Professional Documents

Culture Documents

End of Term Assignment For The Course: Corporate Finance

Uploaded by

Lê Thị Minh Hương0 ratings0% found this document useful (0 votes)

10 views2 pagesBài tập lớn

Original Title

CORPORATE FINANCE -BTL

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBài tập lớn

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesEnd of Term Assignment For The Course: Corporate Finance

Uploaded by

Lê Thị Minh HươngBài tập lớn

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

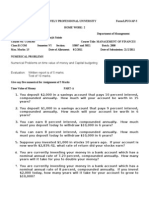

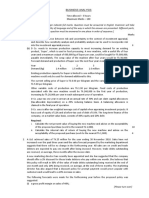

END OF TERM ASSIGNMENT

FOR THE COURSE: CORPORATE FINANCE

Collect the financial statements in 3 continuous years from a listed company

in Vietnam stocks market. Class monitor should be informed about all selected

companies to make sure one company cannot be analysed by more than 1 student.

Prepare an analysis report about these following financial aspects of the company:

1. Financial analysis (50 points)

Prepare trend-analysis for company’s ratios. The computed ratios should

measure those financial aspects of the company.

• Short-term solvency or liquidity

• Long-term solvency or financial leverage

• Asset management or turnover

• Profitability

• Market value

Provide short review on those ratios using acceptable benchmark.

2. Dupont analysis (30 points)

Using Dupont analysis to identify the elements that affect ROE of the

company in three selected years.

3. Capital structure and cost of capital (40 points)

Identify the changes in the company’s capital structure and compute the

company’s cost of capital using CAPM or Dividend Growth Model.

4. Project’s finance analysis

If the company has decided to bid on the contract to supply 150,000 units

per year over the next 7 years. It will cost the company VND 10 billion to install

the equipment necessary to start production. The cost will be depreciated straight-

line to zero over the project’s life. The company estimates that in 7 years, the

equipment can be salvaged for VND 580 million. The fixed production cost will be

VND 2.5 billion per year, and the variable costs should be VND 250,000 per unit.

The company also need an initial investment in net working capital of VND 340

million. Using the cost of capital computed in question 3 as the company’s

required rate of return, what bid price should the company submit?

5. Short-term finance management

Analysing the short-term finance management by interpreting the changes in

operating cycle, cash cycle, and cash management in the studied period.

Deadline: 25/6/2020 in Teams

Other presentation requirements: MS Word with Times New Roman 13; 1.5

lines.

Lecturer

Vu Thi Loan

You might also like

- F9 RM QuestionsDocument14 pagesF9 RM QuestionsImranRazaBozdar0% (1)

- Q and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011Document71 pagesQ and As-Corporate Financial Management - June 2010 Dec 2010 and June 2011chisomo_phiri72290% (2)

- Unit 13 - Managing Financial Principles & TechniquesDocument11 pagesUnit 13 - Managing Financial Principles & TechniquesY.h. Tariq0% (2)

- Capital Budgeting TechniquesDocument2 pagesCapital Budgeting TechniquesmananipratikNo ratings yet

- ACCA p4 2007 Dec QuestionDocument13 pagesACCA p4 2007 Dec QuestiondhaneshwareeNo ratings yet

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- Audit and Assurance December 2011 Exam Paper, ICAEWDocument6 pagesAudit and Assurance December 2011 Exam Paper, ICAEWjakariauzzalNo ratings yet

- MB0045Document3 pagesMB0045Wael AlsawafiriNo ratings yet

- Finances em 2Document3 pagesFinances em 2Craaft NishiNo ratings yet

- Nes 124 - Quiz #6Document2 pagesNes 124 - Quiz #6PatrickNo ratings yet

- ACC208 Sem 2 2021Document3 pagesACC208 Sem 2 202120220354No ratings yet

- Corporate Finance, Term-II, 2021-23Document2 pagesCorporate Finance, Term-II, 2021-23keshav kumarNo ratings yet

- Multiple Choice Theory: Choose The Best Answer. 1 Point EachDocument9 pagesMultiple Choice Theory: Choose The Best Answer. 1 Point EachPao SalvadorNo ratings yet

- Strategic Corporate Finance AssignmentDocument6 pagesStrategic Corporate Finance AssignmentAmbrish (gYpr.in)0% (1)

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Financial Management: Thursday 9 June 2011Document9 pagesFinancial Management: Thursday 9 June 2011catcat1122No ratings yet

- MB0029Document3 pagesMB0029Tenzin KunchokNo ratings yet

- Assignment 2Document4 pagesAssignment 2Jayanth Appi KNo ratings yet

- L4 Auditing Q&ADocument23 pagesL4 Auditing Q&AChiso PhiriNo ratings yet

- Acp5efm13 J CombinedDocument36 pagesAcp5efm13 J CombinedHan HowNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- AssignmentDocument3 pagesAssignmentChourasia HarishNo ratings yet

- IMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Document5 pagesIMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)No ratings yet

- 2.BMMF5103 - EQ Formattedl May 2012Document7 pages2.BMMF5103 - EQ Formattedl May 2012thaingtNo ratings yet

- Advanced Financial Management: Thursday 10 June 2010Document10 pagesAdvanced Financial Management: Thursday 10 June 2010Waleed MinhasNo ratings yet

- Mini Project WorkDocument6 pagesMini Project WorkVengatesh SNo ratings yet

- Capital Budgeting 1 - 1Document103 pagesCapital Budgeting 1 - 1Subhadeep BasuNo ratings yet

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Audit and Assurance (International) : Thursday 5 June 2014Document6 pagesAudit and Assurance (International) : Thursday 5 June 2014SajidZiaNo ratings yet

- Alma Siwi (1701617016) - Tekun Chapter 5Document8 pagesAlma Siwi (1701617016) - Tekun Chapter 5Alma SiwiNo ratings yet

- CV Et QP 2022 - PGPFDocument7 pagesCV Et QP 2022 - PGPFanish mahtoNo ratings yet

- p1 Managerial Finance August 2017Document24 pagesp1 Managerial Finance August 2017ghulam murtazaNo ratings yet

- Financial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Document22 pagesFinancial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Pasupuleti Balasubramaniyam100% (1)

- 1FT & 1JF ACC9011M TCA RESIT 2022 v1Document5 pages1FT & 1JF ACC9011M TCA RESIT 2022 v1waqas aliNo ratings yet

- Accf 2204Document7 pagesAccf 2204Avi StrikyNo ratings yet

- Sem IV (Internal 2010)Document15 pagesSem IV (Internal 2010)anandpatel2991No ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementRajyalakshmi MNo ratings yet

- Saa P5Document12 pagesSaa P5smartguy0No ratings yet

- Capital Budgeting - Phase 2Document39 pagesCapital Budgeting - Phase 2Julie Ann PiliNo ratings yet

- Working Capital and Fund Flow Statement of Modest Infrastucture LTDDocument27 pagesWorking Capital and Fund Flow Statement of Modest Infrastucture LTDMegha HumbalNo ratings yet

- Advanced Financial Management: Tuesday 3 June 2014Document13 pagesAdvanced Financial Management: Tuesday 3 June 2014SajidZiaNo ratings yet

- Capital BudgetingDocument47 pagesCapital BudgetingShaheer AliNo ratings yet

- FAM Assignment Jan 2020Document15 pagesFAM Assignment Jan 2020Anil KumarNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- Advanced Financial Management: Tuesday 3 June 2014Document13 pagesAdvanced Financial Management: Tuesday 3 June 2014sarirahmadNo ratings yet

- CapitalBudgetingAndInvestmentDecisions PDFDocument22 pagesCapitalBudgetingAndInvestmentDecisions PDFMuhammad KashifNo ratings yet

- BudgetDocument14 pagesBudgetKomal Shujaat100% (8)

- Business - Analysis Dec-11Document3 pagesBusiness - Analysis Dec-11SHEIKH MOHAMMAD KAUSARUL ALAMNo ratings yet

- Project Financial Appraisal - NumericalsDocument5 pagesProject Financial Appraisal - NumericalsAbhishek KarekarNo ratings yet

- Lecture 6Document40 pagesLecture 6premsuwaatiiNo ratings yet

- Midterm Exam - Esecon 1ST Sem. 2021-2022Document3 pagesMidterm Exam - Esecon 1ST Sem. 2021-2022raymond moscosoNo ratings yet

- CMA2 P2 Practice Questions PDFDocument12 pagesCMA2 P2 Practice Questions PDFMostafa Hassan100% (1)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)