Professional Documents

Culture Documents

Contemporary Issues in Accounting MCQ PDF

Uploaded by

Kamal samaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contemporary Issues in Accounting MCQ PDF

Uploaded by

Kamal samaCopyright:

Available Formats

lOMoARcPSD|5156943

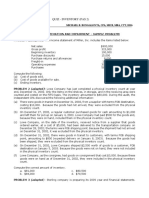

Contemporary Issues in accounting MCQ

Contemporary Issues in Accounting (University of South Australia)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

Multiple choice quiz answers

Week 1

1. Normative accounting theories and research seek to:

- Describe what is normal, or generally accepted, practice

- Prescribe particular approaches not driven by existing practices

- All of the given options are correct.

- Explain and predict particular phenomena based on observation

2. Which of the following statements is true?

- All of the given options are correct

- The profit figure is an objective measure of performance

- Measures of profit ignore many social and environmental externalities caused by the firm

- The company has reported a record profit, therefore it is automatically worthy of support

3. Which of the following is a reason why accounting, and accountants, can be considered very

powerful?

- The output of the accounting process impacts on many decisions which can result in transfers of

funds, and therefore wealth

- All of the given options are correct

- The provision of purported objective information provides users with a source of power to drive

changes to corporations behaviour

- The emphasis on profitability measures provides support to profitable companies which may not be

worthy of support under other measures

4. One criticism of Positive Accounting Theory is that it tells us nothing about:

- Whether the practice or method being used is the most efficient

- All of the given options are correct.

- Which method a firm should use

- Whether the practice or method being used is the most equitable

5. All liability accounts have credit balances. The accounts receivable account is a liability

account. Therefore, the accounts receivable account has a credit balance. Which of the

following statements is correct with respect to the above argument?

- The argument follows a logical and clear reasoning.

- The classification of accounts receivable is consistent with the observed classification of receivables

- The conclusion reached is clearly true

- The argument is illogical

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

6. Which of the following arguments supports the view that regulation is not necessary,

particularly to the extent that it currently exists?

- Markets for information are not efficient and therefore produce a sub-optimum amount of

information, given the problem of 'free riders'

- Investors need protection from fraudulent organisations that may produce misleading information

- Accounting information is like any other good, and people will be prepared to pay for it to the extent

that it has a use.

- Information asymmetry exists because not everyone has the same power over resources to obtain

the information they need

7. Which of the following statements is true about accounting measurements such as

profits and assets?

- They are subject to professional judgment

- They are based on hard, objective, evidence

- They would not vary if prepared by different accountants, providing they were based on the same set

of accounting standards

- All of the given options are correct

8. Statement 1: All the fixed assets in the company are more than 10 years old.

Statement 2: Some of the fixed assets in the company are plant and machinery.

Assuming that Statement 1 and 2 are true, which of the following is correct based on logical

deduction?

- Most plant and machinery in the company is more than 10 years old

- All plant and machinery in the company is more than 10 years old

- Very little of the plant and machinery in the company is more than 10 years old

- No plant and machinery in the company is more than 10 years old

9. The qualitative characteristics of financial reports that make information useful

to users are:

- Comparability

- Understandability, reliability and comparability

- Understandability

- Reliability

10. Theories and models in the social sciences differ from theories in the pure sciences

because:

- A number of theories may be available to describe, or provide a different perspective on, a particular

phenomenon.

- Not all theories in social science have predictions that can be tested.

- Theories about human behaviour cannot be expected to apply all the time, like some natural science

theories.

- All of the given options are correct.

Week 2

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

1. Which of the following is not necessarily a benefit of harmonisation and convergence?

- Increased relevance, functionality and appropriateness for all countries

- Improved understanding and interpretation of financial reports by users in different countries

- Increased comparability and consistency

- Lower preparation costs for companies that have to produce different financial reports in different

countries

2. Which of the following is not assumed by the 'market for managers argument' for

reducing or eliminating regulation

- The managerial labour market operates efficiently

- Information about past management performance will be known by other prospective employers

- Information about past management performance will not be fully impounded in future salaries

- Managers are not approaching retirement

3. Under IFRS 2 and AASB 2 the fair value of share options has to be classified as:

- An expense

- A liability

- An owner's equity

- An asset

4. The process of adopting international accounting standards in Australia did not

Include:

- An initial period of harmonisation where AASB standards were made to be compatible with the

IAS's, but with some divergence allowed where appropriate

- A Corporate Law and Economic Reform Program (CLERP) Report, in 1997, outlining the rationale

and benefits for Australia of adopting international accounting standards

- A decision by the FRC in 2002 that Australia would adopt accounting standards issued by the

IASNB, and no divergence was to be acceptable

- Opposition from the Australian Stock Exchange

5. Which of the following statements is true about accounting regulation?

- It is a set of prescribed rules that provides authoritative direction

- It is developed by an independent authoritative body that has been given the power to govern how

financial statements are to be prepared

- It incorporates a basis for monitoring and enforcing compliance with the specific regulatory

requirements

- All of the given options are correct

6. Regulators often cite investor protection as a basis for more stringent regulation and

financial reporting requirements enacted after a financial crisis. What is not a reason for this?

