Professional Documents

Culture Documents

Evaluating The Hedging Effectiveness in Crude Palm Oil Futures Market: A Bivariate Threshold GARCH Model

Uploaded by

Rafif RzmOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evaluating The Hedging Effectiveness in Crude Palm Oil Futures Market: A Bivariate Threshold GARCH Model

Uploaded by

Rafif RzmCopyright:

Available Formats

The Empirical Economics Letters, 13(11): (November 2014) ISSN 1681 8997

Evaluating the Hedging Effectiveness in Crude Palm Oil

Futures Market: A Bivariate Threshold GARCH Model

You-How Go

Faculty of Business and Finance,

Universiti Tunku Abdul Rahman, Malaysia

Email: goyh@utar.edu.my

Wee-Yeap Lau*

Faculty of Economics and Administration

University of Malaya, Malaysia

Abstract: This paper examines whether there is a significant change in hedging

effectiveness on Crude Palm Oil (CPO) futures market from January 1986 to October

2010. Three models comprise of naïve, conventional and bivariate have been evaluated.

As the volatility of spot and futures markets is not similar across time, both markets

exhibit asymmetric information transmission. Our results show firstly that a bivariate

VAR(16)-threshold(1)-GARCH(1,1) model is found to be an adequate model to

capture volatility spillover between the two markets. Secondly, time-varying hedge

ratio exhibits high volatility especially during Asian financial crisis 1997-98, followed

by the global financial crisis in 2008. Thirdly, the bivariate model performs better than

others in risk reduction. It is imperative to incorporate volatility spillover into

conditional variance and covariance equations as to ensure the accuracy of estimation.

Keywords: Bivariate VAR-Threshold GARCH model, hedging effectiveness, optimal

hedge ratio

JEL Classification Number: G12, G13, G14

1. Introduction

Being one of the world leading producers and exporters of palm oil, Malaysia alone

accounted for 39 percent of world production and 45 percent of world export in 2011

based on the data released by Malaysian Palm Oil Board. Like other commodities, price

movement of crude palm oil (CPO) is subjected to fluctuation. Hence, exploring the

characteristics of price movement is important to producers and suppliers in order for them

to hedge their positions. For hedging strategy, Silber (1985) states that futures contract

plays the role of risk transferring to those who are willing to bear them. However, it is not

always effective to hedge with futures contract as it cannot eliminate the risk in spot

market totally.

*

Corresponding author. Email: wylau@um.edu.my

You might also like

- Assaf 2015Document39 pagesAssaf 2015Goldman ClarckNo ratings yet

- Structural Breaks and Long Memory in Modeling and ForecastingDocument19 pagesStructural Breaks and Long Memory in Modeling and ForecastingNadya LovitaNo ratings yet

- 4 GarchDocument17 pages4 GarchVivek AyreNo ratings yet

- Paper VolatilityTransmissionDocument23 pagesPaper VolatilityTransmissionandaleebrNo ratings yet

- Intro N SummaryDocument21 pagesIntro N SummaryKannan RiseeNo ratings yet

- Assessing The Asymmetric Impact of Oil 2016Document11 pagesAssessing The Asymmetric Impact of Oil 2016Lai Nam TuanNo ratings yet

- Market Anomalies, Asset PricinDocument24 pagesMarket Anomalies, Asset PricinAli RizviNo ratings yet

- ICAPM VECH Asian MarketDocument29 pagesICAPM VECH Asian MarketJovan NjegićNo ratings yet

- Investigation The Hedging Effectiveness of The Indian Crude Oil Futures MarketDocument17 pagesInvestigation The Hedging Effectiveness of The Indian Crude Oil Futures MarketAkriti RajvanshiNo ratings yet

- A Model For Trading The Foreign Exchange MarketDocument15 pagesA Model For Trading The Foreign Exchange MarketKDM JumperNo ratings yet

- Modern Trading With AIDocument15 pagesModern Trading With AIshadmanNo ratings yet

