Professional Documents

Culture Documents

Care Ratings Limited (Care) : Background Stock Performance Details

Uploaded by

Ashutosh GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Care Ratings Limited (Care) : Background Stock Performance Details

Uploaded by

Ashutosh GuptaCopyright:

Available Formats

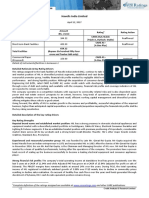

Date : 15th February, 2013

CARE RATINGS LIMITED (CARE)

Stock Performance Details Background

Current Price : Rs. 828.95** Care Ratings (CARE) is the second largest

Face Value : Rs. 10 per share rating company in India after CRISIL in terms

52 wk High / Low : Rs. 986.2 / Rs. 819.0 of rating turnover.

Total Traded Volumes : 14,584 shares**

Market Cap : Rs. 2,366 crore** It provides a spectrum of rating and grading

Sector : Financial Services- Ratings services across instruments and industries and

EPS (FY2012) : Rs. 9.74 per share has graded the largest number of IPOs since

P/E (TTM) : 23.4 (x)^ the introduction of IPO grading in the country.

P/BV (TTM) : 6.28 (x)^

Financial Year End : 1st April – 31st March Since its inception in April 1993, CARE has

BSE Scrip Name : CARERATING completed over 19,000 rating assignments and

BSE Scrip Code : 534804 rated over Rs. 44,000 billion of debt as of

**as on15th February, 2013; ^ as on Dec, 2013 September 30, 2012 across sectors such as

manufacturing, services, banks and

infrastructure.

Shareholding Details – December 2012

Unlike its listed competitors, CRISIL and ICRA

Shareholding which have alliances with international rating

Particulars

Nos. (%) agencies like S&P and Moody’s, CARE is a

Promoter & Promoter Group professionally managed company with

0.00 0.00 majority shareholding held by leading

Holding

domestic banks and financial institutions like

Total Institutional Holdings

1,65,75,810 58.05 IDBI Bank, Canara Bank and SBI to name a few.

(FIIs & DIIs)

Public Holdings 1,19,77,002 41.95 The company is also recognized by the Capital

Total Markets Development Authority, Republic of

2,85,52,812 100.00

Maldives to carry out ratings of debt

instruments and bank loans and facilities for

Maldivian companies and is also looking to

Performance on the Bourses expand its footprint into countries like Nepal

and Mauritius through joint ventures and to

other countries.

as on 15th Feb, 2013

Stock Performance Since Listing Last year in November 2011, CARE acquired a

75.1% equity interest in a risk management

105

software solutions firm, Kalypto Risk

100 Technologies Pvt. Ltd. The acquisition will

95 enable the company to focus on enterprise risk

%

90 management solutions for banking, insurance

and other financial institutions.

85 CARE Rating BSE Mid Cap

80 The company had raised Rs. 5,400 million

through an Offer For Sale during December

2012. As this was an Offer for Sale, the

company did not receive any proceeds.

An Initiative of the BSE Investors’ Protection Fund 1

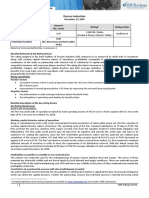

Financial Snapshot

Consolidated Unconsolidated

6M FY FY 6M FY FY FY FY FY FY

Particulars

2013 2012 2013 2012 2011 2010 2009 2008

Income Statement (Rs. in Million) (Rs. in Million)

Income from Operations 912 1,905 899 1,890 1,665 1,362 942 520

Y-o-Y Growth (%) - - - 14% 22% 45% 81% -

Other Income 128 283 126 282 58 158 58 29

Total Income 1,040 2,188 1,025 2,172 1,723 1,520 999 549

Y-o-Y Growth (%) - - - 26% 13% 52% 82% -

Operating Income 571 1,334 576 1,334 1,236 1,064 720 369

Y-o-Y Growth (%) - - 8% 16% 48% 95% -

Operating Margin (%) 55% 61% 56% 61% 72% 70% 72% 67%

Net Profit 498 1,158 500 1,157 879 857 524 267

Y-o-Y Growth (%) - - 32% 3% 64% 96% -

NPM (%) 48% 53% 49% 53% 51% 56% 52% 49%

Balance Sheet

Investments

3,375 2,659 3,465 2,749 2,586 1,860 1,172 784

(Current + Non Current)

