Professional Documents

Culture Documents

EF Group Accounting Policy

EF Group Accounting Policy

Uploaded by

Reini AndriatiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EF Group Accounting Policy

EF Group Accounting Policy

Uploaded by

Reini AndriatiCopyright:

Available Formats

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

INDEX:

1. GENERAL INFORMATION ....................................................................................... 2

2. SUMMARY ........................................................................................................... 3

3. BASIS OF CONSOLIDATION ................................................................................... 5

4. RELATED PARTIES ................................................................................................ 5

5. FOREIGN CURRENCIES ......................................................................................... 5

6. BUSINESS COMBINATIONS ................................................................................... 6

7. GOODWILL .......................................................................................................... 7

8. INTANGIBLE ASSETS ............................................................................................ 7

8.a) Intangible assets acquired externally. ................................................................... 7

8.b) Intangible assets generated internally. ................................................................. 8

9. PROPERTY, PLANT AND EQUIPMENT .......................................................................8

10. PARTICIPATIONS ............................................................................................... 10

11. INVENTORIES .................................................................................................... 10

12. FINANCIAL INSTRUMENTS................................................................................... 10

13. PROVISIONS ..................................................................................................... 11

14. REVENUE RECOGNITION ..................................................................................... 12

15. COST OF MATERIALS AND PURCHASED SERVICES ................................................. 13

16. EMPLOYEE EXPENSES ......................................................................................... 13

17. RETIREMENT BENEFIT COSTS .............................................................................. 13

18. OTHER OPERATING EXPENSES ............................................................................. 13

19. TAXATION ......................................................................................................... 13

EF Corporate Control T Sjöberg 1 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

1. GENERAL INFORMATION

The EF Group of companies (EF or EF Group) is a privately held group of companies

engaged in several programs. The programs are divided into the below business areas.

Language Programs with Travel

Programs where EF offers the opportunity to learn a language and a culture in a country

where the language is spoken. The students are from all over the world and main

destinations are e.g. UK, USA, Malta, Germany and France. EF provides travel,

accommodation, language instruction and other activities.

Language Programs without Travel

Programs where EF provides customers with various types of local language instruction in

their home countries. Travel is not a key component in the services offered (local

language schools and online language instruction).

Au Pair Childcare and Host Family Programs

Programs where EF offers the opportunity to learn a language and a culture while

spending a year in a foreign country (High School Year and Au Pair). EF provides travel,

accommodation and activities, but does not offer any language instruction.

Educational and Leisure Tours

Programs where EF offers cultural and educational tours. These programs include travel,

accommodation and other activities, but no language instruction. The customers are

mainly from USA and Canada with destinations predominantly in Europe.

Academic Degrees

Programs where EF provides customers all over the world the opportunity to acquire

internationally recognized academic degrees. Programs offered for upper secondary

education are A-levels and International Baccalaureate, as well as Bachelor and Master of

Business Administration at university level.

Other

Other includes various supporting activities such as e.g. insurances, real estate,

management and financing.

The activities are performed in various legal groups, all together forming the EF Group.

The consolidated financial statements of the EF Group, its various groups (Group), its

various parent companies (Parent Company), and their subsidiaries (Subsidiaries) shall

be prepared in accordance with the EF Group Accounting Policy.

The financial year of the EF Group is October 1 to September 30. All companies’ part of

the EF Group shall also have such financial year if not required otherwise by local

regulations. Companies whereas such regulations exists, a separate reporting shall be

made for the consolidation purposes.

Questions pertaining to EF Group Accounting Policy should be addressed to EF Education

First, Attention: EF Corporate Control, Haldenstrasse 4, CH-6006 Lucerne, Switzerland.

EF Corporate Control T Sjöberg 2 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

2. SUMMARY

Related parties

Parent Company and Companies controlled by the Parent Company (its subsidiaries), is

all together called Group Companies. Related parties include all entities other than Group

Companies which directly or indirectly is under the control of the ultimate shareholder.

Foreign currencies

Transactions in foreign currencies in local books are recorded at the EF rates of exchange

ruling on the dates of the transactions. For each week exchange rates are announced on

EF intranet.

Monetary assets and liabilities denominated in foreign currencies are translated into the

accounting currency at the EF exchange rate in effect of the balance sheet date.

Goodwill

Goodwill is initially recognized as an asset at cost less any subsequent accumulated

depreciation. The depreciation is calculated on a straight-line basis and should not exceed

10 years.

