Professional Documents

Culture Documents

COVID-19 Financial Tips June 2020

Uploaded by

Community Service Society of New YorkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COVID-19 Financial Tips June 2020

Uploaded by

Community Service Society of New YorkCopyright:

Available Formats

COVID-19 FINANCIAL TIPS

The Financial Coaching Corps of the Community Service Society of New York would like to share

resources and financial tips for New Yorkers who may be struggling during the growing COVID-19 crisis.

Stay informed about the disease by visiting the CDC website and NY Dept of Health Website, or by calling

a special COVID-19 hotline: 1-888-364-3065.

This document will be updated as more information becomes Information on programs and

available.

resources changes frequently during

Contents:

this time. Before making any financial

• Budgeting in a Crisis decisions, be sure to verify the

• Prioritize Necessities

• Manage Financial Obligations information by checking with the

• Protect Your Credit relevant financial institutions and

• Retirement Accounts

• Beware of Scams government agencies for any updates.

• Additional Resources

We urge everyone to check trusted

sources like the NY State Website and

Budgeting and Planning: NYC Gov Website.

• Create a Budget: Now is a valuable time to create or review

your household budget in order to prepare for any financial difficulties in the coming weeks and months.

• Assess your Cash Flow and Resources:

° Determine how much money you have to work with for budgeting purposes. Start by listing your

available resources (cash on hand, bank accounts, emergency funds, or other assets.)

° Assess your available income. During a crisis, some expected income may not materialize, so

only include income that is available to spend. For information on applying for Unemployment

Insurance go to Benefits Plus Online.

• Budget Tools:

To get started, find a straightforward way to track and review your spending and income each

month. There are a wide variety of tools available to help budget and track expenses. Find one that

works for you and your household. Examples include:

• You Need a Budget (YNAB) is a budgeting method that helps to break the paycheck to

paycheck cycle. The software is $84 a year, but YNAB provides excellent free online budgeting

classes, guides, and videos. YNAB uses bank level internet security measures.

• Mint by Intuit (creators of TurboTax) that downloads information from users’ financial institutions

to help track and categorize monthly spending. The software includes advertisements. Mint

uses bank level internet security measures.

• CFPB Spending Tracker is a free pdf tracking tool available through the Consumer Financial

Protection Bureau. This tool is included in the Bureau of Consumer Financial Protection’s Your

Money, Your Goals: A financial empowerment toolkit.

Updated: June 5, 2020 - 1

COVID-19 FINANCIAL TIPS

• CSS/FCC Budget Worksheet: Use the Financial Coaching Corps Budget Worksheet to analyze

and adjust your household budget.

• Create a Timeline:

Aside from your household budget, it may also be useful during the crisis to keep a financial

calendar. A calendar can inform the budget and provide useful information, but should not be used

to replace a regular budget.

° Income: Create an estimated schedule for any upcoming income (wages, unemployment

insurance, Social Security and other benefits), along with the amount you expect to receive.

° Bills: List and categorize your regular monthly bills along with due dates for your bills.

° Auto-Payments: Take time to review your bank statements. Create a clear timeline of regular

auto-payments and direct debits that are currently active on your bank or credit cards.

° Annual/Irregular Expenses: Do not forget to include larger, less frequent expenses like auto

registration fees, deductibles, and self-employment taxes as well. In order to save for the

expense ahead of time, divide the total expense by 12 and set aside 1/12 of the overall payment

each month.

• Cut Discretionary Spending:

Consider strategies to cut down on discretionary spending. Free up room in your budget for the

priorities. Reduce or eliminate the following:

° Spending that increases household debt (purchases on credit cards, new property, new auto

loans, new leases, and other financed purchases),

° spending that can be deferred or negotiated (monthly bills, car insurance, student loan

payments, subscriptions),

° non-emergency savings, and

° spending or savings for non-necessity luxury items, travel, vacation.

Strategies to Reduce Spending:

° Eliminate auto-payments to avoid over-drafting accounts,

° Request to different due dates that line up with when you receive income,

° Switch to using debit cards or cash. Many studies show that consumers spend more with credit

cards than with cash.

° Wait 24 hours after adding items to your cart before making online purchases,

° Plan ahead for in-person shopping by bringing only what you want to spend in cash.

• Build an Emergency Fund:

• Why: An emergency fund is a cash reserve that is specifically set aside for financial emergencies.

• How much: The amount you need to have in an emergency savings fund depends on your situation.

In the current crisis, an ideal emergency fund would contain 3-6 months of necessary household

expenses. However, even 500 dollars can prevent a crisis, so try to save as much as you can.

Updated: June 5, 2020 - 2

COVID-19 FINANCIAL TIPS

• Where: An emergency fund should ideally be saved in an FDIC insured bank or credit union

account. Avoid savings options like CDs or IRAs which will charge fees or penalties to access the

cash in an emergency. Stick with a regular checking or savings account, or explore online options

known as high-yield savings accounts that pay interest.

• How: If your household does not already have any cash saved, consider the following sources as

starters for an emergency fund:

° Your household’s economic stimulus money,

° Your household’s federal or state tax refund,

° Amount of unemployment benefit above your typical weekly income,

° Cash saved as a result of social distancing like travel and entertainment expenses,

° Cash saved as a result of automatic student loan forbearance, or

° Cash saved through budgeting.

• Using Your Emergency Fund:

Emergency funds are designed to carry you through temporary financial hardships, which many

households are experiencing right now. However, in order to make an emergency fund last, be

strategic when using it.

If your household already has an emergency fund or source of cash that could be used as one,

use a budget to assess how long that cash could cover household necessities like food and

rent. Before spending emergency fund cash, ask yourself the following:

(1) Is the purchase a household necessity?

(2) Have you called the service provider to request that the payment be delayed or deferred?

(3) Have you exhausted other available financial supports (such as unemployment insurance)?

If you can answer yes to all these questions, it may be time to use your emergency fund.

• Planning as a Household:

• The Consumer Financial Protection Bureau recommends that families schedule time to discuss

family finances together, including income, expenses, debt, and investments. Maintain a list of

account numbers, usernames, security questions, and passwords and store it securely. Provide

access to a trusted loved one, spouse, or a Financial Caregiver.

• Estate Planning: Estate Planning is preparation of tasks that serve to manage an individual's assets

and income in the event of their incapacitation or death. Most estate plans are set up with the help

of an attorney experienced in estate law. To learn more, schedule a free session with a Certified

Financial Planner through the Science Industry and Business Library.

Prioritize Necessities:

While budgeting is powerful tool to manage household finances, it may not be enough to prevent a major

cash shortfall during a crisis like COVID-19 pandemic. If, after reducing and eliminating excess spending,

and tapping emergency funds, you are still not able to pay all of your bills, it is time to prioritize necessities.

Updated: June 5, 2020 - 3

COVID-19 FINANCIAL TIPS

• Needs, Wants and Obligations: Before you prioritize, understand the distinction between needs,

obligations, and wants.

• Needs: Needs or Necessities are the things required for survival and to maintain your job, shelter,

and health. Pay for needs first. Examples: rent, utilities, food, medication copays, transportation

costs, phone, internet, health insurance.

• Obligations: Obligations are any financial commitment that one has a duty to pay. This includes

debt (credit cards, student loans, court judgments), non-debt obligations (child support, taxes,

insurance, dues), and obligations to oneself (emergency savings, 401k).

• Wants: Wants are expenses that are not required for survival or that you have no obligation to pay.

Pay wants last. Examples: vacations, furniture, luxury goods, new clothes, gambling, grooming, and

gifts.

• First Things First: Always pay for needs first, then obligations, and wants last. In a crisis, some

needs will be greater than others. For example, buying food is more important than paying rent or

utilities. Pay for what is necessary to stay safe and well during the crisis first.

Resources: Listed below are some of the resources that may support individuals who are struggling to pay

necessities. For more resources and information please visit CSS’ Benefits Plus Online and open the

“COVID-19 Resources” Chapter Listing.

• Food:

• Food Pantries: There are a wide variety of organizations supplying free food to NYC through food

pantries, free food markets, community kitchens and restaurants providing free food.

• NYC Free Meals: NYC free meal programs provide ready to eat meals for all New Yorkers. There

are no eligibility requirements, registration procedures, identification, or documentation

requirements.

• Home Delivered Meals: Home delivered meal programs continue to be available during the COVID-

19 pandemic.

• SNAP/Food Stamps and Other Food Benefits: See Benefits Plus Online for updated info on a

wide variety of food-related benefit programs and services.

• Housing:

• Renters: There is currently an active Eviction Moratorium for the entire State of New York set to

expire August 20th, 2020. This means that no tenants may be evicted from their apartments until

that time. However, during the moratorium rent payments are still due on the usual date. So, if you

can pay your rent, you should continue to do so to avoid accumulating rental arrears debt, and the

potential of future eviction. However, if needed, NY tenants may use their Security Deposits to pay

rent that is owed or will become due.

• Homeowners: Under the CARES Act, owners with federally backed mortgages have the right to

request forbearance, and NY State has also directed NY-regulated lenders to waive mortgage

payments for 90 days for borrowers who face financial hardship due to COVID-19.

Updated: June 5, 2020 - 4

COVID-19 FINANCIAL TIPS

° The CFPB has provided a step-by-step guide to requesting mortgage relief for federally backed

mortgages.

° The NY Dept of Financial Services has created a comprehensive guide to seeking mortgage

relief for New York residents, including a list of qualified housing counselors in NY.

• Foreclosure Moratorium: There are active foreclosure moratorium both federally and in New York

State. The New York State moratorium that is set to expire August 20th, 2020.

• Other Housing Resources: For more information about Housing Programs and Services during the

pandemic, and updates to existing housing programs please visit Benefits Plus Online.

• Utilities:

• Electric and Gas: Con Edison and National Grid have suspended service shutoffs for residents

facing financial hardship. Please contact your service provider right away if you can’t pay your

power bill.

• Phone and Internet: Given the coronavirus pandemic and its impact on American society, 750

companies have pledged to:

° not terminate service to any residential or small business customers because of their inability to

pay their bills due to the disruptions caused by the coronavirus pandemic.

° waive any late fees that any residential or small business customers incur because of their

economic circumstances related to the coronavirus pandemic; and

° open its Wi-Fi hotspots to any American who needs them.

A full list of participating providers is here: Keep Americans Connected.

• Water: New York State has issued a moratorium on water shutoffs for the duration of the outbreak.

• Health Insurance

• Department of Financial Services in NY issued a rule that allowed consumers to delay paying their

health insurance premiums until June 1, 2020. Now that the order has expired, the state

recommends contacting your insurer to discuss payment options or for assistance with finding new

coverage.

• Special Enrollment Period: Apply for coverage through NY State of Health by phone at 855-355-

5777, or directly to insurers. The special enrollment period for uninsured New Yorkers is open until

June 15, 2020. If you lost employer coverage, you must apply within 60 days of losing coverage.

