Professional Documents

Culture Documents

Drill 2 Partnership

Uploaded by

weqweqwCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Drill 2 Partnership

Uploaded by

weqweqwCopyright:

Available Formats

Since 1977

BUSINESS LAW ATTY. ONG/LOPEZ

BL.2802 Drill 2 - Partnership MAY 2020

1. A, B, C and D were partners. A assigned his interest in the c. The partnership will be considered a limited partnership as

partnership to his son S. S now wanted to join in the indicated in its name. Only Wilma and Olga will be

management of the enterprise. B, C and D refused. Is the liable with their separate property after the exhaustion of

partnership necessarily dissolved? partnership assets.

a. The partnership is dissolved because of the conveyance by d. Wilma, Olga and Wynona will be considered separate as

A. sole proprietors with each one having a capita

b. The mere assignment did not dissolve the firm. This is so equivalent to their respective contributions.

even if B, C and D did not allow S to participate in the 8. As regards a limited partner, which statement is correct?

firm’s business conduct. a. He cannot be allowed to transact business directly with the

c. The partnership is not dissolve provided B, C and D will partnership of which he is a member as this would result

allow S to join the management of the enterprise. into conflict of interest;

d. The conveyance of interest by A automatically dissolved b. He is automatically the agent of the partnership with gen-

the partnership. eral authority to bind the partnership to contracts with

2. The certificate shall be cancelled when: third persons;

a. There is change in the name of the partnership c. He can only contribute money and property but not

b. Additional limited partner is admitted services;

c. All limited partner cease to be such. d. He has no liability to partnership creditors even if he takes

d. There is a false or erroneous statement in the certificate. part in the management of the partnership.

3. A substituted limited partner is: 9. Unless otherwise provided in a general partnership agreement

a. a person admitted as a partner by the other partners. which of the following statements is correct when a partner

b. a buyer of right of the deceased partner. dies?

c. An assignee admitted to all the rights of a limited partner. The decreased

d. All of the above. The deceased partner’s estate

4. In a limited partnership, the creditor of a limited partner may partner’s executor would be free The partnership

charge the interest of the indebted limited partner, the interest would from any would be

so charged may be redeemed with: automatically partnership dissolve

a. Partnership property become a partner liabilities automatically

b. Separate property of any general partner a. Yes Yes Yes

c. Both partnership property and separate property of the b. Yes No No

general partner cumulatively c. No Yes No

d. Both partnership property and separate property of the d. No No Yes

general partner alternatively 10. B and C formed a limited partnership, with A as a general

5. In three of the following instances, the certificate of a limited partner, while B and C as limited partners, with the following

partnership may be amended. Which is the exception? contributions:

a. Change in the character of the business 1 A contribute a specific parcel of land

b. There is a false or erroneous statement in the certificate. 2 B to contribute P10,000, the first P5,000 upon formation,

c. Death of a general partner and the last P5,000, 10 days after formation.

d. A person is substituted as a limited partner. 3. C contributed a specific car as was stated in the article of

6. A, B and C wish to go into the business together to bottle partnership, when in fact it was not contributed.

mineral water. Each contributed P50,000, but C wanted to If the partnership was dispossessed of the land contributed by

limit his liability to the extent of his contribution, and his name A after delivery to the partnership by the real owner, the effect

to appear in the partnership name. Which form of partnership will be:

as business organization should they choose? a. A is considered a debtor of the partnership

a. General partnership b. A is considered a trustee of the land for and in behalf of

b. Limited partnership the partnership

c. No partnership organization is available c. The partnership will dissolved

d. Limited d. A is to answer for warranty against eviction.