Intangible assets

The cost of acquired intangible assets is their purchase cost together and costs of

acquisition. The depreciation is calculated on a straight-line basis and shall not exceed:

Trademarks, patents 10 years

Computer software 5 years

Others licenses 5 years

Property, plant and equipment

Land and buildings are stated at cost less any subsequent accumulated depreciation and

subsequent accumulated impairment losses. Fixtures and equipment are stated at cost

less accumulated depreciation and any accumulated impairment losses.

In order to be activated, the value of the expense shall exceed USD 1,000 and have a life

span longer than one year. Individual items below USD 1,000 can be activated if they are

part of a project which itself exceeds the threshold. All other expenses shall be cost

accounted for. The depreciation period of property, plant and equipment shall be:

Land not depreciated

Buildings 50 years

Additions to buildings 20 years

Leases and leasehold improvements lease period

Vehicles 5 years

Computers 3 years

Other fixtures and equipment < 5 years

If local regulatory requirements differ from the above such may be applied only if the

impact not is material.

Inventories

Stocks are valued at the lower of costs and net realizable value. Cost is determined on a

FIFO basis (first in first out).

EF Corporate Control T Sjöberg 3 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

Trade receivables

The balances of accounts receivable are stated at nominal value; a provision is made

where deemed necessary. The reserve for trade receivables shall be:

< One year based on historical data

> One year fully reserved

Revenue recognition

Revenue is recognized as follows:

For programs including travel: at departure or start date

For online programs: at start date

For local language learning: when services are rendered

For academic programs: at start date

For sales of goods: at the date of delivery or when the title has passed

For royalties: on invoice date

EF Corporate Control T Sjöberg 4 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

3. BASIS OF CONSOLIDATION

The consolidated financial statements shall incorporate the financial statements of the

Parent Company and entities controlled by the Parent Company (its subsidiaries) on a

“line-by-line” basis. Control is achieved where the Parent Company has the power to

govern the financial and operating policies of an entity so as to obtain benefits from its

activities.

The results of the subsidiaries acquired or disposed of during the year are included in the

consolidated income statement from the effective date of acquisition or up to the effective

date of disposal, as appropriate, unless specifically mentioned as a note to the financial

statements.

Where necessary, adjustments are made to the financial statements of subsidiaries to

bring their accounting policies into line with those used by other members of the Group.

All intra-group transactions, balances income and expenses are eliminated in the

consolidation.

Minority interests in the net assets of consolidated subsidiaries are defined separately

from the Group’s equity therein. Minority interests consist of the amount of those

interests at the date of the original business combination and minority’s share of changes

in equity since the date of the combination. Losses applicable to the minority in excess of

the minority’s interest in the subsidiary’s equity are allocated against the interests of the

Group except to the extent that the minority has a binding obligation and is able to make

an additional investment to cover the losses.

4. RELATED PARTIES

Parent Company and Companies controlled by the Parent Company (its subsidiaries), is

all together called Group Companies.

Related parties include all other than Group Companies, which directly or indirectly are

under the control of the ultimate shareholder and which are not included in the

consolidated financial statements as well as management personnel of consolidated

subsidiaries (Related Parties). The control is the power to govern the financial and

operating policies of an entity so as to obtain benefits from its activities

5. FOREIGN CURRENCIES

The individual financial statements of each group entity are presented in the currency of

the primary economic environment in which the entity operates (its functional currency).

For the purpose of the consolidated financial statements, the results and financial position

of each entity are expressed in USD, which is the functional currency of the Parent

Company, and the presentation currency for the consolidated financial statements.

Transactions in foreign currencies are converted into the functional currency at the

weekly EF rate of exchange ruling at the date of the transaction.

In preparing the financial statements of the individual entities monetary items

denominated in foreign currencies are retranslated into functional currency at the EF

EF Corporate Control T Sjöberg 5 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

rates prevailing on the balance sheet date. Monetary items are money held and assets

and liabilities to be received or paid in fixed or determinable amounts of money.

Non-monetary items carried at fair value that are denominated in foreign currencies are

retranslated at the rates prevailing on the date when the fair value was determined. Non-

monetary items that are measured in terms of historical cost in a foreign currency are not

retranslated.

