Professional Documents

Culture Documents

Chapter 13 - Text Book

Uploaded by

Jilynn Seah0 ratings0% found this document useful (0 votes)

11 views30 pagesOriginal Title

Chapter 13_Text Book(1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views30 pagesChapter 13 - Text Book

Uploaded by

Jilynn SeahCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 30

Global Cost and Availability

of Capital

• Global integration of capital markets has given many

firms access to new and cheaper sources of funds

beyond those available in their home markets.

• If a firm is located in a country with illiquid, small,

and/or segmented capital markets, it can achieve this

lower global cost and greater availability of capital by a

properly designed and implemented strategy.

• Exhibit 13.1 illustrates these points.

13-3 © 2016 Pearson Education, Ltd. All rights reserved.

Exhibit 13.1 Dimensions of the Cost and Availability

of Capital Strategy

13-4 © 2016 Pearson Education, Ltd. All rights reserved.

Global Cost and Availability

of Capital

• A firm that must source its long-term debt and equity in a highly

illiquid domestic securities market will probably have a relatively

high cost of capital and will face limited availability of such

capital which will, in turn, damage the overall competitiveness

of the firm.

• Firms resident in industrial countries with small capital markets

may enjoy an improved availability of funds at a lower cost, but

would also benefit from access to highly liquid global markets.

13-5 © 2016 Pearson Education, Ltd. All rights reserved.

Global Cost and Availability

of Capital

• Firms resident in countries with segmented capital

markets must devise a strategy to escape dependence

on that market for their long-term debt and equity

needs.

• A national capital market is segmented if the required

rate of return on securities in that market differs from

the required rate of return on securities of comparable

expected return and risk traded on other securities

markets.

13-6 © 2016 Pearson Education, Ltd. All rights reserved.

Weighted Average Cost of Capital

• A firm normally finds its weighted average cost of capital

(WACC) by combining the cost of equity with the cost of debt in

proportion to the relative weight of each in the firm’s optimal

long-term financial structure:

13-7 © 2016 Pearson Education, Ltd. All rights reserved.

Cost of Equity

• The capital asset pricing model (CAPM) approach is to

define the cost of equity for a firm by the following

formula:

13-8 © 2016 Pearson Education, Ltd. All rights reserved.

Cost of Equity

• The key component of CAPM is beta, the measure of systematic

risk.

• If beta < 1.0 returns are less volatile than the market

• If beta = 1 returns are the same as the market

• If beta > 1.0 returns are more volatile than the market

13-9 © 2016 Pearson Education, Ltd. All rights reserved.

Cost of Debt

• The normal procedure for measuring the cost of debt requires a

forecast of interest rates for the next few years, the proportions

of various classes of debt the firm expects to use, and the

corporate income tax rate.

• The interest costs of different debt components are then

averaged (according to their proportion).

• The before-tax average, kd, is then adjusted for corporate

income taxes by multiplying it by the expression (1- tax rate), to

obtain kd(1 - t), the weighted average after-tax cost of debt.

13-10 © 2016 Pearson Education, Ltd. All rights reserved.

International Portfolio Theory and

Diversification

• The total risk of any portfolio is therefore composed of

systematic risk (the market as measured by beta) and

unsystematic risk (the individual securities).

• Increasing the number of securities in the portfolio reduces the

unsystematic risk component but leaves the systematic risk

component unchanged.

• A fully diversified domestic portfolio would have a beta of 1.0.

• Exhibit 13.2 illustrates the incremental gains of diversifying both

domestically and internationally.

13-11 © 2016 Pearson Education, Ltd. All rights reserved.

Exhibit 13.2 Market Liquidity, Segmentation, and the

Marginal Cost of Capital

13-12 © 2016 Pearson Education, Ltd. All rights reserved.

International Portfolio Theory and

Diversification

• Internationally diversified portfolios are similar to domestic

portfolios because the investor is attempting to combine assets

that are less than perfectly correlated.

• International diversification is different in that when the investor

acquires assets or securities from outside the investor’s host-

country market, the investor may also be acquiring a foreign

currency-denominated asset. Thus, the investor has actually

acquired two additional assets—the currency of denomination

and the asset subsequently purchased with the currency.

13-13 © 2016 Pearson Education, Ltd. All rights reserved.

International CAPM (ICAPM)

• ICAPM assumes the financial markets are global, not

just domestic.

