Professional Documents

Culture Documents

Utiniftyindexfund 12820200210 213216

Uploaded by

VarathavasuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Utiniftyindexfund 12820200210 213216

Uploaded by

VarathavasuCopyright:

Available Formats

C MYK

Index Fund

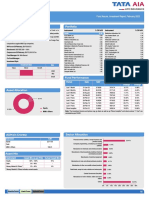

UTI NIFTY INDEX FUND

Investment Objective Portfolio as on January 31, 2020

The principal investment objective of the scheme is to invest in stocks of companies comprising Nifty 50 Index Equity % of NAV

and endeavour to achieve return equivalent to Nifty 50 Index by “passive” investment.

HDFC Bank Ltd. 10.79

However, there can be no assurance or guarantee that the investment objective of the scheme would be Reliance Industries Ltd. 9.29

achieved.

HDFC Ltd. 8.48

ICICI Bank Ltd. 6.92

Infosys Ltd. 5.78

Fund Manager - (Managing the scheme since July-2018)

Date of inception/allotment : Mr. Sharwan Kumar Goyal, CFA, MMS Kotak Mahindra Bank Ltd. 4.60

6th March, 2000 Tata Consultancy Services Ltd. 4.44

ITC Ltd. 4.17

Fund size monthly average: ` 1867.8 Crore NAV per unit as on January 31, 2020 Larsen & Toubro Ltd. 3.44

Closing AUM: ` 1900.36 Crore Growth / Income : ` 78.53, ` 39.56 Axis Bank Ltd. 3.30

Hindustan Unilever Ltd. 2.96

High/ Low of NAV in the month Minimum Investment Amount State Bank of India 2.49

Growth Option : ` 81.15, ` 78.53 ` 5000/- Bajaj Finance Ltd. 2.30

Bharti Airtel Ltd. 2.26

No. of Unit Holding accounts

Maruti Suzuki India Ltd. 1.87

97,015

Asian Paints Ltd. 1.65

Total expense ratio (%) : Direct: 0.10, Regular: 0.17 IndusInd Bank Ltd. 1.54

Market Capitalisation (%) HCL Technologies Ltd. 1.31

Load Structure

Large Mid Small Bajaj Finserv Ltd. 1.16

Entry Load Exit Load

Nestle India Ltd. 1.11

Nil Nil 100 - -

Mahindra & Mahindra Ltd. 1.10

NTPC Ltd. 1.02

Fund Performance Vs Benchmark (CAGR) Titan Company Ltd. 1.01

Ultratech Cement Ltd. 1.01

Fund Performance Vs Benchmark (CAGR) AS ON 31/01/2020 Growth of `10000

Tech Mahindra Ltd. 1.00

NAV Nifty 50 (%) S&P BSE NAV Nifty 50 (`) S&P BSE Sun Pharmaceuticals Industries Ltd. 0.95

Period (%) Sensex (%) Sensex (`)

(`) Power Grid Corporation Of India Ltd. 0.89

1 Year 11.62 11.84 13.59 11,162 11,184 11,359 Bajaj Auto Ltd. 0.84

3 Years 12.91 13.29 15.16 14,395 14,540 15,272 Britannia Industries Ltd. 0.77

5 Years 7.32 7.67 8.29 14,239 14,473 14,895

Since inception* 10.90 11.89 12.31 78,512 93,716 100,977 Dr. Reddys Laboratories Ltd. 0.77

Others 11.38

Different plans have a different expense structure. The performance details provided herein are of regular plan.

*Compounded annualized Growth Rate. Net Current Assets -0.60

For performance details of other Schemes managed by the Fund Manager, please refer the respective Scheme sheets as Total 100.00

listed in page 60 in ‘Fund Manager Summary’.

The Performance of the Bench Mark is calculated using total return index variant of the bench mark index

% of top 10 stocks 61.22

Median Market Cap (` Cr) 327,912

SIP Returns as on January 31, 2020 Weighted Average Market Cap 368,925

Investment Value- Nifty 50 S&P BSE Yield (%) Yield (%) S&P BSE

Period All figures given are provisional and unaudited.

