Professional Documents

Culture Documents

Docshare - Tips - Modaud1 Unit 2 Audit of Cash and Cash Transactions PDF

Docshare - Tips - Modaud1 Unit 2 Audit of Cash and Cash Transactions PDF

Uploaded by

NicOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Docshare - Tips - Modaud1 Unit 2 Audit of Cash and Cash Transactions PDF

Docshare - Tips - Modaud1 Unit 2 Audit of Cash and Cash Transactions PDF

Uploaded by

NicCopyright:

Available Formats

UNIT 2

AUDIT OF CASH AND CASH TRANSACTIONS

Estimated Time: 6.0 HOURS

*Use Louwers 4th edition

Discussion questions 2-1

1. Describe the following cash-related terms. Show pro-forma schedules or examples to

the class.

a. Cash count sheet

b. Bank reconciliation

c. Standard bank confirmation

d. Proof of cash

e. Kiting

f. Lapping

g. Window dressing

2. What should be considered in classifying cash items? What are those items that

should be accounted for as “cash and cash equivalents”? How should we account for

those items that are “not” cash?

Discussion questions 2-2 Controls over the receipt and disbursement of cash

Refer to Louwers 6-9 and 6-10.

Discussion Questions 2-3 Substantive audit procedures for the audit of cash

Refer to Louwers 6-15, 6-16, 6-17, and 6-18.

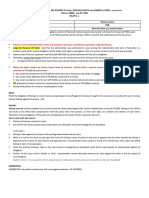

Problem 2-1 Analysis and classification of cash balances

The valuation of cash shown on the balance sheet as of end of 2012 was P3,264,400.

Your examination of cash showed the breakdown to be:

Coins and currency P60,000

Checks received from customers 560,000

Certificate of deposit, term: 2 months 245,000

Petty cash fund 6,000

Postage stamps 400

BDO, checking account balance 2,000,100

Post-dated check, customer 12,000

Post-dated check, employee 8,000

Money order from customer 15,000

Cash in savings account 117,000

Bank draft from customer 45,000

Utility deposit to gas company, refundable 5,000

Cash advance received from customer 8,000

NSF check, customer 20,000

Cash advance to company executive, collectible

on demand 180,000

MBTC, checking account, overdraft (OD) (25,000)

IOUs from employees 7,900

Total P3,264,400

Compute for the correct amount of cash and cash equivalents and its composition as of

December 31, 2012.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-1

Problem 2-2 Analysis and classification of cash balances

Boyet Dee, the controller for Fort Bonifacio Company, determined P10,542,700 as the

amount of cash and cash equivalents that would be reported on its December 31, 2012

financial statements (FS). As per your audit, the following was the breakdown of Boyet’s

schedule of cash and cash equivalents:

a. Commercial savings account of P1,200,000 and commercial checking account

balances of P1,800,000 held at UCPB.

b. Travel advances of 360,000 for executive travel for the first quarter of next year

(employee to reimburse through salary deduction).

c. A separate cash fund in the amount of P3,000,000 restricted for the retirement

of long-term debt.

d. Petty cash fund of P10,000 (inclusive of unreplenished vouchers in the amount

of P4,560).

e. An IOU from a company supervisor in the amount of P190,000.

f. A bank overdraft of P250,000 which occurred at one of the banks the company

uses to deposit its cash receipts. The company had no deposits at this bank

and the Boyet had this amount deducted from cash and cash equivalents in his

schedule.

g. Two certificates of deposit, each totaling P1,000,000. These certificates of

deposit had a maturity of 90 days from the FS date. Date of purchase:

December 30, 2012.

h. A check dated January 12, 2013 in the amount of P125,000.

i. A cash balance of P400,000 at all times at UCPB to ensure future credit

availability (already included in item A). Found out to be not legally restricted as

to withdrawal.

j. P2,100,000 commercial paper of PLDT Co. which is due in 190 days.

k. Currency and coins on hand amounting to P7,700.

