Professional Documents

Culture Documents

Google, Temasek in Talks To Invest in Tokopedia: Business

Uploaded by

abbasithOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Google, Temasek in Talks To Invest in Tokopedia: Business

Uploaded by

abbasithCopyright:

Available Formats

Gulf Times

Sunday, July 5, 2020 3

BUSINESS

China

Google, Temasek in talks convertible

bond hype

sees $624bn

to invest in Tokopedia hunt for each

of this year’s

57 deals

Bloomberg

Singapore

Bloomberg

Beijing

G

oogle and Temasek Hold-

ings are in negotiations to join

A

a funding round of between hunt for returns in China

$500mn and $1bn for Indonesian e- is triggering the biggest

commerce giant PT Tokopedia, ac- stampede into converti-

cording to people familiar with the ble bonds since before the global

matter. financial crisis.

Tokopedia, the online marketplace Investors seized the chance

backed by SoftBank Group Corp’s Vi- to take part in Shanghai Weaver

sion Fund, has held talks with US In- Network Co’s bond sale in June,

ternet giants including Facebook Inc, with the deal about 170,600

Microsoft Corp and Amazon.com Inc, times oversubscribed – the

the people said. highest level since at least 2007,

But Google and Temasek have been according to East Money Infor-

more active in their negotiations and mation Co’s website.

those talks may conclude in com- The average retail subscrip-

ing weeks, they said, asking not to be tion amount for each of this

identified because the discussions are year’s 57 deals through May was

private. 4.41tn yuan ($624bn), Haitong

America’s largest Internet corpo- Securities Co analysts wrote in a

rations have looked increasingly to- recent note.

wards Asia as growth in the US and That was about seven times

Europe slows, seeking to tap the re- more than in the first half of last

gion’s rapidly growing smartphone- year, according to the analysts’

savvy population. data.

Facebook is buying a stake in India’s After regulators last year

Jio Platforms, while its WhatsApp moved to cool a frenzy for con-

unit struck a deal last month to invest vertible bonds, China’s ultra-

in ride-hailing and food delivery giant low interest rates and this year’s

Gojek. Representatives for Tokopedia plentiful liquidity are again fuel-

and Temasek declined to comment. ling demand.

Google didn’t respond to an e-mail The increasingly speculative

seeking comment. nature of the market is apparent

The backing of Alphabet’s Google amid concern China may soon

and Singaporean state investment witness its first convertible-

firm Temasek would mark a major bond default.

boost for one of Southeast Asia’s big- Wild swings in some convert-

gest e-commerce operators. ible bonds prompted closer reg-

Tokopedia co-founder and chief Employees work in front of computers at PT Tokopedia’s office in Jakarta. Tokopedia co-founder and chief executive officer William Tanuwijaya built the country’s most ulatory scrutiny earlier this year.

executive officer William Tanuwi- valuable startup after Gojek after scoring early backing from SoftBank founder Masayoshi Son and Alibaba Group Holding co-founder Jack Ma. In two offerings sold on

jaya built the country’s most valuable Thursday, YingTong Telecom-

startup after Gojek after scoring early erg News in October. Tokopedia came id-19 pandemic, which is rapidly online purchases during widespread up.Indonesia has become a key bat- munication Co saw the book

backing from SoftBank founder Masa- close to finalising its latest financing changing the online shopping land- lockdowns. tleground between the regional rivals: 114,100 times covered, while

yoshi Son and Alibaba Group Holding this year before news emerged of a re- scape in the world’s fourth most pop- Singapore-based rival Shopee – a The country’s e-commerce market Shandong Dawn Polymer Co’s

Ltd co-founder Jack Ma. cent data theft attempt that may have ulous nation. unit of Sea Ltd – is catching up, while is projected to expand from $21bn in notes were 90,175 times over-

It now plans to list shares at home affected 15mn of its users, one of the E-commerce platforms are now Alibaba last month appointed a long- 2019 to $82bn by 2025, according to a subscribed, according to their

as well as in another as-yet-undecid- people said. moving quickly to serve the millions time veteran to head up Lazada and recent study by Google, Temasek and filings late Thursday.

