Professional Documents

Culture Documents

Automobiles: Weak Quarter, But Performance Improves Sequentially

Uploaded by

darshanmadeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Automobiles: Weak Quarter, But Performance Improves Sequentially

Uploaded by

darshanmadeCopyright:

Available Formats

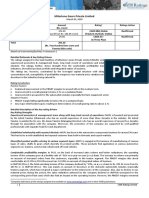

Sector Update

Automobiles

Weak quarter, but performance improves sequentially

As anticipated, Q3FY2020 was a weak quarter for automobile

Q3FY2020 Results Review

companies with the universe’ (ex-TAMO) revenue and net profit

Sector: Automobiles falling by 6% and 10% y-o-y, respectively. However, Q3 performance

was much better as compared to Q2FY2020, where the automobile

Sector View: Neutral universe topline and net profit fell by 15% and 17%, respectively.

Automotive OEM companies reported topline drop of 5% yoy (driven

by drop in the volumes) while the auto ancillary companies topline

dipped by 7% yoy (dragged by weak OEM demand and weakness in

Our active coverage universe overseas markets namely Europe and USA). Automobile companies

CMP PT

held onto the margins, reporting OPM of 12.4% in Q3FY2020 as

Companies

(Rs)

Reco.

(Rs) compared to 12.2% in Q3FY2019. While auto companies had the

benefit of lower commodity prices, it was largely offset by higher

Maruti Suzuki 6,755 Hold 7,500 discounting and negative operating leverage because of weak

Hero Motocorp 2,240 Hold 2,750 demand. OEM companies reported better margin performance with

Bajaj Auto 3,062 Buy 3,670

50 bps yoy improvement (driven by cost control measures) while

the auto ancillary companies margins dropped 60 bps yoy due to

TVS Motors 446 Hold 485

pricing pressures from OEM. The decline in other income of select

M&M @ 525 Buy 665 companies (Maruti Suzuki, M&M and Bajaj Auto) due to lower yields

Ashok Leyland 84 Hold 90 on investments led to the auto universe net profit falling by 10%

y-o-y. Given the better operating performance; OEM’s reported lower

Apollo Tyres # 158 Buy 200

decline of 7% yoy while the auto ancillary companies reported sharp

Greaves Cotton 140 Hold 155 21% drop in profitability.

UR - Under Review, @ MM+MVML

Outlook:

BS6 transition to impact volumes in the near term; Expect recovery

from H2FY2021: Automotive companies, particularly PV and 2W

players, started to introduce BS6 variants in the market from January

Price chart 2020 to ensure smooth transition to BS6 norms. Auto companies would

stop production of BS4 vehicles and completely switch to only BS6

120

110

production by the end of February 2020. Transition to BS6 norms would

100 entail huge cost increases (10-12% hike) and would keep automotive

90 volumes under pressure in the next three to four quarters. We expect

80 recovery in volumes from H2FY2021 with the advent of the festive

70

season and the transition impact of BS6 getting over by then. Huge

60

infrastructure investments coupled with improving rural economy (due

Feb-19

Feb-20

Jun-19

Oct-19

to strong rabi output) are likely to improve economic growth, resulting in

Nifty Nifty Auto sustained recovery in automotive volumes. Moreover, pent-up demand

(auto volumes have been under pressure since H2FY2019) and an

improved financing situation are expected to lead to recovery for the

sector.

Valuation

Automotive volumes are expected to remain under pressure in the near

term given the weak economic growth and transition to BS6 emission

norms w.e.f. April 1, 2020. The Nifty Auto Index has been sluggish

with marginal 4% drop in the past three months as compared to flat

performance of the benchmark Nifty. We retain our Neutral view on

the sector. In the OEM space, we like M&M (due to improved volume

outlook for tractors and new launches in the auto segment) and Bajaj

Auto (market share gains due to new launches and healthy growth

in exports). In the auto ancillary space, we like Balkrishna Industries

(due to healthy demand outlook in key markets due to easing of trade

tensions and favourable weather conditions) and Apollo Tyres (due to

demand recovery in India and ramp up of European operations).

Coronavirus impact: Most automotive OEM’s (except Tata Motors) have

not felt the impact of the fallout of coronavirus in China (certain auto

components players like Bosch have manufacturing plants in China)

on their production so far. OEM’s have inventory for about a month

and have stated that they need to monitor the situation in China for

the next 10-15 days. If production in China is impacted beyond the next

two weeks, the production of automotive companies in India could also

February 20, 2020 13

Sector Update

be impacted. Tata Motors which has manufacturing presence in China has stated that JLR volumes would be

impacted in Q4FY20. Also, the outbreak of the virus has led to the softening of global commodity prices such

as lead (beneficial for Exide Industries) and crude prices (beneficial for tyre players such as Apollo Tyres and

Balkrishna Industries).

