Professional Documents

Culture Documents

Firestone Tiles v. CA

Uploaded by

FSCB0 ratings0% found this document useful (0 votes)

19 views2 pagesFirestone Tiles v. CA

Copyright

© Public Domain

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFirestone Tiles v. CA

Copyright:

Public Domain

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views2 pagesFirestone Tiles v. CA

Uploaded by

FSCBFirestone Tiles v. CA

Copyright:

Public Domain

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

[20] Firestone Tiles v.

CA “special withdrawal slips” to Fojas-Arca to allow them to withdraw

funds from their account.

G.R. No. 113236 | March 5, 2001 | General Banking Law of 2000 2. In January 1978, Firestone Tire & Rubber, Co. (Firestone) and

Petitioner: FIRESTONE TIRE & RUBBER COMPANY OF THE Fojas-Arca entered into a "Franchised Dealership Agreement" where

PHILIPPINES Fojas-Arca has the privilege to purchase on credit and sell Firestone

Respondents: COURT OF APPEALS and LUZON DEVELOPMENT BANK products.

3. From January to May 1978, Fojas-Arca purchased on credit

Recit-Ready Facts: Firestone products with a total amount of P4,896,000.00 paid

1. Firestone and Fojas-Arca entered into a Franchised Dealership through 6 special withdrawal slips drawn upon Luzon. In turn, these

Agreement whereby Fojas-Arca is given the privilege to purchase on were deposited by Firestone with its current account with the

credit and sell Firestone products. Fojas-Arca entered into multiple Citibank. All of them were honored and paid by the Luzon – leading

purchases on credit with Firestone using Luzon Bank’s special Firestone to believe that the succeeding special withdrawal slips

withdrawal slips, which Firestone deposited with Citibank, and were would be sufficiently funded. Thus Firestone extended to Fojas-Arca

subsequently honored. other purchases on credit of its products.

2. Citibank however informed Firestone that two withdrawal slips were 4. Subsequent withdrawal slips were issued by Fojas-Arca to Firestone

dishonored by Luzon for insufficiency of funding, and debited the who similarly deposited them with its Citibank, and Citibank likewise

amount from Firestone’s account. forwarded them to Luzon for payment. However this time, Citibank

3. Firestone filed a complaint for sum of money and damages against informed Firestone that two of the four withdrawal slips deposited

Luzon but the court found no liability on the part of Luzon. The special were dishonored for insufficiency of funds, and as consequence

withdrawal slips clearly indicated that they were non-negotiable and thereof – Citibank debited from Firestone’s account the value of the

thus Luzon had no obligation to notify Firestone of dishonor. two withdrawal slips.

4. The court held that banks are under obligation to treat the accounts of 5. Thus after having their demand unheeded, Firestone filed a

its depositors with meticulous care. Citibank in this case was not complaint against Luzon for a sum of money and for damages.

bound to accept the withdrawal slips as a valid mode of deposit but did 6. Luzon averred that it was not privy to the transactions between

so anyways under the presumption that subsequent slips would be Firestone and Fojas-Arca – thus it has no duty to give notice to

honored and paid. By doing so, it failed in its fiduciary duty to treat the Firestone, and that Firestone was grossly negligent in treating the

accounts of its clients with the highest degree of care. withdrawal slips as negotiable when it is clearly stated therein that it

5. Thus Firestone and Citibank must bear the risks attendant to the is non-negotiable.

acceptance of these instruments

ISSUES:

1. WON Luzon should be held liable for damages suffered by

Doctrine:

Firestone, due to its allegedly belated notice of non-payment of the

1. A bank is under obligation to treat the accounts of its depositors with

withdrawal slips. – NO, Luzon cannot be held liable for damages.

meticulous care.

RATIO:

FACTS: 1. At the outset, it is uncontroverted that the withdrawal slips were non-

1. Fojas-Arca Enterprises (Fojas-Arca) maintains a special savings negotiable, and thus the rules governing the giving of immediate

account with Luzon Development Bank (Luzon). Luzon supplied notice of dishonor of negotiable instruments do not apply in this

case. Luzon was under no obligation to give immediate notice that it

would not make payment on the subject withdrawal slips. WHEREFORE, the petition is DENIED and the decision of the Court of

2. Citibank should have known that withdrawal slips were not Appeals in CA-G.R. CV No. 29546 is AFFIRMED. Costs against petitioner.

negotiable instruments. It could not expect these slips to be treated

as checks by other entities. Payment or notice of dishonor from SO ORDERED.

respondent bank could not be expected immediately, in contrast to

the situation involving checks.

3. In the case at bar, it appears that Citibank, with the knowledge that

respondent Luzon Development Bank, had honored and paid the

previous withdrawal slips, automatically credited petitioner's current

account with the amount of the subject withdrawal slips, then merely

waited for the same to be honored and paid by respondent bank. It

presumed that the withdrawal slips were "good."

4. It bears stressing that Citibank could not have missed the non-

negotiable nature of the withdrawal slips. The essence of

negotiability which characterizes a negotiable paper as a credit

instrument lies in its freedom to circulate freely as a substitute for

money. The withdrawal slips in question lacked this character.

5. A bank is under obligation to treat the accounts of its depositors with

meticulous care, whether such account consists only of a few

hundred pesos or of millions of pesos. The fact that the other

withdrawal slips were honored and paid by respondent bank was no

license for Citibank to presume that subsequent slips would be

honored and paid immediately. By doing so, it failed in its fiduciary

duty to treat the accounts of its clients with the highest degree of

care.