Exchange differences arising on the settlement of monetary items, and on the

retranslation of monetary items, are included in profit or loss for the period. Exchange

differences arising on the retranslation of non-monetary items carried at fair value are

included in profit or loss for the period except for differences arising on the retranslation

of non-monetary items in respect of which gains and losses are recognized directly in

equity. For such non-monetary items, any exchange component of that gain or loss is

also recognized directly in equity.

For the purpose of presenting consolidated financial statements, the assets and liabilities

of the Group’s foreign operations (including comparatives) are expressed in USD using

exchange rates prevailing on the balance sheet date. Income and expense items

(including comparatives) are translated at the average exchange rates for the period,

unless exchange rates fluctuated significantly during that period, in which case the

exchange rates at the dates of the transactions are used. Exchange differences arising, if

any, are classified as equity and transferred to the Group’s translation reserve. Such

translation differences are recognized in profit or loss in the period in which the foreign

operation is disposed of.

Goodwill and fair value adjustments arising on the acquisition of a foreign operation are

treated as assets and liabilities of the foreign operation and translated at the closing rate.

6. BUSINESS COMBINATIONS

The acquisition of new companies/activities is accounted for using the purchase method.

The cost of the acquisition is measured at the aggregate of the fair values, at the date of

exchange, of assets given, liabilities incurred or assumed, and equity instruments issued

by the acquirer in exchange for control of the acquired company, plus any costs directly

attributable to the business combination.

The acquired company’s identifiable assets, liabilities and contingent liabilities that meet

the conditions for recognition under EF Group Accounting Policy are recognized at their

fair values at the acquisition date.

Goodwill arising on acquisition is recognized as an asset and initially measured at cost,

being the excess of the cost of the business combination over the Group’s interest in the

net fair value of the identifiable assets, liabilities and contingent liabilities recognized. If,

after reassessment, the Group’s interest in the net fair value of the acquired company’s

identifiable assets, liabilities and contingent liabilities exceeds the cost of the business

combination, the excess is recognized immediately in profit or loss.

The interest of minority shareholders in the acquired company is initially measured at the

minority’s proportion of the net fair value of the assets, liabilities and contingent liabilities

recognized.

EF Corporate Control T Sjöberg 6 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

7. GOODWILL

Goodwill arising on the acquisition of a subsidiary or a jointly controlled entity and

represents the excess of the cost of acquisition over the Group’s interest in the net fair

value of the identifiable assets, liabilities and contingent liabilities of the subsidiary or

jointly controlled entity recognized at the date of acquisition. Goodwill is initially

recognized as an asset at cost and is subsequently measured at cost less any

accumulated depreciation. Depreciation should not exceed 10 years.

For the purpose of impairment testing, goodwill is allocated to each of the Group’s cash-

generating units expected to benefit from the synergies of the combination. Cash-

generating units to which goodwill has been allocated are tested for impairment annually.

If the recoverable amount of the cash-generating unit is less than the carrying amount of

the unit, the impairment loss is allocated first to reduce the carrying amount of any

goodwill allocated to the unit and then to the other assets of the unit pro-rata on the

basis of the carrying amount of each asset in the unit. An impairment loss recognized for

goodwill is not reversed in a subsequent period.

On disposal of a subsidiary or a jointly controlled entity, the attributable amount of

goodwill is included in the determination of the profit or loss on disposal.

8. INTANGIBLE ASSETS

An intangible asset is an identifiable non-monetary asset without physical substance held

for use in the production or supply of goods or services, for rental to others, or for

administrative purpose.

An entity should recognize an intangible asset if:

It is probable that the asset will generate future economics benefits

The asset is identifiable

The cost of an asset can be measured reliably

Intangible assets are depreciated by the straight-line method over the useful life of the

asset. The depreciation period for intangible assets should not exceed:

Trademarks 10 years

Patents 10 years

Computer software 5 years

Other licenses 5 years

Expenditure on an intangible asset should be recognized as an expense when it is

incurred.

8.a) Intangible assets acquired externally.

Acquired intangible asset should be measured at cost. The cost of an intangible asset

comprises its purchase price, including any import duties and non-refundable purchase

taxes, and any directly attributable expenditure on preparing the asset for its intended

use. Any trade discounts are deducted in arriving at the cost.

EF Corporate Control T Sjöberg 7 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

8.b) Intangible assets generated internally.

Internally generated intangible asset should be measured at cost. The cost of internally

generated intangible asset incurred from the date when the intangible asset first meets

the recognition criteria and comprises all expenditure that can be directly attributed or

allocated on a reasonable and consistent basis, to creating, producing and preparing the

asset for its intended use.