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

- To protect investors in the interests of the public

- To respond to lobbying by those affected by losing money

- To look as if the regulators are doing something that seems to be a problem, and therefore maintain

their position as regulators

- All of the given options are correct

7. Which of the following may be the result of direct or indirect economic and social

consequences of a proposed accounting standard?

- Increased lobbying to maximise the expected positive economic benefits from the standard

- Increased lobbying to minimise the expected negative economic and social consequences from the

standard

- Impact on managerial decisions to optimise the reported numbers

- All of the given options are correct

8. The type of business ownership and financing system, and the taxation system, influence the

nature of accounting practice in different countries. Which of the following describes the

institutional influence more conducive to the increasing scale of globalised business and

development of international accounting standards?

- Outsider systems, where finance is mainly provided by external shareholders, and where the tax

system is separate from the accounting system

- Insider systems, where finance is mainly provided by family owners, banks and government, and the

tax system dominates the accounting system

- Outsider systems, where finance is mainly provided by family owners, banks and government, and

the tax system is separate from the accounting system

- Insider systems, where finance is mainly provided by external shareholders, and where the tax

system dominates the accounting system

9. The free-market perspective of accounting regulation suggests that accounting information:

- Should be provided free of charge

- Should be free of considerations and lobbying of the market

- Should be provided like any other good that is subject to demand and supply

- Will require regulation to avoid underproduction of information

10. Which of the following is an influence on the nature of accounting practice in different

countries

- Accidents in history, such as stock-market crashes

- The strength of the accounting profession

- Religion

- All of the given options are correct

Week 3

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

1. Which of the following best describes the basis of the accounting measurement model

in use today?

- Historical cost accounting

- Current cost accounting

- Historical cost, except where conceptual frameworks and accounting standards allow deviation from

it

- A mixed method accounting model

2. In the historical cost model there is an assumption that the monetary unit is fixed and

constant over time. Which of the following components of the modern economy makes the

assumption less valid than it was at the time the model was developed?

- Specific price-level changes, occasioned by such things as technological advances and shifts in

consumer preferences

- General price-level changes (inflation)

- Physical operating capital maintenance perspective

- All of the given options are correct

3. Assuming a price index calculated 104.5 in 2013, compared with 100 in 2012, for a bundle of

goods, what is the current purchasing power of every dollar, compared to 2012?

- 95.5 cents in every dollar, on average

- 95.69 cents in every dollar, on average

- 96.5 cents in every dollar, on average

- $1.045 in every dollar, on average

4. Which of the following is not a possible limitation with CPPA accounting?

- The prices of the goods and services included in the general price index may not be reflective of the

price movements (inflation) specific to that particular industry.

- The information is simple, and easily understood by users.

- Research has shown that the information provided by CPPA may not be decision-relevant.

- Users might think that the price-level adjusted amounts might reflect the specific value of specific

assets.

5. A limitation of Current Cost Accounting does not include the fact that:

- Replacement costs are easily determined, and therefore the preparation cost is low

- Replacement costs do not reflect what it would be worth if the firm decided to sell it

- CCA assumes assets would in fact be replaced, or replaced with that type of asset and not another

- There are too many versions of current cost accounting, making it confusing to preparers

6. Which of the following is not a reason why alternative methods have not gained acceptance

or been formally implemented?

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

- The arguments for the alternative methods were not logical.

- There appeared to be more interest when inflation was a problem than when it was not.

- Some alternative models were likely to incur significant costs, negative economic consequences and

impacts.

- Lack of support by the public or the government, and eventually by the accounting profession.

7. The reasons the promotion of alternative accounting models to historical cost did not

succeed include:

- There was a lack of agreement as to which model was the best

- The fact that such a change would have been extremely radical and costly

- The fact that such a change would create huge economical consequences, and therefore those

affected would lobby to protect their self-interest

- All of the given options are correct.

8. How would the deprival value of an asset be determined?

- It is the present value of the future cash flows to be generated by the asset, except where the

current replacement cost or net selling price is less than that value

- It is the net selling price, except where the value to the business (present value) is less, or the

current replacement cost greater

- It is the current replacement cost, where the present value is less than the current replacement cost

and greater than the net selling price

- It is the value to the business of the asset (present value), within the bounds that this value is not

less than the net selling price or greater than its current replacement cost

9. What is included in 'income' according to the IASB Conceptual Framework?

- All events that result in an increase in the net assets of the reporting entity, other than owner

contributions

- All events that result in an increase in the net assets of the reporting entity

- Events that relate to the central operations of the entity

- All of the given options are correct

10. Which of the following statements is correct under our current accounting standards?

- Many assets can, or must, be measured at historical cost

- Inventory must be measured at cost, or net realisable value if it is lower

- Property, plant and equipment can be valued at cost where an entity has adopted the 'cost model'

for a class of property, plant and equipment

- All of the given options are correct.

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

Week 4

1. What is the definition of a 'conceptual framework'?

- A conceptual framework is a set of prescriptions of what accounting should be.

- A conceptual framework is a structured positive theory of accounting

- A conceptual framework is a coherent system of objectives and fundamentals that are expected

to lead to consistent standards.

- A conceptual framework is a group of independent concepts on specific accounting issues, that

are grouped together to provide a single reference.

2. What is the purpose of developing a conceptual framework?

- To provide a coherent structure to accounting practice which had developed in an ad hoc way.

- To guide standard-setters to develop standards based on the same concepts and principles,

rather than in a piecemeal approach.

- To guide users where there is no accounting standard covering an issue.

- All of the given options are correct.

3. On what criteria is a 'reporting entity', as defined in SAC 1, dependent?

- Whether there are users that are dependent on the reports to make or evaluate resource

decisions

- Professional judgment providing some guidelines to help make a decision

- Whether there are users that are dependent on the reports to make or evaluate resource

decisions, and professional judgment provides some guidelines to help make a decision

- The Corporations Law based on measures of gross revenue, dollar value of assets and the

number of employees

4. Which of the following is a qualitative characteristic of financial information in general

purpose financial reports, if they are to be useful?

- Understandability

- Comparability

- Reliability

- All of the given options are correct

5. Which characteristic of information, when omitted or misstated, could influence economic

decisions taken by users on the basis of financial statements?

- Relevance

- Reliability

- Materiality

- Comparability

6. Which of the following is a characteristic of reliability?

- It influences economic decisions.

- It represents faithfully what it purports to represent.

- It provides predictive value and feedback to confirm or correct earlier expectations.

- None of the given options are correct.

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

7. Which of the following is true in relation to expenses, according to the IASB Conceptual

Framework?

- Expenses are restricted to transactions and events relating to 'ongoing major or central

operations'.

- There is no reference to matching of revenue and expenses in the Conceptual Framework.

- Expenses would not include losses that were not under the control of the entity, such as

uninsured losses of assets from flood

- None of the given options are correct.

8. Which of the following is not a perceived advantage in developing a conceptual framework

project?

- Standard-setters will be less accountable for their decisions.

- Setting accounting standards will be more economical, despite the resources needed to develop

the conceptual framework and standards.

- It will result in a reduced number of accounting standards where issues are covered by the

conceptual framework

- It will provide a defence and enhance the legitimacy of the accounting profession.

9. Which of the following is a characteristic of relevance?

- It influences economic decisions.

- It represents faithfully what it purports to represent.

- It provides predictive value and feedback to confirm or correct earlier expectations

- None of the given options is correct

10. Over time, a number of objectives have been attributed to information provided within

financial statements. Which of the following is not an objective of financial statements?

- To enable outsiders to assess the stewardship of management.

- To provide information to users that is useful for making and evaluating decisions about the

allocation of scarce resources.

- To enable reporting entities to demonstrate accountability between the entity and those parties

to which the entity is deemed to be accountable

- To help managers to maximise their own wealth and the wealth of the organisation

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

Week 5

1. The 'bonus plan hypothesis' of Positive Accounting Theory suggests managers of firms with

bonus plans tied to reported income are more likely to use accounting methods that:

- Increase prior period reported income

- Increase current period reported income

- Increase future period reported income

- None of the given options are correct.

2. The 'debt/equity hypothesis' of Positive Accounting Theory predicts which of the

following?

- The higher the firm's debt/equity ratio, the more likely managers are to use accounting methods

that lower income.

- The lower the firm's debt/equity ratio, the more likely managers are to use accounting methods

that increase income.

- The higher the firm's debt/equity ratio, the more likely managers are to use accounting methods

that increase income.

- None of the given options are correct.

3. The 'political cost hypothesis' of Positive Accounting Theory suggests which of the

following?

- Large firms are more likely to use accounting choices that reduce reported profits.

- Small firms are more likely to use accounting choices that reduce reported profits.

- Neither large nor small firms are more likely to use accounting choices that reduce reported

profits.

- Both large and small firms are more likely to use accounting choices that reduce reported

profits.

4. Which of the following is the main advantage of using accounting earnings instead of

share prices to determine bonuses?

- Share prices are influenced by market forces that are outside the control of management.

- Accounting information is independently audited.

- Accounting information is unbiased.

- Share prices may be manipulated by managers engaging in insider trading

5. According to Positive Accounting Theory, the existence of debt covenants:

- Can be explained from an efficiency perspective, and gives management an incentive to

manipulate accounting information from an opportunistic perspective

- Can be explained from an opportunistic perspective, and gives management an incentive to

manipulate accounting information from an efficiency perspective

- Can be explained from both efficiency and opportunistic perspectives

- Cannot be explained

6. Which of the following is not true about Positive Accounting Theory?

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

- A positive theory seeks to explain and predict particular phenomena.

- A positive theory focuses on the relationships between various individuals and how accounting

is used to assist in the functioning of these relationships.

- A positive theory prescribes how a particular practice should be undertaken

- All of the given options are correct.

7. It is common practice for managers to be rewarded in a way that is tied to the profits of the

firm, the sales of the firm, or the return on assets. That is, their remuneration is based on the

output of the accounting system.

- Bonus schemes tied to the performance of the firm will be put in place to align the interests of

the owners and the managers.

- Rewarding managers on the basis of accounting profits may induce them to manipulate

accounting numbers.

- There would be limited incentives for the manager to adopt risky strategies that increase the

value of the firm.

- The manager may be reluctant to take on optimal levels of debt.

8. Which of the following bonus schemes would be appropriate for the managers of a

biotechnology research company?

- A market-based bonus scheme, as it is more appropriate to reward the manager in terms of the

market value of the firm's securities, which are assumed to be influenced by expectations about

the net present value of expected future cash flows, and the manager will be given an incentive

to increase the value of the firm.

- A fixed basis scheme, so that the managers would not take great risks, reject risky projects, and

be reluctant to take on optimal levels of debt as it may be beneficial to those with equity in the

firm.

- An accounting-based bonus scheme as this will be in the interest of the manager, as that

manager will potentially receive greater rewards and will not have to bear the costs of the

perceived opportunistic behaviours.

- A combination of fixed basis and accounting-based scheme, as assuming that self-interest

drives the actions of the managers, it may be necessary to put in place remuneration schemes

that reward the managers in a way that is, at least in part, tied to the performance of the firm.

9. Which of the following is an example of political costs under the PAT perspective?

- Wage and salary deductions paid to unions

- Contributions to political parties

- Costs associated with increased wage claims

- The cost of remaining largely unnoticed by government regulatory agencies

10. A contribution of Positive Theory is that it enables us to understand:

- Why interest groups expend resources lobbying for or against particular standards

- Why a manager adopts particular accounting techniques over others

- The effect accounting standards have on different groups and resource allocation

- All of the given options are correct.

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

Week 6

1. Which of the following statements is false?

-Legitimacy is considered to be a resource on which an organisation is dependent for survival.

-Legitimacy Theory suggests that organisations will act in a way that society perceives as legitimate.

-Legitimacy Theory relies upon the notion of the 'social contract'

-Legitimacy Theory asserts that organisations will attempt to ensure that society perceives their actions

as 'legitimate'

2. Which of the following is true about Stakeholder Theory?

-Stakeholder Theory can help managers in solving ethical problems, such as the environment, and gives

managers a practical framework for assessing and balancing interests as long as normative

principles are the foundation upon which decisions are made

-Normative principles are incorporated into organisational decision making, and it allows managers to

give an unbalanced or biased weighting of issues in order to preserve ethical integrity

-Assessing stakeholders is often based on descriptive, not normative, assumptions.

-All of the given options are correct.

3. Which of the following is not a means by which an organisation may attempt to legitimise

its activities?

-Adapting its output, goal and methods of operation to conform to prevailing definitions of legitimacy.

-Attempting, through communication, to alter the definition of social legitimacy so that it conforms to the

organisation's present practices, outputs and values

-Asserting its right to operate under the existing regulatory framework that has been determined by

society

-Attempting, through communication, to become identified with symbols, values or institutions that have

a strong base of legitimacy.

4. The idea of the 'social contract' is that corporations only exist because they benefit:

-Shareholders

-Governments

-Managers

-Society

5. An example of a legitimising symbol would be:

-The World Wide Fund for Nature assessing compliance with the Australian Minerals Industry Code

-Monsanto employing the former CEO of Greenpeace Australia as a consultant

-Changing the name of a company from 'British Petroleum' to 'Beyond Petroleum'

-All of the given options are correct.

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

6. Empirical findings consistent with Legitimacy Theory would be increased disclosure of:

-Environmental good news, immediately following prosecutions for breaches of environmental standards

-Environmental bad news, immediately following prosecutions for breaches of environmental standards

-Environmental good news, immediately preceding prosecutions for breaches of environmental

standards

-Environmental bad news, immediately preceding prosecutions for breaches of environmental standards

7. Managerial Stakeholder Theory suggests that annual reports will be used to:

-Gain the support of powerful stakeholders

-Report on the activities of management with respect to each stakeholder

-Explain why profits may have been sacrificed in order to respect the minimum rights of some

stakeholders

-All of the given options are correct

8. According to Lindblom (1994), which of the following strategies can an organisation adopt

when it perceives that its legitimacy is in question because its actions or operations are at

variance with society's expectations and values?

-Seek to educate and inform its 'relevant public' about actual changes in the organisation's performance

and activities

-Seek to change the perceptions that 'relevant public' have of the organisation's performance and

activities.

-Seek to manipulate perception by deflecting attention from the issue of concern onto other issues to

demonstrate how the organisation has fulfilled social expectations

-All of the given options are correct

9. Institutional Theory suggests which of the following?

-While organisational structures are initially varied, they are gradually homogenized by competition, the

state and professions.

-While organisational structures are initially homogenous, they are gradually varied by competition, the

State and professions

-The organisational structure is determined by institutional factors such as management style and

organisational culture

-The organisational structure is determined by the organisation's most powerful stakeholders

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

10. Which of the following is true about substantive management techniques of legitimation?

-It does not actually reflect any real change in activities.

-Corporate behaviour is portrayed in a manner to 'appear consistent with social values and expectations'

-It involves real, material change in organisational goals, structures, and processes or socially

institutionalized practices

-Companies may publish policies on various issues including the environment but not enforce or set in

place mechanisms for the full adoption of such policies

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

Week 7

1. Which of the following items would not be covered by AASB 141?

-dairy cattle

-wine

-fruit trees

-vines

2. Net present value (NPV) method has been considered as an alternative valuation technique to

historical cost for biological assets. The NPV method may be described as:

-An accounting concept based on the statement of cash flows to determine the present value of

investments.

-A finance technique for testing the efficiency of the market by comparing share prices to the discounted

cash inflows associated with the asset.

-An economic concept based on the notion that an asset's value can be determined from its future cash

flows.

-An accounting method for projecting the revenues and expenses associated with an asset or entity.

3. Which of the following statements is correct with respect to accounting for biological assets

as required in AASB 141?

-A biological asset may initially be recognised at recoverable amount.

-A biological asset that was initially recognised at fair value less point-of-sale costs may subsequently

be recognised at cost when fair value less point-of-sale costs is no longer available.

-If a biological asset is initially recognised at cost it should be measured at cost less any accumulated

depreciation.

-A biological asset may initially be recognised at cost when market-determined prices or value are not

available and for which alternative estimates of fair value are not available.

4. Examples of biological assets include:

-preserved fossilised remains

-aquaculture and fishery holdings

-telecommunications and computer software

-trees in a recreational park.

5. According to AASB 141, which of the following would not apply:

-an investment in a forest as a carbon sink which gives rise to carbon credits that can either be sold or

used to offset pollution caused by the entity

-non human living assets other than animals and plants such as viruses and blood cells

-all of the given answers

-products that are the result of processing after harvest

6. In accordance with AASB 141 a gain or loss may arise from:

-initial recognition of an agricultural produce.

-all of the given answers

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

lOMoARcPSD|5156943

-subsequent measurement dates of a biological asset.

-initial recognition of a biological asset.

7. Where a biological asset is not separable from other assets:

-the value of the package of assets for which an active market exists should be used to assist in

determining the fair value of the biological assets

-the value of the biological asset should be included in the value of the other asset.

-the fair values of the non-biological assets should be subtracted from the package value.

-the value of the package of assets for which an active market exists should be used to assist in

determining the fair value of the biological assets and the fair values of the non-biological assets

should be subtracted from the package value.

8. AASB 141 states that where no active market exists fair value may be determined by:

-using net present values calculated at the current-market determined post-tax rate.

-market prices for similar assets without adjustments to reflect differences.

-the most recent market transaction price, irrespective of any changes to economic conditions.

-sector benchmarks expressed in relevant units for that type of asset.

9. What treatment of revenue recognition is required by AASB 141?

-Changes in the net market values of biological assets that relate to volume changes must be

recognised as revenues or expenses as appropriate in the profit and loss statement.

-Increments and decrements in the net market values of biological assets must be recognized as

revenues or expenses in the profit and loss statement for the financial year in which the increments

or decrements occur.

-Changes in the current replacement cost of biological assets should be treated as adjustments to the

asset revaluation reserve. Revenues should be recognised on the sale of the asset and matched

against the replacement cost of the asset sold.