7. Wilma, Olga and Wynona agreed to form a limited partnership 11. As regards a limited partner, which statement is correct?

with Wilma and Olga as general partners contributing a. He cannot be allowed to transact business directly with the

P50,000.00 each, and Wynona as limited partner contributing partnership of which he is a member as this would result

P100,000.00. The partnership which is to engage in the trading into conflict of interest;

of garments was named "WOW Garments Co., Limited" as b. He is automatically the agent of the partnership with gen-

indicated in the certificate signed and sworn to by the partners eral authority to bind the partnership to contracts with

before a notary public. However, the certificate was not filed third persons;

with the Securities and Exchange Commission. In the c. He can only contribute money and property but not

meantime, the partners already begun operating the business services;

and transacting with third persons. d. He has no liability to partnership creditors even if he takes

a. The partnership entered into by the Wilma, Olga and part in the management of the partnership.

Wynona is void. 12. A partnership is automatically dissolved, except:

b. The partnership will be considered a general a. By the death of any partner

partnership. Accordingly, all partners will be liable with b. By the insolvency of any partner or of the partnership

their separate property after the exhaustion of c. By the civil interdiction of any partner

partnership assets. d. By the insanity of any partner

Page 1 of 2 www.prtc.com.ph BL.2802

EXCEL PROFESSIONAL SERVICES, INC.

13. Allan, Beth and Chris are partners with capital contribution of b. To have on demand true and full information of all things

P15.000, P10.000 and P5,000 respectively. Supposed on affecting the partnership and a formal account of

dissolution, the assets of their partnership amount to only partnership affairs whenever circumstances render it just

P46.000 and it owed Delia the amount of P50.000. Chris owes and reasonable;

Polly on his personal account P6.000. The partners have no c. To have dissolution and winding up by decree of court;

separate personal property except Chris whose separate d. To have all the rights and be subject to all the restrictions

property amounts to P7.000. Which is correct? and liabilities of a partner in a partnership without limited

a. Delia and Polly shall divide Chris separate property partners.

equally. 20. On application by or for partner the court shall decree a

b. Delia and Polly shall divide Chris property pro-rata. dissolution whenever:

c. Delia shall be preferred as regards Chris separate property a. A partner becomes in any other way incapable of

d. Polly shall be preferred as regards Chris separate property performing his part of the partnership contract.

14. Without the written consent or ratification of the specific act b. A partner has been guilty of such conduct as it tends to

by all the limited partners, a general partner or all of the affect prejudicially the carrying on of the business.

general partners have no authority to: c. A partner willfully or persistently commits a breach of the

a. Do any act in contravention of the certificate. partnership agreement that it is not reasonably practicable

b. Do any act that would make it impossible to carry on the to carry on the business in partnership with him.

ordinary business of the partnership. d. All of the above

c. Confess a judgment against the partnership. 21. A substituted limited partner is:

d. All of the above. a. a person admitted as a partner by the other partners.

15. A, B and C, capitalist partners, each contributed P30,000, b. a buyer of right of the deceased partner.

P20.000 and P10,000 respectively; and D, the industrial c. An assignee admitted to all the rights of a limited partner.

partner contributed his services. Suppose X, a customer, is the d. All of the above.

creditor of the firm to the amount of P180,000. How can X 22. In a limited partnership where there are 4 partners:

recover the P180,000? a. All the partners must be limited partners.

a. X must sue the firm and get P60.000 from all the partners b. The number of limited partners must be equal to the

including D, the industrial partner. X can still recover the number of general partners, that is, 2:2.

balance of P120,000 from the four partners jointly. c. The number of limited partners must be greater than the

b. X can recover from the firm P60,000. X can still recover number of general partners, that is, 3:1.

the balance of P120,000 from the capitalist partners only. d. It is enough that there is one limited partner; the rest may

c. X can recover from the firm P60,000. X can still recover all be general partners.

the balance of P120.000 from any of the partners 23. General partners shall have no right to perform the following

solidarity. acts without the written consent or ratification by all the

d. X can recover from the firm P60,000 and consider the limited partners, except:

balance of P120,000 as a loss. a. Admit a person as a general partner.