Research and development costs

Expenditure on research (or on the research phase of an internal project) should be

recognized as an expense when it is incurred. Research is original and planned

investigation undertaken with the prospect of gaining new scientific or technical

knowledge and understanding.

Development costs

An intangible asset arising from development (or from the development phase of an

internal project) should be recognized only if the entity can demonstrate that:

- There is a technical feasibility of completing the asset

- It is intended to complete the asset

- It is possible to measure the expenditure attributable to the intangible asset during its

development activity

- There will be ability to use or sell the intangible asset

Availability of resources to complete, use and obtain the benefits can be demonstrated by

e.g. a business plan showing the technical, financial and other resources needed and the

enterprise ability to secure those resources. Cost attributable to the asset can be reported

from financial systems, if it is possible to report separately cost combined with generating

an intangible asset such as salaries, employment related costs, expenditure on materials

etc.

Internally generated brands, mastheads, publishing titles, customer lists and items

similar in substance should not be recognized as intangible asset.

9. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are recognized as tangible assets if:

- It is held for use in production or supply goods or services, or for rental to the others,

or for administrative purpose

- The expecting useful life exceeds 1 year

- The cost of the asset is higher than USD 1,000

Group of similar items where individual cost is lower than USD 1,000 should be

recognized as a one asset, if the lump sum has a material impact on the value of an

asset. Such asset should be then subject to depreciation as an asset of an initial value

equal to cumulated value of all grouped items.

Useful life is the period over which an asset is expected to be available for use by an

entity.

Initially, property, plant and equipment are carried at the cost of acquisition or

construction. Cost of acquisition consist of purchase price, duties and other non-

refundable taxes paid and other expenses directly attributable to bringing the asset to

EF Corporate Control T Sjöberg 8 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

working condition. Cost of construction is calculated on the basis of the directly

attributable. Borrowing cost must be excluded from the initial value of an asset.

Subsequent to initial recognition property, plant and equipments is carried at:

Land and buildings

Land and buildings held for use in the production or supply of goods or services, or for

administrative purposes, are stated in the balance sheet at cost less any subsequent

accumulated depreciation and subsequent accumulated impairment losses. If local

management deems it necessary to perform a revaluation of a property, such revaluation

needs to be approved by Corporate Control.

Properties in the course of construction for production, rental or administrative purposes,

or for purposes not yet determined, are carried at cost, less any recognized impairment

loss. Cost includes professional fees and, for qualifying assets, borrowing costs capitalized

in accordance with the Group’s accounting policy. Depreciation of these assets, on the

same basis as other property assets, commences when the assets are ready for their

intended use.

Fixture and fittings

Fixtures, furniture, office equipment and vehicles are stated at cost less accumulated

depreciation and any accumulated impairment losses.

Financial lease

Assets held under finance leases are depreciated over their expected useful lives on the

same basis as owned assets or, where shorter, the term of the relevant lease.

Expenses for the repair of property are charged as a cost, unless they result in extending

the useful life of an asset or increase its productivity.

Depreciation is charged so as to write off the cost or valuation of assets over their

estimated useful lives, using the straight-line method.

Depreciation should be calculated monthly. The Depreciation start date should be the first

day of the month following the month the asset has been recorded.

The gain or loss arising on the disposal or retirement of an item of property, plant and

equipment is determined as the difference between the sales proceeds and the carrying

amount of the asset and is recognized in profit or loss.

The following depreciation periods, based on the estimated useful life of the respective

assets, shall be applied:

Land not depreciated

Buildings 50 years

Addition to buildings 20 years

Leases and leasehold improvements lease period

Vehicles 5 years

Computers 3 years

Other fixtures and equipment < 5 years

EF Corporate Control T Sjöberg 9 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

If local regulatory requirements differ from the above such may be applied only if the

impact is immaterial.

10. PARTICIPATIONS

The carrying value of investments in participations is the lower of historical and market

value.

11. INVENTORIES

Inventories comprise goods held for sale or materials or supplies to be consumed in the

production process or in the rendering of services.

Inventories are stated at the lower of cost and net realizable value. Net realizable value is

the estimated selling price less the estimated costs of completion and the estimated cost

necessary to make the sale.

