Professional Documents

Culture Documents

Acctg. QB 2

Uploaded by

Jinx Cyrus RodilloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acctg. QB 2

Uploaded by

Jinx Cyrus RodilloCopyright:

Available Formats

Acco Level 1

EASY

1. A characteristic of partnership which states that there cannot be a partnership without contribution

of money, property, or industry to a common fund

A. Mutual Contribution B.Co-ownership of Contributed Assests

C. Division of Profits or Losses D. Mutual Agency

Answer: A. Mutual Contribution

2. A Jay Cee invested into a partnership a building with a Php 550,000 carrying value and Php 700,000

fair market value. The related mortgage payable of Php 425,000 was assumed by the partnership. As a

result of the investment, the Cee’s capital account would be credited for

A. Php 425,000 B. Php 550,000

C. Php 275,000 D. Php 700,000

Answer: C. Php 275,000

3. A kind of partner who does not take active part in the business of the partnership and is not known as

a partner.

A. Secret Partner B. Dormant Partner

C. Nominal Partner D. Silent Partner

Answer: B. Dormant Partner

AVERAGE

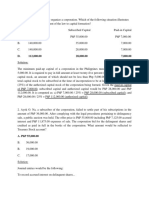

1. Jay Cee and Eigh Arh are best friends and they decided to form a partnership. Cee and Arh receive a

salary of Php 710,000 and Php 820,000, respectively the end of the year, the partnership suffered a loss

of Php 600,000. The partnership agreement provides for the division of profits and losses in the ratio of

2:1 for Cee and Arh, respectively. By how much would Cee’s account decrease?

Answer: Php 620,000

2. JG Partnership was formed on January 1, 2019 by Jin Art and Gin Pee through investing Php 400,000

and Php 800,000, respectively. On April 1, 2019, Jin invested an additional Php 100,000 to the

partnership. Meanwhile, on July 1, 2019, Gin withdrew Php 50,000 from the partnership. An amount of

Php 300,000 was gained as profit of the partnership by December 31, 2019. Compute for the average

capital balances of each partner.

Answer: Jin Art – Php 475,000

Gin Pee – Php 775,000

3. A 15% interest on average capital account balances of partners Hin and Tay was Php 71,250 and Php

116,250, respectively. If the partnership’s profit at the end of the year was Php 300,000 and the

partnership’s agreement for the distribution of profits and losses would be equal, how much would be

partner Tay’s share in profits?

Answer: Php 172,500

DIFFICULT

1. Double D partnership gained a profit amounting to Php 400,000 and the partnership agreement

between Anne Drehs and Ran Dy provided for the following:

a. Bonus to Drehs of 25% of profit after salaries and interest but before bonus;

b. Annual salaries of Php 100,000 to Drehs and Php 60,000 to Dy;

c. Average capital balances’ interests: Php 71,250 and Php 116,250 for Drehs and Dy, respectively;

d. Balance to be divided in a ratio 40:60.

Find Dy’s share in profits.

Answer: Php 199,875

2. Manda Rin and Rambong Bong are partners with capital balances of Php 400,000 and Php 200,000,

respectively. They share profits in a ratio of 3:1. The partners agreed to admit Revilla Go who will invest

Php 240,000 for a one-third interest in the business. Prepare the journal entry for the bonus given and

admission of the new partner.

Answer: Cash Php 240,000

Rin, Capital 30,000

Bong, Capital 10,000

Go, Capital Php 280,000

3. JPIA Inc., the premier tutorial service provider in the country, has the following shareholder’s equity:

*12% Preference Shares, Php 100 par, authorized 4,000 shares, Php 200,000

2,000 shares issued and outstanding

*Ordinary Shares, Php 100 par, authorized 6,000 shares, 3,000 300,000

shares issued and outstanding

*Retained Earnings 260,000

Due to failure of dividend declaration in the past two years and current year’s results of operation, the

board declared cash dividends of Php 200,000. Determine the dividends per share for ordinary

shareholders under non-cumulative and non-participating preference shares

Answer: Php 58.67

CLINCHER

1. Scrutinize each statement below:

I. Retained earnings consist of a pool of funds to be distributed to shareholders.

II. Retained earnings represent cash readily available for dividends.

A. Only the first statement is correct B. Only the second statement is correct

C. Both statements are correct D. Both statements are incorrect

Answer: D. Both statements are incorrect

2. Scrutinize each statement below:

I. When ordinary shares with a par value are sold for a price that exceeds par value, the Ordinary Shares

account is credited only for the par value of the shares sold.

