Professional Documents

Culture Documents

The Role of Finance To The Economy

Uploaded by

Nasrudiin0 ratings0% found this document useful (0 votes)

215 views4 pagesThe financial system plays a crucial role in facilitating economic activity and growth. It provides credit, manages liquidity and risk, and links savings to investment. Specifically, the financial system supports businesses and governments through credit and capital markets, enables international trade, funds infrastructure development, supports employment growth, and balances growth across all economic sectors. Overall, a sound financial system is essential for the successful functioning and development of any modern economy.

Original Description:

finance of the economy

Original Title

The role of finance to the economy

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe financial system plays a crucial role in facilitating economic activity and growth. It provides credit, manages liquidity and risk, and links savings to investment. Specifically, the financial system supports businesses and governments through credit and capital markets, enables international trade, funds infrastructure development, supports employment growth, and balances growth across all economic sectors. Overall, a sound financial system is essential for the successful functioning and development of any modern economy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

215 views4 pagesThe Role of Finance To The Economy

Uploaded by

NasrudiinThe financial system plays a crucial role in facilitating economic activity and growth. It provides credit, manages liquidity and risk, and links savings to investment. Specifically, the financial system supports businesses and governments through credit and capital markets, enables international trade, funds infrastructure development, supports employment growth, and balances growth across all economic sectors. Overall, a sound financial system is essential for the successful functioning and development of any modern economy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

The role of finance to the economy

The functioning of an economy depends on the financial system of a country.

The financial system includes banks as a central entity along with other

financial services providers. The financial system of a country is deeply

entrenched in the society and provides employment to a large population.

According to Baily and Elliott, there are three major functions of the financial

system:

Credit Provision – Credit supports economic activity. Governments can invest

in infrastructure projects by reducing the cycles of tax revenues and correcting

spends, businesses can invest more than the cash they have and individuals can

purchase homes and other utilities without having to save the entire amount in

advance. Banks and other financial service providers give this credit facility to

all stakeholders.

Liquidity provision – Banks and other financial providers protect businesses and

individuals against sudden cash needs. Banks provide the facility of demand

deposits which the business or individual can withdraw at any time. Similarly,

they provide credit and overdraft facility to businesses. Moreover, banks and

financial institutions offer to buy or sell securities as per need and often in large

volumes to fulfil sudden cash requirements of the stakeholders.

Risk management services – Finance provides risk management from the risks

of financial markets and commodity prices by pooling risks. Derivative

transactions enable banks to provide this risk management. These services are

extremely valuable even though they receive a lot of flak due to excesses during

financial crisis.

Savings-investment relationship

The above three major functions are important for the running and development

activities of any economy. Apart from these functions, an economy’s growth is

boosted by the savings-investment relationship. When there are sufficient

savings, only then can there be sizeable investment and production activity. This

savings facility is provided by financial institutions through attractive interest

schemes. The money saved by the public is used by the financial institutions for

lending to businesses at substantial interest rates. These funds allow businesses

to increase their production and distribution activities.

Growth of capital markets

Another important work of finance is to boost growth of capital markets.

Businesses need two types of capital – fixed and working. Fixed capital refers to

the money needed to invest in infrastructure such as building, plant and

machinery. Working capital refers to the money needed to run the business on a

day-to-day basis. This may refer to the ongoing purchase of raw materials, cost

of finishing goods and transport of finished goods to stores or customers. The

financial system helps in raising capital in the following ways:

Fixed capital – Businesses issue shares and debentures to raise fixed capital.

Financial service providers, both public and private, invest in these shares and

debentures to make profits with minimal risk.

Working capital – Businesses issue bills, promissory notes etc. to raise short

term loans. These credit instruments are valid in the money markets that exist

for this purpose.

Foreign exchange markets

In order to support the export and import businessmen, there are foreign

exchange markets whereby businesses can receive and transmit funds to other

countries and in other currencies. These foreign exchange markets also enable

banks and other financial institutions to borrow or lend sums in other currencies.

Moreover, financial institutions can invest and reap profits from their short term

idle money by investing in foreign exchange markets. Governments also meet

their foreign exchange requirements through these markets. Hence, foreign

exchange markets impact the growth and goodwill of an economy in the

international markets.

Government securities

Governments use the financial system to raise funds for both short term and

long term fund requirements. Governments issue bonds and bills at attractive

interest rates and also provide tax concessions. Budget gaps are taken care of by

government securities. Thus, capital markets, foreign exchange markets and

government securities markets are essential for helping businesses, industries

and governments to carry out development and growth activities of the

economy.

Infrastructure and growth

The economic growth depends on the growth of infrastructural facilities of the

country. Key industries such as power, coal, oil determine the growth of other

industries. These infrastructure industries are funded by the finance system of

the country. The capital requirement for infrastructure industries is huge.

Raising such a huge amount is difficult for private players and hence,

traditionally, governments have taken care of infrastructure projects solely.

However, the economic liberalization policy led to the private sector

participation in infrastructure industries. Development and Merchant banks such

as IDBI in India help fund these activities for the private sector.

Trade development

Trade is the most important economic activity. Both, domestic and international

trade are supported by the financial system. Traders need finance which is

provided by the financial institutions. Financial markets on the other hand help

discount financial instruments such as promissory notes and bills. Commercial

banks finance international trade through pre and post-shipment funding. Letters

of credit are issued for importers, thereby helping the country to earn important

foreign exchange.

Employment growth

Financial system plays a key role in employment growth in an economy.

Businesses and industries are financed by the financial systems which lead to

growth in employment and in turn increases economic activity and domestic

trade. Increase in trade leads to increase in competition which leads to activities

such as sales and marketing which further increases employment in these

sectors.

Venture capital

Increase in venture capital or investment in ventures will boost growth in

economy. Currently, the extent of venture capital in India is less. It is difficult

for individual companies to invest in ventures directly due to the risk involved.

It is mostly the financial institutions that fund ventures. An increase in the

number of financial institutions supporting ventures will boost this segment.

Balances economic growth

The growth of different sectors of an economy is balanced through the financial

system. There are primary, secondary and tertiary sector industries and all need

sufficient funds for growth. The financial system of the country funds these

sectors and provides sufficient funds for each sector – industrial, agricultural

and services.

Thus, finance plays a key role in the development of any economy and no

economy can run successfully without a sound financial system.

You might also like

- Tax Policy Responses To The COVID-19 Crisis PDFDocument24 pagesTax Policy Responses To The COVID-19 Crisis PDFSanchit MiglaniNo ratings yet

- Introduction On MoneyDocument34 pagesIntroduction On MoneyJoseph sunday CarballoNo ratings yet

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramNo ratings yet

- Pricing Issues/Case Deliberation Nature View.: Session-8 18/11/2011Document22 pagesPricing Issues/Case Deliberation Nature View.: Session-8 18/11/2011Rajeev ShanbhagNo ratings yet

- Analysis of The Case: Grofers: Re-Energizing Kirana Stores Through M-CommerceDocument4 pagesAnalysis of The Case: Grofers: Re-Energizing Kirana Stores Through M-CommerceAmitrojitNo ratings yet

- FINANCIAL SYSTEM Role in Economic DevelopmentDocument4 pagesFINANCIAL SYSTEM Role in Economic Developmentrevathi alekhya80% (10)

- The Role of Financial System in The EconomyDocument15 pagesThe Role of Financial System in The Economymubarek100% (2)

- Thesis Book PDF PDFDocument48 pagesThesis Book PDF PDFamira abdalleNo ratings yet

- Consumption & SavingsDocument16 pagesConsumption & SavingsHeoHamHố100% (1)

- Global Financial CrisisDocument11 pagesGlobal Financial CrisisQuratulain SajalNo ratings yet

- Public RevenueDocument6 pagesPublic RevenueSandip KarNo ratings yet

- Financial Markets and Their Role in EconomyDocument6 pagesFinancial Markets and Their Role in EconomyMuzammil ShahzadNo ratings yet

- Definition: The Total Stock of Money Circulating in An Economy Is The Money Supply. TheDocument7 pagesDefinition: The Total Stock of Money Circulating in An Economy Is The Money Supply. TheSufian HimelNo ratings yet

- Capital and Money MarketDocument17 pagesCapital and Money MarketBalamanichalaBmcNo ratings yet

- Role of Financial Derivatives in Financial Risk ManagementDocument16 pagesRole of Financial Derivatives in Financial Risk ManagementTYBMS-A 3001 Ansh AgarwalNo ratings yet

- BIF Capital StructureDocument13 pagesBIF Capital Structuresagar_funkNo ratings yet

- Untitled 1Document3 pagesUntitled 1cesar_mayonte_montaNo ratings yet

- 1 Financial MarketDocument35 pages1 Financial MarketSachinGoelNo ratings yet

- What Caused "The Great Depression"Document3 pagesWhat Caused "The Great Depression"kashifshaikh76No ratings yet

- Chap 001Document14 pagesChap 001Adi Susilo100% (1)

- The Future of The Mobile Payment As Electronic Payment System PDFDocument6 pagesThe Future of The Mobile Payment As Electronic Payment System PDFRohan MehtaNo ratings yet