16. A partner whose liability for partnership debts is limited to his b. Admit a person as a limited partner, unless the right to do

capital contribution is called: so is given in the certificate.

a. General partner c. Continue the business with partnership property on the

b. Limited partner death, retirement, insanity, civil interdiction or insolvency

c. General-limited partner of a general partner, unless the right to do so is given in

d. Secret partner the certificate.

17. A decree by the court is necessary to dissolve a general d. To have the partnership books kept at the principal place

partnership based on three of the following grounds. Which of business of the partnership, and at a reasonable hour to

one will not require such decree but will cause the automatic inspect and copy any of them.

dissolution of the partnership? 24. As a general rule, a partner cannot ask for a formal accounting

a. The business of the partnership can only be carried on at a of the affairs of the partnership during its existence and before

loss. it is dissolved, except:

b. A partner is shown to be of unsound mind. a. When he is wrongfully excluded from the partnership

c. A partner has been guilty of such conduct as tends to business

affect prejudicially the carrying on of the business. b. When the right exists under the terms of any agreement

d. A partner is civilly interdicted. c. Whenever other circumstances render it just and

18. Which of the following is not a requisite prescribed by law in reasonable

order that a partnership may be held liable to a third party for d. All of the above

the acts of one of its partners? 25. Which of the following is a false statement?

a. The partner binds the partnership by acquiescence for a. If a limited partnership will be created, registration is a

obligations he may have contracted in good faith. condition precedent for the creation of the limited

b. The partner must have the authority to bind the partnership

partnership. b. If one of the partners in a general partnership contributed a

c. The contract must be in the partnership name or for its building to the partnership, there must be a public

account. instrument and an inventory as a requirement, otherwise

d. The partner must act on behalf of the partnership. the partnership is void

19. Three of the following enumerations are rights of a general c. If a limited partnership will be created, registration is a

partner in a limited partnership that are also enjoyed by a condition subsequent for the creation of the limited

limited partner. Which among them does a limited partner not partnership.

enjoy? d. If a limited partnership is not registered, a general

a. To have the books of the partnership kept at the principal partnership is created.

place of business of the partnership, and at a reasonable

hour to inspect and copy any of them;

Page 2 of 2 www.prtc.com.ph BL.2802

You might also like

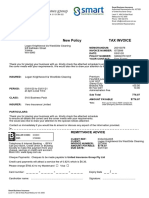

- Certificate of Motor Insurance: Certificate Your Policy Policy +44 (0) 203 966 1495Document3 pagesCertificate of Motor Insurance: Certificate Your Policy Policy +44 (0) 203 966 1495Maria AlexandraNo ratings yet

- PartnershipDocument15 pagesPartnershipchowchow12364% (11)

- Quiz 1Document3 pagesQuiz 1wivada75% (4)

- Partnership and CorporationDocument15 pagesPartnership and CorporationXyrene Keith MedranoNo ratings yet

- SYLLABUS ON AGENCY TRUST and PARTNERSHIPDocument9 pagesSYLLABUS ON AGENCY TRUST and PARTNERSHIPAnne Lorraine DioknoNo ratings yet

- Answer Key On Sample Questions of Partnership LawDocument8 pagesAnswer Key On Sample Questions of Partnership LawHannah Jane Umbay100% (2)

- Law On Sales QUIZZERDocument2 pagesLaw On Sales QUIZZERKatelyn Cosico100% (3)

- The Law On Partnership: Business LawsDocument4 pagesThe Law On Partnership: Business LawsLFGS FinalsNo ratings yet

- Law QuestionsDocument14 pagesLaw QuestionsAlthea CagakitNo ratings yet

- This Study Resource Was: Law On PartnershipDocument5 pagesThis Study Resource Was: Law On PartnershipGraciela InacayNo ratings yet

- ATP - CompilationDocument4 pagesATP - CompilationSheena PagoNo ratings yet

- LAW 102 (Reviewer)Document15 pagesLAW 102 (Reviewer)Marie GarpiaNo ratings yet

- Quiz On PartnershipDocument28 pagesQuiz On PartnershipJhernel SuaverdezNo ratings yet

