Professional Documents

Culture Documents

Question 2-FS

Uploaded by

Rax-Nguajandja KapuireCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question 2-FS

Uploaded by

Rax-Nguajandja KapuireCopyright:

Available Formats

Question 1

Gibson store has the following Trial Balance as at 30 April 2010.

Dr Cr

N$ N$

Capital 12 500

Debtors 10 000

Creditors 11 250

Purchases 45 500

Land & Building at cost 70 000

Sales 149 000

Furniture at cost 6 500

Motor vehicles 22 000

Rent 11 000

Lighting and heating 5 000

Discount allowed 1000

Bad debts 3 000

Accumulated depreciation: Furniture 1 000

Accumulated depreciation: Vehicles 1 250

Provision for bad and doubtful debts 350

Bank 2 300

Bank Loan 13 000

Discount received 150

Returns inward 200

Inventory at as 1 May 2009 11 100

Subscription 900

Total 188 500 188 500

Gibson provided the following further information:

Inventory as at 30 April 2010 amounted to N$10 000.

The lease agreement of 1st May 2009 provides for a monthly rent of N$1 000,

payable in advance on the 1st of every month.

An additional bad debt of N$250 is to be written off. The provision against

doubtful debts is to be adjusted to 2% of outstanding debtors.

Motor Vehicle depreciation is to be charged at 20 % per annum on the cost.

Furniture and Fittings are to be depreciated at 10% using the reducing

balance method.

N$200 was owed to the City of Windhoek as at 30 April 2010.

The subsription fee related to a subsription for a journal. The annual fees of

N$900 was paid on 1st Septermber 2009 and is for a one year period starting

from 1st September 2009.

Required:

1. Prepare a Statement of Profit or Loss and other Comprehensive Income and

the Statement of Financial Position of Gibson store as at 30 April 2010.

2. Pass journal entries for the year end adjustment as at 30 April 2010.

You might also like

- Question 6-FSDocument2 pagesQuestion 6-FSRax-Nguajandja KapuireNo ratings yet

- QN 1Document2 pagesQN 1Rax-Nguajandja KapuireNo ratings yet

- QN 1Document2 pagesQN 1Rax-Nguajandja KapuireNo ratings yet

- Question 8 - Preparation of FSDocument4 pagesQuestion 8 - Preparation of FSRax-Nguajandja Kapuire100% (1)

- Question 2 (22 Marks)Document1 pageQuestion 2 (22 Marks)Rax-Nguajandja KapuireNo ratings yet

- Question 3-FSDocument1 pageQuestion 3-FSRax-Nguajandja KapuireNo ratings yet

- Principles of Microeconomics (PMI511S) : Lecturer: Mr. Mally LikukelaDocument10 pagesPrinciples of Microeconomics (PMI511S) : Lecturer: Mr. Mally LikukelaRax-Nguajandja KapuireNo ratings yet

- APA Style - North West UniversityDocument19 pagesAPA Style - North West UniversityRax-Nguajandja KapuireNo ratings yet

- Quadratic EquationsDocument1 pageQuadratic EquationsRax-Nguajandja KapuireNo ratings yet

- APA Referencing SummaryDocument16 pagesAPA Referencing SummaryRax-Nguajandja KapuireNo ratings yet

- Unit 7 - Cost and ProductionDocument25 pagesUnit 7 - Cost and ProductionRax-Nguajandja KapuireNo ratings yet

- Sustainable Design Principles 5Document51 pagesSustainable Design Principles 5Rax-Nguajandja KapuireNo ratings yet

- Unit 6 - Consumer Equilibrium - 2019Document9 pagesUnit 6 - Consumer Equilibrium - 2019Rax-Nguajandja KapuireNo ratings yet

- A Summary of The Design ProcessDocument11 pagesA Summary of The Design ProcessRax-Nguajandja KapuireNo ratings yet

- Unit 8 - Perfect CompetitionDocument20 pagesUnit 8 - Perfect CompetitionRax-Nguajandja KapuireNo ratings yet

- The Chartered Quantity SurveyorDocument23 pagesThe Chartered Quantity SurveyorRax-Nguajandja KapuireNo ratings yet

- Sustainable Design Principles 2Document34 pagesSustainable Design Principles 2Rax-Nguajandja KapuireNo ratings yet

- Sustainable Design Principles 6Document52 pagesSustainable Design Principles 6Rax-Nguajandja KapuireNo ratings yet