ed location, Tanuwijaya told Bloomb- It was also held back by the Cov- of people forced to make their first “fight harder” as competition heats Bain & Co. “Convertible bonds meet the

needs of the market amid de-

clining bond yields,” said He

Qian, a fund manager at HFT In-

vestment Management Co, who

S&P sees no imminent risk to Indonesia rating from debt plan says more companies will tap the

market given the relatively cheap

funding available. “For fixed-

income investors in the second

Bloomberg deficit with the central bank will weak- response to questions. “This is no dif- half of the year, it will be a key

Jakarta en its independence and trigger rating ferent from the situation that the bank source of outsized returns.” Av-

downgrades. faces in its ordinary course of mon- erage first-day gains in April and

The cost of protecting Indonesia’s etary operations.” May were 16% and 15% respec-

T

he Indonesian government’s five-year dollar bonds, or credit-de- For Moody’s, what will influence its tively, compared to 9.4% in the

plan to sell billions of dollars of fault swaps, slid 14 basis points this rating decision will be “the duration first half of last year, according

bonds to the central bank to fi- week, the most in a month. and other binding constraints under to Haitong.

nance a widening fiscal deficit poses no The so-called burden-sharing plan which the measures are extended,” Investors typically bet on the

immediate threat to the nation’s credit is under “tough discussion” by the Anushka Shah, a senior analyst in securities for potential gains on

rating, according to S&P Global Rat- government and Bank Indonesia to Singapore, said in an e-mail. That “in the equity conversion.

ings. S&P, which already has a negative ensure a prudent plan that maintains turn would determine the scope and When a company sells a con-

outlook on Indonesia’s rating, makes both monetary independence and fis- extent of their usage as a lever to in- vertible, existing shareholders

no distinction between the debt issued cal integrity, a senior finance ministry crease fiscal expenditure beyond what have the right to participate in

by the government, be it to the central official said Friday. is deemed necessary for economic re- the deal to avoid dilution.

bank or to commercial investors, in as- Under the deficit financing propos- covery and rehabilitation,” she said. And unlike most equity offer-

sessing its fiscal impact, according to als, Bank Indonesia may buy bonds Indonesia is rated Baa2 at Moody’s, ings, the bonds don’t have lock-

Kim Eng Tan, a sovereign analyst. worth 574.4tn rupiah ($40bn) to fund equivalent to S&P’s rating. up requirements.

Moody’s Investor Service said sepa- the government’s pandemic response, While the stimulus measures an- That means insiders can sell as

rately that inflation is well-anchored according to the finance ministry. nounced by Indonesia’s government soon as the first day of trading.

in Indonesia and the credit outlook President Joko Widodo’s adminis- will have some effect on fiscal and debt Convertible bond offerings in

would depend on debt duration and tration needs to borrow 1.65 quadril- metrics, the impact will not be mark- China are usually hundreds or

other constraints. lion rupiah this year to fund a budget edly different from the likely deteriora- even thousands of times over-

“Unless there are material and un- deficit of 6.34% of gross domestic tion in other regions, Shah said. subscribed given limited supply

foreseen economic or financial disrup- product and repay its debts. Southeast Asia’s largest economy compared to other types of se-

tions, we do not believe that this plan While some economists have argued entered the crisis with comparatively curities, such as corporate bonds

will affect the credit metrics more than the deficit funding may impact infla- strong fiscal buffers, providing it some or stocks.

we currently expect,” Tan said. tion and money supply in the long run, fiscal space to react, she said. Investors don’t have to pay the

S&P recently downgraded its out- S&P’s Tan said the size of the program “Like many emerging markets glo- full amount of their bids until

look on Indonesia’s BBB rating, the wasn’t large enough to materially af- bally, BI’s move towards unconven- after they get their allocation.

second-lowest investment grade fect monetary operations. tional quantitative easing represents A key difference in this year’s

score, because of the expected fiscal “The impact of inflation, which one way for the government to fund frenzy is that smaller and lower-

deterioration brought about by Cov- recently fell below 2%, will depend its wider borrowing requirements in rated issuers have dominated the

A man walks past an entrance to the Bank Indonesia headquarters in Jakarta. Under the id-19. Indonesia’s currency tumbled partly on how much Bank Indonesia the wake of higher coronavirus-relat- primary market in the first half,

deficit financing proposals, Bank Indonesia may buy bonds worth 574.4tn rupiah ($40bn) 2.1% this week on concern the plan offsets the liquidity impact of its bond ed spending and stimulus measures,” prompting some caution from

to fund the government’s pandemic response, according to the finance ministry. to split the cost of funding the budget purchases,” Tan said in an e-mailed Shah said. analysts.

