Professional Documents

Culture Documents

Branch vs. LLC in The UAE: Form of Establishment Key Features Advantages/Disadvantages Advantages

Uploaded by

Nini KitsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Branch vs. LLC in The UAE: Form of Establishment Key Features Advantages/Disadvantages Advantages

Uploaded by

Nini KitsCopyright:

Available Formats

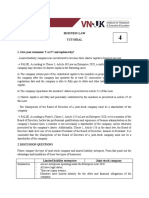

Branch vs.

LLC in the UAE

Although some of the procedures for setting up and obtaining a license can be lengthy, obtaining

the appropriate legal advice will greatly facilitate the process and help foreign companies

understand the optimal legal structure for conducting business in the UAE.

Form of Establishment Key Features Advantages/Disadvantages

Branch - Most popular way for foreign Advantages:

companies to retain 100% ownership;

- The most common procedure for a

- Legally, the Branch is an extension foreign company;

of the parent company so it is not a

separate legal entity; - 100% ownership and control retained;

- The Branch needs to have a national - National agent deals with governmental

service agent. This can be an authorities.

individual or a company provided that

the individual is a UAE national or the

Disadvantages:

company is wholly-owned by UAE

nationals. The national agent does not

acquire any rights in the Branch; it - Significant amount of red-tape to

merely provides services relating to register the Branch and obtain the

federal and local government licence;

requirements such as complying with

the immigration requirements on the - Branch is not a separate legal entity;

Branch’s behalf. National agents will

normally receive a fixed annual fee; - The Company will generally be taxed on

the profits of the Branch;

- The Branch must carry out similar

activities to its parent and is not - Rigorous experience requirements for

permitted to import the products of the the foreign company;

parent company.

- Lengthier procedural requirements than

the LLC

Limited Liability Company - a form of private limited company; Advantages:

- Must be 51% owned by UAE - A separate legal structure;

nationals;

- Limited liability;

- Capital requirement which must be

fully paid-up on incorporation is AED - Any profits retained within the LLC will

300,000 in Dubai and AED 150,000 in generally not be subject to tax in the

Abu Dhabi; parent company’s home jurisdiction;

- Day-to-day management can be - Does not require foreign company to

conducted by a foreign manager and in have significant experience, except in

fact UAE managers often provide a some sector specific areas.

power of attorney to the foreign

managers to enable them to carry-out Disadvantages:

the day-to-day management of the

business; - Has to be 51% UAE owned (although

profits can be shared in a different way);

- It is possible for the LLC’s

memorandum to provide that the - Up-front cost of capitalising the LLC.

profits of the LLC be shared in a ratio

which is different to the percentage of

shares owned by the shareholders (in

practice, it is often the case that the

UAE national receives a small

percentage of the profits).

- The Commercial Companies Law

permits the use of contractual

arrangements to give the minority

shareholder voting, management and

profit sharing rights.

You might also like

- Doing Business in Uae Aug 1920094981Document8 pagesDoing Business in Uae Aug 1920094981Jim SalajohnnyNo ratings yet

- Branch Office v. Separate CorporationDocument3 pagesBranch Office v. Separate Corporationdan pepitoNo ratings yet

- Finance and Accounting For Sustainability, Lecture and BookDocument261 pagesFinance and Accounting For Sustainability, Lecture and Bookjoyamaria99No ratings yet

- Uae Structuring Series (I) From Good To Great: The Constant Evolution of Uae'S Structuring EnvironmentDocument2 pagesUae Structuring Series (I) From Good To Great: The Constant Evolution of Uae'S Structuring EnvironmentHussain MunshiNo ratings yet

- Entity Comparison ChartDocument1 pageEntity Comparison ChartaccoutingfortuneNo ratings yet

- Industrial, Agricultural, Commercial, Service, Investment, Insurance Enterprises and OthersDocument7 pagesIndustrial, Agricultural, Commercial, Service, Investment, Insurance Enterprises and OthersEcaterinaNo ratings yet

- Corp ReviewerDocument12 pagesCorp ReviewerFerl Rama100% (1)

- Forms Types of Business ShortDocument4 pagesForms Types of Business Shortgk concepcionNo ratings yet

- Business Ethics ReviewerDocument8 pagesBusiness Ethics ReviewerRhystle Ann BalcitaNo ratings yet

- Types of Business According To OwnershipDocument5 pagesTypes of Business According To OwnershiphahaniNo ratings yet

- Choose Business EntityDocument2 pagesChoose Business EntityJory Mark Villarmente GogoNo ratings yet

- TORRES - Juvie Ann - A1 - M1-U1 - T1)Document4 pagesTORRES - Juvie Ann - A1 - M1-U1 - T1)Anne TorresNo ratings yet

- Doing Business in The UAEDocument12 pagesDoing Business in The UAENitin JainNo ratings yet

- FinMan_Reviewe_Chapter_4to6Document14 pagesFinMan_Reviewe_Chapter_4to6Jannah May BolanoNo ratings yet

- Doing Business in United Arab Emirates: Bashir Ahmed and Saurbh Kothari Afridi & Angell (Lex Mundi Member Firm)Document8 pagesDoing Business in United Arab Emirates: Bashir Ahmed and Saurbh Kothari Afridi & Angell (Lex Mundi Member Firm)如何如何No ratings yet

- Case-StudiesDocument4 pagesCase-Studies21080091 NGUYEN THI THU TRANGNo ratings yet

- 8115 em Assignment Gaurav S. KadamDocument5 pages8115 em Assignment Gaurav S. KadamAvronNo ratings yet

- UAE Company Formation Guide: Ownership Types and Business LicensesDocument8 pagesUAE Company Formation Guide: Ownership Types and Business LicensesVasu GargNo ratings yet

- Legal Aspects Of: Doing Business in The PhilippinesDocument21 pagesLegal Aspects Of: Doing Business in The PhilippinesRonaldo Santos Jr.No ratings yet

- CorpoDocument15 pagesCorpoCath VillarinNo ratings yet

- Solution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeDocument19 pagesSolution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeCourtneyCollinsntwex100% (40)

- Chapter 4Document24 pagesChapter 4John DoeNo ratings yet

- Chap 3 thương mại quốc tếDocument34 pagesChap 3 thương mại quốc tếĐào Minh NgọcNo ratings yet

- Fabm L2Document3 pagesFabm L2Mar InaNo ratings yet

- Introduction to Corporations LawDocument17 pagesIntroduction to Corporations LawDaniNo ratings yet

- MI CAPITAL Services Newsletter NovemberDocument21 pagesMI CAPITAL Services Newsletter NovemberBnGCA Due-DiligenceNo ratings yet

- Business Organization TypesDocument20 pagesBusiness Organization TypesNadine PantiNo ratings yet

- Types of Business Organizations: Sole Proprietorships, Partnerships, CorporationsDocument10 pagesTypes of Business Organizations: Sole Proprietorships, Partnerships, CorporationsShiraz KhanNo ratings yet

- Introduction Accounting and FinancingDocument5 pagesIntroduction Accounting and FinancingHong TrnhNo ratings yet

- Grade 12 Mabini: Hermwil Rodin D. RobinosDocument2 pagesGrade 12 Mabini: Hermwil Rodin D. RobinosHermwil Rodin RobinosNo ratings yet

- Quick Quiz - Financial ManagementDocument4 pagesQuick Quiz - Financial ManagementJanine Lenie PadronesNo ratings yet

- Establishing A Business in The United Arab EmiratesDocument25 pagesEstablishing A Business in The United Arab EmiratesMohamad RamadanNo ratings yet

- Company Law: Dr. Pratima Narayan Advocate & Law FacultyDocument18 pagesCompany Law: Dr. Pratima Narayan Advocate & Law FacultySmiti JoshiNo ratings yet

- Module 1Document9 pagesModule 1Janielle LacandaloNo ratings yet

- RFBT-Corporations (A-N)Document85 pagesRFBT-Corporations (A-N)Kyle SantosNo ratings yet

- RFBT CorporationsDocument7 pagesRFBT CorporationsKyle SantosNo ratings yet

- Joint Ventures vs SPVs - Key Differences and ComparisonsDocument3 pagesJoint Ventures vs SPVs - Key Differences and Comparisonsanimes prusty89% (9)

- Low Voltage - Business and LawDocument102 pagesLow Voltage - Business and LawGuillermo GonzalezNo ratings yet

- Law ExerciseDocument3 pagesLaw ExerciseFatin InsyirahNo ratings yet

- FinMan_Reviewe_Chapter_4to6Document18 pagesFinMan_Reviewe_Chapter_4to6Jannah May BolanoNo ratings yet

- Understanding Business Ownership and EntrepreneurshipDocument7 pagesUnderstanding Business Ownership and EntrepreneurshipJazareno HallyNo ratings yet

- Tutorial 4 - LE TRAN KHANH PHUONGDocument3 pagesTutorial 4 - LE TRAN KHANH PHUONGPhương Lê Trần KhánhNo ratings yet