The 2012 financial statements of Fort Bonifacio should include (compute for the amounts

or provide the journal entries, as applicable):

1. Cash on hand.

2. Cash in bank.

3. Adjusting entry for item G.

4. Adjusting entry for item H.

5. Cash and cash equivalents.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-2

Problem 2-3 Cash fund count

You conducted a surprise cash count of the imprest petty cash fund of LLL Cosmetics

Corporation on January 5, 2013. The ledger balance for petty cash is P5,000.00 with Per

Dy as the petty cash custodian. Result of your examination revealed the cashier’s drawer

to contain the following:

Bills P1,350.00

Coins 874.75

Petty cash vouchers (PCV):

Delivery charges (12.14.2012) 420.00

Computer repairs (12.18.2012) 700.00

Messenger’s fare (12.23.2012) 120.00

Advances to employees (12.27.2012) 900.00

Checks (including Check 30108) 2,600.00

Sales invoices 1,400.00

Envelope tagged as employees’ contribution 760.00

Additional information:

1. Check 30108, issued by Mr. A, an employee, amounting to P1,200.00 was returned

by the bank as NSF check.

2. The envelope tagged as employees’ contribution has not been opened and still

intact.

Case 1

1. How much is the total unreplenished vouchers counted in the petty cash fund?

2. How much is the total items counted in the petty cash fund?

3. How much is the total accountability of the cashier?

4. How much is the cash shortage/overage?

5. How much is the petty cash fund as of December 31, 2012?

Case 2

In addition to information given above, you found another PCV dated January 3, 2013

spent for photocopying amounting to P24.50. Moreover, you found out that the envelope

tagged as employees’ contribution has been opened and the money removed.

6. How much is the total unreplenished vouchers counted in the petty cash fund?

7. How much is the total items counted in the petty cash fund?

8. How much is the total accountability of the cashier?

9. How much is the cash shortage/overage?

10. How much is the petty cash fund as of December 31, 2012?

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-3

Problem 2-4 Cash fund count

As an associate member of the team that audits Oak Tree Foods Incorporated for the

year ended December 31, 2012, when the United States (US) dollar ($) to Philippine

peso is $1=P41.50, you were assigned to conduct a surprise cash count in the morning

of January 5, 2013. You found the following items inside the petty cash drawer of Pretty,

the cash custodian:

Petty cash vouchers:

Overtime meal for the Christmas Party 12.19.2012 P725.00

Additional expenses – Christmas Party 12.21.2012 965.00

Purchase of hand sanitizer 12.21.2012 96.25

Transportation 12.22.2012 34.00

Purchase of printer ink and folders 12.26.2012 375.00

Gasoline for the van 12.27.2012 690.00

Meals of maintenance left during New Year’s Day 01.01.2013 460.00

Protective lotion used by the person who collected the contribution

for Mulanay dengue patients 01.03.2013 25.00

Floorwax and Lysol 01.03.2013 175.00

Checks

No. 00692 12.28.2012 from Australian Bazaar, customer 1,400.75

No. 12300 12.29.2012 from Monina, employee 1,493.50

No. 10236 01.02.2013 from Nelia Maga, customer 3,150.60

No. 45201 01.03.2013 from Arctic Fever, customer 3,700.45

No. 78090 01.04.2013 from Stella, an employee 1,000.10

Paper bills

2 pcs, P1,000; 3 pcs, P500; 2 pcs, P100; 14 pcs, P20; 1 pc, $5.50 ?

Coins

6 loose, P10; 34 loose, P5; 17 loose, P1 ?

Envelope containing contributions for the dengue patients of

Mulanay, amount indicated P1,400) but per count is P1,375. Inside

the envelope was an official receipt named to the company

amounting to P25 for the protective lotion bought by an employee

who passed around the envelope around the offices.

Additional information:

1. The client maintains an imprest petty cash balance of P10,000.

2. Further investigation also disclosed that the official receipts from December 28 to

January 3 totaled P8,251.80. These were already recorded in the cash receipts

journal.

3. Check No. 78090 was encashed before year-end.

1. Prepare a cash count sheet indicating any overage or shortage.

2. Determine the adjusted balance of petty cash fund as of December 31, 2012

supported by a proof.

Problem 2-5 Procedures for auditing a client’s bank reconciliation

Refer to Louwers 6-47.

Problem 2-6 Manipulated bank reconciliation

Refer to Louwers 6-50.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-4

Problem 2-7 Bank reconciliation

Top Cat Corporation had poor internal control over its cash transactions. Data pertaining

to its cash position at October 31, 2012 were as follows:

The cash book showed a balance of P76,634.77, which included undeposit receipts. A

credit of P950 on the bank records for a deposit made did not appear on the books of the

company.

