Professional Documents

Culture Documents

TS1307 Financial Reports: Test 2 - Question Book

Uploaded by

irma febian0 ratings0% found this document useful (0 votes)

15 views2 pagesOriginal Title

Financial REport 2

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesTS1307 Financial Reports: Test 2 - Question Book

Uploaded by

irma febianCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

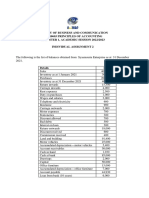

TS1307 Financial reports

Created: 31/05/2017 | Review date: 01/07/2018 | Version: 2017

TS1307 Financial reports

Test 2 – Question book

Chinese name:

PINYIN:

English:

Class:

Student Number:

Time allowed for this Assessment:

Time allowed: 1 hour

Total marks

This assessment will contribute up to 30% of your final mark for this unit

Test conditions

Closed book

You are required to hand up both the question and answer booklets at the end of the test

Assessment conditions:

This test will be conducted under exam conditions and students are not permitted to speak to or

copy from other students.

Misconduct as stipulated in NMIT Student Discipline Rule (NMIT/IR/11) includes “Cheating, attempting

to cheat or knowingly assisting any other student to Cheat or attempt to cheat.”

You are required to answer the questions in the answer book.

Do not remove any staples or pages from either the question or answer books.

Electronic translation dictionaries, graphics calculators and mobile phones are not permitted.

For teacher use:

Question Competent / Not yet competent Mark or NYC

1

2

3

A student will not receive a pass unless they are competent in every question in this Assessment

MELBOURNE POLYTECHNIC INTERNATIONAL PROGRAMS

TS1307 Financial reports Test 1 Question book.doc Page 1 of 2

31/05/2017 © Melbourne Polytechnic 2017

TS1307 Financial reports

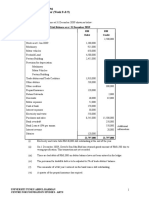

Using the following Trial Balance and additional information provided by a business owned

and operated by Rui Tan you are required to:

a) Prepare the general journal entries to close the ledger on 30/6/12

b) Prepare the following ledger accounts:

- Trading account

- Profit and loss account

- Capital account

c) Prepare the general journal entries necessary for reversals on 1/7/12.

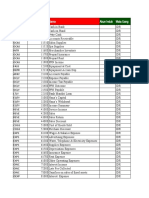

Rui Tan - Trial Balance as at 30 June 2012

Account Debit Credit

Capital 50,000

Drawings 2,500

Sales 67,000

Investments 59,000

Accumulated depreciation – motor vehicles 3,500

Accumulated depreciation – equipment 1,200

Purchases 24,000

Vehicle expenses 300

Customs duty 500

Wages & salaries 3,200

Stock (1/7/11) 3,000

Electricity 2,200

Sales returns 100

Purchase returns 100

Interest revenue 200

Interest expense 100

Commission Revenue 500

Rent 20,000

Stationery expense 1,000

Equipment 4,900

Trade debtors 3,000

Trade creditors 7,200

Allowance for doubtful debts 200

Insurance (on Buildings) 500

Sundry debtors 600

Sundry creditors 500

Goodwill 2,000

Bank 2,600

Loan from BQ Finance Ltd. 22,000

Motor vehicles 20,000

Depreciation – motor vehicles 2,000

Depreciation – equipment 300

Stock of stationery 200

Doubtful debts 100

Prepaid revenue (commission) 200

Accrued expenses (wages) 100

Prepaid expenses (rent) 100

Accrued revenue (interest) 500

152,700 152,700

Additional Information:

Stock on hand at 30/6/12 is valued at $6,000.

TS1307 Financial reports Test 1 Question book.doc Page 2 of 2

31/05/2017 © Melbourne Polytechnic 2017

You might also like

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Practice Comptency Exam 124Document3 pagesPractice Comptency Exam 124Ivan Pacificar BioreNo ratings yet

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Hockey Canada: Financial StatementsDocument21 pagesHockey Canada: Financial StatementsBob MackinNo ratings yet

- Acc 308 - Week4-4-2 Homework - Chapter 13Document6 pagesAcc 308 - Week4-4-2 Homework - Chapter 13Lilian L100% (1)