Wirecard’s missing executive and his alleged role in India deals

Bloomberg Indian travel firm Goomo Orbit and al- across the globe, and establish what role Rupen Vikamsey is suing the fund for an a High Court in Mumbai – alleges that former owners at GI Retail who allege

London leges Marsalek played a central role in ne- senior management figures played in advisory fee he says he’s owed for his Vikamsey and his partner Balasundaram they sold the company for a fraction

gotiating that deal. A lawyer for Marsalek the events leading up to Wirecard’s in- work after the deal. Kumar were not compensated by EMIF of the price to EMIF weeks before the

based in Munich declined to comment on solvency. Wirecard is also under scrutiny Marsalek was involved in negotiations for an “advisory services fee” which made Wirecard deal.

A pair of Indian lawsuits allege Wirecard the cases or discuss his client. by authorities in jurisdictions including between Orbit and EMIF, the lawsuit the deal financially lucrative and was ulti- The Chennai case alleges Marsalek

AG’s former chief operating officer played A Wirecard spokesperson declined to Singapore, Germany and the UK. alleges. Wirecard has previously said it mately the determining factor for them to took part in exchanges that initiated the

a central role in deals that were later comment. Meanwhile Marsalek’s wherea- Meanwhile, Mauritius authorities had no involvement in EMIF until it later sell most of Goomo Orbit to the fund. sale of Hermes to EMIF.

mired in disputes over valuations and bouts are unknown. have started investigating a possible bought assets from the fund. Since Marsalek’s exit from Wirecard, GI Retail’s owners, brothers Ramu and

unpaid fees. Authorities in the Philippines say he round-tripping case linked to Wirecard, Wirecard has never had any direct or Vikamsey filed an additional document to Palaniyapan Ramasamy, were themselves

In one of the civil cases, the previous may have passed through the country be- according to a statement by regulators on indirect relationship with the fund other the court stating that EMIF was acting as sued in London over the deal by Hermes’s

owners of Indian payments company fore boarding a flight to China on June 24. Wednesday. than negotiating the deal to acquire an intermediary for Wirecard to acquire minority shareholders. They said they

Hermes I-Tickets Private Ltc, are suing However, they are also investigating The civil cases describe Marsalek as assets from EMIF, the company said in Indian companies. were compensated based on a purchase

former COO Jan Marsalek alongside whether immigration documents showing linked to EMIF and allege that the execu- response to questions raised by online Vikamsey and his partner are not suing price of $40mn and should be paid using

Wirecard over allegations it made false he entered the Philippines were fake, Dow tive was directly involved in negotiations portal the Foundation for Financial Jour- Wirecard. the higher valuation. Judges are currently

claims about how much it paid to them at Jones reported on Friday. ahead of transactions that have since nalism about the Hermes deal. That case follows the suit filed last year debating whether the case should be

the time. Wirecard was tipped into a full-blown been questioned by analysts over their Vikamsey filed a mediation application in Chennai, India against Wirecard, Mar- heard in Chennai. Marsalek, meanwhile,

The suit alleges Marsalek took part in accounting scandal and filed for insol- opacity and discrepancy of valuations. in Mumbai in March – a step required in salek, EMIF and three other defendants remains out of sight.

negotiations leading to the acquisition vency with a German court after disclos- Marsalek, was fired in June after Wire- commercial cases before they can be that’s centered on a dispute over how Philippines Justice Secretary Menardo

of Hermes by a Mauritius-based private ing last month that €1.9bn ($2.1bn) were card disclosed about four fifths of its net seen by a court – reiterating the claim that much Wirecard paid for Hermes I-Tickets Guevarra told Bloomberg News he may

equity fund called Emerging Market missing from its balance sheet. cash was missing from its balance sheet. he’s owed advisory fees from the EMIF Private Ltd in a 2015 deal. have passed through the country last

Investment Fund in 2015. The lawsuits offer a glimpse into the There’s no suggestion of any personal deal. “I always felt like I was negotiating Wirecard said in public disclosures it week and government immigration

The second case, for unpaid consul- complexity of the task facing investiga- responsibility for the shortfall on Mar- with Wirecard,” Vikamsey said in a phone paid more than $300mn for Hermes and databases show he arrived in Manila on

tancy fees, is against the Mauritian fund tors trying to decipher the finances of salek’s part. EMIF bought Indian travel interview with Bloomberg News. invested in a smaller unit. June 23 before departing for China the

EMIF, which acquired a majority stake in a company with divisions and interests firm Goomo Orbit in 2015 and its founder The suit – which is pending before The case was brought by Hermes’s next day.