Liabilities & Provisions 593 464 589 455 368 275 211 171

Net Worth 4,266 3,768 4,268 3,768 2,943 2,135 1,335 833

RONW (%) 13% 35% 13% 35% 42% 50% 54% 44%

Source : RHP, Note: Ratios are calculated based on data in the RHP

From the Research Desk of LKW’s Gurukshetra.com

The primary source of revenue for the company is derived from its fees from rating services. Notably

on a consolidated and unconsolidated basis, the income from operations (rating services) aggregated to

over 85 per cent of the total revenues for FY 2012. The performance of the topline is directly

proportional to the performance of the Indian debt market, general economic and market conditions

and is inversely proportional to interest rates. Thus, the growth rate for almost all the rating agencies

declined as revenue from bond ratings remained sluggish and volatile in previous quarters and is

expected to remain subdued for the next quarter or so. However, with a general expectation of

momentum picking up in the bond markets in FY 2013 on account of reform announcements and with

further reduction in interest rates, which could be provide impetus for infrastructure investments.

Being the second largest player in the ratings industry, the company is likely to benefit from the rise in

the debt issuance by the corporates.

Recent acquisition of Kalypto by the company will help it to diversify its revenue streams and enhance

its product offerings. However for now, the acquired company is loss making and may continue to

impact the consolidated bottomline till it turns around.

Like its listed competitors like CRISIL and ICRA, CARE too enjoys high margins, strong cashflows and a

debt free status. However, in the ratings industry it has one of the highest margins and return ratios.

This can be observed from the average operating profit margin of over 65 per cent, the average net

profit margin of 50 percent and RONW of over 30 per cent over the years which is on a comparative

basis is higher than its competitors (ICRA and CRISIL - operating profit margin between 30 per cent to

40 per cent, net profit margin between 25 per cent to 30 per cent and return on net worth of 30 per

cent to 40 per cent ).

This efficiency has led to significant investments on its books comprising of investments in fixed

maturity plans, gilt and other income schemes, tax free bonds, commercial paper, certificates of

An Initiative of the BSE Investors’ Protection Fund 2

deposit, equity funds and gold ETFs. The aggregate investment of Rs. 3,375 million as of September 30,

2012 which accounted for almost 70 per cent of the consolidated total assets. However such an

investment is prone to volatility in the financial markets and therefore merits attention.

Peer Comparison

The below mentioned table provides a snapshot of the financial performance of the company as

compared to some of the peers in the category. The financials are on a standalone basis for FY2012

ended in March, 2012.

(Rs. In million)

Particulars CARE Rating ICRA CRISIL

Income from Operations 1,890 2,074 8,069

Operating Income 1,334 625 2,624

Net Profit 1,157 451 2008

Operating Margins (%) 61 42 36

PAT Margins (%) 53 30 28

P/E (x)** NA 22 32

P/BV (x)** NA 3.7 15

Source : Capitaline; Company RHP; ^ as on Dec 2012 (TTM Basis)

About the Industry Outlook

The Ratings Industry prospects are dependent on the Going forward, there appear to be satisfactory

Capital Markets (Equity and Debt) with the Debt Market growth prospects, given that the company has

in particular in the country. Given that the debt markets an established brand, strong cash flows, fair

in India prior to 1992 were at a very nascent stage the growth potential, increased momentum in the

demand for rating services too was relatively lower. CDR space, satisfactory margins and return on

However, post the 2003 SEBI guidelines, to mandatorily equity and satisfactory financial performance

rate the debt issuance with maturity / convertibility over over the years.