- MOCK AssignmentDocument1 pageMOCK AssignmentRax-Nguajandja KapuireNo ratings yet

- Site Visit Memorandum of UnderstandingDocument1 pageSite Visit Memorandum of UnderstandingRax-Nguajandja KapuireNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nabard Working CapitalDocument12 pagesNabard Working CapitalJaspreet SinghNo ratings yet

- MGTS 352 Lab 6 - Product MixDocument12 pagesMGTS 352 Lab 6 - Product MixScaryCloudsNo ratings yet

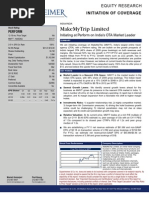

- Make My Trip LTD - Initiating CoverageDocument47 pagesMake My Trip LTD - Initiating CoverageVishal BhargavaNo ratings yet

- Hajvery TextilesDocument6 pagesHajvery TextileszainabNo ratings yet

- Dokumen - Tips - Database-Doucmentation Synergy PDFDocument563 pagesDokumen - Tips - Database-Doucmentation Synergy PDFKelly Rocio Niño RamirezNo ratings yet

- Introduction To Operating CostingDocument12 pagesIntroduction To Operating CostingsachinNo ratings yet

- Annex L: Rev. 00 S. 2023Document4 pagesAnnex L: Rev. 00 S. 2023marygrace hamblosaNo ratings yet

- Agricultural MarketingDocument5 pagesAgricultural MarketingOliver Talip100% (2)

- When Lean Meets Industry 4.0 Next Level Operational ExcellenceDocument17 pagesWhen Lean Meets Industry 4.0 Next Level Operational ExcellenceYun Fung YAPNo ratings yet

- International Regulatory Senior Manager in Paris France Resume Karen MannDocument1 pageInternational Regulatory Senior Manager in Paris France Resume Karen MannKarenMannNo ratings yet

- News Just In:: Et 500 CompaniesDocument2 pagesNews Just In:: Et 500 CompaniesAshutosh ApteNo ratings yet

- Temporary Deviation RequestDocument4 pagesTemporary Deviation Requestsathyabalaraman100% (1)

- E - Library Books 2009Document31 pagesE - Library Books 2009KhaushaliNo ratings yet

- Single Spring Mechanical SealsDocument72 pagesSingle Spring Mechanical SealsconwaymattyNo ratings yet

- 8 Project ReviewDocument28 pages8 Project Reviewmurad_ceNo ratings yet

- Week 4Document5 pagesWeek 4Anabel BahintingNo ratings yet

- A Study On Consumer Buying Behaviour in Retail Readymade Garment ShopsDocument2 pagesA Study On Consumer Buying Behaviour in Retail Readymade Garment ShopsATSx room clashNo ratings yet

- Nitin - Harshad Mehta Scam PDFDocument12 pagesNitin - Harshad Mehta Scam PDFAnkit SangwanNo ratings yet

- Report On Programmed DecisionsDocument22 pagesReport On Programmed DecisionsSamiyah Sohail0% (1)

- UTS Penyaliran TambangDocument4 pagesUTS Penyaliran TambangFadhilah DevaniNo ratings yet

- Norway - Global Trade BarriersDocument8 pagesNorway - Global Trade Barrierszayana kadeejaNo ratings yet

- 5 6172620504097096522Document6 pages5 6172620504097096522Pushpinder KumarNo ratings yet

- Dwnload Full Managerial Accounting 16th Edition Garrison Test Bank PDFDocument26 pagesDwnload Full Managerial Accounting 16th Edition Garrison Test Bank PDFwoollyprytheeuctw100% (9)

- ABC and Flexible BudgetDocument6 pagesABC and Flexible BudgetLhorene Hope DueñasNo ratings yet

- Case Study KesuDocument12 pagesCase Study Kesusharath harady0% (1)

- A Study On Buying Behavior of Teenagers in Kannur DistrictDocument5 pagesA Study On Buying Behavior of Teenagers in Kannur DistrictEditor IJRITCCNo ratings yet

- Labor Law Case DigestsDocument85 pagesLabor Law Case Digestskyche0570% (1)

- Dba Rushford 1689933602836Document15 pagesDba Rushford 1689933602836ASHOK KUMARNo ratings yet

- Problem Statement:-: Project Title: Online Book Store Management SystemDocument3 pagesProblem Statement:-: Project Title: Online Book Store Management SystemFrixumNo ratings yet

- Binu PPT FinalDocument23 pagesBinu PPT FinalBinu JosephNo ratings yet