Professional Documents

Culture Documents

Tariff Guide PDF

Tariff Guide PDF

Uploaded by

joseph ochiengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tariff Guide PDF

Tariff Guide PDF

Uploaded by

joseph ochiengCopyright:

Available Formats

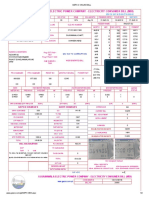

CASH WITHDRAWAL CHARGE Bankers Cheques Issued FOREIGN CURRENCY C/A

ATM transaction (a) To Customers KShs. 200/= per cheque Current (Memo Group Savings (Memo Group

(a) Customers KShs. 30/= per withdrawal (b) To Non-customers KShs. 200/= per cheque 02120, 03120 & 22120) 02100, 03100 & 22100)

(b) Saccolink KShs. 30/= per withdrawal (c) FOSA Bankers Cheques sold by KShs. 100/= per cheque split as follows: Opening Balance USD 50 USD 50

Over the counter for all Savings accounts KShs. 100/= per withdrawal saccos on the bank’s behalf Bank = 50% i.e KShs. 50/= per cheque GBP 50 GBP 50

Saccos = 50% i.e KShs. 50/= per cheque EUR 50 EUR 50

MCO-OP CASH FOREIGN TRANSFER OF FUNDS (OUTWARD) Minimum Operating Balance Nil USD 250

GBP 250

Transactions Bank account Mco-op cash account Mail Transfer

EUR 250

(a) Customers KShs. 2,000/=

Registration Free Free Account Maintenance Fee (p.m) USD 5 Nil

(b) Non-customers KShs. 2,000/=

Foreign Currency Drafts: (in KShs. or equivalent in forex) GBP 5

Daily alert KShs. 5 KShs. 5

(a) Drafts on application KShs. 500/= plus cash handling charges EUR 5

ATM withdrawal KShs. 30 KShs. 30 (where applicable) Stop payments USD 10 Nil

- Postage KShs. 100/= GBP 10

Transfer to Bank account KShs. 35 KShs. 35

- Stamp duty KShs. 2.50 EUR 10

Transfer to Sacco account KShs. 30 KShs. 30 (b) Payment advising fee KShs. 500/= (for Drafts drawn on SA, Indian banks Unpaid Cheques, Refer to USD 35 N/A

Utility payments KShs. 50 KShs. 50 and all drafts of value of $5,000 and above) Drawer & Effects Not Cleared EUR 35

(c) Replacement of Drafts/IMO KShs. 250/= per request plus cost of cable GBP 25

Agent withdrawal (Tiered) KShs. 30 – 120 KShs. 30 - 120 Encashment of Third party USD 5 N/A

Stop Payment instructions Cheques drawn own bank GBP 5

Transfer to Mpesa, Airtel Money, etc (Tiered) KShs. 50 – 220 KShs. 50 - 220

(a) Commission KShs. 500/= EUR 5

Transfer from Bank account KShs. 35 Free (b) SWIFT KShs. 330/= Cheque book - 50 leaves USD 7 N/A GBP 7 EUR 7

Transfer from Sacco account KShs. 30 Free (c) Other foreign bank’s charges KShs. 750/= (to be collected at Branch) Cheque book - 100 leaves USD 15 N/A GBP 15 EUR 15

FOREIGN TRANSFER OF FUNDS (INWARD) Counter cheque USD 4 N/A GBP 4 EUR 4

Balance/other enquiry KShs. 35 KShs. 5

Moneygram transfer (Receiving) Free Internal Transfer Free Free

Debit and Credit alerts KShs. 35 KShs. 10 Purchase of Travellers Cheques 1% minimum KShs. 250.00 plus Audit Certificate USD 15 USD 15 GBP 15

(Includes Postage & Stamps) Postage of KShs. 100.00 per deposit. GBP 15 EUR 15 EUR 15

M-pesa deposit KShs. 35 Free

Purchase of foreign currency notes against Normal buying rate of currency Incoming TT/ SWIFT Free Free

EFT transfer KShs. 150 KShs. 100 TCs presented (includes Postage & Stamps) concerned plus KShs. 25/= per leaf. Outward SWIFT KShs. 1,500/= KShs. 1,500/=

Airtime Purchase (Tiered) KShs. 20 – 50 KShs. 10 – 32 Purchase of Foreign currency notes - For All Transactions Statement USD 2 USD 2