18 months, activity in the Ratings Industry appears to

have picked. In addition to this, RBI’s guidelines to However, rising competition, non-

mandatorily rate commercial paper and public deposit differentiated nature of services offered,

schemes of NBFCs, there has been a marked growth in threat from internal rating based mechanism

the ratings industry in Indian in terms of number and which has been allowed by RBI for the banking

value of instruments. system to measure its credit risk capital as

compared to external credit assessments pose a

RBI also issued prudential guidelines on management of

threat to the business going forward and thus

non-SLR based securities of Scheduled Commercial Banks merit attention.

except Regional Rural Banks (RRBs) and local area banks.

These guidelines require such institutions to make fresh

investments in rated non-SLR securities only.

Notwithstanding the above, the demand for rating

services is also driven by overall capital mobilization in

the economy as economic development fuels demand for

investments and operations related funding.

Given the overall development in the economy and

development of the equity and debt markets in India, the

prospects of the Rating industry appears to be

satisfactory. However, increased competition from other

players in the rating industry, increased focus of

companies on the medium and small enterprises could

result in pressure on the operating and net profit margins

of players in the industry. (Source : RHP)

An Initiative of the BSE Investors’ Protection Fund 3

Financial Graphs

Income from Operations

2,100

1,750

1,400

Rs. in Millions

1,665 1,890

1,050

1,362

700

350

0

FY 2010 FY 2011 FY 2012

Operating Profit & Operating Margins

1,500 78.1 80

74.2

1,200

1,334 76

Rs. in Millions

900

72 %

600 1,236 70.6

1,064 68

300

0 64

FY 2010 FY 2011 FY 2012

Operating Income Operating Margins

PAT & PAT Margins

1,400 62.9 61.2 64

1,200

52.8 60

Rs. in Millins

1,000

800 56

%

600 857 1,157

52

400

879 48

200

0 44

FY 2010 FY 2011 FY 2012

Net Profit Net Profit Margins

An Initiative of the BSE Investors’ Protection Fund 4

Disclaimer

All information contained in the document has been obtained by LKW’s Gurukshetra.com from sources believed to be accurate

and reliable. Although reasonable care has been taken to ensure that the information herein is true, such information is

provided as is without any warranty of any kind, and LKW’s Gurukshetra.com in particular makes no representation or

warranty express or implied, as to the accuracy, timeliness or completeness of any such information. All information

contained herein must be construed solely as statements of opinion, and LKW’s Gurukshetra.com shall not be liable for any

losses incurred by users from any use of this document or its contents in any manner. Opinions expressed in this document are

not the opinions of our company and should not be construed as any indication of our recommendation to buy, sell or invest in

the company under coverage.

Disclosure

Each member of the team involved in the preparation of this report, hereby affirms that there exists no

conflict of interest.

The report has been sponsored and published as part of

Initiative of BSE’s Investors’ Protection Fund

About Us

LOTUS KNOWLWEALTH (LKW), commenced business in 1990 and is currently engaged in providing

WEALTH ADVISORY, CORPORATE ADVISORY and ECONOMIC & FINANCIAL RESEARCH &

CONTENT services.

LKW’s ECONOMIC & FINANCIAL RESEARCH & CONTENT division currently generates Reports on

Economic & Industry Trends, Global & Indian Equity Markets, Fundamental Analysis of IPOs, Companies &

Industries, Management Meeting Reports, Balance Sheet & Financial Analysis Reports and an Economic Political

and Sentiment Barometer. LKW also conducts Capital Market related Training Programs and has cutting edge

expertise in Mutual Fund Analysis and specializes in Grading of Mutual Fund Schemes and IPOs.

GURUKSHETRA.com is an online initiative of LKW that focuses on Personal Finance while theIPOguru.com

is India’s Premier Primary Market (IPO) Portal.

Contact Us

LOTUS KNOWLWEALTH Pvt. Ltd.

