Professional Documents

Culture Documents

Predictive Risk Modelling for Vehicle Insurance Policies

Uploaded by

Upamanyu ChongdarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Predictive Risk Modelling for Vehicle Insurance Policies

Uploaded by

Upamanyu ChongdarCopyright:

Available Formats

Aim: Predictive Risk Modelling to classify underwriting risk for vehicle policies and

quantifying the risky class.

Data: Data has been obtained from kaggle-AllState Claim Prediction challenge. It has

features related to the vehicle and also non vehicle features for example policy related

features. The data is from the period 2005-2007.Since the overall data is very large(around

2.5 GB), a portion of the data may have to be used for practical purposes.

Objectives:

1. Based on the vehicle and policy feature set classify each entry to a risk class. The risk

class can be thought of as a multi class categorical variable.

2. Develop a classification and regression model to predictively classify each entry to

their risk as well as quantify the risk by predicting a claim amount.

Solution Steps:

1. Data Pre-processing and cleaning: Handling missing values and outliers.

2. Exploratory Data Analysis: Univariate and Bivariate analysis. Identifying the

dependencies and the redundant variables.

3. Dividing the data into training and test set (or train-test-validate set).Using the

insurance claim amounts quantify all the vehicle entries by a risk class(say 1-8,1 for

low risk 8 for highest risk.

4. Run a classification model (like SVM/Log. Regression) in order to tackle the multiclass

classification problem of assigning a risk level to each entry in the training set.

5. Run a Regression model (Linear Regression etc.) to predict the claim amounts for

each entry.

6. In each of the steps 4 and 5 various aspects like feature selection, hyper parameter

tuning etc. must be done to optimize the results. Also comparison of results from

multiple regression or classification algorithms may be done to find the suitable

option.

Progress made: I am currently in the Data pre-processing and EDA stage.

You might also like

- Machine Learning Lab Manual 06Document8 pagesMachine Learning Lab Manual 06Raheel Aslam100% (1)

- Assignment 1:: Intro To Machine LearningDocument6 pagesAssignment 1:: Intro To Machine LearningMinh TríNo ratings yet

- Project On Data Mining: Prepared by Ashish Pavan Kumar K PGP-DSBA at Great LearningDocument50 pagesProject On Data Mining: Prepared by Ashish Pavan Kumar K PGP-DSBA at Great LearningAshish Pavan Kumar KNo ratings yet

- Project QuestionsDocument4 pagesProject Questionsvansh guptaNo ratings yet

- Data Mininig ProjectDocument28 pagesData Mininig ProjectKarthikeyan Manimaran67% (3)

- Data Mining UNIT-2 NotesDocument91 pagesData Mining UNIT-2 NotespadmaNo ratings yet

- DSL5Document6 pagesDSL5yash.patil16431No ratings yet

- Predictive Model For E-CommerceDocument3 pagesPredictive Model For E-CommerceNipun Goyal100% (1)

- Assignment 3_LP1Document13 pagesAssignment 3_LP1bbad070105No ratings yet

- Machine Learning Part: Domain OverviewDocument20 pagesMachine Learning Part: Domain Overviewsurya prakashNo ratings yet

- Machin e Learnin G: Lab Record Implementation in RDocument30 pagesMachin e Learnin G: Lab Record Implementation in RyukthaNo ratings yet

- 7 Types of Classification AlgorithmsDocument21 pages7 Types of Classification AlgorithmspritinigamNo ratings yet

- Q. (A) What Are Different Types of Machine Learning? Discuss The DifferencesDocument12 pagesQ. (A) What Are Different Types of Machine Learning? Discuss The DifferencesHassan SaddiquiNo ratings yet

- Data PreprocessingDocument2 pagesData PreprocessingHemantNo ratings yet

- CSC 603_Final ProjectDocument3 pagesCSC 603_Final Projectbme.engineer.issa.mansourNo ratings yet

- Machine LearningDocument52 pagesMachine Learningkartikgautam6622No ratings yet

- 7 Types of Classification Algorithms - Analytics India MagazineDocument17 pages7 Types of Classification Algorithms - Analytics India MagazineJosé-Manuel Martin CoronadoNo ratings yet

- Key Learning's From Marketing Analytics Course Jasdeep Singh (2018EPGP020)Document9 pagesKey Learning's From Marketing Analytics Course Jasdeep Singh (2018EPGP020)Jasdeep SinghNo ratings yet

- Data Mining Algorithms Predication L6Document7 pagesData Mining Algorithms Predication L6u- m-No ratings yet