- Incorporating Signals Into Optimal TradingDocument42 pagesIncorporating Signals Into Optimal Tradingcecatoh228No ratings yet

- Return and Volatility Transmission Between World Oil Prices and Stock Markets of The GCC CountriesDocument24 pagesReturn and Volatility Transmission Between World Oil Prices and Stock Markets of The GCC CountriesPalwasha MalikNo ratings yet

- CAPMDocument24 pagesCAPMMuhammad Usman YusufNo ratings yet

- Optimal Commodity Asset Allocation With A CoherentDocument10 pagesOptimal Commodity Asset Allocation With A CoherentNg TestNo ratings yet

- Modeling and Forecating The Markets Volatility and VAR Dynamics of CommodityDocument42 pagesModeling and Forecating The Markets Volatility and VAR Dynamics of Commodityanon_160676228No ratings yet

- On The Relationship Between Oil and Equity Markets: Evidence From South AsiaDocument17 pagesOn The Relationship Between Oil and Equity Markets: Evidence From South AsiaPrasanjit BiswasNo ratings yet

- A New Anomaly: The Cross-Sectional Profitability of Technical AnalysisDocument35 pagesA New Anomaly: The Cross-Sectional Profitability of Technical AnalysisJaehyun KimNo ratings yet

- Opening Range Break (ORB) StrategyDocument7 pagesOpening Range Break (ORB) StrategyNarek StepanyanNo ratings yet

- Copernican Journal 2015 Vol 4,2Document18 pagesCopernican Journal 2015 Vol 4,2Theodor Octavian GhineaNo ratings yet

- Asymmetric Mean Reversion in Low Liquid Markets EvDocument19 pagesAsymmetric Mean Reversion in Low Liquid Markets EvMouhammad BATHILYNo ratings yet

- Competitive Advantage in Liner Shipping - A Review and Reserach Agenda PDFDocument21 pagesCompetitive Advantage in Liner Shipping - A Review and Reserach Agenda PDFsukhjit78No ratings yet

- GulfDocument27 pagesGulfyash pattewarNo ratings yet

- Futures Markets, Commodity Prices and The Intertemporal Approach To The Current AccountDocument47 pagesFutures Markets, Commodity Prices and The Intertemporal Approach To The Current Accountscorpion2001glaNo ratings yet

- 2009 AFE Al-Muharrami - Market Power Versus Efficient-Structure in Arab GCC BankingDocument11 pages2009 AFE Al-Muharrami - Market Power Versus Efficient-Structure in Arab GCC BankingWahyutri IndonesiaNo ratings yet

- Does Long Memory Matter in Oil Price Volatility Forecasting?Document8 pagesDoes Long Memory Matter in Oil Price Volatility Forecasting?International Association of Scientific Innovations and Research (IASIR)No ratings yet

- Key To Trading Profits - Matching The Probability Distribution of A Contract With An Appropriate Mechanical Trading StrategyDocument9 pagesKey To Trading Profits - Matching The Probability Distribution of A Contract With An Appropriate Mechanical Trading Strategymonubaisoya285No ratings yet

- Oil Prices and Real Estate Investment Trusts (REITs) : Gradual-Shift Causality and Volatility Transmission AnalysisDocument30 pagesOil Prices and Real Estate Investment Trusts (REITs) : Gradual-Shift Causality and Volatility Transmission AnalysisIranti AINo ratings yet

- 1.derivatives and Firm PerformanceDocument13 pages1.derivatives and Firm PerformanceSyed Masroor ShahNo ratings yet

- أثر تباين مخاطر السوق على قدرة نموذج تسعير الأصول الرأسمالية على تفسير التغير في عوائد الأسهمDocument23 pagesأثر تباين مخاطر السوق على قدرة نموذج تسعير الأصول الرأسمالية على تفسير التغير في عوائد الأسهمHamza AlmostafaNo ratings yet

- The Profitability of Style Rotation Strategies inDocument15 pagesThe Profitability of Style Rotation Strategies inArjun LakhaniNo ratings yet