Regd.Office : B Wing, 505-506, Fairlink Centre,

Off Andheri Link Road, Andheri (W),

Mumbai – 400 053

Email : consulting@lotusknowlwealth.com

Tel : 022- 4010 5482 | 4010 5483

Website : www.lkwindia.com | www.gurukshetra.com |

An Initiative of the BSE Investors’ Protection Fund 5

You might also like

- Haldiram Products Private LimitedDocument7 pagesHaldiram Products Private LimitedAman GuptaNo ratings yet

- Group No.-06Document23 pagesGroup No.-06Mohit VaidyaNo ratings yet

- 3i Infotech LimitedDocument5 pages3i Infotech LimitedPratik SuranaNo ratings yet

- Saumya Agarwal ResumeDocument1 pageSaumya Agarwal ResumeArisha NarangNo ratings yet

- Care Ipo NoteDocument13 pagesCare Ipo NoteAngel BrokingNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- Drools Pet Food Private LimitedDocument6 pagesDrools Pet Food Private Limitedkasimmalnas.ipsNo ratings yet

- ICICI Securities - MBA - 2024Document17 pagesICICI Securities - MBA - 20240399shubhankarNo ratings yet

- Max Healthcare Institute Limited-11-04-2020Document6 pagesMax Healthcare Institute Limited-11-04-2020max joharNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Future Corporate Resources - R - 05052020Document7 pagesFuture Corporate Resources - R - 05052020ChristianStefanNo ratings yet

- Anual Report of 2019 of InterwoodDocument5 pagesAnual Report of 2019 of InterwoodAli Hussain Al SalmawiNo ratings yet

- Aditya Birla Nuvo 2008 2009Document172 pagesAditya Birla Nuvo 2008 2009RamaNo ratings yet

- Press Release DFM Foods Limited: Details of Facilities in Annexure-1Document4 pagesPress Release DFM Foods Limited: Details of Facilities in Annexure-1Puneet367No ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Windlas Biotech IPO NoteDocument4 pagesWindlas Biotech IPO Notechinna raoNo ratings yet

- Credit Rating Report for M/S Print Point Galaxy SMEDocument3 pagesCredit Rating Report for M/S Print Point Galaxy SMEnasirNo ratings yet

- STFC Corporate Presentation Q1 FY17 June 2016Document43 pagesSTFC Corporate Presentation Q1 FY17 June 2016Aman SinghNo ratings yet

- Daythree Digital Berhad IPODocument9 pagesDaythree Digital Berhad IPO健德No ratings yet

- Shree Cement's Financial Management and RatiosDocument13 pagesShree Cement's Financial Management and RatiosApurva JawadeNo ratings yet

- Buy Reliance CapitalDocument3 pagesBuy Reliance Capitaldps_virusNo ratings yet

- Your Trust, Our BenchmarkDocument158 pagesYour Trust, Our BenchmarkAnkita RanaNo ratings yet

- Obeetee Textiles - R-10122020Document7 pagesObeetee Textiles - R-10122020DarshanNo ratings yet

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Document11 pagesProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999No ratings yet

- RACL Geartech ratings reaffirmedDocument4 pagesRACL Geartech ratings reaffirmedSourav DuttaNo ratings yet

- Girnar Software Pvt. LTDDocument7 pagesGirnar Software Pvt. LTDnabh.21bms0336No ratings yet

- Ocean Pearl Hotels Private LimitedDocument7 pagesOcean Pearl Hotels Private LimitedAaaaNo ratings yet

- Gulf Oil Lubricants India - Way2Wealth - IC - Jan 2024Document13 pagesGulf Oil Lubricants India - Way2Wealth - IC - Jan 2024Vishal MittalNo ratings yet

- AAA Digital India2Document19 pagesAAA Digital India2akamalapuriNo ratings yet

- Airvision India Private Limited - R - 25082020Document7 pagesAirvision India Private Limited - R - 25082020DarshanNo ratings yet

- Filatex India Limited press release ratings reaffirmedDocument6 pagesFilatex India Limited press release ratings reaffirmedfatNo ratings yet

- Credit Analysis and Research: Investment RationaleDocument6 pagesCredit Analysis and Research: Investment RationaleSunil KumarNo ratings yet

- Transcritption - Financials and Credit RatingsDocument6 pagesTranscritption - Financials and Credit Ratingsmanoj reddyNo ratings yet

- Credit Rating Report Highlights Marico Bangladesh's StrengthsDocument20 pagesCredit Rating Report Highlights Marico Bangladesh's StrengthsPrajaktnanoNo ratings yet

