Professional Documents

Culture Documents

3acc0809 Introduction To Management Accounting Tutorial 7: (ACCA, F5, BPP)

Uploaded by

Sarah RanduOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3acc0809 Introduction To Management Accounting Tutorial 7: (ACCA, F5, BPP)

Uploaded by

Sarah RanduCopyright:

Available Formats

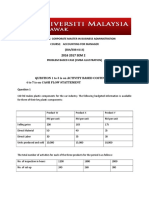

3ACC0809 INTRODUCTION TO MANAGEMENT ACCOUNTING

TUTORIAL 7

Question 1

A company manufactures 2 products, L and M, using the same equipment and similar

processes. An extract of the production data for these products in one period is shown below.

L M

Quantity produced (units) 5,000 7,000

Direct labour hours per unit 1 2

Machine hours per unit 3 1

Set-ups in the period 10 40

Orders handled in the period 15 60

Overhead costs: $

Relating to machine activity 220,000

Relating to production run set-ups 20,000

Relating to handling of orders 45,000

285,000

REQUIRED:

Calculate the production overheads to be absorbed by one unit of each of the products using

the following costing methods:

a. Traditional costing approach using direct labour hour rate to absorb overheads

b. ABC approach, using suitable cost drivers to trace overheads to products

[ACCA, F5, BPP]

Question 2

Una manufactures three products: A, B, and C.

Data for the period just ended is as follows:

A B C

Production units 20,000 25,000 2,000

Sales price (per unit) $20 $20 $20

Material cost (per unit) $5 $10 $10

Labour hours (per unit) 2 hours 1 hour 1 hour

[Labour is paid at the rate of $5 per hour]

Overheads for the period were as follows:

$

Set-up costs 90,000

Receiving 30,000

Despatch 15,000

Machining 55,000

190,000

Cost driver data:

A B C

Machine hours per unit 2 2 2

No. of set-ups 10 13 2

No. of deliveries received 10 10 2

No. of orders despatched 20 20 20

REQUIRED:

a. Calculate the cost (and hence profit) per unit, absorbing all the overheads on the basis of

labour hours.

b. Calculate the cost (and hence profit) per unit absorbing the overheads using an Activity

Based Costing approach.

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Finance Full Moves SopDocument155 pagesFinance Full Moves Sopharoldpsb100% (3)

- Trust Deed - Poverty Eradication Movement Foundation TrustDocument15 pagesTrust Deed - Poverty Eradication Movement Foundation TrustANSY100% (2)

- Elw at PDFDocument131 pagesElw at PDFserdar100% (1)

- Handout Activity Based Costing 2020Document2 pagesHandout Activity Based Costing 2020Nicah AcojonNo ratings yet

- The Impact of Leadership and Change Management Strategy On Organizational Culture and Individual Acceptance of Change During A MergerDocument23 pagesThe Impact of Leadership and Change Management Strategy On Organizational Culture and Individual Acceptance of Change During A MergerSarah RanduNo ratings yet

- 6Document10 pages6ampfcNo ratings yet

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- Intervention ManDocument47 pagesIntervention ManFrederick GbliNo ratings yet

- Tutorial Topic 3 Overhead CostingDocument5 pagesTutorial Topic 3 Overhead CostingPuneetNo ratings yet

- Abc 1Document3 pagesAbc 1Ismael AbbasNo ratings yet

- Combinepdf 2Document6 pagesCombinepdf 2saisandeepNo ratings yet

- HACC428 Tutorial QuestionsDocument36 pagesHACC428 Tutorial QuestionstapiwanashejakaNo ratings yet

- BACT 302 Activity Based CostingDocument25 pagesBACT 302 Activity Based CostingLetsah BrightNo ratings yet

- Activity Based Costing SystemDocument18 pagesActivity Based Costing SystemMAXA FASHIONNo ratings yet

- ABC AssignmentDocument3 pagesABC AssignmentSunil ThapaNo ratings yet

- 602 Assignment 1Document8 pages602 Assignment 1Irina ShamaievaNo ratings yet

- May 2021 G1 Test2Document4 pagesMay 2021 G1 Test2Dipak UgaleNo ratings yet

- WK4 Abc Ii HMWRK QDocument1 pageWK4 Abc Ii HMWRK QFungaiNo ratings yet

- Mba MGT ACCT (ILLUSTRATION QUESTIONS)Document13 pagesMba MGT ACCT (ILLUSTRATION QUESTIONS)biggykhairNo ratings yet