The cost comprise all cost of purchase and other cost incurred in bringing the inventories

to their present location and condition, such as import duties, transport etc. Trade

discounts should be deducted from the cost attributed to inventories. Costs directly

attributed to acquisition should be distributed proportionally to volume of goods

purchased. Immaterial costs (when appropriation is not feasible) should be posted as cost

rather than capitalized.

Writing inventory down to net realizable value should be done on a group basis unless

possible to evaluate item separately.

Cost is calculated using first-in, first-out method.

Cost of sold inventory must be recognized as an expense in the period which the revenue

is recognized. Write-downs or losses of inventory must be recognized as an expense

when the write-down or loss occurs.

12. FINANCIAL INSTRUMENTS

Financial assets and financial liabilities are recognized on the Group’s balance sheet when

the Group becomes a party to the contractual provisions of the instrument.

Trade receivables

Trade receivables are stated at nominal value, less write downs for amounts unlikely to

be recovered.

The reserve for trade receivables shall be:

< One year based on historical data

> One year fully reserved

Investments

Investments are recognized and derecognized on a trade date basis where the purchase

or sale of an investment is under a contract whose terms require delivery of the

investment within the timeframe established by the market concerned, and are initially

measured at fair value, plus directly attributable transaction costs.

EF Corporate Control T Sjöberg 10 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

At subsequent reporting dates, debt securities that the Group has the expressed intention

and ability to hold to maturity (held-to-maturity debt securities) are measured at

amortized cost using the effective interest rate method, less any impairment loss

recognized to reflect irrecoverable amounts. An impairment loss is recognized in profit or

loss when there is objective evidence that the asset is impaired, and is measured as the

difference between the investment’s carrying amount and the present value of estimated

future cash flows discounted at the effective interest rate computed at initial recognition.

Impairment losses are reversed in subsequent periods when an increase in the

investment’s recoverable amount can be related objectively to an event occurring after

the impairment was recognized, subject to the restriction that the carrying amount of the

investment at the date the impairment is reversed shall not exceed what the amortized

cost would have been had the impairment not been recognized.

Cash and cash equivalents

Cash and cash equivalents comprise cash on hand and demand deposits and other short-

term highly liquid investments that are readily convertible to a known amount of cash

and are subject to an insignificant risk of changes in value.

Financial liabilities and equity

Financial liabilities and equity instruments issued by the Group are classified according to

the substance of the contractual arrangements entered into and the definitions of a

financial liability and an equity instrument. An equity instrument is any contract that

evidences a residual interest in the assets of the Group after deducting all of its liabilities.

Bank borrowings

Interest-bearing bank loans and overdrafts are measured at nominal value.

Trade payables

Trade payables are stated at their nominal value.

13. PROVISIONS

Provisions are recognized when the Group has a present obligation as a result of a past

event, and it is probable that the Group will be required to settle that obligation.

Provisions are measured at the directors’ best estimate of the expenditure required to

settle the obligation at the balance sheet date.

EF Corporate Control T Sjöberg 11 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

14. REVENUE RECOGNITION

Revenue from sales of products and services is recognized if the revenue can be reliably

measured, it is probable that the economic benefits of the transaction will flow to the

Entity and all related costs can be reliably measured and assessed.

Revenue is measured at the fair value of the consideration received or receivable and

represents amounts receivable for goods and services provided in the normal course of

business, net of discounts and sales related taxes.

General Revenue Recognition Principle

For most programs, revenue is recognized at departure- or start date of the program,

course or tour sold. At this stage the fee is fixed and determinable, collection has been

reasonably assured and according to cancellation rules the fees collected are non-

refundable (risk transferred to the customer).

Provisions are made for the related expenses incurred after the balance sheet cut-off

date.

Up-front payments received from students are reported as deferred income and

recognized as revenue over the related tuition period.

Products applying the general rule of revenue recognition are:

• Programs including travel

• Language Programs provided online

• Au Pair Childcare

• Host Family Programs

• Educational- and Leisure Tours

• Academic Degrees and related Preparation Programs

Exception applied to Language Programs without a travel component

Revenue generated from customers attending local language learning courses rendered

locally is recognized when the service is rendered, on a monthly basis in accordance with

the monthly production report.

Royalty revenue

Royalty revenues comprises of: initial fees, fees for rights granted by the agreement

(trademark etc.), technical support and prolongation fees.

Royalty fees are non-recoupable.