Scrappage policy would provide boost to the sector: The government is working on a scrappage policy to

revive the automotive sector. If adequate incentives are provided to replace old vehicles with new ones, it

could result in a significant jump in automotive demand.

Key risks: 1) Prolonged weakness in demand. 2) Increased discounting adopted during transition from BS-IV to

BS-VI norms would impact performance.

Preferred picks: M&M, Bajaj Auto, Balkrishna Industries, Exide Industries and Apollo Tyres

Leaders in Q3FY2020: Hero MotoCorp, Bajaj Auto and Exide Industries

Laggards in Q3FY2020: Ashok Leyland, M&M and Apollo Tyres

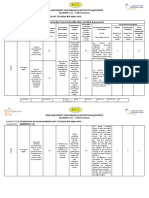

Q3FY2020 result snapshot

Sales (Rs cr) EBIDTA margins (%) PAT (Rs cr)

Particulars Q3 Q3 YoY QoQ Q3 Q3 YoY QoQ Q3 Q3 YoY QoQ

FY20 FY19 % % FY20 FY19 bps bps FY20 FY19 % %

Coverage

Maruti Suzuki 20,706.8 19,668.3 5.3 21.9 10.2 9.8 33.3 69.5 1,564.8 1,489.3 5.1 15.2

Hero Motocorp 6,996.7 7,864.8 -11.0 -7.6 14.8 14.0 80.2 30.5 880.4 769.1 14.5 -4.3

Bajaj Auto 7,639.7 7,435.8 2.7 -0.9 17.9 16.3 159.0 131.4 1,261.6 1,101.9 14.5 -10.0

TVS Motors 4,125.5 4,664.0 -11.5 -5.1 8.8 8.1 75.0 2.1 197.1 178.4 10.5 10.1

M&M # 12,120.3 12,892.5 -6.0 10.8 14.8 13.2 155 66.8 980.7 1,476.0 -33.6 -27.6

Ashok Leyland 4,015.7 6,325.2 -36.5 2.2 5.6 10.3 -466.4 -21.0 29.9 387.9 -92.3 -71.1

Apollo Tyres @ 4,399.7 4,718.4 -6.8 10.4 12.1 11.2 94.9 128.8 173.9 258.0 -32.6 109.3

Greaves Cotton 494.7 506.5 -2.3 0.9 15.6 13.9 167.0 353.1 49.3 47.7 3.4 22.6

Soft Coverage:

Tata Motors @ 71,676.1 76,915.9 -6.8 9.5 10.0 7.7 229.7 -90.3 1,739.4 1,021.5 70.3 NA

Eicher Motors @ 2,371.0 2,341.1 1.3 8.1 25.0 29.0 -404.7 28.5 498.7 533.0 -6.4 -12.9

Exide Industries 2,411.5 2,496.8 -3.4 -7.6 13.3 12.5 74.6 -80.2 217.6 155.0 40.4 -8.3

Bharat Forge 1,076.7 1,692.5 -36.4 -14.5 21.9 28.8 -689.3 -353.8 127.8 271.0 -52.8 -47.8

Ceat @ 1,761.8 1,729.8 1.9 4.2 10.4 8.2 215.8 32.7 53.0 52.8 0.5 18.4

Minda Industries @* 1,326.8 1,470.1 -9.7 -2.4 12.3 12.3 3.9 42.4 49.9 69.4 -28.0 0.9

Sundram Fasteners 692.8 1,018.8 -32.0 -9.7 16.8 19.0 -220.2 -123.8 103.0 111.5 -7.6 45.0

Endurance 1,640.5 1,813.0 -9.5 -7.4 15.9 14.0 192.5 -55.3 124.0 117.4 5.7 -26.6

Technologies @

Motherson Sumi @* 15,661.1 16,473.0 -4.9 -1.7 7.9 8.5 -56.8 -39.2 270.5 389.1 -30.5 -29.7

GNA Axles 214.1 246.3 -13.0 -16.3 11.2 15.8 -463.7 -462.7 7.6 18.0 -57.4 -65.7

Escorts 1,633.4 1,655.1 -1.3 23.4 13.0 12.1 88.1 342.3 153.1 129.2 18.5 34.5

Suprajit Engineering @ 412.3 405.6 1.6 3.5 12.1 15.0 -280.8 -185.3 31.2 39.2 -20.4 -30.6

Lumax Auto 287.0 291.8 -1.7 -2.3 8.3 8.9 -61.3 -103.4 11.6 15.2 -23.6 -44.3

Technologies @

Alicon Castalloy @ 226.9 267.7 -15.2 -14.8 14.0 12.9 110.5 98.1 8.4 11.0 -23.0 -9.9

