Professional Documents

Culture Documents

RMC No. 42-2020 Annex A - PDF

RMC No. 42-2020 Annex A - PDF

Uploaded by

cris gerard trinidad0 ratings0% found this document useful (0 votes)

16 views1 pageOriginal Title

RMC No. 42-2020 Annex A_copy.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageRMC No. 42-2020 Annex A - PDF

RMC No. 42-2020 Annex A - PDF

Uploaded by

cris gerard trinidadCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

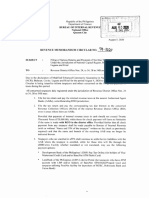

Annex “A”

FILING AND PAYMENT OF ANNUAL INCOME TAX RETURN FOR TAXABLE YEAR 2019

TAXPAYER/FILER BIR FORM NO. FILING INSTRUCTIONS PAYMENT INSTRUCTIONS

Individuals earning purely 1700 January 2018 (ENCS) If the employee availed of the substituted filing, no need to file a return. For Manual and eBIRForms Filers

compensation whose income tax has

been correctly withheld (tax due equals a.) Manual Payment

tax withheld) Any Authorized Agent Bank (AAB); or

Individuals earning purely 1700 January 2018 (ENCS) Manual Filers – use the pre-printed return available in the Revenue District Office In places where there are no AABs,

compensation with two or more (RDO) or the downloadable return found in the BIR website or the return in the Offline the tax due shall be paid with the

employers eBIRForms Package v7.6. The package can be downloaded in the BIR website. concerned Revenue Collection

Non-Resident Alien not engaged in 1700 January 2018 (ENCS) a.) With tax due/payment – Officer (RCO) under the RDO.

trade or business in the Philippines Pre-printed Return available in the RDO

receiving income from sources within Fill-out all applicable fields then file the return with any Authorized Agent b.) Online Payment **

the Philippines Bank (AAB) or to the Revenue Collection Officer (RCO) under the RDO Thru Mobile Payment (GCash/Pay

Individuals with business/practice of 1701 January 2018 (ENCS) Return downloaded from the BIR website Maya); or

profession income only and the method Print the return and fill-out all the applicable fields then file the return with Landbank of the Philippines (LBP)

of deduction used is itemized Link.BizPortal, for taxpayers who have

any AAB or to the RCO under the RDO

deduction ATM account with LBP and/or holders

Return in the Offline eBIRForms Package v 7.6

Individuals with business/practice of 1701 January 2018 (ENCS) of Bancnet ATM/Debit Card or for

Fill-out the return then after successful validation print the return and file with

profession income and at the same taxpayers utilizing PesoNet

time with compensation income (mixed any AAB or to the RCO under the RDO

(depositors of Rizal Commercial

income earner) b.) Without tax due/payment – manual filing not allowed, The “no payment” return

Banking Corporation (RCBC) and

Estates engaged in trade or business 1701 January 2018 (ENCS) shall be filed thru the Offline eBIRForms Package v7.6 by submitting the return Robinsons Bank); or

Trusts engaged in trade or business 1701 January 2018 (ENCS) online Development Bank of the Philippines

Individuals with business/ practice of 1701A January 2018 (NEW) (DBP) Tax Online, for taxpayers-

profession income only and the method eBIRForms Filers/Users– use the Offline eBIRForms Package v7.6 in filling-out the holders of VISA/ Master Credit Card

of deduction used is optional standard return. The package can be downloaded in the BIR website, and if: and/or Bancnet ATM/ Debit Card; or

deduction a) With tax due/payment – after filling-out the return, submit the return online then Union Bank Online Web and Mobile

Individuals with business/ practice of 1701A January 2018 (NEW) print the return and the Tax Return Receipt Confirmation from the eBIRForms Payment Facility, for taxpayers who

profession income only and opted to System. File the return, together with the Tax Return Receipt Confirmation with have account with Union Bank.

avail of 8% flat income tax rate any AAB or to the RCO under the RDO

Corporation, Partnership and other 1702-RT January 2018 (ENCS) If availing of online payment, AITR shall be submitted online. ** Taxpayers who shall pay their tax

Non-Individual who are subject only to b) Without tax due/payment – file the “no payment” return thru the Offline due online are required to file the

regular income tax rate of 30% 1702-RT June 2013 (old version) eBIRForms Package v7.6 by submitting the return online corresponding Annual Income Tax

Corporation, Partnership and other 1702-EX January 2018 (ENCS) v.2 Return (AITR) online through the Offline

Non-Individual who are exempt from Electronic Filing and Payment System (eFPS) Filers/Users of the following: eBIRForms Package v7.6

income tax or subject to 0% (e.g. PEZA a.) BIR Form Nos. 1700, 1701 and 1701A-

registered business with ITH, BOI 1702-EX June 2013 (old version) With or Without tax due/payment- file thru the Offline eBIRForms Package v

registered business with ITH, GPP, For eFPS Filers – ePay through the eFPS

7.6 by following the procedure stated in the eBIRForms Filers/Users

cooperatives, etc.) Facility

b.) BIR Form Nos. 1702-EX, 1702-MX and 1702-RT

Corporation, Partnership and other 1702-MX January 2018 (ENCS)

With or Without tax due/payment- file thru the eFPS Facility by using the old

Non-Individual who are subject to:

version of the returns (June 2013 version) in the eFPS

Special Rate of 5% or 2%, etc. (with or

without Regular IT Rate of 30% and/or 1702-MX June 2013 (old version)

Exempt or 0%)

You might also like

- UPI 2 0 Product Document - 25072017-1Document45 pagesUPI 2 0 Product Document - 25072017-1Anand Raj80% (5)

- Payroll Engagement Proposal (PPC Asia Corporation)Document4 pagesPayroll Engagement Proposal (PPC Asia Corporation)Marvin Celedio100% (2)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Project On IMPS (Immediate Payment Service)Document46 pagesProject On IMPS (Immediate Payment Service)Nayeem100% (1)

- Operations Memo 2016-04-01Document7 pagesOperations Memo 2016-04-01Renniel DimalantaNo ratings yet

- Pao Penafrancia TicketDocument3 pagesPao Penafrancia Ticketcris gerard trinidadNo ratings yet

- Abagon Company (Caselette)Document3 pagesAbagon Company (Caselette)Jodi Ann Echavia Alvarez0% (2)

- Insurance - A Brief Overview: Chapter-1Document58 pagesInsurance - A Brief Overview: Chapter-1Sreeja Sahadevan75% (4)

- RMC No. 44-2022 Annex A (Manner of Filing of AITR)Document2 pagesRMC No. 44-2022 Annex A (Manner of Filing of AITR)wendy lynn amanteNo ratings yet

- 325862-2022-Guidelines in The Filing of Annual Income Tax20220719-11-Pqk5qxDocument3 pages325862-2022-Guidelines in The Filing of Annual Income Tax20220719-11-Pqk5qxRen Mar CruzNo ratings yet

- Annex "A": Filing and Payment of Income Tax Returns For Taxable Year 2018Document1 pageAnnex "A": Filing and Payment of Income Tax Returns For Taxable Year 2018Md PrejulesNo ratings yet

- Manner of Filing and Payment of Income Tax Returns For Taxable Year 2018Document1 pageManner of Filing and Payment of Income Tax Returns For Taxable Year 2018RAS ConsultancyNo ratings yet

- Revenue Memorandum Circular No. 17-2019: SubjectDocument3 pagesRevenue Memorandum Circular No. 17-2019: SubjecttarteinNo ratings yet

- RMC No 24-2018 (Guidelines For FS)Document6 pagesRMC No 24-2018 (Guidelines For FS)GoogleNo ratings yet

- Revenue Memorandum Circular No. 24-2018 Subject:: Bureau of Internal RevenueDocument6 pagesRevenue Memorandum Circular No. 24-2018 Subject:: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- RMC 37-2019Document1 pageRMC 37-2019Lhance BabacNo ratings yet

- RMC No 32-2018 PDFDocument4 pagesRMC No 32-2018 PDFzooeyNo ratings yet

- RMC 88-2018Document1 pageRMC 88-2018KevinPesaseNo ratings yet

- Rdo 56 - Guidelines For Itr FilingDocument64 pagesRdo 56 - Guidelines For Itr FilingrandolphsabenorioNo ratings yet

- Revenue Memorandum Circular No. 37-2019Document2 pagesRevenue Memorandum Circular No. 37-2019Rustan FrozenNo ratings yet

- RMC No. 004-21 - Guidlines in Filing Tax Return and Required AttachmentsDocument9 pagesRMC No. 004-21 - Guidlines in Filing Tax Return and Required AttachmentsVence EugalcaNo ratings yet

- RMC No. 73-2018Document3 pagesRMC No. 73-2018Madi KomoaNo ratings yet

- RMC No. 4-2021 - Filing of Tax Returns, Attachments and PaymentDocument6 pagesRMC No. 4-2021 - Filing of Tax Returns, Attachments and PaymentTrisha TimpogNo ratings yet

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- Tax Reviewer - Train LawDocument8 pagesTax Reviewer - Train LawCelestiaNo ratings yet