- Future Ventures GEPLIPOnote 250411Document2 pagesFuture Ventures GEPLIPOnote 250411vejendla_vinod351No ratings yet

- 04102022073602_Divis_Laboratories_LimitedDocument7 pages04102022073602_Divis_Laboratories_Limiteddivygupta198No ratings yet

- Just Dial Limited. (JDL) : Background Stock Performance DetailsDocument6 pagesJust Dial Limited. (JDL) : Background Stock Performance DetailstsrupenNo ratings yet

- Bharti Airtel Ltd. Research Insight and SWOT AnalysisDocument3 pagesBharti Airtel Ltd. Research Insight and SWOT AnalysisSrinivas NandikantiNo ratings yet

- Financial Corporate Presentation May08Document32 pagesFinancial Corporate Presentation May08darshanabmsNo ratings yet

- Ian Renewable Energy Development Agency Limited - IPO NoteDocument11 pagesIan Renewable Energy Development Agency Limited - IPO NotedeepaksinghbishtNo ratings yet

- Debt Product Suite - Upto 1 Yr - March 2023Document17 pagesDebt Product Suite - Upto 1 Yr - March 2023DeepakNo ratings yet

- Hero Motocop JL21FS034Document7 pagesHero Motocop JL21FS034Shivangi Gupta Student, Jaipuria LucknowNo ratings yet

- AcmeDocument2 pagesAcmePavel ZephyrusNo ratings yet

- Indian HotelsDocument195 pagesIndian HotelsReTHINK INDIANo ratings yet

- Hinduja Healthcare 29dec2020Document8 pagesHinduja Healthcare 29dec2020Bijay MehtaNo ratings yet

- United Spirits Ltd. ReportDocument5 pagesUnited Spirits Ltd. ReportKiranKumarPNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- HDFC Career Opportunities and Job ProfilesDocument14 pagesHDFC Career Opportunities and Job ProfilesRohitNo ratings yet

- Capital Market Corporate ProfileDocument40 pagesCapital Market Corporate ProfilePinank TurakhiaNo ratings yet

- SMFG India Credit Company LimitedDocument9 pagesSMFG India Credit Company Limitedvatsal sinhaNo ratings yet

- Sun Home Appliances Private - R - 25082020Document7 pagesSun Home Appliances Private - R - 25082020DarshanNo ratings yet

- Pidilite Industries: Robust Recovery Margin Pressure AheadDocument15 pagesPidilite Industries: Robust Recovery Margin Pressure AheadIS group 7No ratings yet

- Terrier Security Services (India) Private LimitedDocument7 pagesTerrier Security Services (India) Private Limitedgcgary87No ratings yet

- FSN E-Commerce Ventures Ltd. (Nykaa) : All You Need To Know AboutDocument7 pagesFSN E-Commerce Ventures Ltd. (Nykaa) : All You Need To Know AboutFact checkoutNo ratings yet

- 805632904zaggle Prepaid Ocean Services LimitedDocument6 pages805632904zaggle Prepaid Ocean Services LimitedSuneethaJagadeeshNo ratings yet

- Attra Infotech PVT LTD: Ratings Reaffirmed Summary of Rating ActionDocument7 pagesAttra Infotech PVT LTD: Ratings Reaffirmed Summary of Rating ActionCharan gowdaNo ratings yet

- Otc GuideDocument24 pagesOtc GuideAshutosh GuptaNo ratings yet

- Hospitals Initiating CoverageDocument23 pagesHospitals Initiating CoverageAshutosh GuptaNo ratings yet

- Heineken - Family Control Provides “ Capacity To Suffer”Document4 pagesHeineken - Family Control Provides “ Capacity To Suffer”Ashutosh GuptaNo ratings yet

- Spotlighting Ultramarine PigmentsDocument9 pagesSpotlighting Ultramarine PigmentsAshutosh GuptaNo ratings yet

- Filatex India LimitedDocument14 pagesFilatex India LimitedAshutosh GuptaNo ratings yet