- Activity Based CostingproblemsDocument6 pagesActivity Based CostingproblemsDebarpan HaldarNo ratings yet

- Overhead HWDocument2 pagesOverhead HWTheint Myat KyalsinNo ratings yet

- U Win Bo Myint Cost and Management Overhead Homework - 2Document3 pagesU Win Bo Myint Cost and Management Overhead Homework - 2Theint Myat KyalsinNo ratings yet

- 12914sugg Pe2 gp2 1Document33 pages12914sugg Pe2 gp2 1harshrathore17579No ratings yet

- Example - ABCDocument7 pagesExample - ABCFelicia ChinNo ratings yet

- T5 - Activity-Based Costing - Open Book TeamDocument3 pagesT5 - Activity-Based Costing - Open Book TeamSujib BarmanNo ratings yet

- Exc 1Document2 pagesExc 1Anonymous OxCDfW1CFVNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Accountancy and Management ACADEMIC YEAR 2020/2021 Bachelor of Accounting (Hons.)Document4 pagesUniversiti Tunku Abdul Rahman Faculty of Accountancy and Management ACADEMIC YEAR 2020/2021 Bachelor of Accounting (Hons.)Shi Yan LNo ratings yet

- Cost Management Problems B 2Document49 pagesCost Management Problems B 2PushpaNo ratings yet

- Overheads - IBADocument6 pagesOverheads - IBAZehra HussainNo ratings yet

- Planning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be AnsweredDocument5 pagesPlanning, Control and Performance Management: Time Allowed 3 Hours ALL FOUR Questions Are Compulsory and MUST Be Answeredapi-19836745No ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostHemant AherNo ratings yet

- DAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDocument3 pagesDAC503 ILLUSTRATIVE QUESTION - Cost Accumulation & PricingDavidNo ratings yet

- Chapter 4-Exercises-Managerial AccountingDocument3 pagesChapter 4-Exercises-Managerial AccountingSheila Mae LiraNo ratings yet

- Activity Based CostingDocument3 pagesActivity Based Costingsumit kumarNo ratings yet

- Chemical SolutionsDocument4 pagesChemical SolutionsHira RaisNo ratings yet

- Revision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Document5 pagesRevision Week 1. Questions. Question 1. Cost of Goods Manufactured, Cost of Goods Sold, Income Statement. (A)Sujib BarmanNo ratings yet

- AFAR Set BDocument11 pagesAFAR Set BRence Gonzales0% (2)

- Tugas Individual 345Document7 pagesTugas Individual 345Mochamad PutraNo ratings yet

- Abc Costing One PageDocument1 pageAbc Costing One Pagerajaahsankhan28No ratings yet

- Activity Based Cost Accounting ProblemsDocument3 pagesActivity Based Cost Accounting ProblemsVicky VigneshNo ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument3 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Quiz ABCDocument2 pagesQuiz ABCZoey Alvin EstarejaNo ratings yet

- Activity-Based Costing: Question IM 10.1 IntermediateDocument6 pagesActivity-Based Costing: Question IM 10.1 IntermediateZohaib AslamNo ratings yet

- 2.2 PM - Activity Based Costing - 250622Document26 pages2.2 PM - Activity Based Costing - 250622abhijit tikekarNo ratings yet

- Activity Based Costing HCCDocument8 pagesActivity Based Costing HCCIhsan danishNo ratings yet

- ABC and CashFlow QuestionDocument11 pagesABC and CashFlow QuestionTerryDemetrioCesarNo ratings yet

- Zegu Cac 414 Practice QuestionsDocument9 pagesZegu Cac 414 Practice Questionsloise zvizvaiNo ratings yet

- Lecture 2 - Practice QuestionDocument8 pagesLecture 2 - Practice QuestionBhunesh KumarNo ratings yet

- Activity Based Costing: Presented By: Anurag Garg Himanshu Sumit Garg AnjliDocument17 pagesActivity Based Costing: Presented By: Anurag Garg Himanshu Sumit Garg AnjliSumit GargNo ratings yet

- Chapter 5 ABC System For StudentsDocument14 pagesChapter 5 ABC System For StudentsNour Al Kaddah100% (1)

- Project Case Study - Acc116 Oct-Feb 2023Document5 pagesProject Case Study - Acc116 Oct-Feb 2023Vishnu MenonNo ratings yet

- ABC CostingDocument17 pagesABC CostingHameed Ullah KhanNo ratings yet

- CMA QN November 2017Document7 pagesCMA QN November 2017Goremushandu MungarevaniNo ratings yet