- Machine Learning Predicts Traffic Using Accident DataDocument12 pagesMachine Learning Predicts Traffic Using Accident DataN. Akhila GoudNo ratings yet

- YadobDocument47 pagesYadobsadeq behbehanianNo ratings yet

- Chapter 3 AssignmentDocument12 pagesChapter 3 Assignmentshuaibu abdullahiNo ratings yet

- Assignment 3Document4 pagesAssignment 3Aditya BossNo ratings yet

- Python and ML Content For Page 16Document22 pagesPython and ML Content For Page 16Sumaiya KauserNo ratings yet

- DWM Lab ManualDocument92 pagesDWM Lab ManualHemamaliniNo ratings yet

- CE802 ReportDocument7 pagesCE802 ReportprenithjohnsamuelNo ratings yet

- Quantitative Methods For Management: Analysis PurposeDocument2 pagesQuantitative Methods For Management: Analysis Purposesudheer gottetiNo ratings yet

- Effectiveness Assessment Between Sequential Minimal Optimization and Logistic Classifiers For Credit Risk PredictionDocument9 pagesEffectiveness Assessment Between Sequential Minimal Optimization and Logistic Classifiers For Credit Risk PredictionInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Machine Learning AlgorithmDocument8 pagesMachine Learning AlgorithmShivaprakash D MNo ratings yet

- Predictive Analysis 1Document22 pagesPredictive Analysis 1nenavathprasad170No ratings yet

- Unit 7 MLDocument33 pagesUnit 7 MLYuvraj ChauhanNo ratings yet

- Day13 K Means ClusteringDocument4 pagesDay13 K Means ClusteringPriya kambleNo ratings yet

- ML Module IiiDocument12 pagesML Module IiiCrazy ChethanNo ratings yet

- For More Visit WWW - Ktunotes.inDocument21 pagesFor More Visit WWW - Ktunotes.inArcha RajanNo ratings yet

- PM Alternate ProjectDocument2 pagesPM Alternate ProjectAnmol SinghNo ratings yet

- Project 1Document4 pagesProject 1aqsa yousafNo ratings yet

- Project Data Mining Tanaya LokhandeDocument58 pagesProject Data Mining Tanaya Lokhandetanaya lokhandeNo ratings yet

- 7 K-Means ClusteringDocument4 pages7 K-Means ClusteringArvind Kumar Yadav0% (1)

- B24 ML Exp-1Document10 pagesB24 ML Exp-1SAKSHI TUPSUNDARNo ratings yet

- Applying Big Data Analytics TechniquesDocument4 pagesApplying Big Data Analytics TechniquesAdam GameChannelNo ratings yet

- Week 10 - PROG 8510 Week 10Document16 pagesWeek 10 - PROG 8510 Week 10Vineel KumarNo ratings yet

- DWDM Unit-3: What Is Classification? What Is Prediction?Document12 pagesDWDM Unit-3: What Is Classification? What Is Prediction?Sai Venkat GudlaNo ratings yet

- PCX - RepoHHHHHHHHHrtDocument13 pagesPCX - RepoHHHHHHHHHrtSaid RahmanNo ratings yet

- Data Science Assignment 2Document14 pagesData Science Assignment 2anigunasekaraNo ratings yet

- AI ProjectResearchPaperDocument9 pagesAI ProjectResearchPapermedisecureeeNo ratings yet

- ML 1Document20 pagesML 1Adwait RaichNo ratings yet

- UntitledDocument202 pagesUntitledforatação pcenootebokNo ratings yet

- Chapter-3-Common Issues in Machine LearningDocument20 pagesChapter-3-Common Issues in Machine Learningcodeavengers0No ratings yet

- Q No. 1 1.1machine Learning:: Machine Learning Is The Study of Computer Algorithms That Improve AutomaticallyDocument10 pagesQ No. 1 1.1machine Learning:: Machine Learning Is The Study of Computer Algorithms That Improve AutomaticallysajidNo ratings yet

- Crime Prediction in Nigeria's Higer InstitutionsDocument13 pagesCrime Prediction in Nigeria's Higer InstitutionsBenjamin BalaNo ratings yet

- DMWH M3Document21 pagesDMWH M3BINESHNo ratings yet

- Business Report On Data Mining: By: Aditya Janardan Hajare Batch: PGPDSBA Mar'C21 Group 1Document18 pagesBusiness Report On Data Mining: By: Aditya Janardan Hajare Batch: PGPDSBA Mar'C21 Group 1Aditya HajareNo ratings yet