-Revenue should be recognised in the statement of comprehensive income on the sale of the asset.

Losses should be recognised as a result of a write-down to recoverable amount.

10. Biological assets may be difficult to classify as current or non-current because:

-The operating cycle of the entity may be unknown.

-The asset may unexpectedly become ill or die.

-The value of the asset may change depending on management's intention.

-The same physical assets may have either a shorter or longer life span depending on management

intention.

Downloaded by Hidden Truth (thehiddentruth001@gmail.com)

You might also like

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalMohitAhujaNo ratings yet

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorFrom EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorNo ratings yet

- BUSINESS LAW and EthicsDocument2 pagesBUSINESS LAW and EthicsSowjanya TalapakaNo ratings yet

- The Difference Between Auditors and Forensic AccountantsDocument1 pageThe Difference Between Auditors and Forensic AccountantsMohammed MickelNo ratings yet

- Case Study Pakistan Model Shariah Governance Framework PDFDocument17 pagesCase Study Pakistan Model Shariah Governance Framework PDFsyedtahaali100% (3)

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- How Organizational Structure Impacts Communication at Ethio TelecomDocument44 pagesHow Organizational Structure Impacts Communication at Ethio TelecomfajjiNo ratings yet

- Ch-6 Expected Utility As A Basis For Decision-Making The Evolution of TheoriesDocument17 pagesCh-6 Expected Utility As A Basis For Decision-Making The Evolution of Theoriessimmi33100% (2)

- AUDIT BasicDocument10 pagesAUDIT BasicKingo StreamNo ratings yet

- Principles of AuditingDocument81 pagesPrinciples of AuditingSahana Sameer KulkarniNo ratings yet

- cREATIVE ACCOUNTINGDocument12 pagescREATIVE ACCOUNTINGAshraful Jaygirdar0% (1)

- Auditing CH 1Document20 pagesAuditing CH 1Nigussie BerhanuNo ratings yet

- A Framework For The Implementation of AI in The Financial Services Sector in ZimbabweDocument89 pagesA Framework For The Implementation of AI in The Financial Services Sector in Zimbabweagreement.kaguraomnizwNo ratings yet

- Risk Management CH 2.Document47 pagesRisk Management CH 2.Aschenaki MebreNo ratings yet

- KPA For Peak PerformanceDocument3 pagesKPA For Peak PerformancejyothirajscribdNo ratings yet

- Corporate Governance and Risk Management Question BankDocument2 pagesCorporate Governance and Risk Management Question BankSumit Soni100% (1)

- ProjectDocument22 pagesProjectlipikaNo ratings yet

- Auditing Liabilities AssertionsDocument7 pagesAuditing Liabilities AssertionsSanjeevParajuliNo ratings yet

- Effects of Financial Management Reforms On Financial Corruption in Nigeria Public SectorDocument14 pagesEffects of Financial Management Reforms On Financial Corruption in Nigeria Public SectorEditor IJTSRDNo ratings yet

- Intangible ResourcesDocument14 pagesIntangible ResourcesPat NNo ratings yet

- Assignment No 1Document7 pagesAssignment No 1Shehar BanoNo ratings yet

- Ethics in Financial AccountingDocument83 pagesEthics in Financial AccountingDipneeta Barad100% (1)

- ch1 BPP Slide f1 ACCADocument95 pagesch1 BPP Slide f1 ACCAIskandar Budiono100% (1)

- Consumerism As An Emerging ForceDocument34 pagesConsumerism As An Emerging Forceevneet216736No ratings yet

- "Impact of Artificial Intelligence On Financial MarketDocument7 pages"Impact of Artificial Intelligence On Financial MarketDivya GoyalNo ratings yet

- Syllabus of Shivaji University MBADocument24 pagesSyllabus of Shivaji University MBAmaheshlakade755No ratings yet

- Cecchetti-5e-Ch11 - Econ of Financial IntermediationDocument53 pagesCecchetti-5e-Ch11 - Econ of Financial IntermediationammendNo ratings yet

- Tradeoff Theory of Capital StructureDocument10 pagesTradeoff Theory of Capital StructureSyed Peer Muhammad ShahNo ratings yet

- Combating Money Laundering in MsiaDocument16 pagesCombating Money Laundering in MsiaOliver John100% (1)

- Internal Auditing Quiz 2Document3 pagesInternal Auditing Quiz 2richarddiagmelNo ratings yet

- Ifim Unit 1 - NotesDocument17 pagesIfim Unit 1 - NotesJyot DhamiNo ratings yet

- Companies Act, 2017 (Introduction) : Karachi Tax Bar AssociationDocument30 pagesCompanies Act, 2017 (Introduction) : Karachi Tax Bar AssociationRizwan MalikNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Designing A Global Financing StrategyDocument23 pagesDesigning A Global Financing StrategyShankar ReddyNo ratings yet