- Risk Spillovers Between Oil and Stock Markets: A VAR For VaR AnalysisDocument12 pagesRisk Spillovers Between Oil and Stock Markets: A VAR For VaR AnalysisThe IsaiasNo ratings yet

- Hou Et Al 15 Digesting Anomalies and Investment ApproachDocument56 pagesHou Et Al 15 Digesting Anomalies and Investment ApproachPeterParker1983No ratings yet

- SSRN Id4342008Document98 pagesSSRN Id4342008Jack MonroeNo ratings yet

- 1 s2.0 S2212567113000567 Main PDFDocument10 pages1 s2.0 S2212567113000567 Main PDFAnonymous Q6w4hHjBcNo ratings yet

- FFTFM and CAPM From ThailandDocument10 pagesFFTFM and CAPM From ThailandKeroro GunsoNo ratings yet

- High Frequency Trading From An Evolutionary Perspective: Financial Markets As Adaptive SystemsDocument20 pagesHigh Frequency Trading From An Evolutionary Perspective: Financial Markets As Adaptive SystemskarenNo ratings yet

- Security Performance-Capm Sa&Moroc Aajfa040205 CoffieDocument21 pagesSecurity Performance-Capm Sa&Moroc Aajfa040205 CoffieakpanyapNo ratings yet

- Modelling Volatility Using GARCH Models: Evidence From Egypt and IsraelDocument11 pagesModelling Volatility Using GARCH Models: Evidence From Egypt and Israelyash231987No ratings yet

- Avoiding Momentum Crashes: Dynamic Momentum and Contrarian TradingDocument33 pagesAvoiding Momentum Crashes: Dynamic Momentum and Contrarian TradingLoulou DePanamNo ratings yet

- International Review of Financial Analysis: Vasco Vendrame, Jon Tucker, Cherif GuermatDocument8 pagesInternational Review of Financial Analysis: Vasco Vendrame, Jon Tucker, Cherif GuermatAiqa AliNo ratings yet

- J Econlet 2019 05 041Document5 pagesJ Econlet 2019 05 041sonia969696No ratings yet

- Pairs Trading Across Mainland China and Hong Kong Stock MarketsDocument29 pagesPairs Trading Across Mainland China and Hong Kong Stock MarketskarenNo ratings yet

- Exchange Rate Volatility, Sectoral Trade, and The Aggregation Bias (Baru)Document31 pagesExchange Rate Volatility, Sectoral Trade, and The Aggregation Bias (Baru)your daily doseNo ratings yet

- Desantis 1997Document32 pagesDesantis 1997renanrboNo ratings yet

- Lesser Antilles Lines: The Island of San Humberto: CASE 2, Managerial Economics, YANGON - MBA - Batch 7, UTCC-UMFCCIDocument3 pagesLesser Antilles Lines: The Island of San Humberto: CASE 2, Managerial Economics, YANGON - MBA - Batch 7, UTCC-UMFCCIAnonymous tKfOiw100% (1)

- Assessing The Profitability of Intraday Opening Range Breakout StrategiesDocument11 pagesAssessing The Profitability of Intraday Opening Range Breakout StrategiestechkasambaNo ratings yet

- A Framework For Analysis of Strategy Development in Globalizing Markets PDFDocument23 pagesA Framework For Analysis of Strategy Development in Globalizing Markets PDFNely PerezNo ratings yet

- A Closed-Form Solution For Optimal Mean-Reverting Trading StrategiesDocument32 pagesA Closed-Form Solution For Optimal Mean-Reverting Trading StrategiesTererember BorNo ratings yet

- A Comparative Study Between The Fama and French Three-Factor Model and The Fama and French Five-Factor Model: Evidence From The Egyptian Stock MarketDocument18 pagesA Comparative Study Between The Fama and French Three-Factor Model and The Fama and French Five-Factor Model: Evidence From The Egyptian Stock MarketSamar El-BannaNo ratings yet

- Forecasting Intraday Trading Volume: A Kalman Filter ApproachDocument16 pagesForecasting Intraday Trading Volume: A Kalman Filter Approach6doitNo ratings yet