Amount (`) Fund (`) (`) Sensex (`) Fund Nifty 50 Sensex (%)

1 Year 120,000 125,327 125,467 127,158 8.30 8.52 11.20

3 Years

5 Years

360,000

600,000

412,491

775,455

414,237

782,190

428,047

809,641

9.03

10.19

9.32

10.54

11.56

11.93

Sectoral Breakdown ( % as compared to Benchmark )

7 Years 840,000 1,235,792 1,254,472 1,293,158 10.84 11.26 12.11

10 Years 1,200,000 2,079,258 2,143,554 2,217,521 10.59 11.16 11.80 FINANCIAL SERVICES 42%

Since inception 1,820,000 4,367,438 4,727,835 4,925,187 10.73 11.65 12.12

Note: Systematic Investment Plan (SIP) returns are worked out assuming investment of ` 10,000/- every month at NAV per unit of the 15%

OTHERS

scheme as on the first working day for the respective time periods. The loads have not been taken into account. @:Since inception for

above mentioned schemes is taken for the period December 2004 to January 2020 (Since SIP facility was introduced in November

2004). Past performance may or may not be sustained in future. ENERGY 14%

13%

Tracking Error as on 31st January 2020 IT

Tracking Error Non-Annualised Annualised Tracking error CONSUMER GOODS 12%

Over last 1 year 0.0013 0.0207

Over last 3 year 0.0066 0.1044 AUTOMOBILE 6%

Over last 5 year 0.0095 0.1507

Since Inception 0.1044 1.6508 -1%

NCA

Past performance may or may not be sustained in the future.

-5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45%

` 10,000 invested at inception: UTI Nifty Index Fund Vs. Nifty 50 UTI Nifty Index Fund

110,000

100,000

93,716 AS ON 31/01/2020

90,000

80,000 78,512 Quantitative Indicators Fund Benchmark

70,000

60,000 Beta 1.00

50,000 Standard Deviation (Annual) 12.05% 12.10%

40,000

Sharpe ratio (%) 0.65

30,000

Portfolio Turnover Ratio (Annual) 0.18

20,000

10,000

-

Mar-02

Mar-06

Mar-10

Mar-14

Mar-18

UTI Nifty Index Fund Nifty 50

Initiative

SMS: NIF to 5676756 to get scheme details.

For Product Label, Refer Page no. 62

22

C MYK

You might also like

- A Comparative Study Between Equity Investing and Mutual Fund InvestingDocument8 pagesA Comparative Study Between Equity Investing and Mutual Fund InvestingAditya Mukherjee0% (1)

- NIFTY Bank Index OverviewDocument2 pagesNIFTY Bank Index OverviewLee leeNo ratings yet

- Bank NIFTY Components and WeightageDocument2 pagesBank NIFTY Components and WeightageUptrend0% (2)

- Sbi and HDFC BankDocument51 pagesSbi and HDFC BankSumit ChakravortyNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Uti Children'S Career Fund - Investment Plan: JANUARY 2023Document3 pagesUti Children'S Career Fund - Investment Plan: JANUARY 2023rout.sonali20No ratings yet

- UTIFLEXICAPFUNDDocument2 pagesUTIFLEXICAPFUNDmeghaNo ratings yet

- BOP One Pager Jan 2019Document1 pageBOP One Pager Jan 2019Ashwin HasyagarNo ratings yet

- Tata India Consumption FundDocument1 pageTata India Consumption FundJeremiah SolomonNo ratings yet

- Value Product Note October-20Document2 pagesValue Product Note October-20Swades DNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, June 2021 ULIF 027 12/01/09 ITT 110editor's cornerNo ratings yet

- 578380618monthly Communique May, 2022Document12 pages578380618monthly Communique May, 2022Dhairya BuchNo ratings yet

- Sbi Banking and Financial Services Fund Factsheet (August-2021-415-1)Document1 pageSbi Banking and Financial Services Fund Factsheet (August-2021-415-1)charan ThakurNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundJeremiah SolomonNo ratings yet

- 2020756102monthly Communique June, 2022Document13 pages2020756102monthly Communique June, 2022Dhairya BuchNo ratings yet