- Chapter - 1 - Introduction To Strategic Management AccountingDocument11 pagesChapter - 1 - Introduction To Strategic Management AccountingNusrat Islam100% (1)

- Principles of Management NotesDocument179 pagesPrinciples of Management NotesVishnuNo ratings yet

- Slaus 700Document36 pagesSlaus 700Charitha Lakmal100% (2)

- Introduction To Trade BlocsDocument19 pagesIntroduction To Trade BlocsMT RANo ratings yet

- Lecture 4-Auditing & Corporate GovernanceDocument19 pagesLecture 4-Auditing & Corporate GovernanceNatalia NaveedNo ratings yet

- Group and Module Schedules for Money and Banking CourseDocument3 pagesGroup and Module Schedules for Money and Banking Coursetripathi.shantanu3778No ratings yet

- Brand AccountingDocument19 pagesBrand Accountingrushikes8050% (2)

- Comprehensively_Prepared_Document_of_the_Questions_and_Answers_for_the_Interview_of_Senior_Auditor.docx_filename_= UTF-8''Comprehensively Prepared Document of the Questions and Answers for the Interview of Senior AuDocument42 pagesComprehensively_Prepared_Document_of_the_Questions_and_Answers_for_the_Interview_of_Senior_Auditor.docx_filename_= UTF-8''Comprehensively Prepared Document of the Questions and Answers for the Interview of Senior AumalaknisarkakarNo ratings yet

- Financial Management Syllabus - Madras University - B.com Ca - 2019Document2 pagesFinancial Management Syllabus - Madras University - B.com Ca - 2019jeganrajrajNo ratings yet

- International Business M.com 3rd Sem RecentDocument33 pagesInternational Business M.com 3rd Sem RecentViraja GuruNo ratings yet

- Dividend Policy ExplainedDocument13 pagesDividend Policy ExplainedMohammad MoosaNo ratings yet

- Corporate Governance in VietnamDocument69 pagesCorporate Governance in Vietnamhi_monestyNo ratings yet

- FM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFDocument28 pagesFM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFvasantharao100% (1)

- Iii Am MCQ Fintech FairDocument16 pagesIii Am MCQ Fintech Fairsureshbeliver005No ratings yet

- AF101 AssignmentDocument11 pagesAF101 AssignmentPritkesh Prasad100% (1)

- Cost AuditDocument6 pagesCost AuditaryanrajvkNo ratings yet

- International Accounting IssuesDocument29 pagesInternational Accounting IssuesHetal GadhviNo ratings yet

- Financial Management Lessons From KautilyaDocument3 pagesFinancial Management Lessons From Kautilyak gowtham kumarNo ratings yet

- Management Accounting and Risk Management in Malaysian Financial Institutions: An Exploratory StudyDocument22 pagesManagement Accounting and Risk Management in Malaysian Financial Institutions: An Exploratory StudytisyahaiderNo ratings yet

- 5.1 Financial Statement Analysis CH 25 I M PandeyDocument21 pages5.1 Financial Statement Analysis CH 25 I M Pandeyjoshi_ashu100% (2)

- The Auditing ProfessionDocument10 pagesThe Auditing Professionmqondisi nkabindeNo ratings yet

- Deegan - FAT3e - Chapter - 12: StudentDocument17 pagesDeegan - FAT3e - Chapter - 12: StudentKamal samaNo ratings yet

- Deegan - FAT3e - Chapter - 09: StudentDocument16 pagesDeegan - FAT3e - Chapter - 09: StudentKamal samaNo ratings yet

- Deegan FAT3e TestBank Chapter 07Document17 pagesDeegan FAT3e TestBank Chapter 07Kamal samaNo ratings yet

- Deegan_FAT3e_chapter_06_conceptual_frameworkDocument19 pagesDeegan_FAT3e_chapter_06_conceptual_frameworkKamal samaNo ratings yet

- Deegan FAT3e TestBank Chapter 08Document17 pagesDeegan FAT3e TestBank Chapter 08Kamal samaNo ratings yet

- Deegan FAT3e TestBank Chapter 10Document17 pagesDeegan FAT3e TestBank Chapter 10Kamal samaNo ratings yet

- Deegan FAT3e TestBank Chapter 04Document20 pagesDeegan FAT3e TestBank Chapter 04Kamal samaNo ratings yet

- Deegan_FAT3e_chapter_05_key_conceptsDocument20 pagesDeegan_FAT3e_chapter_05_key_conceptsKamal samaNo ratings yet