You might also like

- Business2018 4 20411553Document12 pagesBusiness2018 4 20411553Sri PraveenNo ratings yet

- Ibbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Document2 pagesIbbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Bastián EnrichNo ratings yet

- today newsDocument1 pagetoday news19UBCA020 HARIHARAN KNo ratings yet

- Companies - Dealroom - Co - 05Document1 pageCompanies - Dealroom - Co - 05Tyler JohnsonNo ratings yet

- Fortune USA - August - September 2022Document112 pagesFortune USA - August - September 2022Caio TomazNo ratings yet

- Sample Project DASHBOARD REPORT - 03th October 2022 Construction WEEK No. 26Document1 pageSample Project DASHBOARD REPORT - 03th October 2022 Construction WEEK No. 26moes83No ratings yet

- Rabobank Grains-and-Oilseeds-Map-2021 Apr2021 DIGITALDocument1 pageRabobank Grains-and-Oilseeds-Map-2021 Apr2021 DIGITALolivier.hanne64No ratings yet

- Doha Bank posts 5% rise in Q1 profit to QR381mnDocument14 pagesDoha Bank posts 5% rise in Q1 profit to QR381mnSri PraveenNo ratings yet

- 3-Risk Return (Recent Data)Document3 pages3-Risk Return (Recent Data)Yash AgarwalNo ratings yet

- ShieldGruppe Dashboard Model Work Task 1Document1 pageShieldGruppe Dashboard Model Work Task 1Charielle Esthelin BacuganNo ratings yet

- The Wall Street Journal - 15 02 2022Document28 pagesThe Wall Street Journal - 15 02 2022Владислав ВойтенкоNo ratings yet

- October 2022 eDocument20 pagesOctober 2022 eEng Clive KabelengaNo ratings yet

- All English Editorials 13 - 1Document21 pagesAll English Editorials 13 - 1alifia 09No ratings yet

- rc0913_AlliedDocument4 pagesrc0913_AlliedsymonpatenNo ratings yet

- Ibiciro Tugenderaho Mu Gutanga Serivisi Guhera Taliki 4 Gashyantare 2022Document1 pageIbiciro Tugenderaho Mu Gutanga Serivisi Guhera Taliki 4 Gashyantare 2022paul KAGABONo ratings yet

- Mayor Adams Claims NYC Is Back and A ParadiseDocument1 pageMayor Adams Claims NYC Is Back and A ParadiseRamonita GarciaNo ratings yet

- 100 Best ChatGPT Prompts To Unleash AI's Potential - Metaverse PostDocument3 pages100 Best ChatGPT Prompts To Unleash AI's Potential - Metaverse PostShea17% (6)

- Mindmap For Pharma Supply ChainsDocument1 pageMindmap For Pharma Supply ChainsNgoc PhamNo ratings yet

- Accounting Standards BT O'neill Ngirazi Accounting Standards BT O'neill NgiraziDocument7 pagesAccounting Standards BT O'neill Ngirazi Accounting Standards BT O'neill NgirazicelineNo ratings yet

- OKR CANVAS - Copy of KANVAS OKR FINALDocument1 pageOKR CANVAS - Copy of KANVAS OKR FINALNendiNo ratings yet

- Time Magazine August 17 2015 USADocument64 pagesTime Magazine August 17 2015 USAalfian nurdiansyahNo ratings yet

- Beat The Bank TutorialDocument3 pagesBeat The Bank TutorialgirliepoplollipopNo ratings yet

- How To GrowDocument32 pagesHow To GrowMelfx MelfxNo ratings yet

- (PREVIEW - ONLY) SH SCCCI Flyer - 20160815 - 4Document2 pages(PREVIEW - ONLY) SH SCCCI Flyer - 20160815 - 4me2 monkNo ratings yet