6. In the ordinary and usual course of banking operations, current

account deposits are accepted by the bank on the basis of deposit

slips prepared and signed by the depositor, or the latter's agent or

representative, who indicates therein the current account number to

which the deposit is to be credited, the name of the depositor or

current account holder, the date of the deposit, and the amount of

the deposit either in cash or in check.

7. The withdrawal slips were not checks. Citibank was not bound to

accept the withdrawal slips as a valid mode of deposit. But having

erroneously accepted them as such, Citibank — and Firestone as

account-holder — must bear the risks attendant to the acceptance of

these instruments. Firestone and Citibank could not now shift the risk

and hold Luzon liable for their admitted mistake.

Disposition of the Court

You might also like

- Cathay v. Vasquez 399 SCRA 207Document2 pagesCathay v. Vasquez 399 SCRA 207FSCBNo ratings yet

- CIR v. PrietoDocument2 pagesCIR v. PrietoFSCBNo ratings yet

- Espidol v. COMELECDocument3 pagesEspidol v. COMELECFSCB0% (1)

- Abad v. COMELECDocument2 pagesAbad v. COMELECFSCBNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2019rev MS493Document2 pages2019rev MS493deepak777No ratings yet

- Public International Law - Dean Sedfrey M. CandelariaDocument16 pagesPublic International Law - Dean Sedfrey M. CandelariaAndrei Da JoseNo ratings yet

- 12 Cases For OmbudsmanDocument13 pages12 Cases For OmbudsmanElixirLanganlanganNo ratings yet

- 2012 Contracts Slides CH 7Document42 pages2012 Contracts Slides CH 7lindajkangNo ratings yet

- Jurnal Hukum - 2020 - 623-2244-2-pbDocument8 pagesJurnal Hukum - 2020 - 623-2244-2-pbKarimullah SaingNo ratings yet

- BCPC PresentationDocument40 pagesBCPC PresentationJoy Navaja Dominguez88% (41)

- Aguinaldo DoctrineDocument7 pagesAguinaldo Doctrineapril75No ratings yet

- Private Firearm SaleDocument2 pagesPrivate Firearm SalepreppeddudeNo ratings yet

- Dela Cruz - SPL Case DigestDocument4 pagesDela Cruz - SPL Case DigestJefferson A. dela CruzNo ratings yet

- Fifteen Reasons You Should Own A GunDocument2 pagesFifteen Reasons You Should Own A GunAmmoLand Shooting Sports NewsNo ratings yet

- Tan Vs Crisologo 2017Document2 pagesTan Vs Crisologo 2017Clyde TanNo ratings yet

- 2017 DOJ Free Bar Notes in Remedial LawDocument9 pages2017 DOJ Free Bar Notes in Remedial LawRoland ApareceNo ratings yet

- How Create A Calendar by Your Photos Using GimpDocument27 pagesHow Create A Calendar by Your Photos Using GimpEmiliano ProgrammiNo ratings yet

- Vice President Real Estate in Dallas FT Worth TX Resume Kevin BennettDocument2 pagesVice President Real Estate in Dallas FT Worth TX Resume Kevin BennettKevinBennett1No ratings yet

- #12-Digest-Matuguina Wood Vs CADocument2 pages#12-Digest-Matuguina Wood Vs CAJared RiveraNo ratings yet

- Notice: Privacy Act Systems of RecordsDocument34 pagesNotice: Privacy Act Systems of RecordsJustia.comNo ratings yet

- Civil Procedure Notes Compiled University of San Carlos College of Law 23Document5 pagesCivil Procedure Notes Compiled University of San Carlos College of Law 23Jan NiñoNo ratings yet

- Benedict Atkinson, Brian Fitzgerald (Auth.) - A Short History of Copyright - The Genie of Information-Springer International Publishing (2014)Document145 pagesBenedict Atkinson, Brian Fitzgerald (Auth.) - A Short History of Copyright - The Genie of Information-Springer International Publishing (2014)kovacmilovanovicNo ratings yet

- Save Our Springs TCEQ LawsuitDocument24 pagesSave Our Springs TCEQ LawsuitAnonymous Pb39klJNo ratings yet

- Las - LC4 Filipino Sa Piling Larang Akad Week 4Document9 pagesLas - LC4 Filipino Sa Piling Larang Akad Week 4FORBETA, KIANNE GELL C.No ratings yet

- Creation of LGU-Municipality of JimenezDocument5 pagesCreation of LGU-Municipality of JimenezJamiah HulipasNo ratings yet

- CDR SC JaidwalDocument68 pagesCDR SC JaidwalbabbuNo ratings yet

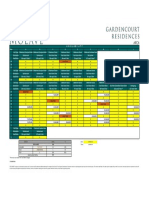

- Gardencourt Residences Molave Availability (July 19, 2022)Document1 pageGardencourt Residences Molave Availability (July 19, 2022)Nicolo MendozaNo ratings yet

- Affidavit Right To Travel and Declaration of StatusDocument15 pagesAffidavit Right To Travel and Declaration of StatusCharles Fowler100% (4)

- People Vs JanjalaniDocument3 pagesPeople Vs JanjalaniLee MatiasNo ratings yet

- Epc SchedulesDocument321 pagesEpc SchedulesAli Asghar ShahNo ratings yet

- Form-LRA-12 Affidavit of Lost TitleDocument2 pagesForm-LRA-12 Affidavit of Lost TitleEmpress DagiNo ratings yet

- Intranslaw - Zbornik 2017.Document593 pagesIntranslaw - Zbornik 2017.Emir DžambegovićNo ratings yet

- RamesDocument1 pageRamesAngelito RegulacionNo ratings yet

- Thomas Skinner GenealogyDocument11 pagesThomas Skinner Genealogybskinner5812No ratings yet