- Consumer Behavior of Credit Card Users in An Emerging MarketDocument12 pagesConsumer Behavior of Credit Card Users in An Emerging MarketUtal AntorNo ratings yet

- Crowding OutDocument3 pagesCrowding OutsattysattuNo ratings yet

- Exchange Rate ManagementDocument19 pagesExchange Rate ManagementRohit JangidNo ratings yet

- ch-3 Public ExpenditureDocument35 pagesch-3 Public ExpenditureyebegashetNo ratings yet

- The Research ProposalDocument29 pagesThe Research Proposalmuse tamiru100% (1)

- Exchange Rate SystemsDocument27 pagesExchange Rate SystemsmaurishkaNo ratings yet

- If MCQ 40 Nos.Document7 pagesIf MCQ 40 Nos.gowthamNo ratings yet

- Public FinanceDocument12 pagesPublic Financeahmednor2012No ratings yet

- Role of Finance in The Development of An EconomyDocument20 pagesRole of Finance in The Development of An EconomyRøhãñ PãrdëshîNo ratings yet

- Role of Finance in The Development of An Economy: Savings-Finance - Investment RelationshipDocument3 pagesRole of Finance in The Development of An Economy: Savings-Finance - Investment RelationshipNikhil KapoorNo ratings yet

- Fin4040 Assignment OneDocument6 pagesFin4040 Assignment OnedeeNo ratings yet

- What Is Loan Syndication?: Participants in A Syndicated LoanDocument15 pagesWhat Is Loan Syndication?: Participants in A Syndicated Loansuyash srivastavaNo ratings yet

- An Overview of The Financial System CH 1Document14 pagesAn Overview of The Financial System CH 1Bamlak WenduNo ratings yet

- Group Assignment 1Document5 pagesGroup Assignment 1Swapnil ChaudhariNo ratings yet

- FmiDocument9 pagesFmipritish mohantyNo ratings yet

- Financial System and The Economy 3Document3 pagesFinancial System and The Economy 3Kehinde AbioseNo ratings yet

- Structure of Indian Financial SystemDocument34 pagesStructure of Indian Financial SystemmoqimNo ratings yet

- Financial Market ExerciseDocument6 pagesFinancial Market ExerciseShamraj E. SunderamurthyNo ratings yet

- Savings-Investment Relationship:: Financial SystemDocument2 pagesSavings-Investment Relationship:: Financial SystempraveenNo ratings yet

- Fmi Assignment 2Document15 pagesFmi Assignment 2Jaishree MBA2021MBNo ratings yet

- Financial SystemDocument14 pagesFinancial Systemlie moreNo ratings yet

- Financial Markets - OverviewDocument6 pagesFinancial Markets - OverviewCharmaine Klaire Agan AlonzoNo ratings yet

- Financial Economics CH One Material HDocument29 pagesFinancial Economics CH One Material Hyihun0521No ratings yet

- Financial Markets and Services-1Document117 pagesFinancial Markets and Services-1Nagu BabuNo ratings yet

- Indian Financial Institutions and Markets Unit 1 Basis of Financial SystemDocument11 pagesIndian Financial Institutions and Markets Unit 1 Basis of Financial SystemAnitha RNo ratings yet

- IfsDocument23 pagesIfsRahul Kumar JainNo ratings yet

- Module IDocument36 pagesModule IKrishna GuptaNo ratings yet

- Financial Institution and MarketsDocument57 pagesFinancial Institution and MarketsTushar GaurNo ratings yet

- Roles of Financial Services in Economic DevelopmentDocument3 pagesRoles of Financial Services in Economic DevelopmentShruti VarshneyNo ratings yet

- A Financial System Is A System That Allows The Exchange of Funds Between LendersDocument5 pagesA Financial System Is A System That Allows The Exchange of Funds Between LendersLakshmiRengarajanNo ratings yet

- Fin 203 Assignment 1Document12 pagesFin 203 Assignment 1aarzu dangiNo ratings yet

- Chapter One An Overview of The Financial SystemDocument57 pagesChapter One An Overview of The Financial SystemNatnael AsfawNo ratings yet

- Revised Project NotesDocument11 pagesRevised Project Notessanjay josephNo ratings yet

- Components of IFS NotesDocument6 pagesComponents of IFS NotesPrasad IngoleNo ratings yet

- Financial Institution Hand OutDocument24 pagesFinancial Institution Hand OutwubeNo ratings yet

- FinancialDocument6 pagesFinancialJaalali A GudetaNo ratings yet

- Chapter - IDocument9 pagesChapter - IHabte WorkuNo ratings yet

- Capital MarketDocument45 pagesCapital MarketjakindedhiaNo ratings yet

- Features of The Financial System of DevelpoedDocument35 pagesFeatures of The Financial System of DevelpoedChahat PartapNo ratings yet

- Capital MarketDocument36 pagesCapital Marketmayuri chaudhariNo ratings yet

- Capital MarketsDocument12 pagesCapital MarketsSanoj Kumar YadavNo ratings yet

- Retail Store Manager in Atlanta GA Resume Margaret (Maggie) WixDocument3 pagesRetail Store Manager in Atlanta GA Resume Margaret (Maggie) WixMargaretWixNo ratings yet

- Monopoly and Market Failure Lesson 2Document12 pagesMonopoly and Market Failure Lesson 2api-53255207No ratings yet

- ConsolidateStatement Mar 20Document5 pagesConsolidateStatement Mar 20Coid CekNo ratings yet

- Managerial Economics BookDocument150 pagesManagerial Economics BookAbdo Bunkari100% (1)

- Communicating Positioning StrategyDocument3 pagesCommunicating Positioning StrategyShafi SaifNo ratings yet

- From BMC To Financial Projection 1 Dan 2 FileDocument34 pagesFrom BMC To Financial Projection 1 Dan 2 FileJEREMIA GUNAWANNo ratings yet

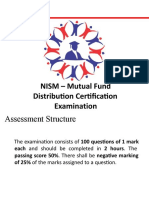

- NISM - Mutual Fund Distribution Certification ExaminationDocument169 pagesNISM - Mutual Fund Distribution Certification ExaminationPMNo ratings yet

- Arbitrage in India: Past, Present and FutureDocument22 pagesArbitrage in India: Past, Present and FuturetushartutuNo ratings yet

- Nism Equity DerivativesDocument65 pagesNism Equity DerivativesPoonam JadhavNo ratings yet

- Applied Economics Lesson 10 - Tools and Techniques in BusinessDocument48 pagesApplied Economics Lesson 10 - Tools and Techniques in BusinessBernardita Sison-CruzNo ratings yet

- Political Thinking: Becoming A Responsible Citizen: Chapter OutlineDocument14 pagesPolitical Thinking: Becoming A Responsible Citizen: Chapter OutlineKristin DikiciyanNo ratings yet

- Sales & Distribution Management (Assignment 2 BBA)Document7 pagesSales & Distribution Management (Assignment 2 BBA)chiragNo ratings yet

- Corporation - Proforma EntriesDocument21 pagesCorporation - Proforma EntriesnuggsNo ratings yet

- Parkin 8e Tif ch23 QuizetDocument55 pagesParkin 8e Tif ch23 QuizetManpreet SinghNo ratings yet

- Part 1 The Philipine Financial SystemDocument17 pagesPart 1 The Philipine Financial SystemRona MaglahusNo ratings yet

- Chapter Four: Advanced Financial Accounting Code: ACFN 511 Load:5 ECTS/3 Cr. HRDocument70 pagesChapter Four: Advanced Financial Accounting Code: ACFN 511 Load:5 ECTS/3 Cr. HRRACHEL KEDIRNo ratings yet

- AvATrade - The Ultimate Forex Platform For Zimbabweans New To Forex Trading - The ChronicleDocument12 pagesAvATrade - The Ultimate Forex Platform For Zimbabweans New To Forex Trading - The Chroniclemarshy bindaNo ratings yet

- Ch07-Forecasting Share Price MovementsDocument40 pagesCh07-Forecasting Share Price MovementsTrần AnhNo ratings yet

- Mutual Fund As An Investment AvenueDocument62 pagesMutual Fund As An Investment Avenueamangarg13100% (8)

- About Morgan Stanley Group IncDocument7 pagesAbout Morgan Stanley Group IncjobelcaballeroNo ratings yet

- Mukul ShardaDocument3 pagesMukul Shardashubh_braNo ratings yet

- UNIT 2 MarketingDocument10 pagesUNIT 2 MarketingMaite Toquero IriarteNo ratings yet

- Palak (Ifs)Document1 pagePalak (Ifs)rpk1812100% (1)

- Up SellingDocument4 pagesUp SellingKhokha JamaliehNo ratings yet

- Lesson3-Capital StructureDocument8 pagesLesson3-Capital StructureKiro ParafrostNo ratings yet

- CHAPTER-11 Case StudiesDocument21 pagesCHAPTER-11 Case StudiesHate MeNo ratings yet

- buscom 4Document6 pagesbuscom 4dmangiginNo ratings yet

- DRM 1 - Credit Derivatives V2Document41 pagesDRM 1 - Credit Derivatives V2Mukul BaviskarNo ratings yet