The bank statement had a balance of P68,835.99. The outstanding checks were as

follows:

No. 0210667 P462.80

0210671 490.00

0210693 1,053.00

0210734 789.94

0210737 1,648.20

0210749 643.15

The cashier misappropriated all undeposited receipts in excess of P10,880.07 and

prepared the following reconciliation:

Balance per books, October 31, 2012 P76,634.77

Add: Outstanding checks

No. 0210734 P789.94

0210737 1,648.20

0210749 643.15 3,081.29

P78,966.06

Less: Undeposited receipts 10,880.07

Balance per bank, October 31, 2012 P68,835.99

Unrecorded credit 950.00

Correct cash balance, October 31, 2012 P67,885.99

How much did the cashier misappropriate and explain how did it happen?

Problem 2-8 Bank reconciliation

You are auditing the general cash for Daisy Duck Company for the fiscal year ended July

31, 2012. The client has not prepared the July 31 bank reconciliation. After a brief

discussion with the owner, you agree to prepare the reconciliation, with assistance from

one of Daisy Duck’s clerks. You obtain the following information:

General Bank

Ledger Statement

Beginning balance P49,610 P61,030

Deposits 250,560

Cash receipts journal 254,560

Checks cleared (236,150)

Cash disbursements journal (218,110)

July bank service charge (870)

Note paid directly (61,000)

NSF check (3,110)

Ending balance P86,060 P10,460

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-5

June 30 Bank Reconciliation

Information in General Ledger and Bank Statement

Balance per bank P57,530

Deposits in transit 6,000

Outstanding checks 17,420

Balance per books 46,110

Additional information obtained:

a. Checks clearing that were outstanding on June 30 totalled P16,920.

b. Checks clearing that were recorded in the July disbursements journal totalled

P204,670.

c. A check for P10,600 cleared the bank, but had not been recorded in the cash

disbursements journal. It was for an acquisition of inventory. Daisy Duck uses the

periodic inventory method.

d. A check for P3,960 was charged to Daisy Duck Company but had been written on a

different company’s bank account.

e. Deposits included P6,000 from June and P244,560 for July.

f. The bank charged Daisy Duck Company’s account for a non-sufficient check with a

total amount of P3,110. The credit manager concluded that the customer intentionally

closed its account and the owner left the city. The check was turned over to a

collection agency.

g. A note for P58,000, plus interest, was paid directly to the bank under an agreement

signed four months ago. The note payable was recorded at P58,000 on Daisy Duck

Company’s books.

1. Compute the amount of checks outstanding on July 31.

2. How much is the deposits in transit on July 31?

3. How much is the adjusted cash balance on July 31?

Problem 2-9 Interbank transfers schedule

Refer to Louwers 6-49.

Problem 2-10 Proof of cash

Refer to Louwers 6-48.

Problem 2-11 Proof of cash

While performing an opinion audit of the financial statements of Malaber Company as of

December 31, 2012, you have extracted the following data regarding the cash account:

November 30 December 31

a. Balances per books P619,304 P670,392

b. Balances per bank 742,800 774,696

c. Outstanding checks 254,096 320,184*

*A check of P20,000 was certified by the bank.

d. The cash receipts book showed a total of P9,341,780 while the bank statement for

the month of December showed total credits of P5,401,800.

e. Malaber records NSF checks as reduction of cash receipts. However, NSF checks

which are later redeposited are then recorded as regular receipts. The data about the

NSF checks are as follows:

1. Returned by the bank in December and recorded by the company in January

2011, P9,200.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-6

2. Returned by the bank in December and recorded by the company in

December, P25,000.

3. Returned by the bank in November and recorded by the company in

December, P1,000.

f. A bank credit memo dated December 27, 2012 was received by Malaber stating that

the company’s account was credited for the net proceeds of a note for P8,060. This is

not yet recorded in the books.

g. A check of Malabey Company amounting to P9,292 was charged to the company

account by the bank in error on December 30.

h. The company has hypothecated its accounts receivable with the bank under an

agreement whereby the bank lends the company 80% of the hypothecated accounts

receivable. The company performs accounting and collection of the accounts.

Adjustments of the loan are made from daily sales reports and deposits.

i. The bank credits the company account and increases the amount of the loan for 80%

of the reported sales. The loan agreement states specifically states that the sales

report must be accepted by the bank before the company is credited. Sales reports

are forwarded by the company to the bank on the first day following the date of sales.