- Utivalueopportunitiesfund 193Document2 pagesUtivalueopportunitiesfund 193201 TVNo ratings yet

- Tata Multi Cap FundDocument1 pageTata Multi Cap FundHarsh SrivastavaNo ratings yet

- Page 34Document1 pagePage 34bharath kumarNo ratings yet

- Edelweiss Factsheet Nifty 50 Index December MF 2022Document1 pageEdelweiss Factsheet Nifty 50 Index December MF 2022June RobertNo ratings yet

- 8ccff Pms Communique August 22Document13 pages8ccff Pms Communique August 22pradeep kumarNo ratings yet

- Multi Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110Document1 pageMulti Cap Fund: Fund Assure, Investment Report, June 2021 ULIF 060 15/07/14 MCF 110editor's cornerNo ratings yet

- ABSL Flexicap Fund Facsheet PDFDocument1 pageABSL Flexicap Fund Facsheet PDFKiranmayi UppalaNo ratings yet

- UlipDocument1 pageUlipsanu091No ratings yet

- HDFC MF Factsheet April 2023-1Document1 pageHDFC MF Factsheet April 2023-1Jayashree PawarNo ratings yet

- 590784414monthly Communique March, 2022Document12 pages590784414monthly Communique March, 2022Dhairya BuchNo ratings yet

- Canara Robeco Emerging Equities PDFDocument1 pageCanara Robeco Emerging Equities PDFJasmeet Singh NagpalNo ratings yet

- NTDOP Product Note 31st October 2020Document2 pagesNTDOP Product Note 31st October 2020Swades DNo ratings yet

- Dear Investor, HDFC TaxSaver fund document is relevant for your reviewDocument3 pagesDear Investor, HDFC TaxSaver fund document is relevant for your reviewJignesh Jagjivanbhai PatelNo ratings yet

- EMERGING OPPORTUNITIES FUND INVESTMENT REPORTDocument1 pageEMERGING OPPORTUNITIES FUND INVESTMENT REPORTJeremiah SolomonNo ratings yet

- Corporate BrochureDocument66 pagesCorporate Brochuresingharcharan074No ratings yet

- Aditya Birla Sun Life Equity Hybrid '95 Fund - Aggressive Hybrid FundDocument1 pageAditya Birla Sun Life Equity Hybrid '95 Fund - Aggressive Hybrid FundKiranmayi UppalaNo ratings yet

- Top 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Document1 pageTop 200 Fund: Fund Assure, Investment Report, April 2021 ULIF 027 12/01/09 ITT 110Prafful TriPathiNo ratings yet

- SBI Multi Asset Allocation Fund FactsheetDocument1 pageSBI Multi Asset Allocation Fund FactsheetamanNo ratings yet

- India Consumer Fund PortfolioDocument1 pageIndia Consumer Fund PortfolioNitish KumarNo ratings yet

- Axis Growth Opportunities FundDocument1 pageAxis Growth Opportunities FundManoj JainNo ratings yet

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- Tata Mid Cap Growth Fund December 2019Document2 pagesTata Mid Cap Growth Fund December 2019ChromoNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankVishal GandhleNo ratings yet

- Page 6Document1 pagePage 6Ekushey TelevisionNo ratings yet

- Tata Whole Life Mid Cap Equity FundDocument1 pageTata Whole Life Mid Cap Equity FundK Dviya VennelaNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty BankBharat BajoriaNo ratings yet

- SAPM Assignment 2Document10 pagesSAPM Assignment 2jhilikNo ratings yet

- NIFTY Bank Index OverviewDocument2 pagesNIFTY Bank Index OverviewAhmedNasirNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFÄñîRûddhâ JâdHäv ÂjNo ratings yet

- Value Investing: Managing Your Money Using Principles!Document8 pagesValue Investing: Managing Your Money Using Principles!Parthiv JethiNo ratings yet

- Sbi Nifty Midcap 150 Index FundDocument1 pageSbi Nifty Midcap 150 Index Fundpratik panchalNo ratings yet

