Professional Documents

Culture Documents

Rent Income: 225,150,693.36 / 2 112,575,346.7 GPS: 750,256,369.32 - ( (115,269,569.45 + 27,589,869.36) - 66,542,321.25)

Uploaded by

Augusto Campit0 ratings0% found this document useful (0 votes)

19 views2 pages- The document contains income statements for Ricardo Dalisay and Alyana Arevalo-Dalisay for the tax year.

- For Ricardo Dalisay, the gross income was PHP 746.5 million with a taxable income of PHP 203.2 million resulting in an income tax of PHP 70.7 million.

- For Alyana Arevalo-Dalisay, the gross income was PHP 180 million but there was a taxable loss so the income tax was PHP 0.

Original Description:

Original Title

FRANCO_TAX

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- The document contains income statements for Ricardo Dalisay and Alyana Arevalo-Dalisay for the tax year.

- For Ricardo Dalisay, the gross income was PHP 746.5 million with a taxable income of PHP 203.2 million resulting in an income tax of PHP 70.7 million.

- For Alyana Arevalo-Dalisay, the gross income was PHP 180 million but there was a taxable loss so the income tax was PHP 0.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views2 pagesRent Income: 225,150,693.36 / 2 112,575,346.7 GPS: 750,256,369.32 - ( (115,269,569.45 + 27,589,869.36) - 66,542,321.25)

Uploaded by

Augusto Campit- The document contains income statements for Ricardo Dalisay and Alyana Arevalo-Dalisay for the tax year.

- For Ricardo Dalisay, the gross income was PHP 746.5 million with a taxable income of PHP 203.2 million resulting in an income tax of PHP 70.7 million.

- For Alyana Arevalo-Dalisay, the gross income was PHP 180 million but there was a taxable loss so the income tax was PHP 0.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Name: Kurt Lexter S.

Franco Section: BAMM1-01

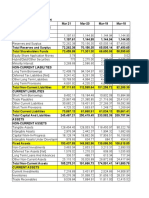

Ricardo “Cardo” Dalisay Alyana R. Arevalo - Dalisay

Rent Income ₱112,575,346.7 Rent Income ₱112,575,346.7

Gross Income ₱746,514,598.5 Gross Income ₱180,001,541

Total Allowable Deductions ₱467,413,567.2 Total Allowable ₱193,156,055.4

Deductions

Taxable Income ₱203,241,157 Taxable Income ₱0

Income Tax ₱70,744,405 Income Tax ₱0

Gross Compensation Income ₱873,433

Income Tax ₱152,030

Solution: Ricardo “Cardo” Dalisay

Rent Income: 225,150,693.36 / 2 = 112,575,346.7

GPS: 750,256,369.32 – [(115,269,569.45 + 27,589,869.36) – 66,542,321.25]

750,256,369.32 – (182,859,438.8 - 66,542,321.25)

750,256,369.32 – 116,317,117.5 = 633,939,251.8

Gross Income: 633,939,251.8 + 112,575,346.7 = 746,514,598.5

Total Allowable Deduction:

Discount: 750,256,369.32 x 0.25 = 187,564,092.3

187,564,092.3 x 0.20 = 37,512,818.47

Salaries: 235,417,328.66 – 25% (Senior), 15% (PWD), 60% (Normal)

Normal Salary: 235,417,328.66 x 0.60 = 141,250,397.2

PWD (15%): 235,417,328.66 x 0.15 = 35,312,599.29

35,312,599.29 x 1.25 = 44,140,749.11

SC (25%): 235,417,328.66 x 0.25 = 58,854,332.15

58,854,332.15 x 1.15 = 67,682,481.97

o Utility Expense: 68,415,324.89

o Storage Expense: 75,849,632.58

o Rent Expense: 32,562,162.94

o Normal Salary: 235,417,328.66 x 0.60 = 141,250,397.2

35,312,599.29 x 1.25 = 44,140,749.11

58,854,332.15 x 1.15 = 67,682,481.97

Utility Expense: 68,415,324.89

Storage Expense: 75,849,632.58

Rent Expense: 32,562,162.94

Total: 467,413,567.2

Net Income: 746,514,598.5 - 467,413,567.2 = 279,101,031.3

Taxable Income: 279,101,031.3 – 75,859,874.25 = 203,241,157.1

Income Tax: {[203,241,157.1 – 8,000,000] x (0.35) + 2,410,000}

(195,241,157.1 x 0.35) + 2,410,000 = 68,334,404.97

68,334,404.97 + 2,410,000 = 70,744,404.97

Gross Compensation Income:

Regular Salary – 748,251.02

Overtime Pay – 44,587.21

Holiday Pay – 56,987.33

Night Differential Pay – 65,415.94

Total: 915,241.5

SSS Contribution – 19,586.20

Pag-Ibig – 6,974.21

PhilHealth – 10,458.69

Labor Dues – 4,789.25

Total: 41,808.35

GCI: 915,241.5 - 41,808.35 = 873,433.15

Income Tax: {873,433.15 – 800,000 [x 0.30 (+130,000)]}

[73,433.15 x 0.30 (+ 130,000)]

22,029.945 + 130,000 = 152,029.945

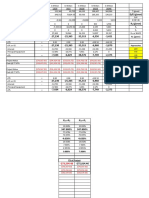

Solution: Alyana R. Arevalo - Dalisay

GPS: 452,639,143.00 – [(365,123,657.21 + 98,546,245.47) – 78,456,954.01]

452,639,143.00 – (463,669,902.7 - 78,456,954.01)

452,639,143.00 – 385,212,948.7 = 67,426,194.3

Gross Income: 67,426,194.3 + 112,575,346.7 = 180,001,541

Total Allowable Deduction:

Salary Expense: 78,965,321.36

Utility Expense: 66,784,214.56

Storage Expense: 4,589,369.24

Repairs and Maintenance Expense: 10,254,987.32

Rent Expense: 32,562,162.94

Total: 193,156,055.4

Net Income: 180,001,541 - 193,156,055.4 = -13,154,514.4/ 0

Taxable Income: -13,154,514.4 – 55,758,589.36 = -68,913,103.76/ 0

Income Tax: 0

You might also like

- Profit & Loss Statement: O' Lites GymDocument8 pagesProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- Goldman Sachs Equity Research ReportDocument2 pagesGoldman Sachs Equity Research ReportSaras Dalmia0% (1)

- Financial StatementDocument6 pagesFinancial StatementCeddie UnggayNo ratings yet

- Budget 2021Document5 pagesBudget 2021Jobeth DaculaNo ratings yet

- Icaew FMDocument16 pagesIcaew FMcima2k15No ratings yet

- Business PlanDocument10 pagesBusiness PlanDanah Jane GarciaNo ratings yet

- Income Statement: Year 2023 2024 2025 2026 2027Document3 pagesIncome Statement: Year 2023 2024 2025 2026 2027Bryan Dino Lester GarnicaNo ratings yet

- Financial Analysis of Wipro LTDDocument60 pagesFinancial Analysis of Wipro LTDparas bagde100% (1)

- Chapter 1 - An Overview of Changing Financial Services IndustryDocument14 pagesChapter 1 - An Overview of Changing Financial Services IndustryMiza MuhammadNo ratings yet

- Homework #1 - Ratio AnalysisDocument9 pagesHomework #1 - Ratio Analysisfgdsafds100% (1)

- FS FINAL Copy 2Document27 pagesFS FINAL Copy 2lois martinNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisNyll GasconNo ratings yet

- Assignment 2 Question 1: 1A) Statement of Comprehensive IncomeDocument17 pagesAssignment 2 Question 1: 1A) Statement of Comprehensive IncomesmaNo ratings yet

- Axis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- GGRMDocument4 pagesGGRMholtreng lolNo ratings yet

- Horizontal Balance SheetDocument2 pagesHorizontal Balance Sheetkathir_petroNo ratings yet

- Final Cookies FsDocument8 pagesFinal Cookies FsDanah Jane GarciaNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- Balance Sheet of WiproDocument3 pagesBalance Sheet of WiproRinni JainNo ratings yet

- Sample Format FSDocument2 pagesSample Format FStanglaolynetteNo ratings yet

- ICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Projection Summary Isargas Group For Investor Oct 2019Document4 pagesProjection Summary Isargas Group For Investor Oct 2019Anton CastilloNo ratings yet

- Pro Forma Balance Sheet: Year 0 1 2 AssetsDocument39 pagesPro Forma Balance Sheet: Year 0 1 2 AssetsLala ReyesNo ratings yet