The bank allocates each deposit 80% to the payment of the loan, and 20% to the

company account. Thus, only 80% of each day’s sales and 20% of each collection

deposits are entered in the bank statement. The company accountant records the

hypothecation of new accounts receivable (80% of sales) as a debit to Cash and a

credit to the Bank Loan as of the date of sales. One hundred percent of the collection

on accounts receivable is recorded as cash receipt; 80% of the collection is recorded

in the cash disbursements books as a payment on the loan. In addition with the

hypothecation, the following information were discovered:

1. Collection on accounts receivable deposited in December, other than

deposits in transit, totaled to P4,800,000.

2. Included in the undeposited collections is cash from the hypothecation of

accounts receivable. Sales were P162,000 on November 30, and P169,000

on December 31, the balance was made up from collections of P128,440

which was entered in the books in the manner indicated above.

j. For the month of December, the interest on the bank loan amounting to P24,560 was

charged by the bank against the account of Malaber. This was not recorded in the

books.

Prepare a four-column proof of cash of the cash receipts and cash disbursements

recorded on the bank statement and on the company’s books for the month of December

2012. The reconciliation should agree with the cash figure that will appear in the

company’s financial statements. Thereafter, determine the following:

1. Cash balance as of November 30.

2. Cash balance as of December 31.

3. Book receipts for December 31.

4. Book disbursements for December 31.

5. Cash shortage at December 31, if there’s any.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-7

Problem 2-12 Comprehensive problem

You were able to gather the following from the December 31, 2012 trial balance of Bugs

Bunny Corporation in connection with your audit of the company:

Cash on hand P530,000

Petty cash fund 10,450

Gold Keeper Bank current account 1,230,000

Diamond Bank current account no. 01 1,080,000

Diamond Bank current account no. 02 (80,000)

Bronze Bank savings account 1,200,000

Bronze Bank time deposit (three-month) 500,000

Cash on hand includes the following items:

a. Customer’s check for P40,000 returned by bank on December 26, 2012 due to

insufficient fund but subsequently re-deposited and cleared by the bank on January 8,

2013.

b. Customer’s check for P20,000 dated January 2, 2013, received on December 29,

2012.

c. Postal money orders received from customers, P30,000.

The petty cash fund consisted of the following items as of December 31, 2012.

Currency and coins P2,350

Unreplenished petty cash vouchers 1,300

Currency in an envelope marked “collections for charity” with 1,200

names attached

Employees’ vales 1,600

Check drawn by Bugs Bunny Corporation, payable to the petty 4,000

cashier

Total P10,450

Included among the checks drawn by Bugs Bunny Corporation against the Gold Keeper

current account and recorded in December 2012 are the following:

a. Check written and dated December 29, 2012 and delivered to payee on January 2,

2013, P80,000.

b. Check written on December 27, 2012, dated January 2, 2013, delivered to payee on

December 29, 2012, P40,000.

The credit balance in the Diamond Bank current account No. 2 represents checks drawn

in excess of the deposit balance. These checks were still outstanding at December 31,

2012.

The savings account deposit in Bronze Bank has been set aside by the board of directors for

acquisition of new equipment. This account is expected to be disbursed in the next four months

from the balance sheet date.

Based on the above and the result of your audit, determine the adjusted balances of the following

as of December 31, 2012:

1. Cash on hand.

2. Petty cash fund.

3. Gold Keeper Bank current account.

4. Cash and cash equivalents.

Auditing Practice I Third Term, AY 2013-2014

Workbook Page 2-8

You might also like

- CPAR Auditing TheoryDocument62 pagesCPAR Auditing TheoryKeannu Lewis Vidallo96% (46)

- Assignment of Debt Agreement ClsDocument3 pagesAssignment of Debt Agreement ClsSelena Express100% (2)

- Non Current Asset Questions For ACCADocument11 pagesNon Current Asset Questions For ACCAAiril RazaliNo ratings yet

- Financial Accounting Problems: Problem I (Current Assets)Document21 pagesFinancial Accounting Problems: Problem I (Current Assets)Fery AnnNo ratings yet

- Unit I - Audit of Investment Property - Final - t31314Document11 pagesUnit I - Audit of Investment Property - Final - t31314Jake Bundok50% (2)

- GOSI Contribution CalculationDocument10 pagesGOSI Contribution CalculationMohamed Shanab100% (1)