- No Commission EUR 2 EUR 2

Sale of foreign currency notes - For All Transactions GBP 2 GBP 2

STATEMENTS * Free mini statement * Free mini statement

- No Commission

Scheduled statements Free Draft against currency notes or Inward TTs Charge 1.5% + cost of draft (KShs. 602.50)

E-statements Free

Current Account Savings Account

Interim statements per page KShs. 100/= DOCUMENTARY BILLS - LOCAL Dormant Account Re-activation USD 5 USD 5

ATM Mini Statements Free Bills commission 0.25% minimum KShs. 600/= EUR 5 EUR 5

Daily and special request Statements KShs. 100/= per statement Postage KShs. 100/= GBP 5 GBP 5

Duplicate/additional statements/old records KShs. 250/= per copy Stamp duty Nil Cash withdrawal 0.25% for amounts above 0.25% for amounts above

2-5 years KShs. 500/= per copy USD 2,500, USD 2,500

DOCUMENTARY OUTWARD LCs GBP 1,700 & GBP 1,700 &

5 years KShs. 1,000/= per copy

Establishing: EUR 2000 EUR 2000

Closed account (cash) KShs. 1,000/= per copy (a) Sight 0.5% per quarter, minimum KShs. 1000/= Cash Deposit- Small notes denominations

OLD RECORDS (b) Usance 0.5% per quarter, minimum KShs. 1000/= (USD 1, 5, 10 & 20) 1% – Min. USD 5, 1% – Min. USD 5,

Retrieval (cheques, vouchers) KShs. 250/= per copy Amendments (GBP 1, 5 & 10) EUR 5 EUR 5 &

RTS Mail (a) Increase amount of credit or expiry date 0.5% per quarter minimum KShs. 1,000/= (EUR 1, 5, 10 & 20) GBP 5 GBP 5

Where the Bank is not at fault KShs. 100/= per each returned letter (b) Other amendments KShs. 2,000/= per amendments Cash deposit- Big note denominations Up to USD 10,000 - Free Up to USD 10,000 – Free

Acceptance by Bank Above USD 10,000, Above USD 10,000,

(a) Payment 0.25% min. KShs. 1,000/= GBP 6,700 & GBP 6,700 &

STOP PAYMENTS (CUSTOMER CHEQUES)

(b) Discharging (when credit expires

Foreign Currency Account US$ 5 or equivalent per cheque EUR 7,700 - EUR 7,700 –

with less 50% utilisation 0.1% on balance, minimum KShs. 500/=

Current Account KShs. 400/= 0.5% of the amount 0.5% of the amount

Cable/Swift charges

Cost of Revenue Stamp USD 1 USD 1

(a) Full KShs. 5,000/=

EUR 1 EUR 1

CLOSURE OF ACCOUNT (b) Short KShs. 1,000/=

GBP 1 GBP 1

Goldfish a/c Free Release of documents against undertaking 0.15% of value, minimum KShs. 600/=

Account Closure USD 5 USD 5

max. KShs. 5,000/=

Foreign Currency Current Account US$ 7 or equivalent EUR 5 EUR 5

All other accounts: DOCUMENTARY LETTERS OF CREDIT (INWARD) GBP 5 GBP 5

Less than three months KShs. 1,000/= Advising without confirmation Cheques paid against ENC & Excesses 3% of ENC or Excess amount

3 months to 6 months KShs. 500/= (a) Customer KShs. 1,000/= min USD/EUR 30 GBP 20

Over 6 months KShs. 300/= (b) Non-customers KShs. 2,000/= Cheques paid against ENC & Excesses for Saccos USD/EUR 15 GBP 10 per cheque

Transfer of Accounts (inter-branch) Free Advising credit & adding confirmation: Payee USD/EUR 7 GBP 5

(a) Customer 0.4% + telex or cables/swift charges of KShs. 2,000/= Unpaid cheques technical reason USD/EUR 10 GBP 7

CLEARING & REMITTANCES

(b) Non-customers 0.5%f + telex or cable/swift charges of KShs. 2,000/= GOLDFISH

Clearing Discrepancy fees US$20 + telex or SWIFT Charges of KShs. 2,000/= Minimum opening balance (cash) KShs. 50,000/=

All Cheques Free Bills Negotiated under credit or advance made in KShs. (or other currencies) Minimum operating balance KShs. 50,000/=

EFT (Automated Payments) for Jumbo Link Customers (a) Customers 0.3% min. KShs. 1,000/= plus interest for tenor period Account maintenance fee for balances