- TS1307 Financial Reports: Test 2 - Question BookDocument4 pagesTS1307 Financial Reports: Test 2 - Question Bookirma febianNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Screenshot 2023-12-02 at 6.15.54 PMDocument5 pagesScreenshot 2023-12-02 at 6.15.54 PMn8zn5278y9No ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Questions On Preparation of Financial Statements 1-4Document4 pagesQuestions On Preparation of Financial Statements 1-4LaoneNo ratings yet

- Question IA 2 - Topic 4Document2 pagesQuestion IA 2 - Topic 4YAANESHWARAN A/L CHANDRAN STUDENTNo ratings yet

- Practice Questions-IAS-1Document2 pagesPractice Questions-IAS-1Ayyan AzeemNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesNazir AhmadNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Final Exam - Inter 1 (Batch 2022) - RevDocument14 pagesFinal Exam - Inter 1 (Batch 2022) - RevVanessa vnssNo ratings yet

- Sole Proprietorship Final AccountDocument4 pagesSole Proprietorship Final Accountsujan BhandariNo ratings yet

- Competency PracticeDocument2 pagesCompetency PracticeJames Darwin TehNo ratings yet

- (BUS-AC1) : Finbus2Document7 pages(BUS-AC1) : Finbus2mNo ratings yet

- Toaz - Info Prelim Midterm PRDocument98 pagesToaz - Info Prelim Midterm PRClandestine SoulNo ratings yet

- ASSIGNMENTDocument3 pagesASSIGNMENTDoreen OngNo ratings yet

- Accounting Fundamentals - PWS - 7Document11 pagesAccounting Fundamentals - PWS - 7Meet PatelNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- M.B.A (2021 Pattern)Document105 pagesM.B.A (2021 Pattern)Mayur HariyaniNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- 2021 S2 18 Limited COmpanyDocument2 pages2021 S2 18 Limited COmpanyJingyiNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- IA2 Prelims 1 - CLDocument2 pagesIA2 Prelims 1 - CLAdriiiNo ratings yet

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

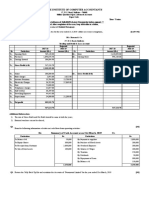

- The Institute of Computer AccountantsDocument1 pageThe Institute of Computer AccountantsankitNo ratings yet

- ANS - 1 (A, B, C)Document5 pagesANS - 1 (A, B, C)Nazir AhmadNo ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- MODULE 8 Learning ActivitiesDocument5 pagesMODULE 8 Learning ActivitiesChristian Cyrous AcostaNo ratings yet

- Adobe Scan 17-Dec-2022Document18 pagesAdobe Scan 17-Dec-2022unnuNo ratings yet

- Powerjob Inc CaseDocument6 pagesPowerjob Inc CaseGloryNo ratings yet

- Work SheetDocument3 pagesWork SheetsuperwafiNo ratings yet

- Problems On LiabilitiesDocument6 pagesProblems On LiabilitiesKorinth BalaoNo ratings yet

- Book 2Document8 pagesBook 2May ManseNo ratings yet

- ACC2124 Mid-Term Test S2/17Document2 pagesACC2124 Mid-Term Test S2/17Niz IsmailNo ratings yet

- Simple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Document11 pagesSimple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Masood Ahmad AadamNo ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- MBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersDocument3 pagesMBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersMishra FamilyNo ratings yet

- Gold Company Provided The Following Trial Balance On June 30 PDFDocument3 pagesGold Company Provided The Following Trial Balance On June 30 PDFRengeline LucasNo ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Assignment-2: MCA204 Financial Accounting and ManagementDocument6 pagesAssignment-2: MCA204 Financial Accounting and ManagementrashNo ratings yet

- WorkDocument8 pagesWorkshifaanjum7172No ratings yet

- Homework P4 4ADocument8 pagesHomework P4 4AFrizky Triputra CahyahanaNo ratings yet

- April 2022 (Fa4)Document7 pagesApril 2022 (Fa4)Amelia RahmawatiNo ratings yet

- UNITEC-engineering Management 7050 2012 s2Document7 pagesUNITEC-engineering Management 7050 2012 s2donNo ratings yet

- Additional Illustrations-20Document16 pagesAdditional Illustrations-20Gulneer LambaNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- #Modul D3 BING SKHGDocument32 pages#Modul D3 BING SKHGirma febianNo ratings yet

- Detail Biaya Non Pendidikan MahasiswaDocument2 pagesDetail Biaya Non Pendidikan Mahasiswairma febianNo ratings yet