Initial and prolongation fees from franchisee operations, fees charged for the use of

continuing rights granted by the agreement and fees for technical support are recognized

as revenue in full on invoice date.

Royalty revenues for rights granted and technical support are calculated at least quarterly

as a per cent of franchisees gross income reported by the franchisees.

Real estate

Real Estate revenue is recognized on an accrual basis in accordance with the substance of

the agreement.

EF Corporate Control T Sjöberg 12 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

Sales of goods

Revenue from sales of goods is recognized at the date of delivery to the customer or

when the rights to goods are transferred to the customer. Advance payments received

from the customers are deferred and recorded as an income when the related goods has

been delivered (title to goods has passed to the buyer).

Financial income

Interest income is accrued on a time basis, by reference to the principal outstanding and

at the effective interest rate applicable, which is the rate that exactly discounts estimated

future cash receipts through the expected life of the financial asset to that asset’s net

carrying amount.

Dividend income from investments is recognized when the shareholders’ rights to receive

payment have been established

15. COST OF MATERIALS AND PURCHASED SERVICES

Cost of materials and purchased services consist of teacher-, student transportation-,

tuition-, accommodation expenses, as well as service costs. Provision is made for the

related expenses to be incurred after balance sheet date.

16. EMPLOYEE EXPENSES

Employee expenses include all expenses for employees of the Company, including e.g.

salaries, social fees and pensions and other related expenses. Expenses are attributed to

the period to which they relate.

17. RETIREMENT BENEFIT COSTS

Payments to defined contribution retirement plans are charged as an expense as they fall

due. Payments made to state-managed retirement benefit schemes are dealt with as

payments to defined contribution plans where the Group’s obligations under the plans are

equivalent to those arising in a defined contribution retirement benefit plan.

The Entities shall not have any defined benefit retirement plans if it is not required by

local law and regulation.

18. OTHER OPERATING EXPENSES

The operating expenses are generally taken into account in the period to which they

relate. Other operating expenses include travel cost.

Expenses for marketing activities are activated and cost accounted for in the period to

which the marketing campaign relates to.

19. TAXATION

Income tax expense represents the sum of the tax currently payable and deferred tax.

The tax currently payable is based on taxable profit for the year. Taxable profit differs

from profit as reported in the income statement because it excludes items of income or

expense that are taxable or deductible in other years and it further excludes items that

EF Corporate Control T Sjöberg 13 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

APM EF GROUP: APPENDIX C EF INTERNAL INFORMATION

EF FINANCIAL REPORTING

ACCOUNTING POLICIES

EF GROUP ACCOUNTING POLICY

are never taxable or deductible. The Group’s liability for current tax is calculated using

tax rates that have been enacted or substantively enacted by the balance sheet date.

Deferred tax is recognized on differences between the carrying amounts of assets and

liabilities in the financial statements and the corresponding tax base used in the

computation of taxable profit, and are accounted for using the balance sheet liability

method. Deferred tax liabilities are generally recognized for all taxable temporary

differences and deferred tax assets are recognized to the extent that it is probable that

taxable profits will be available against which deductible temporary differences can be

utilized.

The carrying amount of deferred tax assets is reviewed at each balance sheet date and

reduced to the extent that it is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to apply in the period when

the liability is settled or the asset realized. Deferred tax is charged or credited to profit or

loss, except when it relates to items charged or credited directly to equity, in which case

the deferred tax is also dealt with in equity.

Deferred tax assets and liabilities are offset when there is a legally enforceable right to

set off current tax assets against current tax liabilities and when they relate to income

taxes levied by the same taxation authority and the Group intends to settle its current tax

assets and liabilities on a net basis.

EF Corporate Control T Sjöberg 14 (14) Rev A 7/16/2014

Z:\Corporate Control\Consolidation\FY14 Closing\Audit Prep\APM FY14\APM EF GROUP APPENDIX C EF GAP_20140710_FINAL.doc

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Coffee KingdomDocument13 pagesCoffee Kingdomlumonyet hohoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Process Safety - Recommended Practice On KPIsDocument90 pagesProcess Safety - Recommended Practice On KPIsfrancis100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Balance Sheet Detective Additional AnalysisDocument2 pagesBalance Sheet Detective Additional AnalysisAlina ZubairNo ratings yet

- Check List For Revenue Audit of A BankDocument4 pagesCheck List For Revenue Audit of A Bankjibujinson50% (2)