Balkrishna Industries 1,183.5 1,196.6 -1.1 6.9 30.8 24.4 640.3 338.7 220.7 144.7 52.5 -24.2

Auto Universe 163,074.4 174,089.5 -6.3 6.9 11.3 10.2 110.9 -24.1 8,754.4 8,785.9 -0.4 17.3

Auto universe (ex 91,398.4 97,173.6 -5.9 4.8 12.4 12.2 16.0 29.9 7,015.0 7,764.4 -9.7 -9.1

TAMO)

Source: Company; Sharekhan Research # MM+MVML ; @ Consolidated; @* not comparable due to acquisition;

February 20, 2020 14

Sector Update

Valuations

EPS (Rs) P/E (X) Price Target

Companies CMP Reco

FY19 FY20E FY21E FY19 FY20E FY21E (Rs)

Coverage

Maruti Suzuki 6,755 248.3 205.1 242.3 27.2 32.9 27.9 Hold 7,500

Hero Motocorp 2,240 169.5 173.3 167.3 13.2 12.9 13.4 Hold 2,750

Bajaj Auto 3,062 149.8 174.9 186.3 20.4 17.5 16.4 Buy 3,670

TVS Motors $ 446 14.1 14.5 15.8 29.4 28.6 26.3 Hold 485

M&M @ $ 525 43.6 34.1 31.7 6.8 8.7 9.3 Buy 665

Ashok Leyland 84 7.0 2.0 1.9 12.0 42.0 44.2 Hold 90

Apollo Tyres # 158 15.4 10.2 14.4 10.3 15.5 11.0 Buy 200

Greaves Cotton 140 7.5 7.2 7.7 18.7 19.4 18.2 Hold 155

Soft Coverage:

Eicher Motors # 18,845 807.4 764.5 870.3 23.3 24.7 21.7 Not Under Coverage

Balkrishna Industries 1,266 40.5 50.0 59.5 31.3 25.3 21.3 Positive

Exide Industries $ 178 8.7 10.0 10.6 15.6 13.6 12.8 Positive

Sundram Fasteners # 450 21.8 16.5 16.5 20.6 27.3 27.3 Neutral

GNA Axles 234 30.7 26.5 22.6 7.6 8.8 10.4 Book Out

Lumax Auto Tech# 107 9.6 8.3 8.6 11.1 12.9 12.4 Neutral

Tata Motors# * 158 -2.9 -4.6 8.7 NA NA 18.2 Not Under Coverage

Tata Motors- DVR #* 65 -2.9 -4.6 8.7 NA NA 7.5 Not Under Coverage

Alicon Castalloy Ltd. # 362 39.6 26.3 38.9 9.1 13.8 9.3 Positive

Mayur Uniquoters 275 19.7 17.0 19.9 14.0 16.2 13.8 Positive

Source: Company; Sharekhan Research

@-MM & MVML; #- Consolidated;*FY19 EPS adjusted for impairment loss; $ core business valuation

February 20, 2020 15

Sector Update

Revision in earnings estimates

Current Previous Target

Company Name Change in Estimate Reasoning

Reco Reco Price

Maruti Suzuki Downwards To factor in weaker-than-anticipated results and Hold Hold 7,500

lower realisations due to exit from the diesel

segment, we have cut our FY2020 and FY2021

estimates by 7%.

Hero MotoCorp Maintained Hero’s results were ahead of estimates, driven Hold Hold 2,750

by better-than-expected margin performance. We

have broadly retained our earnings estimates.

Bajaj Auto Upwards BAL is expected to continue outpacing the Buy Buy 3,670

industry’s growth, driven by launch of new

products with additional features and robust

export growth. Given the better-than-anticipated

margin performance in Q3FY2020, we have

marginally raised our FY2021 and FY2022

estimates by 3%.

TVS Motors Upwards The 2W industry is expected to recover from Reduce Hold 485

H2FY2021 post the transition to BS6 emission

norms. Moreover, sustained cost-control measures

and improving localisation levels would enable

TVSM to offset cost pressures on account of BS6

norms. We expect TVSM margin improvement to

sustain. We have raised our FY2020 and FY2021

estimates due to better-than-expected Q3 results

and rollover our multiple on FY2022 earnings.

M&M Downwards New launches in the automotive segment would Buy Buy 665

boost automotive sales volumes. Moreover, with

higher rabi sowing and water reservoir levels,

M&M expects the tractor industry to return to the

growth trajectory and expects volumes to rise by

5% in FY2021. Given the impact of transition to

BS6 norms, we have cut our FY2020 and FY2021

estimates by 6%.

Ashok Leyland Downwards Domestic MHCV demand is expected to remain Hold Hold 90

under pressure over the next 3 to 4 quarters due

to subdued economic growth and cost increases

due to BS6 transition. Demand revival would take

time and is expected to recover from H2FY2021.

