Professional Documents

Culture Documents

Assignment

Uploaded by

M ASIF0 ratings0% found this document useful (0 votes)

11 views2 pagesOriginal Title

M & A

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesAssignment

Uploaded by

M ASIFCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

ASSIGNMENT

NAME MUHAMMAD ASIF

ID NO 11150

DATE 11/06/2020

Mergers and acquisitions (M&A) and joint ventures are examples of

corporate investment decisions whose impact usually extend beyond

the economic boundaries of the individual decision-making firm, and

they are “one of the most important events in corporate finance, both

for a firm and the economy”.

The “managers acting as shareholders’ agents, decide in which assets

to invest, and how to finance those investments”, it is stated that “a

major part of financial research is concerned with the effect of

managerial decisions on the market value of the firm”. The effect of

MAJV on firms’ ex-post performance and risk has been examined and

the findings favor poor performance

The literature does not provide a unified theoretical or empirical

explanation as to why firms choose MAJV over other forms of

combining resources such as franchising and trademark agreements,

long-term buy/sell agreements, and one-time-only buy/sell

transactions to accomplish some objectives

The only consensus the empirical research has established is that

shareholders of target firms gain positive abnormal returns at the

announcement of M&As. On the other hand, the average return to the

acquiring firm’s shareholders is less clear and favors poor

performance

Poor performance following M&As means that the acquiring firms’

shareholders lose their wealth, on average, which suggests that M&As

are not always purely economically (maximizing firm value)

motivated. Indeed, the literature suggests that in addition to search

for the economic synergy, which is meant to maximize the acquiring

firm’s net present value of future profits, the acquiring firms’

managers acquire other firms due to the agency motives such as

“increasing the size of the firm, the opportunity to diversify, and

making himself less replaceable.

You might also like

- Merger and Acqusition Paper FinalDocument3 pagesMerger and Acqusition Paper FinalM ASIFNo ratings yet

- Merger and Acqusition Paper FinalDocument3 pagesMerger and Acqusition Paper FinalM ASIFNo ratings yet

- FRM Final 11150Document9 pagesFRM Final 11150M ASIFNo ratings yet

- M&A AlternativesDocument2 pagesM&A AlternativesM ASIFNo ratings yet

- Merger and Acqusition Paper FinalDocument3 pagesMerger and Acqusition Paper FinalM ASIFNo ratings yet

- Economics of Pakistan ECO 211Document2 pagesEconomics of Pakistan ECO 211M ASIFNo ratings yet

- Major Assignment 11150Document9 pagesMajor Assignment 11150M ASIFNo ratings yet

- Firm Valuation, and Value CreationDocument3 pagesFirm Valuation, and Value CreationM ASIFNo ratings yet

- Muhammad Asif Id NO 11150Document5 pagesMuhammad Asif Id NO 11150M ASIFNo ratings yet

- Muhammad Asif Id NO 11150Document5 pagesMuhammad Asif Id NO 11150M ASIFNo ratings yet

- Strategy Formulation: Situation Analysis & Business StrategyDocument32 pagesStrategy Formulation: Situation Analysis & Business StrategyM ASIFNo ratings yet

- Financial Risk Managment AssignmentDocument2 pagesFinancial Risk Managment AssignmentM ASIFNo ratings yet

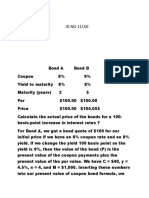

- Bond A Bond BDocument2 pagesBond A Bond BM ASIFNo ratings yet

- Id No 11150Document1 pageId No 11150M ASIFNo ratings yet

- Falak Niaz CVDocument6 pagesFalak Niaz CVM ASIFNo ratings yet

- Id No 11150Document1 pageId No 11150M ASIFNo ratings yet

- Assignment of SMDocument1 pageAssignment of SMM ASIFNo ratings yet

- Project Management Major Assigment: Muhammad AsifDocument11 pagesProject Management Major Assigment: Muhammad AsifM ASIFNo ratings yet

- David CH 1Document29 pagesDavid CH 1Novita HalimNo ratings yet

- Burj Bank Limited, Formerly Known As Dawood Islamic Bank Limited (DIBL), Now Part of AlDocument1 pageBurj Bank Limited, Formerly Known As Dawood Islamic Bank Limited (DIBL), Now Part of AlM ASIFNo ratings yet

- Muhammad Asif ID NO 11150 Assignment of Mergers / Acquistions DATE 21/05/2020Document1 pageMuhammad Asif ID NO 11150 Assignment of Mergers / Acquistions DATE 21/05/2020M ASIFNo ratings yet

- Regression - SPSS Annotated Output.Document5 pagesRegression - SPSS Annotated Output.M ASIFNo ratings yet

- Og1 9 Batch Sample Paper r3Document5 pagesOg1 9 Batch Sample Paper r3Saim AliNo ratings yet

- David sm13 PPT 09Document24 pagesDavid sm13 PPT 09Alejandro Perez SantanaNo ratings yet

- Cost Accounting by Matz and Usry 7th Edition Manual PDFDocument4 pagesCost Accounting by Matz and Usry 7th Edition Manual PDFM ASIF0% (1)

- Curriculam Vitae: Irfan Ahmad (Registered Electrical Engineer With Pakistan Engineering Council)Document2 pagesCurriculam Vitae: Irfan Ahmad (Registered Electrical Engineer With Pakistan Engineering Council)M ASIFNo ratings yet

- David CH 1Document29 pagesDavid CH 1Novita HalimNo ratings yet

- Sampling 2Document22 pagesSampling 2Sachin SahooNo ratings yet

- Muhammad Asif AssignimentDocument2 pagesMuhammad Asif AssignimentM ASIFNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)