Internal & External KShs. 0 to KShs. 250 (Depending on customer (Min. USD20 or equivalent) below minimum KShs. 400/= for amounts less than 50,000/=

agreement with the bank) (b) Non customer 0.4% min. KShs. 1,000/= plus interest for tenor period

EFT (from other Banks) (Min. USD20 or equivalent). JUMBO JUNIOR ACCESS ACCOUNT

Inward EFTs KShs. 200/= Minimum opening balance KShs. 500/=

Salary Processing

FOREIGN BILLS FOR COLLECTION (OUTWARD) Minimum operating balance KShs. 500/=

(a) Manual KShs. 250/= Clean: Elebank Free for new accounts

(b) Pension KShs. 100/= (a) Minimum bill amount USD50 0.3% flat. Minimum Replacing Elebank KShs. 500/=

KShs. 1,000/= plus courier or equivalent charges Bank cheque to school KShs. 100/= per cheque

(c) FOSA Salary KShs. 50/=

(Applies to any amount above $500) Maintenance fee NIL

(d) Salary returned to employer KShs. 300/= + cost of instrument

(b) Bills drawn on countries where Annual birthday cards Free

Produce proceeds - processed KShs. 100/=

the bank is not represented Additional charge of KShs. 500/=

Tax Refunds - processed KShs. 150/= CO-OP SALARY

(c) Bills drawn in currency different

Tea bonus: from that of the paying bank’s Additional charge of KShs. 500/= Minimum opening balance (cash) NIL

(a) Amounts over KShs. 1000/= KShs. 150/= (d) Bills drawn in Swiss Francs (CHF) 5 CHF or equivalent as additional charge Minimum operating balance NIL

(b) Amounts of less than KShs. 1000/= KShs. 50/= Documentary 0.3% flat. Minimum KShs. 1,000/= plus courier charges Maintenance fee NIL

Loans & Share deductions on behalf of KShs. 200/= per entrythe Society/Employer Tracer/Chase for payment not received KShs. 600/= plus related costs incurred

Report for Audit purposes KShs. 1,000/= per request EXECUTIVE BANKING SERVICE

Photocopies (per page) KShs. 75/= FOREIGN BILLS FOR COLLECTION (INWARD) Executive membership:-

Cash handling Commission Clean 0.3% flat min. KShs. 1.000/= (Applies to any amount) Minimum account balances KShs. 50,000/=

1. Deposits No charge for ALL amounts deposited Documentary 0.3% flat min. KShs. 1.000/= (Applies to any amount) Monthly Membership Fees KShs. 1,000/= if balances maintained above KShs. 50,000/=

2. Withdrawals Tracer/Chaser KShs. 600/= plus related cost and KShs. 1,500/= if the balance is not maintained

(i) Co-operative Societies Extension of bills 0.3% min. KShs. 1,000/= plus cable/swift charges of

KShs. 1,000/=

Executive plus membership:-

- Amount below 1 million No charge Minimum account balances KShs. 100,000/=

Charge for bonding goods KShs. 1,000/= plus bonding and consignment fees

- 1 million and over with notice 1/16% per transaction per day minimum Monthly Membership Fees KShs. 2,000/= if balances maintained above KShs. 100,000/= and

Holding commission/where bill is

KShs. 2,000/= KShs. 2,500/= if the balance is not maintained

outstanding 1 month after due date KShs. 1,000/= flat per month

- 1 million and over without notice 1/8% per transaction per day minimum

Note/protest KShs. 1,000/= per bill plus notary fees **** The executive plus membership category will be on invitation only

KShs. 3,000/=

Document handling charge KShs. 1,000/= plus collection commission (Unpaid/unaccepted)

(ii) Other customers 0.2% for KShs. 1 Million and above per customerper day HABA NA HABA ACCESS ACCOUNT

Discharging to other banks KShs. 2,000/= per discharge

subject to a max. of KShs. 10,000/= Minimum opening balance KShs. 500/=

Handling Large Coins (On relationship basis) KShs. 100/= per bag of coins GUARANTEES Minimum operating balance NIL

Fees payment into school A/C Free Guarantee issuance in Kenya shilling Maintenance fee for all balances KShs. 25/= per month

Bankers opinion KShs. 1,000/= (a) Shipping Guarantees (must be for Imports

Access of Back up Data stored with us KShs. 200/= per visit under a collection or letter of Credit and YEA ACCESS ACCOUNT

Mutilated Notes Collection 1% of amount minimum KShs. 2,000/= absence of B/L can be Adequately explained) 1% per half yearly or part thereof Min. KShs. 1,000/= Minimum opening balance NIL

Purchase of Treasury Bills/Bonds on behalf of customers (b) Wholly secured by cash or 1st class Minimum operating balance NIL

(a) Up to KShs. 10 million 1% of interest earned min. KShs. 1,500/= bank counter guarantee 1% per half yearly or part thereof Min. KShs. 1,000/= Bank cheque to school KShs. 100/= per cheque

(b) Above KShs. 10 million up to KShs. 50 million 0.75% int. earned min. KShs. 1,500/= (c) Guarantee not wholly secured - issued in Debit card KShs. 500/=

(c) Over KShs. 50 million 0.5% of int. earned min. KShs. 1,500/= KShs. (including Shipping Guarantee Bonds) 1.25% per half yearly or part thereof Min. KShs. 1,000/= Maintenance fee NIL

Other Money Transfer Charges: (d) Totally unsecured (in local currency) 1.5% per half yearly or part thereof Min. KShs. 1,000/=

Guarantee issuance in Foreign Currency

HEKIMA SAVINGS ACCOUNT

M-banking transactions KShs. 35/= Minimum opening balance (cash) NIL

(a) Guarantee issuance in foreign currency

M-banking Bulk KShs. 57 (KShs. 35/= + KShs. 22 M-pesa charges) Minimum operating balance NIL

with Cross-boarder exposure 1% per quarter or part thereof Min. KShs. 2,000/=

Incoming RTGS Free Maintenance fee NIL

(b) Amendments to guarantees per half yearly

RTGS out-going KShs. 500/= regardless of amount Over the counter withdrawal Once after 3 months

or part thereof Min. 1,000/= KShs. 1,000/= plus transmission charges 1.5%

Swift charges (Outgoing) KShs. 1,500/= regardless of amount

Incoming swift payments KShs. 500/= PRODUCTS Debit Card

Amendments of outgoing swift payments KShs. 600/= New Card KShs. 500/=

CURRENT ACCOUNT Renewal of Card KShs. 500/=

STANDING ORDERS Minimum opening balance: Replacement of Card KShs. 500/=

On establishment (External) KShs. 250/= per instructions Individuals KShs. 5,000

Co-operatives KShs. 10,000 Credit Card

On establishment (Internal) Free

Amendment KShs. 250/= Companies KShs. 10,000 Local New Card KShs. 3,000/=

Processing Minimum operating balance Nil Local Card annual fee KShs. 3,000/=

(a) To same bank (Co-op) Free Account maintenance fee KShs. 300/= per month International New Card KShs. 3,500/=

(b) To other banks KShs. 200/= per payment Ledger fees KShs. 35/= per entry International Card annual fee KShs. 3,500/=

Cheque books KShs. 7.50/= per leaf printing Gold Card New KShs. 6,000/=

(c) All Loan accounts Free

+ KShs. 2.50 stamp duty per leaf Gold Card annual fee KShs. 6,000/=

Unpaid standing order

Counter cheque KShs. 500/= per leaf

(a) Lack of funds (External) KShs. 2,500/=

For third-party payments Consult your nearest branch

Supplementary cards annual fees

Lack of funds (Internal) Free Local Classic KShs. 2,000/=

Unpaid cheques

(b) Stopped KShs. 500/= Refer to drawer KShs. 2,500/= International Classic KShs. 3,000/=

(c) Suspended KShs. 500/= Payee KShs. 500/= Gold Card Free

DIRECT DEBITS Uncleared effects KShs. 2,500/= Interest rates 1.16% of revolved balances

Bulk payments Between KShs. 50/= to KShs. 200/= negotiable, Technical reason KShs. 700/= Late payment fees 5% of minimum payable

payable by the originator of DDA Stop payment per notice KShs. 400/= Bonus fees 5% of bonus amount awarded

DDA’S from other banks KShs. 150/= per customer Certificate of balance KShs. 400/= per certificate Card replacement fees KShs. 500/=

Originator of DDA is our account holder Between KShs. 50/= to KShs. 200/= negotiable to the Fate advised on telephone Actual cost - min. KShs. 500/= per cheque Overlimit fees KShs. 1,000/=

customer who signed up for DDA Minimum Interest charge for O/D KShs. 1,000/= Unpaid payment fees KShs. 2,500/=

Unpaid Direct Debits (Lack of funds) KShs. 300/= Cheques paid against ENC & Excesses 3% of ENC or Excess amount per cheque

CALL DEPOSIT

Unpaid direct debits (All reasons) KShs. 50/= to the originator per transaction Minimum KShs. 2,000/=

Cheques paid against ENC & Excesses for Saccos KShs. 1,000/= per cheque Minimum opening balance (cash) KShs. 50,000

SAFE CUSTODY (Half year) Other features As per the contract certificate

Sealed Packages/Envelopes/compounded cheques KShs. 1,500/= per item INSTANT ACCESS ACCOUNT

FIXED DEPOSIT

Share Certificates KShs. 750/= Minimum opening balance (cash) KShs. 1,500/=

Minimum operating balance KShs. 1,000/= Minimum opening balance (cash) KShs. 50,000

Deeds KShs. 750/= per item

Maintenance fee (for balances below Other features As per the contract certificate

Small Box KShs. 1,000/= per item

Large Box KShs. 1,500/= per item KShs. 20,000)/= KShs. 200/=

Access charge 3 visits per quarter free, thereafter

KShs. 200/= per visit. Note to all customers:

These fees and charges are applicable as of March 2016. Kindly contact your branch for charges/fees not captured on this tariff poster. Excise duty charge of 10% will apply to all fees, commissions and charges.

RENTERS SAFES (B.S.S CO-OP TRUST ONLY) (HALF YEAR) The information captured is subject to change.

(Staff-half price, deposit for keys – free)

Very small KShs. 2,000/=

Small KShs. 2,400/=

Medium KShs. 4,000/=

Large KShs. 6,000/=

Deposit of keys (refundable) KShs. 3,000/=

Loss of keys (replacement) Depends on Company doing the repair

Night safe facility – per wallet –

You might also like

- KCB Internet Banking Application Form For IndividualsDocument5 pagesKCB Internet Banking Application Form For IndividualsCharles MugeshNo ratings yet

- Pooja Deshmukh SIP Project New (1) - 1Document45 pagesPooja Deshmukh SIP Project New (1) - 1Suraj Kamble100% (2)

- 4868 - Fraud Card Not Present New DocumentDocument2 pages4868 - Fraud Card Not Present New DocumentRowan AtkinsonNo ratings yet

- NTSA Kenya Registered SaccosDocument160 pagesNTSA Kenya Registered SaccosSamuel Kamau79% (14)

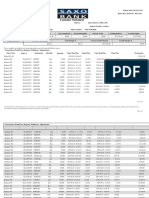

- Bickslow Bank Statement Template - TemplateLabDocument1 pageBickslow Bank Statement Template - TemplateLabbaga ibakNo ratings yet

- J4Wqqbkgi8Vflgwdkdwrvmh: Quick BreakupDocument8 pagesJ4Wqqbkgi8Vflgwdkdwrvmh: Quick BreakupWaqar AhmedNo ratings yet

- September 2019 EBill-VodafoneDocument9 pagesSeptember 2019 EBill-VodafoneAshish Jha100% (1)

- "Customer Perception On Credit Card With Special Referance To Sbi Credit Card Nagpur 'Document51 pages"Customer Perception On Credit Card With Special Referance To Sbi Credit Card Nagpur 'shiv infotechNo ratings yet

- MCQs On KYCDocument7 pagesMCQs On KYCParmila Choudhary67% (3)

- Sdcap0011095735Document3 pagesSdcap0011095735fazal ahmedNo ratings yet

- Https Iiprd - MetavanteDocument5 pagesHttps Iiprd - MetavanteShahab HussainNo ratings yet

- Maintenance Bill: Uptown Condominium Owners Welfare AssociationDocument1 pageMaintenance Bill: Uptown Condominium Owners Welfare AssociationkiranNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S Chargesprasadrahul12No ratings yet

- 602691443Document13 pages602691443nani3388No ratings yet

- Bill To: Account Summary: Date: Statement # Account Number Page 1 of 1Document1 pageBill To: Account Summary: Date: Statement # Account Number Page 1 of 1Ullah KunNo ratings yet

- Gujranwala Electric Power Company - Electricity Consumer Bill (Mdi)Document2 pagesGujranwala Electric Power Company - Electricity Consumer Bill (Mdi)Rana AmjadNo ratings yet

- 00094853-XXXXXXXXX160XXX3194-110015-20112019 2 PDFDocument3 pages00094853-XXXXXXXXX160XXX3194-110015-20112019 2 PDFunsa siddiquiNo ratings yet

- 1-3686823325 1-3686823325 20120101Document5 pages1-3686823325 1-3686823325 20120101Kuria Kang'etheNo ratings yet

- State Bank of IndiaDocument1 pageState Bank of IndiaAnjusha NairNo ratings yet

- Your Account Summary: F-240 Telephone Number: MultipleDocument4 pagesYour Account Summary: F-240 Telephone Number: MultipleAaron CruzNo ratings yet

- Iesco Online BilllDocument2 pagesIesco Online BilllKhalid GulNo ratings yet

- Tax Invoice: SIVASAKTHI GAS SERVICE (0000117430)Document2 pagesTax Invoice: SIVASAKTHI GAS SERVICE (0000117430)PeriyasamyNo ratings yet

- Mkombozi Commercial Bank - Financial Statement Dec - 2019 PDFDocument1 pageMkombozi Commercial Bank - Financial Statement Dec - 2019 PDFMsuyaNo ratings yet

- Document Request Detail PrintDocument4 pagesDocument Request Detail PrintJoVic2020No ratings yet

- Eveready kOLKATA 27112012Document39 pagesEveready kOLKATA 27112012animesh8672777No ratings yet

- 2023 January Cer 5217037 BL-006789549Document1 page2023 January Cer 5217037 BL-006789549Backup Grace100% (1)

- Eb Bill Apr - May21Document1 pageEb Bill Apr - May21Ananth DesikanNo ratings yet

- Account Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)Document1 pageAccount Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)mr batmanNo ratings yet

- Please PAY: TOTAL: $997.50 BY: 12-APR-2023Document1 pagePlease PAY: TOTAL: $997.50 BY: 12-APR-2023ICCNo ratings yet

- Sanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Document3 pagesSanlam Kenya Plc. - Audited Financial Statements For The Period Ended 31st Dec 2017Anonymous KAIoUxP7No ratings yet

- Customer Statement: Ayman K KhlifatDocument4 pagesCustomer Statement: Ayman K KhlifatTFAL TEAMNo ratings yet

- Account Usage and Recharge Statement: Your Usage Your SpendDocument15 pagesAccount Usage and Recharge Statement: Your Usage Your SpendKunal MandalaywalaNo ratings yet

- Trustee Zach Mottl's Water BillsDocument6 pagesTrustee Zach Mottl's Water BillsDavid GiulianiNo ratings yet

- BillDocument1 pageBillAamir KhowajaNo ratings yet

- STATMENT DE SearsDocument4 pagesSTATMENT DE SearsJESUS4USNo ratings yet

- 5 PDFDocument1 page5 PDFRonald De GuzmanNo ratings yet

- Name of Subdivision/IRCA: TEZPUR ESD # IDocument1 pageName of Subdivision/IRCA: TEZPUR ESD # IMontumoni TalukdarNo ratings yet

- Anabel Medeiros 407ETR Bill - DOB Aug 18 1966 Driv Lic M21280410665818Document1 pageAnabel Medeiros 407ETR Bill - DOB Aug 18 1966 Driv Lic M21280410665818jhake940No ratings yet

- Nwachukwu Martin Ikenna: Customer StatementDocument2 pagesNwachukwu Martin Ikenna: Customer StatementMartinNo ratings yet

- Í - (+È NAILSÂDOTÂGLOWÂPH ÂÂÂ Â Ç+&' 5+Î Nails Dot Glow Phils., IncDocument2 pagesÍ - (+È NAILSÂDOTÂGLOWÂPH ÂÂÂ Â Ç+&' 5+Î Nails Dot Glow Phils., IncRACELLE ACCOUNTINGNo ratings yet

- Federal Electricity & Water Authority - Bill InquiryDocument1 pageFederal Electricity & Water Authority - Bill InquirySrinivasan GunnerNo ratings yet

- BillDocument1 pageBillParth BhandariNo ratings yet

- 2012 April TelephoneBill-Prakash 1981Document5 pages2012 April TelephoneBill-Prakash 1981Surya PrakashNo ratings yet

- Bank Statement-MerlinDocument1 pageBank Statement-MerlinSudheer ChowdaryNo ratings yet

- 4249CDAEE74065E3Document1 page4249CDAEE74065E3Irfan AhmedNo ratings yet

- eStatementFile Jan2018 PDFDocument3 pageseStatementFile Jan2018 PDFAnonymous MV9YvFxhS2No ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument7 pagesMobile Services: Your Account Summary This Month'S ChargessooriroyNo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - Statement PDFDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - Statement PDFAman KodwaniNo ratings yet

- LT E-BillDocument2 pagesLT E-BillA Venkata NagarjunaNo ratings yet

- Https Doc 08 1g Apps Viewer - GoogleusercontentDocument5 pagesHttps Doc 08 1g Apps Viewer - GoogleusercontentIsmaliza IshakNo ratings yet

- Collection Summary Demand Summary: Loan Details Insurance DetailsDocument2 pagesCollection Summary Demand Summary: Loan Details Insurance DetailsDURGAPUR-BOLPURNo ratings yet

- Bank Statement Template 1 - TemplateLabDocument1 pageBank Statement Template 1 - TemplateLabJosé PlasenciaNo ratings yet

- PDFDocument4 pagesPDFMark Christian CruzNo ratings yet

- AadmDocument6 pagesAadmSandhya ParabNo ratings yet

- DJBBillDocument2 pagesDJBBillAshish KhantwalNo ratings yet

- Bank of Kigali 1H 2010 Results UpdateDocument48 pagesBank of Kigali 1H 2010 Results UpdateBank of KigaliNo ratings yet

- Idoc - Pub Electricity-Bill PDFDocument1 pageIdoc - Pub Electricity-Bill PDFUsman JaffarNo ratings yet

- E-Bill# 003045008 Dated June 2020 For Account# 00000693168Document2 pagesE-Bill# 003045008 Dated June 2020 For Account# 00000693168Keisha MussingtonNo ratings yet

- Bharti Airtel Services LTD.: Your Account Summary This Month'S ChargesDocument5 pagesBharti Airtel Services LTD.: Your Account Summary This Month'S ChargesPankaj AzadNo ratings yet

- BPI - JokoDocument1 pageBPI - Jokobktsuna0201No ratings yet

- Caribbean Cinema Giftland Mall Pattensen East Coast DemeraraDocument2 pagesCaribbean Cinema Giftland Mall Pattensen East Coast Demeraralino fornollesNo ratings yet

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiNo ratings yet

- Tariff Guide Adc043c528Document1 pageTariff Guide Adc043c528Kameneja LeeNo ratings yet

- Fees and Rate Sheet Jul 2023 (V11jul23)Document1 pageFees and Rate Sheet Jul 2023 (V11jul23)Mrbear GraphicsNo ratings yet

- Banking Services: Fees and ChargesDocument46 pagesBanking Services: Fees and ChargesIsaacNo ratings yet

- Pre-Qualification of Suppliers For Supply of Goods and Services For The FY 2021-2023 19628Document19 pagesPre-Qualification of Suppliers For Supply of Goods and Services For The FY 2021-2023 19628Samuel KamauNo ratings yet

- KOZI FlyerDocument2 pagesKOZI FlyerSamuel KamauNo ratings yet

- OMNIPOWER 3-Phase - Installation and User Guide - EnglishDocument8 pagesOMNIPOWER 3-Phase - Installation and User Guide - EnglishSamuel KamauNo ratings yet

- What Are Some Psychological Facts That People Don't Know?: Related QuestionsDocument10 pagesWhat Are Some Psychological Facts That People Don't Know?: Related QuestionsSamuel KamauNo ratings yet

- CBA Tariff-Guide-January - 2018Document13 pagesCBA Tariff-Guide-January - 2018Samuel KamauNo ratings yet

- Siemon Datakeep DC Cabinets Emea - Spec SheetDocument5 pagesSiemon Datakeep DC Cabinets Emea - Spec SheetSamuel KamauNo ratings yet

- Beneficial Owners Manual Bo-Manual-V1Document30 pagesBeneficial Owners Manual Bo-Manual-V1Samuel KamauNo ratings yet

- Tariff Guide: All Tariff Charges Are Exclusive of Applicable TaxesDocument1 pageTariff Guide: All Tariff Charges Are Exclusive of Applicable TaxesSamuel KamauNo ratings yet

- Actualtests - Cisco.642 104.Exam.Q.and.a.05.26.09Document74 pagesActualtests - Cisco.642 104.Exam.Q.and.a.05.26.09Samuel KamauNo ratings yet

- WWW Unixmen Com Setup Learning Management System EfrontDocument14 pagesWWW Unixmen Com Setup Learning Management System EfrontSamuel KamauNo ratings yet

- WWW Wirelessdomination Com How To Crack Wifi Password UsingDocument16 pagesWWW Wirelessdomination Com How To Crack Wifi Password UsingSamuel KamauNo ratings yet

- Presentation ON The Proposed East Africa Optical Fibre Submarine Cable SystemDocument9 pagesPresentation ON The Proposed East Africa Optical Fibre Submarine Cable SystemSamuel KamauNo ratings yet

- ODesk Test QsDocument2 pagesODesk Test QsSamuel KamauNo ratings yet

- SMA 2471 Numerical Analysis TIEDocument6 pagesSMA 2471 Numerical Analysis TIESamuel KamauNo ratings yet

- Butterworth ApproximationDocument13 pagesButterworth ApproximationSamuel KamauNo ratings yet

- Credit Risk ManagementDocument3 pagesCredit Risk ManagementNandu PaladuguNo ratings yet

- Sol. Man. - Chapter 2 Notes PayableDocument12 pagesSol. Man. - Chapter 2 Notes PayableChristine Mae Fernandez Mata100% (1)

- Agrarian Production Credit Program (APCP) Resolution No. 8Document5 pagesAgrarian Production Credit Program (APCP) Resolution No. 8carlos-tulali-1309100% (1)

- Gempesaw v. CADocument15 pagesGempesaw v. CAGia DimayugaNo ratings yet

- FINA Exam1 - PracticeDocument6 pagesFINA Exam1 - Practicealison dreamNo ratings yet

- The Procedures That Maslovskaya Should Employ in Examining The Loans Are AsDocument4 pagesThe Procedures That Maslovskaya Should Employ in Examining The Loans Are Asgeonardo sNo ratings yet

- Banker Customer RelationshipDocument18 pagesBanker Customer RelationshipShahriar Kabir KhanNo ratings yet

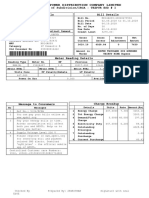

- 2302-3372 - 2000212531 - Triveni Educational and Social Welfare Society - 2023-03-03T19 - 53 - 50 UTCDocument2 pages2302-3372 - 2000212531 - Triveni Educational and Social Welfare Society - 2023-03-03T19 - 53 - 50 UTCaniketlore7No ratings yet

- Bank Islam IBDocument1 pageBank Islam IBNoor Aliza50% (2)

- Enhanced Consumer Credit Report: Enquiry DetailsDocument9 pagesEnhanced Consumer Credit Report: Enquiry Detailsarcman17100% (1)

- Payment Gateway Day 3Document1 pagePayment Gateway Day 3veda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Neha Singh Project TybafDocument31 pagesNeha Singh Project Tybafneha 779100% (1)

- FIN515 Unit2 Learning Activity SolutionsDocument7 pagesFIN515 Unit2 Learning Activity SolutionsalvaroNo ratings yet

- Unified Directives 2072Document343 pagesUnified Directives 2072dhunjukrishnaNo ratings yet

- Endorsment LetterDocument1 pageEndorsment LetterdushakilNo ratings yet

- Annex 30 - BRSDocument1 pageAnnex 30 - BRSLikey PromiseNo ratings yet

- FCG - List of Top 100 Stockholders Q1 (Common Shares) Ending 31 March 2024Document5 pagesFCG - List of Top 100 Stockholders Q1 (Common Shares) Ending 31 March 2024Amino BenitoNo ratings yet

- Assignment - Commercial Banking System and Role of RBIDocument6 pagesAssignment - Commercial Banking System and Role of RBIShivam GoelNo ratings yet

- ENGLISH 5 Q1 Lesson 1Document10 pagesENGLISH 5 Q1 Lesson 1cha100% (1)

- Application Form 8170323004780 PDFDocument4 pagesApplication Form 8170323004780 PDFMIS PROCESSNo ratings yet

- Question Set Fabozzi, Chapter 12Document14 pagesQuestion Set Fabozzi, Chapter 12Hoang HaNo ratings yet

- Short Term FinancingDocument15 pagesShort Term FinancingJoshua CabinasNo ratings yet

- Chapter 9 Basic Reconcillation StatementDocument11 pagesChapter 9 Basic Reconcillation StatementRon louise Pereyra100% (1)

- Deposit SlipDocument2 pagesDeposit Slipsoly2k12No ratings yet

- Bank StatementDocument6 pagesBank StatementJayden PrasadNo ratings yet

- DEEEPPDocument6 pagesDEEEPPCHOICE BROKERNo ratings yet