- RMC No. 79-2020Document2 pagesRMC No. 79-2020Lulu Adaro VillanuevaNo ratings yet

- Mo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven StoresDocument4 pagesMo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven Storesbuwa moNo ratings yet

- Ta081 2023Document1 pageTa081 2023sandraNo ratings yet

- Accounting Technician Level 3 - Module 3 Part 2Document4 pagesAccounting Technician Level 3 - Module 3 Part 2Rona Amor MundaNo ratings yet

- 7 ElevenDocument17 pages7 ElevenCir Arnold Santos IIINo ratings yet

- RMC No 19-2019 PDFDocument2 pagesRMC No 19-2019 PDFRobea Marie GaspayNo ratings yet

- Tax Inter Quick Referencer by ICAIDocument17 pagesTax Inter Quick Referencer by ICAITushar kumarNo ratings yet

- RMC No. 54-2023 Annex ADocument3 pagesRMC No. 54-2023 Annex ASean AndersonNo ratings yet

- BIR 2019 Income Tax DescriptionDocument20 pagesBIR 2019 Income Tax DescriptionRiselle Ann SanchezNo ratings yet

- RMC No. 40-2023Document1 pageRMC No. 40-2023Nadine CruzNo ratings yet

- Individuals: Income Tax DescriptionDocument17 pagesIndividuals: Income Tax DescriptionMichael Olmedo NeneNo ratings yet

- Income Tax PDFDocument19 pagesIncome Tax PDFPhia CustodioNo ratings yet

- Bir Form No. 0622Document2 pagesBir Form No. 0622Joel SyNo ratings yet

- What Is Percentage Tax?Document3 pagesWhat Is Percentage Tax?Lucas JuanchoNo ratings yet

- Percentage Tax: o o o o o oDocument11 pagesPercentage Tax: o o o o o oMark Joseph BajaNo ratings yet

- Guidelines and Instruction For BIR Form No. 1701: - Who Shall File? - When and Where To File and PayDocument5 pagesGuidelines and Instruction For BIR Form No. 1701: - Who Shall File? - When and Where To File and Payromeojr sibullasNo ratings yet

- Percentage TaxDocument5 pagesPercentage TaxGIGI BODONo ratings yet

- Income TaxDocument14 pagesIncome TaxArielle CabritoNo ratings yet

- BIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedDocument9 pagesBIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedJAYAR MENDZNo ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- Income TaxDocument15 pagesIncome TaxJessNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument7 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionfiazNo ratings yet

- Income Tax Description: IndividualsDocument13 pagesIncome Tax Description: IndividualsJAYAR MENDZNo ratings yet

- LAwhahahhaDocument21 pagesLAwhahahhaJeselle BagsicanNo ratings yet

- Percentage TaxDocument7 pagesPercentage TaxArielle CabritoNo ratings yet

- Percentage Tax ReviewerDocument5 pagesPercentage Tax ReviewerJerico ManaloNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument15 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionTausif ArshadNo ratings yet

- Tot RR On It and WT RR 4 2024Document25 pagesTot RR On It and WT RR 4 2024floravielcasternoboplazoNo ratings yet

- Revenue Regulation 1-2013Document7 pagesRevenue Regulation 1-2013Jerwin DaveNo ratings yet

- Index For Income TaxDocument20 pagesIndex For Income TaxMark Joseph BajaNo ratings yet

- Income TaxDocument20 pagesIncome TaxEjNo ratings yet

- RMO No. 5-2002Document13 pagesRMO No. 5-2002lantern san juanNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- Module 7 TAXDocument8 pagesModule 7 TAXgracevylmae04No ratings yet

- Mid-Term-Day 1-Other Percentage Taxes (Opt)Document52 pagesMid-Term-Day 1-Other Percentage Taxes (Opt)Christine Joyce MagoteNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Emelyn Ventura SantosNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument40 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionSammar EllahiNo ratings yet

- Annex ADocument5 pagesAnnex Ajosef.delacuestaNo ratings yet

- Income Tax - Bureau of Internal RevenueDocument21 pagesIncome Tax - Bureau of Internal Revenue홍혜연No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- BIRSALA Membership Form-June 2022Document1 pageBIRSALA Membership Form-June 2022cris gerard trinidadNo ratings yet

- BIRSALA Loan Application Form-June 2019Document2 pagesBIRSALA Loan Application Form-June 2019cris gerard trinidadNo ratings yet

- BIR Savings and Loan Association Inc. (BIRSALA)Document2 pagesBIR Savings and Loan Association Inc. (BIRSALA)cris gerard trinidadNo ratings yet

- ALDEN FS-update 2019Document57 pagesALDEN FS-update 2019cris gerard trinidadNo ratings yet

- Schedule of Taxes and Licenses Paid - Year 2019Document2 pagesSchedule of Taxes and Licenses Paid - Year 2019cris gerard trinidadNo ratings yet

- Invoice Center HistoryDocument3 pagesInvoice Center Historycris gerard trinidadNo ratings yet

- RMC No. 134-2019Document1 pageRMC No. 134-2019cris gerard trinidadNo ratings yet

- Sports FestDocument9 pagesSports Festcris gerard trinidadNo ratings yet

- TRAIN LAW - Income TaxDocument53 pagesTRAIN LAW - Income Taxcris gerard trinidadNo ratings yet

- Annual ReportDocument43 pagesAnnual Reportcris gerard trinidadNo ratings yet

- Customer A/C Reference Documenttext Doc - Date Amt in Doc. Cu CurrDocument8 pagesCustomer A/C Reference Documenttext Doc - Date Amt in Doc. Cu Currcris gerard trinidadNo ratings yet

- CPDProvider CPA 052419Document26 pagesCPDProvider CPA 052419cris gerard trinidadNo ratings yet

- Fraud Risk Management Program, Featuring Mr. TOMMY SEAHDocument4 pagesFraud Risk Management Program, Featuring Mr. TOMMY SEAHCFE International Consultancy Group100% (1)

- Supplementary Addendum of Cap Ii 1 PDFDocument301 pagesSupplementary Addendum of Cap Ii 1 PDFcasarokarNo ratings yet

- BPI Vs de Reny Fabric Industries Inc, 35 SCRA 253Document2 pagesBPI Vs de Reny Fabric Industries Inc, 35 SCRA 253Courtney TirolNo ratings yet

- KITACO Engineering Corporation: Terms & ConditionsDocument6 pagesKITACO Engineering Corporation: Terms & ConditionsEl MacheteNo ratings yet

- About: Company Namejpmorgan Chase & CoDocument3 pagesAbout: Company Namejpmorgan Chase & CoMorgan MunyoroNo ratings yet

- Bank Marketing 1Document69 pagesBank Marketing 1nirosha_398272247No ratings yet

- The Eclectica Fund - Performance Attribution Report - December 2010Document3 pagesThe Eclectica Fund - Performance Attribution Report - December 2010pick6No ratings yet

- Illustration PDFDocument3 pagesIllustration PDFsrcrsrNo ratings yet

- RJ02RS6821 PDFDocument2 pagesRJ02RS6821 PDFtalvinder singhNo ratings yet

- The Basics of Social Security SystemDocument7 pagesThe Basics of Social Security SystemRon Gerald RicaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicepramodyad5810No ratings yet

- Top 40 Wealth Management Firms 2017Document3 pagesTop 40 Wealth Management Firms 2017JonNo ratings yet

- Deloitte CollectionsDocument16 pagesDeloitte Collectionscongsang099970No ratings yet

- Decennial Liability: A Potential Time Bomb For U.S. Design Professionals?Document4 pagesDecennial Liability: A Potential Time Bomb For U.S. Design Professionals?Hashim MuhammudNo ratings yet

- AT - First Preboard (October 2011)Document12 pagesAT - First Preboard (October 2011)Kim Cristian MaañoNo ratings yet

- Interest, Present & Future Value, NPV ExplainedDocument8 pagesInterest, Present & Future Value, NPV ExplainedAlfi Shahrier NiloyNo ratings yet

- AMENDMENT TO SOP ON E-PROCUREMENT 26 May 2016 PDFDocument3 pagesAMENDMENT TO SOP ON E-PROCUREMENT 26 May 2016 PDFsahaNo ratings yet

- Psa PDFDocument286 pagesPsa PDFJina NamNo ratings yet

- Complete BB Project 5 SHWETADocument75 pagesComplete BB Project 5 SHWETAAbhishek JainNo ratings yet

- Compound InterestDocument22 pagesCompound InterestAnonymous rDNAiszDjX100% (1)

- TTTTTDocument3 pagesTTTTTManoj KumarNo ratings yet

- Safe Deposit LockerDocument3 pagesSafe Deposit LockerPaul BlessonNo ratings yet

- Financial Performance Analysis of Prime BankDocument58 pagesFinancial Performance Analysis of Prime BankSapnaNo ratings yet

- Ijarah FinancingDocument50 pagesIjarah FinancingDeliaFitrianaHidayatNo ratings yet

- Oblicon Article and CasesDocument32 pagesOblicon Article and Casesnylorjay0% (1)