Professional Documents

Culture Documents

Bank Nifty

Bank Nifty

Uploaded by

Gopikumar ManoharanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Nifty

Bank Nifty

Uploaded by

Gopikumar ManoharanCopyright:

Available Formats

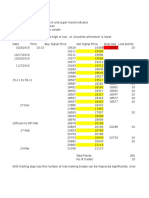

ORB 2 PM — Intraday Bank Nifty Strategy

Kirubakaran Rajendran

Kirubakaran Rajendran

May 19, 2018 · 5 min read

Many a times we would have noticed the market trading range bound without much

movement, however post 2 PM we have seen many times, market move in one sided

direction when the day high or day low is broken.

It could be due to various reason like, the news that comes in during market hours,

Geo political events that affect other international markets which in turn affects

Indian markets or its the time European markets opens up and fresh inflows occur.

What if we could ignore all the noise till 2 pm, and then trade the day high or low

breakouts. It would be much easier for traders, as we don’t need to sit in front of

terminal all the time, we just place the orders at 2 pm and carry on with our work.

So the rules of the game is

Check Bank Nifty day high and day low at 2 PM

Buy when day high is crossed and Short when day low is crossed, exit at 3:20 PM or

when stop loss is hit.

Place SL-M orders for both Buy(day high as entry ) & Sell (day low as entry) at 2

PM and relax.

Bank Nifty Intraday chart

When market starts trending after 2pm, it could trigger any of the order and the

other order will act as a stop loss. or you can also keep a fixed stop loss of

0.5%. In the above example, on 26th April 2018, Bank Nifty crossed the day high

after 2PM, which triggered Buy order and by 3:20 PM, the position has been squared

off in profit.

Here’s another example, on March 6th 2018, Bank Nifty broke its day low after 2 PM

and ended up with huge profits by 3:20 when we closed the intraday position.

And remember, not every trades end up in profits. Sometimes, you need to face

losses as well but those are limited. In the below trade, after initial buy

trigger, it hit stop loss and short trade was triggered which ended up in minimal

loss by end of the day when position was squared off.

You might also like

- Oi Pulse Full CourseDocument224 pagesOi Pulse Full Courserahul.drkNo ratings yet

- Trading Nifty Futures For A Living by Chartless Trader Vol Book 1Document3 pagesTrading Nifty Futures For A Living by Chartless Trader Vol Book 1Anantha TheerthanNo ratings yet

- Nifty CalculationDocument25 pagesNifty Calculationpratz2706No ratings yet

- The Wolf - Strategy PDFDocument6 pagesThe Wolf - Strategy PDFSiva Sangari100% (1)

- Bank Nifty Weekly FnO Hedging StrategyDocument5 pagesBank Nifty Weekly FnO Hedging StrategySanju GoelNo ratings yet

- ST Sir Gems, Subhadip Sir Pivots and Explanation of IDF by DR - VivekDocument101 pagesST Sir Gems, Subhadip Sir Pivots and Explanation of IDF by DR - VivekUsha JagtapNo ratings yet

- Bank Nifty BacktestingDocument2 pagesBank Nifty BacktestingDebapriya GhoshNo ratings yet

- First Method - Banknifty BreakoutDocument5 pagesFirst Method - Banknifty BreakoutsrirubanNo ratings yet

- Shiv Trend FinderDocument15 pagesShiv Trend FinderstelsoftNo ratings yet

- Nifty TrendDocument2 pagesNifty TrendLokesh NANo ratings yet

- Bank Nifty Technical Analysis: Image Taken From ORANGE Facebook AccountDocument29 pagesBank Nifty Technical Analysis: Image Taken From ORANGE Facebook AccountektapatelbmsNo ratings yet

- Secret Formula of Intraday Trading Techniques StrategiesDocument7 pagesSecret Formula of Intraday Trading Techniques StrategiesJenny JohnsonNo ratings yet

- Trader PyramidDocument12 pagesTrader Pyramidramji3115337No ratings yet

- Ambush Trades - Bank Nifty-1Document23 pagesAmbush Trades - Bank Nifty-1harish2005No ratings yet

- Stockmock - Monthly 1-3pmDocument4 pagesStockmock - Monthly 1-3pmHarieswar ReddyNo ratings yet

- Microsoft Word - BTC 54 Strategy For Crude OilDocument5 pagesMicrosoft Word - BTC 54 Strategy For Crude Oilrakesh1890No ratings yet

- Price Action Madness, Part 3 - 2-22-17Document64 pagesPrice Action Madness, Part 3 - 2-22-17kalelenikhlNo ratings yet

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Document7 pagesStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Riya VermaNo ratings yet

- StrategiesDocument3 pagesStrategiesudipthNo ratings yet

- Nifty SignalDocument14 pagesNifty SignalmahendraboradeNo ratings yet

- Velluri Strategy Nifty FiftyDocument14 pagesVelluri Strategy Nifty Fiftysamcool87No ratings yet

- An Early Morning Trader StrategyDocument3 pagesAn Early Morning Trader StrategySasikumar ThangaveluNo ratings yet

- Buy Level Buy LevelDocument9 pagesBuy Level Buy LevelJeniffer RayenNo ratings yet

- Options Trading Beginner: Rach's Self ImprovementDocument4 pagesOptions Trading Beginner: Rach's Self Improvementhc87No ratings yet

- Options Trade - Options Strategy BuilderDocument4 pagesOptions Trade - Options Strategy Builderradesh.reddyNo ratings yet

- Gmail - The New Way To Trade BankNiftyDocument6 pagesGmail - The New Way To Trade BankNiftyNeil Potter0% (1)