Given weak Q3 results and volume pressures

in the near term, we have cut our FY2020 and

FY2021 estimates.

Apollo Tyres Maintained We have retained our FY2021 estimates given the Hold Buy 200

in-line operating performance in Q3FY2020. We

have introduced FY2022 earnings in this note and

expect strong 28% earnings CAGR over FY2020-

FY2022, driven by recovery in domestic demand

and margin improvement. We rollover our target

multiple of 12x to FY2022 earnings and upgrade

our recommendation to Buy.

Greaves Cotton Upwards Volumes are expected to be under pressure as Hold Hold 155

3W diesel engines fall post steep cost increases.

Drop in diesel 3W volumes would offset the strong

growth in electric scooters and aftermarkets

and we expect flat volumes for FY2021. Given

better-than-expected 3QFY2020 results and new

product launches in the electric scooter segment,

we have increased our FY2021 estimates by

about 7%.

February 20, 2020 16

Sector Update

Revision in earnings estimates

Current Previous Target

Company Name Change in Estimate Reasoning

Reco Reco Price

Balkrishna Industries Upwards Balkrishna surprised positively with strong margin Positive Positive 1469

improvement in Q3FY2020. As per management,

Q3 margins are sustainable given favourable

raw-material prices and captive sourcing of

carbon black. To factor margin improvement and

sales of carbon black outside (second phase of

carbon black plant would create certain surplus

capacity), we have raised our FY2021 and

FY2022 estimates by ~20%.

Alicon Castalloy Maintained Strong order book in both domestic and exports Positive Positive 469

provides robust growth visibility and we expect

a 15% topline CAGR over FY2020-FY2022.

Moreover, margin improvement is expected

to sustain given the cost-control initiatives.

Q3FY2020 results were ahead of our estimates

as margins surprised positively. We have broadly

retained our earnings estimates for FY2021.

Exide Industries Downwards Exide’s topline growth is expected to recover Positive Positive 227

on account of improvement in automotive OEM

volumes and improved traction in the industrial

segment. Margins are expected to improve driven

by soft lead prices and cost-control measures

undertaken by the company. We have reduced

our FY2020 and FY2021 earnings estimates by

7% each to factor topline miss in Q3FY2020 and

lower realisation due to fall in lead prices.

GNA Axles Downwards Revenue is expected to remain under pressure Positive Book NA

given the deterioration in export markets, Out

especially in the U.S. Margins are expected

to decline due to negative operating leverage

because of fall in the topline and adverse mix due

to steep decline in exports. We have reduced our

FY2020 and FY2021 estimates by 26% and 35%,

respectively.

February 20, 2020 17

Sector Update

Volume growth (%) Segmental volume growth trend in CV

100%

MSIL

80%

HMCL

BAL 60%

TVS

40%

M&M (Auto)

M&M (Tractor) 20%

ALL 0%

TAMO (Domestic) Q1FY19 Q2FY19 Q3FY19 Q4FY19 Q1FY20 Q2FY20 Q3FY20

-20%

TAMO (JLR)

Eicher (Motorcycle) -40%

Eicher (CV) -60%

-40 -30 -20 -10 0 10 MHCV LCV

Source: Company; Sharekhan Research Source: Company; Sharekhan Research

Segmental volume growth trend in 2W and PV Auto universe y-o-y revenue growth trend

20% 120,000 30

15% 100,000 20

10%

80,000

5% 10

0% 60,000

Q1FY19 Q2FY19 Q3FY19 Q4FY19 Q1FY20 Q2FY20 Q3FY20 0

-5% 40,000

-10% -10

20,000

-15%

-20% 0 -20

Q1FY19 Q2FY19 Q3FY19 Q4FY19 Q1FY20 Q2FY20 Q3FY20

-25%

2W PV Auto universe Revenues (LHS - Rs Cr) Growth (% - RHS)

Source: Company; Sharekhan Research Source: Company; Sharekhan Research

Auto universe y-o-y EBITDA - OPM trend Auto universe y-o-y PAT growth trend

16,000 16 10000 40

14,000 30

15 8000

12,000 20

14

10,000 6000 10

8,000 13

4000 0

6,000

12 -10

4,000 2000

11 -20

2,000

0 -30

0 10

Q1FY19 Q2FY19 Q3FY19 Q4FY19 Q1FY20 Q2FY20 Q3FY20

Q1FY19 Q2FY19 Q3FY19 Q4FY19 Q1FY20 Q2FY20 Q3FY20

Auto Universe EBITDA (Rs cr) Adjusted OPM (%) Auto universe Pat Adjusted (Rs Cr - LHS) Growth (% - RHS)