- Journals To Trial Balance/lembar Jwban Test 2 Journal To TBDocument5 pagesJournals To Trial Balance/lembar Jwban Test 2 Journal To TBirma febianNo ratings yet

- Journals To Trial Balance/lembar Jwban Test 2 Journal To TBDocument5 pagesJournals To Trial Balance/lembar Jwban Test 2 Journal To TBirma febianNo ratings yet

- Data Hutang Ke VendorDocument4 pagesData Hutang Ke Vendorirma febianNo ratings yet

- 1103-001 Piutang Usaha IDR Account Receivable IDRDocument6 pages1103-001 Piutang Usaha IDR Account Receivable IDRirma febianNo ratings yet

- 219 218 1 PBDocument10 pages219 218 1 PBPeronika Sari BarusNo ratings yet

- No Par Value Stock DefinitionDocument2 pagesNo Par Value Stock DefinitionblezylNo ratings yet

- Fill in The Blanks FMDocument3 pagesFill in The Blanks FMSaadNo ratings yet

- FEMA (Non Debt Instruments Rules) 2019Document48 pagesFEMA (Non Debt Instruments Rules) 2019tinkuNo ratings yet

- Audit of Liab ModuleDocument13 pagesAudit of Liab ModuleChristine Mae Fernandez MataNo ratings yet

- 15 - Investments - TheoryDocument8 pages15 - Investments - TheoryROMAR A. PIGANo ratings yet

- Answered Step-By-Step: Data Relating To The Shareholders' Equity of Martin Co. During..Document8 pagesAnswered Step-By-Step: Data Relating To The Shareholders' Equity of Martin Co. During..Jefferson MañaleNo ratings yet

- Case Study AssignmentDocument3 pagesCase Study AssignmentfalinaNo ratings yet

- Process Costing and Management Accounting: in Today's Business EnvironmentDocument8 pagesProcess Costing and Management Accounting: in Today's Business Environmentمحمد زرواطيNo ratings yet

- ACCO101Document37 pagesACCO101Belle AustriaNo ratings yet

- Sast Regulations, 2011Document28 pagesSast Regulations, 2011Ekansh TiwariNo ratings yet

- Risk-Coverage Risks: Chapter - 9 Insurance ClaimsDocument24 pagesRisk-Coverage Risks: Chapter - 9 Insurance Claimss2sNo ratings yet

- Daftar Akun Rumah Cantik HanaDocument4 pagesDaftar Akun Rumah Cantik HanaLSP SMKN 1 BanjarmasinNo ratings yet

- ParCor FINALS Quiz 1 ReviewerDocument13 pagesParCor FINALS Quiz 1 ReviewerRei Vincent GatchalianNo ratings yet

- Journal EntryDocument4 pagesJournal EntryRhio venus LacsamanaNo ratings yet

- Final ProjectDocument59 pagesFinal Projectarchit sahayNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Finance360 ExamDocument5 pagesFinance360 Examrdm9c2100% (2)

- Corporation Law ReviewerDocument14 pagesCorporation Law ReviewerRichard Allan Lim100% (1)

- A Case Study On TcsDocument6 pagesA Case Study On TcsRajiv MondalNo ratings yet

- Insider Trading at LordstownDocument8 pagesInsider Trading at LordstownKirk HartleyNo ratings yet

- SOFPDocument1 pageSOFPmirza fawadNo ratings yet

- Current AssetsDocument17 pagesCurrent AssetsNhemia ElevencionadoNo ratings yet

- Fabm2 Q1mod2 Statement of Comprehensive Income Frances Beraquit Bgo v1Document26 pagesFabm2 Q1mod2 Statement of Comprehensive Income Frances Beraquit Bgo v1Monina Durana LegaspiNo ratings yet

- Business Finance Week 2-3Document7 pagesBusiness Finance Week 2-3Luisa RadaNo ratings yet

- Cash and Cash Equivalents TheoriesDocument5 pagesCash and Cash Equivalents Theoriesjane dillanNo ratings yet

- Submission Tutorial 2 - SolutionDocument5 pagesSubmission Tutorial 2 - SolutionNdisa ChumaNo ratings yet

- LTCC Problem 2 Complete Journal EntriesDocument4 pagesLTCC Problem 2 Complete Journal EntriesMerliza JusayanNo ratings yet

- Chapter 4 CB Problems - IDocument11 pagesChapter 4 CB Problems - IRoy YadavNo ratings yet