- IOP V2 Product Note 31st October 2020Document2 pagesIOP V2 Product Note 31st October 2020Swades DNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Banksandeep jainNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFMinal PatilNo ratings yet

- ABSL Frontline Equity Fund Factsheet PDFDocument1 pageABSL Frontline Equity Fund Factsheet PDFKiranmayi UppalaNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- NIFTY Bank Index OverviewDocument2 pagesNIFTY Bank Index OverviewVikas GowdaNo ratings yet

- NIFTY Bank Index: A Benchmark for Indian Banking StocksDocument2 pagesNIFTY Bank Index: A Benchmark for Indian Banking StocksGupta JeeNo ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankalrickbarwa2006No ratings yet

- Ibef IvDocument9 pagesIbef Ivritvik singh rautelaNo ratings yet

- Amchem Products Private LimitedDocument19 pagesAmchem Products Private LimitedAtika malikNo ratings yet

- WhiteOak Capital MF Factsheet Aug 2022Document12 pagesWhiteOak Capital MF Factsheet Aug 2022Nahi bataungaNo ratings yet

- March 29, 2019: Portfolio CharacteristicsDocument2 pagesMarch 29, 2019: Portfolio Characteristicsprem sagarNo ratings yet

- Ind Nifty Bank PDFDocument2 pagesInd Nifty Bank PDFalrickbarwa2006No ratings yet

- Ind Nifty BankDocument2 pagesInd Nifty Bankjayeshrane2107No ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- TCS Financial Results: Quarter III FY 2020 - 21Document27 pagesTCS Financial Results: Quarter III FY 2020 - 21VarathavasuNo ratings yet

- Shareholding PatternDocument5 pagesShareholding PatternVarathavasuNo ratings yet

- Live EnterprsisdDocument21 pagesLive EnterprsisdVarathavasuNo ratings yet

- Capital StructureDocument3 pagesCapital StructureVarathavasuNo ratings yet

- TCS Condensed Standalone Interim Balance Sheet and Statement of Profit and LossDocument37 pagesTCS Condensed Standalone Interim Balance Sheet and Statement of Profit and LossVarathavasuNo ratings yet

- SEBI (LODR) RegulationsDocument118 pagesSEBI (LODR) RegulationsWWWEEEENo ratings yet

- SEBI (LODR) RegulationsDocument118 pagesSEBI (LODR) RegulationsWWWEEEENo ratings yet

- SebiDocument372 pagesSebiNagabhushanaNo ratings yet

- Gland Pharma LimitedDocument316 pagesGland Pharma LimitedPranav WarneNo ratings yet

- SebiDocument372 pagesSebiNagabhushanaNo ratings yet

- Trident Limited: Statement of Unaudited Financial Results For The Quarter and Period Ended December 31, 2020Document4 pagesTrident Limited: Statement of Unaudited Financial Results For The Quarter and Period Ended December 31, 2020VarathavasuNo ratings yet

- Indian Company Securities Issuance GuideDocument32 pagesIndian Company Securities Issuance GuideKevin PaulNo ratings yet

- 000.104%kt, Pidilite: Ramkrishna Mandir Road, Andheri - E, Mumbai 400059, IndiaDocument11 pages000.104%kt, Pidilite: Ramkrishna Mandir Road, Andheri - E, Mumbai 400059, IndiaVarathavasuNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document2 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076VarathavasuNo ratings yet

- List of Abbreviation Abbreviation Full FormDocument2 pagesList of Abbreviation Abbreviation Full FormVarathavasuNo ratings yet

- Important QuotesDocument1 pageImportant QuotesVarathavasuNo ratings yet

- Claim Form - Group Health InsuranceDocument5 pagesClaim Form - Group Health Insurancevizag mdindiaNo ratings yet

- Contact details and account statement for HDFC Mutual Fund investmentDocument3 pagesContact details and account statement for HDFC Mutual Fund investmentrekha nairNo ratings yet

- HDFC ERGO renews Optima Restore Floater Insurance Policy for Preeti BajpaiDocument4 pagesHDFC ERGO renews Optima Restore Floater Insurance Policy for Preeti BajpaiHoooooNo ratings yet