- Hudson Value Partners Special Situations New AddressDocument7 pagesHudson Value Partners Special Situations New AddressAshutosh GuptaNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- 1839 - ACE & APEX Shade CardDocument2 pages1839 - ACE & APEX Shade CardAshutosh GuptaNo ratings yet

- Filatex India LimitedDocument14 pagesFilatex India LimitedAshutosh GuptaNo ratings yet

- A Study of Performance Analysis of Gold Loan Nbfcs Based On Camels ModelDocument19 pagesA Study of Performance Analysis of Gold Loan Nbfcs Based On Camels ModelAshutosh GuptaNo ratings yet

- COVID-19 Impact on Packaging CompanyDocument3 pagesCOVID-19 Impact on Packaging CompanyAshutosh GuptaNo ratings yet

- The Best-Practice EVA Software Toolkit: AppendixDocument3 pagesThe Best-Practice EVA Software Toolkit: AppendixAshutosh GuptaNo ratings yet

- Warren Buffett Way PDFDocument8 pagesWarren Buffett Way PDFIsrael ZepahuaNo ratings yet

- The Unusual Billionaires Saurabh Mukherjea: March 2018Document4 pagesThe Unusual Billionaires Saurabh Mukherjea: March 2018Ashutosh GuptaNo ratings yet

- Thij NGH: Packaging LimitedDocument2 pagesThij NGH: Packaging LimitedAshutosh GuptaNo ratings yet

- IT Sector 4QFY19 Results PreviewDocument16 pagesIT Sector 4QFY19 Results PreviewAshutosh GuptaNo ratings yet

- IDirect MahindraLog ICDocument28 pagesIDirect MahindraLog ICAshutosh GuptaNo ratings yet

- Saurabh Mukherjea Profiles The Unusual Billionaires' From IndiaDocument2 pagesSaurabh Mukherjea Profiles The Unusual Billionaires' From IndiaAshutosh GuptaNo ratings yet

- DB Corp Annual Report PDFDocument317 pagesDB Corp Annual Report PDFAshutosh GuptaNo ratings yet

- Q2-FY19 Result Update: CMP: 125 Target: 263Document7 pagesQ2-FY19 Result Update: CMP: 125 Target: 263Ashutosh GuptaNo ratings yet

- Natco IC 11june2019Document33 pagesNatco IC 11june2019Ashutosh GuptaNo ratings yet

- Warehousing Industry October 2018Document14 pagesWarehousing Industry October 2018Mayank RankaNo ratings yet

- Watts & Bolts: A Monthly Round-Up of Key Data & ImplicationsDocument15 pagesWatts & Bolts: A Monthly Round-Up of Key Data & ImplicationsAshutosh GuptaNo ratings yet

- TanFac Ind LTD - 4 Jan 2013Document6 pagesTanFac Ind LTD - 4 Jan 2013Ashutosh GuptaNo ratings yet

- Mold-Tek Packaging - Q4FY19 - Result Update - 12062019 - 13-06-2019 - 09Document6 pagesMold-Tek Packaging - Q4FY19 - Result Update - 12062019 - 13-06-2019 - 09Ashutosh GuptaNo ratings yet

- Mahindra Logistics IPO Note Provides Tech-Enabled Logistics Solutions OverviewDocument10 pagesMahindra Logistics IPO Note Provides Tech-Enabled Logistics Solutions OverviewAshutosh GuptaNo ratings yet

- BLS International 2QFY19 (CMP Rs 128, Mcap Rs 13bn, Fair Value Rs 277)Document1 pageBLS International 2QFY19 (CMP Rs 128, Mcap Rs 13bn, Fair Value Rs 277)Ashutosh GuptaNo ratings yet

- Mold-Tek Packaging - Q3FY20 - RU - 14022020 - 17-02-2020 - 16Document6 pagesMold-Tek Packaging - Q3FY20 - RU - 14022020 - 17-02-2020 - 16Ashutosh GuptaNo ratings yet

- HDFC AMC Initiation - 9april2019Document31 pagesHDFC AMC Initiation - 9april2019Sunita ShrivastavaNo ratings yet