- An Opportunity For The Opportunities To Come.: Sector 102, GurugramDocument36 pagesAn Opportunity For The Opportunities To Come.: Sector 102, Gurugramkumaranupam_gauravNo ratings yet

- Financial Accounting SummaryDocument23 pagesFinancial Accounting SummaryKapeLatte (카페라떼)No ratings yet

- Companies - Dealroom - Co - 02Document1 pageCompanies - Dealroom - Co - 02Tyler JohnsonNo ratings yet

- Singapore Economy Disruption Financial TechnologyDocument1 pageSingapore Economy Disruption Financial TechnologyPanNo ratings yet

- HBL Mumbai 25072021Document12 pagesHBL Mumbai 25072021Nayudamma Chowdary VattikutiNo ratings yet

- White Paper Victoria VRDocument23 pagesWhite Paper Victoria VRRandy HerdianNo ratings yet

- Scheme Launched For..: Ayushman SahakarDocument1 pageScheme Launched For..: Ayushman SahakarR MedipalliNo ratings yet

- Workshop Tips: 6 Award WinningDocument15 pagesWorkshop Tips: 6 Award WinningJackSiedschlagNo ratings yet

- Paper MakingDocument1 pagePaper MakingBurak KucukkelesNo ratings yet

- Infome Vta Aforo Acumulado OctDocument128 pagesInfome Vta Aforo Acumulado OctAlexandra Marilu Soto CoroNo ratings yet

- Ferdi p213 A Physical Vulnerability To Climate Change Index Which Are TheDocument37 pagesFerdi p213 A Physical Vulnerability To Climate Change Index Which Are Theleorely reyesNo ratings yet

- SystemsDocument1 pageSystemsumNo ratings yet

- Web 2.0 Weekly - : Special EditionDocument31 pagesWeb 2.0 Weekly - : Special EditionDavid ShoreNo ratings yet

- LBP A3 Example Office Case StudyDocument1 pageLBP A3 Example Office Case StudyOsvaldo ColinNo ratings yet

- Reporte Ventas Diarias Total PerúDocument11 pagesReporte Ventas Diarias Total PerúFranco Camacho CanchariNo ratings yet

- 160 PDFDocument1 page160 PDFchristian vergaray gonzalesNo ratings yet

- Annual business planning and budgeting processesDocument1 pageAnnual business planning and budgeting processesvivekcp87No ratings yet

- Birla AlokyaDocument18 pagesBirla AlokyaanjaligargisbNo ratings yet

- Glacier NPDocument1 pageGlacier NPapi-19487128No ratings yet

- Qualitative Research Plan - IDDocument4 pagesQualitative Research Plan - IDLianurismudjayanaNo ratings yet

- 2 Accountancy Test (Partnerships) (Responses)Document1 page2 Accountancy Test (Partnerships) (Responses)Raghav MadaanNo ratings yet

- Kingship in MacbethDocument1 pageKingship in MacbethJustineNo ratings yet

- Current Affairs-166Document3 pagesCurrent Affairs-166Ganji LakshmanaraoNo ratings yet

- Value-Map TM DeloitteDocument1 pageValue-Map TM DeloitteHugo SalazarNo ratings yet

- 1344 Organic World 2022 LRDocument346 pages1344 Organic World 2022 LRedgoitesNo ratings yet

- Cr01plan PDFDocument7 pagesCr01plan PDFnaval consulNo ratings yet

- JPM Earnings Momentum 2016-05-08Document32 pagesJPM Earnings Momentum 2016-05-08kmacculloughNo ratings yet

- The Time LineDocument2 pagesThe Time Linenibrah faheemNo ratings yet

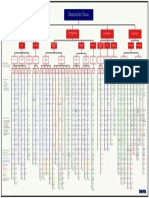

- World Government ChartDocument1 pageWorld Government ChartJo100% (1)

- U-Drain at 10+xxx (To Be Measured) : Chainage: 11+600Document1 pageU-Drain at 10+xxx (To Be Measured) : Chainage: 11+600Pradeep Kumar TKNo ratings yet

- Pukekohe MapDocument1 pagePukekohe MapBen RossNo ratings yet

- BPW Water Network AssessmentDocument2 pagesBPW Water Network AssessmentabbasithNo ratings yet

