Professional Documents

Culture Documents

Employees Tax - Pay As You Earn (PAYE) System

Uploaded by

belindaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employees Tax - Pay As You Earn (PAYE) System

Uploaded by

belindaCopyright:

Available Formats

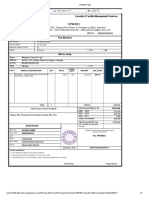

Employees Tax - Pay As You Earn (PAYE)

System

CATEGORY: PAY AS YOU EARN (PAYE)

The Pay As You Earn (PAYE) system is a method of paying Income Tax on remuneration. The

employer is mandated to deduct tax from salary or pension earnings before paying out the net

salary or pension.

This article is intended to provide you with a simple and logical introduction to some basic

principles of Income Tax as it applies to employees.

The Income Tax Act [Chapter 23:06] specifies what elements of an employee’s remuneration or

earnings are subject to tax and at what rate of tax. It also deals with what income is exempt from

tax and what deductions are allowed from these earnings, prior to tax being calculated.

Assume then for a moment that everything you earn - be it in cash, benefits, or an item of value

given instead of cash - is subject to some form of tax. However, the determination of the value

and its associated tax liability in respect of any of these forms of payments will differ in some

cases.

The official tax table operates on an escalating scale basis, (i.e. the higher your earnings, the

greater percentage tax you pay on each bracket of earnings). When your earnings reach a certain

amount, the percentage stops increasing and a flat rate of tax becomes applicable for any

earnings above this level - that is Marginal Tax Rate (MTR).

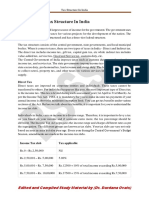

The Table below shows tax tables for period before 1 August 2019.

Currency Earned by Employee Tax-Free Threshold Highest Rate of PAYE

RTGS$ 350.00 45%

Earnings in US$ were being taxed using same tax tables above after converting the foreign

currency earnings into RTGS$ using the interbank rate.

The Table below shows the tax free threshold, rates of PAYE and highest bracket of Earnings for

salaries paid in RTGS$ and US$ with effect from 1 August 2019.

Currency Earned by Employee Tax-Free Threshold Highest Rate of PAYE

RTGS$ 700.00 40%

USD 70.00 40%

The due date for the submission of PAYE returns and payment is the 10th of the following

month.

PAYE is calculated as follows:

1. Determine gross income for the day/week/month/year.

2. Deduct exempt income, for instance bonus: You get => Income

3. Deduct allowable deductions, e.g. pension: You get => Taxable Income.

4. Please refer to tax tables. You get => Tax on Taxable Income.

5. Deduct tax credits e.g. elderly, blind or disabled persons ($750.00) and medical credit

$1.00 of every $2.00 paid: You get => Tax after credits.

6. Calculate 3% Aids Levy and add to tax after credits: You get actual tax payable.

You might also like

- Example Showing Unfairness & Discrimination - Labor's PolicyDocument12 pagesExample Showing Unfairness & Discrimination - Labor's PolicyJohn GriffithNo ratings yet

- What Type of Information Is Necessary To Complete A Tax ReturnDocument4 pagesWhat Type of Information Is Necessary To Complete A Tax ReturnDianna RabadonNo ratings yet

- The Federal Income Tax System For Individuals: WebextensionDocument5 pagesThe Federal Income Tax System For Individuals: WebextensionBecky Bergeon SteeleNo ratings yet

- Tax and Super: How Is Super Taxed ?Document2 pagesTax and Super: How Is Super Taxed ?khilanvekariaNo ratings yet

- TdsDocument4 pagesTdsAdityaNo ratings yet

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- Philippines Tax ComputationDocument19 pagesPhilippines Tax ComputationJoy Chrisky Vinluan-Lobendino67% (3)

- Income Tax Course Manual (2021 T1) PDFDocument138 pagesIncome Tax Course Manual (2021 T1) PDFMrDorakonNo ratings yet

- How To Calculate TDS From SalaryDocument3 pagesHow To Calculate TDS From SalaryNaveen Kumar NaiduNo ratings yet

- En 05 10022Document2 pagesEn 05 10022Jeremy WebbNo ratings yet

- ACC 111 Chapter 7 Lecture NotesDocument5 pagesACC 111 Chapter 7 Lecture NotesLoriNo ratings yet

- Payroll: Company Financial Salaries Wages DeductionsDocument5 pagesPayroll: Company Financial Salaries Wages DeductionsKavitaNo ratings yet

- Computation of TaxDocument17 pagesComputation of TaxJo LouiseNo ratings yet

- Guide To Taxation of Married Couples and Civil PartnersDocument12 pagesGuide To Taxation of Married Couples and Civil PartnerspetermhanleyNo ratings yet