- CE802 PilotDocument2 pagesCE802 PilotprenithjohnsamuelNo ratings yet

- Only QuatDocument8 pagesOnly QuatBI11-286 Nguyễn Xuân VinhNo ratings yet

- Asynchronous Claisfication Basic ConcepsDocument2 pagesAsynchronous Claisfication Basic ConcepsLinda AmunyelaNo ratings yet

- Data Mining Problem 2 ReportDocument13 pagesData Mining Problem 2 ReportBabu ShaikhNo ratings yet

- Car Insurance Claim Prediction - First SeminarDocument26 pagesCar Insurance Claim Prediction - First SeminarDr. Myat Mon KyawNo ratings yet

- Unit 8 Classification and Prediction: StructureDocument16 pagesUnit 8 Classification and Prediction: StructureKamal KantNo ratings yet

- Assignment Instructions For The Data Analytics ReportDocument5 pagesAssignment Instructions For The Data Analytics Reportrobert jnr MartinNo ratings yet

- DATA MINING and MACHINE LEARNING. PREDICTIVE TECHNIQUES: ENSEMBLE METHODS, BOOSTING, BAGGING, RANDOM FOREST, DECISION TREES and REGRESSION TREES.: Examples with MATLABFrom EverandDATA MINING and MACHINE LEARNING. PREDICTIVE TECHNIQUES: ENSEMBLE METHODS, BOOSTING, BAGGING, RANDOM FOREST, DECISION TREES and REGRESSION TREES.: Examples with MATLABNo ratings yet

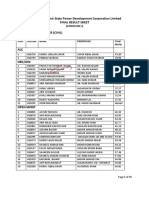

- Code # Roll No Name PC Comments O/P (6) (5) (3) (8) (4) (8) Main (6) TotalDocument10 pagesCode # Roll No Name PC Comments O/P (6) (5) (3) (8) (4) (8) Main (6) TotalUpamanyu ChongdarNo ratings yet

- Profile: Zimbabwe Security ForcesDocument12 pagesProfile: Zimbabwe Security ForcesUpamanyu ChongdarNo ratings yet

- EvolutionDocument21 pagesEvolutionUpamanyu ChongdarNo ratings yet

- Purple Dragon PDFDocument106 pagesPurple Dragon PDFUpamanyu ChongdarNo ratings yet

- J&K Police Crime BranchDocument7 pagesJ&K Police Crime Branchchandni babunuNo ratings yet

- TRSP Transcript WB Oral Interview Brookings Syeduzzaman Box393214B PUBLICDocument23 pagesTRSP Transcript WB Oral Interview Brookings Syeduzzaman Box393214B PUBLICUpamanyu ChongdarNo ratings yet

- Gradation List of IPS & SPS Officers As On 08.02.2020Document12 pagesGradation List of IPS & SPS Officers As On 08.02.2020Upamanyu ChongdarNo ratings yet

- Selection ListDocument19 pagesSelection ListakibNo ratings yet

- Selection ListDocument19 pagesSelection ListakibNo ratings yet

- Lessons from Vietnam: Dealing with Dual Threats in CounterinsurgencyDocument15 pagesLessons from Vietnam: Dealing with Dual Threats in CounterinsurgencyUpamanyu ChongdarNo ratings yet

- Elections in the Ottoman Empire, 1876-1919Document23 pagesElections in the Ottoman Empire, 1876-1919Fauzan RasipNo ratings yet

- Staniland - Kashmir Since 2003Document28 pagesStaniland - Kashmir Since 2003Upamanyu ChongdarNo ratings yet

- Class SyriaDocument26 pagesClass SyriaUpamanyu ChongdarNo ratings yet

- 21 - Chapter 5 Jammu and Kashmir Police and Low Intensity Conflict PDFDocument44 pages21 - Chapter 5 Jammu and Kashmir Police and Low Intensity Conflict PDFUpamanyu ChongdarNo ratings yet

- Ensemble Techniques for PD DiagnosisDocument1 pageEnsemble Techniques for PD DiagnosisUpamanyu Chongdar0% (1)

- Technology RequirementDocument1 pageTechnology RequirementUpamanyu ChongdarNo ratings yet

- 1 3 PDFDocument7 pages1 3 PDFShihabHasanNo ratings yet

- Kashmir Loc trade-USIPDocument20 pagesKashmir Loc trade-USIPUpamanyu ChongdarNo ratings yet

- 1 3 PDFDocument7 pages1 3 PDFShihabHasanNo ratings yet

- Article On Warlordism Within Pashtun Tribal SocietyDocument22 pagesArticle On Warlordism Within Pashtun Tribal SocietyRobert KhanNo ratings yet