- Law On Partnership and Corporation ReviewerDocument8 pagesLaw On Partnership and Corporation ReviewerNoreen Delizo100% (1)

- Partnership Law Atty. Macmod: Multiple ChoiceDocument10 pagesPartnership Law Atty. Macmod: Multiple ChoiceSe'f BenitezNo ratings yet

- PARCORDocument5 pagesPARCORSamuel FerolinoNo ratings yet

- PartnershipDocument18 pagesPartnershipVanessa DozonNo ratings yet

- ATP Sample QuestionsDocument5 pagesATP Sample QuestionsJanet FabiNo ratings yet

- UntitledDocument14 pagesUntitledKimNo ratings yet

- EH405 ATP WWW - Midterm ExamDocument3 pagesEH405 ATP WWW - Midterm ExamJandi Yang100% (1)

- Drill 1 Partnership PDFDocument2 pagesDrill 1 Partnership PDFMaeNo ratings yet

- Kier Jhoem - BLAW E-01 V2Document4 pagesKier Jhoem - BLAW E-01 V2Kier MahusayNo ratings yet

- Business Law and Regulation Quiz 1Document5 pagesBusiness Law and Regulation Quiz 1Jennica Mae RuizNo ratings yet

- CA51017 Departmentals Quiz 2 and Quiz 3Document13 pagesCA51017 Departmentals Quiz 2 and Quiz 3artemisNo ratings yet

- B Law Review P-Corp-coop 2022Document43 pagesB Law Review P-Corp-coop 2022Joyce Ann CortezNo ratings yet

- College of Business and AccountancyDocument3 pagesCollege of Business and AccountancyNorbelyn PujanesNo ratings yet

- Business Law and Regulation Quiz 1Document5 pagesBusiness Law and Regulation Quiz 1Jennica Mae RuizNo ratings yet

- RFBT Drill 2 (Partnership, Corpo, and Nego)Document13 pagesRFBT Drill 2 (Partnership, Corpo, and Nego)ROMAR A. PIGA100% (1)

- Q2 - PartnershipDocument6 pagesQ2 - PartnershipAngela Nichole Carandang100% (1)

- Buslaw2 Midterm ExamDocument5 pagesBuslaw2 Midterm ExamGwen Brossard100% (1)

- Parcor QuizzerDocument5 pagesParcor QuizzerMirelle OpizNo ratings yet

- COMLAW3 Quiz No. 4Document2 pagesCOMLAW3 Quiz No. 4Secret AdmirerNo ratings yet

- Partnership MCQ'SDocument6 pagesPartnership MCQ'SAngelo MilloraNo ratings yet

- Midterms Law On PartnershipsDocument13 pagesMidterms Law On PartnershipsAngela Nichole CarandangNo ratings yet

- AssDocument10 pagesAssaccounts 3 lifeNo ratings yet

- Partnerships & Cooperatives MCQS: Pup Ay 2018-2019 Second SemesterDocument17 pagesPartnerships & Cooperatives MCQS: Pup Ay 2018-2019 Second SemesterAnonymous ns4yaNoNo ratings yet

- ASSIGNMENTDocument7 pagesASSIGNMENTCrizelda BauyonNo ratings yet

- CompiledDocument84 pagesCompiledzepzepNo ratings yet

- RFBT 4-Partnership Pre-TestDocument4 pagesRFBT 4-Partnership Pre-TestCharles D. Flores0% (1)

- Business Law and Regulation Quiz 2Document6 pagesBusiness Law and Regulation Quiz 2Jennica Mae RuizNo ratings yet

- BSA BL2 Prelims 2022Document6 pagesBSA BL2 Prelims 2022Joy Consigene100% (1)