- IAS 12 Income TaxesDocument4 pagesIAS 12 Income Taxeshae1234No ratings yet

- Fit Chap012Document56 pagesFit Chap012djkfhadskjfhksd100% (2)

- Chapter 7Document21 pagesChapter 7api-263146371No ratings yet

- Company Financial Salaries Wages Deductions: Payroll Taxes in U.SDocument4 pagesCompany Financial Salaries Wages Deductions: Payroll Taxes in U.SSampath KumarNo ratings yet

- PdataDocument6 pagesPdataRazor11111No ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Tax Topics: Blanche Lark ChristersonDocument6 pagesTax Topics: Blanche Lark Christersonapi-301040925No ratings yet

- Tax AuditDocument49 pagesTax AuditRebecca Mendes100% (1)

- General Payroll, Employment and DeductionsDocument6 pagesGeneral Payroll, Employment and DeductionsJosh LeBlancNo ratings yet

- 2021 Gr12 Maths Literacy WKBKDocument20 pages2021 Gr12 Maths Literacy WKBKtinashe chirukaNo ratings yet

- Document Pay SlipDocument3 pagesDocument Pay SlipAfaq AnwarNo ratings yet

- General Tax Information Sheet For Au Pairs: Will I Owe Taxes On My Weekly Stipends?Document6 pagesGeneral Tax Information Sheet For Au Pairs: Will I Owe Taxes On My Weekly Stipends?milanesasNo ratings yet

- Payroll SystemDocument4 pagesPayroll SystemAkinuli OlaleyeNo ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- Income Tax Law & Practice Unit 4Document8 pagesIncome Tax Law & Practice Unit 4MuskanNo ratings yet

- Stripe Atlas Guide To Business TaxesDocument1 pageStripe Atlas Guide To Business TaxesKeyse BasoraNo ratings yet

- Understanding The Salary Deductions On Your PayslipDocument10 pagesUnderstanding The Salary Deductions On Your PayslipChristianNo ratings yet

- Tax and SuperDocument3 pagesTax and SuperEmmaNo ratings yet

- Advance Tax PaymentDocument4 pagesAdvance Tax PaymentJaneesNo ratings yet

- Annual Gross IncomeDocument4 pagesAnnual Gross IncomeMarilyn Perez OlañoNo ratings yet

- TSP 536Document8 pagesTSP 536Dakota WoodwardNo ratings yet

- Q No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentsDocument3 pagesQ No4:10 Sources of Nontaxable Income / Other Sources: Income That Isn't Taxed 1. Disability Insurance PaymentswaqasNo ratings yet

- Tax Relief ProgramDocument8 pagesTax Relief ProgramJK BCNo ratings yet

- Payroll and DeductionsDocument3 pagesPayroll and DeductionsmankahnganglumNo ratings yet

- Tax Calculator - Overview: InstructionsDocument9 pagesTax Calculator - Overview: InstructionsphobosanddaimosNo ratings yet

- Ncome Tax: Business StructuresDocument51 pagesNcome Tax: Business StructuresGab VillahermosaNo ratings yet

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharDocument17 pagesSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraNo ratings yet

- Print Tax On Savings Interest - How Much Tax You Pay - GOV - UKDocument5 pagesPrint Tax On Savings Interest - How Much Tax You Pay - GOV - UKscribd.peworNo ratings yet

- Payroll OrlDocument4 pagesPayroll OrlJose OcandoNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Fit Chap012Document53 pagesFit Chap012biomed12No ratings yet

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Employers' GuideDocument42 pagesEmployers' GuideGarth ChambersNo ratings yet

- Some Taxation Considerations For Entity FormationDocument8 pagesSome Taxation Considerations For Entity FormationFredNo ratings yet

- Centorbi - AE Taxes White Paper - DL - GGDocument8 pagesCentorbi - AE Taxes White Paper - DL - GGchad centorbiNo ratings yet

- Week 3-Local TaxationDocument23 pagesWeek 3-Local TaxationShanique WilliamsNo ratings yet

- How To Compute Income TaxDocument36 pagesHow To Compute Income TaxbrownboomerangNo ratings yet

- Employers' GuideDocument44 pagesEmployers' GuideMary Ann AdrianoNo ratings yet

- Direct and Indirect TaxesDocument47 pagesDirect and Indirect TaxesThomasGetye67% (3)

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalNo ratings yet

- Interview QuestionsDocument12 pagesInterview QuestionsnadeemNo ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- Business Taxation MeaningDocument4 pagesBusiness Taxation MeaningSheila Mae AramanNo ratings yet

- E Filing Income Tax Return OnlineDocument53 pagesE Filing Income Tax Return OnlineMd MisbahNo ratings yet

- Expenses SimilarlyDocument4 pagesExpenses SimilarlybelindaNo ratings yet

- Presumptive Tax LegislationDocument3 pagesPresumptive Tax LegislationbelindaNo ratings yet

- Presumptive Tax LegislationDocument3 pagesPresumptive Tax LegislationbelindaNo ratings yet

- Category: Tax CreditsDocument2 pagesCategory: Tax CreditsbelindaNo ratings yet

- Attachment Report PDFDocument68 pagesAttachment Report PDFbelinda67% (3)

- AZNAR Vs CTADocument2 pagesAZNAR Vs CTAMCNo ratings yet

- 7th Pay RevisionDocument2 pages7th Pay RevisionAnonymous U9MoBKINo ratings yet

- W-8BEN: Certificate Status) ) ), .Document1 pageW-8BEN: Certificate Status) ) ), .NierNo ratings yet

- Value Added Tax (Vat) .PPT FinalDocument57 pagesValue Added Tax (Vat) .PPT FinalNick254No ratings yet

- July 3, 2018: Hermilando Mandanas, Et Al., Petitioners Executive Secretary Paquito Ochoa, Et Al., RespondentsDocument3 pagesJuly 3, 2018: Hermilando Mandanas, Et Al., Petitioners Executive Secretary Paquito Ochoa, Et Al., RespondentsDayanarah MarandaNo ratings yet

- John Leur C. Virtucio Written ReportDocument12 pagesJohn Leur C. Virtucio Written ReportLeMignonD.RoxasNo ratings yet

- Capital Gains Statement: Nippon India Credit Risk Fund - Growth Plan Growth Option (Inf204K01Fq3)Document3 pagesCapital Gains Statement: Nippon India Credit Risk Fund - Growth Plan Growth Option (Inf204K01Fq3)kulwinder singhNo ratings yet

- Gujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - SlipDocument1 pageGujarat Narmada Valley Fertilizers & Chemicals LTD: Pay - Slipkeyur patelNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pardeep JaatNo ratings yet

- British Airways Vs CIR (Actually This Is CIR Vs BOAC)Document2 pagesBritish Airways Vs CIR (Actually This Is CIR Vs BOAC)Ton Ton CananeaNo ratings yet

- Slip 0232 01 2019Document513 pagesSlip 0232 01 2019Shahaan ZulfiqarNo ratings yet

- GR 183531Document3 pagesGR 183531ChaNo ratings yet

- US Internal Revenue Service: p1546Document24 pagesUS Internal Revenue Service: p1546IRSNo ratings yet

- Sworn Declaration FormDocument1 pageSworn Declaration FormAnawin FamadicoNo ratings yet

- Plan Expenditure and NonDocument3 pagesPlan Expenditure and NonkankshNo ratings yet

- Digested Tax I CasesDocument4 pagesDigested Tax I CasesCresteynTeyngNo ratings yet

- Tax Invoice: Plot No. 837, Udyog Vihar Phase - 5, Gurgaon-122016, HaryanaDocument1 pageTax Invoice: Plot No. 837, Udyog Vihar Phase - 5, Gurgaon-122016, HaryanaMazhar KhanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pritish SahalotNo ratings yet

- 2.form of Appeal-ATIRDocument2 pages2.form of Appeal-ATIRwasim nisar0% (1)

- Budget 2021 Summary Mrunal Competitive ExamsDocument24 pagesBudget 2021 Summary Mrunal Competitive ExamsVarun MatlaniNo ratings yet

- Dhamara To BBSR LioDocument1 pageDhamara To BBSR Lio9853318441No ratings yet

- 0310000100113329ffd - PSP (1) .RPTDocument4 pages0310000100113329ffd - PSP (1) .RPTrahulNo ratings yet

- Canarabank Annex - III To SCSSDocument6 pagesCanarabank Annex - III To SCSSiddrxNo ratings yet

- Hetzner 2023-01-04 R0017904414Document1 pageHetzner 2023-01-04 R0017904414djsaba2010No ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Under Composite Scheme of VAT Assessment Annexure-I Project/ Contract Details (EPC Contracts)Document2 pagesUnder Composite Scheme of VAT Assessment Annexure-I Project/ Contract Details (EPC Contracts)ghaghra bridgeNo ratings yet

- Manajemen SNDocument3 pagesManajemen SNDWI ANDININo ratings yet

- 22Document2 pages22TWCNo ratings yet

- F1099R RCPSDocument2 pagesF1099R RCPSherbs22225847No ratings yet

- Problem Set - Deferred TaxesDocument2 pagesProblem Set - Deferred TaxeslykaNo ratings yet