- BS en 12075-1997 - (2018-06-28 - 03-58-44 Am)Document14 pagesBS en 12075-1997 - (2018-06-28 - 03-58-44 Am)Rankie ChoiNo ratings yet

- PDF 20230219 143109 0000Document1 pagePDF 20230219 143109 0000Sam SamNo ratings yet

- Altascio Technologies India Private Limited: D&B Business DirectoryDocument4 pagesAltascio Technologies India Private Limited: D&B Business DirectoryHaritha HaribabuNo ratings yet

- F5 - Mock A - AnswersDocument13 pagesF5 - Mock A - AnswersmasangaaxNo ratings yet

- Kalyan Jewellers India LimitedDocument3 pagesKalyan Jewellers India LimitedJijo JosephNo ratings yet

- Technology - Entrepreneurship - Bringing - Innovation - To... - (PG - 264 - 302) - Chapter 8Document39 pagesTechnology - Entrepreneurship - Bringing - Innovation - To... - (PG - 264 - 302) - Chapter 8Uzma NaumanNo ratings yet

- Managerial Economics Applications Strategies and Tactics 13th Edition James R Mcguigan R Charles Moyer Frederick H Deb HarrisDocument33 pagesManagerial Economics Applications Strategies and Tactics 13th Edition James R Mcguigan R Charles Moyer Frederick H Deb Harriskatieterryrlrb100% (11)

- Electrical Enclosure Catalog Ca304001en PDFDocument524 pagesElectrical Enclosure Catalog Ca304001en PDFNathanNo ratings yet

- FABM2 LAS 10 Income and Business TaxationDocument13 pagesFABM2 LAS 10 Income and Business TaxationXander AlcantaraNo ratings yet

- Irrm Revision NotesDocument19 pagesIrrm Revision Notesteam aspirantsNo ratings yet

- Agence France-PresseDocument2 pagesAgence France-PresseZainab Ali KhanNo ratings yet

- Myeg InvoiceDocument1 pageMyeg InvoiceRiaz KhanNo ratings yet

- Lessons From The Titans: What Companies in The New Economy Can Learn From The Great Industrial Giants To Drive Sustainable Success Scott DavisDocument52 pagesLessons From The Titans: What Companies in The New Economy Can Learn From The Great Industrial Giants To Drive Sustainable Success Scott Davisjason.hollendonner905100% (19)

- Character Formation Chapter 5.docx Version 1Document8 pagesCharacter Formation Chapter 5.docx Version 1Criminegrology TvNo ratings yet

- Union vs. VivarDocument2 pagesUnion vs. VivarKê MilanNo ratings yet

- Summary On "Uber: The New Face of E-Commerce"Document2 pagesSummary On "Uber: The New Face of E-Commerce"Sonu Tandukar100% (1)

- Burgelman 1983Document20 pagesBurgelman 1983Hoàng BảoNo ratings yet

- Q1 Module 7Document40 pagesQ1 Module 7Guada Guan FabioNo ratings yet

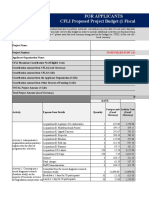

- Modus RP Cfli Proposed Project Budget For Project Spanning 1 Fy - enDocument17 pagesModus RP Cfli Proposed Project Budget For Project Spanning 1 Fy - enHélio MutombeneNo ratings yet

- Portfolio Revision: Raj Kumar Faculty, PUDocument24 pagesPortfolio Revision: Raj Kumar Faculty, PUrajunsc100% (4)

- Inspection Checklist: A. Tools and Equipment YES NODocument1 pageInspection Checklist: A. Tools and Equipment YES NOHENJEL PERALESNo ratings yet

- FINAL REPORT (Edited) 161-009-45 PDFDocument87 pagesFINAL REPORT (Edited) 161-009-45 PDFpabel ahmedNo ratings yet

- Kim2005 PDFDocument12 pagesKim2005 PDFHassan TariqNo ratings yet

- Entrepreneurship Budget of WorkDocument3 pagesEntrepreneurship Budget of WorkRachel BandiolaNo ratings yet

- 32-95 Rev 4 - Environmental Occupational Health and Safety Incident ManagementDocument69 pages32-95 Rev 4 - Environmental Occupational Health and Safety Incident ManagementZinhle DlaminiNo ratings yet

- 123Document3 pages123Dilan WarnakulasooriyaNo ratings yet