- Deegan FAT3e TestBank Chapter 02Document16 pagesDeegan FAT3e TestBank Chapter 02Kamal samaNo ratings yet

- COMPARATIVE MULTIPLES VALUATIONDocument29 pagesCOMPARATIVE MULTIPLES VALUATIONI DNo ratings yet

- FM Assignment 1Document8 pagesFM Assignment 1SAKSHAM ARJANINo ratings yet

- Past Paper Tax PDFDocument102 pagesPast Paper Tax PDFUmar AkhtarNo ratings yet

- Basic concepts of macroeconomics question bankDocument2 pagesBasic concepts of macroeconomics question bankChinmay AgarwalNo ratings yet

- SVCL Application WB FundDocument16 pagesSVCL Application WB FundSurajPandeyNo ratings yet

- MGT101 Short Notes 1 - 22 - VU Study TricksDocument15 pagesMGT101 Short Notes 1 - 22 - VU Study TricksHRrehmanNo ratings yet

- EPS Calculation IllustrationDocument5 pagesEPS Calculation IllustrationXyzNo ratings yet

- SBMC Blank v2 2 PDFDocument1 pageSBMC Blank v2 2 PDFSusan BvochoraNo ratings yet

- M4 Prac Exer. 2Document10 pagesM4 Prac Exer. 2Jasmine ActaNo ratings yet

- Financial Analysis of Unilever: Created by Pei Yin, MA Ling YinDocument7 pagesFinancial Analysis of Unilever: Created by Pei Yin, MA Ling YinAditi BhiteNo ratings yet

- Intercorporate Investments PDFDocument1 pageIntercorporate Investments PDFMohaiminul Islam ShuvraNo ratings yet

- Managerial Finance (503) EMBA Summer-2020 Jahangirnagar UniversityDocument4 pagesManagerial Finance (503) EMBA Summer-2020 Jahangirnagar UniversityIsmail EmonNo ratings yet

- #858 3-31-22 Independent Agency Quarterly Summary ReportDocument25 pages#858 3-31-22 Independent Agency Quarterly Summary ReportActionNewsJaxNo ratings yet

- MASTER-BUDGETDocument36 pagesMASTER-BUDGETRafols AnnabelleNo ratings yet

- Inventory Quiz ProblemsDocument9 pagesInventory Quiz Problemspenny coronado100% (1)

- FM Assignment-2Document8 pagesFM Assignment-2Rajarshi DaharwalNo ratings yet

- Gold Trading, Inc. Adjusted Trial Baalnce 31-Dec-20Document2 pagesGold Trading, Inc. Adjusted Trial Baalnce 31-Dec-20ME Valleser0% (1)

- Cost Allocation, Customer Profitability Analysis, and Sales-Variance AnalysisDocument41 pagesCost Allocation, Customer Profitability Analysis, and Sales-Variance AnalysisFidelina CastroNo ratings yet

- Costing Accounting Practice SetDocument2 pagesCosting Accounting Practice SetKristel SumabatNo ratings yet

- Acc 106 Ebook Answer Topic 2Document6 pagesAcc 106 Ebook Answer Topic 2syifa azhari 3BaNo ratings yet

- Full Multiple Choice For StudentsDocument80 pagesFull Multiple Choice For StudentsĐỗ LinhNo ratings yet

- At The Beginning of Fiscal Year 2014 The City ofDocument1 pageAt The Beginning of Fiscal Year 2014 The City ofDoreenNo ratings yet

- AtelengDocument2 pagesAtelengGarp BarrocaNo ratings yet

- Swing Vs Steady AssignmentDocument4 pagesSwing Vs Steady AssignmentVivek Singh100% (3)

- Food Costs Supervisory SalariesDocument11 pagesFood Costs Supervisory SalariesJames CrombezNo ratings yet

- Different Types of Finance: (Anoushka Agarwal-1920234)Document3 pagesDifferent Types of Finance: (Anoushka Agarwal-1920234)bts foreverNo ratings yet

- DuPont Case StudyDocument1 pageDuPont Case Studyjlee174No ratings yet

- 18 x12 ABC A Traditional Cost Accounting (MAS) BobadillaDocument12 pages18 x12 ABC A Traditional Cost Accounting (MAS) BobadillaAnnaNo ratings yet

- Presentation:: Name: Shehar Bano Roll Num: G1F17BSCM0018 Presented To: Prof Yasir IqbalDocument20 pagesPresentation:: Name: Shehar Bano Roll Num: G1F17BSCM0018 Presented To: Prof Yasir IqbalAHMAD ALINo ratings yet

- PALACIO - FS Analysis NARRATIVEDocument2 pagesPALACIO - FS Analysis NARRATIVEPinky DaisiesNo ratings yet