Professional Documents

Culture Documents

Operations

Uploaded by

Ali KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Operations

Uploaded by

Ali KhanCopyright:

Available Formats

Threats and Opportunities

Going online presents unique threats and opportunities for the ME, careful analysis of these and

proper planning will not only diversify the risk but also give the ME a competitive edge over other

similar MEs.

Opportunities:

1) As we know that space is one of the biggest constraints for the ME, going online will aid to

overcome this constraint to a great deal.

2) Diversification of channel and reduction in location-based risk.

3) Creation of good-will and brand recognition, through home delivery service.

4) Alternate cash stream to strengthen the present operations.

5) Opportunity to scale-up the business and increasing the reach to an audience at the country

level.

6) Less inventory obsolescence due to less demand and ultimate discard. Thus, generating

more profits for the ME.

7) Same cyclical patterns and demand trends as the brick and motor retail. Thus, no additional

risk of demand variability.

8) The management can leverage their prior understanding of the domain knowledge and

customer tastes in the online retail.

Threats:

1) As human capital is also scarce resource for our ME, additional time consumed in sorting and

packing can lead to dissatisfaction or even potential loss of present clients due to

unattended customers.

2) Loss of focus on the core operations.

3) Less knowledge of online platforms may lead to create an obstacle to fully exploit them.

4) Additional working capital requirements may rise the cost of operations. As being the

supplier “Khazanay” may work to create a credit policy that may extend to 60 days.

Furthermore, if this additional working capital is financed through debt, then it will increase

the financing cost further.

Challenges:

1) Planning, forecasting, scheduling and channeling the goods would be a major challenge for

the ME, as the management is not conversant with the scientific methodologies and rely

heavily on judgement.

2) Capital arrangement and allocation might also be a challenge as the ME is over stretched

with financial constraints. This fact is interwound with the lower pace of the economic

growth and the current corona crisis which makes arrangement of capital even worse.

3) Additional working capital access remains a major issue for the ME. Even financing option

will be very cumbersome for the ME, as the banks are very cautious in money lending and

the requirements to extend such services are very lengthy, time consuming and difficult to

understand for the ME.

4) As, most MEs are not tax registered or do not fully disclose their taxable incomes dealing

with companies like “Khazana” will also pose specific challenge.

5) The ME has very limited experience dealing with claims and returns. Becoming conversant

with the terms of trade will also needs consideration.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Analyze The Market Entry Phases of Atlas-Copco, and Its Impact On Distributors, Customers and The Company Itself?Document9 pagesAnalyze The Market Entry Phases of Atlas-Copco, and Its Impact On Distributors, Customers and The Company Itself?Ali KhanNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Vaue Chain - 6Document1 pageVaue Chain - 6Ali KhanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Case of Unidentified IndustriesDocument2 pagesThe Case of Unidentified IndustriesAli Khan100% (4)

- Context Sources of Competitive Advantage: External PositionalDocument2 pagesContext Sources of Competitive Advantage: External PositionalAli KhanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Financial 5Document2 pagesFinancial 5Ali KhanNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- MarketingDocument3 pagesMarketingAli KhanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ge 1Document3 pagesGe 1Ali KhanNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Q9. How To Strengthen and Functioning of The International Financial System?Document1 pageQ9. How To Strengthen and Functioning of The International Financial System?Ali KhanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Q5. Which Is The Best Way To Control Prices/inflation, Which Policy Tool?Document1 pageQ5. Which Is The Best Way To Control Prices/inflation, Which Policy Tool?Ali KhanNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Unholy Trinity: Also Called The Impossible TrinityDocument2 pagesUnholy Trinity: Also Called The Impossible TrinityAli KhanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Global Operations (International Expansion)Document1 pageGlobal Operations (International Expansion)Ali KhanNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Price in Cash - Price of Futures Contract BasisDocument2 pagesPrice in Cash - Price of Futures Contract BasisAli KhanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Increase Visibility and Continuous Feeding of Sales PipelineDocument1 pageIncrease Visibility and Continuous Feeding of Sales PipelineAli KhanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Breaking Through The ClutterDocument1 pageBreaking Through The ClutterAli KhanNo ratings yet

- WSES SWOT Analysis: Threat of SubstitutesDocument2 pagesWSES SWOT Analysis: Threat of SubstitutesAli KhanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Porter Five Forces Analysis: Degree of Industry RivalryDocument1 pagePorter Five Forces Analysis: Degree of Industry RivalryAli KhanNo ratings yet

- Increasing Competitiveness of WSES: WeaknessesDocument1 pageIncreasing Competitiveness of WSES: WeaknessesAli KhanNo ratings yet