- Corporate law notes on companies limited by guaranteeDocument7 pagesCorporate law notes on companies limited by guaranteeTayo AkinkuolieNo ratings yet

- Corporations: Organization and Capital Stock Transaction: Corporation Second GradeDocument113 pagesCorporations: Organization and Capital Stock Transaction: Corporation Second GradePeter WagdyNo ratings yet

- Business Ethics Week 1 8 ReviewerDocument11 pagesBusiness Ethics Week 1 8 ReviewerKeiNo ratings yet

- Business Structure OptionsDocument4 pagesBusiness Structure OptionsJodie MohrNo ratings yet

- Dubai Business ServicesDocument1 pageDubai Business ServicesTanjaNo ratings yet

- Mainland Business in Dubai - Mainland Company FormationDocument15 pagesMainland Business in Dubai - Mainland Company FormationShiva kumarNo ratings yet

- Types of Business Structures in the PhilippinesDocument7 pagesTypes of Business Structures in the PhilippinesBusiness100% (1)

- Presentation 8 EconomicsDocument46 pagesPresentation 8 EconomicsAshmita MahadeosinghNo ratings yet

- Lesson 4 Financial ManagementDocument3 pagesLesson 4 Financial ManagementLand DoranNo ratings yet

- Corporation Chapter 1 NotesDocument3 pagesCorporation Chapter 1 NotesNyah MallariNo ratings yet

- Las in Org MGT Week4Document9 pagesLas in Org MGT Week4sarah fojasNo ratings yet

- Choosing the Right Business StructureDocument27 pagesChoosing the Right Business StructureDaisy RomaresNo ratings yet

- In Tax LeveragedBuyouts (LBOs) NoexpDocument3 pagesIn Tax LeveragedBuyouts (LBOs) NoexpRAKSHIT CHAUHANNo ratings yet

- PARTNERTSHIPDocument2 pagesPARTNERTSHIPMafel Udarve JumuadNo ratings yet

- Dwnload Full Corporate Finance European Edition 2nd Edition Hillier Solutions Manual PDFDocument35 pagesDwnload Full Corporate Finance European Edition 2nd Edition Hillier Solutions Manual PDFdesidapawangl100% (10)

- Business FormsDocument1 pageBusiness FormskhanyamadonselaNo ratings yet

- HOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”From EverandHOW TO START & OPERATE A SUCCESSFUL BUSINESS: “The Trusted Professional Step-By-Step Guide”No ratings yet

- Declaration Form: Spice Eye Uganda Registered and Owned by Facebook Inc in Names ofDocument1 pageDeclaration Form: Spice Eye Uganda Registered and Owned by Facebook Inc in Names ofNini KitsNo ratings yet

- Business Blueprint SampleDocument9 pagesBusiness Blueprint SampleMoumee ChandaNo ratings yet

- Facebook Page Set UpDocument1 pageFacebook Page Set UpNini KitsNo ratings yet

- Onlinemarketingstrategy 090828040645 Phpapp01Document43 pagesOnlinemarketingstrategy 090828040645 Phpapp01Maryem YaakoubiNo ratings yet

- 844E Gigacenter Quick Start Guide: Package ContentsDocument12 pages844E Gigacenter Quick Start Guide: Package ContentsNini KitsNo ratings yet

- Building The Cognitive Enterprise Nine Action Areas Deep Dive - 29030229USENDocument80 pagesBuilding The Cognitive Enterprise Nine Action Areas Deep Dive - 29030229USENNini KitsNo ratings yet

- Start Time Activity Responsibility MatchDocument2 pagesStart Time Activity Responsibility MatchNini KitsNo ratings yet

- Personal Financial Statement of Ssali Rodhni Kiggundu 1999Document2 pagesPersonal Financial Statement of Ssali Rodhni Kiggundu 1999Nini KitsNo ratings yet

- XYZ Company Asset Inventory ReportDocument1 pageXYZ Company Asset Inventory ReportNini KitsNo ratings yet

- Exhibit A SAMPLE CONTRACT PDFDocument11 pagesExhibit A SAMPLE CONTRACT PDFSuppliers ptyNo ratings yet

- XYZ Company Asset Inventory ReportDocument1 pageXYZ Company Asset Inventory ReportNini KitsNo ratings yet

- Assets Mark PC Senag LoanDocument7 pagesAssets Mark PC Senag LoanNini KitsNo ratings yet

- Maintenance Contract: PurposeDocument3 pagesMaintenance Contract: PurposeNini KitsNo ratings yet

- Manage finances with multiple money accountsDocument2 pagesManage finances with multiple money accountsNini KitsNo ratings yet

- A Gringa in Oaxaca PDFDocument54 pagesA Gringa in Oaxaca PDFPeggy BryanNo ratings yet

- Virtualization Types: OS, Hardware Emulation, and ParavirtualizationDocument7 pagesVirtualization Types: OS, Hardware Emulation, and ParavirtualizationvinoopnvNo ratings yet

- FSN Lullaby Warmer Resus Plus&PrimeDocument4 pagesFSN Lullaby Warmer Resus Plus&PrimemohdkhidirNo ratings yet

- Effectiveness of Drug and Substance Abuse Prevention Programs PDFDocument245 pagesEffectiveness of Drug and Substance Abuse Prevention Programs PDFjohn gooco100% (2)

- 2 The Crypt of Elder Hallow 2ndDocument13 pages2 The Crypt of Elder Hallow 2ndmike roulette100% (1)

- The Irish Light 10Document28 pagesThe Irish Light 10Twinomugisha Ndinyenka RobertNo ratings yet

- Medicard Phil Inc. vs. CIRDocument2 pagesMedicard Phil Inc. vs. CIRhigoremso giensdksNo ratings yet

- Annual Report-2018-19 (English)Document242 pagesAnnual Report-2018-19 (English)Alle de BeusNo ratings yet

- Cut Nyak Dhien: Aceh's Legendary Resistance LeaderDocument5 pagesCut Nyak Dhien: Aceh's Legendary Resistance LeaderKhoerudin KhoerudinNo ratings yet

- Exercise For FitnessDocument44 pagesExercise For FitnessSheena Mae Sube PoNo ratings yet

- Explore the City Centre in Salt Lake, KolkataDocument7 pagesExplore the City Centre in Salt Lake, Kolkataaishwarya raniNo ratings yet

- Letter To Editor NDocument5 pagesLetter To Editor NNavya AgarwalNo ratings yet

- Gold V Essex CCDocument11 pagesGold V Essex CCZACHARIAH MANKIRNo ratings yet

- Fatima! Through The Eyes of A ChildDocument32 pagesFatima! Through The Eyes of A ChildThe Fatima Center100% (1)

- Self Unbound Ego Dissolution in PsychedelicDocument11 pagesSelf Unbound Ego Dissolution in Psychedelicszucsanna123456789No ratings yet

- Songs Masters Campfire SongbookDocument50 pagesSongs Masters Campfire SongbookGuillaume Metz86% (7)

- Lecture 1 (Introductory Class)Document23 pagesLecture 1 (Introductory Class)Amara SoOmroNo ratings yet

- 2.3 Stabilized MaterialDocument11 pages2.3 Stabilized MaterialMamush LetaNo ratings yet

- Insertion Mangement Peripheral IVCannulaDocument20 pagesInsertion Mangement Peripheral IVCannulaAadil AadilNo ratings yet

- Stranger Things Episode Script 2 05 Chapter Five Dig DugDocument67 pagesStranger Things Episode Script 2 05 Chapter Five Dig Dugyonas123No ratings yet

- Indexed Journals of Pakistan - Medline and EmbaseDocument48 pagesIndexed Journals of Pakistan - Medline and EmbaseFaisal RoohiNo ratings yet

- Cookery 10Document5 pagesCookery 10Angelica CunananNo ratings yet

- Ritangle 2018 QuestionsDocument25 pagesRitangle 2018 QuestionsStormzy 67No ratings yet

- T e 2552731 Describe The Creature Writing Worksheet - Ver - 2Document3 pagesT e 2552731 Describe The Creature Writing Worksheet - Ver - 2Minah ZamanNo ratings yet

- A. Music G8 Fourth QuarterDocument7 pagesA. Music G8 Fourth Quarterjason bernalNo ratings yet

- Master of Business Administration MBA BrochureDocument7 pagesMaster of Business Administration MBA BrochureAnmol SadwalNo ratings yet

- Igbe Religion's 21st Century Syncretic Response to ChristianityDocument30 pagesIgbe Religion's 21st Century Syncretic Response to ChristianityFortune AFATAKPANo ratings yet

- Increased Demand of Parcels For Residential Experts' Interest To Have New Parcelation Map Drainage ProblemDocument23 pagesIncreased Demand of Parcels For Residential Experts' Interest To Have New Parcelation Map Drainage ProblemTesfuGebreslassieNo ratings yet

- Far Eastern Shipping Vs CADocument2 pagesFar Eastern Shipping Vs CAAnonymous 5MiN6I78I0No ratings yet