• Our WACC equation adjusts for new opportunities:

• The risk-free rate is unlikely to change much, but beta

easily could change.

• Exhibit 13.3 presents an example for Nestlé

13-14 © 2016 Pearson Education, Ltd. All rights reserved.

Exhibit 13.3 The Cost of Equity for Nestlé of

Switzerland

13-15 © 2016 Pearson Education, Ltd. All rights reserved.

Equity Risk Premiums

• The weighted average cost of capital is normally used

as the risk-adjusted discount rate whenever a firm’s

new projects are in the same general risk class as its

existing projects.

• On the other hand, a project-specific required rate of

return should be used as the discount rate if a new

project differs from existing projects in business or

financial risk.

13-16 © 2016 Pearson Education, Ltd. All rights reserved.

Equity Risk Premiums

• In practice, calculating a firm’s equity risk premium is quite

controversial.

• While the CAPM is widely accepted as the preferred method of

calculating the cost of equity for a firm, there is rising debate

over what numerical values should be used in its application

(especially the equity risk premium).

• This risk premium is the average annual return of the market

expected by investors over and above riskless debt, the term (km

– krf).

13-17 © 2016 Pearson Education, Ltd. All rights reserved.

Equity Risk Premiums

• While the field of finance does agree that a cost of

equity calculation should be forward-looking,

practitioners typically use historical evidence as a basis

for their forward-looking projections.

• The current debate begins with a debate over what

actually happened in the past.

• Arithmetic and geometric average returns provide

different historic risk premiums and they differ across

countries.

13-18 © 2016 Pearson Education, Ltd. All rights reserved.

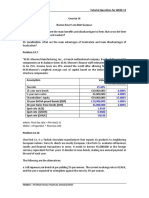

Equity Risk Premiums

• Different analysts and academics tend to use different

measures for the market risk premium.

• Exhibit 13.4 shows how this can lead to significantly

different results.

13-19 © 2016 Pearson Education, Ltd. All rights reserved.

Exhibit 13.4 Alternative Estimates of Cost of Equity for a

Hypothetical U.S. Firm Assuming β = 1 and krf = 4%

13-20 © 2016 Pearson Education, Ltd. All rights reserved.

The Demand for Foreign Securities: The Role of International

Portfolio Investors

• Gradual deregulation of equity markets during the past three

decades not only elicited increased competition from domestic

players but also opened up markets to foreign competitors.

• To understand the motivation of portfolio investors to purchase

and hold foreign securities requires an understanding of the

principals of:

– portfolio risk reduction;

– portfolio rate of return; and

– foreign currency risk.

13-21 © 2016 Pearson Education, Ltd. All rights reserved.

The Demand for Foreign Securities: The Role of International

Portfolio Investors

• Both domestic and international portfolio managers are asset

allocators whose objective is to maximize a portfolio’s rate of

return for a given level of risk, or to minimize risk for a given rate

of return.

• Since international portfolio managers can choose from a larger

bundle of assets than domestic portfolio managers,

internationally diversified portfolios often have a higher

expected rate of return, and nearly always have a lower level of

portfolio risk since national securities markets are imperfectly

correlated with one another.

13-22 © 2016 Pearson Education, Ltd. All rights reserved.

The Demand for Foreign Securities: The Role of International

Portfolio Investors

• Market liquidity (observed by noting the degree to which a firm

can issue a new security without depressing the existing market

price) can affect a firm’s cost of capital.

• In the domestic case, a firm’s marginal cost of capital will

eventually increase as suppliers of capital become saturated

with the firm’s securities.

• In the multinational case, a firm is able to tap many capital

markets above and beyond what would have been available in a

domestic capital market only.

13-23 © 2016 Pearson Education, Ltd. All rights reserved.

The Demand for Foreign Securities: The Role of International

Portfolio Investors

• Capital market segmentation is caused mainly by:

– government constraints;

– institutional practices; and

– investor perceptions.

• While there are many imperfections that can affect the

efficiency of a national market, these markets can still

be relatively efficient in a national context but

segmented in an international context (recall the

finance definition of efficiency).

13-24 © 2016 Pearson Education, Ltd. All rights reserved.

The Demand for Foreign Securities: The Role of International

Portfolio Investors

• Some capital market imperfections include:

– Asymmetric information

– Lack of transparency

– High transaction costs

– Foreign exchange risks

– Political risks

– Corporate governance issues

– Regulatory barriers

13-25 © 2016 Pearson Education, Ltd. All rights reserved.