- Bid Strategy & TacticsDocument15 pagesBid Strategy & TacticsRashmi Ranjan Panigrahi67% (3)

- 84 Solinap V Del RosarioDocument1 page84 Solinap V Del Rosarioluigimanzanares100% (1)

- 3rd On-Line Quiz - Substantive Test For CashDocument3 pages3rd On-Line Quiz - Substantive Test For CashMJ YaconNo ratings yet

- Applied Auditing Audit of Receivables Problem 1: QuestionsDocument9 pagesApplied Auditing Audit of Receivables Problem 1: QuestionsPau SantosNo ratings yet

- Chapter 01 - Auditing and Assurance ServicesDocument74 pagesChapter 01 - Auditing and Assurance ServicesBettina OsterfasticsNo ratings yet

- Applied Auditing Report (Audit of Receivables)Document7 pagesApplied Auditing Report (Audit of Receivables)mary louise magana100% (1)

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Chinee CastilloNo ratings yet

- Cost2 1 PDF FreeDocument9 pagesCost2 1 PDF FreeIT GAMING100% (1)

- 520-FinalllDocument38 pages520-FinalllHatake KakashiNo ratings yet

- MODAUD1 UNIT 4 Audit of Inventories PDFDocument9 pagesMODAUD1 UNIT 4 Audit of Inventories PDFJoey WassigNo ratings yet

- 10.28.2017 MT (Audit of Receivables)Document7 pages10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- AssignmentDocument6 pagesAssignmentIryne Kim PalatanNo ratings yet

- IntAcct Cash CashEquivalents 1Document3 pagesIntAcct Cash CashEquivalents 1Arkhie DavocolNo ratings yet

- Auditing TheoryDocument13 pagesAuditing TheoryRaven GarciaNo ratings yet

- Far 102 - Cash and Cash EquivalentsDocument4 pagesFar 102 - Cash and Cash EquivalentsKeanna Denise GonzalesNo ratings yet

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Heinie Joy PauleNo ratings yet

- CPAR Fringe Benefits (Batch 90) - HandoutDocument13 pagesCPAR Fringe Benefits (Batch 90) - HandoutAljur SalamedaNo ratings yet

- Cash To Inventory Reviewer 1Document15 pagesCash To Inventory Reviewer 1Patricia Camille AustriaNo ratings yet

- Auditing 1 Final ExamDocument8 pagesAuditing 1 Final ExamEdemson NavalesNo ratings yet

- Activity - Audit of InventoryDocument2 pagesActivity - Audit of InventoryRyan DueÑas GuevarraNo ratings yet

- Months To Go Until They MatureDocument5 pagesMonths To Go Until They MatureJude SantosNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- Audit Problems FinalDocument48 pagesAudit Problems FinalShane TabunggaoNo ratings yet

- Chapter 5 Audit of InventoryDocument10 pagesChapter 5 Audit of InventoryMarkie GrabilloNo ratings yet

- Aud ThEORY 2nd PreboardDocument11 pagesAud ThEORY 2nd PreboardJeric TorionNo ratings yet

- Test Bank - 02012021Document13 pagesTest Bank - 02012021Charisse AbordoNo ratings yet

- Chapter 6 Quiz KeyDocument3 pagesChapter 6 Quiz Keymar8357No ratings yet

- Ms 03 - CVP AnalysisDocument10 pagesMs 03 - CVP AnalysisDin Rose GonzalesNo ratings yet

- Review of Accounting ProcessDocument2 pagesReview of Accounting ProcessSeanNo ratings yet

- Audit of Cash and Cash EquivalentsDocument9 pagesAudit of Cash and Cash Equivalentspatricia100% (1)

- Unit 1 Erica Abegonia Sec Code 416 Exercise 1Document2 pagesUnit 1 Erica Abegonia Sec Code 416 Exercise 1Ivan AnaboNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- Case #1: Book BankDocument40 pagesCase #1: Book BankJohn Lloyd YastoNo ratings yet

- AGS CUP 6 Auditing Elimination RoundDocument17 pagesAGS CUP 6 Auditing Elimination RoundKenneth RobledoNo ratings yet

- Adv 1 - Dept 2010Document16 pagesAdv 1 - Dept 2010Aldrin100% (1)

- National Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Document14 pagesNational Federation of Junior Philipinne Institute of Accountants - National Capital Region Auditing (Aud)Tricia Jen TobiasNo ratings yet