- Camarilla and Fibonacci Pivots LevelsDocument5 pagesCamarilla and Fibonacci Pivots LevelsNayan PatelNo ratings yet

- Pre Webinar Presentation 4th 5th JanDocument11 pagesPre Webinar Presentation 4th 5th JanJenny JohnsonNo ratings yet

- Banknifty StrategiesDocument15 pagesBanknifty StrategiesChandrasekar ChandramohanNo ratings yet

- Session Breakout StrategyDocument2 pagesSession Breakout Strategyvamsi kumar0% (1)

- FIBODocument27 pagesFIBOPragnesh ShahNo ratings yet

- 5 EMA StrategyDocument8 pages5 EMA Strategydesignfordummy100% (1)

- How Big Players Traps Retailers in StockmarketDocument4 pagesHow Big Players Traps Retailers in StockmarketDare DesaiNo ratings yet

- Method Nifty 50Document16 pagesMethod Nifty 50Richard JonesNo ratings yet

- Gap Trading IntradayDocument2 pagesGap Trading IntradayAbhinav KumarNo ratings yet

- Which Tool Is Good For Intraday Stock Scanning - QuoraDocument4 pagesWhich Tool Is Good For Intraday Stock Scanning - QuoracsanchezptyNo ratings yet

- BNF Option Trading On ExpiryDocument35 pagesBNF Option Trading On ExpirySwastik TiwariNo ratings yet

- Maddy - Make Wealth From Intraday Trading - Based On Price Action, 5 Setups For Day Trading (2021)Document30 pagesMaddy - Make Wealth From Intraday Trading - Based On Price Action, 5 Setups For Day Trading (2021)pardhunani143No ratings yet

- 6 Best Books On Intraday Trading - Financial Analyst Insider PDFDocument8 pages6 Best Books On Intraday Trading - Financial Analyst Insider PDFAbhishek MusaddiNo ratings yet

- What To Expect From 9th MentoringDocument27 pagesWhat To Expect From 9th Mentoringgurukarthick_dbaNo ratings yet

- INtraday Trading Methods For NiftyDocument4 pagesINtraday Trading Methods For Niftymuddisetty umamaheswar100% (1)

- Nifty Options ProfitDocument16 pagesNifty Options ProfitMohanNo ratings yet

- Raj OptionDocument9 pagesRaj OptionPearlboy Muthuselvan N100% (1)

- Long Put Calendar SpreadDocument3 pagesLong Put Calendar SpreadpkkothariNo ratings yet

- Ultimate Loss Recovery Strategy UpdatedDocument3 pagesUltimate Loss Recovery Strategy UpdatedThanaram SauNo ratings yet

- Strength of The TrendDocument14 pagesStrength of The TrendDavid VenancioNo ratings yet

- Nifty & Bank Nifty Strategy Contest Thr..Document6 pagesNifty & Bank Nifty Strategy Contest Thr..AnmohieyNo ratings yet

- MTP For NiftyDocument3 pagesMTP For NiftyAnil KumarNo ratings yet

- Trading Tips and Cheat Sheet For Beginners: DisclaimerDocument14 pagesTrading Tips and Cheat Sheet For Beginners: DisclaimerZayn TranNo ratings yet

- Forward: Muhammad The Prophet of IslamDocument17 pagesForward: Muhammad The Prophet of IslamSajid QureshiNo ratings yet

- 22 Rules of Trading - Mauldin EconomicsDocument5 pages22 Rules of Trading - Mauldin EconomicsJignesh71No ratings yet

- BankNifty Futures Intraday StratagyDocument156 pagesBankNifty Futures Intraday StratagysachinNo ratings yet

- You Oi Pulse & Success - SlidesDocument9 pagesYou Oi Pulse & Success - SlidesAmitNo ratings yet

- Gann, W.D. - Gann's 28 Trading RulesDocument2 pagesGann, W.D. - Gann's 28 Trading RulesfredNo ratings yet

- Banknifty IntradayDocument117 pagesBanknifty IntradayUmesh ThakkarNo ratings yet

- ScreenerDocument1 pageScreenermanishnp1993No ratings yet

- Bank Nifty Weekly-Wednesday Option Trading FormulaDocument4 pagesBank Nifty Weekly-Wednesday Option Trading FormulamkranthikumarmcaNo ratings yet

- The Last Kiss StrategyDocument9 pagesThe Last Kiss StrategyVarun VasurendranNo ratings yet

- Read Option SymbolDocument1 pageRead Option SymbolGopikumar Manoharan0% (1)

- Option CHain AnalysisDocument1 pageOption CHain AnalysisGopikumar ManoharanNo ratings yet

- Tamil ArchelogyDocument2 pagesTamil ArchelogyGopikumar ManoharanNo ratings yet

- Bagavat GitaDocument1 pageBagavat GitaGopikumar ManoharanNo ratings yet

- Skanda PuranamDocument5 pagesSkanda PuranamGopikumar ManoharanNo ratings yet

- AldebaranDocument3 pagesAldebaranGopikumar ManoharanNo ratings yet

- Bhagavada PuranamDocument4 pagesBhagavada PuranamGopikumar ManoharanNo ratings yet

- Ashwini NakshatraDocument1 pageAshwini NakshatraGopikumar ManoharanNo ratings yet

- Bharani NakshatraDocument1 pageBharani NakshatraGopikumar ManoharanNo ratings yet

- Pushya NakshatraDocument2 pagesPushya NakshatraGopikumar ManoharanNo ratings yet