Source: Company; Sharekhan Research Source: Company; Sharekhan Research

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

February 20, 2020 18

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he or its associates

or his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of

the company at the end of the month immediately preceding the date of publication of the research report nor have any material

conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further, the

analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg

Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE

/ NSE / MSEI (CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786;

Mutual Fund: ARN 20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- CF34-10E LM June 09 Print PDFDocument301 pagesCF34-10E LM June 09 Print PDFPiipe780% (5)

- A Guide To The Automation Body of Knowledge, 2nd EditionDocument8 pagesA Guide To The Automation Body of Knowledge, 2nd EditionTito Livio0% (9)

- Factory Act Gujarat PDFDocument2 pagesFactory Act Gujarat PDFKeith100% (1)

- Volatility Index 75 Macfibonacci Trading PDFDocument3 pagesVolatility Index 75 Macfibonacci Trading PDFSidibe MoctarNo ratings yet

- India - Sector Update - AutomobilesDocument21 pagesIndia - Sector Update - AutomobilesRaghav RawatNo ratings yet

- IDirect Auto SectorUpdate 27mar20 PDFDocument13 pagesIDirect Auto SectorUpdate 27mar20 PDFSuryansh SinghNo ratings yet

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocument5 pages354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNo ratings yet

- Two Wheeler Sector - 26 May 2015Document48 pagesTwo Wheeler Sector - 26 May 2015Nishi TaraiNo ratings yet

- Bajaj Ru Q4fy20 LKP 21st May'20Document4 pagesBajaj Ru Q4fy20 LKP 21st May'20Deepak GNo ratings yet

- Visit Us atDocument3 pagesVisit Us atrooni889No ratings yet

- Rounded Recovery Broadens Opportunity Pie : (Exhibit 1)Document16 pagesRounded Recovery Broadens Opportunity Pie : (Exhibit 1)naman makkarNo ratings yet

- Tvs Motors LTD: Company OverviewDocument3 pagesTvs Motors LTD: Company OverviewJOEL JOHNSONNo ratings yet

- Automobiles: Angels Outweighing DemonsDocument14 pagesAutomobiles: Angels Outweighing DemonsbradburywillsNo ratings yet

- Auto Ancilliary Report - Feb23Document9 pagesAuto Ancilliary Report - Feb23adityaNo ratings yet

- Rhb-Report-My Auto-Autoparts Sector-Update 20221220 Rhb-455520052830373463a0e2ea31079 1671616235Document6 pagesRhb-Report-My Auto-Autoparts Sector-Update 20221220 Rhb-455520052830373463a0e2ea31079 1671616235Premier Consult SolutionsNo ratings yet

- Two Wheeler Industry 13 May 2010Document43 pagesTwo Wheeler Industry 13 May 2010Sushmita MohantaNo ratings yet

- Automobile Automobile AncillaryDocument3 pagesAutomobile Automobile Ancillaryprem sagarNo ratings yet

- Trimegah CF 20231124 ASII - A Mid-2024 PlayDocument12 pagesTrimegah CF 20231124 ASII - A Mid-2024 PlayMuhammad ErnandaNo ratings yet

- January 30, 2009Document1 pageJanuary 30, 2009fad_jav100% (2)

- Bajaj Auto LTD - An AnalysisDocument25 pagesBajaj Auto LTD - An AnalysisDevi YesodharanNo ratings yet

- Stock Report On Baja Auto in India Ma 23 2020Document12 pagesStock Report On Baja Auto in India Ma 23 2020PranavPillaiNo ratings yet

- 1.1 Importance of The TopicDocument10 pages1.1 Importance of The TopicKushi RajuNo ratings yet

- Milestone Gears Private Limited-03-09-2020Document4 pagesMilestone Gears Private Limited-03-09-2020Puneet367No ratings yet

- Asahi India Glass Initiation - 210702Document31 pagesAsahi India Glass Initiation - 210702vandit dharamshi100% (1)

- MiCE TATA PROJECTDocument23 pagesMiCE TATA PROJECTKhushi ShahNo ratings yet

- Management Discussion and AnalysisDocument30 pagesManagement Discussion and Analysispanditak521No ratings yet

- Atul Auto 1QFY20 Result Update - 190813 - Antique ResearchDocument4 pagesAtul Auto 1QFY20 Result Update - 190813 - Antique ResearchdarshanmadeNo ratings yet

- Two-Wheeler Sector: Shape Shifting in The Wake of BS-VI and ElectrificationDocument64 pagesTwo-Wheeler Sector: Shape Shifting in The Wake of BS-VI and Electrificationadityakhanna83No ratings yet

- Auto - 4QFY19 Results Preview - HDFC Sec-201904120846431602685Document13 pagesAuto - 4QFY19 Results Preview - HDFC Sec-201904120846431602685Sonakshi AgarwalNo ratings yet

- Mahindra & Mahindra LTD.: Key Result Highlights - Q4FY17Document6 pagesMahindra & Mahindra LTD.: Key Result Highlights - Q4FY17anjugaduNo ratings yet

- Insights Government To Liberalise Auto Sector Over Next Five YearsDocument7 pagesInsights Government To Liberalise Auto Sector Over Next Five YearsNickael TanNo ratings yet

- MOSL Subros 201809 Initiating CoverageDocument18 pagesMOSL Subros 201809 Initiating Coveragerchawdhry123No ratings yet

- Ashok Leyland: Tough Times Ahead Downgrade To ReduceDocument5 pagesAshok Leyland: Tough Times Ahead Downgrade To ReduceYogesh KumarNo ratings yet

- Mahindra Logistics Limited: Challenging Business Outlook For The Medium TermDocument6 pagesMahindra Logistics Limited: Challenging Business Outlook For The Medium TermdarshanmadeNo ratings yet

- SH 2015 Q3 1 ICRA AutocomponentsDocument7 pagesSH 2015 Q3 1 ICRA AutocomponentsjhampiaNo ratings yet

- Bajaj Auto 1QFY20 Result Update - 190729 - Antique Research PDFDocument5 pagesBajaj Auto 1QFY20 Result Update - 190729 - Antique Research PDFdarshanmadeNo ratings yet

- Management Discussion and AnalysisDocument22 pagesManagement Discussion and AnalysisChiradeep BhattacharyaNo ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- Transcript Earnings Call-Maruti Suzuki Q4F 20 and Full Year FY20Document12 pagesTranscript Earnings Call-Maruti Suzuki Q4F 20 and Full Year FY20AswinAniNo ratings yet

- Ashoka Buildcon Limited: Healthy Business Outlook StaysDocument6 pagesAshoka Buildcon Limited: Healthy Business Outlook StaysdarshanmadeNo ratings yet

- Ashok Leyland Q3FY19 Result UpdateDocument4 pagesAshok Leyland Q3FY19 Result Updatekapil bahetiNo ratings yet

- IndiNivesh Best Sectors Stocks Post 2014Document49 pagesIndiNivesh Best Sectors Stocks Post 2014Arunddhuti RayNo ratings yet

- Maruti Suzuki India: Muted Quarter Volume Trough Seemingly in SightDocument12 pagesMaruti Suzuki India: Muted Quarter Volume Trough Seemingly in SightDushyant ChaturvediNo ratings yet

- Maruti Suzuki India: Volume Decline in Offing, Expensive ValuationsDocument13 pagesMaruti Suzuki India: Volume Decline in Offing, Expensive ValuationsPulkit TalujaNo ratings yet

- Indian IT Services - Sector Report 6mar09Document73 pagesIndian IT Services - Sector Report 6mar09BALAJI RAVISHANKARNo ratings yet

- Auto Parts in KSADocument3 pagesAuto Parts in KSAmohammad gouseNo ratings yet

- Equity Report: Apollo TyresDocument10 pagesEquity Report: Apollo TyresGracey ReignNo ratings yet

- Coronavirus' Impact On India's Auto Sector - The Economic TimesDocument2 pagesCoronavirus' Impact On India's Auto Sector - The Economic TimesPreshit DalviNo ratings yet

- 2009 Indian Auto Sector OutlookDocument3 pages2009 Indian Auto Sector OutlookvineetksrNo ratings yet

- A Mar A Raja BatteriesDocument12 pagesA Mar A Raja Batteriesjoshhere141No ratings yet

- Strategy Auto 20230302 Mosl Su PG012Document12 pagesStrategy Auto 20230302 Mosl Su PG012Aakash ChhariaNo ratings yet

- Research Report Maruti Suzuki Ltd.Document8 pagesResearch Report Maruti Suzuki Ltd.Harshavardhan pasupuletiNo ratings yet

- Asian Paints: Volume Led Growth ContinuesDocument9 pagesAsian Paints: Volume Led Growth ContinuesanjugaduNo ratings yet

- Castrol India LTD: November 06, 2018Document17 pagesCastrol India LTD: November 06, 2018Yash AgarwalNo ratings yet

- Indian Automotive Market - FrostDocument5 pagesIndian Automotive Market - FrostdesijarmanNo ratings yet

- With India's Economy Growing at About 7%, Why The Auto Industry Is Hurting So Badly?Document6 pagesWith India's Economy Growing at About 7%, Why The Auto Industry Is Hurting So Badly?JPNo ratings yet

- TVS Motor - 1QFY20 Result - JM FinancialDocument8 pagesTVS Motor - 1QFY20 Result - JM FinancialdarshanmadeNo ratings yet

- Balkrishna Industries: Steady Run Ahead After Strong Q4Document6 pagesBalkrishna Industries: Steady Run Ahead After Strong Q4darshanmadeNo ratings yet

- ICRA Report 2 WheelersDocument6 pagesICRA Report 2 WheelersMayank JainNo ratings yet

- Capital Goods: Gujarat Apollo Industries LTDDocument20 pagesCapital Goods: Gujarat Apollo Industries LTDcos.secNo ratings yet

- Nirmal Bang Tyre Sector Initiating Coverage 15 December 2020Document45 pagesNirmal Bang Tyre Sector Initiating Coverage 15 December 2020Kumar DiwakarNo ratings yet

- Pidilite-Apr21 2020Document8 pagesPidilite-Apr21 2020KRUTIK MEHTANo ratings yet

- Epw AutocompDocument1 pageEpw Autocompkalita_onlineNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- ITC by EdelweissDocument9 pagesITC by EdelweissdarshanmadeNo ratings yet

- Agri and Chemicals - 3QFY20 Preview - 20200116 - IIFLDocument22 pagesAgri and Chemicals - 3QFY20 Preview - 20200116 - IIFLdarshanmadeNo ratings yet

- Agrochem PCDocument6 pagesAgrochem PCdarshanmadeNo ratings yet

- Spark - Agri Update Dec 2019Document19 pagesSpark - Agri Update Dec 2019darshanmadeNo ratings yet

- MindTree Kotak Institutional-Q4FY22Document14 pagesMindTree Kotak Institutional-Q4FY22darshanmadeNo ratings yet

- Angel One Q4FY22 ResultsDocument6 pagesAngel One Q4FY22 ResultsdarshanmadeNo ratings yet

- IDirect AtulAuto CoUpdate Apr22Document5 pagesIDirect AtulAuto CoUpdate Apr22darshanmadeNo ratings yet

- Mindtree-Q4FY22 MOFSLDocument12 pagesMindtree-Q4FY22 MOFSLdarshanmadeNo ratings yet

- Agri Inputs: Resurgent Monsoon (0% Deficit) Bodes Well For Agrochemical CompaniesDocument13 pagesAgri Inputs: Resurgent Monsoon (0% Deficit) Bodes Well For Agrochemical CompaniesdarshanmadeNo ratings yet

- Housing Development Finance Corporation: Steady PerformanceDocument5 pagesHousing Development Finance Corporation: Steady PerformancedarshanmadeNo ratings yet

- Bajaj Auto: To Outgrow The IndustryDocument6 pagesBajaj Auto: To Outgrow The IndustrydarshanmadeNo ratings yet

- Cummins YesDocument8 pagesCummins YesdarshanmadeNo ratings yet

- Maruti Suzuki: Demand To Remain Muted in Near TermDocument5 pagesMaruti Suzuki: Demand To Remain Muted in Near TermdarshanmadeNo ratings yet

- Piramal Enterprises - MOStDocument8 pagesPiramal Enterprises - MOStdarshanmadeNo ratings yet

- Moil 20nov19 Kotak PCG 00153Document7 pagesMoil 20nov19 Kotak PCG 00153darshanmadeNo ratings yet

- HDFC Life - 1QFY20 Result - SharekhanDocument7 pagesHDFC Life - 1QFY20 Result - SharekhandarshanmadeNo ratings yet

- KNR Constructions Limited: A Strong Bounce BackDocument6 pagesKNR Constructions Limited: A Strong Bounce BackdarshanmadeNo ratings yet

- Max Financial Services: Strong Business, Attractive ValuationsDocument5 pagesMax Financial Services: Strong Business, Attractive ValuationsdarshanmadeNo ratings yet

- Wonderla Holidays - 1QFY20 Result - SharekhanDocument7 pagesWonderla Holidays - 1QFY20 Result - SharekhandarshanmadeNo ratings yet

- Spandana Sphoorty Financial Limited: Sector: Banks & Finance Result UpdateDocument7 pagesSpandana Sphoorty Financial Limited: Sector: Banks & Finance Result UpdatedarshanmadeNo ratings yet

- Coal India: Lower E-Auction Price Impact Performance Valuation AttractiveDocument6 pagesCoal India: Lower E-Auction Price Impact Performance Valuation AttractivedarshanmadeNo ratings yet

- IndianHotel-June11 2020Document7 pagesIndianHotel-June11 2020darshanmadeNo ratings yet

- S L S L (SLSL) : Uven IFE Ciences TDDocument5 pagesS L S L (SLSL) : Uven IFE Ciences TDdarshanmadeNo ratings yet

- Kewal Kiran Clothing: Margins To Remain Stressed, Book OutDocument4 pagesKewal Kiran Clothing: Margins To Remain Stressed, Book OutdarshanmadeNo ratings yet