- Audit of Cash and Cash Equivalents PDFDocument4 pagesAudit of Cash and Cash Equivalents PDFRandyNo ratings yet

- Auditing Practice Problem 2Document1 pageAuditing Practice Problem 2Jessa Gay Cartagena TorresNo ratings yet

- JPIA Financial Accounting 1 (Prelims)Document20 pagesJPIA Financial Accounting 1 (Prelims)Kristienalyn De AsisNo ratings yet

- ReviewerDocument43 pagesReviewergnim1520No ratings yet

- Audit of ReceivablesDocument2 pagesAudit of ReceivablesCarmelaNo ratings yet

- Afar 106 - Home Office and Branch Accounting PDFDocument3 pagesAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNo ratings yet

- Cash With Cash EqualantDocument5 pagesCash With Cash EqualantkaviyapriyaNo ratings yet

- Auditing TheoryDocument11 pagesAuditing Theoryfnyeko100% (1)

- ACC460Document6 pagesACC460Samantha SchumacherNo ratings yet

- AP 5906q ReceivablesDocument3 pagesAP 5906q ReceivablesJulia MirhanNo ratings yet

- Correction of ErrorsDocument6 pagesCorrection of ErrorsJanjielyn MoralesNo ratings yet

- Chapter 14Document32 pagesChapter 14faye anneNo ratings yet

- Aaca Receivables and Sales ReviewerDocument13 pagesAaca Receivables and Sales ReviewerLiberty NovaNo ratings yet

- CHAPTER 10 - Pre-Board ExaminationsDocument34 pagesCHAPTER 10 - Pre-Board Examinationsmjc24No ratings yet

- AFAR - Part 2Document13 pagesAFAR - Part 2Myrna Laquitan100% (1)

- Audit of CashDocument1 pageAudit of CashXandae MempinNo ratings yet

- Fear and Risk in Audit Process PDFDocument25 pagesFear and Risk in Audit Process PDFElena DobreNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- Multiple Choic1Document4 pagesMultiple Choic1stillwinmsNo ratings yet

- Ch07 Audit Planning Assessment of Control Risk1Document26 pagesCh07 Audit Planning Assessment of Control Risk1Mary GarciaNo ratings yet

- Unit 2 - Cash and Cash EquivalentsDocument8 pagesUnit 2 - Cash and Cash EquivalentsJeremy Jess ArizabalNo ratings yet

- Unit 2. CashDocument8 pagesUnit 2. CashDaphne100% (1)

- Jan 2015 (Manila) ,: Holidays in PhilippinesDocument1 pageJan 2015 (Manila) ,: Holidays in PhilippinesJake BundokNo ratings yet

- Calendar - 2015 02 01 - 2015 03 01 PDFDocument1 pageCalendar - 2015 02 01 - 2015 03 01 PDFJake BundokNo ratings yet

- At Reviewer Part II - (May 2015 Batch)Document22 pagesAt Reviewer Part II - (May 2015 Batch)Jake BundokNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- Debt Securities: BondsDocument9 pagesDebt Securities: BondsCorinne GohocNo ratings yet

- Dlsu Thesis Paper LetterheadDocument1 pageDlsu Thesis Paper LetterheadJake BundokNo ratings yet

- REVIEW QUESTIONS Investment in Debt SecuritiesDocument1 pageREVIEW QUESTIONS Investment in Debt SecuritiesJake BundokNo ratings yet

- AP 5904 InvestmentsDocument9 pagesAP 5904 InvestmentsJake BundokNo ratings yet

- Unit II - Audit of Intangibles and Other Assets - Final - t31314Document9 pagesUnit II - Audit of Intangibles and Other Assets - Final - t31314Jake BundokNo ratings yet

- MODAUD1 UNIT 6 - Audit of InvestmentsDocument7 pagesMODAUD1 UNIT 6 - Audit of InvestmentsJake BundokNo ratings yet

- Seitani (2013) Toolkit For DSGEDocument27 pagesSeitani (2013) Toolkit For DSGEJake BundokNo ratings yet

- X Deal FoodDocument1 pageX Deal FoodJake BundokNo ratings yet

- (169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsDocument5 pages(169472718) MODAUD1 UNIT 1 - Analysis and Correction of ErrorsJervin LabroNo ratings yet