- China Speeds Up Process of Merging Top 2 Brokers: BusinessDocument1 pageChina Speeds Up Process of Merging Top 2 Brokers: BusinessabbasithNo ratings yet

- Business 5-5Document1 pageBusiness 5-5abbasithNo ratings yet

- Clouds May Be Parting For Dividend Investors On US Stock MarketDocument1 pageClouds May Be Parting For Dividend Investors On US Stock MarketabbasithNo ratings yet

- Community 2nd PhaseDocument1 pageCommunity 2nd PhaseabbasithNo ratings yet

- WALL ROOF U VALUE CALCUALTION Rev 1 PDFDocument1 pageWALL ROOF U VALUE CALCUALTION Rev 1 PDFabbasithNo ratings yet

- Water Cooled Chiller Compliance Form Rev 1Document1 pageWater Cooled Chiller Compliance Form Rev 1madhivananspNo ratings yet

- WINDOW U VALUE CALCULATION Rev 1 PDFDocument1 pageWINDOW U VALUE CALCULATION Rev 1 PDFabbasithNo ratings yet

- Pressure Piles On Lebanon As IMF Warns Implosion Is AcceleratingDocument1 pagePressure Piles On Lebanon As IMF Warns Implosion Is AcceleratingabbasithNo ratings yet

- WATER CONSERVATION CHECKLISTDocument1 pageWATER CONSERVATION CHECKLISTmadhivananspNo ratings yet

- PAC COMPLIANCE FORM Rev 1Document1 pagePAC COMPLIANCE FORM Rev 1abbasithNo ratings yet

- WATER CONSERVATION CHECKLISTDocument1 pageWATER CONSERVATION CHECKLISTmadhivananspNo ratings yet

- HTM 2022 S1Document49 pagesHTM 2022 S1Maher Al LobnanyNo ratings yet

- WAC COMPLIANCE FORM Rev 2Document1 pageWAC COMPLIANCE FORM Rev 2abbasithNo ratings yet

- HVAC Requirements Project Location PinDocument1 pageHVAC Requirements Project Location PinabbasithNo ratings yet

- HTM 05-02 2014Document109 pagesHTM 05-02 2014abbasithNo ratings yet

- PanchatantraDocument23 pagesPanchatantraabbasithNo ratings yet

- LIGHTING AND POWER CHECKLIST Rev 3Document2 pagesLIGHTING AND POWER CHECKLIST Rev 3abbasithNo ratings yet

- Carrier-0 Cover PageDocument1 pageCarrier-0 Cover PageabbasithNo ratings yet

- HFDP Certification Catalog Long VersionDocument12 pagesHFDP Certification Catalog Long VersionMohammed ToemaNo ratings yet

- Firecode - Fire Safety in The NHS: Health Technical Memorandum Operational ProvisionsDocument50 pagesFirecode - Fire Safety in The NHS: Health Technical Memorandum Operational ProvisionsVijay SharmaNo ratings yet

- PanchatantraDocument23 pagesPanchatantraabbasithNo ratings yet

- 30RW/30RWA: Water-Cooled/Condenserless Liquid Chillers With Integrated Hydronic ModuleDocument20 pages30RW/30RWA: Water-Cooled/Condenserless Liquid Chillers With Integrated Hydronic ModuleKossu69No ratings yet

- Honeywell HealthCare BrochureDocument16 pagesHoneywell HealthCare BrochureabbasithNo ratings yet

- Tank Yard ReqDocument1 pageTank Yard ReqabbasithNo ratings yet

- Vertical, Horizontal and Rectangular Tank SpecificationsDocument1 pageVertical, Horizontal and Rectangular Tank SpecificationsabbasithNo ratings yet

- HFDP Certification Catalog Long VersionDocument12 pagesHFDP Certification Catalog Long VersionMohammed ToemaNo ratings yet

- Tank Yard ReqDocument1 pageTank Yard ReqabbasithNo ratings yet

- Kahanion Ki DunyaDocument131 pagesKahanion Ki Dunyafakharuddin56No ratings yet

- Business Finance MODULE 1 EdDocument8 pagesBusiness Finance MODULE 1 EdALMIRA LOUISE PALOMARIANo ratings yet

- Investor Presentation (Company Update)Document17 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Leverage Notes by CA Mayank Kothari SirDocument48 pagesLeverage Notes by CA Mayank Kothari Sirbinu100% (2)

