50% found this document useful (2 votes)

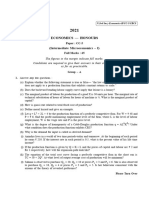

1K views3 pagesNumerical Questions On Price Discrimination: D D F F D F

This document contains 6 numerical questions about price discrimination. The questions provide demand curves and cost functions for firms selling products in multiple markets. They ask to determine profit-maximizing prices and outputs for the firms under price discrimination and no price discrimination, and to compare the profits and policies for the firms.

Uploaded by

Arnica TradersCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

50% found this document useful (2 votes)

1K views3 pagesNumerical Questions On Price Discrimination: D D F F D F

This document contains 6 numerical questions about price discrimination. The questions provide demand curves and cost functions for firms selling products in multiple markets. They ask to determine profit-maximizing prices and outputs for the firms under price discrimination and no price discrimination, and to compare the profits and policies for the firms.

Uploaded by

Arnica TradersCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd