Professional Documents

Culture Documents

How To Report Hobby Activity On A Tax Return - Final PDF

Uploaded by

Jacen BondsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Report Hobby Activity On A Tax Return - Final PDF

Uploaded by

Jacen BondsCopyright:

Available Formats

How to report hobby activity on a tax return

For 2018 and later years, on tax returns, hobby income is reported on Schedule 1 (Form 1040), line 21,

Other income. Hobby income is taxed at the taxpayer’s regular rate.

The 2017 Tax Cuts and Jobs Act suspends miscellaneous itemized deductions including hobby expense

deductions for tax years 2018 through 2025.

For tax years before 2018 and after 2025, taxpayers can deduct expenses, but there are some

restrictions:

• To deduct expenses related to a hobby, taxpayers must itemize.

• Taxpayers can only deduct hobby expenses, along with other miscellaneous expenses, that are

more than 2 percent of their adjusted gross income (AGI).

• Expenses are limited to the amount of income the hobby generates, so expenses can’t generate

a loss to reduce other income reported on the return.

How to report business activity on a tax return

Taxpayers usually report business income on Schedule C (Form 1040), Profit or Loss from Business and

attach it to their tax return. The profit or loss is then carried to Form 1040. Self-employed taxpayers can

also take deductions for retirement plan contributions and health insurance premiums on Form 1040.

To determine profit, taxpayers will report the gross receipts from the business and then reduce those

receipts by the expenses incurred in running the business. In general, the business can fully deduct these

expenses, with the exception of property or equipment, which must be depreciated over its useful life.

Business expenses are not limited to the amount of income the business earns, so a loss can reduce

other income reported on the taxpayer’s return.

Taxpayers who own a business also must pay self-employment taxes, at a rate of 15.3 percent. Self-

employed individuals must pay the employer and employee portions of self-employment tax and then

can deduct one half of the expense on the return.

© Unauthorized distribution or dissemination without permission from The Tax Institute is prohibited.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

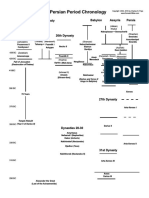

- Persian Period Chronology: 21st Dynasty 25th Dynasty Assyria Babylon PersiaDocument1 pagePersian Period Chronology: 21st Dynasty 25th Dynasty Assyria Babylon PersiaJacen BondsNo ratings yet

- Profit or Loss From Farming: Schedule FDocument2 pagesProfit or Loss From Farming: Schedule FJacen BondsNo ratings yet

- PassPortApplication PDFDocument6 pagesPassPortApplication PDFvcvnoffjNo ratings yet

- IseeExiledKemetics PDFDocument340 pagesIseeExiledKemetics PDFJacen BondsNo ratings yet

- MillunHhaTuwrahh 9.5 EDDocument400 pagesMillunHhaTuwrahh 9.5 EDJacen BondsNo ratings yet

- Instructions For Form 8949: Future DevelopmentsDocument12 pagesInstructions For Form 8949: Future DevelopmentsJacen Bonds0% (1)

- LB6 Final PDFDocument111 pagesLB6 Final PDFJacen BondsNo ratings yet

- Tax Benefit Rule - Recoveries May Not Be TaxableDocument1 pageTax Benefit Rule - Recoveries May Not Be TaxableJacen BondsNo ratings yet

- The Gun That Changed HistoryDocument17 pagesThe Gun That Changed HistoryJacen Bonds100% (1)

- Who Pays Your Jury Fee?: Employer: How Many Employees Do You Have? Juror: Are You Employed?Document1 pageWho Pays Your Jury Fee?: Employer: How Many Employees Do You Have? Juror: Are You Employed?Jacen BondsNo ratings yet

- POSC433Document9 pagesPOSC433qweaNo ratings yet

- Understanding Investment ConceptsDocument14 pagesUnderstanding Investment ConceptskingNo ratings yet

- OBAATAN NhomaDocument60 pagesOBAATAN NhomaJacen Bonds100% (1)

- An Introduction To Metaphysics by Henri BergsonDocument21 pagesAn Introduction To Metaphysics by Henri BergsonThabo MoketeNo ratings yet

- Awakening The Natural Genius in Black ChildrenDocument11 pagesAwakening The Natural Genius in Black Childrentiara moore100% (1)

- Kemetic PDFDocument26 pagesKemetic PDFI am that I am100% (9)

- Women in YorubaDocument15 pagesWomen in YorubaMerry CorvinNo ratings yet

- WhatSavingswhyimportant PDFDocument2 pagesWhatSavingswhyimportant PDFAnkitaNo ratings yet

- VA243seal - Interpretarea Sigiliului SumerianDocument14 pagesVA243seal - Interpretarea Sigiliului SumerianSubliminalNo ratings yet

- F0281035042 PDFDocument8 pagesF0281035042 PDFJacen BondsNo ratings yet

- The Harrowing Middle PassageDocument18 pagesThe Harrowing Middle PassageJacen BondsNo ratings yet

- b29010895 PDFDocument520 pagesb29010895 PDFJacen Bonds100% (1)

- nrcs144p2 034963Document1 pagenrcs144p2 034963Jacen BondsNo ratings yet

- 1.3 Mansa Musa BioDocument2 pages1.3 Mansa Musa BioJacen BondsNo ratings yet

- Mariner June 2008 PDFDocument22 pagesMariner June 2008 PDFjufercrazNo ratings yet

- PDF on African Religions & Their InfluenceDocument114 pagesPDF on African Religions & Their InfluenceJacen Bonds100% (1)

- (E) AfricanBank 2007 Ch4 PDFDocument46 pages(E) AfricanBank 2007 Ch4 PDFAtish KissoonNo ratings yet

- MillunHhaTuwrahh 9.5 EDDocument400 pagesMillunHhaTuwrahh 9.5 EDJacen BondsNo ratings yet

- Distributions From Individual Retirement Arrangements (Iras)Document64 pagesDistributions From Individual Retirement Arrangements (Iras)Jacen BondsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)