- Berger Paints Bangladesh Financial AnalysisDocument20 pagesBerger Paints Bangladesh Financial Analysisarian11No ratings yet

- 59 Biggest Mistakes Made by Property Investors and How To Avoid Them - Helen Collier-KogtevsDocument129 pages59 Biggest Mistakes Made by Property Investors and How To Avoid Them - Helen Collier-Kogtevsmauricio0327100% (1)

- Hul Wacc PDFDocument1 pageHul Wacc PDFutkNo ratings yet

- Assk SipDocument59 pagesAssk Sipakshaykhade9834No ratings yet

- Your Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / KyanDocument6 pagesYour Answers To 2 Decimal Places.) : Profit Margin Ratio Company Choose N/ Choose D / Barco / Kyanmohitgaba19No ratings yet

- Report on Summer Training at IDBI Federal Life InsuranceDocument49 pagesReport on Summer Training at IDBI Federal Life InsuranceAshu Agarwal67% (6)

- List of Global Macro Portfolio Managers PDFDocument3 pagesList of Global Macro Portfolio Managers PDFHilton GrandNo ratings yet

- Valuation-Dividend Discount ModelDocument23 pagesValuation-Dividend Discount Modelswaroop shettyNo ratings yet

- Barrons Magazine - November 20 2023 - Barrons MagazineDocument52 pagesBarrons Magazine - November 20 2023 - Barrons MagazineluqmanNo ratings yet

- FinanceDocument108 pagesFinanceChaitanya DaraNo ratings yet

- Master Thesis Investment BankingDocument6 pagesMaster Thesis Investment Bankingf1t1febysil2100% (2)

- Fund Profile FRT0009AUDocument3 pagesFund Profile FRT0009AUalistercantNo ratings yet

- Bill Akron Case Scenario: Exhibit 1 Select Spot and Forward RatesDocument5 pagesBill Akron Case Scenario: Exhibit 1 Select Spot and Forward RatesNGOC NHINo ratings yet

- Nombrado, Sean Lester CBET - 01 - 303A Review Questions Concept Review Questions Test QuestionsDocument5 pagesNombrado, Sean Lester CBET - 01 - 303A Review Questions Concept Review Questions Test QuestionsSean Lester S. NombradoNo ratings yet

- Operating Activities:: What Are The Classification of Cash Flow?Document5 pagesOperating Activities:: What Are The Classification of Cash Flow?samm yuuNo ratings yet

- Alcohol may help treat tremors, claims studyDocument154 pagesAlcohol may help treat tremors, claims studyAbhishek TomarNo ratings yet

- Study on Saving and Investment PreferencesDocument57 pagesStudy on Saving and Investment PreferencesTasmay EnterprisesNo ratings yet

- Day Trading Strategies - For Beginners To Advanced Day Traders, Strategy Is KeyDocument16 pagesDay Trading Strategies - For Beginners To Advanced Day Traders, Strategy Is KeysumonNo ratings yet

- Inflation Accounting Adjusts Financials for Rising PricesDocument7 pagesInflation Accounting Adjusts Financials for Rising PricesDisha DesaiNo ratings yet

- Chapter 2 FS and Transaction Analysis PDFDocument53 pagesChapter 2 FS and Transaction Analysis PDFleen mercadoNo ratings yet

- MODULE 2 - Discussion and Sample ProblemsDocument15 pagesMODULE 2 - Discussion and Sample ProblemsUSD 654No ratings yet

- Format of Holding of Specified Securities Network18 Media & Investments LimitedDocument5 pagesFormat of Holding of Specified Securities Network18 Media & Investments LimitedDigvijayNo ratings yet

- 5.1 Holding Period ReturnDocument48 pages5.1 Holding Period ReturnSrilekha BasavojuNo ratings yet

- Ra 7227 PDFDocument68 pagesRa 7227 PDFTricia Aguila-MudlongNo ratings yet

- Boa Tos AfarDocument5 pagesBoa Tos AfarMr. CopernicusNo ratings yet

- Victoria's Secret Annual ReportDocument13 pagesVictoria's Secret Annual Reportapi-373843164% (28)

- Report on S&P Global IncDocument36 pagesReport on S&P Global IncLIANo ratings yet