- Chapter 2Document13 pagesChapter 2bartabatoes rerunNo ratings yet

- LawwwwwDocument8 pagesLawwwwwJannefah Irish SaglayanNo ratings yet

- ABl 3Document51 pagesABl 3Dawn Rei DangkiwNo ratings yet

- Dissolution and Winding UpDocument5 pagesDissolution and Winding Up2022101718No ratings yet

- CRC AceDocument3 pagesCRC AceNaSheengNo ratings yet

- Partnership ExerciseDocument11 pagesPartnership ExerciseCris Tarrazona Casiple0% (1)

- WWDocument7 pagesWWNico evansNo ratings yet

- RFBT 2nd Monthly AssessmentDocument11 pagesRFBT 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- AAO - SNITCH-ParCor Reviewer QuestionsDocument39 pagesAAO - SNITCH-ParCor Reviewer Questionsby ScribdNo ratings yet

- Partnership Law Atty. Macmod: Multiple ChoiceDocument10 pagesPartnership Law Atty. Macmod: Multiple ChoiceJomarNo ratings yet

- Law Midterm QuestionsDocument14 pagesLaw Midterm QuestionsExequiel ZoletaNo ratings yet

- Partnership (Questions Only)Document23 pagesPartnership (Questions Only)JeromeNo ratings yet

- MCQDocument16 pagesMCQSelenä Heärt75% (4)

- College of Business Administration Law On Business Organization Part I. IdentificationDocument2 pagesCollege of Business Administration Law On Business Organization Part I. IdentificationGhrace Segundo CocalNo ratings yet

- BLT Final Pre-Boards NCPARDocument12 pagesBLT Final Pre-Boards NCPARlorenceabad07No ratings yet

- Partnership Notes1Document20 pagesPartnership Notes1sepaquidaoNo ratings yet

- Saint Vincent College of CabuyaoDocument4 pagesSaint Vincent College of CabuyaoRovic OrdonioNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesFrom EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesNo ratings yet

- Audit Sampling: Quiz 2Document8 pagesAudit Sampling: Quiz 2weqweqwNo ratings yet

- Drill 2 CorporationDocument2 pagesDrill 2 CorporationweqweqwNo ratings yet

- Drill Contract 1 PDFDocument2 pagesDrill Contract 1 PDFweqweqw0% (1)

- Audit Evidence Quiz 1: Multiple ChoiceDocument7 pagesAudit Evidence Quiz 1: Multiple ChoiceweqweqwNo ratings yet

- Drill CooperativeDocument2 pagesDrill Cooperativeweqweqw0% (1)

- Drill Contract 2Document2 pagesDrill Contract 2weqweqwNo ratings yet

- Drill Credit TransactionsDocument2 pagesDrill Credit TransactionsweqweqwNo ratings yet

- QUIZ 3 InfoDocument32 pagesQUIZ 3 InfoweqweqwNo ratings yet

- TAX.2810 - Capital Gains & Losses - PPT PDFDocument8 pagesTAX.2810 - Capital Gains & Losses - PPT PDFweqweqwNo ratings yet

- Drill Contract 1 PDFDocument2 pagesDrill Contract 1 PDFweqweqw0% (1)

- Audit Evidence Quiz 1: Multiple ChoiceDocument7 pagesAudit Evidence Quiz 1: Multiple ChoiceweqweqwNo ratings yet

- MCR DemoDocument64 pagesMCR Demopramod78No ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument14 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionheyheyNo ratings yet

- IFRS 17 in South AfricaDocument12 pagesIFRS 17 in South AfricaDanielNo ratings yet

- Corporate Insolvency MechanismDocument2 pagesCorporate Insolvency MechanismCM ChiewNo ratings yet

- MS Yukos Enterprises (EA) LTD Another Vs MS Maxinsure (T) LTD Another (Commercial Case 30 of 2021) 2022 TZHCComD 93 (8 April 2022)Document72 pagesMS Yukos Enterprises (EA) LTD Another Vs MS Maxinsure (T) LTD Another (Commercial Case 30 of 2021) 2022 TZHCComD 93 (8 April 2022)hamisNo ratings yet