- MODAUD1 UNIT 3 - Audit of ReceivablesDocument11 pagesMODAUD1 UNIT 3 - Audit of ReceivablesJake BundokNo ratings yet

- MODAUD1 UNIT 4 - Audit of Inventories PDFDocument9 pagesMODAUD1 UNIT 4 - Audit of Inventories PDFJake BundokNo ratings yet

- MODAUD1 UNIT 5 - Audit of Biological AssetsDocument5 pagesMODAUD1 UNIT 5 - Audit of Biological AssetsJake BundokNo ratings yet

- Methods of Evaluating Capital InvestmentsDocument5 pagesMethods of Evaluating Capital InvestmentsJake BundokNo ratings yet

- ObliCon Case DigestDocument8 pagesObliCon Case DigestJohn Waltz SuanNo ratings yet

- June 2011 Results PresentationDocument17 pagesJune 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Reserva TroncalDocument5 pagesReserva TroncalInter_vivosNo ratings yet

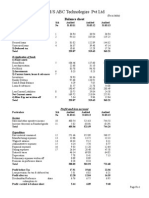

- Balance Sheet of M/S ABC Technologies PVT LTDDocument3 pagesBalance Sheet of M/S ABC Technologies PVT LTDSmitha RajNo ratings yet

- Ch14 - 2015Document86 pagesCh14 - 2015lawrence hNo ratings yet

- Harmer v. CIR, 10th Cir. (2001)Document6 pagesHarmer v. CIR, 10th Cir. (2001)Scribd Government DocsNo ratings yet

- Resume of KarencoslinDocument3 pagesResume of Karencoslinapi-24131152No ratings yet

- BSPLDocument2 pagesBSPLrohitrgsNo ratings yet

- G.G. Sportswear Manufacturing Corp. vs. Banco de Oro Unibank, Inc.Document2 pagesG.G. Sportswear Manufacturing Corp. vs. Banco de Oro Unibank, Inc.kdescallarNo ratings yet

- GenMath Week 1 10Document90 pagesGenMath Week 1 10Noni Montalbo100% (1)

- Jonsay vs. Solidbank Corporation Now MetropolitanBank and Trust CompanyDocument43 pagesJonsay vs. Solidbank Corporation Now MetropolitanBank and Trust CompanyAnnaNo ratings yet

- Balance SheetDocument7 pagesBalance Sheetmhrscribd014No ratings yet

- Foreclosure Benchbook 2 0 - Foreclosure CLE 6-27-11Document64 pagesForeclosure Benchbook 2 0 - Foreclosure CLE 6-27-11Christopher Martin100% (1)

- Weaknesses of Stock Market of IndiaDocument2 pagesWeaknesses of Stock Market of Indiachronicler92100% (1)

- FM - Bankruptcy, Reorganization and LiquidationDocument17 pagesFM - Bankruptcy, Reorganization and LiquidationpandanarangNo ratings yet

- Direct and Indirect InvestmentDocument3 pagesDirect and Indirect InvestmentShariful IslamNo ratings yet

- Alex G Baraona BIO For Salvador Holdings International CorporationDocument7 pagesAlex G Baraona BIO For Salvador Holdings International CorporationAlexGBaraonaNo ratings yet

- Kuenzle & StreiffDocument2 pagesKuenzle & Streiffaerwincarlo4834No ratings yet

- Benefits of Mortgage Refinancing You Must KnowDocument3 pagesBenefits of Mortgage Refinancing You Must KnowriyaNo ratings yet

- TAX Digests Cases BenefitsDocument7 pagesTAX Digests Cases BenefitsRomhead SJNo ratings yet

- Recruitment Process of Brac Bank LimitedDocument60 pagesRecruitment Process of Brac Bank LimitedSabyasachi BosuNo ratings yet

- Naguit vs. Court of Appeals G.R. No. 118375 CASE DIGESTDocument1 pageNaguit vs. Court of Appeals G.R. No. 118375 CASE DIGESTLBitzNo ratings yet

- NFLPA 2014 Dept of Labor LM-2 Part 1Document93 pagesNFLPA 2014 Dept of Labor LM-2 Part 1Robert LeeNo ratings yet

- 5.TN Treasury Code Vol1 77-150Document74 pages5.TN Treasury Code Vol1 77-150Porkodi SengodanNo ratings yet

- CF Assignment 1Document4 pagesCF Assignment 1Kashif KhurshidNo ratings yet