The Effect of Market Liquidity and

Segmentation

• The degree to which capital markets are illiquid or segmented has an

important influence on a firm’s marginal cost of capital (and thus on its

weighted average cost of capital).

• The marginal return on capital at different budget levels is denoted as MRR in

Exhibit 13.5.

• If the firm is limited to raising funds in its domestic market, the line MCCD

shows the marginal domestic cost of capital.

• If the firm has additional sources of capital outside the domestic (illiquid)

capital market, the marginal cost of capital shifts right to MCCF.

• If the MNE is located in a capital market that is both illiquid and segmented,

the line MCCU represents the decreased marginal cost of capital if it gains

access to other equity markets.

13-26 © 2016 Pearson Education, Ltd. All rights reserved.

Exhibit 13.5 Market Liquidity, Segmentation, and the

Marginal Cost of Capital

13-27 © 2016 Pearson Education, Ltd. All rights reserved.

The Cost of Capital for MNEs Compared to

Domestic Firms

• Determining whether a MNEs cost of capital is higher or lower

than a domestic counterpart is a function of the:

– marginal cost of capital;

– relative after-tax cost of debt;

– optimal debt ratio; and

– relative cost of equity.

• While the MNE is supposed to have a lower marginal cost of

capital (MCC) than a domestic firm, empirical studies show the

opposite (as a result of the additional risks and complexities

associated with foreign operations).

13-28 © 2016 Pearson Education, Ltd. All rights reserved.

The Cost of Capital for MNEs Compared to

Domestic Firms

• This relationship lies in the link between the cost of capital, its availability,

and the opportunity set of projects.

• As the opportunity set of projects increases, the firm will eventually need to

increase its capital budget to the point where its marginal cost of capital is

increasing.

• The optimal capital budget would still be at the point where the rising

marginal cost of capital equals the declining rate of return on the opportunity

set of projects.

• This would be at a higher weighted average cost of capital than would have

occurred for a lower level of the optimal capital budget.

13-29 © 2016 Pearson Education, Ltd. All rights reserved.

Exhibit 13.6 The Cost of Capital

for MNE and Domestic Counterpart Compared

13-30 © 2016 Pearson Education, Ltd. All rights reserved.

The Cost of Capital for MNEs Compared to

Domestic Firms

• In conclusion, if both MNEs and domestic firms do

actually limit their capital budgets to what can be

financed without increasing their MCC, then the

empirical findings that MNEs have higher WACC stands.

• If the domestic firm has such good growth

opportunities that it chooses to undertake growth

despite an increasing marginal cost of capital, then the

MNE would have a lower WACC.

13-31 © 2016 Pearson Education, Ltd. All rights reserved.

Exhibit 13.7 Do MNEs Have a Higher or Lower Cost of Capital

Than Their Domestic Counterparts?

13-32 © 2016 Pearson Education, Ltd. All rights reserved.

You might also like

- Chapter 11 - Text Book ReferenceDocument22 pagesChapter 11 - Text Book ReferenceJilynn SeahNo ratings yet

- Chapter 12 - Text BookDocument26 pagesChapter 12 - Text BookJilynn SeahNo ratings yet

- Chapter 13 - Class Notes PDFDocument33 pagesChapter 13 - Class Notes PDFJilynn SeahNo ratings yet

- C14 - Tutorial Ques PDFDocument2 pagesC14 - Tutorial Ques PDFJilynn SeahNo ratings yet

- C14 - Tutorial Ques PDFDocument2 pagesC14 - Tutorial Ques PDFJilynn SeahNo ratings yet

- C14 - Tutorial Ques PDFDocument2 pagesC14 - Tutorial Ques PDFJilynn SeahNo ratings yet

- C14 - Tutorial Answer PDFDocument5 pagesC14 - Tutorial Answer PDFJilynn SeahNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- New Silkroutes Group Limited Annual Report 2015Document92 pagesNew Silkroutes Group Limited Annual Report 2015WeR1 Consultants Pte LtdNo ratings yet

- Apache Corporation (NYSE, Nasdaq: APA) and Total S.A. (NYSE:TOT) Today Announced A Significant Oil Discovery at The Maka Central-1 Well Drilled Offshore Suriname On Block 58.Document3 pagesApache Corporation (NYSE, Nasdaq: APA) and Total S.A. (NYSE:TOT) Today Announced A Significant Oil Discovery at The Maka Central-1 Well Drilled Offshore Suriname On Block 58.Suriname MirrorNo ratings yet

