Professional Documents

Culture Documents

MR W/in 15 Days, To The CTA Division.: Vat Refund (Sec. 112 Nirc)

Uploaded by

Monalie0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

112.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageMR W/in 15 Days, To The CTA Division.: Vat Refund (Sec. 112 Nirc)

Uploaded by

MonalieCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

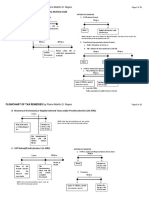

VAT REFUND (Sec.

112 NIRC)

Within 2 years from the close of the taxable

quarter when the sale was made, file an

administrative claim with the CIR

CIR has 120 days from the filing of the

claim to decide (Mandatory)

Inaction by CIR within 120 days = DENIAL Actual Denial by CIR

30 days from the date of receipt of the

decision or lapse of the 120 day to

elevate to CTA Division

MR w/in 15 days, to the

CTA Division.

Upon denial, elevate to

CTA En banc (15 days)

Appeal to the Supreme

Court (15 days)

You might also like

- Tax Remidies of The TaxpayerDocument6 pagesTax Remidies of The TaxpayerJustin Robert RoqueNo ratings yet

- Magicsheets - Civil Procedure - Time LimitsDocument1 pageMagicsheets - Civil Procedure - Time LimitsCK D100% (1)

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Flowchart of Tax Remedies I. Remedies Un PDFDocument12 pagesFlowchart of Tax Remedies I. Remedies Un PDFJunivenReyUmadhayNo ratings yet

- FLOWCHART OF TAX REMEDIES by Pierre Martin D. ReyesDocument11 pagesFLOWCHART OF TAX REMEDIES by Pierre Martin D. ReyesKEMPNo ratings yet

- Remedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimDocument14 pagesRemedies and Prescriptive Periods Prepared By: Dr. Jeannie P. LimCourt StenographerNo ratings yet

- Tax RemediesDocument14 pagesTax RemediesMatt Marqueses PanganibanNo ratings yet

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiNo ratings yet

- CTA and Taxpayers Remedies-2020Document66 pagesCTA and Taxpayers Remedies-2020Agui S. T. PadNo ratings yet

- Flowchart of Tax Remedies 2019 Update TRDocument11 pagesFlowchart of Tax Remedies 2019 Update TRBlackjack SharedNo ratings yet

- Flowchart of Tax Remedies 2019 Update TRDocument11 pagesFlowchart of Tax Remedies 2019 Update TRAbraham Marco De GuzmanNo ratings yet

- Republic of The Philippines V. Liberato P. Mola Cruz G.R. No. 236629, July 23, 2018 DoctrineDocument3 pagesRepublic of The Philippines V. Liberato P. Mola Cruz G.R. No. 236629, July 23, 2018 DoctrineMona Lie100% (1)

- VAT Refund (Section 112) v. Tax Refund (Section 229) NIRCDocument1 pageVAT Refund (Section 112) v. Tax Refund (Section 229) NIRCKaren Supapo100% (2)

- Tax Remedies Flowchart (Revised)Document6 pagesTax Remedies Flowchart (Revised)GersonGamas0% (1)

- Tax Remedies: (Lecture Notes)Document27 pagesTax Remedies: (Lecture Notes)WilsonNo ratings yet

- DIGEST - Sitel Philippines Corp. v. CIRDocument3 pagesDIGEST - Sitel Philippines Corp. v. CIRAgatha ApolinarioNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- Outline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancDocument1 pageOutline of Procedure in The Court of Tax Appeals (Cta) Appeal To The CTA Division Appeal To The Supreme Court Appeal To The Cta en BancRaymond RogacionNo ratings yet

- DIGEST - Sitel Philippines Corp. v. CIRDocument3 pagesDIGEST - Sitel Philippines Corp. v. CIRAgatha ApolinarioNo ratings yet

- PM Reyes Flowchart of Tax Remedies (Feb 2023 Update)Document11 pagesPM Reyes Flowchart of Tax Remedies (Feb 2023 Update)Avril ZamudioNo ratings yet

- Studying 04 Flowchart of Tax Remedies 2019 Update TR (1) WithMarginNotesDocument11 pagesStudying 04 Flowchart of Tax Remedies 2019 Update TR (1) WithMarginNotesCelestino Law100% (1)

- 2020 Reme TPDocument24 pages2020 Reme TPManuel VillanuevaNo ratings yet

- Tax Remidies of The TaxpayerDocument8 pagesTax Remidies of The TaxpayerNikki Coleen SantinNo ratings yet

- Heirs of Jose Sy Bang, Heirs of Julian Sy and Oscar Sy vs. Rolando Sy G.R. No. 114217/ G.R. No. 150797 October 13, 2009Document4 pagesHeirs of Jose Sy Bang, Heirs of Julian Sy and Oscar Sy vs. Rolando Sy G.R. No. 114217/ G.R. No. 150797 October 13, 2009JaylordPataotaoNo ratings yet

- Cir V. Team Sual Corporation: Doctrine/SDocument3 pagesCir V. Team Sual Corporation: Doctrine/SDaLe AparejadoNo ratings yet

- Remedies For National Taxes Period Reckoning DayDocument4 pagesRemedies For National Taxes Period Reckoning DayAnn SaturayNo ratings yet

- Tax Remedies Flowchart RevisedDocument1 pageTax Remedies Flowchart RevisedJake MacTavishNo ratings yet

- CIR v. TEAM SUALDocument3 pagesCIR v. TEAM SUALDawn Bernabe100% (1)

- Tax Refund/Tax Credit (Sec. 229 Nirc)Document1 pageTax Refund/Tax Credit (Sec. 229 Nirc)MonalieNo ratings yet

- (Tax Refunds & Remedies) : Saint Louis University School of LawDocument5 pages(Tax Refunds & Remedies) : Saint Louis University School of LawSui JurisNo ratings yet

- Pre-Assessment Notice (PAN) : Appeal To CTA en BancDocument1 pagePre-Assessment Notice (PAN) : Appeal To CTA en Banc18isloveNo ratings yet

- Reviewer TaxrevDocument7 pagesReviewer Taxrevlaw.school20240000No ratings yet

- Procedure in Protest Cases - TCCDocument2 pagesProcedure in Protest Cases - TCCattyaarongocpa9645No ratings yet

- 9 Control Sheet - AppealsDocument2 pages9 Control Sheet - AppealsUsman Ahmed ManiNo ratings yet

- Tariff Classification Dispute Settlement/Protest: Protest Receipt The Comm ShallDocument1 pageTariff Classification Dispute Settlement/Protest: Protest Receipt The Comm ShallAngelica RoseNo ratings yet

- Lumbera Tax Easy NotesDocument19 pagesLumbera Tax Easy NotesMark Gregory SalayaNo ratings yet

- Remedies LKGDocument41 pagesRemedies LKGHNicdaoNo ratings yet

- MasterSheet11 Appeals SirTariqTunio STTDocument2 pagesMasterSheet11 Appeals SirTariqTunio STTKamran MehboobNo ratings yet

- Quick Rundown of The Protest ProcedureDocument5 pagesQuick Rundown of The Protest ProcedureYasha Min HNo ratings yet

- Sec. 229 Is Inapplicable Two-Year Period in Sec. 112 Refers Only To Administrative ClaimsDocument3 pagesSec. 229 Is Inapplicable Two-Year Period in Sec. 112 Refers Only To Administrative ClaimsAnonymous Lu6MrQmNo ratings yet

- 180-Day Period On Tax AssessmentDocument6 pages180-Day Period On Tax AssessmentRowie DomingoNo ratings yet

- Appeals & Revision WorksheetDocument4 pagesAppeals & Revision WorksheetMallika VermaNo ratings yet

- 9.visayas Geothermal vs. CIR, GR No. 197525Document20 pages9.visayas Geothermal vs. CIR, GR No. 197525Leizl A. VillapandoNo ratings yet

- TreeDocument1 pageTreeEricaNo ratings yet

- BOC Sec 2205Document3 pagesBOC Sec 2205Jieme OrtizNo ratings yet

- Steag State PowerDocument7 pagesSteag State PowerDNAANo ratings yet

- Flowchart of Tax Remedies 2017 Update PRDocument11 pagesFlowchart of Tax Remedies 2017 Update PRMarjorie Kate CresciniNo ratings yet

- Remedies of A TaxpayerDocument1 pageRemedies of A TaxpayerPrincess Mae SamborioNo ratings yet

- 2024-03-30 - MsmeDocument21 pages2024-03-30 - MsmeAshutosh SrivastavaNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. Toledo Power, INC., Respondent. G.R. No. 183880 January 20, 2014Document1 pageCommissioner of Internal Revenue, Petitioner, vs. Toledo Power, INC., Respondent. G.R. No. 183880 January 20, 2014LDNo ratings yet

- TABLE 3: Procedure in Criminal CasesDocument1 pageTABLE 3: Procedure in Criminal CasesJP JimenezNo ratings yet

- Marubeni Philippines Corporation vs. Commissioner of Internal Revenue, 825 SCRA 401, June 05, 2017Document13 pagesMarubeni Philippines Corporation vs. Commissioner of Internal Revenue, 825 SCRA 401, June 05, 2017Vida MarieNo ratings yet

- Procedure of Protest of Real Property TaxationDocument1 pageProcedure of Protest of Real Property TaxationMonalieNo ratings yet

- Marubeni vs. CIRDocument15 pagesMarubeni vs. CIRMiakaNo ratings yet

- San Roque Power Corporation Vs CIRDocument21 pagesSan Roque Power Corporation Vs CIRJessNo ratings yet

- 2023 AUSL LMT - Comm and Tax Law (Clarification)Document1 page2023 AUSL LMT - Comm and Tax Law (Clarification)Matt Panganiban MejosNo ratings yet

- Dispute Resolution Procedure: Ranjan Kumar BhowmikDocument10 pagesDispute Resolution Procedure: Ranjan Kumar Bhowmikmir makarim ahsanNo ratings yet

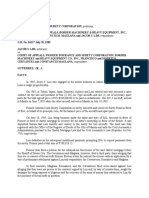

- Petitioner Vs Vs Respondent: First DivisionDocument6 pagesPetitioner Vs Vs Respondent: First DivisionButch MaatNo ratings yet

- Question The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealDocument3 pagesQuestion The Constitutionality or Legality of Tax Ordinances or Revenue Measures On AppealMowie AngelesNo ratings yet

- Pioneer and RefractoriesDocument4 pagesPioneer and RefractoriesMonalieNo ratings yet

- Doctrine:: Spouses Dennis Orsolino and Melody Orsolino Vs Violeta Frany G.R. No. 193887 March 29, 2017Document2 pagesDoctrine:: Spouses Dennis Orsolino and Melody Orsolino Vs Violeta Frany G.R. No. 193887 March 29, 2017Monalie100% (1)

- Procedure of Protest of Real Property TaxationDocument1 pageProcedure of Protest of Real Property TaxationMonalieNo ratings yet