- BS - Mumbai 13 April 2020 PDFDocument12 pagesBS - Mumbai 13 April 2020 PDFRakesh GujralNo ratings yet

- Presentation Insurance Verticals of HDFC BankDocument11 pagesPresentation Insurance Verticals of HDFC BanknavkoolNo ratings yet

- HDFC Life Insurance Company LTD.: VisionDocument4 pagesHDFC Life Insurance Company LTD.: VisionCOOK EAT REPEATNo ratings yet

- Healthy SIP Returns Over 15, 10 and 5 YearsDocument4 pagesHealthy SIP Returns Over 15, 10 and 5 YearsAkash BNo ratings yet

- HDFC Life InsuranceDocument12 pagesHDFC Life Insurancesaswat mohantyNo ratings yet

- May 2019 Current Affairs Capsule for Banking, Finance and EconomyDocument45 pagesMay 2019 Current Affairs Capsule for Banking, Finance and EconomyMallika BalimaneNo ratings yet

- Anjali Bisht V-ADocument77 pagesAnjali Bisht V-AAnjali BishtNo ratings yet

- Dissertation On Home LoanDocument6 pagesDissertation On Home LoanHelpWritingAPaperCanada100% (1)

- CSR HDFC Ar 2017 PDFDocument6 pagesCSR HDFC Ar 2017 PDFsiddhartha karNo ratings yet

- Monthly Current Affairs Capsule September 2018 PDFDocument35 pagesMonthly Current Affairs Capsule September 2018 PDFbhajjiNo ratings yet

- Customers Perception Towards HDFC Standard LifeDocument76 pagesCustomers Perception Towards HDFC Standard Lifeabhishekpadhi100% (5)

- Customer Relationship ManagementDocument88 pagesCustomer Relationship Managementphanindra_madasu0% (1)

- Renewal of Your Easy Health Floater Standard Insurance PolicyDocument5 pagesRenewal of Your Easy Health Floater Standard Insurance PolicyMayur KrishnaNo ratings yet

- HDFC Bank Car Loan Finance AnalysisDocument40 pagesHDFC Bank Car Loan Finance AnalysisAneesAnsariNo ratings yet

- Comparing HDFC Home Loans to RivalsDocument79 pagesComparing HDFC Home Loans to Rivalsishant bhatNo ratings yet

- Fdocuments - in A Project Report On The Analysis and Comparative Study of Sbi and HDFC MutualDocument88 pagesFdocuments - in A Project Report On The Analysis and Comparative Study of Sbi and HDFC Mutualparmeen singhNo ratings yet

- HDFC ERGO General Insurance Company Limited: Marine Cum Erection InsuranceDocument8 pagesHDFC ERGO General Insurance Company Limited: Marine Cum Erection InsurancePrakhar ShuklaNo ratings yet

- HDFC Bank Project ReportDocument54 pagesHDFC Bank Project ReportAkash PatelNo ratings yet

- HDFC Asset Management Company LimitedDocument3 pagesHDFC Asset Management Company LimitedHoney AliNo ratings yet

- Financial Performance Analysis of HDFC Using Dupont AnalysisDocument7 pagesFinancial Performance Analysis of HDFC Using Dupont AnalysisMohmmedKhayyumNo ratings yet

- Project On Bajaj AllianceDocument76 pagesProject On Bajaj Alliancekiran_mallana_gowda79% (19)

- Attrition Analysis & Retention Strategies in HDFC SlicDocument68 pagesAttrition Analysis & Retention Strategies in HDFC Slicssmauni67% (3)

- RBI Policy - Key Challenges For The Banking SectorDocument4 pagesRBI Policy - Key Challenges For The Banking SectorRekha LohiaNo ratings yet

- HDFC Life product list updated Nov 2014Document3 pagesHDFC Life product list updated Nov 2014Joseph ThompsonNo ratings yet

- Summer Training Project On HDC Bank Varanasi SHISH MBA SAMS IBM VaranasiDocument85 pagesSummer Training Project On HDC Bank Varanasi SHISH MBA SAMS IBM VaranasiShish ChoudharyNo ratings yet