- 10 1108 - Reps 10 2019 0134Document19 pages10 1108 - Reps 10 2019 0134Alyan WaheedNo ratings yet

- Answers To Essay QuestionsDocument17 pagesAnswers To Essay QuestionsDarren LimNo ratings yet

- The Difficulties in Using A Cost Leadership Strategy in Emerging MarketsDocument15 pagesThe Difficulties in Using A Cost Leadership Strategy in Emerging MarketsWesley S. LourençoNo ratings yet

- Does The Adaptive Market Hypothesis Explain The Evolution of EmergingDocument12 pagesDoes The Adaptive Market Hypothesis Explain The Evolution of Emergingsalsabil alsadyNo ratings yet

- Difficulties in Using A Cost Leadership Strategy in Emerging MarketsDocument16 pagesDifficulties in Using A Cost Leadership Strategy in Emerging MarketsMarselinus Aditya Hartanto TjungadiNo ratings yet

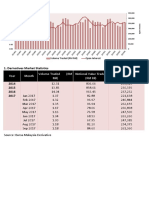

- Year Month Volume Traded (RM Mil) Notional Value Traded (RM Bil) Open InterestDocument1 pageYear Month Volume Traded (RM Mil) Notional Value Traded (RM Bil) Open InterestRafif RzmNo ratings yet

- Cointegration and The Optimal Hedge Ratio: The General Case: Donald LienDocument5 pagesCointegration and The Optimal Hedge Ratio: The General Case: Donald LienRafif RzmNo ratings yet

- Economic Modelling: Jian ZhouDocument9 pagesEconomic Modelling: Jian ZhouRafif RzmNo ratings yet

- Paci Fic-Basin Finance Journal: Yang Hou, Steven LiDocument23 pagesPaci Fic-Basin Finance Journal: Yang Hou, Steven LiRafif RzmNo ratings yet

- Wearables & Homestyle Accomplishment Report - CY 2023Document6 pagesWearables & Homestyle Accomplishment Report - CY 2023Jonathan LarozaNo ratings yet

- Zero Trust Deployment Plan 1672220669Document1 pageZero Trust Deployment Plan 1672220669Raj SinghNo ratings yet

- Local Labor Complaint FormDocument1 pageLocal Labor Complaint FormYVONNE PACETENo ratings yet

- Entry CheckerDocument32 pagesEntry CheckerJosé Sánchez Ramos100% (1)

- William SantiagoDocument5 pagesWilliam SantiagoSubhadip Das SarmaNo ratings yet

- 10 ĐỀ HSG ANH 9 + FILE NGHE + KEYDocument86 pages10 ĐỀ HSG ANH 9 + FILE NGHE + KEYHa TrangNo ratings yet

- Sencor-Scooter-One-App-EN YeaaDocument7 pagesSencor-Scooter-One-App-EN Yeaaeh smrdimNo ratings yet

- Oscam FilesDocument22 pagesOscam Filesvalievabduvali2001No ratings yet

- Sama Vedi Upakarma Mantra 2019Document12 pagesSama Vedi Upakarma Mantra 2019ramdausNo ratings yet

- Gundarks Fantastic Technology Personal Gear WEG40158 PDFDocument114 pagesGundarks Fantastic Technology Personal Gear WEG40158 PDFPed_exing100% (3)

- 50CDocument65 pages50Cvvikram7566No ratings yet

- Employee Engagement ReportDocument51 pagesEmployee Engagement Reportradhika100% (1)

- DigestDocument9 pagesDigestOliveros DMNo ratings yet

- DZone ScyllaDB Database Systems Trend ReportDocument49 pagesDZone ScyllaDB Database Systems Trend ReportSidharth PallaiNo ratings yet

- Name: Nitesh Bagla Enrollment No: 19Bsp1776 IBS Campus: Kolkata Mobile No: 9681759023 E-Mail Id: SIP Proposal I. SIP ProposedDocument3 pagesName: Nitesh Bagla Enrollment No: 19Bsp1776 IBS Campus: Kolkata Mobile No: 9681759023 E-Mail Id: SIP Proposal I. SIP ProposedNitesh BaglaNo ratings yet