- F11340000120144004Insurance ContractDocument71 pagesF11340000120144004Insurance ContractmuglersaurusNo ratings yet

- Guide To Technical Analysis Sjc963Document18 pagesGuide To Technical Analysis Sjc963Frank DiazNo ratings yet

- Angel Broking Final Project ReportDocument80 pagesAngel Broking Final Project ReportAnkur SrivastavaNo ratings yet

- HSL Techno-Sector Buzzer: Retail ResearchDocument4 pagesHSL Techno-Sector Buzzer: Retail ResearchDinesh ChoudharyNo ratings yet

- ACI Diploma Sample QuestionsDocument7 pagesACI Diploma Sample Questionsattractram100% (1)

- Balance Sheet of TV18 BroadcastDocument6 pagesBalance Sheet of TV18 BroadcastrotiNo ratings yet

- Andres Pou: Miami - Dade Community CollegeDocument2 pagesAndres Pou: Miami - Dade Community CollegeChandra SimsNo ratings yet

- The Theory of Stock Market EfficiencyDocument21 pagesThe Theory of Stock Market EfficiencyMario Andres Rubiano RojasNo ratings yet

- 2012 Banking Services RFP - Exhibit Items - Supplement To Exhibit SAP PDFDocument0 pages2012 Banking Services RFP - Exhibit Items - Supplement To Exhibit SAP PDFanilr008No ratings yet

- J B Gupta Classes: General TopicsDocument29 pagesJ B Gupta Classes: General TopicsceojiNo ratings yet

- Project Report - BS 12Document6 pagesProject Report - BS 12PRIYAM XEROXNo ratings yet

- Factsheet NIFTY Alpha Quality Value Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Quality Value Low-Volatility 30drsubramanianNo ratings yet

- Jadestone Energy Corporate Marketing Presentation-Feb 2017Document25 pagesJadestone Energy Corporate Marketing Presentation-Feb 2017kaiselkNo ratings yet

- Revised Schedule VI RequirementsDocument23 pagesRevised Schedule VI RequirementsBharadwaj GollapudiNo ratings yet

- The Securitzation of Commodities - RitterDocument6 pagesThe Securitzation of Commodities - RitterCervino InstituteNo ratings yet

- Merrill Finch IncDocument7 pagesMerrill Finch IncAnaRoqueniNo ratings yet

- Private Equity, FOF OperatorsDocument5 pagesPrivate Equity, FOF Operatorspeplayer1No ratings yet

- Amaranth Advisors: Burning Six Billion in Thirty DaysDocument24 pagesAmaranth Advisors: Burning Six Billion in Thirty DaysRosalina MaharanaNo ratings yet

- PR - Order in The Matter of M/s Pinnacle Ventures India LimitedDocument2 pagesPR - Order in The Matter of M/s Pinnacle Ventures India LimitedShyam SunderNo ratings yet

- MarketshomeworkDocument2 pagesMarketshomeworkMae BawaganNo ratings yet

- Day Trading For Dummies Cheat SheetDocument3 pagesDay Trading For Dummies Cheat SheetJay Mel75% (4)

- 06 2010 Mechel Carbon Presentation New June 2010v1Document18 pages06 2010 Mechel Carbon Presentation New June 2010v1Kasi ViswanathanNo ratings yet

- Larry Pesavento & Peggy Mackay - Opening Price Principle - The Best Kept Secret On Wall StreetDocument105 pagesLarry Pesavento & Peggy Mackay - Opening Price Principle - The Best Kept Secret On Wall StreetSwapneel Dey100% (5)

- Backtesting Potential Reversal Zone With Harmonic Pattern Plus PDFDocument11 pagesBacktesting Potential Reversal Zone With Harmonic Pattern Plus PDFRaimundo MotaNo ratings yet

- SEBI: Functions, Powers and ObjectivesDocument3 pagesSEBI: Functions, Powers and ObjectivesRoyalRächerNo ratings yet

- Currency FuturesDocument76 pagesCurrency FuturessachinremaNo ratings yet

- Annual Report 2016 17 NewDocument79 pagesAnnual Report 2016 17 Newsabey22991No ratings yet

- Kirti Mukh Puja ViddhiDocument6 pagesKirti Mukh Puja Viddhimkthakur6410No ratings yet