Professional Documents

Culture Documents

Tax Laws Question Paper Online

Uploaded by

Maaz AlamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Laws Question Paper Online

Uploaded by

Maaz AlamCopyright:

Available Formats

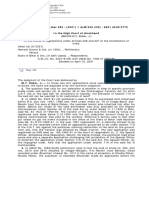

Faculty of Law, Jamia Millia Islamia, New Delhi

Question Paper, May, 2020

Subject : Tax Law-I

B.A.LL.B. VI Semester Regular/Self Finance.

Important Instructions:

1. All questions are compulsory and carry equal marks.

2. Words limits for each answer is 1000 to 1500.

3. Answer should be submitted by email to eakramuddin@jmi.ac.in latest by 4:00pm on 26.05.2020.

Unit- I

Que. 1. Define the word 'Income' and 'Agricultural Income' under Income Tax Act 1965 with the help

of decided cases.

Unit- II

Que. 2. What do you mean by 'Income from Salaries'. Explain the concept of diverson of income and

application of income by citing leading cases.

Unit- III

Que. 3. Discuss the concept of 'Profits and Gains from Business or Profession' and distinguish between

capital expenditure and revenue expenditure. Complete your answer with the help of leading cases.

Unit- IV

Que. 4. Explain the idea of Clubing of Income of other person in Assessee's total income. Complete your

answer with the ruling of cases Batta Kalyani v. CIT (1985) 154 ITR 59 and J.M. Mokashi v. CIT

(1994) 207 ITR 252 (Bom). with regard to the clubing of income.

Unit- V

Que. 5. What do you mean by Assessment and Best Judgment Assessment?

You might also like

- MD Imtiaz Alam 5001733141 Self: Medi Assist Insurance Tpa Pvt. LTDDocument2 pagesMD Imtiaz Alam 5001733141 Self: Medi Assist Insurance Tpa Pvt. LTDMaaz AlamNo ratings yet

- We Create Value For Your: Service ExpertiseDocument3 pagesWe Create Value For Your: Service ExpertiseMaaz AlamNo ratings yet

- Moot Proposition, 3rd GSM NMCCDocument5 pagesMoot Proposition, 3rd GSM NMCCMaaz Alam0% (1)

- Details of Officers of Trade Marks Registry, MumbaiDocument9 pagesDetails of Officers of Trade Marks Registry, MumbaiMaaz AlamNo ratings yet

- E-Nyayaganga Short Story Writing Competition: Bidxia/Viewform?Usp PP - UrlDocument1 pageE-Nyayaganga Short Story Writing Competition: Bidxia/Viewform?Usp PP - UrlMaaz AlamNo ratings yet

- CollageMaker 20211007 150907990Document4 pagesCollageMaker 20211007 150907990Maaz AlamNo ratings yet

- J 1982 3 SCC 24 1982 SCC Cri 535 AIR 1982 SC 1325 Alammaaz1998 Gmailcom 20210404 121022 1 93Document93 pagesJ 1982 3 SCC 24 1982 SCC Cri 535 AIR 1982 SC 1325 Alammaaz1998 Gmailcom 20210404 121022 1 93Maaz AlamNo ratings yet

- Eaenest Business - 2019 - SCC - OnLine - Bom - 1793Document19 pagesEaenest Business - 2019 - SCC - OnLine - Bom - 1793Maaz AlamNo ratings yet

- 1st National Moot Court Competition 2022 Virtual Moot Proposition MinDocument6 pages1st National Moot Court Competition 2022 Virtual Moot Proposition MinMaaz AlamNo ratings yet

- Standard of Legal Education in India-Trying To Bridging The Gap Between Nlus and Non-NlusDocument8 pagesStandard of Legal Education in India-Trying To Bridging The Gap Between Nlus and Non-NlusMaaz AlamNo ratings yet

- Health Law Assignment List RegularDocument1 pageHealth Law Assignment List RegularMaaz AlamNo ratings yet

- Standford iOS - Assignment #1Document7 pagesStandford iOS - Assignment #1Brian SmithNo ratings yet

- Jamia Millia Islamia, New Delhi: List of Students Department Wise/State Wise/Gender WiseDocument270 pagesJamia Millia Islamia, New Delhi: List of Students Department Wise/State Wise/Gender WiseMaaz AlamNo ratings yet

- J 2001 SCC OnLine Jhar 285 2001 1 JLJR 225 2001 AIHC 2 Alammaaz1998 Gmailcom 20210327 233716 1 6Document6 pagesJ 2001 SCC OnLine Jhar 285 2001 1 JLJR 225 2001 AIHC 2 Alammaaz1998 Gmailcom 20210327 233716 1 6Maaz AlamNo ratings yet

- Application For The Post of Member of Placement CommitteeDocument1 pageApplication For The Post of Member of Placement CommitteeMaaz AlamNo ratings yet

- Ruplai Labour Law VIIIDocument16 pagesRuplai Labour Law VIIIMaaz AlamNo ratings yet

- Lawgically YoursDocument2 pagesLawgically YoursMaaz AlamNo ratings yet

- Dumping Defn & MeasuresDocument42 pagesDumping Defn & MeasuresKiran ModiNo ratings yet

- J 2008 SCC OnLine Del 1081 ILR 2009 1 Del 722 2008 1 Alammaaz1998 Gmailcom 20201017 234256 1 15Document15 pagesJ 2008 SCC OnLine Del 1081 ILR 2009 1 Del 722 2008 1 Alammaaz1998 Gmailcom 20201017 234256 1 15Maaz AlamNo ratings yet

- Format WritDocument5 pagesFormat Writnayanj04No ratings yet

- Letter of Appointment - JLRI MaazDocument1 pageLetter of Appointment - JLRI MaazMaaz AlamNo ratings yet

- Report Writing PDFDocument21 pagesReport Writing PDFMzwandile MngadiNo ratings yet

- Standford iOS - Assignment #1Document7 pagesStandford iOS - Assignment #1Brian SmithNo ratings yet

- Proforma Cover Page Assignment JMIDocument1 pageProforma Cover Page Assignment JMIMaaz Alam50% (2)

- Application For The Post of Member of Placement CommitteeDocument1 pageApplication For The Post of Member of Placement CommitteeMaaz AlamNo ratings yet

- Strict and Absolute LiabilityDocument12 pagesStrict and Absolute LiabilityMaaz AlamNo ratings yet

- Rules of Procedure: of The 2020 International Criminal Court Moot Court CompetitionDocument23 pagesRules of Procedure: of The 2020 International Criminal Court Moot Court CompetitionMaaz AlamNo ratings yet

- Aadhaar JudgmentDocument1,448 pagesAadhaar JudgmentThe WireNo ratings yet

- White Paper 22022019 PDFDocument79 pagesWhite Paper 22022019 PDFKunal KhandelwalNo ratings yet

- One Small Step For Women - Female-Friendly Provisions in The Rome PDFDocument39 pagesOne Small Step For Women - Female-Friendly Provisions in The Rome PDFMaaz AlamNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)