- Rationale For Increasing Marketing BudgetDocument1 pageRationale For Increasing Marketing BudgetAli KhanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Report On KQDocument71 pagesReport On KQmunishka abdille25No ratings yet

- 900K Earnings in One Year WSO ReportDocument14 pages900K Earnings in One Year WSO ReportlacatrinaentrajineraNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Online Selling Site Policies and GuidelinesDocument3 pagesOnline Selling Site Policies and GuidelinesLeslie CatindigNo ratings yet

- Internship ReportDocument77 pagesInternship ReportanjaliNo ratings yet

- Estimated Proposal PT Surya Buana Lestari Jaya (22000+HACCP)Document9 pagesEstimated Proposal PT Surya Buana Lestari Jaya (22000+HACCP)Fakhrul AnamNo ratings yet

- LIC CaseDocument9 pagesLIC CaseSaurabh SinghNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Utb Programmes 2021-2022Document3 pagesUtb Programmes 2021-2022labid.mccNo ratings yet

- Middle Managers Role in Strategy ImplementationDocument20 pagesMiddle Managers Role in Strategy Implementationrajivsharma79No ratings yet

- Ravindra EnergyDocument111 pagesRavindra EnergyCA Dipesh JainNo ratings yet

- Banking & Financial Services Job Skills & Competencies FrameworkDocument19 pagesBanking & Financial Services Job Skills & Competencies FrameworkMithun KNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 167 Sep2019 PDFDocument13 pages167 Sep2019 PDFShah KhanNo ratings yet

- Unit 5 IT ConsultingDocument8 pagesUnit 5 IT ConsultingFatima AliNo ratings yet

- Coors UaeDocument14 pagesCoors UaeSamer Al-MimarNo ratings yet

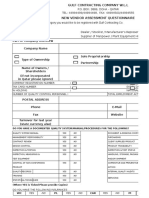

- QMS F 09A Rev 05 New Vendor Assessment QuestionnaireDocument16 pagesQMS F 09A Rev 05 New Vendor Assessment QuestionnairermdarisaNo ratings yet

- Strategic Management MBA III 538483064Document2 pagesStrategic Management MBA III 538483064Sidharth KapoorNo ratings yet

- Case Study No.2 Analysis On Toyota's Operations ManagementDocument3 pagesCase Study No.2 Analysis On Toyota's Operations Managementzarah mae aday50% (2)

- Branch Accounts: Where The Head Office Maintains All The AccountsDocument6 pagesBranch Accounts: Where The Head Office Maintains All The AccountsTawanda Tatenda HerbertNo ratings yet

- Restraint of Trade: Emerging Trends: Varun SrinivasanDocument12 pagesRestraint of Trade: Emerging Trends: Varun Srinivasansazib kaziNo ratings yet

- ANALE - Stiinte Economice - Vol 2 - 2014 - FinalDocument250 pagesANALE - Stiinte Economice - Vol 2 - 2014 - FinalmhldcnNo ratings yet

- Guidance On Good Data Management Practices QAS15 624 16092015Document35 pagesGuidance On Good Data Management Practices QAS15 624 16092015Suryakumar ShivasagaranNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cost Accounting Research PaperDocument8 pagesCost Accounting Research PaperRoseBing0% (1)

- Chapter 16 Extra Problem and SolutionDocument3 pagesChapter 16 Extra Problem and SolutionVincent PhamNo ratings yet

- SECTION B (Answer All Questions in This Section)Document3 pagesSECTION B (Answer All Questions in This Section)Hiraya ManawariNo ratings yet

- Budgeting AnswersDocument16 pagesBudgeting AnswersMuhammad Hassan UddinNo ratings yet

- Oracle 1z0 1005 PDFDocument7 pagesOracle 1z0 1005 PDFAshive Mohun100% (1)

- QG To SADDocument125 pagesQG To SADValix CPANo ratings yet

- Freight Forwarding SoftwareDocument10 pagesFreight Forwarding SoftwareShuklendu BajiNo ratings yet

- AFAR 04 Business CombinationDocument9 pagesAFAR 04 Business CombinationPym-Kaytitinga St. Joseph ParishNo ratings yet

- DSP Blackrock Tax Saver Fund KimDocument22 pagesDSP Blackrock Tax Saver Fund KimPRANUNo ratings yet

- Revision Notes Book Corporate Finance Chapter 1 18Document15 pagesRevision Notes Book Corporate Finance Chapter 1 18Yashrajsing LuckkanaNo ratings yet

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4.5 out of 5 stars4.5/5 (3)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (90)