- 3 Soal AMB - Des2018Document4 pages3 Soal AMB - Des2018Try WijayantiNo ratings yet

- Kuis Paralel AML - UTSDocument4 pagesKuis Paralel AML - UTSGrace EsterMNo ratings yet

- ABC Costing 2Document4 pagesABC Costing 2محمد شہبازNo ratings yet

- Handout Standard ABC and PERTDocument3 pagesHandout Standard ABC and PERTdarlenexjoyceNo ratings yet

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- MODULE 6 Mid-Term Exam Review Exercises - F23Document6 pagesMODULE 6 Mid-Term Exam Review Exercises - F23pratibhaNo ratings yet

- Popquizch4Au11 182nlk8Document3 pagesPopquizch4Au11 182nlk8PrincessNo ratings yet

- Problem in Activity Based CostingDocument3 pagesProblem in Activity Based CostingLee Thomas Arvey FernandoNo ratings yet

- Cost Accounting Smart WorkDocument25 pagesCost Accounting Smart WorkmaacmampadNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- ACCO1115 - 2021 - JULY - EXAM - OnlineDocument11 pagesACCO1115 - 2021 - JULY - EXAM - OnlineSarah RanduNo ratings yet

- January 2020 AA2 QuestionsDocument8 pagesJanuary 2020 AA2 QuestionsSarah RanduNo ratings yet

- May 2020 AA1 QuestionsDocument6 pagesMay 2020 AA1 QuestionsSarah RanduNo ratings yet

- ACCO1115 - May 2017 - EXAMDocument9 pagesACCO1115 - May 2017 - EXAMSarah RanduNo ratings yet

- Acco 1115Document9 pagesAcco 1115Sarah RanduNo ratings yet

- July 2020 AA1 QuestionsDocument6 pagesJuly 2020 AA1 QuestionsSarah RanduNo ratings yet

- Netflix, Inc.: FORM 10-KDocument74 pagesNetflix, Inc.: FORM 10-KSarah RanduNo ratings yet

- Authentic Leadership and Employee Voice Behavior: A Multi-Level Psychological ProcessDocument13 pagesAuthentic Leadership and Employee Voice Behavior: A Multi-Level Psychological ProcessSarah RanduNo ratings yet

- Marketing's Contribution To The Implementation of Business Strategy: An Empirical AnalysisDocument13 pagesMarketing's Contribution To The Implementation of Business Strategy: An Empirical AnalysisSarah RanduNo ratings yet

- Tutorial 5 Non-Current Depreciation and Disposal - 40519Document2 pagesTutorial 5 Non-Current Depreciation and Disposal - 40519Sarah RanduNo ratings yet

- Jan 2020 AA1 QuestionsDocument7 pagesJan 2020 AA1 QuestionsSarah RanduNo ratings yet

- Influence of Participation in Strategic Change: Resistance, Organizational Commitment and Change Goal AchievementDocument24 pagesInfluence of Participation in Strategic Change: Resistance, Organizational Commitment and Change Goal AchievementSarah RanduNo ratings yet

- Tutorial 7 - Control Accounts - 40138Document2 pagesTutorial 7 - Control Accounts - 40138Sarah RanduNo ratings yet

- Leadership and Strategic ChangesDocument32 pagesLeadership and Strategic ChangesSarah RanduNo ratings yet

- Tutorial 9 - Partnerships - 245463Document3 pagesTutorial 9 - Partnerships - 245463Sarah Randu100% (1)

- Tutorial 8 - Correction of Error - 42762Document3 pagesTutorial 8 - Correction of Error - 42762Sarah RanduNo ratings yet

- 3.1 The Hierarchy of DataDocument4 pages3.1 The Hierarchy of DataSarah RanduNo ratings yet

- Tutorial 3 - Bad Debts and Provision For Doubtful Debt - Copy - 41137Document2 pagesTutorial 3 - Bad Debts and Provision For Doubtful Debt - Copy - 41137Sarah RanduNo ratings yet

- Tutorial 4 - Accruals and Prepayment - 41624Document2 pagesTutorial 4 - Accruals and Prepayment - 41624Sarah RanduNo ratings yet

- Tutorial 2 - Capital and Revenue Expenditure - 34685Document2 pagesTutorial 2 - Capital and Revenue Expenditure - 34685Sarah RanduNo ratings yet

- Tutorial 6 - Accounting For Valuation of Inventories - 41967Document2 pagesTutorial 6 - Accounting For Valuation of Inventories - 41967Sarah RanduNo ratings yet

- Task 1: Arithmetic & Geometric Sequence: TH TH RD THDocument2 pagesTask 1: Arithmetic & Geometric Sequence: TH TH RD THSarah RanduNo ratings yet

- CHAPTER 1 ARITMETIC & GEOMETRIC SEQUENCE qm3Document22 pagesCHAPTER 1 ARITMETIC & GEOMETRIC SEQUENCE qm3Sarah RanduNo ratings yet

- Early Warning Signals: Retail and Corporate LoansDocument3 pagesEarly Warning Signals: Retail and Corporate Loanseo publicationsNo ratings yet

- Course Syllabus - The Economics of Cities and Regions 2017-2018Document8 pagesCourse Syllabus - The Economics of Cities and Regions 2017-2018FedeSivakNo ratings yet

- Us DPP Book Fas123r PDFDocument466 pagesUs DPP Book Fas123r PDFNavya BinaniNo ratings yet

- PIT HomeworkDocument2 pagesPIT HomeworkNhi Nguyen0% (1)

- Investment BKG - SyllabusDocument3 pagesInvestment BKG - SyllabusAparajita SharmaNo ratings yet

- "Financial Markets - Yale" Plus 3 More CoursesDocument4 pages"Financial Markets - Yale" Plus 3 More Coursessamudragupta06No ratings yet

- dp08-21 - Web AnnexesDocument60 pagesdp08-21 - Web AnnexesJuton SahaNo ratings yet

- Bank of BarodaDocument24 pagesBank of Barodachris_win30460850% (6)

- Cognitivie Statman 2006Document10 pagesCognitivie Statman 2006Rudi PrasetyaNo ratings yet

- Evercore ISI's Best "Core" IdeasDocument21 pagesEvercore ISI's Best "Core" IdeasJoyce Dick Lam PoonNo ratings yet

- 1 Walmart and Macy S Case StudyDocument3 pages1 Walmart and Macy S Case StudyMihir JainNo ratings yet

- Aquintey Vs TibongDocument10 pagesAquintey Vs TibongjessapuerinNo ratings yet

- Algorithmic Trading and Quantitative StrategiesDocument7 pagesAlgorithmic Trading and Quantitative StrategiesSelly YunitaNo ratings yet

- FMA MindmapDocument6 pagesFMA MindmapJ.S. AlbertNo ratings yet

- Analysis On Pre Merger and Post Merger Financial Performance of Selected Banks in IndiaDocument57 pagesAnalysis On Pre Merger and Post Merger Financial Performance of Selected Banks in IndiaSimran TalrejaNo ratings yet

- Accounting For Business Combination PART 1Document30 pagesAccounting For Business Combination PART 1Niki DimaanoNo ratings yet

- luyện tập IFRSDocument6 pagesluyện tập IFRSÁnh Nguyễn Thị NgọcNo ratings yet

- Lampiran C - Raw Judgement - 29 - Kejuruteraan Bintai Kindenko SDN BHDDocument21 pagesLampiran C - Raw Judgement - 29 - Kejuruteraan Bintai Kindenko SDN BHDFen ChanNo ratings yet

- VE Banking Tests Unit06Document2 pagesVE Banking Tests Unit06Andrea CosciaNo ratings yet

- Export Pricing 4Document17 pagesExport Pricing 4Rohit JindalNo ratings yet

- Perluasan Pengaturan Gadai Setelah Dikeluarkannya Peraturan Otoritas Jasa Keuangan Tentang Usaha PergadaianDocument10 pagesPerluasan Pengaturan Gadai Setelah Dikeluarkannya Peraturan Otoritas Jasa Keuangan Tentang Usaha PergadaianAhmad BusiriNo ratings yet

- RocketDocument5 pagesRocketFariha Mehzabin NoshinNo ratings yet

- Annual Report of IOCL 126Document1 pageAnnual Report of IOCL 126NikunjNo ratings yet

- Masterlist - Course - Offerings - 2024 (As at 18 July 2023)Document3 pagesMasterlist - Course - Offerings - 2024 (As at 18 July 2023)limyihang17No ratings yet

- Hex NutsDocument1 pageHex NutsAgung SYNo ratings yet

- Dissertation Michael AgstenDocument5 pagesDissertation Michael AgstenCanYouWriteMyPaperForMeCanada100% (1)