- The Role of The Securities and Exchange Commission in The Nigerian Capital MarketDocument7 pagesThe Role of The Securities and Exchange Commission in The Nigerian Capital MarketMabo DamisaNo ratings yet

- Sol Vamshi Final 30nov19Document10 pagesSol Vamshi Final 30nov19Balaji MahiNo ratings yet

- Supercomnet Technologies - Shaping Noteworthy ProspectsDocument6 pagesSupercomnet Technologies - Shaping Noteworthy ProspectsFong Kah YanNo ratings yet

- INVESTMENT MANAGER LICENSINGDocument14 pagesINVESTMENT MANAGER LICENSINGgloomy monsterNo ratings yet

- Financial Markets and InstitutionsDocument21 pagesFinancial Markets and InstitutionsanilaNo ratings yet

- Chapter 3Document7 pagesChapter 3ALI SHER HaidriNo ratings yet

- Developing Klusters in Butchery IndustryDocument13 pagesDeveloping Klusters in Butchery IndustryChimegErdenebatNo ratings yet

- FM QPDocument4 pagesFM QPtimepass3595No ratings yet

- Primer On Stable Value ProductsDocument15 pagesPrimer On Stable Value ProductsRobert SerenaNo ratings yet

- Sample Business Plan PresentationDocument66 pagesSample Business Plan PresentationvandanaNo ratings yet

- CH 3 Project IdentificationDocument38 pagesCH 3 Project IdentificationyimerNo ratings yet

- Merchant Banking SyllabusDocument4 pagesMerchant Banking SyllabusjeganrajrajNo ratings yet

- Introduction of Subject: 1.1 Financial Analysis and ReviewDocument55 pagesIntroduction of Subject: 1.1 Financial Analysis and ReviewSunil PadwalNo ratings yet

- CQG SymbolsDocument32 pagesCQG SymbolsCyril HoneyStars ChiaNo ratings yet

- GE Matrix Explained: Analyzing Business Units by Strength and Market AttractivenessDocument26 pagesGE Matrix Explained: Analyzing Business Units by Strength and Market AttractivenessFijo JoseNo ratings yet

- Motilal OswalDocument12 pagesMotilal OswalRajesh SharmaNo ratings yet

- Secretarial Practices: Important QuestionsDocument3 pagesSecretarial Practices: Important QuestionsdisushahNo ratings yet

- Achieving Financial PerformanceDocument8 pagesAchieving Financial PerformanceozuwoNo ratings yet

- Financial Accounting - 1Document42 pagesFinancial Accounting - 1MajdiNo ratings yet

- FEDAI RulesDocument39 pagesFEDAI Rulesnaveen_ch522No ratings yet

- Corporate Liquidation Answer SheetDocument4 pagesCorporate Liquidation Answer SheetsatyaNo ratings yet

- QUIZ in AUDIT OF SHAREHOLDERS EQUITYDocument2 pagesQUIZ in AUDIT OF SHAREHOLDERS EQUITYLugh Tuatha DeNo ratings yet

- Importance of FinTech Collaboration in Hong KongDocument3 pagesImportance of FinTech Collaboration in Hong KongMohiuddinNo ratings yet

- UK Distribution Dynamics 2Q 2012Document20 pagesUK Distribution Dynamics 2Q 2012g_simpson1160No ratings yet

- FebResearch Team:Source: BSPDocument3 pagesFebResearch Team:Source: BSPRobert RamirezNo ratings yet

- Roles You Could Play at The RBIDocument1 pageRoles You Could Play at The RBIshelharNo ratings yet

- Feasibility StudyDocument14 pagesFeasibility StudyMaria pervaiz AwanNo ratings yet

- Sumaiya - Financial Management Assignment 1 - 80201190060Document5 pagesSumaiya - Financial Management Assignment 1 - 80201190060Sumaiya SayeediNo ratings yet

- FHFA V CountrywideDocument178 pagesFHFA V Countrywideny1david100% (2)

- MAKING INVESTMENT DECISIONSDocument48 pagesMAKING INVESTMENT DECISIONSShantanu SinhaNo ratings yet