II. When ordinary shares without par value are sold, the proceeds should be credited to the ordinary

shares account.

A. Only the first statement is correct B. Only the second statement is correct

C. Both statements are correct D. Both statements are incorrect

Answer: C. Both statements are correct

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Johnson and Vanderhoef PMHNP Certification Review ManualDocument451 pagesJohnson and Vanderhoef PMHNP Certification Review ManualSoojung Nam93% (14)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- BSBMGT402 Implement Operational Plan KM2Document17 pagesBSBMGT402 Implement Operational Plan KM2cplerk78% (9)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Marketing AssignmentDocument13 pagesMarketing AssignmentHawe MesfinNo ratings yet

- Test Bank 4Document5 pagesTest Bank 4Jinx Cyrus RodilloNo ratings yet

- Ch13TB PDFDocument25 pagesCh13TB PDFJinx Cyrus RodilloNo ratings yet

- SolMan (Advanced Accounting)Document190 pagesSolMan (Advanced Accounting)Jinx Cyrus RodilloNo ratings yet

- Acctg. QB 1-2Document3 pagesAcctg. QB 1-2Jinx Cyrus RodilloNo ratings yet

- Multiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument11 pagesMultiple Choice: Identify The Choice That Best Completes The Statement or Answers The QuestionJinx Cyrus RodilloNo ratings yet

- Acctg. QB 1-1Document8 pagesAcctg. QB 1-1Jinx Cyrus Rodillo0% (1)

- Science QBDocument4 pagesScience QBJinx Cyrus Rodillo0% (1)

- Cost Accounting Quiz Bee EasyDocument9 pagesCost Accounting Quiz Bee EasyJinx Cyrus RodilloNo ratings yet

- 13 Factory Overhead - DepartmentaliationDocument25 pages13 Factory Overhead - DepartmentaliationGab Gab Malgapo100% (1)

- Acctg. QB 1-1Document8 pagesAcctg. QB 1-1Jinx Cyrus RodilloNo ratings yet

- Acctg. QB 1-2Document3 pagesAcctg. QB 1-2Jinx Cyrus RodilloNo ratings yet

- Test Bank 4Document5 pagesTest Bank 4Jinx Cyrus RodilloNo ratings yet

- Test Bank 3Document11 pagesTest Bank 3Jinx Cyrus RodilloNo ratings yet

- Midterms Reviewer - No Northwest Corner Least Cost Method Vogels MethodDocument24 pagesMidterms Reviewer - No Northwest Corner Least Cost Method Vogels MethodJinx Cyrus RodilloNo ratings yet

- Syllabus in Accounting Information SystemDocument7 pagesSyllabus in Accounting Information SystemJinx Cyrus Rodillo100% (1)

- SolMan (Advanced Accounting)Document190 pagesSolMan (Advanced Accounting)Jinx Cyrus RodilloNo ratings yet

- OM Narrative ReportDocument9 pagesOM Narrative ReportJinx Cyrus RodilloNo ratings yet

- ParCor QuizDocument4 pagesParCor QuizJinx Cyrus Rodillo0% (1)

- License Plate Recognition Methods Employing Neural NetworksDocument34 pagesLicense Plate Recognition Methods Employing Neural Networksmuhammad rohmattullahNo ratings yet

- Carl Hansen and Son Main Catalog 2017Document113 pagesCarl Hansen and Son Main Catalog 2017chloevagyok100% (1)

- Simplified SFM Theory Book by CA Jatin Nagpal - CompressedDocument47 pagesSimplified SFM Theory Book by CA Jatin Nagpal - CompressedSatyendraGuptaNo ratings yet

- The Use of Social Media and Its Influence On Employee Performance: The Case of Zain BahrainDocument6 pagesThe Use of Social Media and Its Influence On Employee Performance: The Case of Zain BahrainInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- JVC AV-21CS24 AV-21CX14 Service ManualDocument86 pagesJVC AV-21CS24 AV-21CX14 Service ManualLara Atos100% (4)

- Freenas9.1.0 GuideDocument272 pagesFreenas9.1.0 GuideAmit ShuklaNo ratings yet

- List of DOS CommandsDocument22 pagesList of DOS CommandsVikash SharmaNo ratings yet

- Module 3 Consignment Mar 26 2023Document26 pagesModule 3 Consignment Mar 26 2023Lorifel Antonette Laoreno TejeroNo ratings yet

- Computer Investigatory Project Class 12 FLIGHT BOOKLINGDocument34 pagesComputer Investigatory Project Class 12 FLIGHT BOOKLINGNiklesh Selva100% (3)

- Assignment 2 Text File InglesiiiDocument6 pagesAssignment 2 Text File InglesiiiEstrella De SantiagoNo ratings yet

- Dyson - Design Engineer - Job DescriptionDocument2 pagesDyson - Design Engineer - Job DescriptionShilton SoaresNo ratings yet

- X6 RM-551 RM-552 RM-559 SM L3&4 PDFDocument230 pagesX6 RM-551 RM-552 RM-559 SM L3&4 PDFElmer Leodan Rojas CachayNo ratings yet

- Site ExpensesDocument85 pagesSite Expensesranadip mayraNo ratings yet

- WACC Berger Paints Bahar RoyDocument12 pagesWACC Berger Paints Bahar RoyBahar RoyNo ratings yet

- MS-203 - Charles Hubbell CollectionDocument8 pagesMS-203 - Charles Hubbell CollectionStargazerNo ratings yet

- CHK 232 Understanding Organisational Culture PDFDocument6 pagesCHK 232 Understanding Organisational Culture PDFAnca IscuNo ratings yet

- Highway Engineering Section 1Document9 pagesHighway Engineering Section 1Eric NagumNo ratings yet

- Chapter 7 Assessing and Securing Your Credit: Personal Finance, 6e (Madura)Document22 pagesChapter 7 Assessing and Securing Your Credit: Personal Finance, 6e (Madura)Huỳnh Lữ Thị NhưNo ratings yet

- Handbook For Councillors - UrbanDocument59 pagesHandbook For Councillors - UrbanJustice MurapaNo ratings yet

- How To Identify and Control: Rats MiceDocument2 pagesHow To Identify and Control: Rats Miceghoshtapan4321No ratings yet

- EPM202 Self-Assessment ExerciseDocument12 pagesEPM202 Self-Assessment Exercisemasdo19No ratings yet

- Time Capsule InvestigationDocument9 pagesTime Capsule InvestigationPaola GarciaNo ratings yet

- Shared Memory Multiprocessors: Logical Design and Software InteractionsDocument107 pagesShared Memory Multiprocessors: Logical Design and Software Interactionsfariha2002No ratings yet

- Absolute Sale - Dumapit To ZernaDocument3 pagesAbsolute Sale - Dumapit To ZernaMegan HerreraNo ratings yet

- Present Scenario and Some Problems of Handloom Industry A Study With Handloom Weavers' in Tufanganj Block-I of Cooch Behar District West BengalDocument19 pagesPresent Scenario and Some Problems of Handloom Industry A Study With Handloom Weavers' in Tufanganj Block-I of Cooch Behar District West BengalAVISEK CHAUDHURINo ratings yet

- Within A Given Material, The Speed of Sound:: Is ConstantDocument5 pagesWithin A Given Material, The Speed of Sound:: Is ConstantOsman Gone RanaNo ratings yet

- The Product Process MatrixDocument4 pagesThe Product Process Matrixhpeter195798No ratings yet