Professional Documents

Culture Documents

Computation Statement

Computation Statement

Uploaded by

ajaya thakur0 ratings0% found this document useful (0 votes)

18 views2 pagesINCOME TAX COMPUTATION STATEMENT - BUSNINESS INCOME & OTHER SOUECES

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentINCOME TAX COMPUTATION STATEMENT - BUSNINESS INCOME & OTHER SOUECES

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesComputation Statement

Computation Statement

Uploaded by

ajaya thakurINCOME TAX COMPUTATION STATEMENT - BUSNINESS INCOME & OTHER SOUECES

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

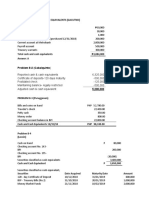

INCOME TAX COMPUTATION STATEMENT

SUMANTA RAGAVENDRA

CHANDNI CHOWK ,DELHI,

Status:- Individual Fin. Year:- 2017-18

PAN:- XYZ Ass. Year:- 2018-19

DOB:- 8/6/1994

Computation of Taxable Income

Amt.(Rs) Amt.(Rs)

1) Income From Business or Profession

Net income from Business- Building material Supply 245,000.00

in Trade Name "Sumanta Traders"

Deemed Profit as per prov.of Sec 44 AD of Income tax Act

1) Income From Other Sources

Interest received From Saving Bank - -

Other Income-Interest from Others 48,000.00 48,000.00

Gross Total income 293,000.00

Less: Deduction U/s Chapter VI A:

U/S 80C- insurance & other deduction -

U/S 80D- Mediclaim -

U/S 80TTA-Interest on saving bank A/c -

Net Taxable income 293,000.00

Computation of Total Income Tax

Tax On Net Income 2,150.00

Less: Rebate U/s 87A 2,150.00

Tax After Rebate -

Add: Education Cess -

Total Tax Payable -

Add: Interest U/S 234 (A) -

Add: Interest U/S 234 (F) -

Tax payable -

Less TDS deducted -

Less: Self Assesment Tax Paid Round up to -

Tax Refundable/Payable -

Proprietor

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Emirates Return TicketDocument1 pageEmirates Return TicketShaheen Rahman50% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Bank Statement Template 4 - TemplateLabDocument1 pageBank Statement Template 4 - TemplateLabAida Bracken100% (1)

- #BWNLLSV #000000Q5P7TTY0A3#000FME90F Christyl Smith Carlton Arms North 6609 Markstown DR Apt C TAMPA FL 33617-9365Document11 pages#BWNLLSV #000000Q5P7TTY0A3#000FME90F Christyl Smith Carlton Arms North 6609 Markstown DR Apt C TAMPA FL 33617-9365shani Chahal100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bjaz GC Policy ScheduleDocument3 pagesBjaz GC Policy ScheduleKoushik DeyNo ratings yet

- Dengue Care BrochureDocument3 pagesDengue Care BrochureRobin VermaNo ratings yet

- Pakistan M Edical Commission Pakistan M Edical Commission Pakistan M Edical CommissionDocument1 pagePakistan M Edical Commission Pakistan M Edical Commission Pakistan M Edical CommissionMEHRAJNo ratings yet

- Invoice Shalter BatugadeDocument8 pagesInvoice Shalter BatugadeFuri HZNo ratings yet

- Flight Ticket - Nagpur To Mumbai: Passenger's Name Status Seat No. Ticket No. 1. MR Anand Kumar Tripathi ConfirmedDocument3 pagesFlight Ticket - Nagpur To Mumbai: Passenger's Name Status Seat No. Ticket No. 1. MR Anand Kumar Tripathi ConfirmedAlok Anand Narayan TripathiNo ratings yet

- Challan Form - Fee PaymentDocument2 pagesChallan Form - Fee Paymentdebun_sahaNo ratings yet

- Xbox Gamepass by @dualshopDocument6 pagesXbox Gamepass by @dualshopahmaxder3No ratings yet

- Cash and Cash EquivalentDocument22 pagesCash and Cash EquivalentDanielle Nicole MarquezNo ratings yet

- RPS E - CommerceDocument20 pagesRPS E - CommerceElias KetarenNo ratings yet

- Case Problem Chapter 11Document3 pagesCase Problem Chapter 11Anggi Gayatri Setiawan100% (2)

- Statement of Account: Membership Summary Information For Member # 56228 As of 3/31/20Document4 pagesStatement of Account: Membership Summary Information For Member # 56228 As of 3/31/20Mark HolobaughNo ratings yet

- Chap 5 - Material Handling PDFDocument49 pagesChap 5 - Material Handling PDFAnonymous T1QorvONo ratings yet

- Problems Chapter 7 PDFDocument9 pagesProblems Chapter 7 PDFCa AdaNo ratings yet

- Nganluong Integration Guide Checkout v31 En-1Document18 pagesNganluong Integration Guide Checkout v31 En-1Phùng Minh HảiNo ratings yet

- Date Description Cheque No Debit Credit BalanceDocument2 pagesDate Description Cheque No Debit Credit BalanceDhivya BhaskaranNo ratings yet

- Bank Statement 2Document1 pageBank Statement 2bc180204979 ALI FAROOQNo ratings yet

- Account Statement: Penyata AkaunDocument2 pagesAccount Statement: Penyata AkaunAsyraf SyazwanNo ratings yet

- Roofing Invoice TemplateDocument2 pagesRoofing Invoice TemplateMubasher IqbalNo ratings yet

- Payment Receipt: This Receipt Is Not Proof That Funds Have Reached The BeneficiaryDocument1 pagePayment Receipt: This Receipt Is Not Proof That Funds Have Reached The BeneficiaryXiaomi PadNo ratings yet

- Pengerjaan POU R SHMD 23 Mei 2023Document10 pagesPengerjaan POU R SHMD 23 Mei 2023sribungaria444No ratings yet

- Demurrage Detention - General TermsDocument3 pagesDemurrage Detention - General TermsMithunNo ratings yet

- Safexpress Sip Report Mba PDFDocument36 pagesSafexpress Sip Report Mba PDFSmrita Rai100% (1)

- 03.09.19 - Home To Bus StandDocument2 pages03.09.19 - Home To Bus StandNitesh RokadeNo ratings yet

- Charge SlipDocument2 pagesCharge SlipSunny GuptaNo ratings yet

- Cash App April 2024 Account StatementDocument37 pagesCash App April 2024 Account StatementsemplebizzNo ratings yet

- Dr. Reddy's - 900011757Document1 pageDr. Reddy's - 900011757srinivaskurellaNo ratings yet

- 15 Recent IELTS Writing Task 2 TopicsDocument3 pages15 Recent IELTS Writing Task 2 TopicsLokesh NANo ratings yet