Professional Documents

Culture Documents

Strategic Finance All Question-5

Uploaded by

TheNOOR129Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Finance All Question-5

Uploaded by

TheNOOR129Copyright:

Available Formats

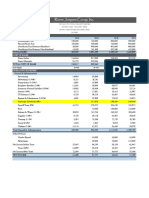

Question No 1

Total Initial Outlay

Cost of Machine 1,300,000

Installation Cost 91,000

Transportation Cost 39,000

Training Cost 13,000

Total Cost of Machine 1,443,000

Working Cost of Capital 8,000

Sales Proceed from old machine -84,029

Tax on Gain 7,002

Total Cost of Assets 1,373,973

Detail 1 2 3 4 5 6 7

Sales (Units) 20,000 22,000 24,200 26,620 29,282 32,210 35,431

Sales Price 70 70 70 70 70 70 70

Total Sale 1,400,000 1,540,000 1,694,000 1,863,400 2,049,740 2,254,714 2,480,185

Cash CGS (22%) -308,000 -338,800 -372,680 -409,948 -450,943 -496,037 -545,641

Gross Profit 1,092,000 1,201,200 1,321,320 1,453,452 1,598,797 1,758,677 1,934,545

Cash Operating Expense (11%) -154,000 -169,400 -186,340 -204,974 -225,471 -248,019 -272,820

Profit Before Tax 938,000 1,031,800 1,134,980 1,248,478 1,373,326 1,510,658 1,661,724

Depreciation on New Machine -288,600 -461,760 -277,056 -166,234 -166,234 -83,117 0

Depreciation on Old Machine 70,025

Incremental Depreciation -218,576 -461,760 -277,056 -166,234 -166,234 -83,117 0

Profit Before Tax 719,425 570,040 857,924 1,082,244 1,207,092 1,427,542 1,661,724

Tax @ 50% -359,712 -285,020 -428,962 -541,122 -603,546 -713,771 -830,862

Profit after tax 359,712 285,020 428,962 541,122 603,546 713,771 830,862

Add Back Depreciation 218,576 461,760 277,056 166,234 166,234 83,117 0

Incremental Salvage Value -50,000 25,000

Tax Gain/(Saving) 25,000 -12,500

Working Cost of Capital 8,000

Net Cash Flow 578,288 746,780 681,018 707,356 769,780 796,888 851,362

Old Machine Working

Cost of Old Machine 900,000

Installation Cost 18,000

Transportation Cost 27,000

Total Cost 945,000

Depreciation of 1st Year 314,969

Depreciation of 2nd Year 420,053

Depreciation of 3rd Year 139,955

Book Value 70,025

Sales Price 84,029

Gain on Sales 14,005

Page 5 of 17

You might also like

- Strategic Finance All Question-13Document1 pageStrategic Finance All Question-13TheNOOR129No ratings yet

- Strategic Finance All Question-6Document1 pageStrategic Finance All Question-6TheNOOR129No ratings yet

- Enterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13Document20 pagesEnterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13KabeerMalikNo ratings yet

- Presentation Group F Update T6Document21 pagesPresentation Group F Update T6Phạm Hồng SơnNo ratings yet

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Capital Investment Break-Up: Marketing and PromotionDocument7 pagesCapital Investment Break-Up: Marketing and PromotionDeepak RamamoorthyNo ratings yet

- Profit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aDocument1 pageProfit & Loss PT TCP M Arif Rahman - 2005151018 - Akp-3aM Arif RahmanNo ratings yet

- ChapDocument61 pagesChapJahara GarciaNo ratings yet

- A&f - Group Assignment - Assignment 2Document8 pagesA&f - Group Assignment - Assignment 2lavaniaNo ratings yet

- Entrep - 3Document2 pagesEntrep - 3Kyle josonNo ratings yet

- Profit and Loss ProjectionDocument1 pageProfit and Loss ProjectionMisbah SajidNo ratings yet

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- Profit and Loss AssumptionDocument2 pagesProfit and Loss Assumptionمحمد عليNo ratings yet

- Profit and Loss ProjectionDocument1 pageProfit and Loss ProjectionAbel GetachewNo ratings yet

- Attok Petroroleum AnalysisDocument44 pagesAttok Petroroleum Analysisfareed608No ratings yet

- Income Statement P2 JayatamaDocument1 pageIncome Statement P2 JayatamaShula KinantiNo ratings yet

- Lucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiDocument21 pagesLucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiMuhammad AreebNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- Profit & Loss Detail: DescriptionDocument18 pagesProfit & Loss Detail: DescriptionAde PardedeNo ratings yet

- Cashflow Net Room RevenueDocument4 pagesCashflow Net Room RevenueAshadi CahyadiNo ratings yet

- Exhibit 1Document9 pagesExhibit 1jeffblake1216No ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- Group7 (Financial Statements)Document6 pagesGroup7 (Financial Statements)Bea Dela PeniaNo ratings yet

- Standalone Kitchen Model WorkingDocument3 pagesStandalone Kitchen Model WorkingSujith psNo ratings yet

- Data Case 8Document31 pagesData Case 8milagrosNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintAbhay Kumar SinghNo ratings yet

- Financial Statements Income Statement Body Works Fitness Gym Projected Income StatementsDocument4 pagesFinancial Statements Income Statement Body Works Fitness Gym Projected Income StatementsMark Joseph OlinoNo ratings yet

- Maruti SuzukiDocument88 pagesMaruti SuzukiNishant SharmaNo ratings yet

- SECUREX (PVT.) Limited: Statement of Comprehensive Income For The Year Ended 29 February 2016 2016 Notes TakaDocument4 pagesSECUREX (PVT.) Limited: Statement of Comprehensive Income For The Year Ended 29 February 2016 2016 Notes TakaBiplob K. SannyasiNo ratings yet

- Tata Motors PLDocument2 pagesTata Motors PLSravani BotchaNo ratings yet

- Term Paper Excel Calculations-Premier Cement Mills Ltd.Document40 pagesTerm Paper Excel Calculations-Premier Cement Mills Ltd.Jannatul TrishiNo ratings yet

- Non-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286Document8 pagesNon-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286shahzad khalidNo ratings yet

- Coffee CubeDocument5 pagesCoffee Cubes3976142No ratings yet

- TCS Profit and Loss StatementsDocument2 pagesTCS Profit and Loss StatementsRuchita MoreNo ratings yet

- RJC Fin ProjectionsDocument1 pageRJC Fin Projectionsapi-365066163No ratings yet

- Management Wesb08 PunbDocument12 pagesManagement Wesb08 PunbRusilah KhalilNo ratings yet

- 1 Consolidated Statement of Assets and Liabilities ParticularsDocument11 pages1 Consolidated Statement of Assets and Liabilities ParticularsSagar ChaurasiaNo ratings yet

- 17sept 2018Document15 pages17sept 2018prachiNo ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- ToyotaDocument4 pagesToyotaعبدالرحمن منصورNo ratings yet

- Hindustanprofit LossDocument2 pagesHindustanprofit LossPradeep WaghNo ratings yet

- I Fitness Venture StandaloneDocument15 pagesI Fitness Venture StandaloneThe keyboard PlayerNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- E. Sensitivities and ScenariosDocument3 pagesE. Sensitivities and ScenariosDadangNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- Larsen & Toubro Infotech LTD - Income Statement - Thomson Reuters Eikon 10-Aug-2019 01:04Document140 pagesLarsen & Toubro Infotech LTD - Income Statement - Thomson Reuters Eikon 10-Aug-2019 01:04Nishant SharmaNo ratings yet

- Project ReportDocument19 pagesProject ReportCA DïvYã PrÁkàsh JäîswãlNo ratings yet

- New Smart Phone Calculation AnalysisDocument10 pagesNew Smart Phone Calculation AnalysisErro Jaya RosadyNo ratings yet

- Dilip BuildconDocument59 pagesDilip BuildconNishant SharmaNo ratings yet

- 31 March 2020Document8 pages31 March 2020lojanbabunNo ratings yet

- Groupe Ariel CaseDocument9 pagesGroupe Ariel CasePaco Colín86% (7)

- Project Report Final 1Document11 pagesProject Report Final 1ManiyarSant & Co., Chartered AccountantsNo ratings yet

- Island Power (IPWR) Incremental Earning Forecast For The Project (Purchasing Machine Outright) From The Year 2017-2022Document4 pagesIsland Power (IPWR) Incremental Earning Forecast For The Project (Purchasing Machine Outright) From The Year 2017-2022Ruma RashydNo ratings yet

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- Income Statement of Mahaweli Reach HotelDocument7 pagesIncome Statement of Mahaweli Reach Hotelदेवीना गिरीNo ratings yet

- 5 Year Financial PlanDocument25 pages5 Year Financial Plananwar kadiNo ratings yet

- P and L PDFDocument2 pagesP and L PDFjigar jainNo ratings yet

- Book 2Document18 pagesBook 2Aishwarya DaymaNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Plagiarism Report PDFDocument2 pagesPlagiarism Report PDFTheNOOR129No ratings yet

- Strategic Finance All Question-15Document1 pageStrategic Finance All Question-15TheNOOR129No ratings yet

- Documents Required For Tax ReturnDocument1 pageDocuments Required For Tax ReturnTheNOOR129No ratings yet

- Strategic Finance All Question-17Document1 pageStrategic Finance All Question-17TheNOOR129No ratings yet

- Strategic Finance All Question-16 PDFDocument1 pageStrategic Finance All Question-16 PDFTheNOOR129No ratings yet

- Strategic Finance All Question-16 PDFDocument1 pageStrategic Finance All Question-16 PDFTheNOOR129No ratings yet

- Strategic Finance All Question-11Document1 pageStrategic Finance All Question-11TheNOOR129No ratings yet

- Strategic Finance All Question-8Document1 pageStrategic Finance All Question-8TheNOOR129No ratings yet

- Strategic Finance All Question-10Document1 pageStrategic Finance All Question-10TheNOOR129No ratings yet

- Strategic Finance All Question-4Document1 pageStrategic Finance All Question-4TheNOOR129No ratings yet

- Strategic Finance All Question-3Document1 pageStrategic Finance All Question-3TheNOOR129No ratings yet

- Strategic Finance All Question-2Document1 pageStrategic Finance All Question-2TheNOOR129No ratings yet

- Question No 3Document1 pageQuestion No 3TheNOOR129No ratings yet

- Question No 2Document1 pageQuestion No 2TheNOOR129No ratings yet

- Question No 4Document1 pageQuestion No 4TheNOOR129No ratings yet

- Assignment No 1 From Book Question No 1: Detail 0 1 2 3 4 5Document1 pageAssignment No 1 From Book Question No 1: Detail 0 1 2 3 4 5TheNOOR129No ratings yet

- Question No 1Document1 pageQuestion No 1TheNOOR129No ratings yet

- Impact of Demographic Factors Affecting The Decision of NonDocument1 pageImpact of Demographic Factors Affecting The Decision of NonTheNOOR129No ratings yet

- Oral Presentaion SkillsDocument20 pagesOral Presentaion SkillsDr. Wael El-Said100% (2)

- Economics LecturesDocument81 pagesEconomics LecturesTheNOOR129No ratings yet

- FDI and FIIDocument17 pagesFDI and FIIsharathNo ratings yet

- 1.doosan D1146Document1 page1.doosan D1146Md. ShohelNo ratings yet

- Linux Memory ExplainedDocument60 pagesLinux Memory ExplainedRaphael AraujoNo ratings yet

- SCH 415 Computer Applications in Chemistry: at The End of This Unit You Should Be Able To General ObjectiveDocument21 pagesSCH 415 Computer Applications in Chemistry: at The End of This Unit You Should Be Able To General ObjectiveFELIX ORATINo ratings yet

- Maneesh Misra CV - 1Document3 pagesManeesh Misra CV - 1Rohit KarhadeNo ratings yet

- Extractive Metallurgy Pachuca Tank DesignDocument8 pagesExtractive Metallurgy Pachuca Tank DesignXtet AungNo ratings yet

- Thermister O Levels Typical QuestionDocument4 pagesThermister O Levels Typical QuestionMohammad Irfan YousufNo ratings yet

- 12-24VDC Powered Ignition System: N N N N N N NDocument2 pages12-24VDC Powered Ignition System: N N N N N N NLeinner RamirezNo ratings yet

- 1LA7070-4AB10-Z A11 Datasheet en PDFDocument1 page1LA7070-4AB10-Z A11 Datasheet en PDFKraponis TylnessNo ratings yet

- Helicoil Plus en 0100Document56 pagesHelicoil Plus en 0100Khổng MạnhNo ratings yet

- Lululemon Sample Case AnalysisDocument49 pagesLululemon Sample Case AnalysisMai Ngoc PhamNo ratings yet

- DAR Vol1-2013Document744 pagesDAR Vol1-2013chitransh2002No ratings yet

- DITS 2213 Final Exam OSDocument6 pagesDITS 2213 Final Exam OSAmirul FaizNo ratings yet

- Perez V Monetary BoardDocument4 pagesPerez V Monetary BoardlawNo ratings yet

- A Case Study On Mahindra's Blue Sense Application Project by RohitDocument43 pagesA Case Study On Mahindra's Blue Sense Application Project by RohitrohitNo ratings yet

- User Manual For FDC 2.1Document13 pagesUser Manual For FDC 2.1Jeni FragaNo ratings yet

- 2023-04-28 NMSU Executive SummaryDocument2 pages2023-04-28 NMSU Executive SummaryDamienWillisNo ratings yet

- 358 IG Fashion Pack PDFDocument4 pages358 IG Fashion Pack PDFbovsichNo ratings yet

- Top Notch 1, 3° Edicion Workbook Answer KeyDocument14 pagesTop Notch 1, 3° Edicion Workbook Answer KeyLuis Lopez90% (61)

- BOOK2Document201 pagesBOOK2Chetan Satish PadoleNo ratings yet

- A.R. Meenakshi v. State of Tamil Nadu, (Madras)Document9 pagesA.R. Meenakshi v. State of Tamil Nadu, (Madras)J VenkatramanNo ratings yet

- Space Vector Modulation - An Introduction - TutoriDocument11 pagesSpace Vector Modulation - An Introduction - TutorileonardoNo ratings yet

- Designing The Highway: Reported By: Juvy Ann Acabo Czarina AguilarDocument12 pagesDesigning The Highway: Reported By: Juvy Ann Acabo Czarina AguilarCzarinaCanarAguilarNo ratings yet

- Pathfinder House RulesDocument2 pagesPathfinder House RulesilililiilililliliI100% (1)

- IBEC BPL System ArchitectureDocument2 pagesIBEC BPL System ArchitectureAleksandar ConevNo ratings yet

- SAM3-P256 Development Board Users Manual: This Datasheet Has Been Downloaded From at ThisDocument21 pagesSAM3-P256 Development Board Users Manual: This Datasheet Has Been Downloaded From at ThissunnguyenNo ratings yet

- Leading With Emotional IntellegenceDocument10 pagesLeading With Emotional IntellegencevvvasimmmNo ratings yet

- Photoshop TheoryDocument10 pagesPhotoshop TheoryShri BhagwanNo ratings yet

- RICS APC Candidate Guide-Aug 2015-WEB PDFDocument24 pagesRICS APC Candidate Guide-Aug 2015-WEB PDFLahiru WijethungaNo ratings yet

- Batch 2 SEC Online Test AnswersDocument5 pagesBatch 2 SEC Online Test AnswersBhairav YouthsNo ratings yet