- Cera SanitaryWare Company Update PDFDocument8 pagesCera SanitaryWare Company Update PDFdarshanmadeNo ratings yet

- Aurobindo Q2 FY21RU-YES SECURITIES PDFDocument4 pagesAurobindo Q2 FY21RU-YES SECURITIES PDFdarshanmadeNo ratings yet

- Finolex Cables: Weak Quarter Headwinds PersistsDocument6 pagesFinolex Cables: Weak Quarter Headwinds PersistsdarshanmadeNo ratings yet

- Talbros Automotive Components - Kotak SecuritiesDocument7 pagesTalbros Automotive Components - Kotak SecuritiesdarshanmadeNo ratings yet

- DR Reddy's Lab - Management Visit Note - Centrum 05092019 PDFDocument6 pagesDR Reddy's Lab - Management Visit Note - Centrum 05092019 PDFdarshanmadeNo ratings yet

- Delivers Healthy Performance: Sector: Agri Chem Result UpdateDocument6 pagesDelivers Healthy Performance: Sector: Agri Chem Result UpdatedarshanmadeNo ratings yet

- CIMB-Financial Statement 2014 PDFDocument413 pagesCIMB-Financial Statement 2014 PDFEsplanadeNo ratings yet

- PMP Cheat SheetDocument9 pagesPMP Cheat SheetzepededudaNo ratings yet

- Case Laws IBBIDocument21 pagesCase Laws IBBIAbhinjoy PalNo ratings yet

- CPS Fitting Stations by County - 22 - 0817Document33 pagesCPS Fitting Stations by County - 22 - 0817Melissa R.No ratings yet

- Progress Test 3Document7 pagesProgress Test 3Mỹ Dung PntNo ratings yet

- Ansoff Matrix of TescoDocument2 pagesAnsoff Matrix of TescoMy GardenNo ratings yet

- Farm LeaseDocument5 pagesFarm LeaseRocketLawyer100% (1)

- Module 1 Unit 2 - Hardware and Software MGT PDFDocument7 pagesModule 1 Unit 2 - Hardware and Software MGT PDFRose Bella Tabora LacanilaoNo ratings yet

- Instructions For Form 8824Document4 pagesInstructions For Form 8824Abdullah TheNo ratings yet

- Bank Statement - Feb.2020Document5 pagesBank Statement - Feb.2020TRIVEDI ANILNo ratings yet

- Architect Strengths and Weaknesses - 16personalitiesDocument4 pagesArchitect Strengths and Weaknesses - 16personalitiesIsaacNo ratings yet

- UntitledDocument72 pagesUntitledMark SinclairNo ratings yet

- Afirstlook PPT 11 22Document20 pagesAfirstlook PPT 11 22nickpho21No ratings yet

- 10 Professional Tax Software Must-Haves White PaperDocument2 pages10 Professional Tax Software Must-Haves White PaperRakesh KumarNo ratings yet

- JavaDocument14 pagesJavaGANESH REDDYNo ratings yet

- 2.21 - Hazard Identification Form - Fall ProtectionDocument3 pages2.21 - Hazard Identification Form - Fall ProtectionSn AhsanNo ratings yet

- Jacob Engine Brake Aplicación PDFDocument18 pagesJacob Engine Brake Aplicación PDFHamilton MirandaNo ratings yet

- Novtang (Int'l Wed)Document3 pagesNovtang (Int'l Wed)raymondsuwsNo ratings yet

- Dialux BRP391 40W DM CT Cabinet SystemDocument20 pagesDialux BRP391 40W DM CT Cabinet SystemRahmat mulyanaNo ratings yet

- 6-GFM Series: Main Applications DimensionsDocument2 pages6-GFM Series: Main Applications Dimensionsleslie azabacheNo ratings yet

- TCS-60 WebDocument94 pagesTCS-60 WebNasrul Salman100% (1)

- Application & Registration Form MSC International Business Management M2Document11 pagesApplication & Registration Form MSC International Business Management M2Way To Euro Mission Education ConsultancyNo ratings yet

- Guide Book - Investing and Doing Business in HCMC VietnamDocument66 pagesGuide Book - Investing and Doing Business in HCMC VietnamemvaphoNo ratings yet

- Define Technical Settings For All Involved Systems: PrerequisitesDocument2 pagesDefine Technical Settings For All Involved Systems: PrerequisitesGK SKNo ratings yet

- Citigroup - A Case Study in Managerial and Regulatory FailuresDocument70 pagesCitigroup - A Case Study in Managerial and Regulatory FailuresJulius NatividadNo ratings yet

- GMD 15 3161 2022Document22 pagesGMD 15 3161 2022Matija LozicNo ratings yet