- Source:Capitaline Database Disclaimer:Capitaline Database HasDocument2 pagesSource:Capitaline Database Disclaimer:Capitaline Database HasDebanjan MukherjeeNo ratings yet

- Axis BankDocument14 pagesAxis BankAswini Kumar BhuyanNo ratings yet

- Final Ma Jud Ni FinancialsDocument78 pagesFinal Ma Jud Ni FinancialsMichael A. BerturanNo ratings yet

- Housing Development Finance Corp LTD (HDFC IN) - AdjustedDocument4 pagesHousing Development Finance Corp LTD (HDFC IN) - AdjustedAswini Kumar BhuyanNo ratings yet

- Tata Steel FinancialsDocument8 pagesTata Steel FinancialsManan GuptaNo ratings yet

- Osd Formulation ProjectDocument5 pagesOsd Formulation Projectsourav karmakarNo ratings yet

- Comparitive Profit and Loss Statement of Unitech Group For The Year Ended 2008Document4 pagesComparitive Profit and Loss Statement of Unitech Group For The Year Ended 2008mukulpharmNo ratings yet

- The IB League 2022 - Support File - XIMB - Team BlastersDocument2 pagesThe IB League 2022 - Support File - XIMB - Team Blastersmanshi choudhuryNo ratings yet

- Assignment 5cDocument7 pagesAssignment 5cAnisa Septiana DewiNo ratings yet

- Indirect Expenses AnalysisDocument5 pagesIndirect Expenses AnalysisnurhafizahNo ratings yet

- Fs Squash CookiesDocument10 pagesFs Squash CookiesDanah Jane GarciaNo ratings yet

- Rem 111 Group 9Document7 pagesRem 111 Group 9Nicole CantosNo ratings yet

- Annextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015Document3 pagesAnnextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015vandv printsNo ratings yet

- HDFC P and LDocument1 pageHDFC P and Lragaveyndhar maniNo ratings yet

- Appendix I: Financial Statement of Nestle India - in Rs. Cr.Document3 pagesAppendix I: Financial Statement of Nestle India - in Rs. Cr.XZJFUHNo ratings yet

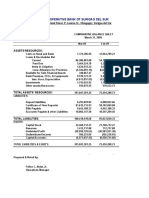

- Cooperative Bank of Surigao Del SurDocument4 pagesCooperative Bank of Surigao Del SurAnonymous iScW9lNo ratings yet

- Career CommissionDocument3 pagesCareer CommissionElvin ShllakuNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- Company Finance Profit & Loss (Rs in CRS.) : Company: ITC LTD Industry: CigarettesDocument16 pagesCompany Finance Profit & Loss (Rs in CRS.) : Company: ITC LTD Industry: CigarettesAnimesh GuptaNo ratings yet

- Profit and LossDocument2 pagesProfit and LossSourav RajeevNo ratings yet

- Clarissa Computation StramaDocument29 pagesClarissa Computation StramaZejkeara ImperialNo ratings yet

- Diamond Bank PLC (Access Bank PLC) Taraba State Summary of Tax Liability For 2013-2018Document9 pagesDiamond Bank PLC (Access Bank PLC) Taraba State Summary of Tax Liability For 2013-2018Alabi OlamideNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- UntitledDocument4 pagesUntitledUST AC HEDNo ratings yet

- Lab4 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissaDocument7 pagesLab4 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissaFahmi GilangNo ratings yet

- Blackstone 3 Q21 Supplemental Financial DataDocument20 pagesBlackstone 3 Q21 Supplemental Financial DataW.Derail McClendonNo ratings yet

- Bajaj Auto Financial AnalysisDocument16 pagesBajaj Auto Financial AnalysisprachimadaanNo ratings yet

- A. Biaya Tidak Tetap: Uraian T A H U NDocument1 pageA. Biaya Tidak Tetap: Uraian T A H U NAzima RahmahNo ratings yet

- Part D.2-Vertical AnalysisDocument32 pagesPart D.2-Vertical AnalysisQuendrick Surban100% (1)

- E. Sensitivities and ScenariosDocument3 pagesE. Sensitivities and ScenariosDadangNo ratings yet

- Financial AspectDocument13 pagesFinancial AspectAngelica CalubayNo ratings yet

- FS SquashDocument10 pagesFS SquashDanah Jane GarciaNo ratings yet

- EREGL DCF ModelDocument10 pagesEREGL DCF ModelKevser BozoğluNo ratings yet

- Itc LTD: Balance Sheet FY17-18 FY16-17 FY15-16Document4 pagesItc LTD: Balance Sheet FY17-18 FY16-17 FY15-16gouri khanduallNo ratings yet

- Balance Sheet: Sources of FundsDocument3 pagesBalance Sheet: Sources of FundsJay MogradiaNo ratings yet

- Universe 18Document70 pagesUniverse 18fereNo ratings yet

- Valuation AssignmentDocument20 pagesValuation AssignmentHw SolutionNo ratings yet

- Profit and Loss AssumptionDocument2 pagesProfit and Loss Assumptionمحمد عليNo ratings yet

- Tax and Salary Computation For Quest MediaDocument7 pagesTax and Salary Computation For Quest MediaDavid OlanrewajuNo ratings yet

- MPCC Event Center ProFroma 052013 Lead Income Statement Lead Income StatementDocument1 pageMPCC Event Center ProFroma 052013 Lead Income Statement Lead Income StatementAnn WeilerNo ratings yet

- Islamic Law: Conventional LeaseDocument10 pagesIslamic Law: Conventional LeaseAqsa batoolNo ratings yet

- VAT ChallanDocument2 pagesVAT Challanrajeshutkur0% (1)

- Flowchart FinanceDocument1 pageFlowchart FinanceMark Anthony OrasaNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomezxcNo ratings yet

- 2016 SSS Loan Form PDFDocument4 pages2016 SSS Loan Form PDFAnonymous 1AXVu3Gh60% (5)

- Avon Case: Week 12 - April 6, 2006Document14 pagesAvon Case: Week 12 - April 6, 2006Giridhar GaneshNo ratings yet

- Over Trading - Working CapitalDocument4 pagesOver Trading - Working CapitalIan Bob WilliamsNo ratings yet

- Benfitsform Starbucks BeanstockDocument1 pageBenfitsform Starbucks BeanstockAndrew Christopher CaseNo ratings yet

- Payment of Retirement Benefit Application Form PDFDocument2 pagesPayment of Retirement Benefit Application Form PDFWajahat_Raza_QureshiNo ratings yet

- Capital Structure and Leverage Quiz # 3Document4 pagesCapital Structure and Leverage Quiz # 3Maurice Hanellete EspirituNo ratings yet

- Acleda Bank Case StudyDocument15 pagesAcleda Bank Case StudySophie LamNo ratings yet

- Review Topics For Cpa ReviewfgDocument5 pagesReview Topics For Cpa ReviewfgYaj CruzadaNo ratings yet

- FINC 302 2020 (Ready)Document7 pagesFINC 302 2020 (Ready)Nana Yaw100% (1)

- Tulis Tangan Kertas A4 Potret/scan Hasil Kerja Anda, Lalu Kirim Ke GCR KitaDocument2 pagesTulis Tangan Kertas A4 Potret/scan Hasil Kerja Anda, Lalu Kirim Ke GCR KitaPatar ElmausNo ratings yet

- Govt Eservices WebsitesDocument2 pagesGovt Eservices WebsitesSivakumar MurugesanNo ratings yet

- 1CDocument7 pages1CAndy LegalRottgesNo ratings yet

- Supply Chain Finance: Master The Essentials To Maximize The BenefitsDocument4 pagesSupply Chain Finance: Master The Essentials To Maximize The BenefitsMuhammadKashifNo ratings yet

- Researching Financing OptionsDocument2 pagesResearching Financing OptionsAbdulRehman100% (1)

- Accounts Payable Accounts Receivable Accrual Principle Accrued Income Accrued LiabilitiesDocument6 pagesAccounts Payable Accounts Receivable Accrual Principle Accrued Income Accrued LiabilitiesMargarete DelvalleNo ratings yet

- Lecture 6 Exercise Financial AccountinngDocument34 pagesLecture 6 Exercise Financial AccountinngNaeem KhanNo ratings yet

- Chap 7 Engg Economy PDFDocument59 pagesChap 7 Engg Economy PDFRaven CabanatanNo ratings yet

- Tata Corus Tata Teltly Final PresentationDocument27 pagesTata Corus Tata Teltly Final PresentationAbhishek GarodiaNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- CH 19Document21 pagesCH 19Ahmed Al EkamNo ratings yet