- 5021 Solutions 7Document7 pages5021 Solutions 7karsten_fdsNo ratings yet

- Company Law Module - Zimbabwe Institute of Management (ZIM)Document61 pagesCompany Law Module - Zimbabwe Institute of Management (ZIM)Tawanda Tatenda Herbert100% (3)

- BMA 12e PPT Ch20 EditDocument29 pagesBMA 12e PPT Ch20 EditIndera hgNo ratings yet

- (CD) Philippine Export and Foreign Loan Guarantee Corporation vs. V.P. Eusebio Construction - G.R. No. 140047-July 13, 2004-YSarmientoDocument2 pages(CD) Philippine Export and Foreign Loan Guarantee Corporation vs. V.P. Eusebio Construction - G.R. No. 140047-July 13, 2004-YSarmientoylourahNo ratings yet

- HP Buyside Intermediary Fee AgreementDocument2 pagesHP Buyside Intermediary Fee AgreementLivros juridicosNo ratings yet

- Types of InstumentsDocument2 pagesTypes of InstumentsAJAYMISHRA789No ratings yet

- Difference Between Spa VS GpaDocument1 pageDifference Between Spa VS GpaJune Karl CepidaNo ratings yet

- Introduction To Company LawDocument14 pagesIntroduction To Company LawGYANESHWAR MALHOTRANo ratings yet

- Negotiable Instrument Act 1881Document19 pagesNegotiable Instrument Act 1881Shaktikumar95% (19)

- Void AgreementsDocument15 pagesVoid AgreementsKartik GulaniNo ratings yet

- Indian Contract Act Smart Notes and MCQDocument61 pagesIndian Contract Act Smart Notes and MCQAkansha DwivediNo ratings yet

- Midterms Quiz 1 and 2 EssayDocument2 pagesMidterms Quiz 1 and 2 EssayCamille G.No ratings yet

- FormulaireDocument2 pagesFormulaireweldsaidiNo ratings yet

- Schedule 18 - Form of Continuity GuaranteeDocument2 pagesSchedule 18 - Form of Continuity GuaranteechloeNo ratings yet

- Pacific Timber Export Corporation vs. Court of AppealsDocument2 pagesPacific Timber Export Corporation vs. Court of Appealsmario navalezNo ratings yet

- Gardner Vs Court of AppealsDocument12 pagesGardner Vs Court of AppealsGenevieve BermudoNo ratings yet

- Umali vs. CA (Corpo)Document2 pagesUmali vs. CA (Corpo)ggg10No ratings yet

- Mock Test of Jaiib Principles & Practices of Banking.: AnswerDocument12 pagesMock Test of Jaiib Principles & Practices of Banking.: Answeraao wacNo ratings yet

- Logan Knightwood Ta WestSide Cleaning (033LOGA005) - Tax InvoiceDocument4 pagesLogan Knightwood Ta WestSide Cleaning (033LOGA005) - Tax InvoiceLoki KingNo ratings yet

- In Re: M&S Grading, Inc. - Document No. 5Document2 pagesIn Re: M&S Grading, Inc. - Document No. 5Justia.comNo ratings yet

- Certificate of Pet Liability InsuranceDocument1 pageCertificate of Pet Liability InsuranceMaria lisa mooreNo ratings yet

- Diagnostic ExamsDocument13 pagesDiagnostic ExamsGerard Nelson ManaloNo ratings yet

- GL 08-03-2017 OutputDocument201 pagesGL 08-03-2017 OutputSaurabh AgarwalNo ratings yet

- Obligations and Contracts Binalbagan Tech Inc Vs CA 219 SCRA 777 February 7, 2020 CASE DIGESTDocument3 pagesObligations and Contracts Binalbagan Tech Inc Vs CA 219 SCRA 777 February 7, 2020 CASE DIGESTBrenda de la GenteNo ratings yet