• Community Health Advocates: Community Health Advocates (CHA), a program of the Community

Service Society, provides free and confidential individual counseling about health insurance in New

York State. Staff will continue to answer the Helpline from 9-4, Monday to Friday: 1-888-614-5400

(Phone appointments only).

Updated: June 5, 2020 - 5

COVID-19 FINANCIAL TIPS

Financial Obligations

Once necessities are paid for, obligations such as child support, taxes, insurance, and debt

payments should also be paid. There may be options to help those effected by COVID-19 pay for and

manage their obligations. See resources below. Obligations are listed in priority order from highest to

lowest. Please see the FCC Factsheet “How to Prioritize Paying Your Bills in a Financial Crisis”.

• Child Support

• The New York City Office of Child Support Services (OCSS) Customer Service Walk-In Center will

be closed until further notice due to COVID-19. You can also visit this website for Child Support

Services outside of NYC.

• Petitions: Beginning May 18, courts in several regions will begin accepting new petitions for child

support matters. New York State Unified Court System.

• Modify Orders: You can ask the court to modify your current obligation amount if your income has

decreased by fifteen (15) percent or more since the order was last modified. You may also file

support modification petitions, motions, and requests with the New York City Family Court by email

at NYFCSupport@nycourts.gov.

• Taxes

• Payment and Filing: The April 15 tax filing deadline has been moved to July 15th. More information

will be available at the website below. The IRS has also issued guidance allowing all individual and

other non-corporate tax filers to defer up to $1 million of federal income tax (including self-

employment tax) payments due on April 15, 2020, until July 15, 2020, without penalties or interest.

• NYC Free Virtual Tax Prep: is an end-to-end service where an IRS certified Volunteer Income Tax

Assistance (VITA)/Tax Counseling for the Elderly (TCE) volunteer preparer will video conference

with you to help prepare your 2019 tax return using a secure digital system.

° This service is available for families earning $64,000 or less in 2019 and single filers earning

$45,000 or less in 2019. Note: Volunteer preparers can also assist non-filers with stimulus

payments.

° To use this service, you must have access to a computer, tablet, or smartphone; a stable

internet connection; and the ability to download secure video conference software.

• Insurance (Auto, Home, Life, Etc.)

• New York State Dept of Financial Services has requested that all NY state regulated insurance

providers (including health, dental, disability, life, auto, home, liability, etc.) offer the following

to customers who demonstrate hardship resulting from COVID-19:

° Offering payment accommodations, such as allowing consumers to defer payments at no cost,

extending payment due dates, or waiving late or reinstatement fees;

° Working with consumers to avoid cancellation or non-renewal of insurance policies for failure to

pay premiums on time and other reasons;

° Providing flexibility regarding proof of death or other condition that triggers benefits under life

insurance;

Updated: June 5, 2020 - 6

COVID-19 FINANCIAL TIPS

° Providing consumers with information and timely access to all medically necessary covered

health care services, including testing and treatment for COVID-19;

° For help with all other types of insurance, contact the NY Department of Financial Services.

• Student Loans

• The CARES Act requires federal student loan servicers to suspend payments and credit reporting

on certain federal loans during the pandemic. For more information about CARES Act student loan

forbearance eligibility and rules, go to: EDCAP - Student Loan Updates.

• CSS’ Education Debt Consumer Assistance Program provides free over-the-phone counseling and

assistance for all student loan questions and concerns. Call 888-614-5004 or email

edcap@cssny.org. All services are free and unbiased.

• Credit Cards and Other Debt

• FDIC Guidelines: The FDIC is encouraging banks to work with customers seriously affected by

COVID-19, including temporary business closures, slowdowns, or sickness. The FDIC is

encouraging banks to allow customers to skip loan payments with no adverse consequences for the

borrower, extend loan terms, and waiving late payment fees on credit cards and other loans.

• Warning! Before skipping payments or otherwise operating in a manner that differs from the terms

of a loan, contact your bank to determine its flexibility during this time. Paying your debts late or not

at all can result in penalties, interest charges, and damage to your credit score.

• New York State Dept of Financial Services has issued a rule that all NY state regulated banks and

lenders provide the following to customers who demonstrate hardship resulting from COVID-19:

° Waiving overdraft fees;

° Providing new loans on favorable terms;

° Waiving late fees for credit card and other loan balances;

° Waiving automated teller machine (ATM) fees;

° Increasing ATM daily cash withdrawal limits;

° Waiving early withdrawal penalties on time deposits (CDs);

° Increasing credit card limits for creditworthy customers;

° Offering payment accommodations, such as allowing loan customers to defer payments at no

cost, extending the payment due dates or otherwise adjusting or altering terms of existing loans,

which would avoid delinquencies, triggering events of default or similar adverse consequences,

and negative credit agency reporting caused by COVID-19 related disruptions; and more.

° For more information and updates, or to request help with a bank or lender go to: NY Dept of

Financial Services

Protecting Your Credit

On-time payment history is the number one factor in credit scoring. That is why you should always try to

make the minimum payments on your credit card and other debt if you can. Being behind or late on your

payments has a long-lasting negative impact on your credit reports and scores. Learn more about the

factors that influence your credit score visit the CFPB website here. Below are steps you should take to

protect your credit during the pandemic:

Updated: June 5, 2020 - 7

COVID-19 FINANCIAL TIPS

• Contact Your Lenders:

• If you have trouble paying your bills, or loans, or can’t pay the minimum, reach out to your lenders

or creditors as soon as possible.

• The sooner you get in touch with your lenders or service providers, the more likely you will be to

avoid damaging your credit report.

• The CFPB has resources to help you discuss the impact of COVID-19 on your financial

situation with your lenders.

• Credit Reporting under the CARES Act

• The Coronavirus Aid, Relief, and Economic Security (CARES) Act requires creditors and other

service providers to comply with certain guidelines for reporting information to the credit bureaus

during the pandemic. As per the CFPB, the current guidelines are as follows:

° If your account is current and you make an agreement to make a partial payment, skip a

payment, or other accommodation, then the creditor is to report to credit reporting companies

that you are current on your loan or account. This applies only if you are meeting the terms of

the agreement.

° If your account is already delinquent and you make an agreement, then your account

will maintain that status during the agreement until you bring the account current.

° If your account is already delinquent and you make an agreement, and you bring your account

current, the creditor must report that you are current on your loan or account.

° This CARES Act requirement applies only to agreements made between January 31, 2020 and

the later of either:

° 120 days after March 27, 2020 or

° 120 days after the national emergency concerning COVID–19 ends.

• Free Weekly Credit Reports

The best way to ensure that your credit information is accurate and up to date is to regularly access a

copy of your free credit report at AnnualCreditReport.com.

• You can now get a free credit report at AnnualCreditReport.com from each of the three nationwide

credit reporting agencies ( Equifax, TransUnion, and Experian) once every week until April 2021.

• If you find inaccurate information on your credit reports, or you believe a creditor or lender has

reported information incorrectly, use the CFPB’s step-by-step guide to dispute that information, You

can also submit a complaint to the CFPB at consumerfinance.gov/complaint.

Retirement Savings and Investments

• Early Withdrawal:

Currently, workers are facing duel challenges when it comes to managing their retirement savings: financial

hardship due to job loss, and market volatility devaluing their investments. For these reasons, individuals

may have a desire to withdraw money from their IRA, 401k and 403b accounts early.

However, early withdrawals are not without pitfalls. This is because if your financial situation continues to

deteriorate, you may be unable to pay the money back, or to pay the taxes on the withdrawal. You may

Updated: June 5, 2020 - 8

COVID-19 FINANCIAL TIPS

“lock in” your losses if you withdraw your money before the market recovers. It is strongly recommended

that all investors seek qualified financial advice before taking an early withdrawal from an IRA.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, includes new provisions that

make it easier for those affected by the outbreak to access retirement funds.

° During the year 2020, no one will have to take a required minimum distribution (RMD). This

applies to all taxpayers who are otherwise required to receive an RMD in 2020.

° Individuals who need to take money from a retirement account before age 59 ½ will not have

the usual 10% penalty in 2020. They can draw up to $100,000. Individuals who take a

distribution of up to $100,000 will have three years to pay taxes on the income and can put the

money back into the account during the three-year time period. This is only for those who meet

criteria of being affected by the coronavirus. For more information: Retirement Account Rule

Suspension for IRAs, 401(k) or 403 (b).

• Free Financial Planning:

• New Yorkers who would like to speak with a qualified professional about retirement planning and

investments can do so for free through the services of the Science Industry and Business Library.

Go online to make a 30-minute phone appointment with a member of the Financial Planners

Association of New York.

Scams:

• Beware of scammers selling bogus medical treatments, vaccines, and tests, and learn the facts about

the coronavirus. There is currently no FDA-approved vaccine to prevent the disease, so ignore offers

promising otherwise. Report scammers here: FTC Website

• Warning! The government will not contact you via phone call, text, or email regarding your stimulus

payment. The government will not ask you to provide your Social Security number, bank account

number, credit card number, or any kind of upfront payment in order to receive your stimulus. Report

scams and learn more here: FTC - Coronavirus Scams

Additional Resources:

• Access NYC: Find help in NYC with food, money, housing, work and more on ACCESS NYC.

• The Community Service Society of New York is continuing to meet the needs of our constituents during

this rapidly evolving public health emergency. Call our free hotlines if you need help navigating the

COVID-19 crisis.

• CSS’ Benefits Plus Learning Center has created comprehensive guides covering a wide range of topics

on how to find federal, state and city resources for New Yorkers during the emergency state of COVID-

19.

• NYC Financial Empowerment Centers provide free one-on-one professional, financial counseling and

coaching to support you in reaching your goals. Services available in English, Spanish, Haitian Creole,

Punjabi, Russian, American Sign Language, and others. Book an appointment online and create/login

to your Financial Empowerment Portal account.

Updated: June 5, 2020 - 9

You might also like

- COVID-19 Financial Tips April 2021Document11 pagesCOVID-19 Financial Tips April 2021Community Service Society of New YorkNo ratings yet

- Highlights of The Enacted Fy 2020-2021 New York State BudgetDocument4 pagesHighlights of The Enacted Fy 2020-2021 New York State BudgetNew York SenateNo ratings yet

- CFB Notice To Amber AdlerDocument3 pagesCFB Notice To Amber AdlerCity & State New YorkNo ratings yet

- Highlights of The Enacted Fy 2020-2021 New York State BudgetDocument4 pagesHighlights of The Enacted Fy 2020-2021 New York State BudgetNew York SenateNo ratings yet

- Complaint Against Strulovich and OberlanderDocument32 pagesComplaint Against Strulovich and OberlanderDNAinfoNewYorkNo ratings yet

- Boston Just Cause Ordinance Draft Sept 2015Document12 pagesBoston Just Cause Ordinance Draft Sept 2015Richard Vetstein100% (1)

- MT Morris: Downtown Revitalization in Rural New York StateDocument29 pagesMT Morris: Downtown Revitalization in Rural New York StateprobrockportNo ratings yet

- Idaho Medical Marijuana Act of 2022Document11 pagesIdaho Medical Marijuana Act of 2022Marijuana MomentNo ratings yet

- In Re: Ottoson-King V., 4th Cir. (2001)Document7 pagesIn Re: Ottoson-King V., 4th Cir. (2001)Scribd Government DocsNo ratings yet

- Mark Dixon State of Arizona Notice of Claim 1-12-13 PDFDocument16 pagesMark Dixon State of Arizona Notice of Claim 1-12-13 PDFfixpinalcountyNo ratings yet

- 2008 JA New York Annual ReportDocument40 pages2008 JA New York Annual ReportJANewYorkNo ratings yet

- Sarah Palin New York Times LawsuitDocument25 pagesSarah Palin New York Times LawsuitThe Daily DotNo ratings yet

- Wyoming Marijuana InitiativesDocument20 pagesWyoming Marijuana InitiativesMarijuana Moment100% (1)

- Wells Fargo Bank N.A. V Erobobo wNEW YORK 5 2013Document13 pagesWells Fargo Bank N.A. V Erobobo wNEW YORK 5 2013MackLawfirmNo ratings yet

- Albert Moehring v. The Bank of New York Mellon, 4th Cir. (2014)Document2 pagesAlbert Moehring v. The Bank of New York Mellon, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- CH 01Document13 pagesCH 01Juan CarlosNo ratings yet

- Fiji - Ministry of Education Strategic Plan 2009 To 2011Document52 pagesFiji - Ministry of Education Strategic Plan 2009 To 2011Intelligentsiya HqNo ratings yet

- FHFA V Deutsche Bank PDFDocument112 pagesFHFA V Deutsche Bank PDFperritoxx2No ratings yet

- Lawsuit Filed Against Arizona Patriot GroupsDocument32 pagesLawsuit Filed Against Arizona Patriot GroupsRoger OgdenNo ratings yet

- FijiTimes - Feb 22 2013Document48 pagesFijiTimes - Feb 22 2013fijitimescanadaNo ratings yet

- South Dakota 2022 Marijuana Ballot MeasuresDocument18 pagesSouth Dakota 2022 Marijuana Ballot MeasuresMarijuana Moment100% (1)

- Commerce Bank, Et Al. v. Bank of New York MellonDocument69 pagesCommerce Bank, Et Al. v. Bank of New York MellonIsaac GradmanNo ratings yet

- DisasterRecoveryClaims BrochureDocument2 pagesDisasterRecoveryClaims Brochureheather valenzuelaNo ratings yet

- (20-22398 29) Emergency Request For A Temporary Restraining Order DE 159Document6 pages(20-22398 29) Emergency Request For A Temporary Restraining Order DE 159larry-612445No ratings yet

- Warrants Related To The Charges Against Roanoke City Council Member Robert Jeffrey Jr.Document22 pagesWarrants Related To The Charges Against Roanoke City Council Member Robert Jeffrey Jr.David CrossNo ratings yet

- Borrower Requested Solicitation Filled OutDocument11 pagesBorrower Requested Solicitation Filled Outmichael ellisNo ratings yet

- Bansilal Inv 1 1.3 PDFDocument1 pageBansilal Inv 1 1.3 PDFManya BhosaleNo ratings yet

- 2016.11.23 Responsive Records - Part 2Document190 pages2016.11.23 Responsive Records - Part 2DNAinfoNewYorkNo ratings yet

- Georgia Residential Mgt. AgreementDocument4 pagesGeorgia Residential Mgt. AgreementalperNo ratings yet

- 2013 New York Coop Summit ProgramDocument8 pages2013 New York Coop Summit ProgramfranklenraymondNo ratings yet

- Pomrenke-Virginia State BarDocument26 pagesPomrenke-Virginia State BarBrit StackNo ratings yet

- Tax Free Weekend InfoDocument6 pagesTax Free Weekend InfoMichael AllenNo ratings yet

- Pre-Application Statement FormDocument9 pagesPre-Application Statement FormDNAinfoNewYorkNo ratings yet

- Financing An Overseas Veterinary Education For U.S. CitizensDocument7 pagesFinancing An Overseas Veterinary Education For U.S. Citizensscott quakkelaar100% (1)

- Credit Card Agreement For Consumer Cards in Capital One Bank (USA), N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One Bank (USA), N.Ajeremywright100% (1)

- Estate of Dennis Choquette v. Corrections Corporation of America, Et. Al.Document70 pagesEstate of Dennis Choquette v. Corrections Corporation of America, Et. Al.Michael_Lee_RobertsNo ratings yet

- 2019 New York State Senate Veterans' Hall of Fame HonoreesDocument63 pages2019 New York State Senate Veterans' Hall of Fame HonoreesNew York SenateNo ratings yet

- HRG Texas Lease RBPDocument17 pagesHRG Texas Lease RBPFranz FrankoNo ratings yet

- Solved Thyme Bank of New York Expects New Deposit Inflows NextDocument1 pageSolved Thyme Bank of New York Expects New Deposit Inflows NextM Bilal SaleemNo ratings yet

- The Bank of New York Mellon Designated by Fannie Mae As Document CustodianDocument1 pageThe Bank of New York Mellon Designated by Fannie Mae As Document CustodianNye LavalleNo ratings yet

- Arizona's Pandemic UnemploymentDocument40 pagesArizona's Pandemic UnemploymentklassiqNo ratings yet

- Redfin Filed Complaint PDFDocument76 pagesRedfin Filed Complaint PDFGeekWireNo ratings yet

- Tenancy Agreement TemplateDocument11 pagesTenancy Agreement TemplatemikeokslongNo ratings yet

- Gallivan Historical Tour Guide 2.26.2015Document28 pagesGallivan Historical Tour Guide 2.26.2015New York Senate100% (1)

- Key Aspects of State and D.C. Medical Marijuana LawsDocument16 pagesKey Aspects of State and D.C. Medical Marijuana LawsMPP100% (2)

- SCOTUS Brief Trump v. New York Jurisdictional Statement ADocument164 pagesSCOTUS Brief Trump v. New York Jurisdictional Statement ALaw&CrimeNo ratings yet

- Pierhouse ComplaintDocument20 pagesPierhouse ComplaintDNAinfoNewYorkNo ratings yet

- NEW 2014 Historic WOD BookDocument104 pagesNEW 2014 Historic WOD BookNew York SenateNo ratings yet

- Section 8 ApplicationDocument10 pagesSection 8 ApplicationjrnitschkeNo ratings yet

- Consumer FinanceDocument87 pagesConsumer Financearn01dNo ratings yet

- Evolution and Implications of The Kabul Bank CrisisDocument6 pagesEvolution and Implications of The Kabul Bank CrisisRobin Kirkpatrick BarnettNo ratings yet

- Home Hardening Tax Exemption TIP - 22A01-07Document2 pagesHome Hardening Tax Exemption TIP - 22A01-07ABC Action NewsNo ratings yet

- Preliminary 2017-2018 Report of The New York State Senate Standing Committee On HealthDocument44 pagesPreliminary 2017-2018 Report of The New York State Senate Standing Committee On HealthNew York SenateNo ratings yet

- Domestic Violence Lease TerminationDocument2 pagesDomestic Violence Lease TerminationJeremy PageNo ratings yet

- Amjid 3Document17 pagesAmjid 3jaish khanNo ratings yet

- MMPE08Document21 pagesMMPE08Joshua CornitoNo ratings yet

- How To Budget Your Money WiselyDocument2 pagesHow To Budget Your Money WiselyBrando Neil SarciaNo ratings yet

- Financial LiteracyDocument5 pagesFinancial LiteracyPAVO, JUDY V.No ratings yet

- Making Money Work For YouDocument20 pagesMaking Money Work For YouAnthony Diaz GNo ratings yet

- What Is Personal FinanceDocument16 pagesWhat Is Personal Financesirjagz0611No ratings yet

- Health Initiatives RFP: Uninsured Outreach Partners in Central and Western New YorkDocument13 pagesHealth Initiatives RFP: Uninsured Outreach Partners in Central and Western New YorkCommunity Service Society of New YorkNo ratings yet

- Health Initiatives RFP: Keep New York Covered (KNYC)Document11 pagesHealth Initiatives RFP: Keep New York Covered (KNYC)Community Service Society of New YorkNo ratings yet

- Testimony: City Council Hearing On Hospital Costs and Access To Care, 10/15/2021Document7 pagesTestimony: City Council Hearing On Hospital Costs and Access To Care, 10/15/2021Community Service Society of New YorkNo ratings yet

- HCFANY Budget TestimonyDocument10 pagesHCFANY Budget TestimonyCommunity Service Society of New YorkNo ratings yet

- How New Yorkers Feel About Affordability and Healthcare ReformDocument25 pagesHow New Yorkers Feel About Affordability and Healthcare ReformCommunity Service Society of New YorkNo ratings yet

- New York Housing Fact Sheet - Assembly (Non NYC)Document85 pagesNew York Housing Fact Sheet - Assembly (Non NYC)Community Service Society of New YorkNo ratings yet

- Patient Medical Debt Protection Act One PagerDocument1 pagePatient Medical Debt Protection Act One PagerCommunity Service Society of New YorkNo ratings yet

- CSS Testimony: Joint Legislative Session On HospitalsDocument12 pagesCSS Testimony: Joint Legislative Session On HospitalsCommunity Service Society of New YorkNo ratings yet

- New York Housing Fact Sheet - Senate (Non NYC)Document38 pagesNew York Housing Fact Sheet - Senate (Non NYC)Community Service Society of New YorkNo ratings yet

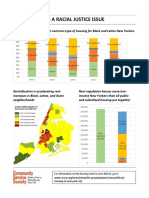

- Rent Justice As Racial JusticeDocument2 pagesRent Justice As Racial JusticeCommunity Service Society of New YorkNo ratings yet

- New Yorkers Weigh in On Top Priorities For The New MayorDocument1 pageNew Yorkers Weigh in On Top Priorities For The New MayorCommunity Service Society of New YorkNo ratings yet

- COVID-19 Financial TipsDocument5 pagesCOVID-19 Financial TipsCommunity Service Society of New York100% (1)

- New York Housing Fact Sheet - NYC SenateDocument25 pagesNew York Housing Fact Sheet - NYC SenateCommunity Service Society of New YorkNo ratings yet

- Community Service Society's Role in Passing Paid Faimly Leave in New York.Document29 pagesCommunity Service Society's Role in Passing Paid Faimly Leave in New York.Community Service Society of New YorkNo ratings yet

- Health Equity - Panel On Accessing Health Equity in New York City (Program)Document4 pagesHealth Equity - Panel On Accessing Health Equity in New York City (Program)Community Service Society of New YorkNo ratings yet

- New York Housing Fact Sheet - NYC AssemblyDocument66 pagesNew York Housing Fact Sheet - NYC AssemblyCommunity Service Society of New YorkNo ratings yet

- #FairFares Letter To MayorDocument2 pages#FairFares Letter To MayorDavid MeyerNo ratings yet

- Open Letter To Mayor de Blasio From Progressive LeadersDocument2 pagesOpen Letter To Mayor de Blasio From Progressive LeadersCommunity Service Society of New YorkNo ratings yet

- Making College More Affordable For New Yorkers Who Need The Most SupportDocument17 pagesMaking College More Affordable For New Yorkers Who Need The Most SupportCommunity Service Society of New YorkNo ratings yet

- Community Service Society's Role in Passing Paid Family Leave in New York State.Document29 pagesCommunity Service Society's Role in Passing Paid Family Leave in New York State.Community Service Society of New YorkNo ratings yet

- Health Professionals in Support of Paid Family LeaveDocument3 pagesHealth Professionals in Support of Paid Family LeaveCommunity Service Society of New YorkNo ratings yet

- Launching A Neighborhood-Based Community Health Worker InitiativeDocument40 pagesLaunching A Neighborhood-Based Community Health Worker InitiativeCommunity Service Society of New YorkNo ratings yet

- Making College More Affordable For New Yorkers Who Need The Most Support - Unheard Third ChartsDocument7 pagesMaking College More Affordable For New Yorkers Who Need The Most Support - Unheard Third ChartsCommunity Service Society of New YorkNo ratings yet

- NYC Alliance To Preserve Public Housing: October 2013 Letter To Chairman Rhea and Mayor BloombergDocument3 pagesNYC Alliance To Preserve Public Housing: October 2013 Letter To Chairman Rhea and Mayor BloombergCommunity Service Society of New YorkNo ratings yet

- NYC Alliance To Preserve Public Housing: Position On NYCHA's 2014 Annual PlanDocument10 pagesNYC Alliance To Preserve Public Housing: Position On NYCHA's 2014 Annual PlanCommunity Service Society of New YorkNo ratings yet

- Timeline: A Legacy of HopeDocument6 pagesTimeline: A Legacy of HopeCommunity Service Society of New York100% (1)

- PH Css Test Nycha Plan 610Document1 pagePH Css Test Nycha Plan 610Community Service Society of New YorkNo ratings yet

- CSS Center For Benefits & Services (CBS) One PagerDocument2 pagesCSS Center For Benefits & Services (CBS) One PagerCommunity Service Society of New YorkNo ratings yet

- A Project Report On Financial Statement of Icici Bank PuneDocument85 pagesA Project Report On Financial Statement of Icici Bank PuneAMIT K SINGH0% (1)

- Problem 15 - 1 Books of German CompanyDocument3 pagesProblem 15 - 1 Books of German CompanyCOCO IMNIDANo ratings yet

- Differences Between A Partnership and CorporationDocument4 pagesDifferences Between A Partnership and CorporationIvan BendiolaNo ratings yet

- Debenture: Corporate Finance InstrumentDocument1 pageDebenture: Corporate Finance InstrumentsalmanNo ratings yet

- Issue of Debentures Redemption of Debentures UnderwrtingDocument47 pagesIssue of Debentures Redemption of Debentures UnderwrtingKeshav PantNo ratings yet

- Credit Role - Jai-KisanDocument2 pagesCredit Role - Jai-Kisan21-23 Shashi KumarNo ratings yet

- The SPACE Matrix AnalysisDocument6 pagesThe SPACE Matrix AnalysisMarwan Al-Asbahi100% (1)

- Offer LetterDocument3 pagesOffer LetterAditya GadgilNo ratings yet

- Provision For DDDocument3 pagesProvision For DDCooking Classes with Zainab 12No ratings yet

- Goldilocks-All Bout GoldilocksDocument13 pagesGoldilocks-All Bout GoldilocksCharisse Nhet Clemente64% (14)

- Chapter 2Document19 pagesChapter 2Mahi MaheshNo ratings yet

- Problems Faced in Marketing of Foreign Goods by Multinational CompaniesDocument7 pagesProblems Faced in Marketing of Foreign Goods by Multinational Companiesdipabali chowdhuryNo ratings yet

- How To Create Corporation WorksheetDocument4 pagesHow To Create Corporation WorksheetMaryNo ratings yet

- The Economics of Commercial Real Estate PreleasingDocument33 pagesThe Economics of Commercial Real Estate PreleasingSuhas100% (1)

- Ifrs Usgaap NotesDocument38 pagesIfrs Usgaap Notesaum_thai100% (1)

- Report Sales Periode 23, OktDocument5 pagesReport Sales Periode 23, OktgarnafiqihNo ratings yet

- Khali Tin ChallanDocument2 pagesKhali Tin ChallanNimeshNo ratings yet

- Chapter 1: Introduction To The Study of GlobalizationDocument80 pagesChapter 1: Introduction To The Study of GlobalizationAshton Travis HawksNo ratings yet

- LESSON5Document5 pagesLESSON5Ira Charisse BurlaosNo ratings yet

- The Genesis of Bank Deposits (W. F. Crick)Document13 pagesThe Genesis of Bank Deposits (W. F. Crick)João Henrique F. VieiraNo ratings yet

- An Analysis of The Suitability of The CME CF BRR For The Creation of Regulated Financial Products (UPDATED) PDFDocument24 pagesAn Analysis of The Suitability of The CME CF BRR For The Creation of Regulated Financial Products (UPDATED) PDFJsNo ratings yet

- Indian Aluminium IndustryDocument6 pagesIndian Aluminium IndustryAmrisha VermaNo ratings yet

- Corporate Finance Formula SheetDocument5 pagesCorporate Finance Formula SheetChan Jun LiangNo ratings yet

- Richard Ellson ConsultingDocument4 pagesRichard Ellson Consultingnrhuron13No ratings yet

- NPO StandardsDocument9 pagesNPO Standardsbngo01No ratings yet

- Contoh Laporan KeuanganDocument4 pagesContoh Laporan KeuanganDiva Nadya ArdhetaNo ratings yet

- D. All of ThemDocument6 pagesD. All of ThemRyan CapistranoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Vamshi KrishnaNo ratings yet

- ICQDocument12 pagesICQAndrew LamNo ratings yet

- Introduction To Government AccountingDocument34 pagesIntroduction To Government AccountingAnnamae Teoxon100% (1)

- The Age of Magical Overthinking: Notes on Modern IrrationalityFrom EverandThe Age of Magical Overthinking: Notes on Modern IrrationalityRating: 4 out of 5 stars4/5 (24)

- Prisoners of Geography: Ten Maps That Explain Everything About the WorldFrom EverandPrisoners of Geography: Ten Maps That Explain Everything About the WorldRating: 4.5 out of 5 stars4.5/5 (1145)

- Briefly Perfectly Human: Making an Authentic Life by Getting Real About the EndFrom EverandBriefly Perfectly Human: Making an Authentic Life by Getting Real About the EndNo ratings yet

- Dark Psychology & Manipulation: Discover How To Analyze People and Master Human Behaviour Using Emotional Influence Techniques, Body Language Secrets, Covert NLP, Speed Reading, and Hypnosis.From EverandDark Psychology & Manipulation: Discover How To Analyze People and Master Human Behaviour Using Emotional Influence Techniques, Body Language Secrets, Covert NLP, Speed Reading, and Hypnosis.Rating: 4.5 out of 5 stars4.5/5 (110)

- 1177 B.C.: The Year Civilization Collapsed: Revised and UpdatedFrom Everand1177 B.C.: The Year Civilization Collapsed: Revised and UpdatedRating: 4.5 out of 5 stars4.5/5 (111)

- Hey, Hun: Sales, Sisterhood, Supremacy, and the Other Lies Behind Multilevel MarketingFrom EverandHey, Hun: Sales, Sisterhood, Supremacy, and the Other Lies Behind Multilevel MarketingRating: 4 out of 5 stars4/5 (103)

- The Wicked and the Willing: An F/F Gothic Horror Vampire NovelFrom EverandThe Wicked and the Willing: An F/F Gothic Horror Vampire NovelRating: 4 out of 5 stars4/5 (21)

- Why We Die: The New Science of Aging and the Quest for ImmortalityFrom EverandWhy We Die: The New Science of Aging and the Quest for ImmortalityRating: 4 out of 5 stars4/5 (3)

- Cult, A Love Story: Ten Years Inside a Canadian Cult and the Subsequent Long Road of RecoveryFrom EverandCult, A Love Story: Ten Years Inside a Canadian Cult and the Subsequent Long Road of RecoveryRating: 4 out of 5 stars4/5 (44)

- If I Did It: Confessions of the KillerFrom EverandIf I Did It: Confessions of the KillerRating: 3 out of 5 stars3/5 (133)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansFrom EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansRating: 4 out of 5 stars4/5 (17)

- Perfect Murder, Perfect Town: The Uncensored Story of the JonBenet Murder and the Grand Jury's Search for the TruthFrom EverandPerfect Murder, Perfect Town: The Uncensored Story of the JonBenet Murder and the Grand Jury's Search for the TruthRating: 3.5 out of 5 stars3.5/5 (68)

- Troubled: A Memoir of Foster Care, Family, and Social ClassFrom EverandTroubled: A Memoir of Foster Care, Family, and Social ClassRating: 4.5 out of 5 stars4.5/5 (26)

- The Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchFrom EverandThe Exvangelicals: Loving, Living, and Leaving the White Evangelical ChurchRating: 4.5 out of 5 stars4.5/5 (13)

- Teaching to Transgress: Education as the Practice of FreedomFrom EverandTeaching to Transgress: Education as the Practice of FreedomRating: 5 out of 5 stars5/5 (76)

- American Jezebel: The Uncommon Life of Anne Hutchinson, the Woman Who Defied the PuritansFrom EverandAmerican Jezebel: The Uncommon Life of Anne Hutchinson, the Woman Who Defied the PuritansRating: 3.5 out of 5 stars3.5/5 (66)

- The Other Significant Others: Reimagining Life with Friendship at the CenterFrom EverandThe Other Significant Others: Reimagining Life with Friendship at the CenterRating: 4 out of 5 stars4/5 (1)

- Body Language: Decode Human Behaviour and How to Analyze People with Persuasion Skills, NLP, Active Listening, Manipulation, and Mind Control Techniques to Read People Like a Book.From EverandBody Language: Decode Human Behaviour and How to Analyze People with Persuasion Skills, NLP, Active Listening, Manipulation, and Mind Control Techniques to Read People Like a Book.Rating: 5 out of 5 stars5/5 (81)

- My Grandmother's Hands: Racialized Trauma and the Pathway to Mending Our Hearts and BodiesFrom EverandMy Grandmother's Hands: Racialized Trauma and the Pathway to Mending Our Hearts and BodiesRating: 5 out of 5 stars5/5 (70)

- His Needs, Her Needs: Building a Marriage That LastsFrom EverandHis Needs, Her Needs: Building a Marriage That LastsRating: 4.5 out of 5 stars4.5/5 (100)

- Disfigured: On Fairy Tales, Disability, and Making SpaceFrom EverandDisfigured: On Fairy Tales, Disability, and Making SpaceRating: 4.5 out of 5 stars4.5/5 (396)