- Eapp Module 7 W11Document5 pagesEapp Module 7 W11Valerie AsteriaNo ratings yet

- Case Digest: Dante O. Casibang vs. Honorable Narciso A. AquinoDocument3 pagesCase Digest: Dante O. Casibang vs. Honorable Narciso A. AquinoMaria Cherrylen Castor Quijada100% (1)

- Chapter 18Document24 pagesChapter 18Baby KhorNo ratings yet

- Accounting For Non-Profit OrganizationsDocument38 pagesAccounting For Non-Profit Organizationsrevel_131100% (1)

- Oxford University Colleges' ProfilesDocument12 pagesOxford University Colleges' ProfilesAceS33No ratings yet

- Ebook4Expert Ebook CollectionDocument42 pagesEbook4Expert Ebook CollectionSoumen Paul0% (1)

- Applicability of ESIC On CompaniesDocument5 pagesApplicability of ESIC On CompaniesKunalKumarNo ratings yet

- Eternal Generation What Is Eternal Generation?Document2 pagesEternal Generation What Is Eternal Generation?Jake DavilaNo ratings yet

- Dax CowartDocument26 pagesDax CowartAyu Anisa GultomNo ratings yet

- Social Inequality and ExclusionDocument3 pagesSocial Inequality and ExclusionAnurag Agrawal0% (1)

- Manual of Seamanship PDFDocument807 pagesManual of Seamanship PDFSaad88% (8)

- Reflection (The Boy Who Harnessed The Wind)Document1 pageReflection (The Boy Who Harnessed The Wind)knightapollo16No ratings yet

- ЛексикологіяDocument2 pagesЛексикологіяQwerty1488 No nameNo ratings yet

- Kansai Survival Manual CH 15Document2 pagesKansai Survival Manual CH 15Marcela SuárezNo ratings yet

- Financial Management Model Question PaperDocument2 pagesFinancial Management Model Question PaperdvraoNo ratings yet

- The End of Craving: Recovering the Lost Wisdom of Eating WellFrom EverandThe End of Craving: Recovering the Lost Wisdom of Eating WellRating: 4.5 out of 5 stars4.5/5 (83)

- Sully: The Untold Story Behind the Miracle on the HudsonFrom EverandSully: The Untold Story Behind the Miracle on the HudsonRating: 4 out of 5 stars4/5 (103)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Hero Found: The Greatest POW Escape of the Vietnam WarFrom EverandHero Found: The Greatest POW Escape of the Vietnam WarRating: 4 out of 5 stars4/5 (19)

- The Meth Lunches: Food and Longing in an American CityFrom EverandThe Meth Lunches: Food and Longing in an American CityRating: 5 out of 5 stars5/5 (5)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (98)

- The Future of Geography: How the Competition in Space Will Change Our WorldFrom EverandThe Future of Geography: How the Competition in Space Will Change Our WorldRating: 4 out of 5 stars4/5 (6)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- Dirt to Soil: One Family’s Journey into Regenerative AgricultureFrom EverandDirt to Soil: One Family’s Journey into Regenerative AgricultureRating: 5 out of 5 stars5/5 (125)

- This Changes Everything: Capitalism vs. The ClimateFrom EverandThis Changes Everything: Capitalism vs. The ClimateRating: 4 out of 5 stars4/5 (349)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- The Fabric of Civilization: How Textiles Made the WorldFrom EverandThe Fabric of Civilization: How Textiles Made the WorldRating: 4.5 out of 5 stars4.5/5 (58)

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachFrom EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachRating: 3.5 out of 5 stars3.5/5 (6)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (9)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- Economics 101: How the World WorksFrom EverandEconomics 101: How the World WorksRating: 4.5 out of 5 stars4.5/5 (34)

- The Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaFrom EverandThe Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaNo ratings yet

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)