, 2031 (UpdatedLatest) 911201653222PMDocument10 pagesLiquorAct, 2031 (UpdatedLatest) 911201653222PMNarendra KumarNo ratings yet

- Capiii Corporatelaw June13Document12 pagesCapiii Corporatelaw June13Narendra KumarNo ratings yet

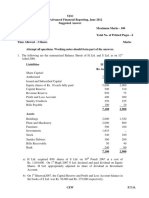

- CAP-III Advanced Financial Reporting Consolidated Balance SheetDocument17 pagesCAP-III Advanced Financial Reporting Consolidated Balance SheetNarendra KumarNo ratings yet

- IncomeTaxAct20581252019125151PM PDFDocument151 pagesIncomeTaxAct20581252019125151PM PDFNarendra KumarNo ratings yet

- Capiii Advaccounting June13Document19 pagesCapiii Advaccounting June13Narendra KumarNo ratings yet

- Income Tax Circular Collection 2056-20572182015 124229 PM-minDocument89 pagesIncome Tax Circular Collection 2056-20572182015 124229 PM-minNarendra KumarNo ratings yet

- hUuf tyf 3/hUuf lgM;u{df kDocument66 pageshUuf tyf 3/hUuf lgM;u{df kNarendra KumarNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Financial ReportingDocument11 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Financial ReportingNarendra KumarNo ratings yet

- IncomeTaxAct, 2058andrules, 2059122201912536PM PDFDocument165 pagesIncomeTaxAct, 2058andrules, 2059122201912536PM PDFTorreus AdhikariNo ratings yet

- incometaxactandrule413201741323PM PDFDocument254 pagesincometaxactandrule413201741323PM PDFNarendra KumarNo ratings yet

- IncomeTaxAct, 2058 (LastUpdated) 17201633614PMDocument127 pagesIncomeTaxAct, 2058 (LastUpdated) 17201633614PMreaderNo ratings yet

- Madira Actand Antasulk Act 125201911327 PMDocument117 pagesMadira Actand Antasulk Act 125201911327 PMNarendra KumarNo ratings yet

- Accounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Document12 pagesAccounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Badiuz FaruquiNo ratings yet

- Income Tax Circular Collection 2056-20572182015 124229 PM-minDocument89 pagesIncome Tax Circular Collection 2056-20572182015 124229 PM-minNarendra KumarNo ratings yet

- Chapter 3 Analyzing Bank PerformanceDocument84 pagesChapter 3 Analyzing Bank Performancesubba raoNo ratings yet

- Midterm 2 SolutionDocument11 pagesMidterm 2 SolutiondavidNo ratings yet

- Management and Construction of The Three Gorges ProjectDocument6 pagesManagement and Construction of The Three Gorges ProjectGuoqiang LiuNo ratings yet

- Accounting For InvestmentDocument14 pagesAccounting For Investmentefe davidNo ratings yet

- Money Growth and Inflation: in This Chapter, Look For TheDocument15 pagesMoney Growth and Inflation: in This Chapter, Look For TheK59 Vo Doan Hoang AnhNo ratings yet

- MathsDocument15 pagesMathsBharathi RajuNo ratings yet

- Trafigura Master LNG Sale and Purchase AgreementDocument58 pagesTrafigura Master LNG Sale and Purchase AgreementAgungNo ratings yet

- CALCULATING ANNUITIES AND FUTURE VALUESDocument10 pagesCALCULATING ANNUITIES AND FUTURE VALUESLyzette LeanderNo ratings yet

- IRP, PPP, and Currency DerivativesDocument4 pagesIRP, PPP, and Currency DerivativesAnonymous Jf9PYY2E8No ratings yet

- Impact of Financial Literacy On Investment Decisions A Study of Himachal Pradesh PDFDocument267 pagesImpact of Financial Literacy On Investment Decisions A Study of Himachal Pradesh PDFSujay SinghviNo ratings yet

- SINDHI PAHAKAS 1. Aaee Taando Khararan, BorchyaniDocument11 pagesSINDHI PAHAKAS 1. Aaee Taando Khararan, BorchyanisindhigulabNo ratings yet

- Alquin DDocument2 pagesAlquin DkenjochelNo ratings yet

- Foundations of Financial Management 14th Edition Block Solutions ManualDocument25 pagesFoundations of Financial Management 14th Edition Block Solutions ManualMaryMurphyatqb100% (50)

- SecretDocument13 pagesSecretElla MyrrNo ratings yet

- Sri Lanka Automobile Demand Assignment PDFDocument2 pagesSri Lanka Automobile Demand Assignment PDFAmanda HerathNo ratings yet

- ICARE Preweek RFBT Preweek 1Document12 pagesICARE Preweek RFBT Preweek 1john paulNo ratings yet

- Taxation: DFA 2104YDocument16 pagesTaxation: DFA 2104YFhawez KodoruthNo ratings yet

- BIWS LBO Quick ReferenceDocument18 pagesBIWS LBO Quick Referencesuperandroid21No ratings yet

- Shahnawaz PtojectDocument46 pagesShahnawaz Ptojectmirsami838No ratings yet

- Staff Wellfare Master CircularDocument149 pagesStaff Wellfare Master CirculardebcsenNo ratings yet

- Module 5 - Interests Formula and RatesDocument14 pagesModule 5 - Interests Formula and RatesAnna HansenNo ratings yet

- Chapter 2 - Bank Negara Malaysia (BNM)Document44 pagesChapter 2 - Bank Negara Malaysia (BNM)Nur HazirahNo ratings yet

- Swap ValuationDocument14 pagesSwap ValuationHANSHU LIUNo ratings yet

- Complete BB Project 5 SHWETADocument75 pagesComplete BB Project 5 SHWETAAbhishek JainNo ratings yet

- DPWH Expropriation Case Interest Rate ReducedDocument12 pagesDPWH Expropriation Case Interest Rate ReducedHazel FernandezNo ratings yet

- International Parity Conditions: Dr. Ch. Venkata Krishna Reddy Associate ProfessorDocument34 pagesInternational Parity Conditions: Dr. Ch. Venkata Krishna Reddy Associate Professorkrishna reddyNo ratings yet

- Chapter-21 Cash Flow AnalysisDocument38 pagesChapter-21 Cash Flow AnalysisSimran KaurNo ratings yet

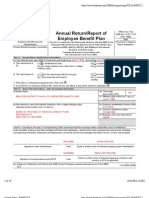

- Carpenters Annuity Fund 2007Document19 pagesCarpenters Annuity Fund 2007Latisha WalkerNo ratings yet

- FIN 102 Banking and Financial Institutions OverviewDocument10 pagesFIN 102 Banking and Financial Institutions Overviewron aviNo ratings yet

- Credit Appraisal Process ReportDocument44 pagesCredit Appraisal Process ReportMuskan Maheshwari100% (2)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (87)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (798)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (58)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (709)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- Faith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateFrom EverandFaith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateRating: 5 out of 5 stars5/5 (33)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- Summary of The 33 Strategies of War by Robert GreeneFrom EverandSummary of The 33 Strategies of War by Robert GreeneRating: 3.5 out of 5 stars3.5/5 (20)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchFrom EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchRating: 4 out of 5 stars4/5 (114)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Company Of One: Why Staying Small Is the Next Big Thing for BusinessFrom EverandCompany Of One: Why Staying Small Is the Next Big Thing for BusinessRating: 3.5 out of 5 stars3.5/5 (14)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Amazon Unbound: Jeff Bezos and the Invention of a Global EmpireFrom EverandAmazon Unbound: Jeff Bezos and the Invention of a Global EmpireRating: 4.5 out of 5 stars4.5/5 (72)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 5 out of 5 stars5/5 (24)