Professional Documents

Culture Documents

Advance Assignement Three

Uploaded by

Solomon AbebeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advance Assignement Three

Uploaded by

Solomon AbebeCopyright:

Available Formats

Admas University

Olympia Campus

Department of Accounting & Finance

Individual Assignment II on the course advanced Accounting

By Instructor Dirar Abreha Phone Number: - 0914189646

Last submission June 20/2020

Workout Question

Your work should be clear and neat

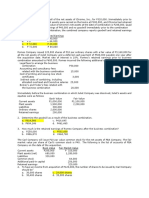

The balance sheets of both companies immediately after the acquisition of shares are as

follows and the cash balance before acquisition date was $200,000.

Balance Sheet P Company S Company

Cash $ 40,000 $ 40,000

Other current assets 280,000 100,000

Plant and equipment 240,000 80,000

Land 80,000 40,000

Investment in Sill 160,000

Total assets $ 800,000 $ 260,000

Liabilities $ 120,000 $ 100,000

Common stock 400,000 100,000

Other Contributed capital 80,000 20,000

Retained earnings 200,000 40,000

Total Liab. and Equity $ 800,000 $ 260,000

Case I (a): Assume that on January 1, 2013, P Company acquired all the outstanding

stock (10,000 shares) of S Company for cash of $160,000. What journal entry would P

Company make to record the shares of S Company acquired?

Case I (b): Assume that on January 1, 2013, P Company acquired 90% (9,000 shares) of the

stock of S Company for $144,000. What journal entry would P Company make to record the

shares of S Company acquired?

Case II (a): Assume that on January 1, 2013, P Company acquired 80% (8,000 shares) of the

stock of S Company for $148,000. We assume the difference is attributable to land and with

a current market value higher than historical cost by $5,000 and $7,000 respectively.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Name: Quiz 1: Ch. 1, 2 and 3 ACCT 405 Spring 2021Document4 pagesName: Quiz 1: Ch. 1, 2 and 3 ACCT 405 Spring 2021Fiveer FreelancerNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Advanced Accounting Chapter 1Document11 pagesAdvanced Accounting Chapter 1Nellie Panedy80% (15)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Advanced Accounting Chapter 1 PDF FreeDocument11 pagesAdvanced Accounting Chapter 1 PDF FreeSitiNo ratings yet

- Consolidated Financial Statements: On Date of Business CombinationDocument19 pagesConsolidated Financial Statements: On Date of Business Combination512781No ratings yet

- Consolidated FS Date of AcquisitionDocument30 pagesConsolidated FS Date of AcquisitionSanhica Chantahl PacquiaoNo ratings yet

- Exercises (7-27-18)Document2 pagesExercises (7-27-18)Justin ManaogNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- FEU Quiz 2 Conso SYDocument6 pagesFEU Quiz 2 Conso SYclarissa paragas50% (2)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- Acctg For Business Combination - Second Evaluation PDFDocument2 pagesAcctg For Business Combination - Second Evaluation PDFDebbie Grace Latiban Linaza100% (1)

- ReSA B45 AFAR First PB Exam - Questions, Answers - SolutionsDocument23 pagesReSA B45 AFAR First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Document5 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- TeDocument8 pagesTeRaja JulianNo ratings yet

- Business Combination by DayagDocument37 pagesBusiness Combination by Dayagkristian Garcia85% (13)

- FEU Quiz 2 Conso SY DocxDocument6 pagesFEU Quiz 2 Conso SY DocxBryle EscosaNo ratings yet

- Tutorial 2Document4 pagesTutorial 2bolaemil20No ratings yet

- Chapter 3 ExaminationDocument4 pagesChapter 3 ExaminationSurameto HariyadiNo ratings yet

- Abc-Problems With SolutionsDocument5 pagesAbc-Problems With SolutionsJohn JackNo ratings yet

- Série 1 ENDocument5 pagesSérie 1 ENilyasosirajNo ratings yet

- Lyceum of Alabang: Partnership AccountingDocument4 pagesLyceum of Alabang: Partnership AccountingJoshua UmaliNo ratings yet

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Problem 1-BSDocument2 pagesProblem 1-BSteraNo ratings yet

- CH6-7 Home QuizDocument5 pagesCH6-7 Home QuizAngel MenodiadoNo ratings yet

- Partnership Incorporation and LiquidationDocument3 pagesPartnership Incorporation and Liquidationrav danoNo ratings yet

- Test BankDocument38 pagesTest BankSophia Marie MoratoNo ratings yet

- Notes Holding CompanyDocument4 pagesNotes Holding CompanySaurav NasaNo ratings yet

- Advanced Accounting 2 BDocument3 pagesAdvanced Accounting 2 BMila AgaNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Latihan Soal Akm Bab 1Document2 pagesLatihan Soal Akm Bab 1sovia devirahmaNo ratings yet

- AC15 Quiz 1 Test PaperDocument6 pagesAC15 Quiz 1 Test PaperKristine Esplana ToraldeNo ratings yet

- Partnersip TutorialsDocument4 pagesPartnersip Tutorialsjames VillanuevaNo ratings yet

- Negros Oriental State University: Brett ClydeDocument4 pagesNegros Oriental State University: Brett ClydeCORNADO, MERIJOY G.No ratings yet

- Peer Quiz No.1: Partnership Formation: TotalDocument4 pagesPeer Quiz No.1: Partnership Formation: Totaldianel villaricoNo ratings yet

- 6 Afar To Summary Quizzer 1 Solution Oct 2016Document44 pages6 Afar To Summary Quizzer 1 Solution Oct 2016Love Villa100% (1)

- AFAR Quiz Bee QuestionsDocument3 pagesAFAR Quiz Bee QuestionsMarc ToresNo ratings yet

- Farparcor 2 Chapter 1 Exercises Problem AnswersDocument10 pagesFarparcor 2 Chapter 1 Exercises Problem AnswersWillnie Shane LabaroNo ratings yet

- 6 Advanced Accounting 2DDocument3 pages6 Advanced Accounting 2DRizky Nugroho SantosoNo ratings yet

- Partnership FormationDocument12 pagesPartnership FormationMa Teresa B. CerezoNo ratings yet

- Advacc Midterm AssignmentsDocument11 pagesAdvacc Midterm AssignmentsAccounting MaterialsNo ratings yet

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- 1 Formation 1Document7 pages1 Formation 1martinfaith958No ratings yet

- Quiz 3 - Business Combination and Consolidated Financial StatementsDocument3 pagesQuiz 3 - Business Combination and Consolidated Financial StatementsMaria LopezNo ratings yet

- Mid Advanced Acc. First09-10Document4 pagesMid Advanced Acc. First09-10Carl Adrian ValdezNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Intermediate Accounting Practice Sets 1Document17 pagesIntermediate Accounting Practice Sets 1Mhaydel Garcia67% (3)

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- 26174partnership Formation QuestionsDocument4 pages26174partnership Formation Questionsramizrazaa813No ratings yet

- AdVacc Q1Document5 pagesAdVacc Q1Red Yu100% (1)

- Business CombinationDocument10 pagesBusiness CombinationCloudKielGuiang0% (1)

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument133 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFLote Marcellano71% (14)

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument156 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFJamille Rose PagulayanNo ratings yet

- Grade 1 Mathimathics (Repaired)Document77 pagesGrade 1 Mathimathics (Repaired)Solomon AbebeNo ratings yet

- Assignment Part 1 & 2 - Page 3Document1 pageAssignment Part 1 & 2 - Page 3Solomon Abebe100% (1)

- Document 12Document1 pageDocument 12Solomon AbebeNo ratings yet

- Chapter 4Document14 pagesChapter 4Solomon AbebeNo ratings yet

- Chapter 3Document12 pagesChapter 3Solomon AbebeNo ratings yet

- Advanced My Full NoteDocument27 pagesAdvanced My Full NoteSolomon AbebeNo ratings yet

- Advance Chapter OneDocument42 pagesAdvance Chapter OneSolomon Abebe100% (4)

- VAT Form Page-1Document1 pageVAT Form Page-1Solomon AbebeNo ratings yet

- Advance Assignement TwoDocument1 pageAdvance Assignement TwoSolomon AbebeNo ratings yet

- Advance Assignement OneDocument1 pageAdvance Assignement OneSolomon AbebeNo ratings yet

- Bouchers Tax Implimentation DirectiveDocument10 pagesBouchers Tax Implimentation DirectiveSolomon AbebeNo ratings yet

- VAT Form Page-2Document1 pageVAT Form Page-2Solomon AbebeNo ratings yet

- List of Metaphors and Similes For KidsDocument2 pagesList of Metaphors and Similes For KidsSolomon AbebeNo ratings yet

- East African English Uganda, Tanzania) :: (Kenya PhonologyDocument7 pagesEast African English Uganda, Tanzania) :: (Kenya PhonologySolomon AbebeNo ratings yet

- 600MostCommonAE Idioms PDFDocument0 pages600MostCommonAE Idioms PDFwatashivnnNo ratings yet

- Cbe CH3 N 4Document13 pagesCbe CH3 N 4Solomon Abebe100% (2)

- English Grammar BookDocument7 pagesEnglish Grammar BookTiaNắngNgọtNo ratings yet

- English Grammar BookDocument7 pagesEnglish Grammar BookTiaNắngNgọtNo ratings yet

- English Grammar - Tenses TableDocument5 pagesEnglish Grammar - Tenses TableGeorgopoulos NikosNo ratings yet

- English Grammar - Tenses TableDocument5 pagesEnglish Grammar - Tenses TableGeorgopoulos NikosNo ratings yet

- 600MostCommonAE Idioms PDFDocument0 pages600MostCommonAE Idioms PDFwatashivnnNo ratings yet

- General Required DocumentsDocument2 pagesGeneral Required DocumentsSolomon AbebeNo ratings yet

- INTRODUTIONDocument1 pageINTRODUTIONSolomon AbebeNo ratings yet

- An Assesment of Cash Management Practice in Commercial Bank of EthiopiaDocument2 pagesAn Assesment of Cash Management Practice in Commercial Bank of EthiopiaSolomon Abebe100% (25)

- Proposalfor National Bank of EthiopiaDocument11 pagesProposalfor National Bank of EthiopiaSolomon Abebe100% (1)

- Sales Without Cash RegisterDocument2 pagesSales Without Cash RegisterSolomon AbebeNo ratings yet

- Chapter One An Overview of Strategic ManagementDocument18 pagesChapter One An Overview of Strategic ManagementSolomon AbebeNo ratings yet

- Rural DevelopmentDocument5 pagesRural DevelopmentSolomon Abebe100% (1)

- Literature ProjectDocument25 pagesLiterature ProjectSolomon AbebeNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet